26 July 2022 Afternoon Session Analysis

Euro jumped as a large rate hike could be expected soon after.

The euro, which is widely traded by investors worldwide, surged following the increasing possibility of a big rate hike. According to the member of the ECB, Latvian central bank governor Martins Kazaks revealed that the large rate hike may not be over yet, after raising its interest rate by 50 basis points last week. However, he also reiterated that no clear forward guidance would be given at this point of time, but the rate increase in September also needs to be quite significant. Nevertheless, the gains of the single currency were limited after downbeat data was released from the Eurozone. According to the ifo Institute for Economic Research, the Germany ifo Business Climate Index declined from 92.2 to 88.6, missing the consensus forecast of 90.2. With that, it shows that the current German business environment remains clouded, while the outlook is blurred. As of writing, the pair of EUR/USD is up by 0.18% to 1.0238.

In the commodities market, the crude oil price up 0.93% to $97.70 a barrel amid the Russia-Ukraine war heightened. Yesterday, Russia fired a few missiles to Ukraine’s Odesa port, one day after the grain export deal had been achieved between these two countries. Besides, the gold prices went up 0.36% to $1725.80 a troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Jul) | 98.7 | 97.3 | – |

| 22:00 | USD – New Home Sales (Jun) | 696K | 664K | – |

Technical Analysis

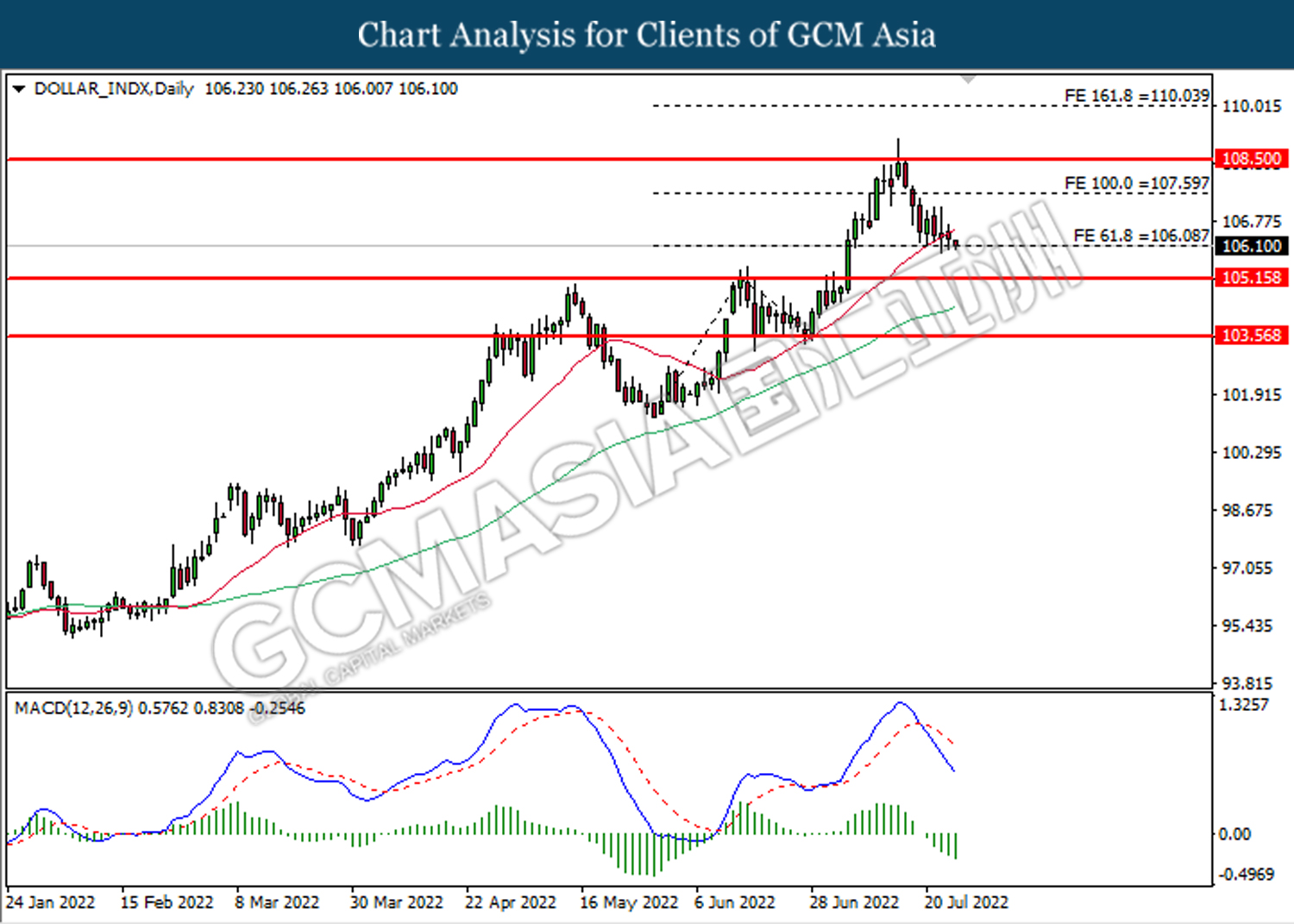

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 106.10. MACD which illustrated increasing bearish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

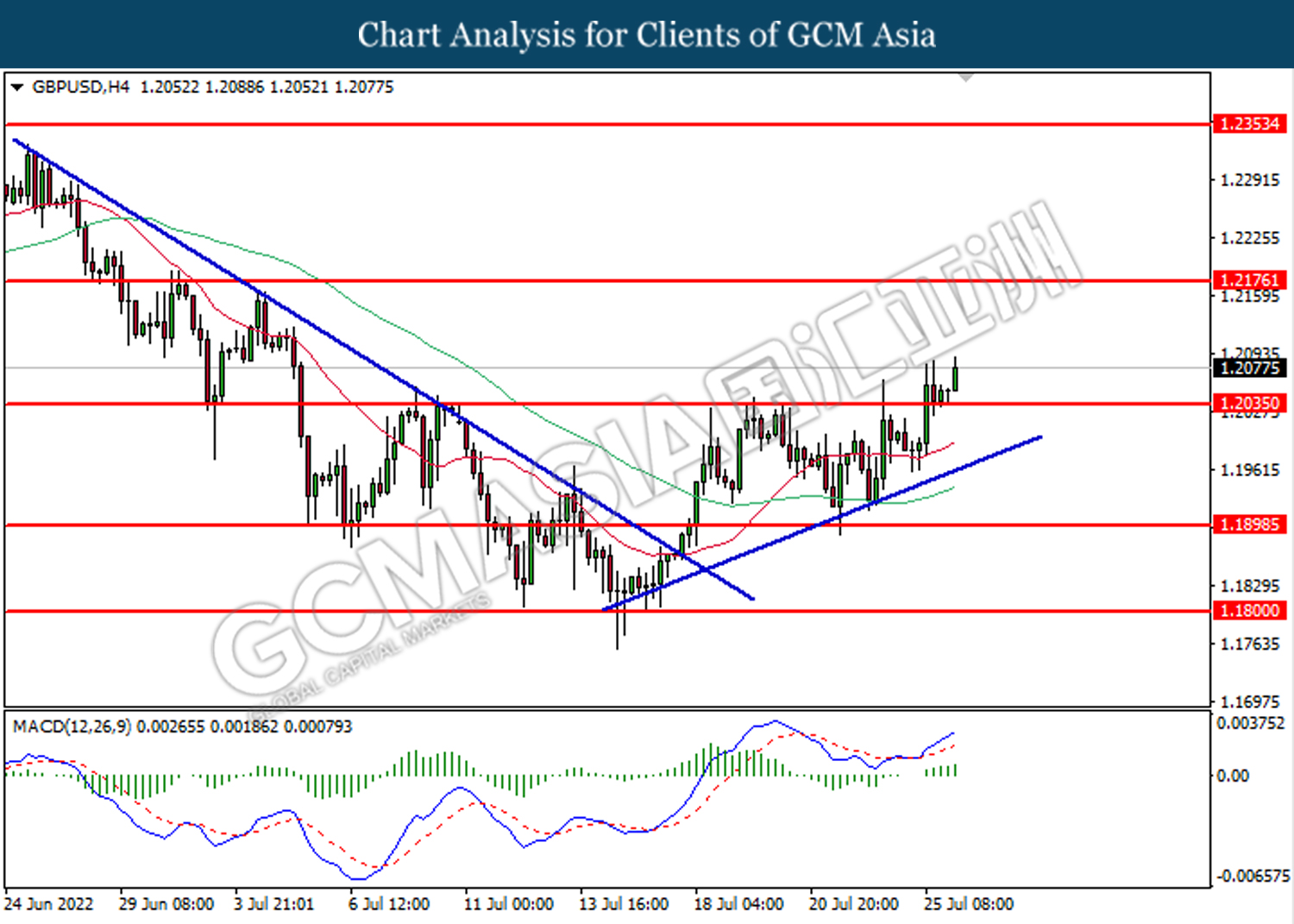

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2035. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2175.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

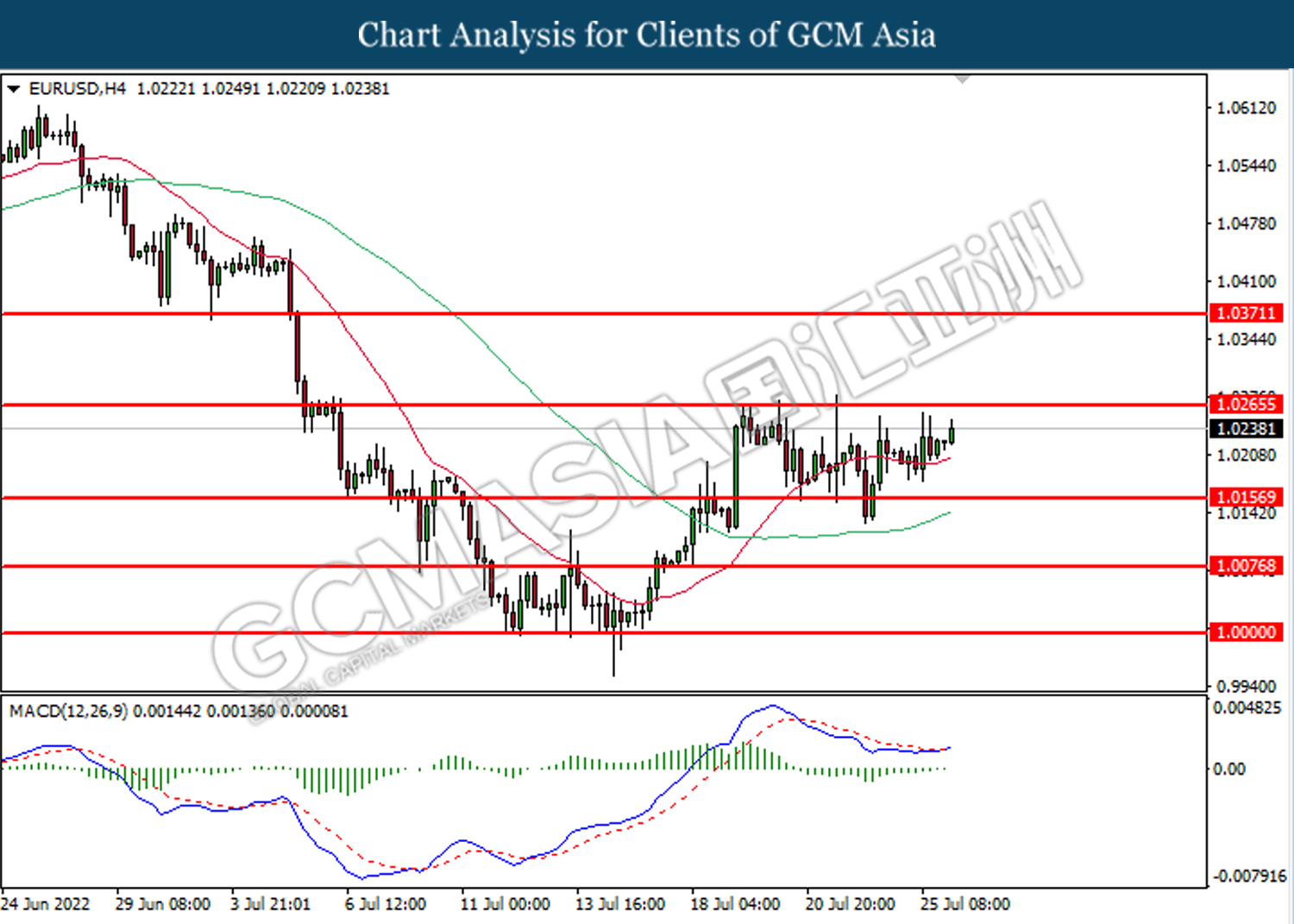

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

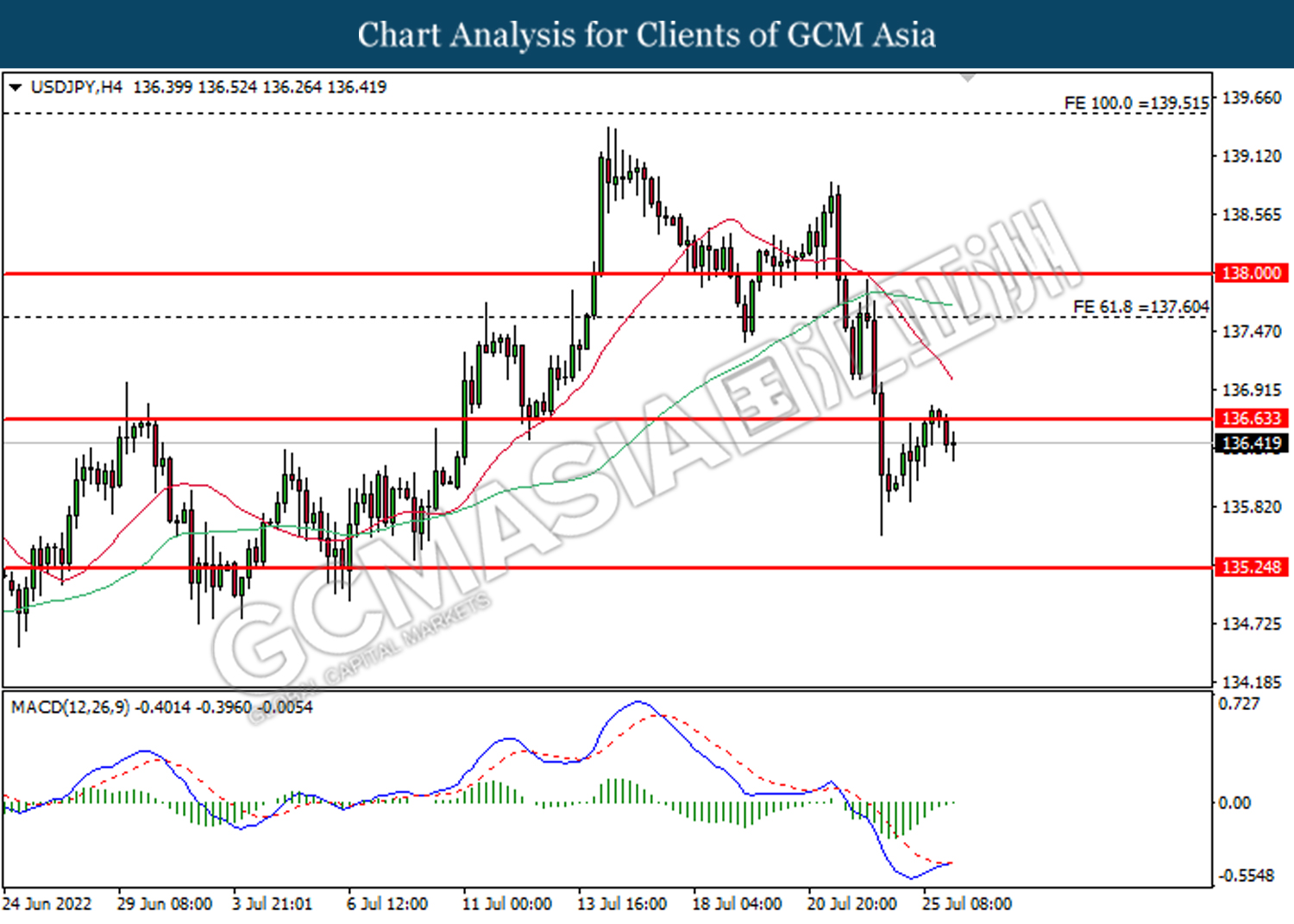

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 136.65. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 136.65, 137.60

Support level: 135.25, 133.15

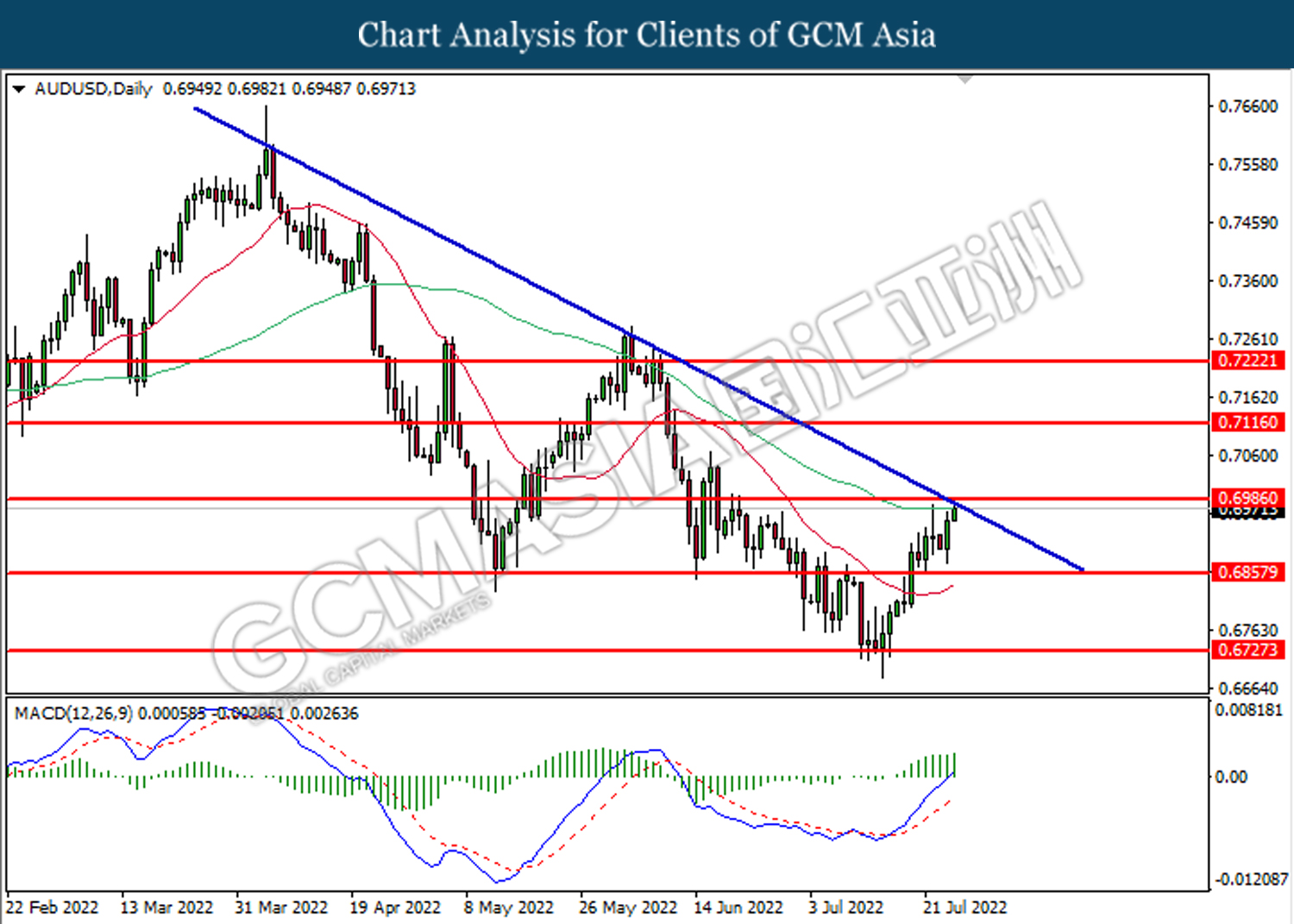

AUDUSD, Daily: AUDUSD was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the trendline.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

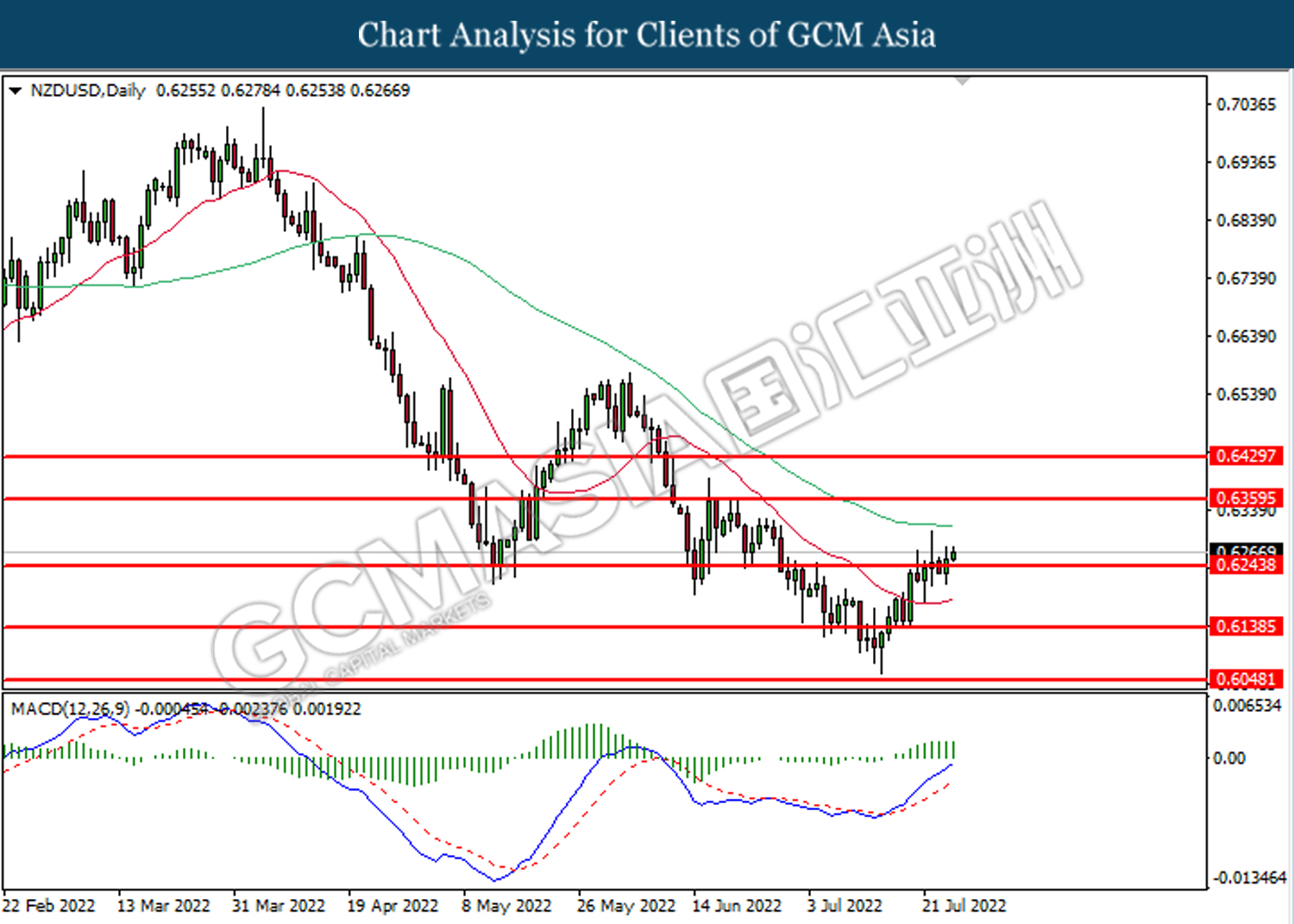

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

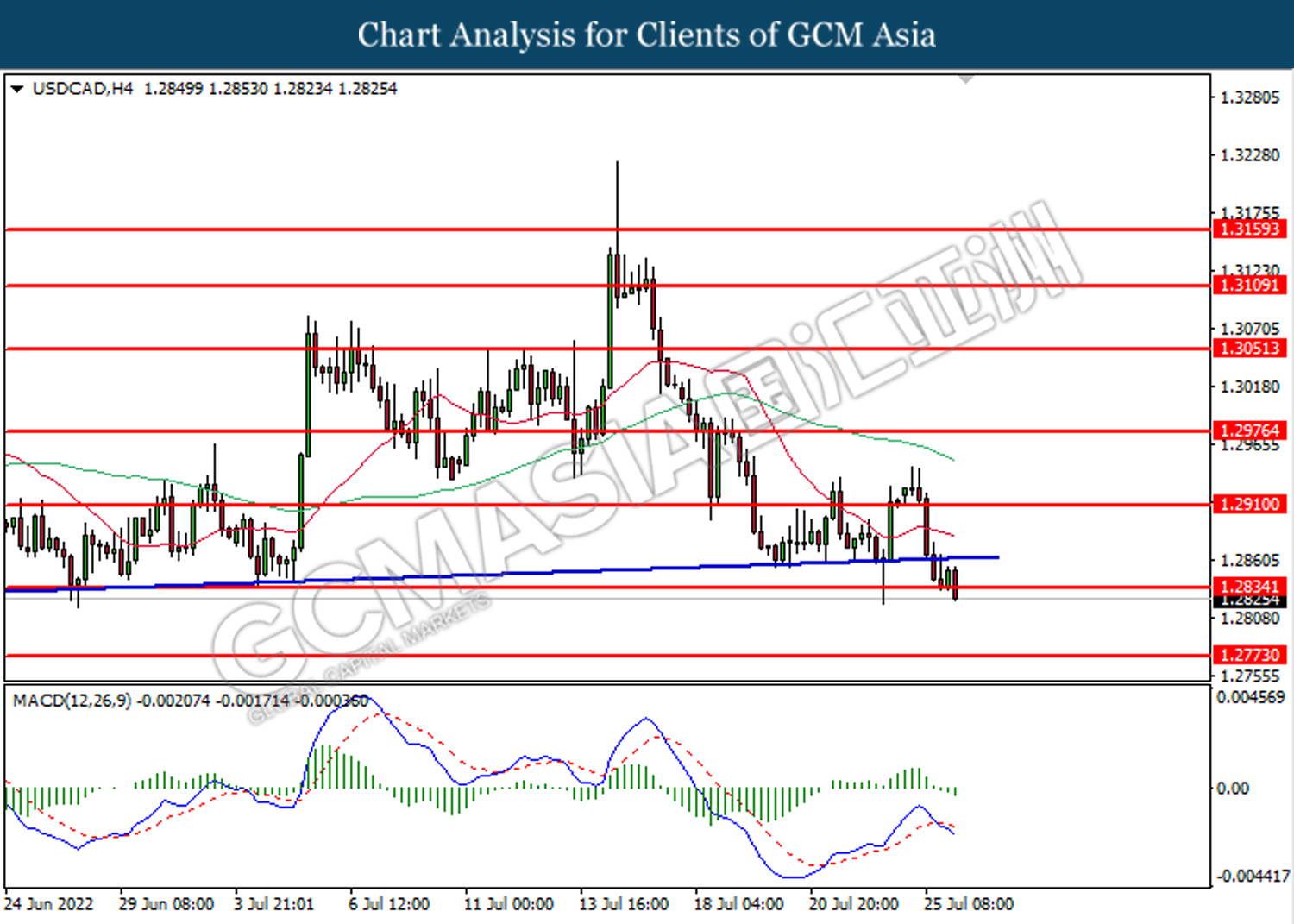

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2835. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2910, 1.2975

Support level: 1.2835, 1.2775

USDCHF, Daily: USDCHF was traded lower while currently retesting the upward trendline. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

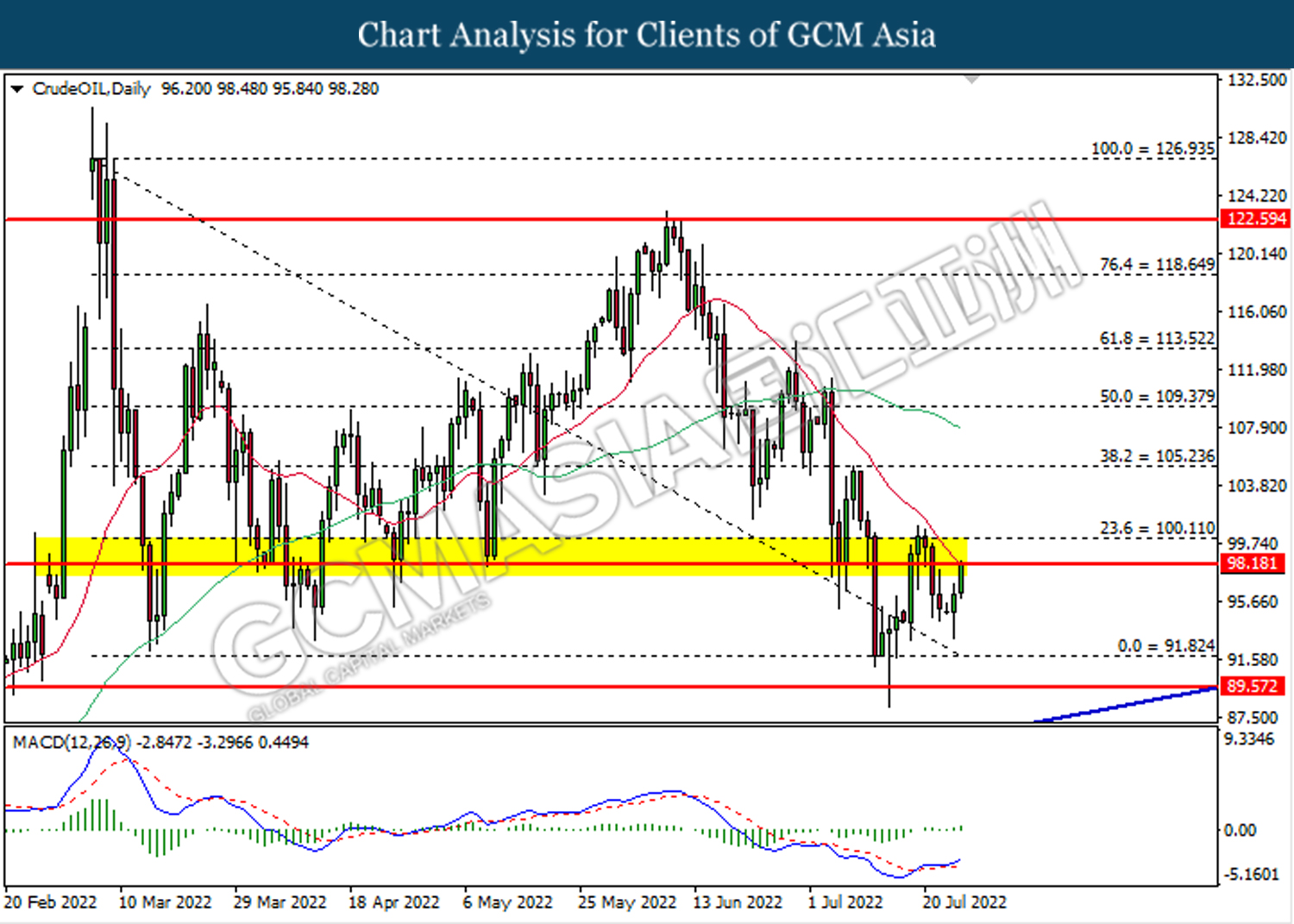

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 98.20. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

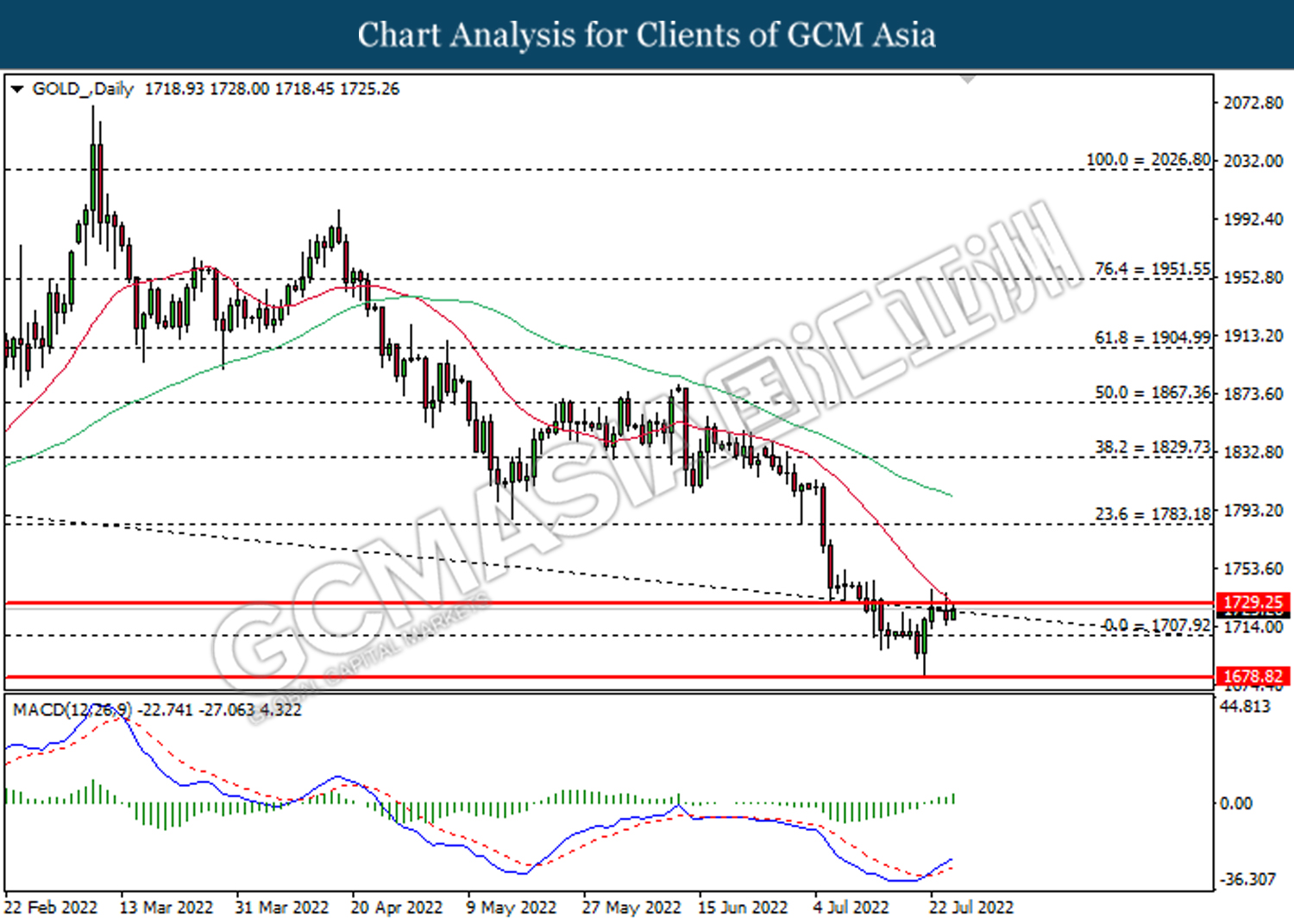

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80