27 July 2022 Morning Session Analysis

Dollar jumped as recession worries heightened.

The dollar index, which traded against a basket of six major currencies reversed its course successfully, after falling for 3 consecutive trading day amid the heightening of market concern over the recession risk. Recently, the Russian gas giant Gazprom announced a plan to reduce its gas flow via Nord Steam 1 pipeline to Germany, claiming that the purpose of shutting down one of the two remaining working turbines was due to technical issues at a pumping facility on the Baltic coast. However, the German government stated there was no technical reason for it to limit the supply. On the other side, the Eurozone have come into a consensus that an emergency plan to cut the natural gas consumption by 15% over the next nine months would be implemented, aiming to reduce the reliance against Russia natural gas. The exacerbating of tensions between Europe and Russia has spurred the risk-off sentiment in the market, prompted the investors to move their holdings toward safe haven dollar. At this juncture, investors are eyeing on the upcoming Federal Reserve meeting in order to gauge the likelihood direction of the dollar index going forward. As of writing, the dollar index surged 0.68% to 107.20.

In the commodities market, the crude oil price up 0.02% to $95.55 a barrel after falling substantially yesterday. The appreciation of the US dollar caused the cost of oil became expensive for the non-US buyers. Besides, the gold prices went down 0.04% to $1717.70 a troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Statement

(28th July)

02:00 USD FOMC Press Conference

(28th July)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jun) | 0.7% | 0.2% | – |

| 22:30 | USD – Pending Home Sales (MoM) (Jun) | 0.7% | -1.5% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.466M | -1.037M | – |

| 02:00

(28thJuly)

|

USD – Fed Interest Rate Decision | 1.75% | 2.50% | – |

Technical Analysis

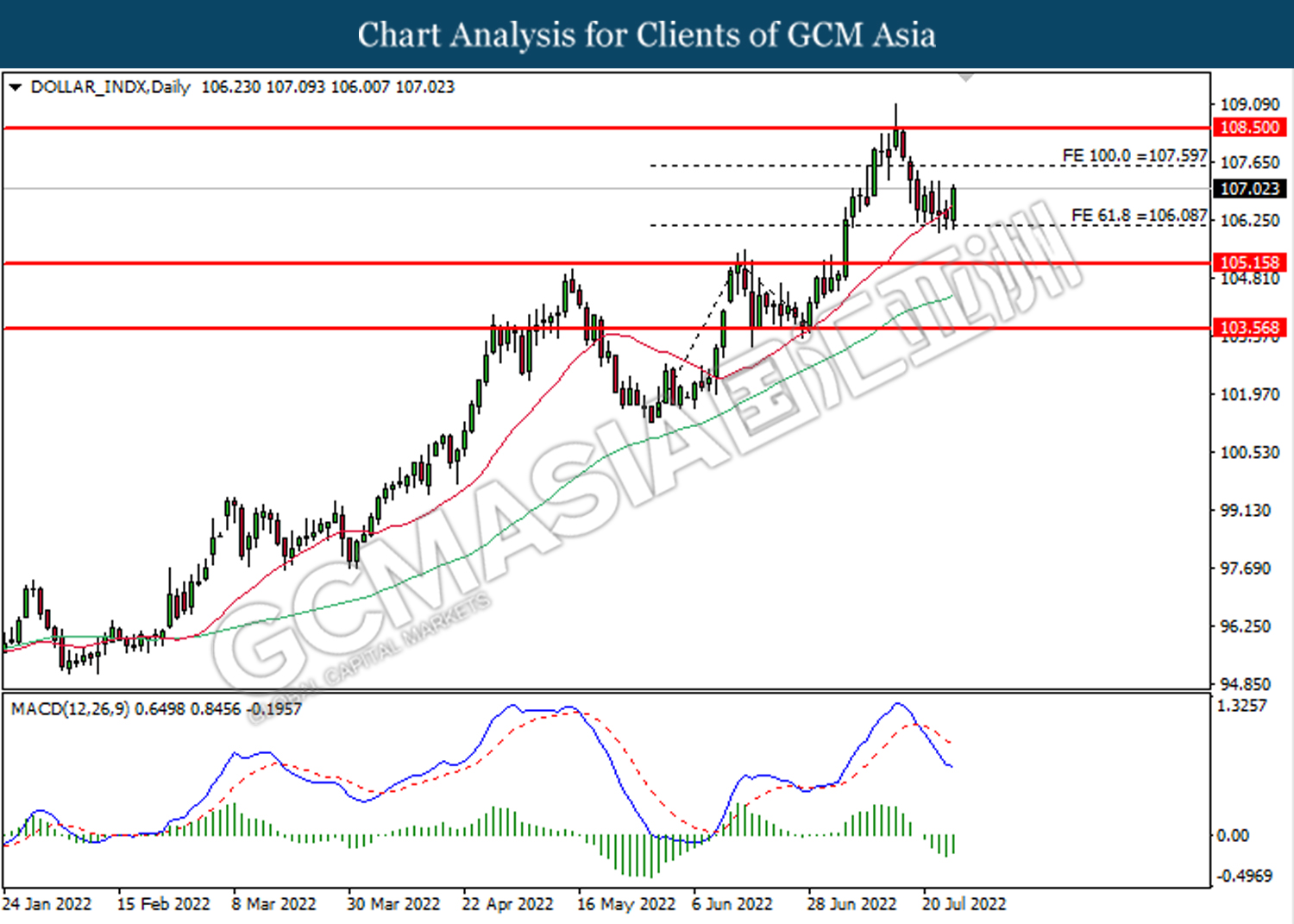

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 106.10. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.60.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

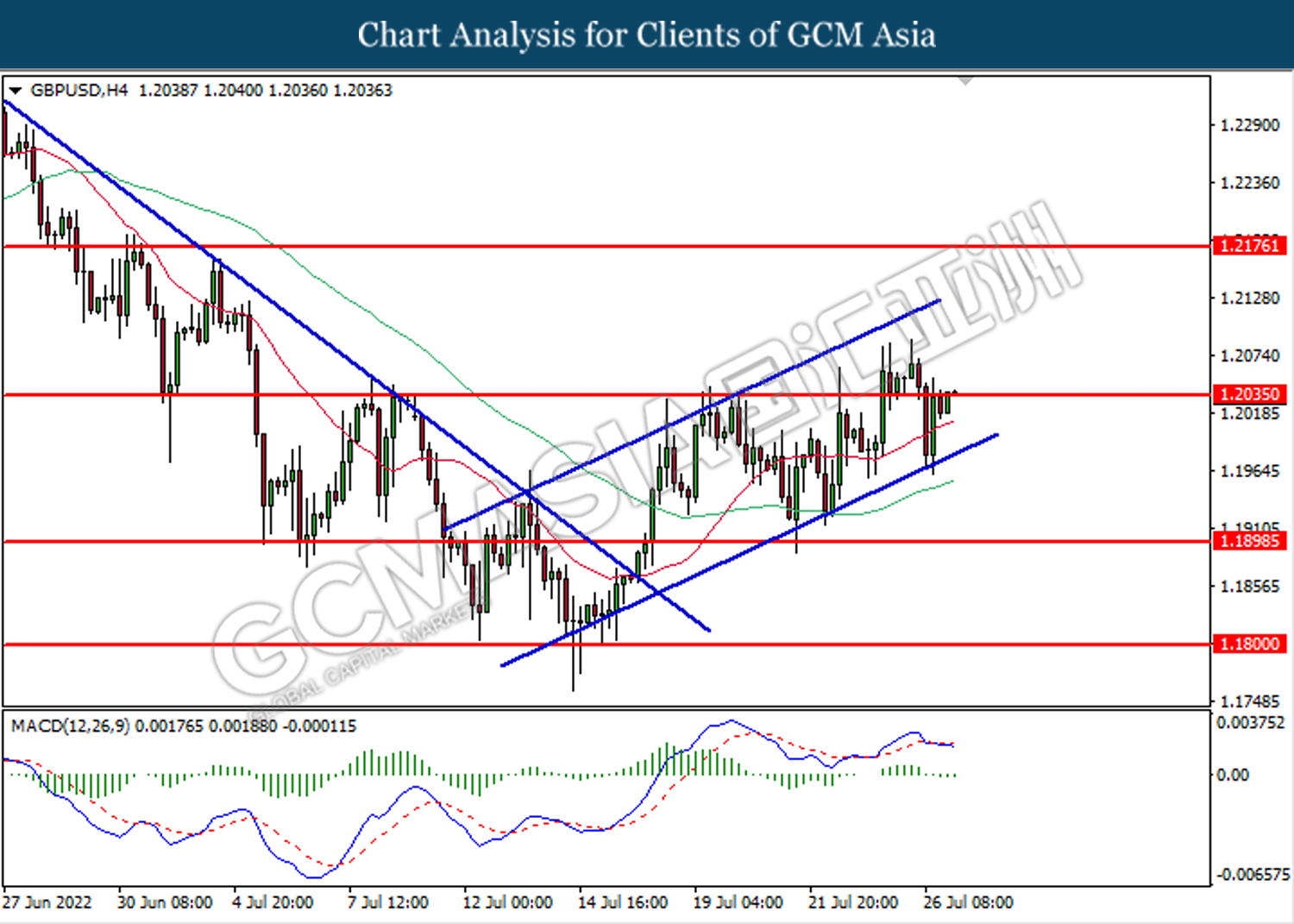

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2035. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2035, 1.2175

Support level: 1.1900, 1.1800

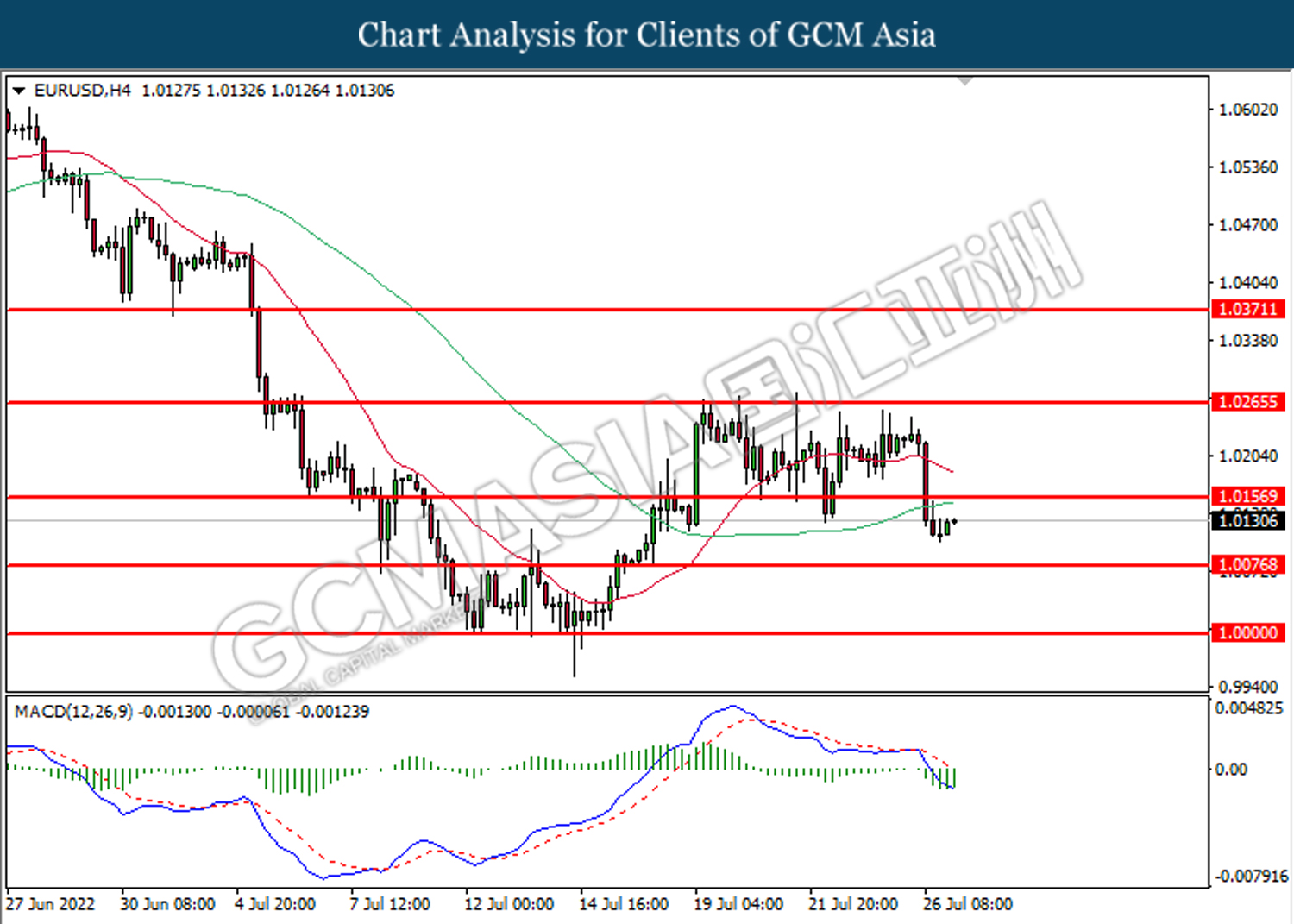

EURUSD, H4: EURUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its rebound toward the resistance level at 1.0155.

Resistance level: 1.0155, 1.0265

Support level: 1.0075, 1.0000

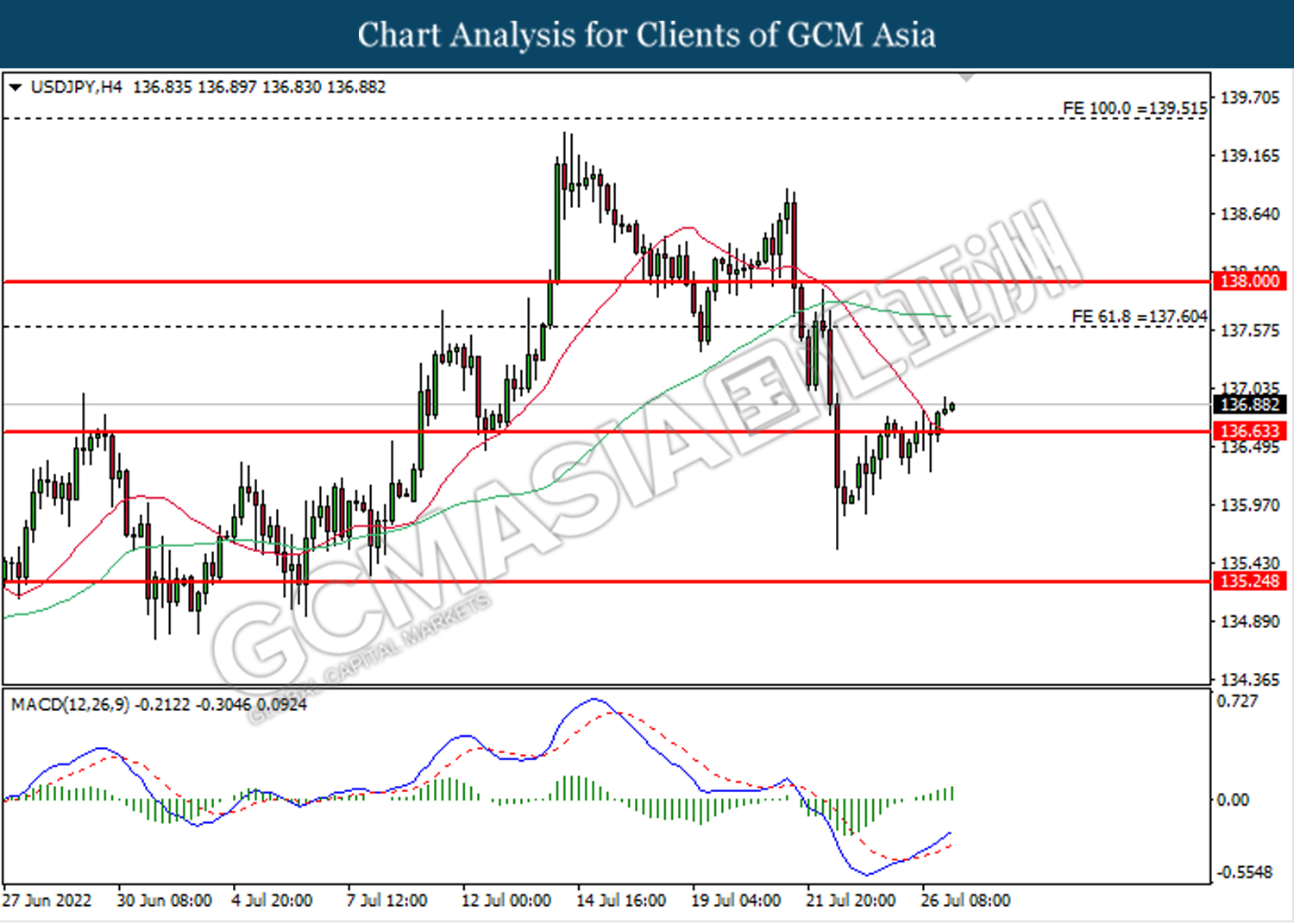

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 137.60.

Resistance level: 137.60, 138.00

Support level: 136.65, 135.25

AUDUSD, Daily: AUDUSD was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the trendline.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

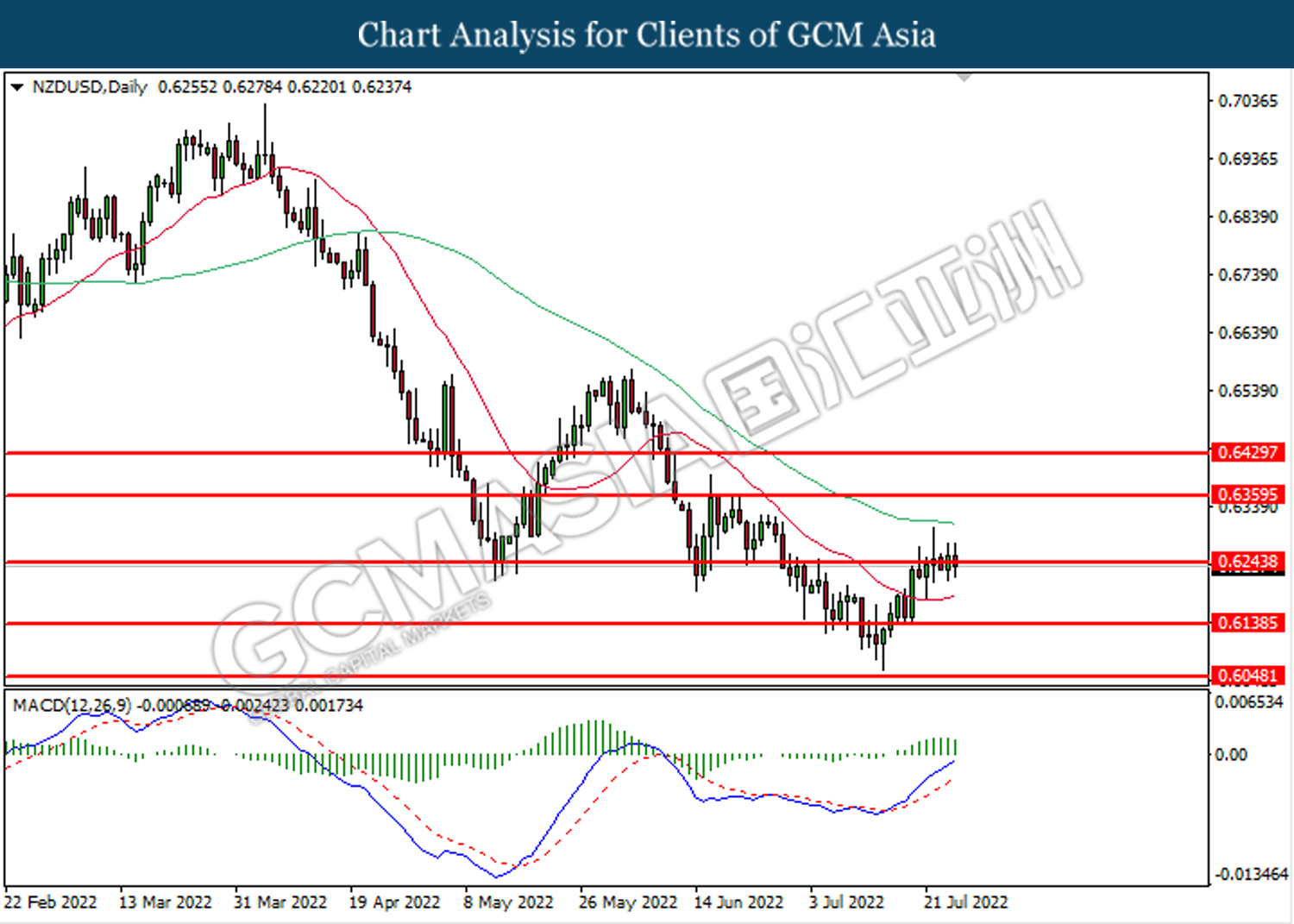

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, H4: USDCAD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2825.

Resistance level: 1.2925, 1.2985

Support level: 1.2825, 1.2755

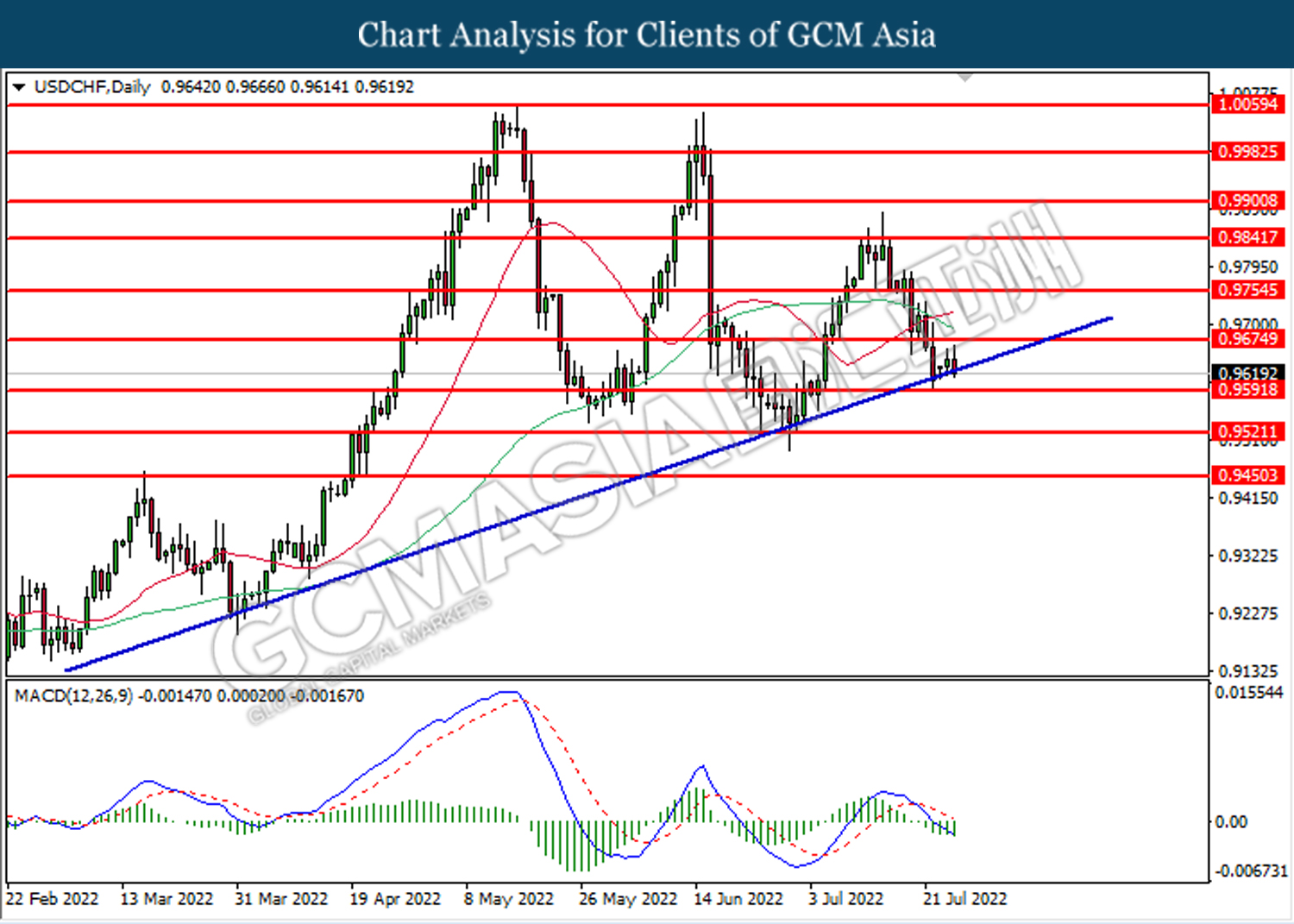

USDCHF, Daily: USDCHF was traded lower while currently retesting the upward trendline. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

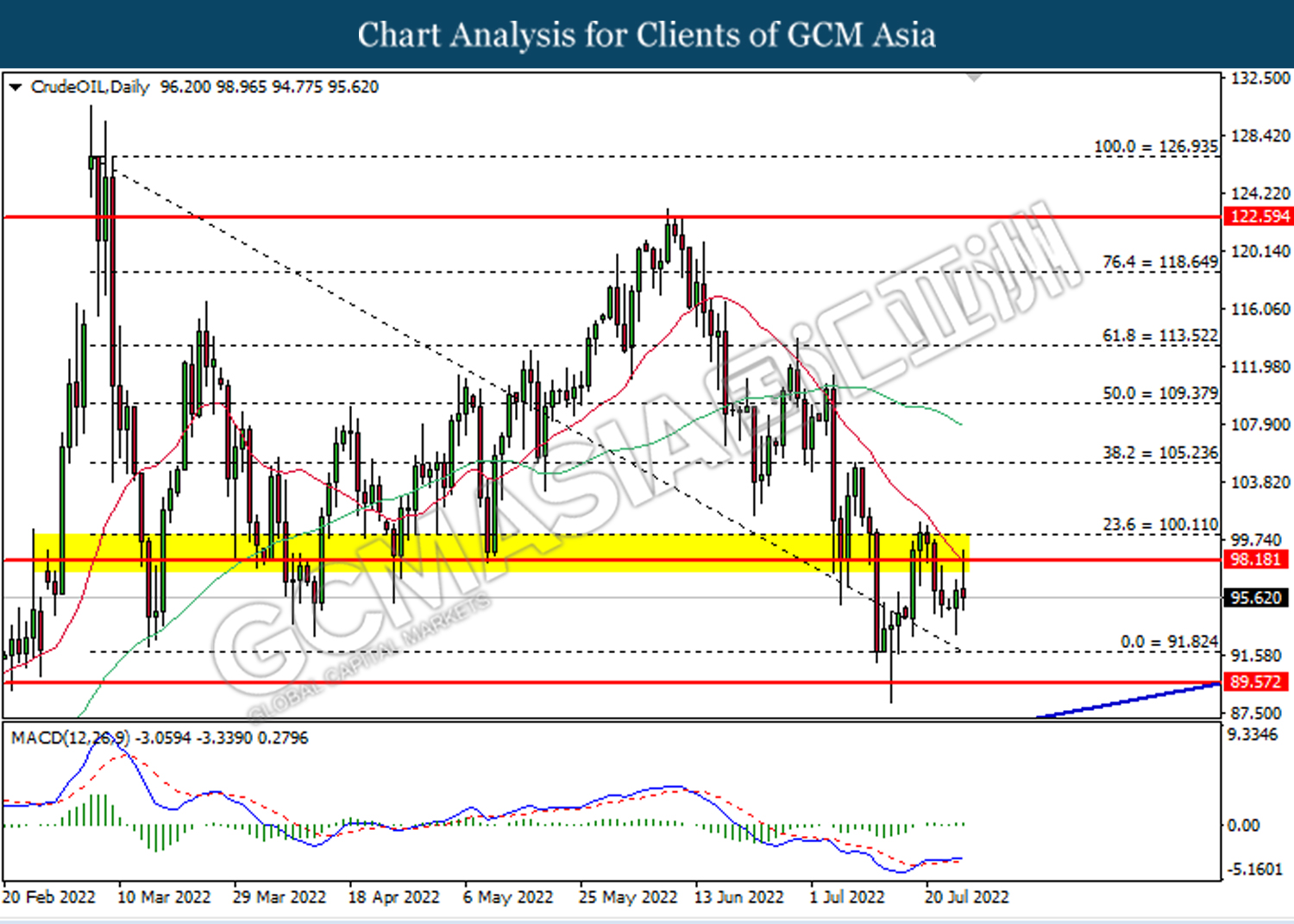

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 98.20. MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

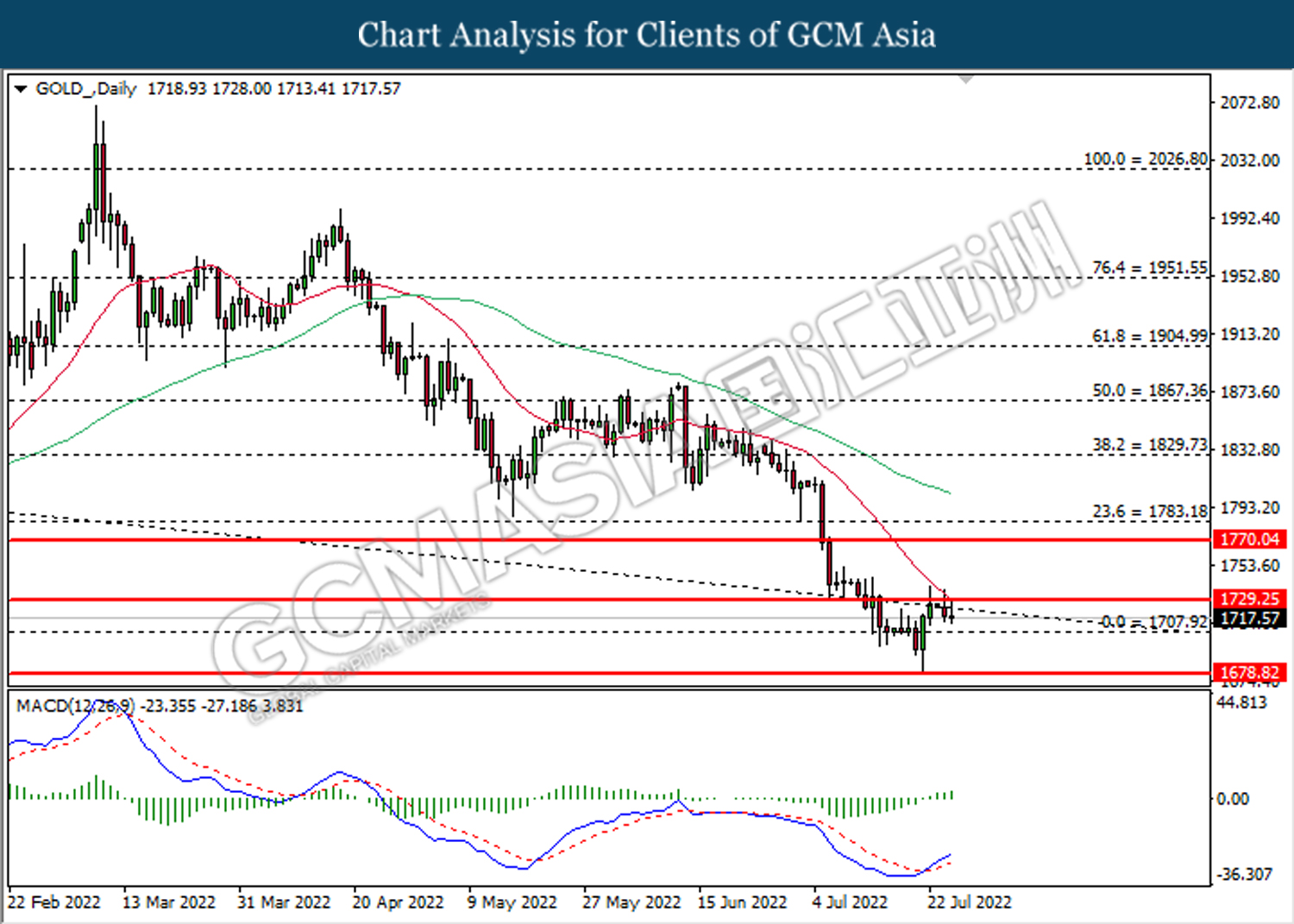

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1729.25. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical rebound in short term.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80