27 July 2022 Afternoon Session Analysis

Euro slumped upon heightening energy crisis risk.

The EUR/USD which traded by majority of investors dropped significantly on yesterday trading session amid the rising concerns upon energy supply shortage in European. According to Reuters, EU energy commissioner Kadri Simson claimed on Tuesday that Europe would face a massive supply gap if Russia fully cuts off gas supply through Nord Stream 1 in July. Besides, she reiterated that 15% of gas usage in Europe was reduced in order to preserve supplies in case of a slowdown in Russian gas inflows. The shortage of gas supplies would bring negative prospects toward economic progression in Europe it was one of the largest dependent on commodities. In addition, US Dollar surged following the IMF lowered its global growth forecast again on Tuesday, which causing Euro extended its losses. The growth cut from a prediction in April of 3.6% to 3.2% in 2022 as well as 2023 growth forecast lowered to 2.9% from the April estimate of 3.6%. The pessimistic economic outlook had prompted investors to shift their capitals toward safe-haven assets such as US Dollar. As of writing, EUR/USD appreciated by 0.31% to 1.0145.

In the commodities market, the crude oil price depreciated by 0.04% to 94.95 per barrel as of writing over the soaring concerns on global economic downturn. On the other hand, the gold price eased by 0.15% to 1715.45 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Statement

(28th July)

02:00 USD FOMC Press Conference

(28th July)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jun) | 0.7% | 0.2% | – |

| 22:30 | USD – Pending Home Sales (MoM) (Jun) | 0.7% | -1.5% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.466M | -1.037M | – |

| 02:00

(28thJuly)

|

USD – Fed Interest Rate Decision | 1.75% | 2.50% | – |

Technical Analysis

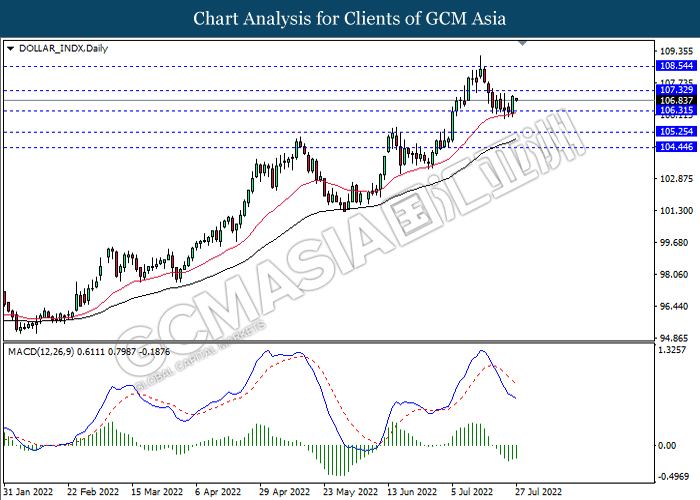

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 107.30, 108.55

Support level: 106.30, 105.25

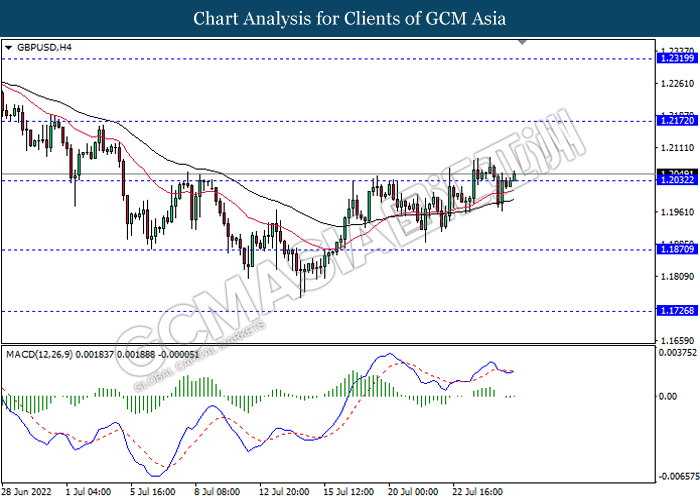

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

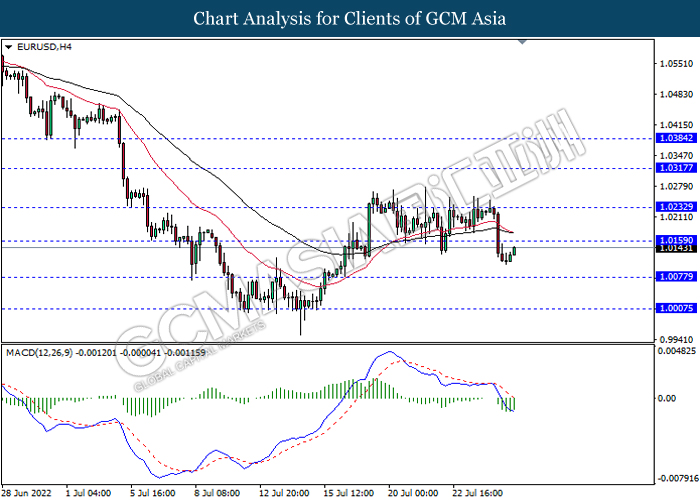

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0160, 1.0230

Support level: 1.0075, 1.0005

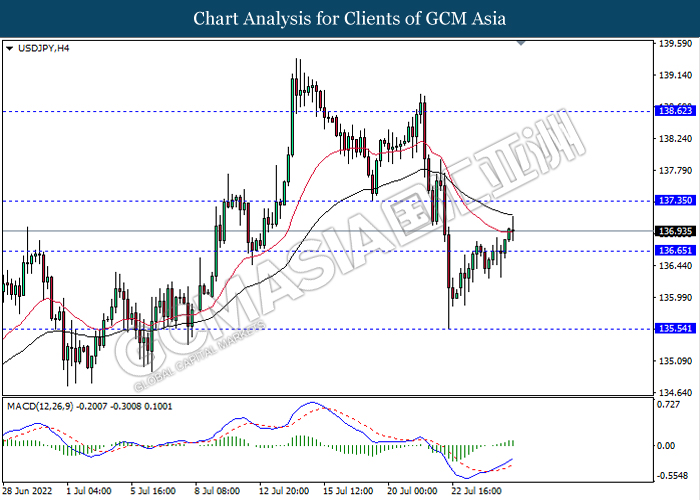

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 137.35, 138.60

Support level: 136.65, 135.55

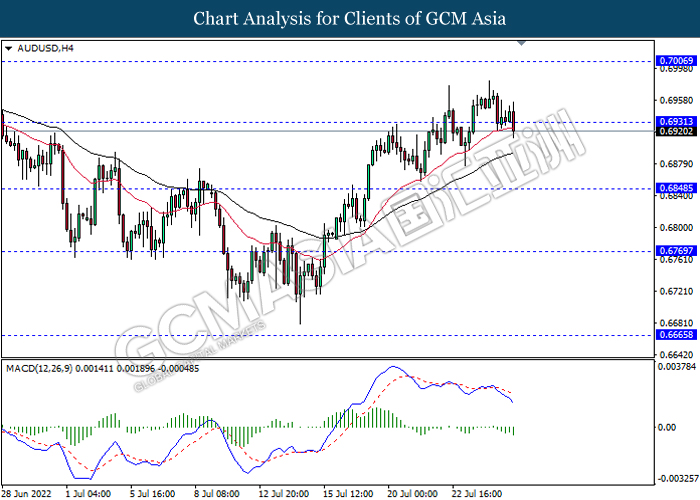

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

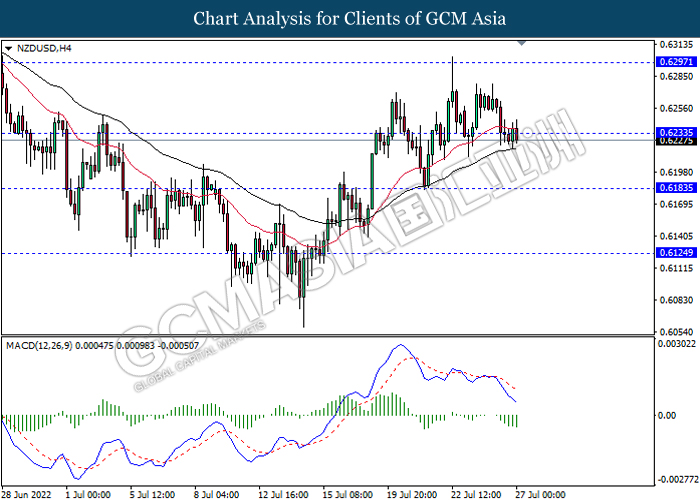

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6235, 0.6295

Support level: 0.6185, 0.6125

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

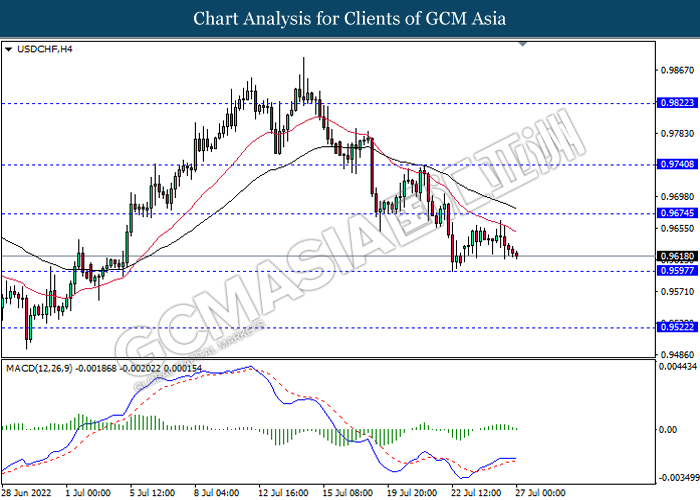

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

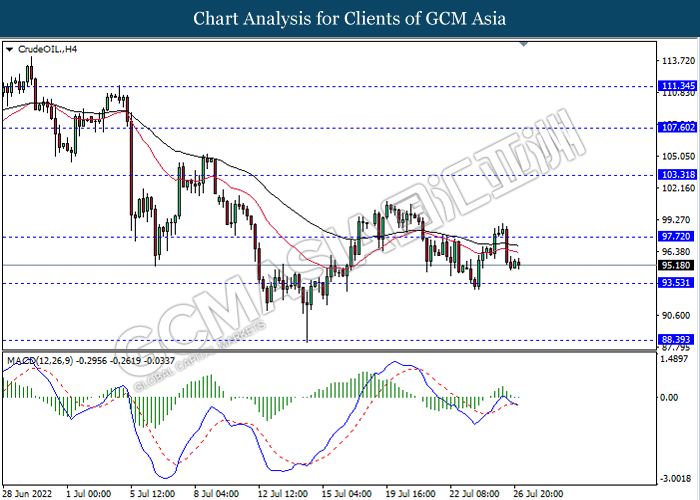

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

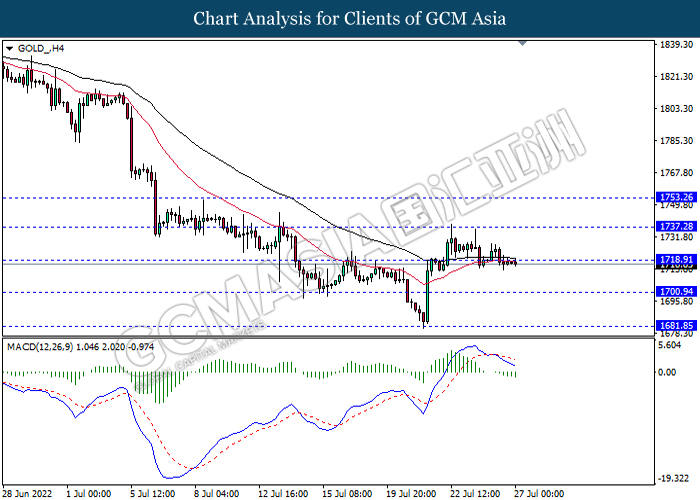

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85