28 July 2022 Morning Session Analysis

US Dollar slipped after Fed unleashed its rate hike decision.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday after the Federal Reserve announced its interest rate decision. According to the FOMC meeting in the early day, Fed had raised its interest rate by 75 basis point to 2.50%, which meet the consensus forecast. As the second consecutive 0.75% rate hikes did not surprise the market participants as well as the market had already digested the information about the interest rate increase, it stoked a shift in sentiment toward other assets which having better prospects. Nonetheless, Federal Reserve Chairman Jerome Powell claimed that the central bank would highly focus on the economic data in order to determine future moves at the September meeting. On the economic data front, the Dollar Index extended its losses amid the bearish economic data. According to National Association of Realtors, the US Pending Home Sales MoM for June notched down from the previous reading of 0.4% to -8.6%, missing the market expectation of -1.5%. The downbeat economic data had dialed down the market optimism toward economy progression in the US. As of writing, the Dollar Index eased by 0.66% to 106.34.

In the commodities market, the crude oil price appreciated by 0.90% to $98.15 per barrel as of writing. The US Crude Oil Inventories had decreased by 4.523M, which more than the market forecast of -1.037M. In addition, the gold price surged by 0.98% to $1736.00 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q2) | -1.60% | 0.40% | – |

| 20:30 | USD – Initial Jobless Claims | 251K | 253K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 107.30, 108.55

Support level: 106.30, 105.25

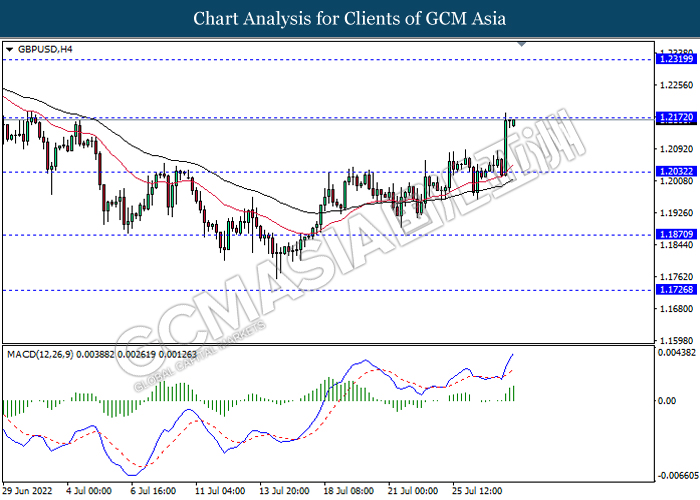

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

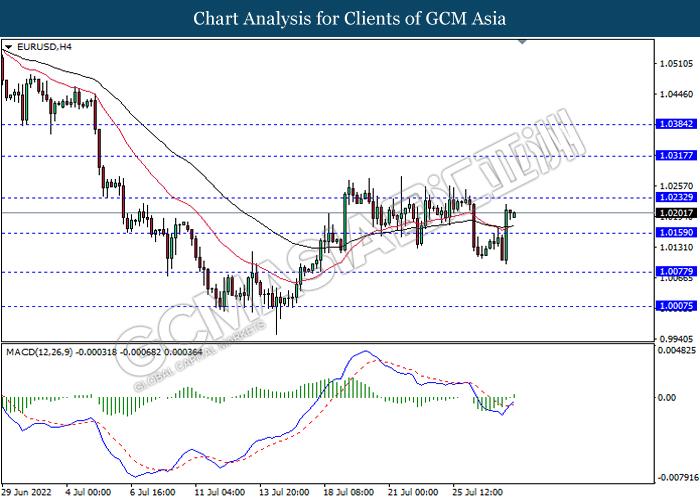

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

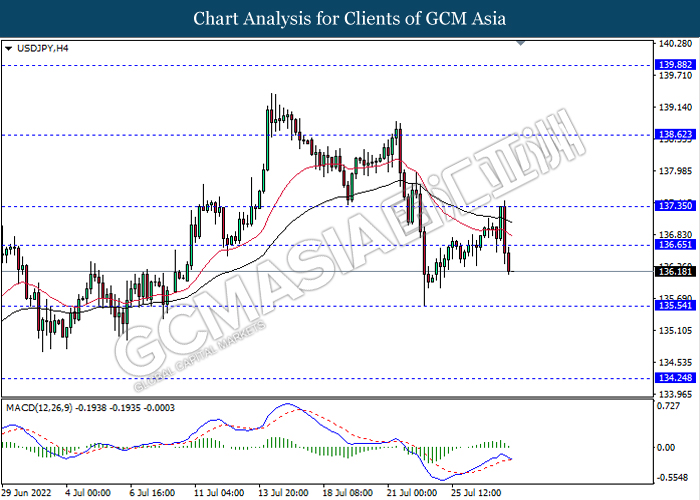

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

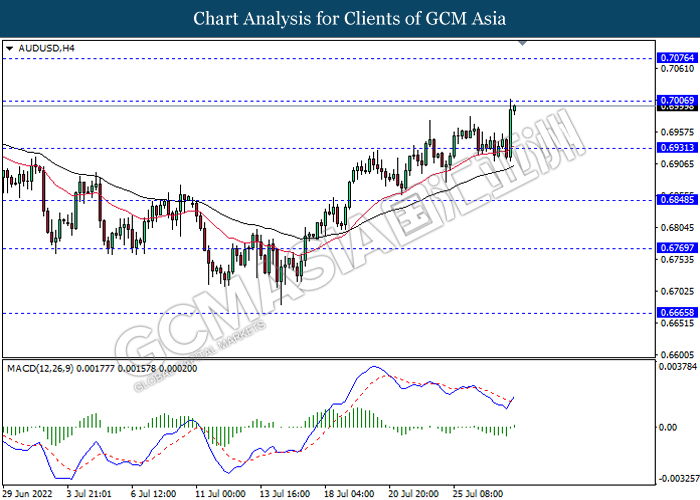

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

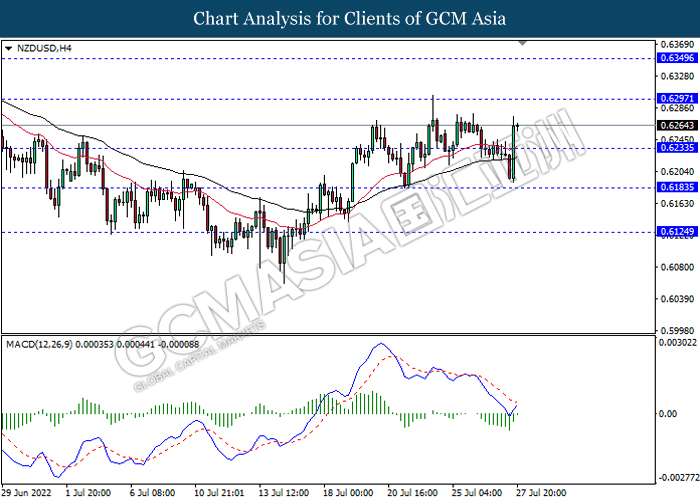

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

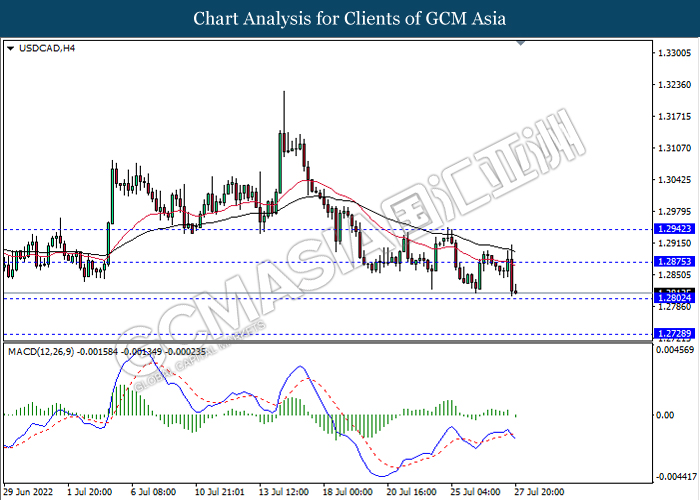

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

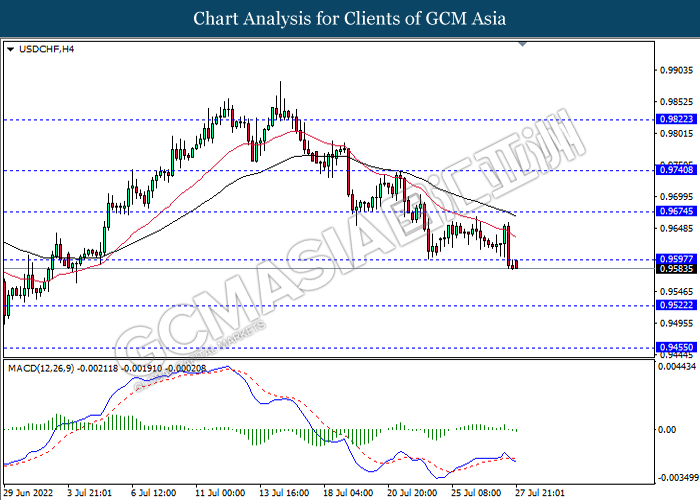

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

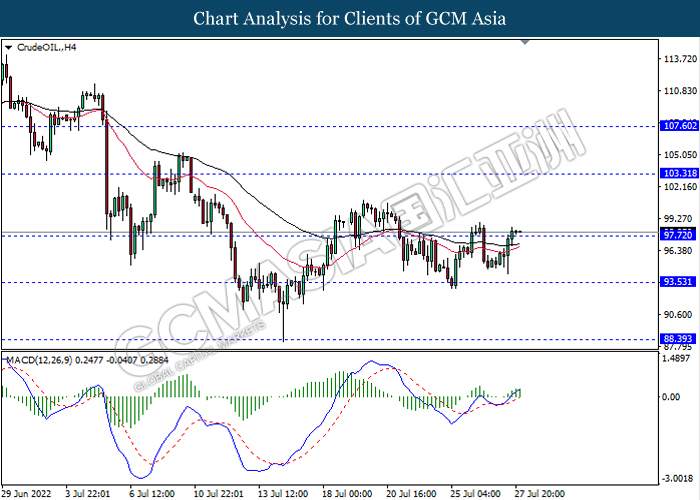

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1753.25, 1766.20

Support level: 1737.30, 1718.90