29 July 2022 Morning Session Analysis

US Dollar dropped amid weakened economic data.

The Dollar Index which traded against a basket of six major currencies eased since yesterday after the bearish economic data has been released, which dragged down the appeal of US Dollar. According to Bureau of Economic Analysis, the US Gross Domestic Product (GDP) for the second quarter posted at the reading of -0.9%, missing the market forecast of 0.5%. Besides, the US Initial Jobless Claims came in at the reading of 256K, higher than the consensus expectation of 253K. These two economic data had showed that the economy progression in the US was in recession as well as the current US labor market remained fragile, which tamped down investors’ interest to invest in the US currency. In addition, the Dollar Index extended its losses after Apple reported its higher-than-expected fiscal earnings, which prompted investors to turn their attention to risk-appetite market such as US stocks. As of writing, the Dollar Index depreciated by 0.28% to 106.03.

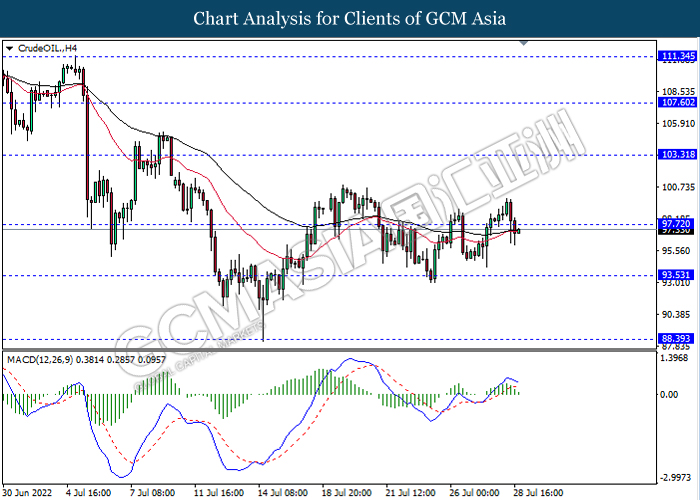

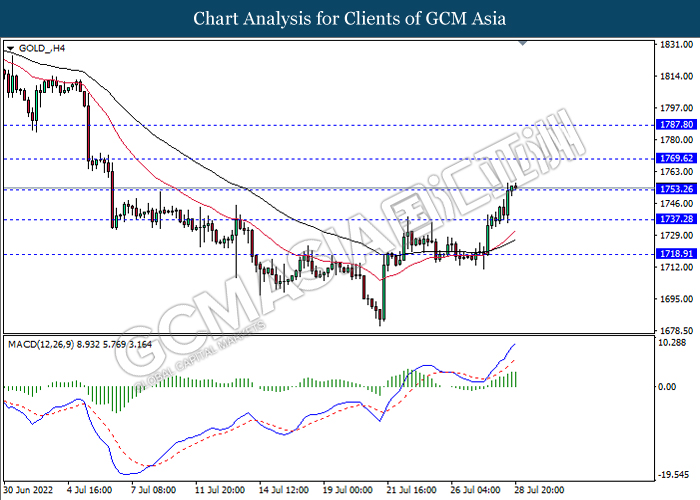

In the commodities market, the crude oil price appreciated by 0.94% to $97.33 per barrel as of writing after a sharp decline throughout the overnight trading session as the global recession fears keep hovering in the market. On the other hand, the gold price appreciated by 0.16% to $1753.05 per troy ounce as of writing over the slip of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Jul) | 133K | 15K | – |

| 16:00 | EUR – German GDP (QoQ) (Q2) | 0.20% | 0.10% | – |

| 17:00 | EUR – CPI (YoY) (Jul) | 8.60% | 8.70% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Jun) | 0.30% | 0.50% | – |

| 20:30 | CAD – GDP (MoM) (May) | 0.30% | -0.20% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

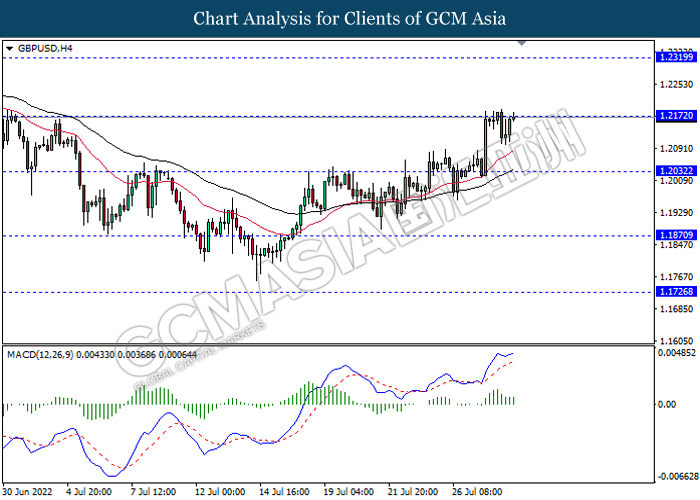

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

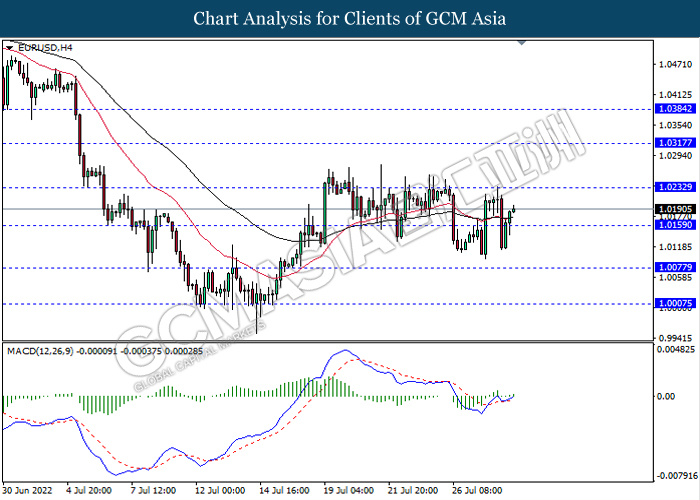

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

USDJPY, H4: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 135.55, 136.65

Support level: 134.25, 133.10

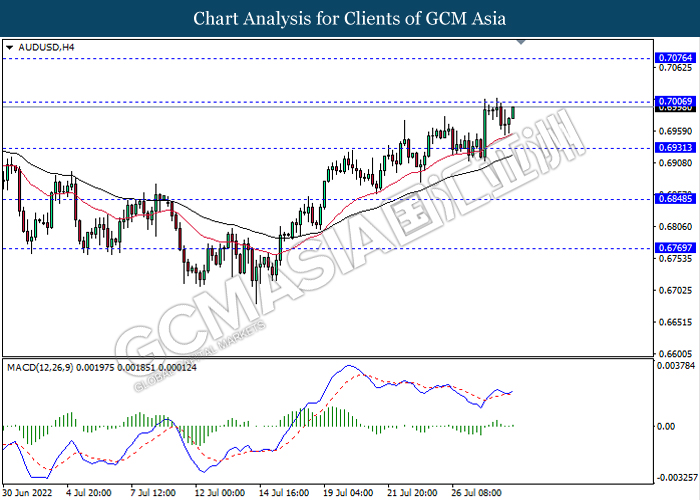

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

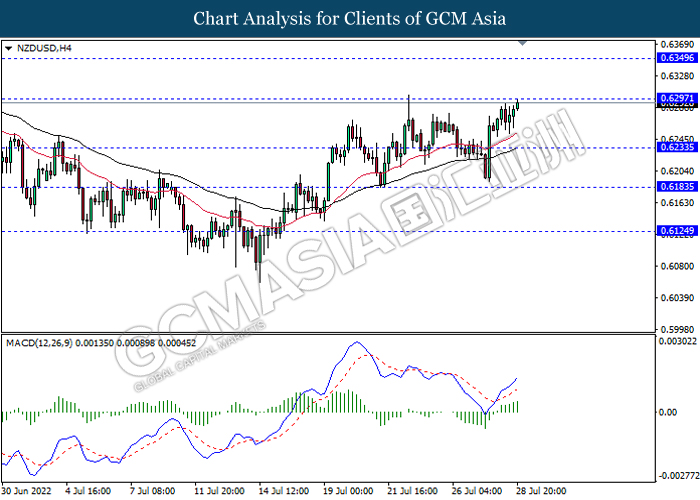

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

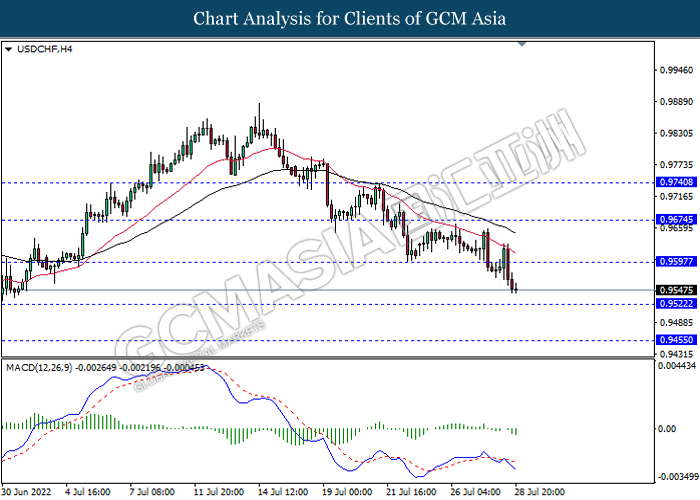

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1769.60, 1787.80

Support level: 1753.25, 1737.30