1 August 2022 Afternoon Session Analysis

Eurozone CPI rose higher than expected, Euro heightened.

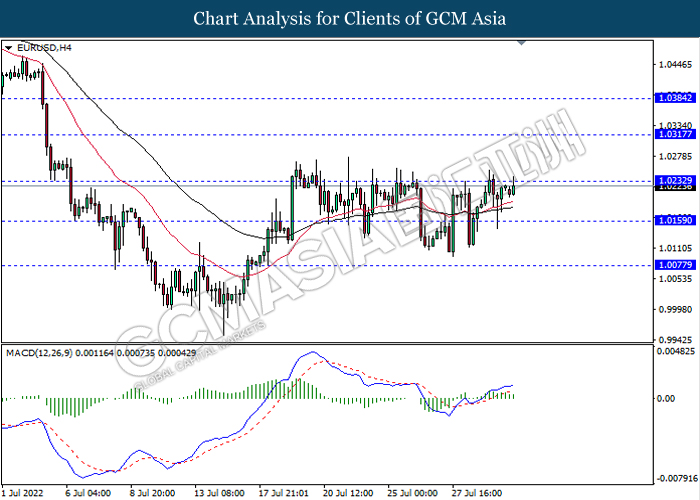

The EUR/USD which traded by majority of investors rallied on last Friday after the Eurozone CPI data released. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY posted at the reading of 8.9%, exceeding the market expectation of 8.6%. The higher-than-expected CPI data showed that the soaring inflation risk keep lingering in the European, which increasing the odds of rate hikes from European Central Bank (ECB) in order to tamp down rising prices. Nonetheless, the gains experienced by Euro has been limited over the bearish economic data. The Germany Unemployment Change for July came in at the reading of 48K, which higher than the consensus forecast of 15K. Besides that, the Germany Gross Domestic Product (GDP) QoQ in second quarter notched down from the previous reading of 0.8% to 0.0%, missing the 0.1% as widely expected. The downbeat economic data had raised the market concerns on the economy recession in Eurozone, which spurred bearish momentum on the Euro. As of writing, EUR/USD appreciated by 0.11% to 1.0229.

In the commodities market, the crude oil price depreciated by 1.42% to $97.27 per barrel as of writing after an unexpected drop in Chinese factory activity raised concerns over slowing crude demand in the world’s second largest economy. On the other hand, the gold price edged down by 0.22% to $1778.15 per troy ounce as of writing. However, the overall trend of gold remained bullish amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Jul) | 49.2 | 49.2 | – |

| 16:30 | GBP – Manufacturing PMI (Jul) | 52.2 | 52.2 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 53.0 | 52.0 | – |

Technical Analysis

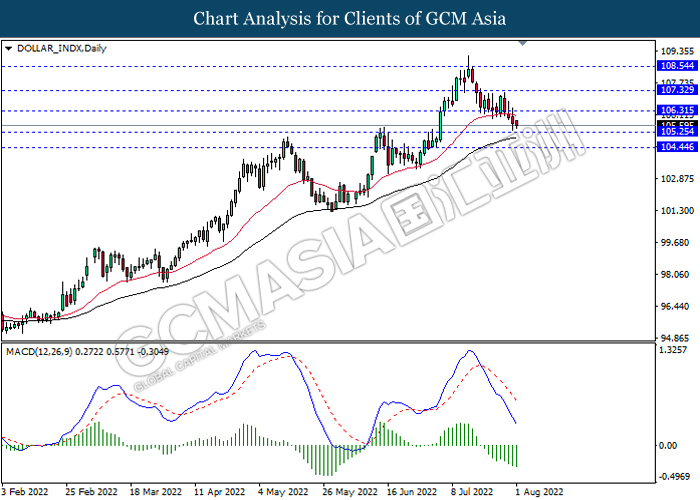

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

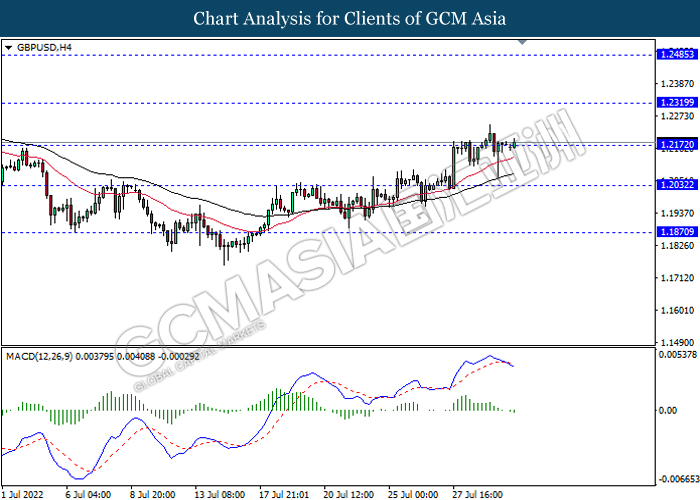

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2320, 1.2485

Support level: 1.2170, 1.2030

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

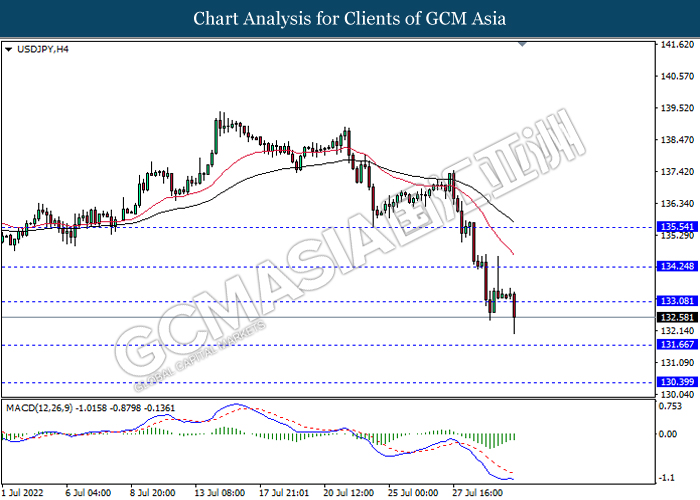

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 133.10, 134.25

Support level: 131.65, 130.40

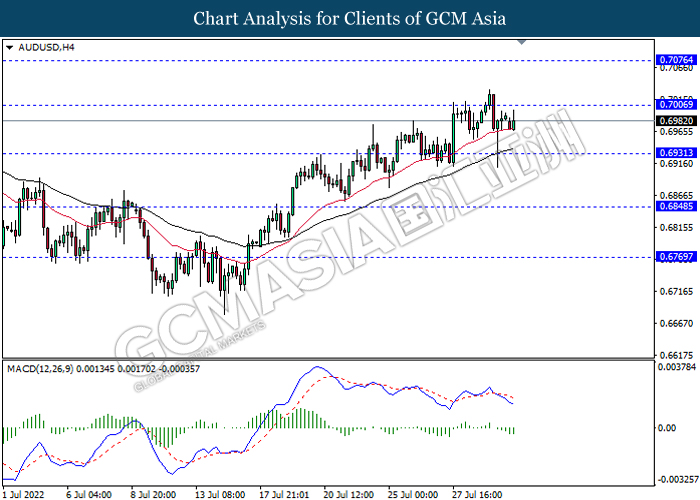

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

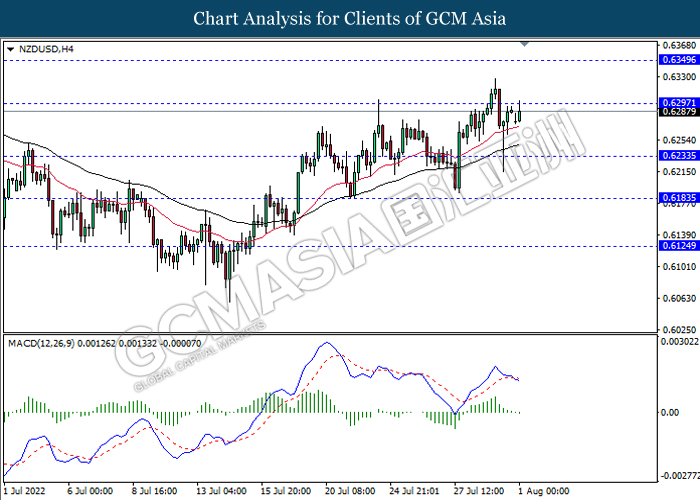

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

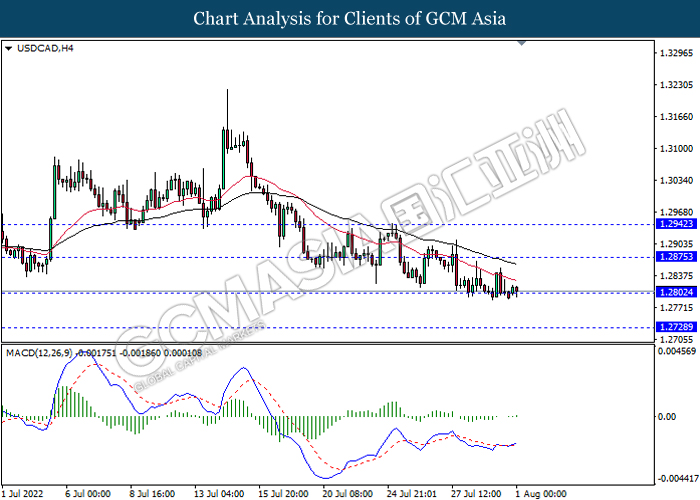

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

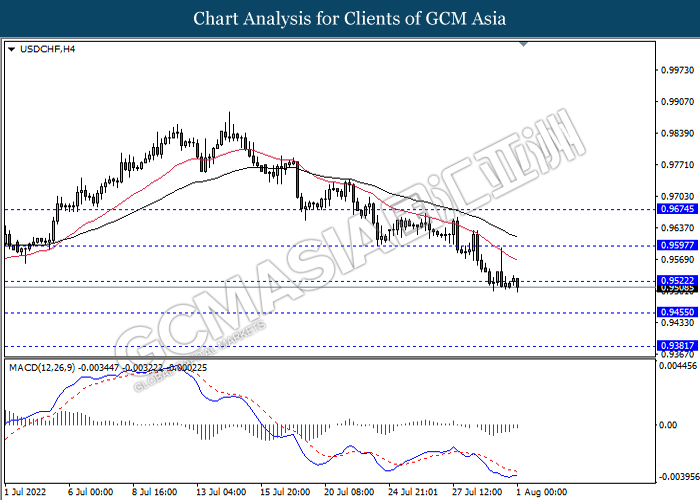

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9520, 0.9595

Support level: 0.9455, 0.9380

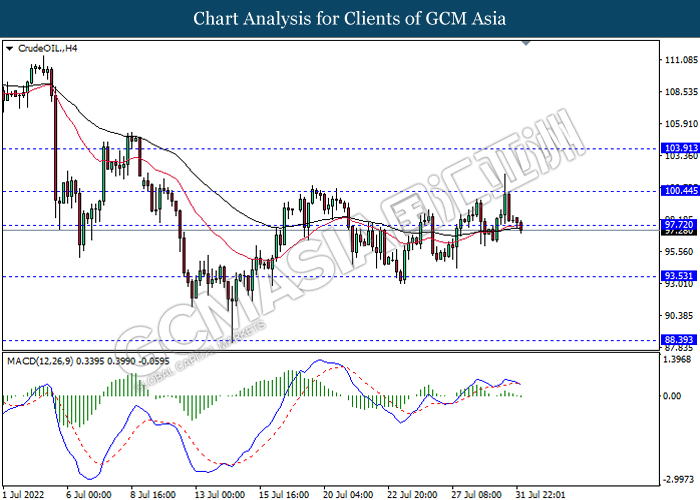

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 97.70, 100.45

Support level: 93.55, 88.40

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1769.60, 1787.80

Support level: 1753.25, 1737.30