2 August 2022 Morning Session Analysis

Dollar slumped as the tightening path of the Fed rugged.

The dollar index, which traded against a basket of six major currencies, plunged as the global investors reassessed the tightening path of the Fed while expecting the Fed will not increase the interest rate as aggressively as the majority thought. According to the Fed Rate Monitor Tool, the likelihood of a 50-basis point interest rate upward adjustment is roughly about 93%, while the possibility of 75-basis point rate hike is just about 7.0%. With that, it shows that the market participants are expecting a less aggressive rate hike would be carried out by the Federal Reserve in the upcoming meeting, which scheduled on 22 September. On data front, there was a upbeat manufacturing data which released yesterday had limited the losses of the dollar index. According to the ISM, the US ISM Manufacturing PMI came in at 52.8, stronger than the consensus forecast of 52.0. The data showed that the economic activity in the manufacturing sector has achieved a 26th consecutive month of growth since the last contraction in May 2020. Nonetheless, the eyes of the global investors are now on the crucial employment data, including Nonfarm Payroll and Unemployment Rate. As of writing, the dollar index dropped 0.47% to 105.40.

In the commodities market, the crude oil price was down 0.38% to $93.75 a barrel amid surprise contraction in Chinese factory activity, which fueled the market fears over the oil demand outlook. Besides, the gold prices appreciated by 0.04% to $1771.40 per troy ounce as the tensions between US and China heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision | 1.35% | 1.85% | – |

| 22:00 | USD – JOLTs Job Openings (Jun) | 11.254M | 11.000M | – |

Technical Analysis

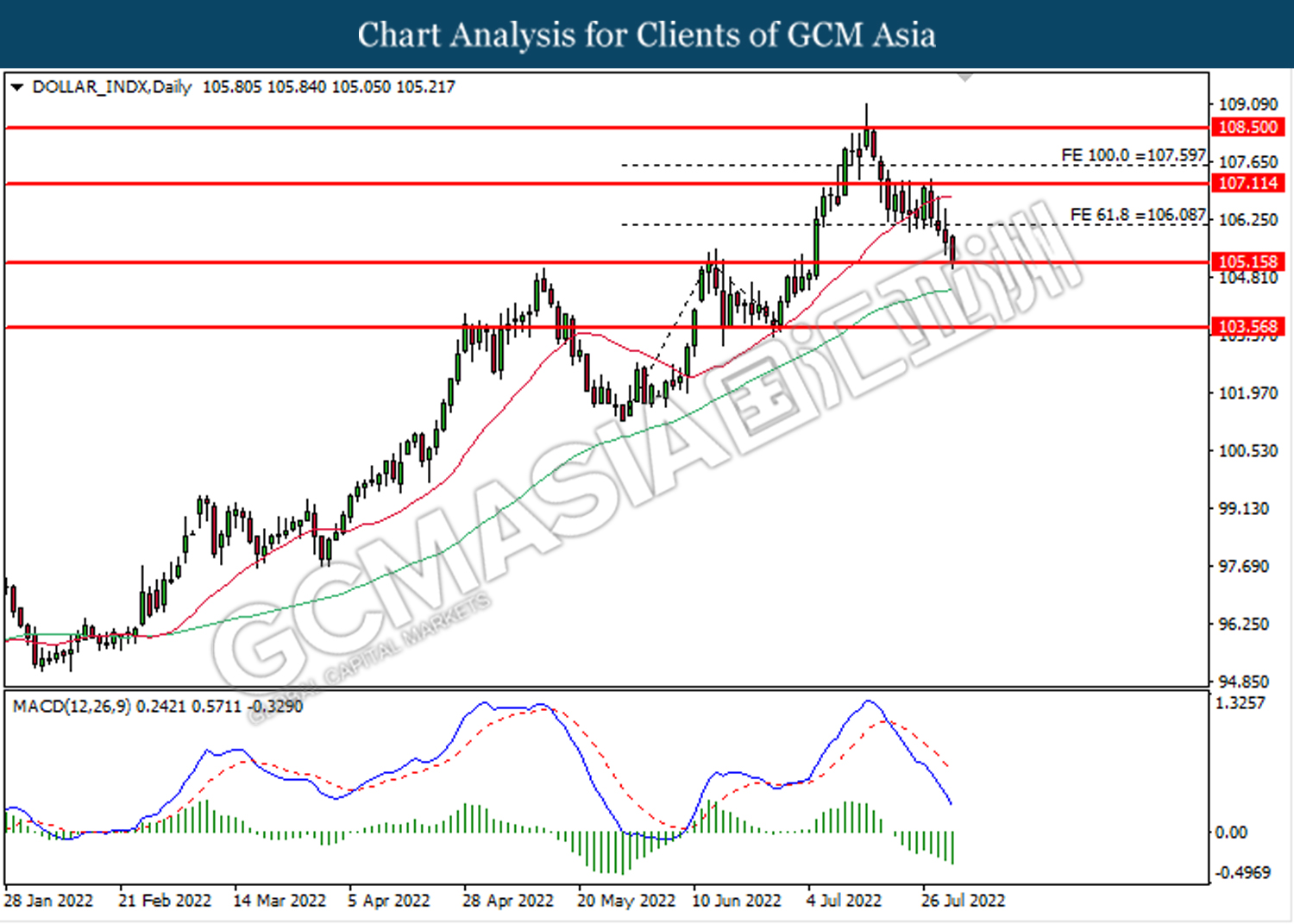

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 105.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 106.10, 107.10

Support level: 105.15, 103.55

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2355.

Resistance level: 1.2355, 1.2480

Support level: 1.2175, 1.2035

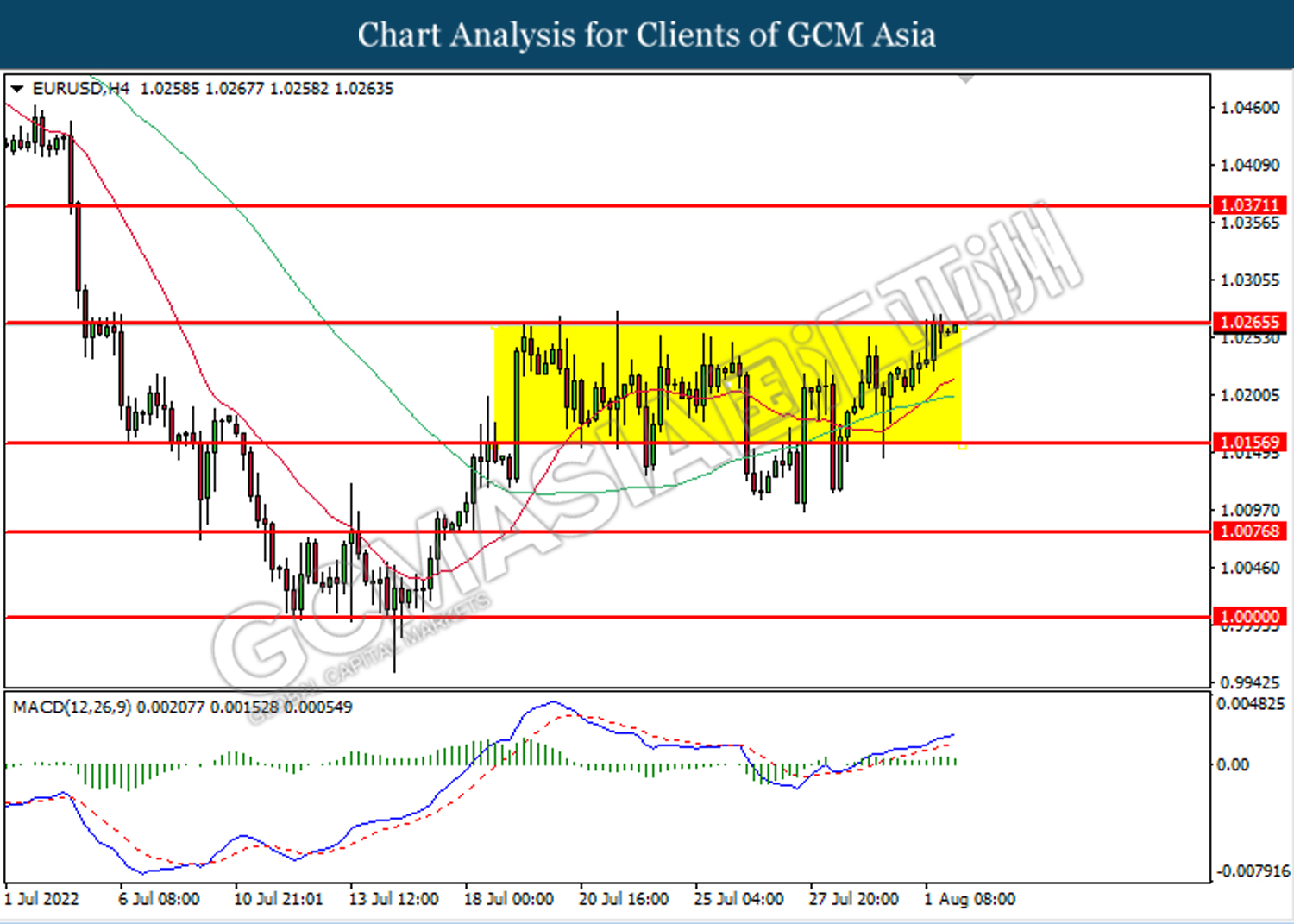

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.0265. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

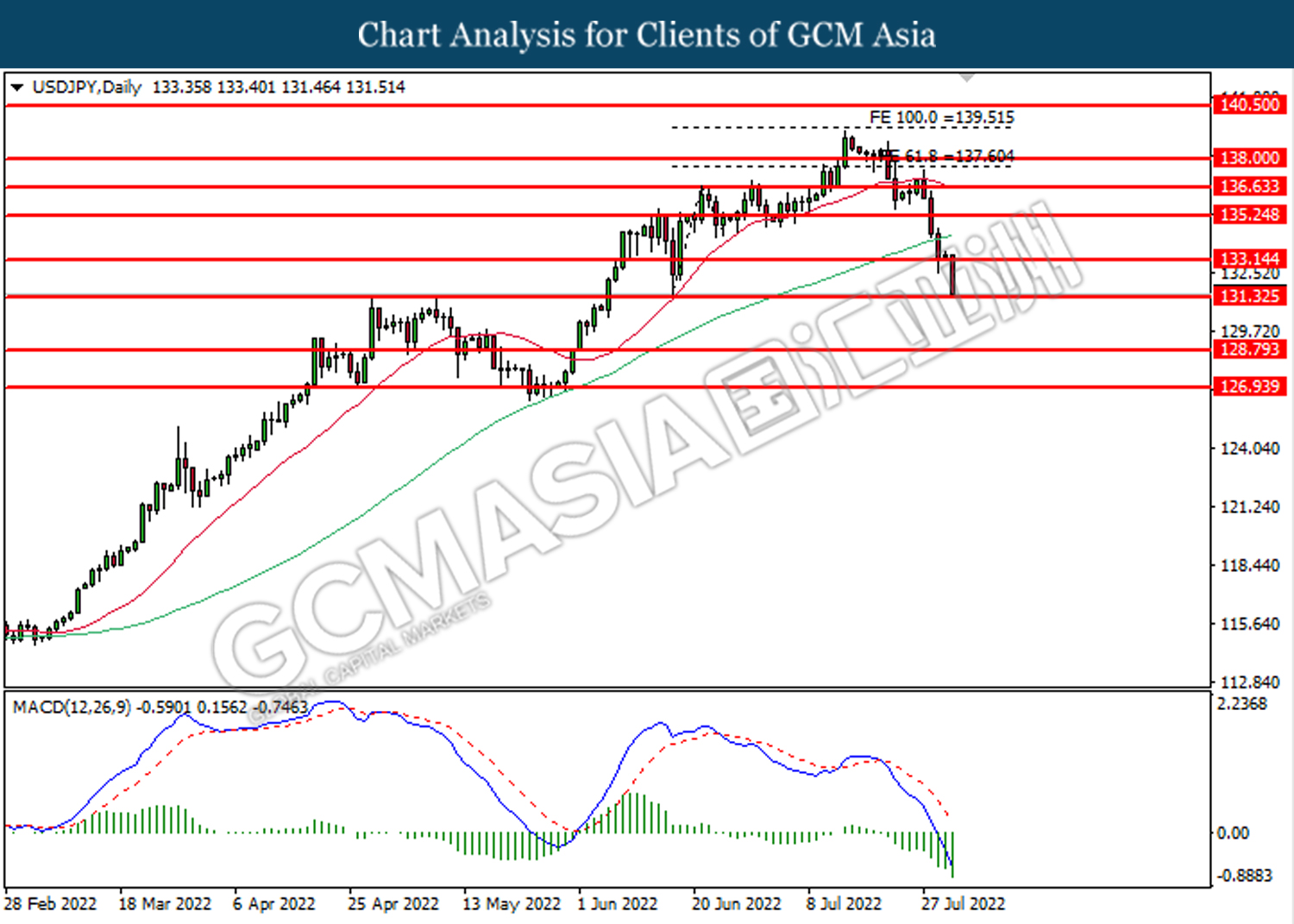

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.35. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout the support level.

Resistance level: 133.15, 135.25

Support level: 131.35, 128.80

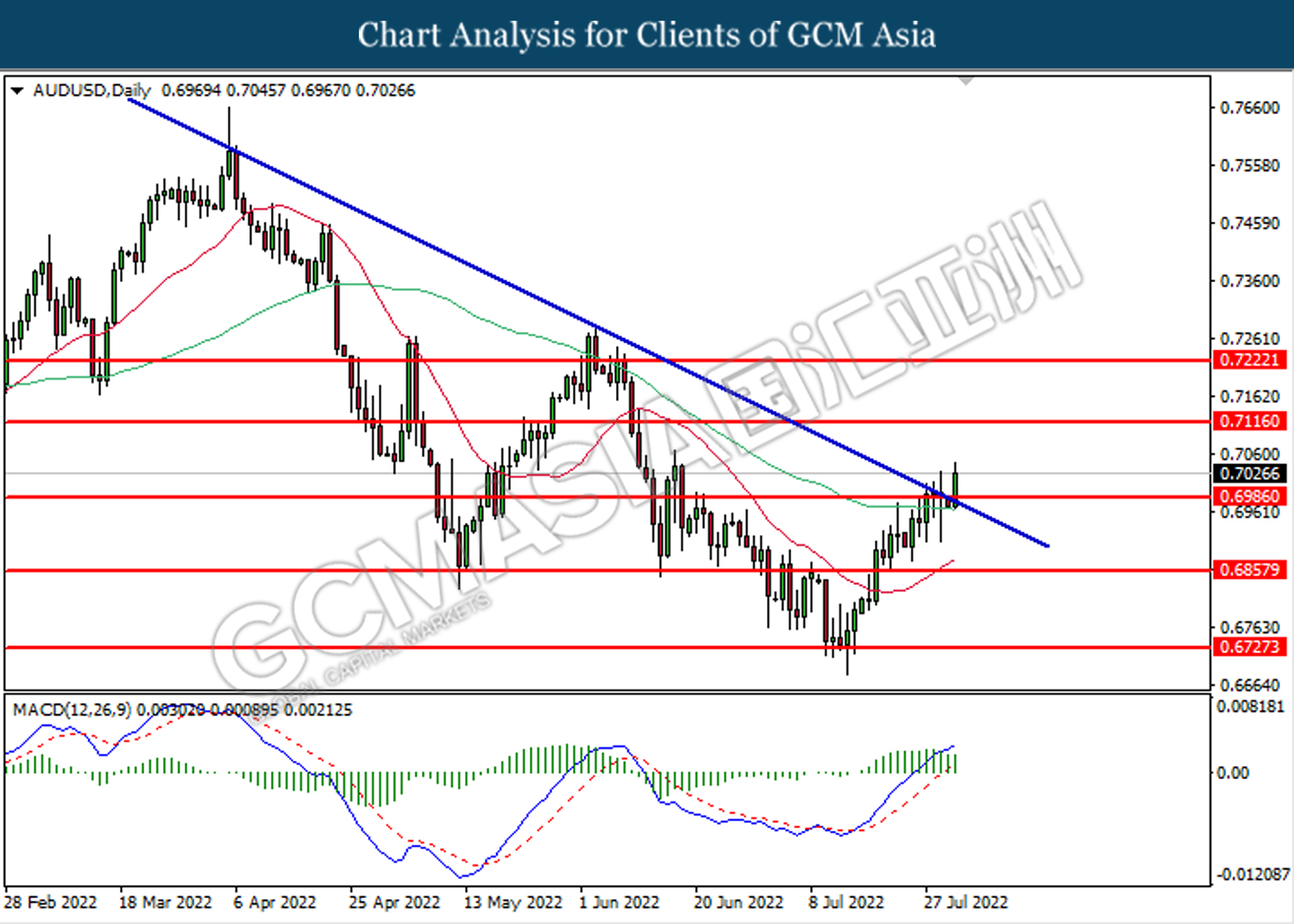

AUDUSD, Daily: AUDUSD was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the trendline.

Resistance level: 0.6985, 0.7115

Support level: 0.6655, 0.6725

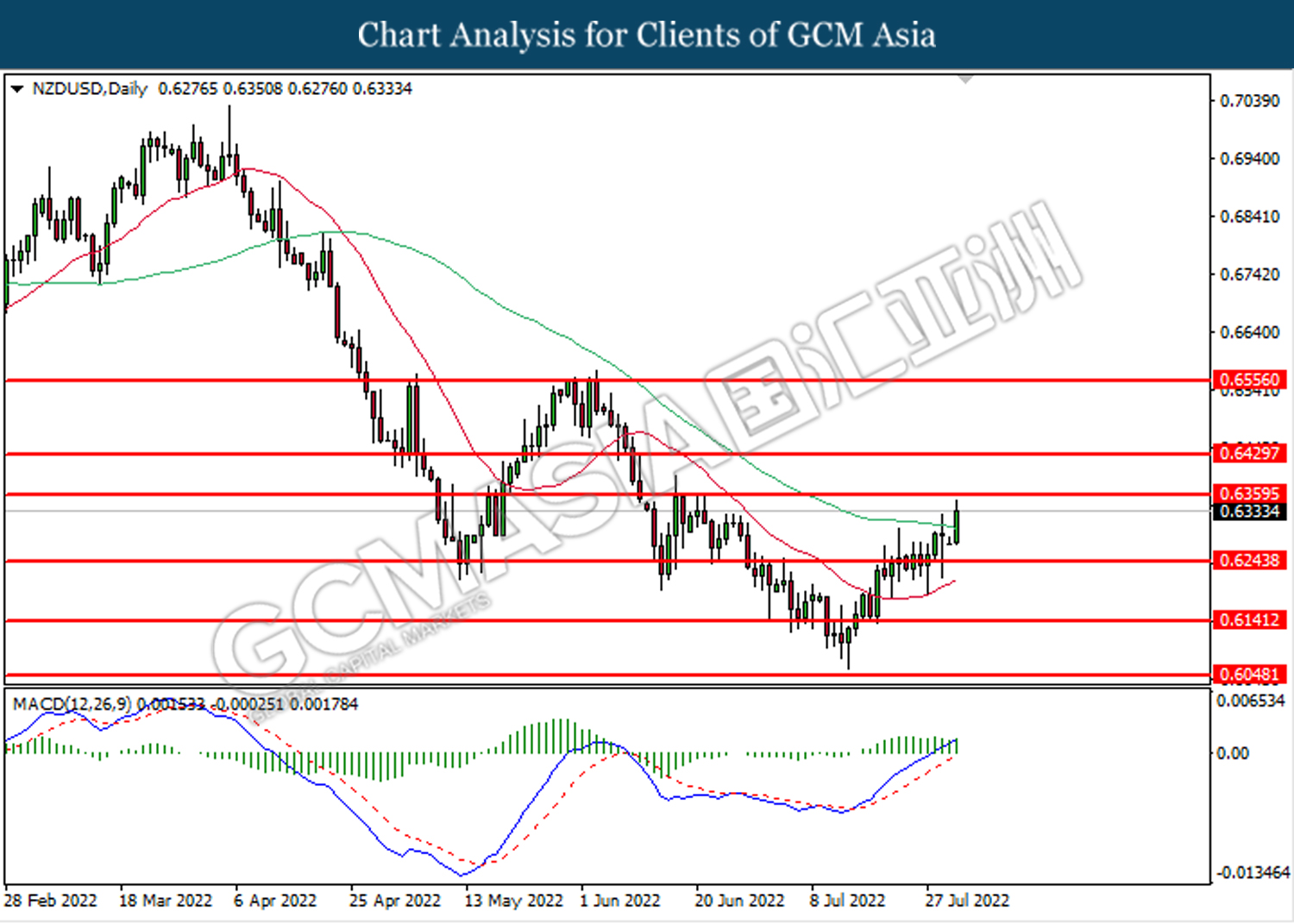

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded higher following prior rebound near the support level at 1.2805. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2925.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

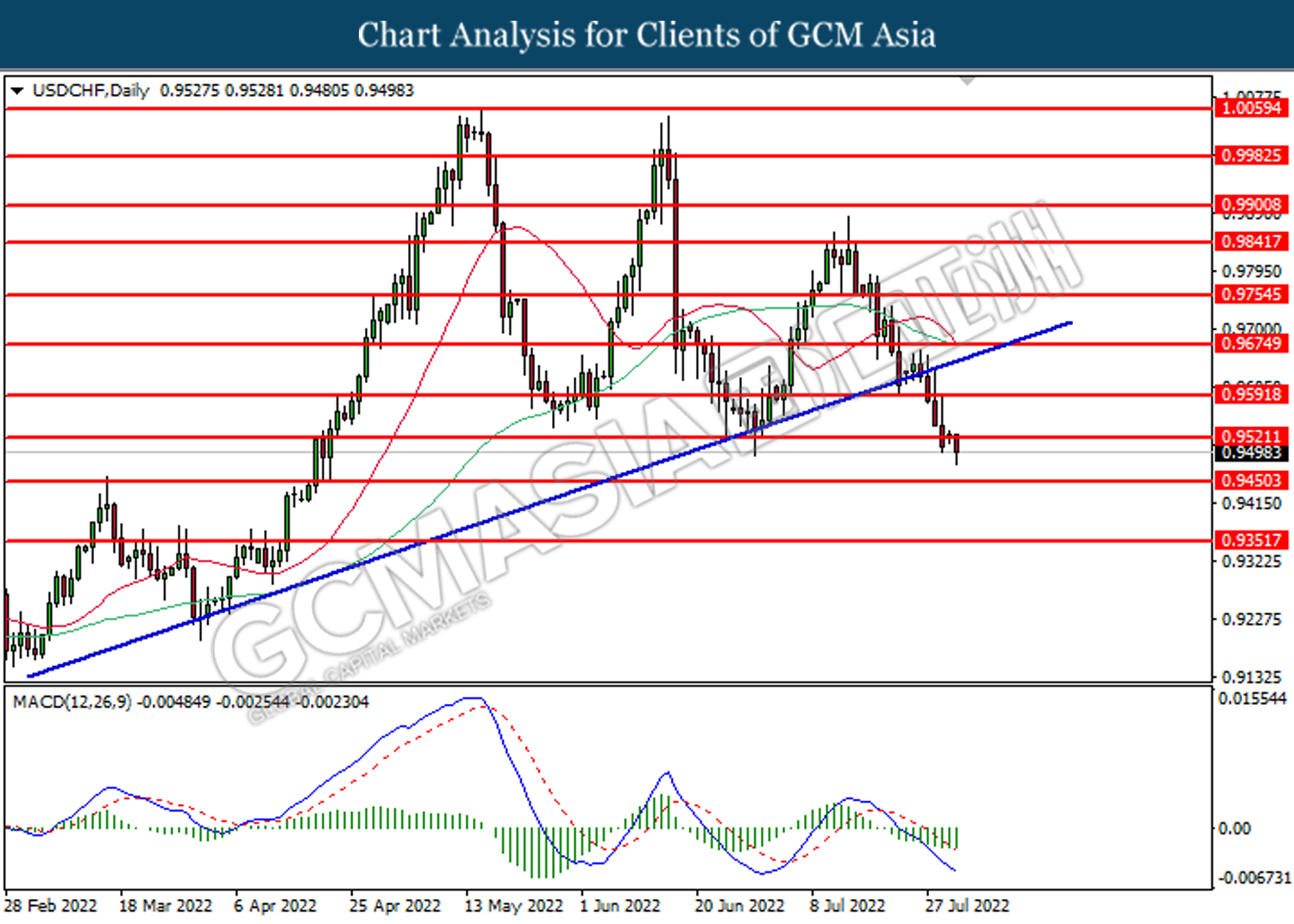

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

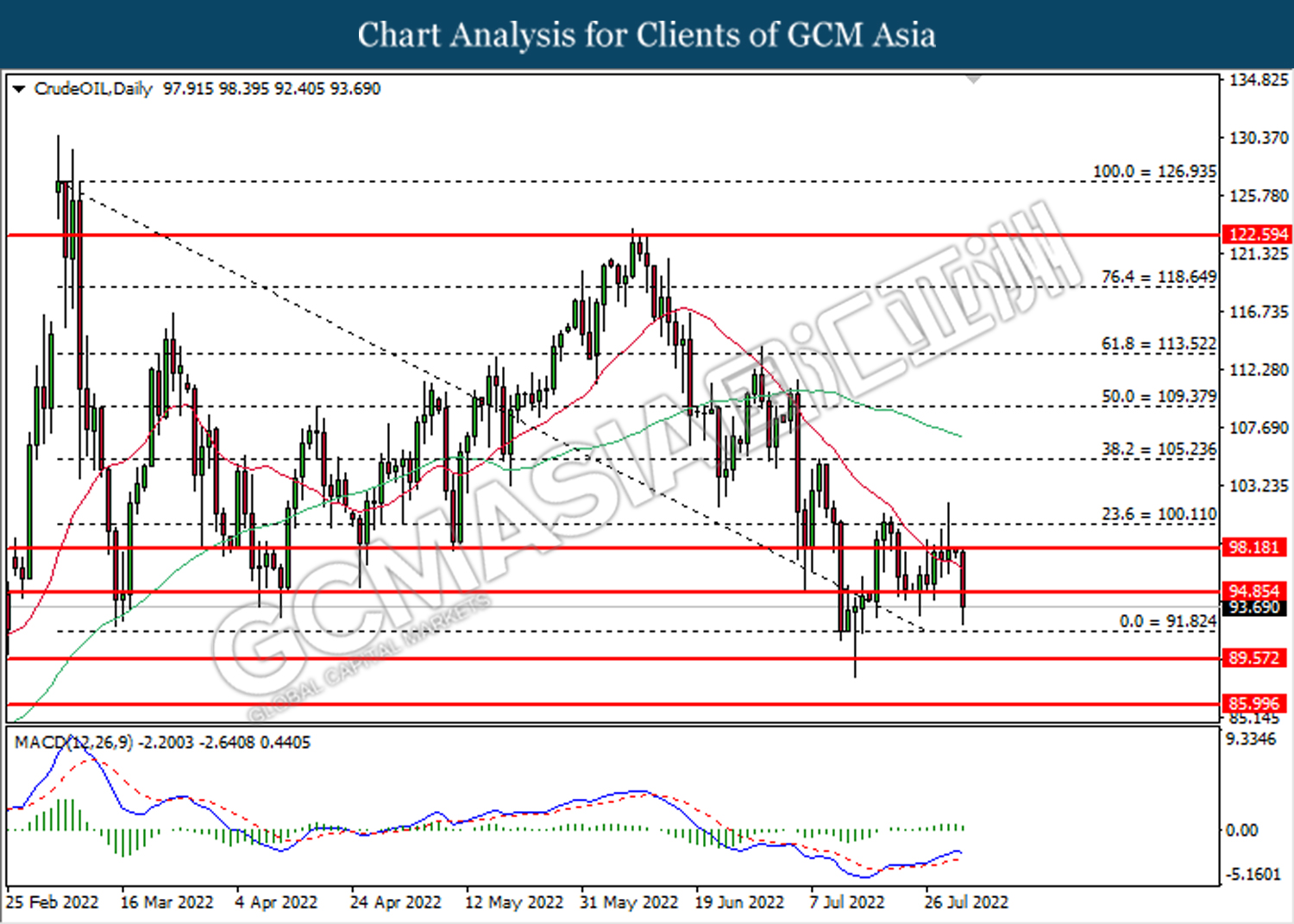

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level 94.85. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 98.20, 100.10

Support level: 94.85, 91.80

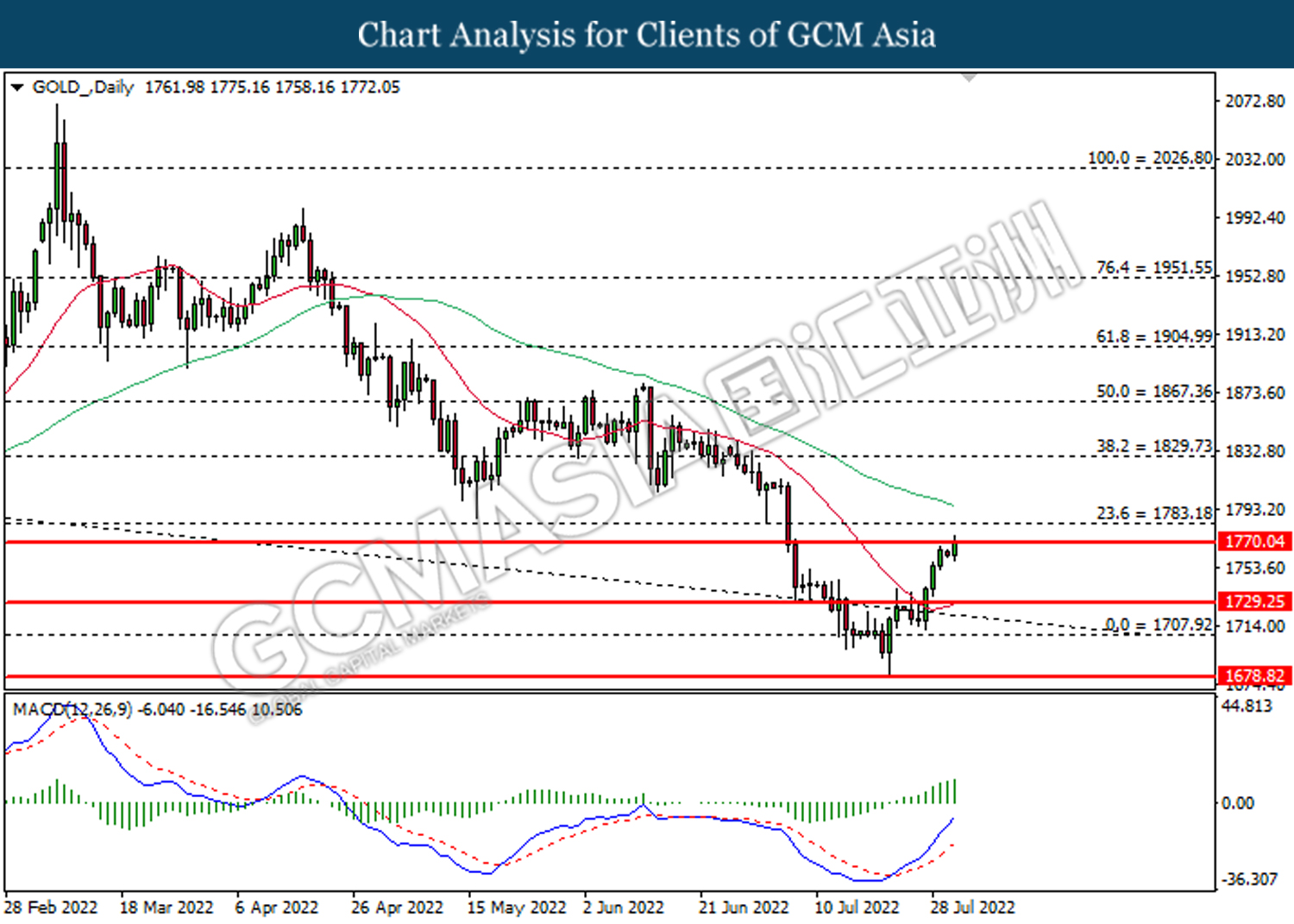

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1770.05. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90