3 August 2022 Morning Session Analysis

Dollar revived following hawkish tone from Fed officials.

The dollar index, which traded against a basket of six major currencies, rebounded sharply after falling for 4 consecutive trading days, as Fed officials hinted that more rate hikes could be expected in the near term. According to the statement from San Francisco Fed President Mary Daly, she emphasized that the US central bank still has a long way to cool the overheating economy back to normal, implying higher interest rates in the future. Besides, she also vowed that investors should not interpret the recent big interest rate as an indication of the end of rate hikes, whereby the tightening path will still be continued. On the other side, the Chicago Fed President Charles Evans has also commented that he does not rule out the possibility of raising another half point in September or a more aggressive of 75 basis point hike in the upcoming September meeting. With the hawkish tone from Fed officials, the market participants flee into the US dollar market. However, the gains of the dollar index were limited by the downbeat employment data yesterday. According to the Bureau of Labor Statistics, the US JOLTs Job Openings came in at 10.698M, missing the consensus forecast of 11.000M, providing insight that the US employment market are cooling off.

In the commodities market, the crude oil price was down 0.03% to $93.75 a barrel amid the market concern over the global recession outweigh the supply tight issues, while market participants are waiting for the oil output plan from OPEC+. Besides, the gold prices dropped 0.08% to $1759.50 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Jul) | 52.8 | 52.8 | – |

| 16:30 | GBP – Services PMI (Jul) | 53.3 | 53.3 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 55.3 | 53.5 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -4.523M | – | – |

Technical Analysis

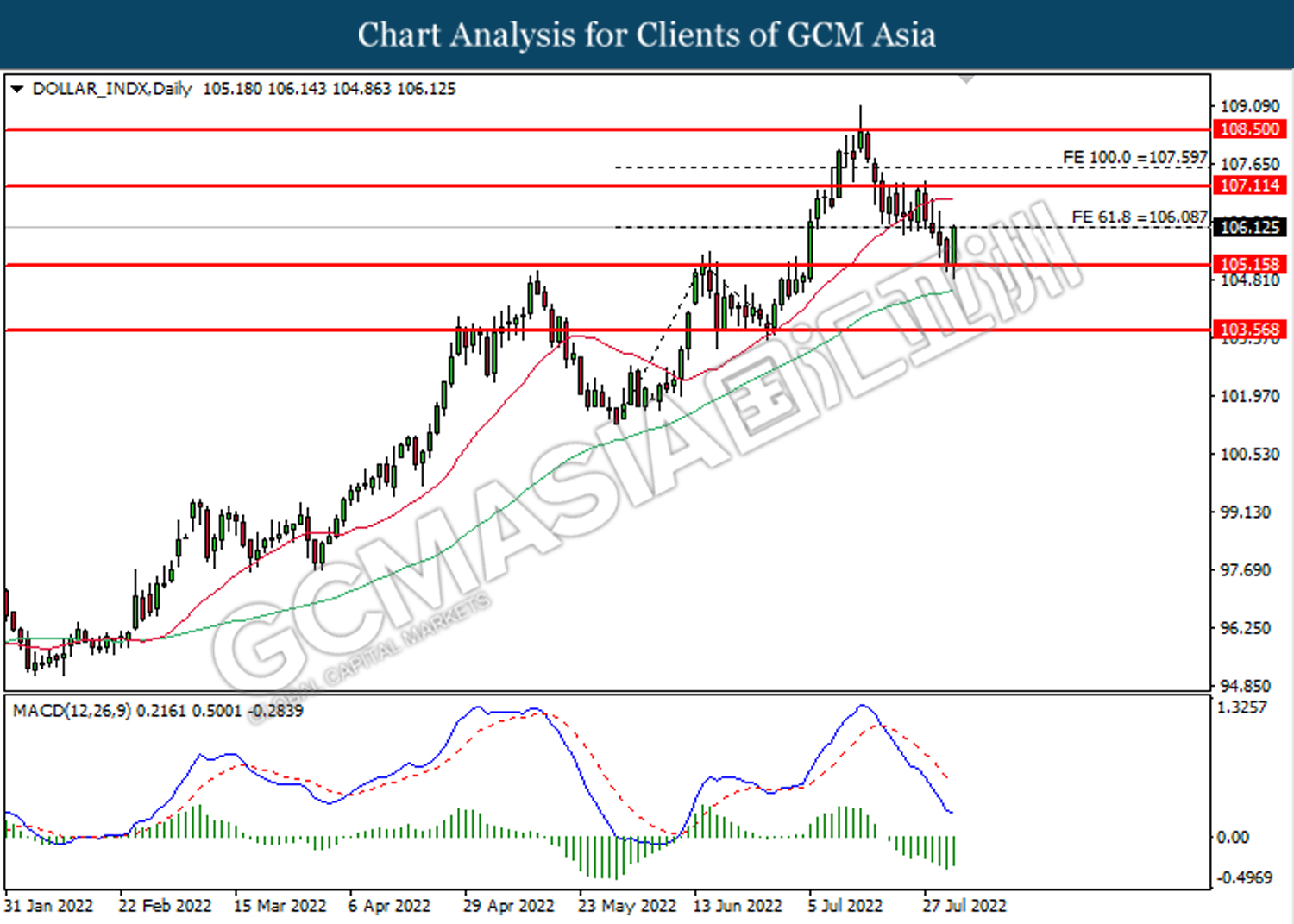

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 106.10. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 106.10, 107.10

Support level: 105.15, 103.55

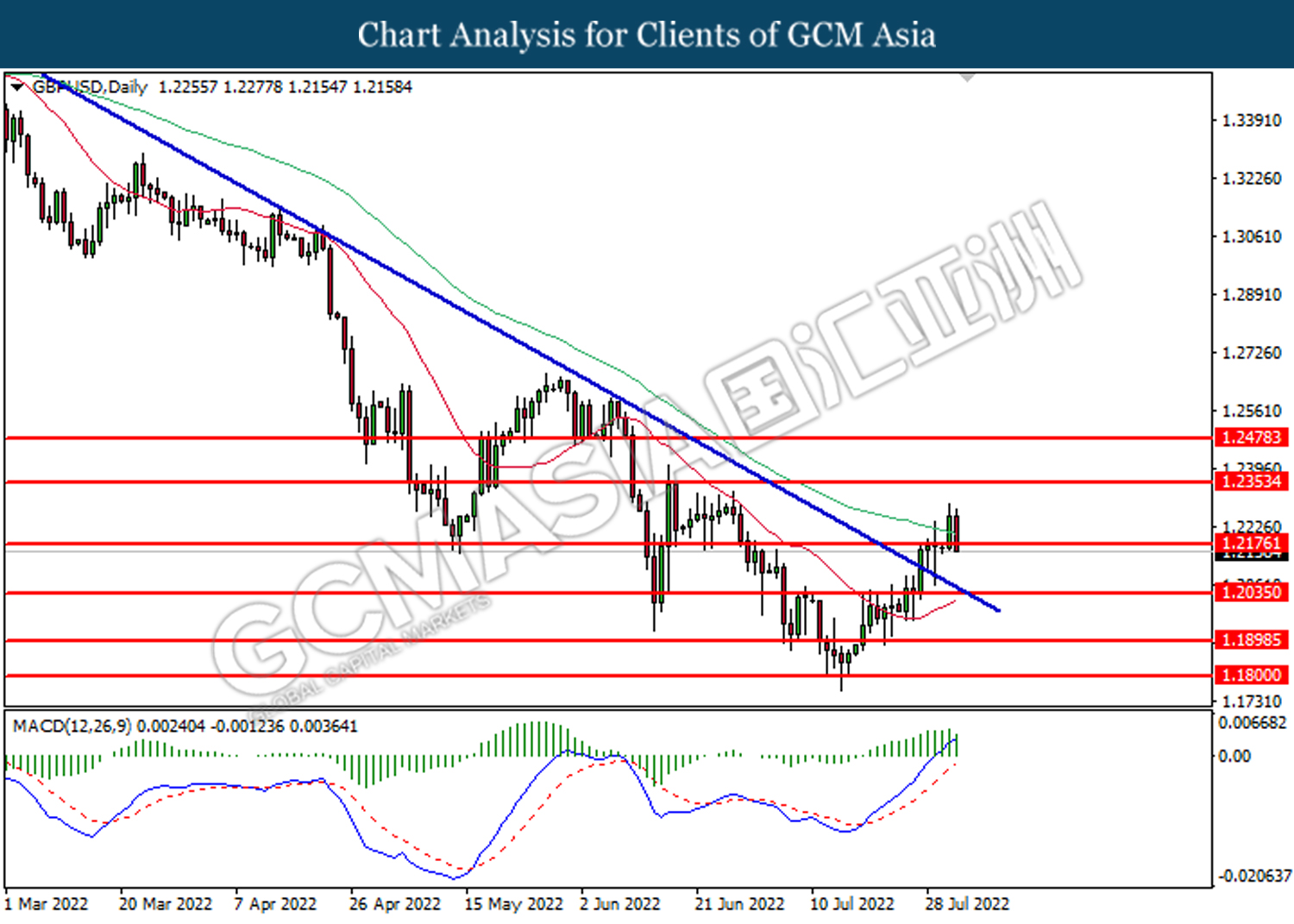

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2175. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2355, 1.2480

Support level: 1.2175, 1.2035

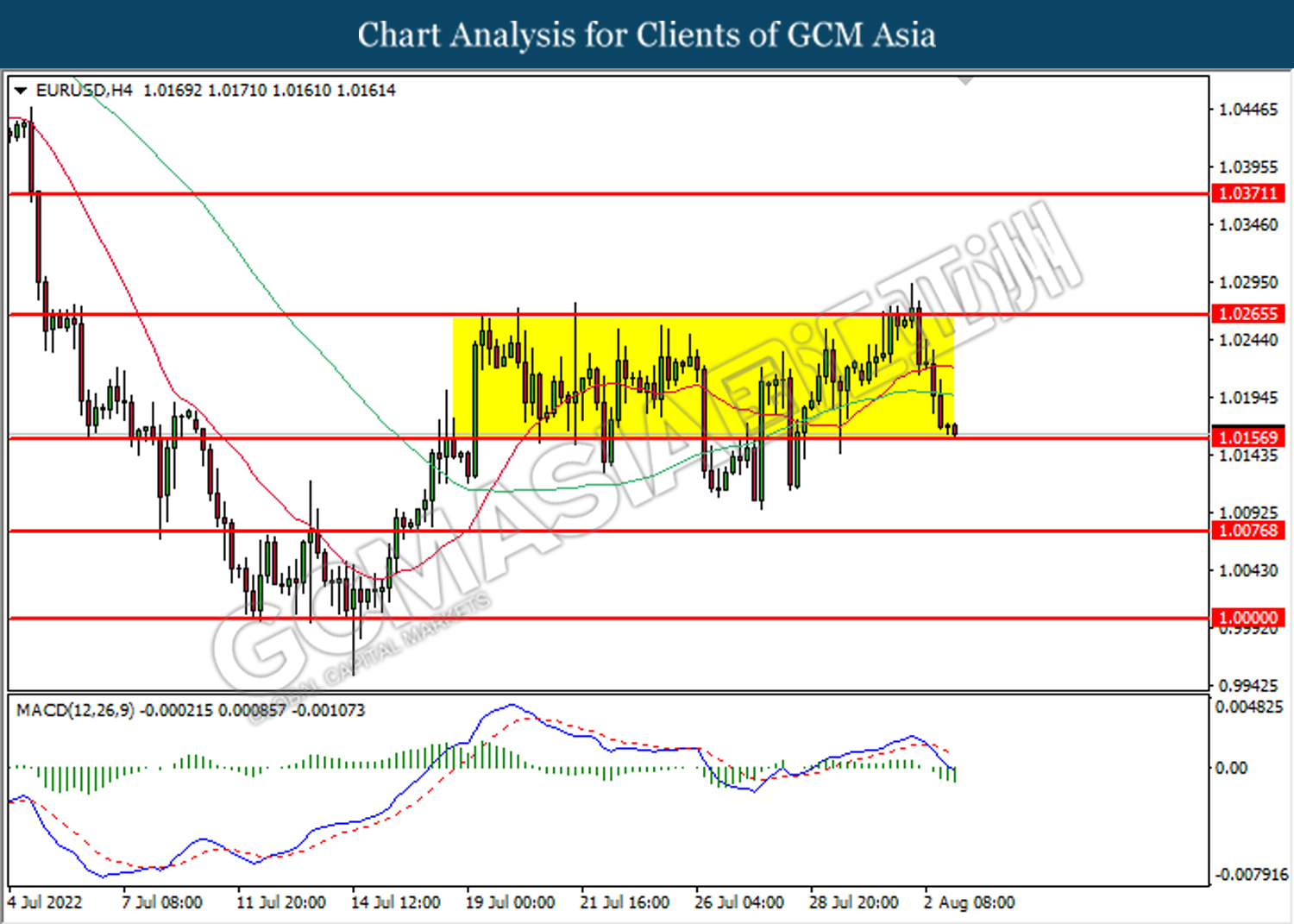

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

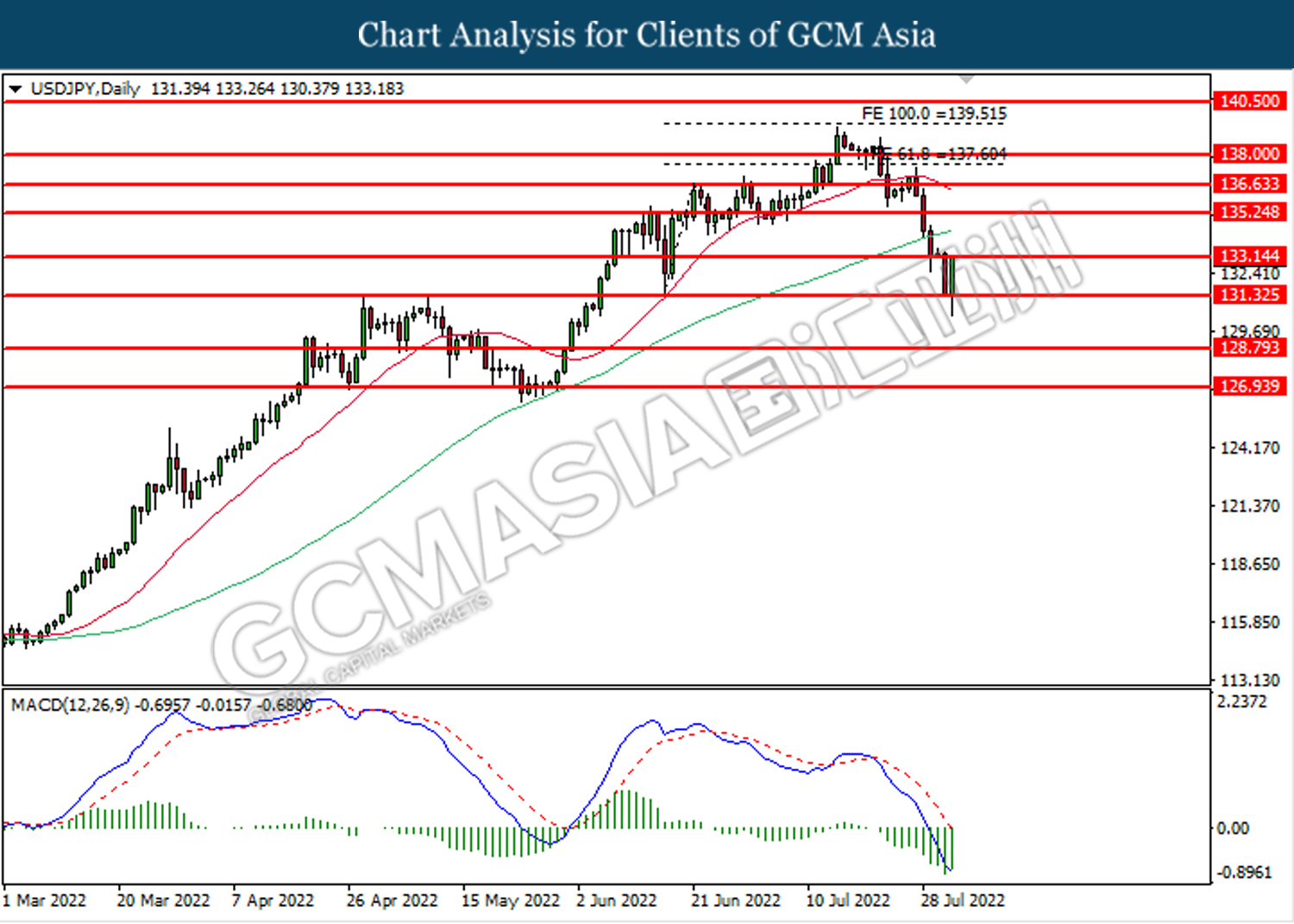

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 133.15. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 133.15, 135.25

Support level: 131.35, 128.80

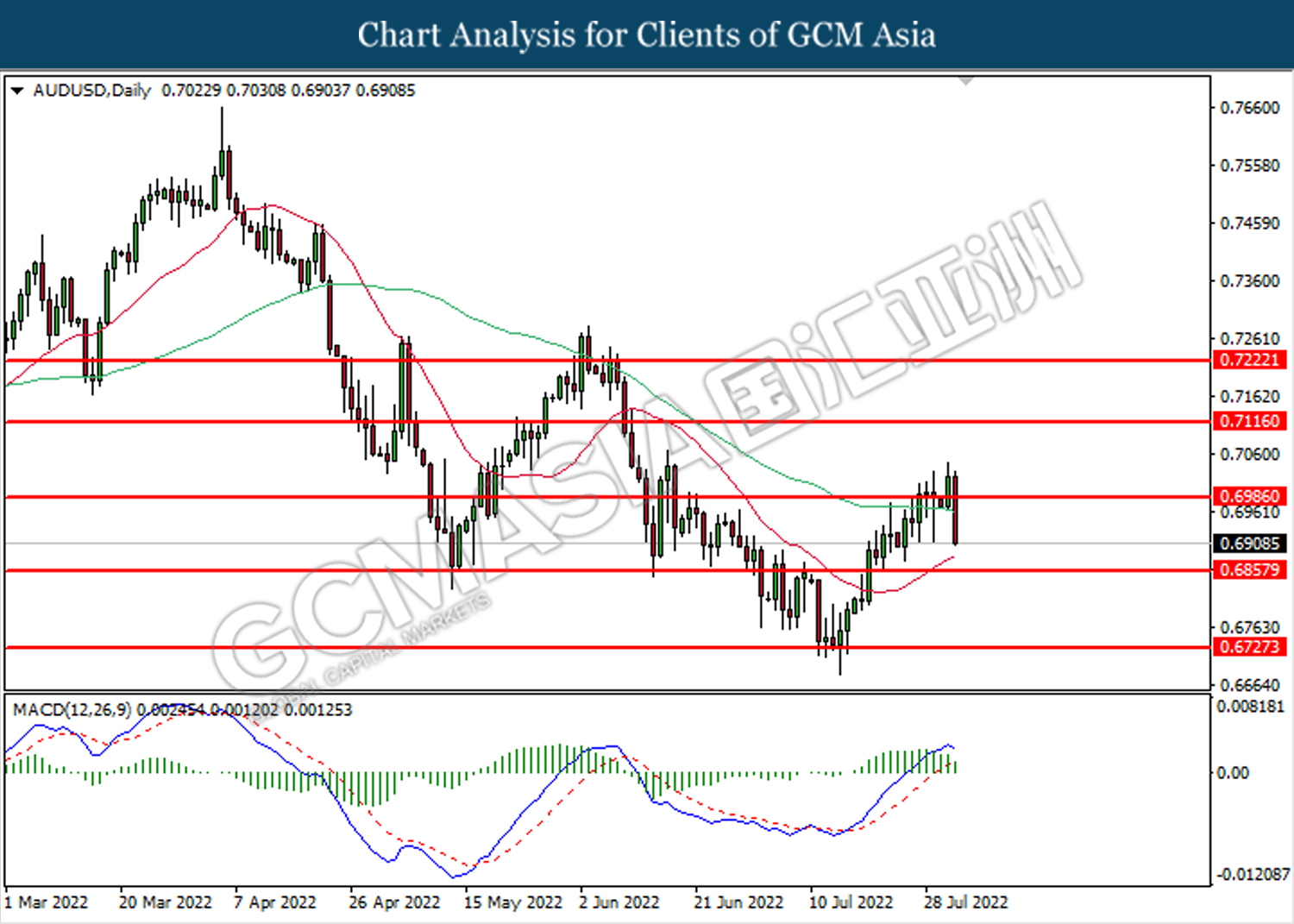

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6985. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6855.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

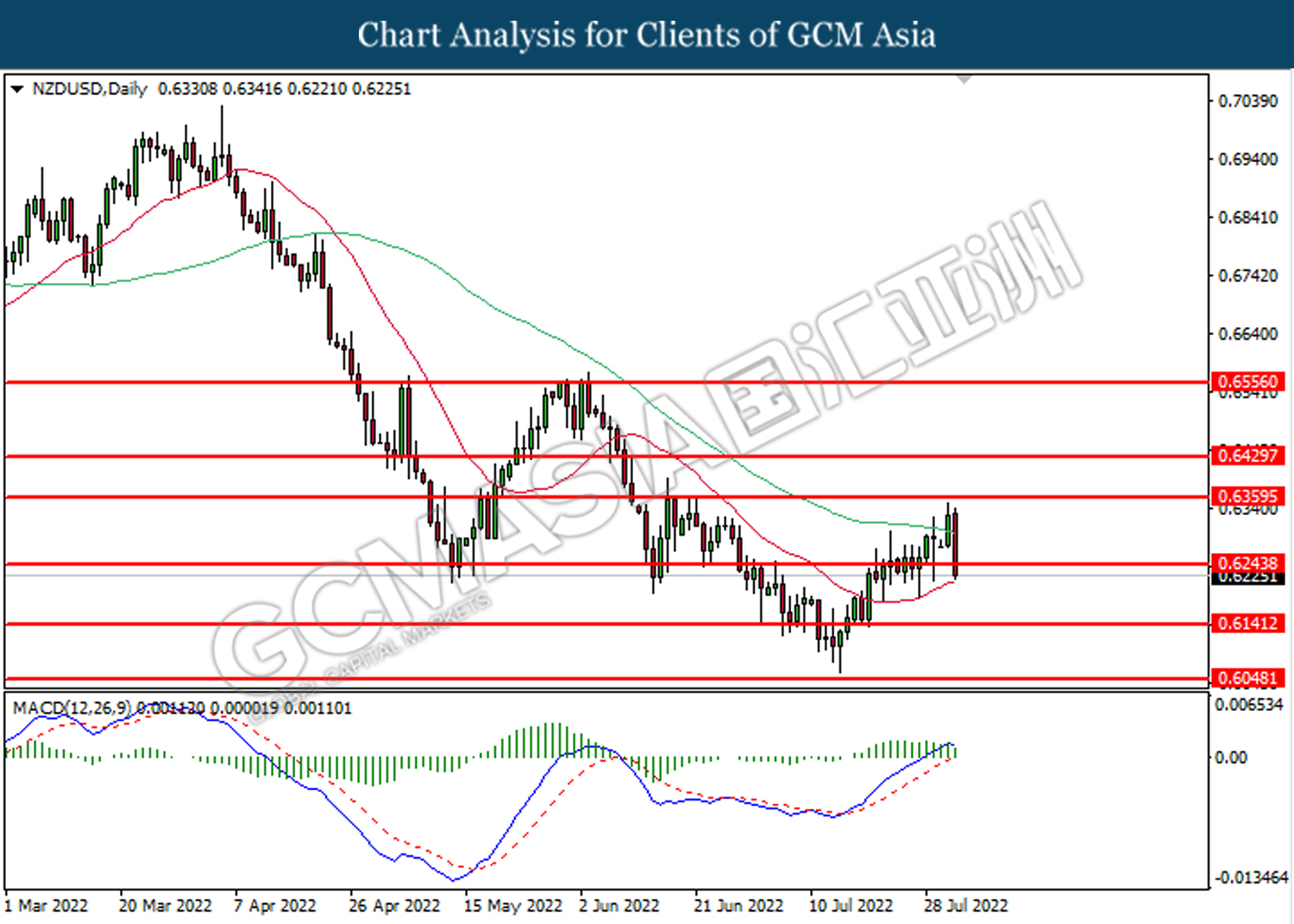

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6245. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

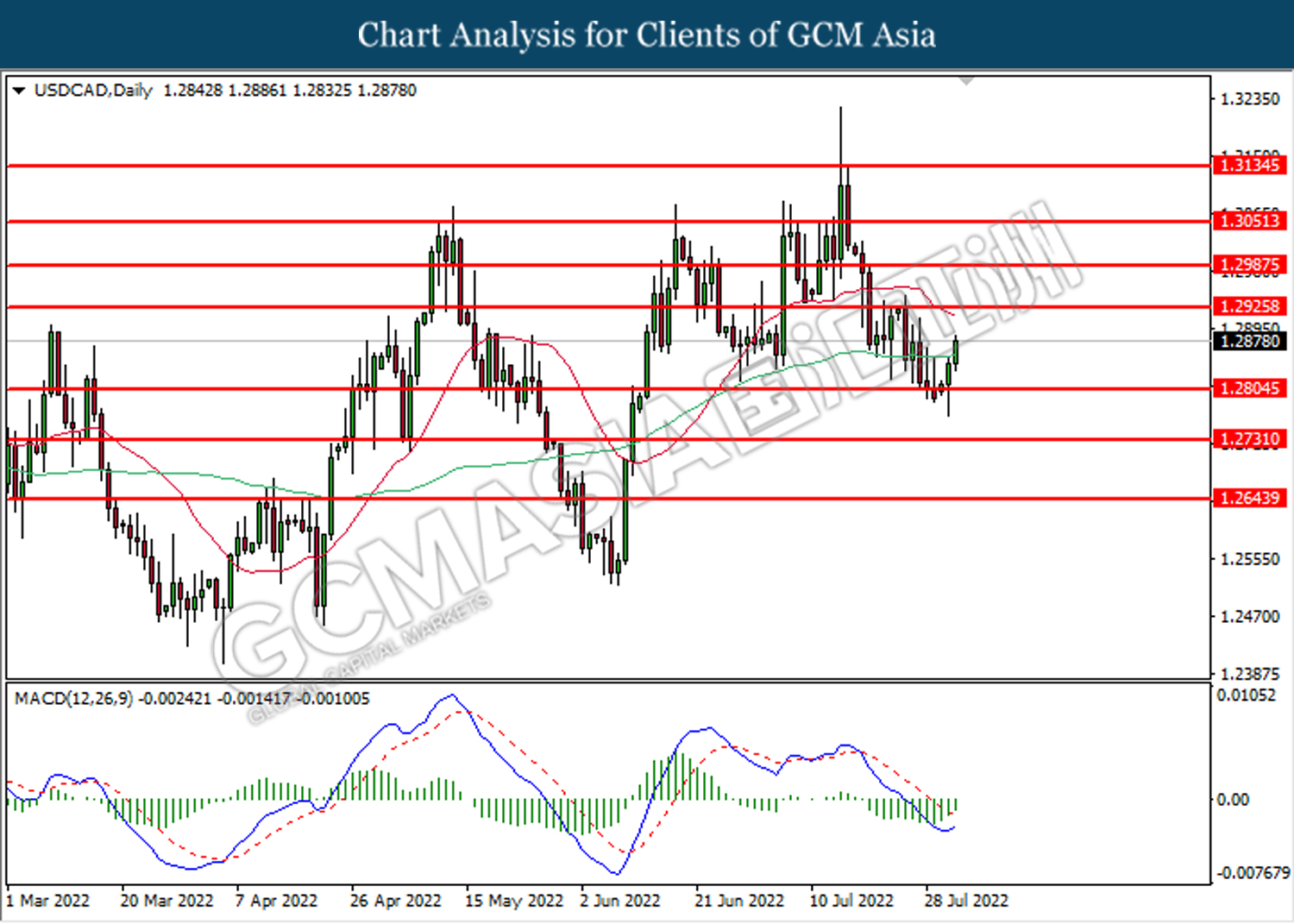

USDCAD, Daily: USDCAD was traded higher following prior rebound near the support level at 1.2805. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2925.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

USDCHF, Daily: USDCHF was traded higher following prior rebound near the support level at 0.9520. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9590.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

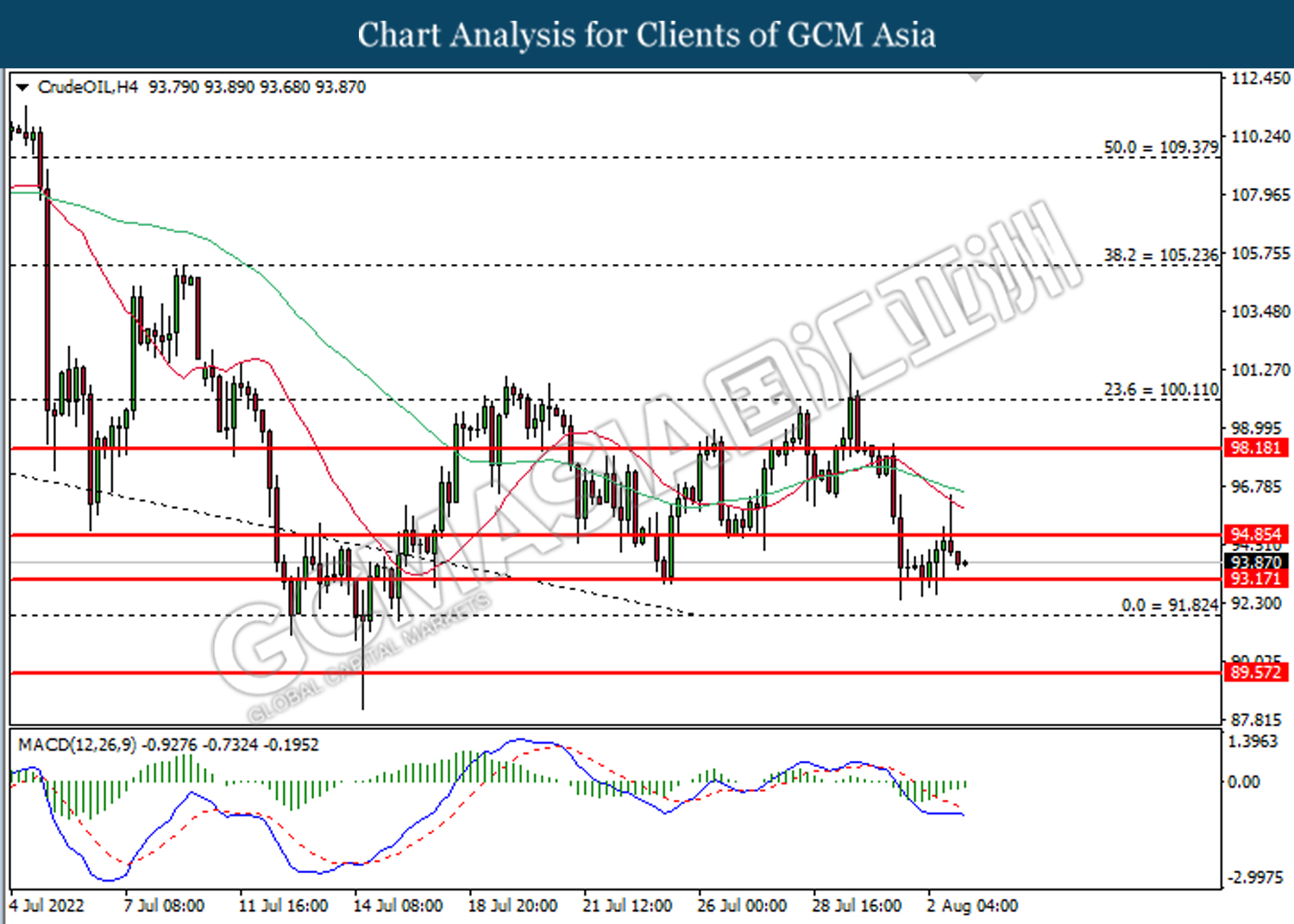

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 94.85. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical rebound in short term.

Resistance level: 94.85, 98.20

Support level: 93.15, 91.80

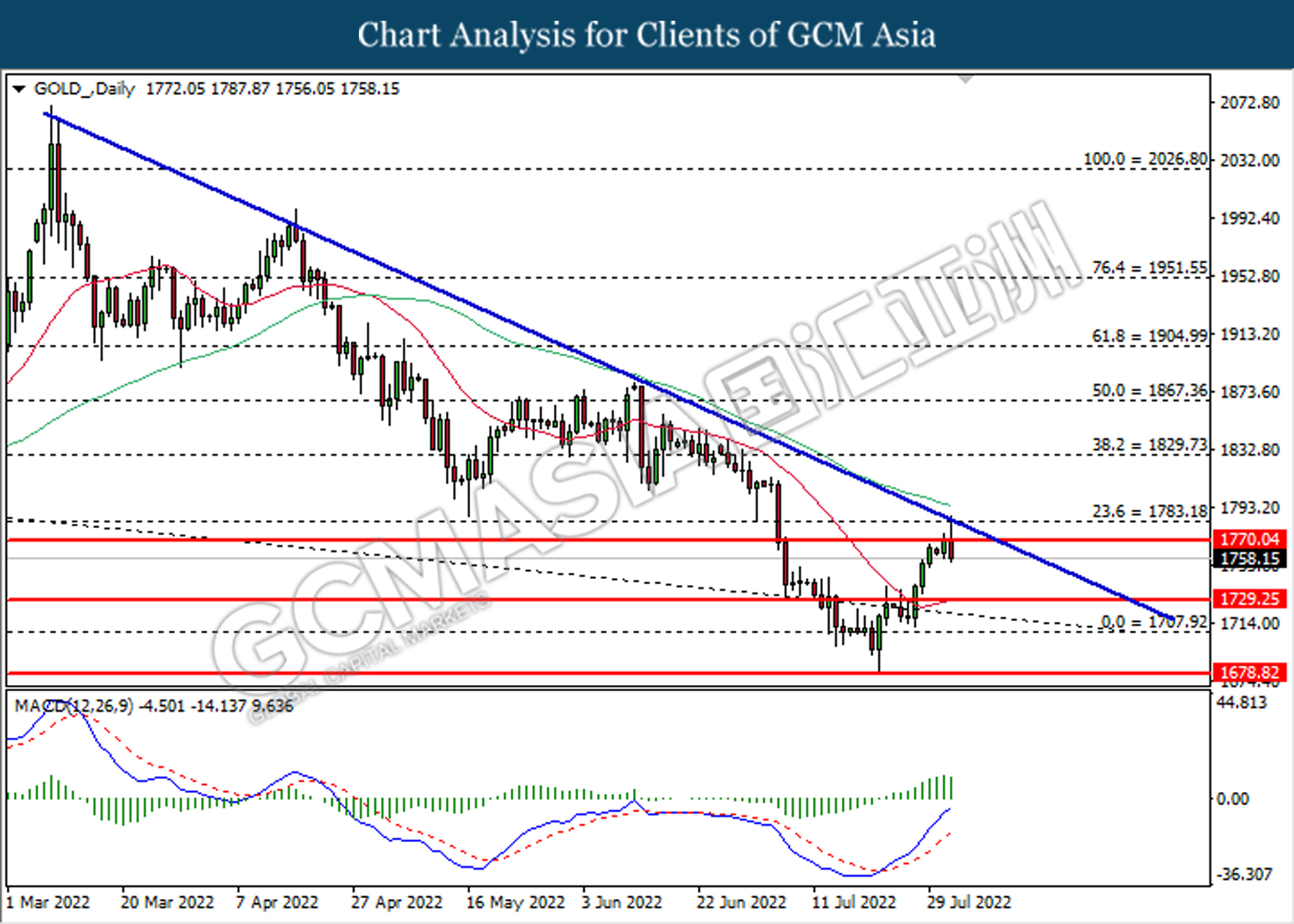

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90