15 August 2022 Morning Session Analysis

US Dollar surged as fears upon nuclear disaster sparked demand on safe-haven asset.

The Dollar Index which traded against a basket of six major currencies rebounded significantly from its lower level as the escalating tensions between Russia-Ukraine had stoked a shift in sentiment toward the safe-haven Greenback. According to Reuters, Ukraine is currently targeting Russian soldiers who war at Europe’s largest nuclear power station, sparking a fear upon the nuclear catastrophe. The International Atomic Energy Agency (IAEA), which is seeking to monitor the nuclear plant, has warned of a nuclear disaster if multiple incidents of shelling continue to persist at the Zaporizhzhia facility in southern Ukraine. Besides, the US Dollar extend its gains over the backdrop of hawkish statement from Federal Reserve recently. San Francisco Federal Reserve Bank President Mary Daly claimed that the Federal Reserve was still open the possibility of another 75-basis point rate hike in September. As of writing, the US Dollar appreciated by 0.04% to 105.70.

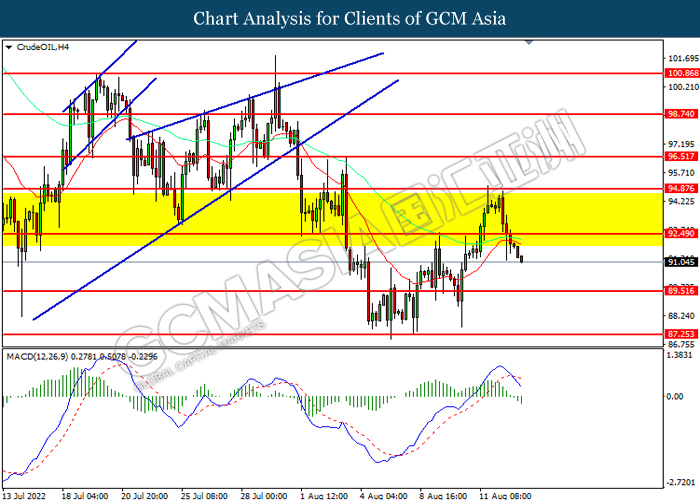

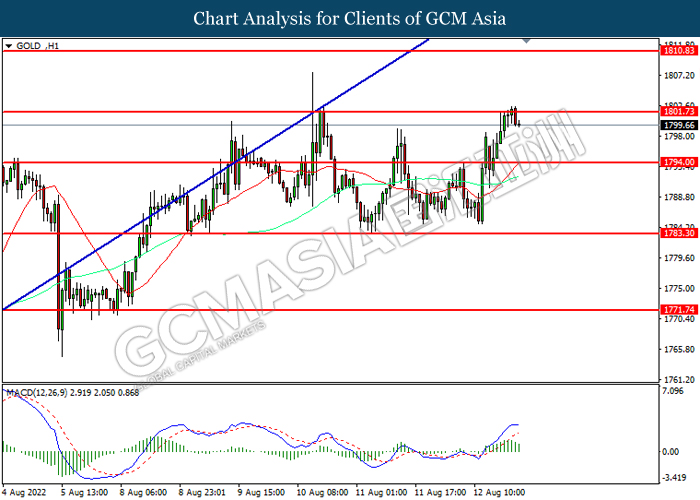

In the commodities market, the crude oil price extends its losses by 0.29% to $91.15 per barrel as of writing. The oil market edged lower as fears upon the global recession risk continue to weigh down the market demand on this black-commodity. On the other hand, the gold market appreciated by 0.01% to $1800.05 per troy ounces as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

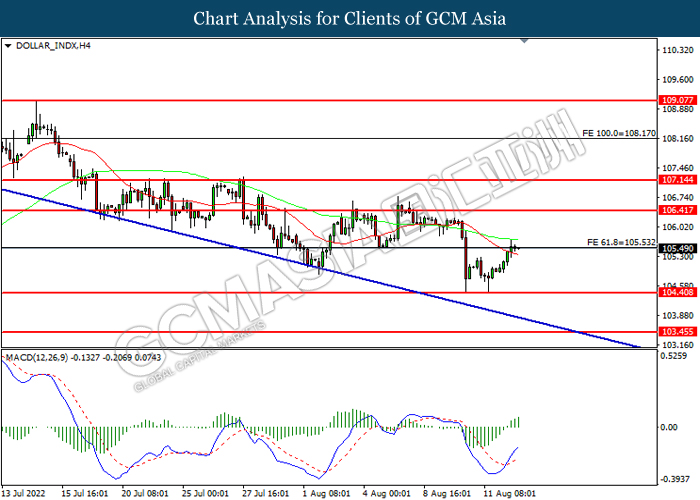

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 106.40, 107.15

Support level: 105.55, 104.40

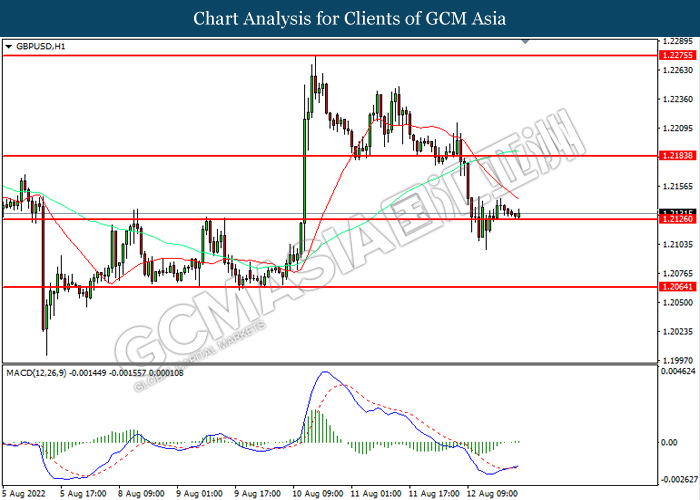

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2185, 1.2275

Support level: 1.2125, 1.2065

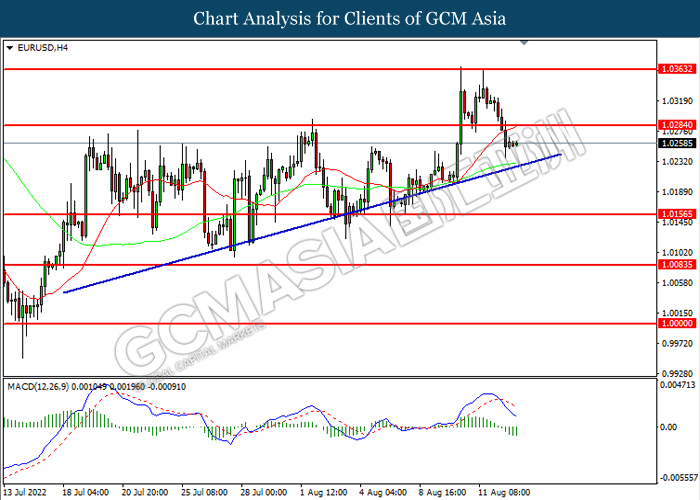

EURUSD, H4: EURUSD was traded lower following prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0285, 1.0365

Support level: 1.0155, 1.0085

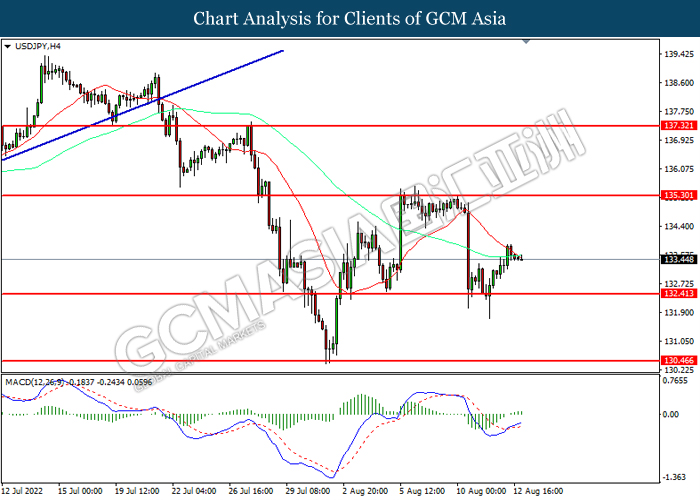

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.30, 137.30

Support level: 132.40, 130.45

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7120, 0.7195

Support level: 0.7030, 0.6955

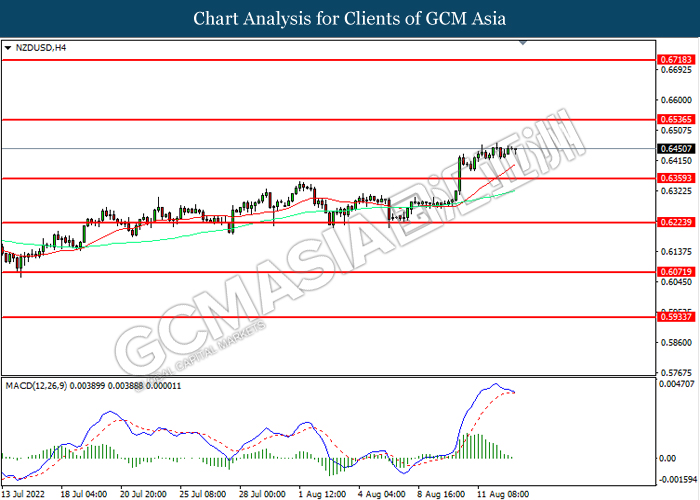

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6360, 0.6225

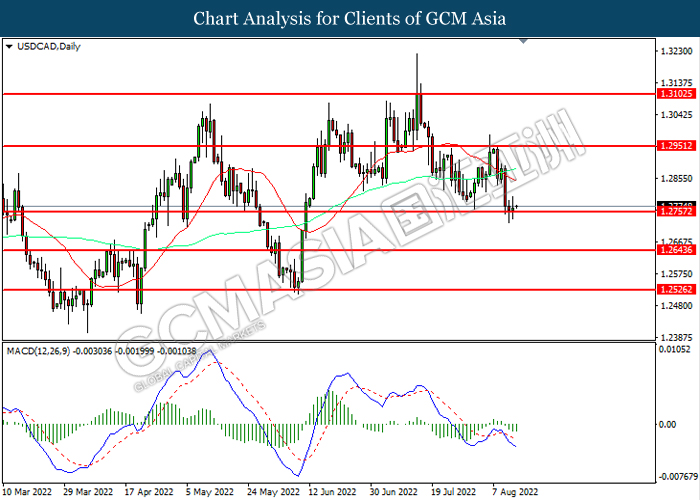

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2950, 1.3105

Support level: 1.2755, 1.2645

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9505, 0.9635

Support level: 0.9410, 0.9305

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 92.50, 94.85

Support level: 89.50, 87.25

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction

Resistance level: 1801.75, 1810.85

Support level: 1794.00, 1785.30