15 August 2022 Afternoon Session Analysis

Pound dived despite better-than-expected GDP released.

The Pound Sterling, which is widely traded by global investors, plunged as the UK economy closed its second quarter of 2022 in a recession. According to the Office for National Statistics, the UK GDP data came in at -0.1%, far weaker than the prior quarter’s reading of 0.8% growth. The downbeat UK GDP data showed that the UK economy shrank significantly, where it heads toward recession amid the rising of inflationary pressures and political uncertainty heightened. Besides, the Bank of England (BoE) warned that the UK economy is likely fall into recession this year, whereby the recession is expected to last for more than a year. With that, the high possibility of prolonged recession risk suppressed the value of the UK currency, while putting the pound’s outlook in a cloudy state. On the other side, the strengthening of dollar index amid the heightening of risk-off sentiment also squeezed the value of GBP/USD, retaining the currency pair from a rebound. As of writing, the pair of GBP/USD dipped by 0.12% to 1.2115.

In the commodities market, the crude oil price dipped -0.95% to $90.55 a barrel as the flows of oil through Druzhba pipeline resumed after the payment has been made by Russia. Besides, the gold prices depreciated -0.48% to $1794.80 per troy ounce amid the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

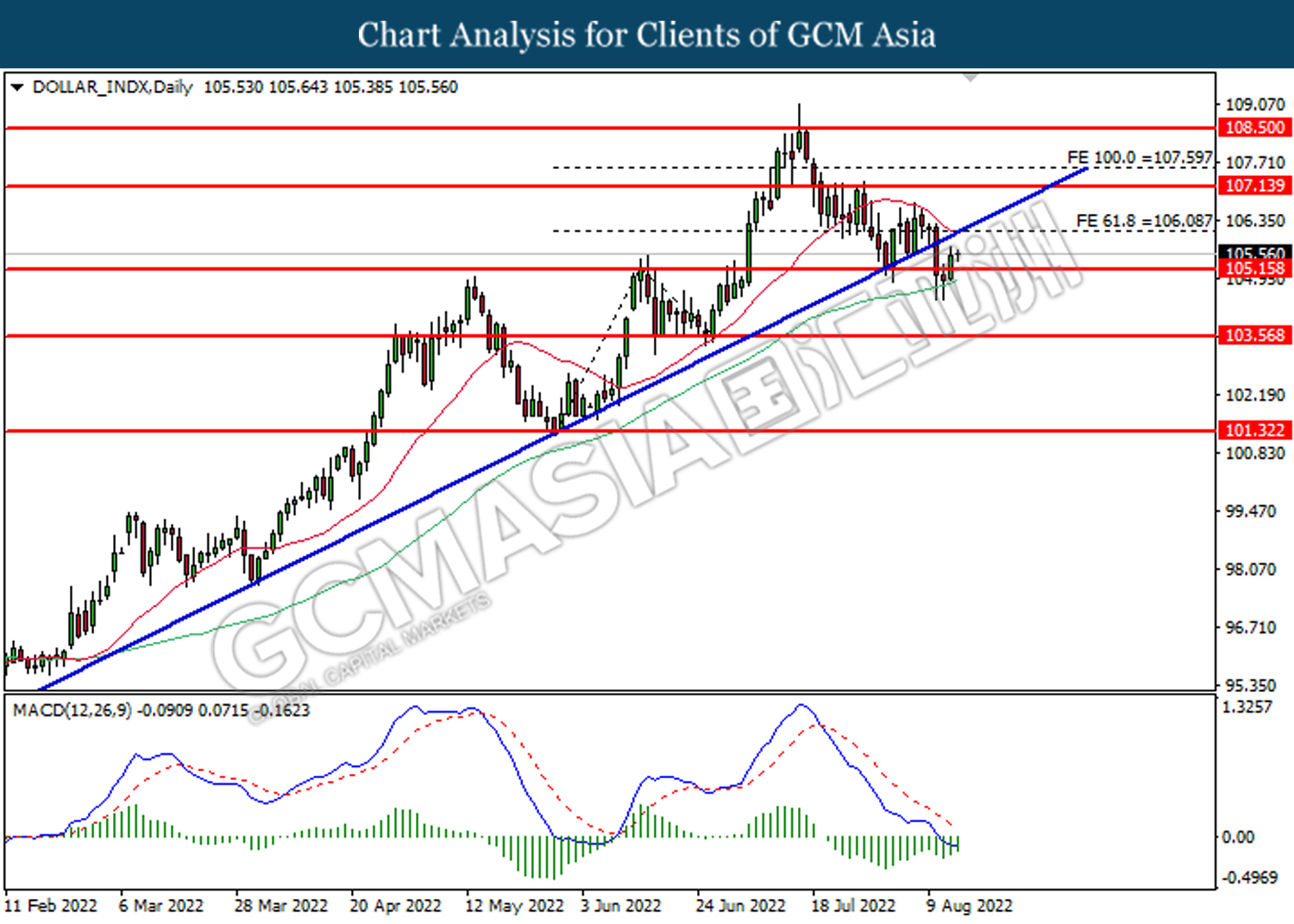

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 105.15. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 106.10.

Resistance level: 106.10, 107.15

Support level: 105.15, 103.55

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support upward trendline. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the trendline.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

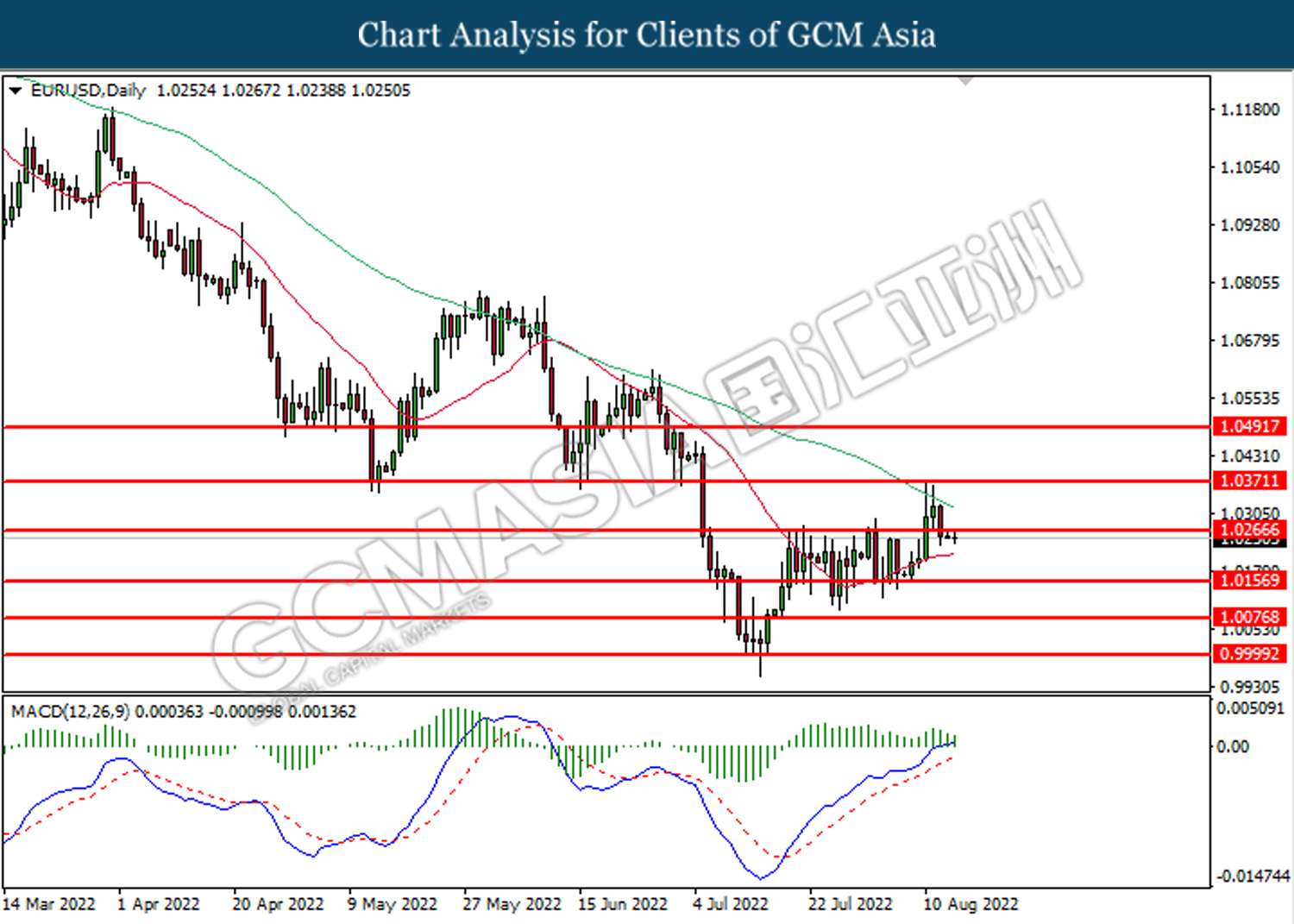

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0265. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0155.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

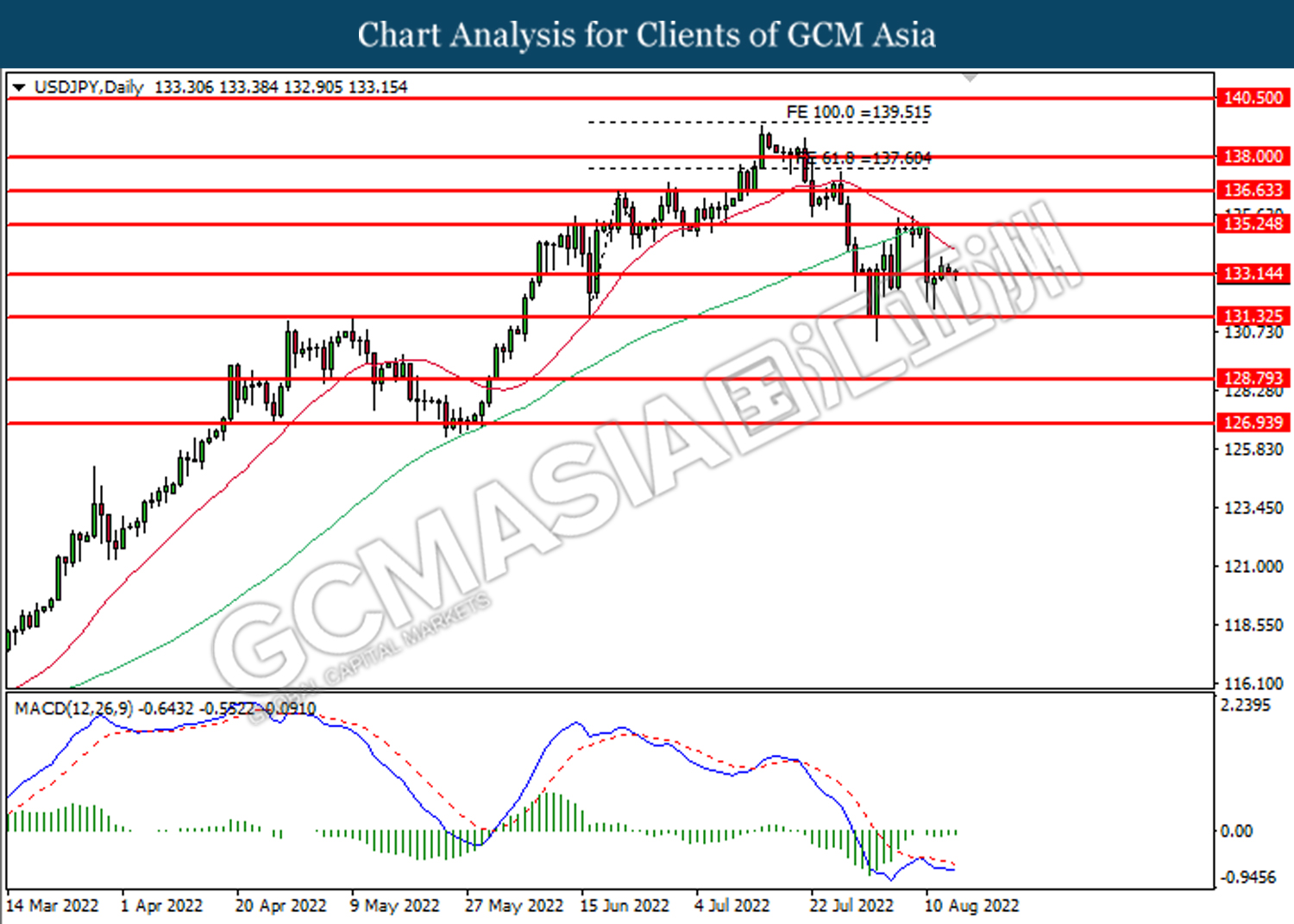

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.15. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

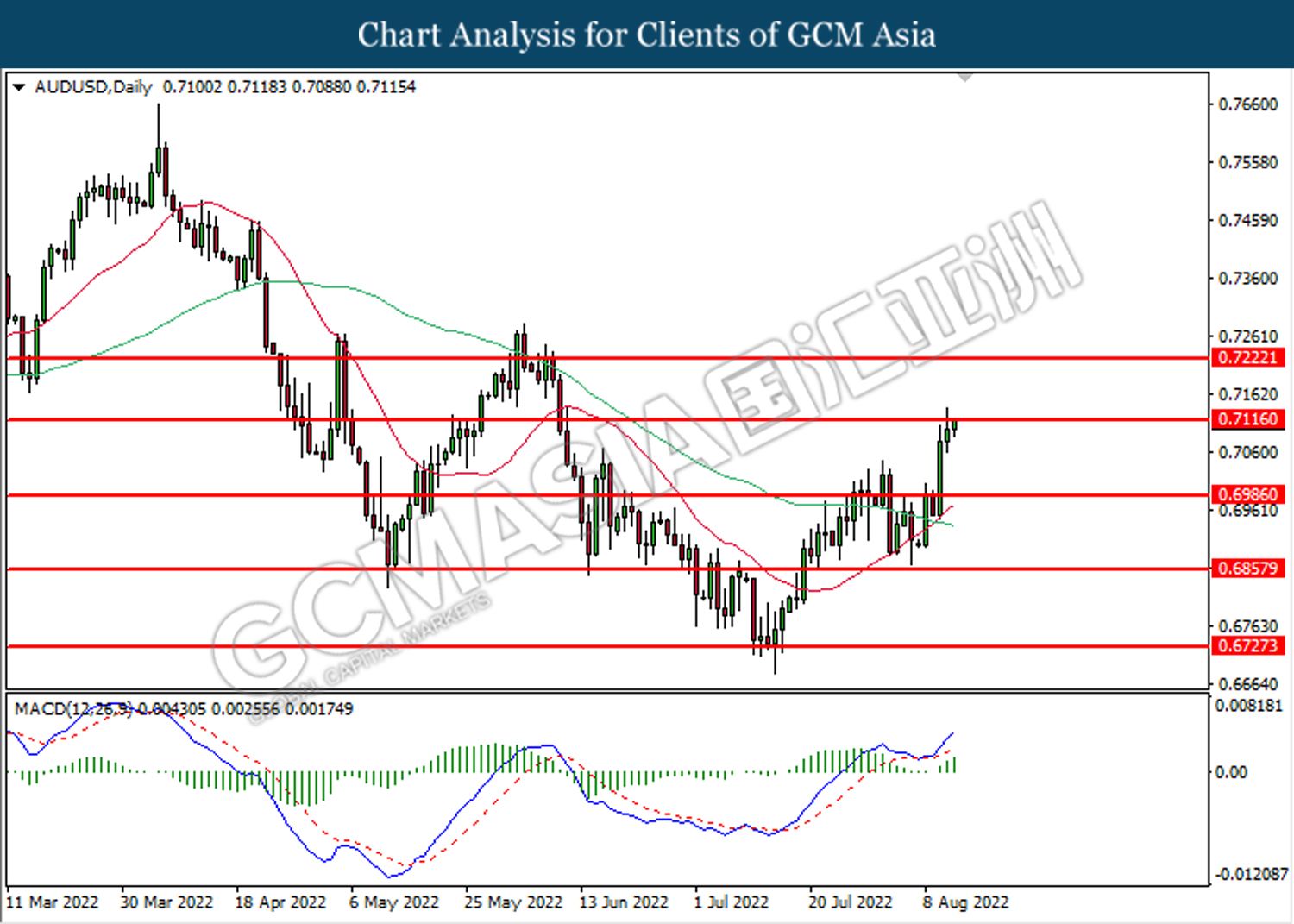

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7115. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

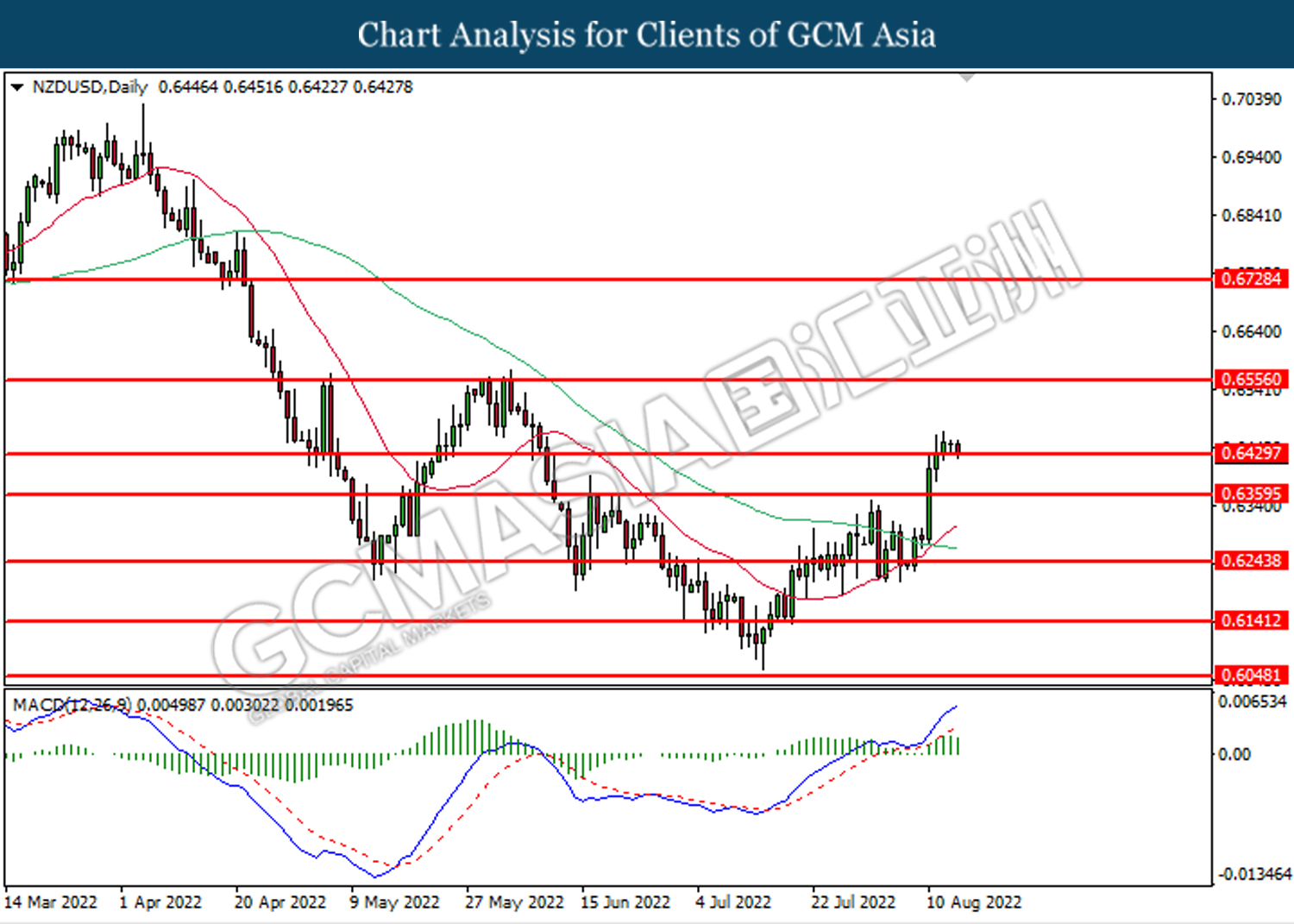

NZDUSD, Daily: NZDUSD was traded lower while currently retesting the support level at 0.6430. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6555, 0.6730

Support level: 0.6430, 0.6360

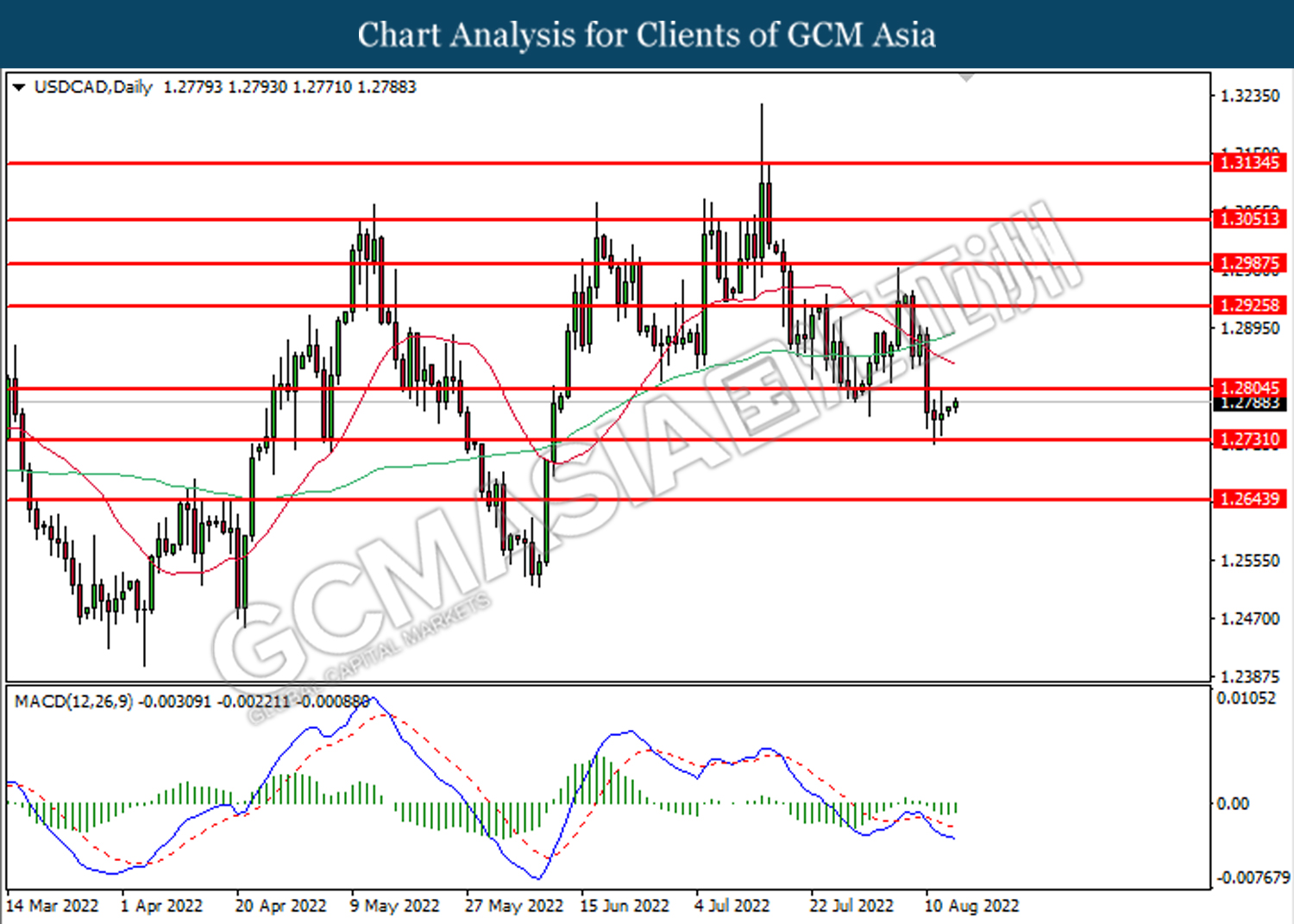

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2730. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2805.

Resistance level: 1.2805, 1.2925

Support level: 1.2730, 1.2645

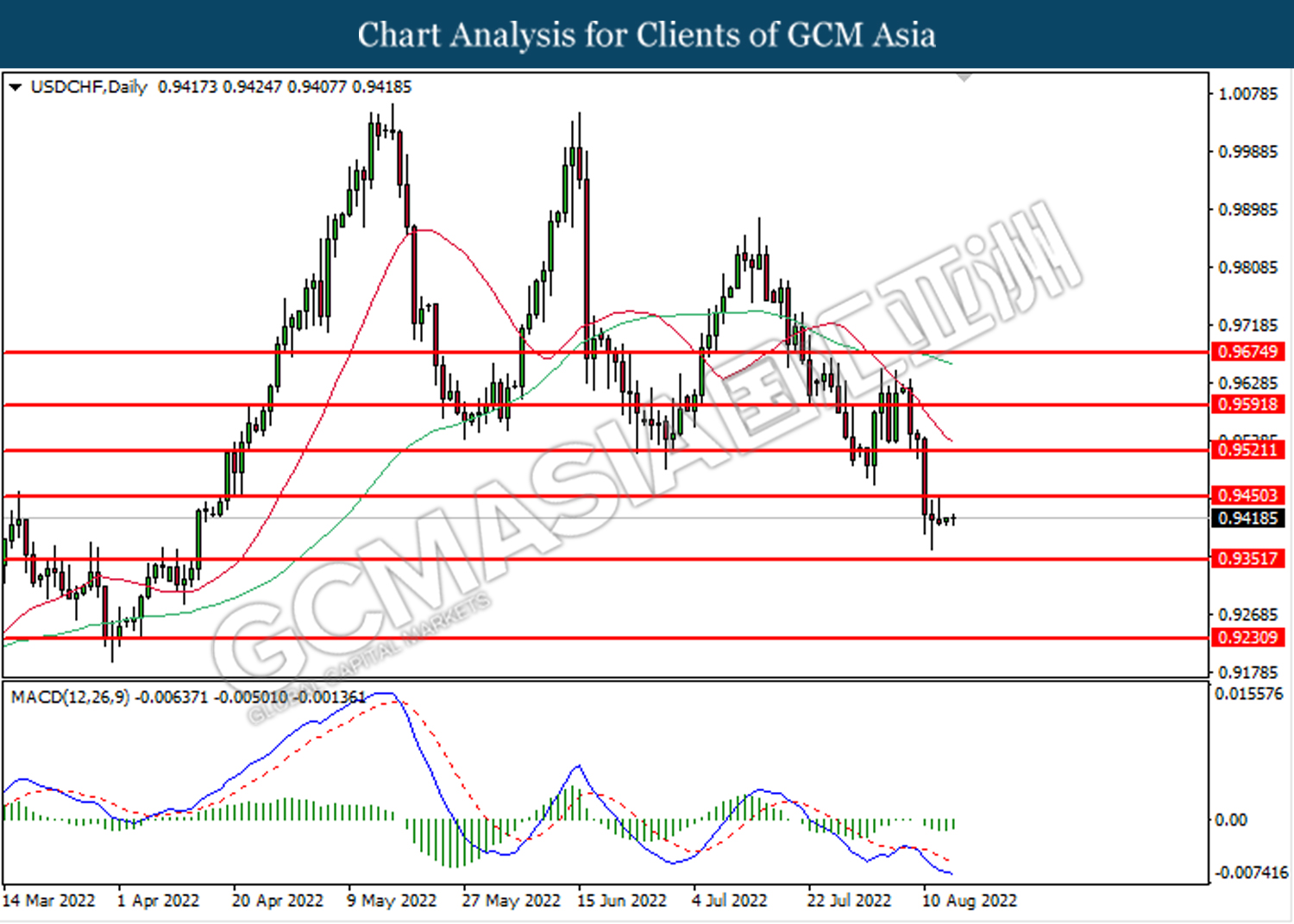

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9450. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9350.

Resistance level: 0.9450, 0.9520

Support level: 0.9350, 0.9230

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the upward trendline. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level ate 89.70.

Resistance level: 93.15, 98.20

Support level: 89.70, 87.30

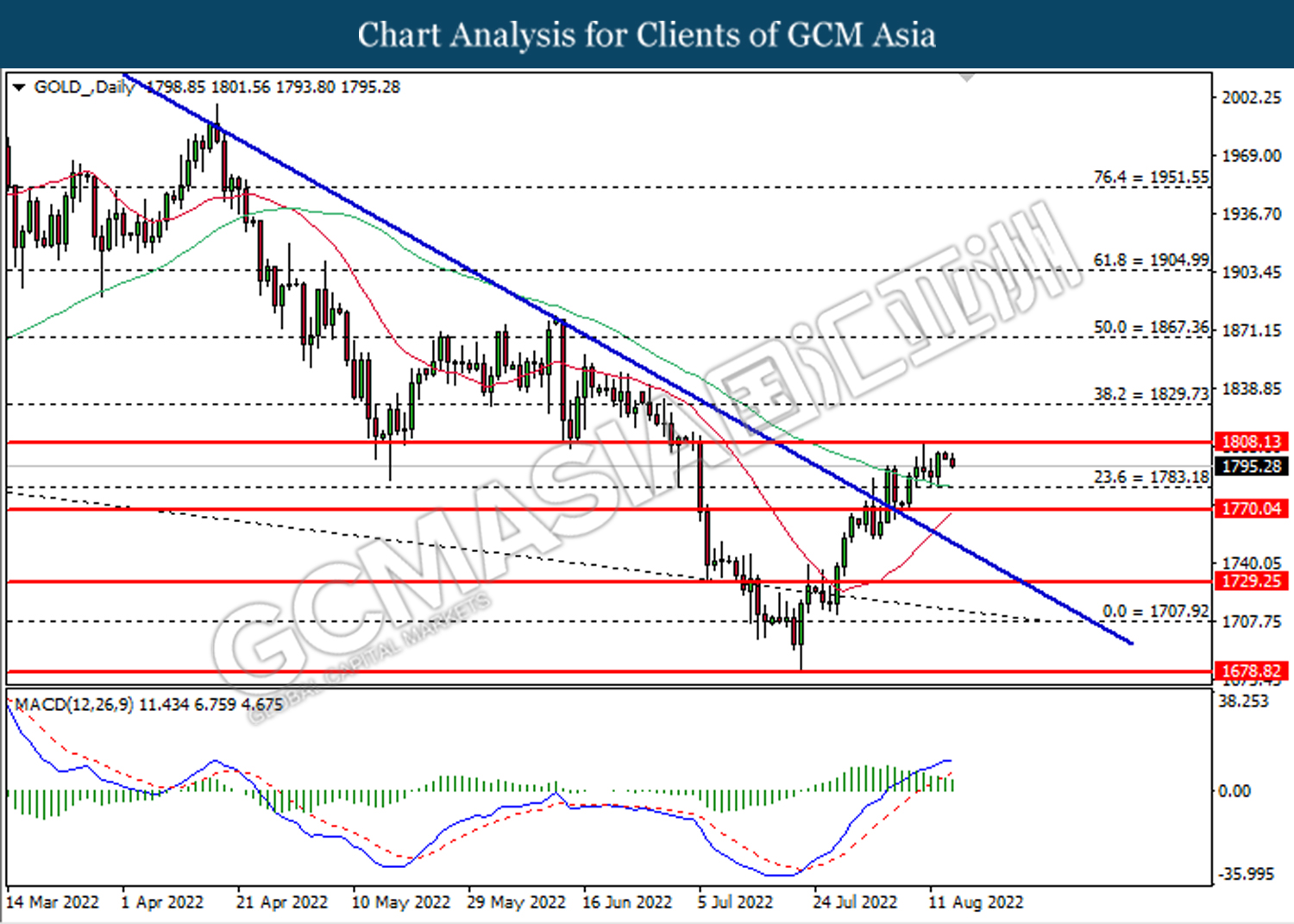

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1808.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1783.20.

Resistance level: 1808.15, 1829.75

Support level: 1783.20, 1770.05