16 August 2022 Morning Session Analysis

US Dollar extends its gain as accelerating risk-off sentiment in the global market.

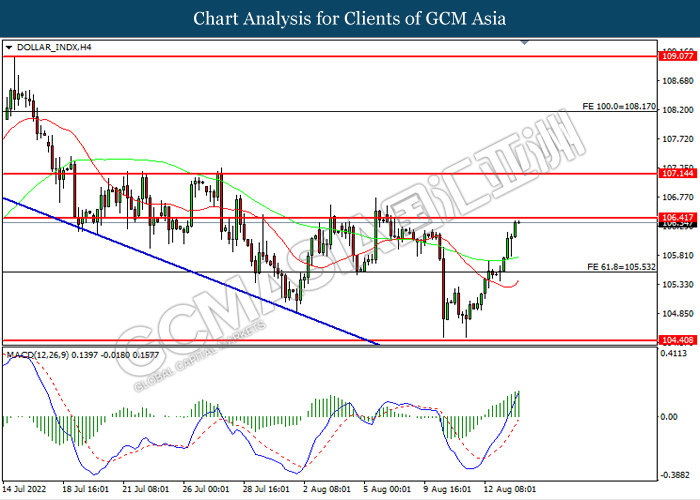

The Dollar Index which traded against a basket of six major currencies extend its gains on yesterday while Chinese-proxy currencies such as Australia Dollar and New Zealand Dollar retreated over the backdrop of a string of downbeat economic data from China. According to National Bureau of Statistics, China Industrial Production notched down from the preliminary reading of 3.9% to 3.8%, missing the market forecast at 4.6%, which indicating the recovery momentum for the Chinese economy still remained stagnant. Such downbeat economic data had sparked further risk-off sentiment in the global financial market, increasing the appeal for the safe-haven US Dollar. On the monetary policy front, the People’s Bank of China had reduced its benchmark lending rate by 10 basis points to 2.75%, diminishing the market demand for the Chinese Yuan. The unexpected move from the People’s Bank of China had prompted investors to shift their portfolio into US Dollar as investors speculated the rate hike possibilities from the Federal Reserve in future. As of writing, the Dollar Index appreciated by 0.82% to 106.50.

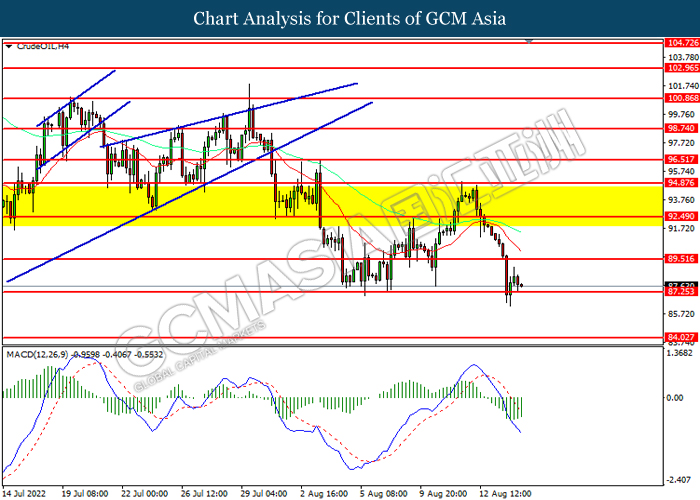

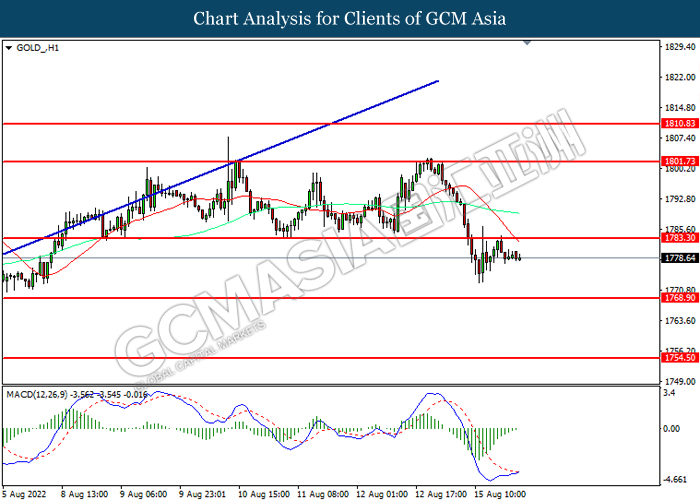

In the commodities market, the crude oil price tumbled significantly on yesterday, while closing its price at $87.25 per barrel. The overall trend for the crude oil remained bearish amid weak economic data from China had added further pressure toward the global recession risk. On the other hand, the gold market slumped 0.01% to $1779.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Jun) | 6.20% | 4.50% | – |

| 14:00 | GBP – Claimant Count Change (Jul) | -20.0K | – | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Aug) | -53.8 | -52.7 | – |

| 20:30 | USD – Building Permits (Jul) | 1.696M | 1.640M | – |

| 20:30 | CAD – Core CPI (MoM) (Jul) | 0.30% | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 106.40, 107.15

Support level: 105.55, 104.40

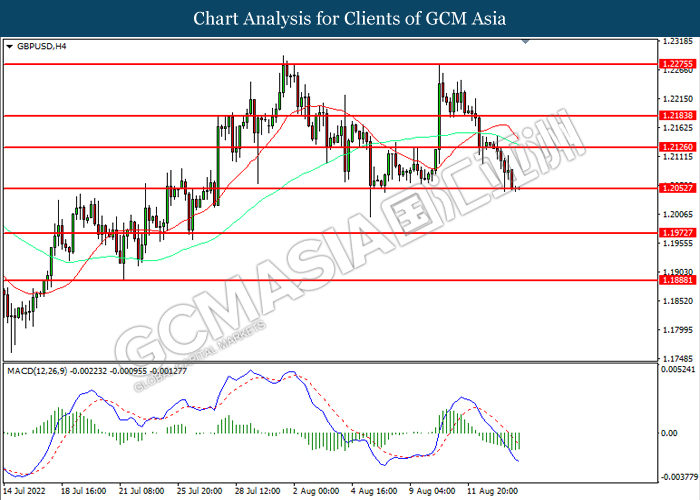

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2125, 1.2185

Support level: 1.2055, 1.1975

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0285, 1.0365

Support level: 1.0155, 1.0085

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 135.30, 137.30

Support level: 132.40, 130.45

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7120, 0.7195

Support level: 0.6990, 0.6895

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6455, 0.6535

Support level: 0.6340, 0.6225

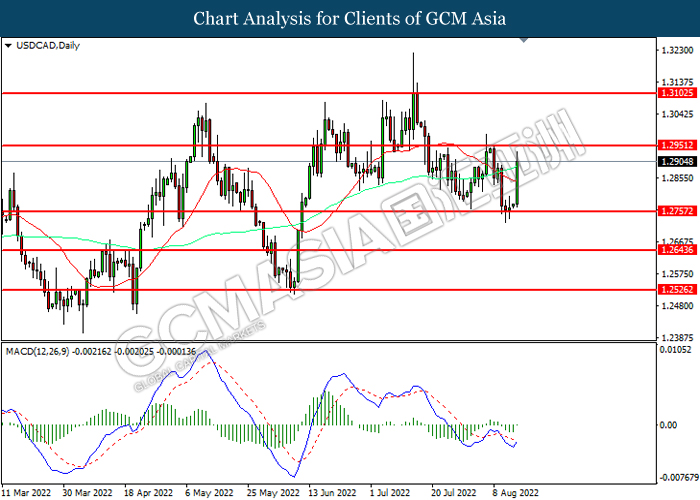

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2950, 1.3105

Support level: 1.2755, 1.2645

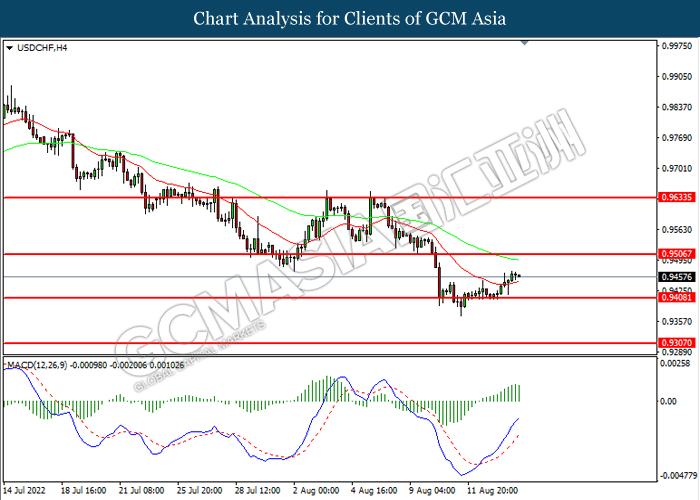

USDCHF, H4: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9505, 0.9635

Support level: 0.9410, 0.9305

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 89.50, 92.50

Support level: 87.25, 84.05

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1783.30, 1801.75

Support level: 1768.90, 1754.50