18 August 2022 Afternoon Session Analysis

Pound slumped as stagflation risk buoyed.

The Pound Sterling retreated from its higher-level following UK inflation rate hit record high, spurring further negative prospect toward economic momentum in the UK region. Though, investors would focus more on the monetary policy decision from Bank of England recently to receive further trading signal. According to Office for National Statistics, the UK Consumer Price Index (CPI) roses by 10.1% in the year of July, up from a reading of 9.4% in June while exceeding the market forecast at 9.80%. The UK inflation has risen above 10% for the first time in 40 years, driven by soaring prices for good and fuel as households come under mounting pressure from cost-of-living crisis. Economists warned that soaring inflation rate would hit poorer families hardest, dialled down the market optimism toward the overall economic progression in the United Kingdom. Nonetheless, the losses experienced by the Pound Sterling was limited by the hawkish expectation from Bank of England in future. Several analysts warned that the Bank of England would now like increase their interest rates further – with financial market expecting them to more than double to 3.75%, adding further pressure on the economic progression in UK. As for now, investors would still continue to focus on further monetary policy statement from Bank of England to receive further trading signal. As of writing, the pair of GBP/USD up 0.03% to 1.2050.

In the commodities market, the crude oil price rose 0.91% to $87.65 a barrel as Iran seeks assurances if the U.S. withdraws from a pact again, where the uncertainty heightened. Besides, the gold prices depreciated by -0.10% to $1765.00 a troy ounce following the release of hawkish bias meeting minutes from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Jul) | 8.90% | 8.90% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 265K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Aug) | -12.3 | -5 | – |

| 22:00 | USD – Existing Home Sales (Jul) | 5.12M | 4.88M | – |

Technical Analysis

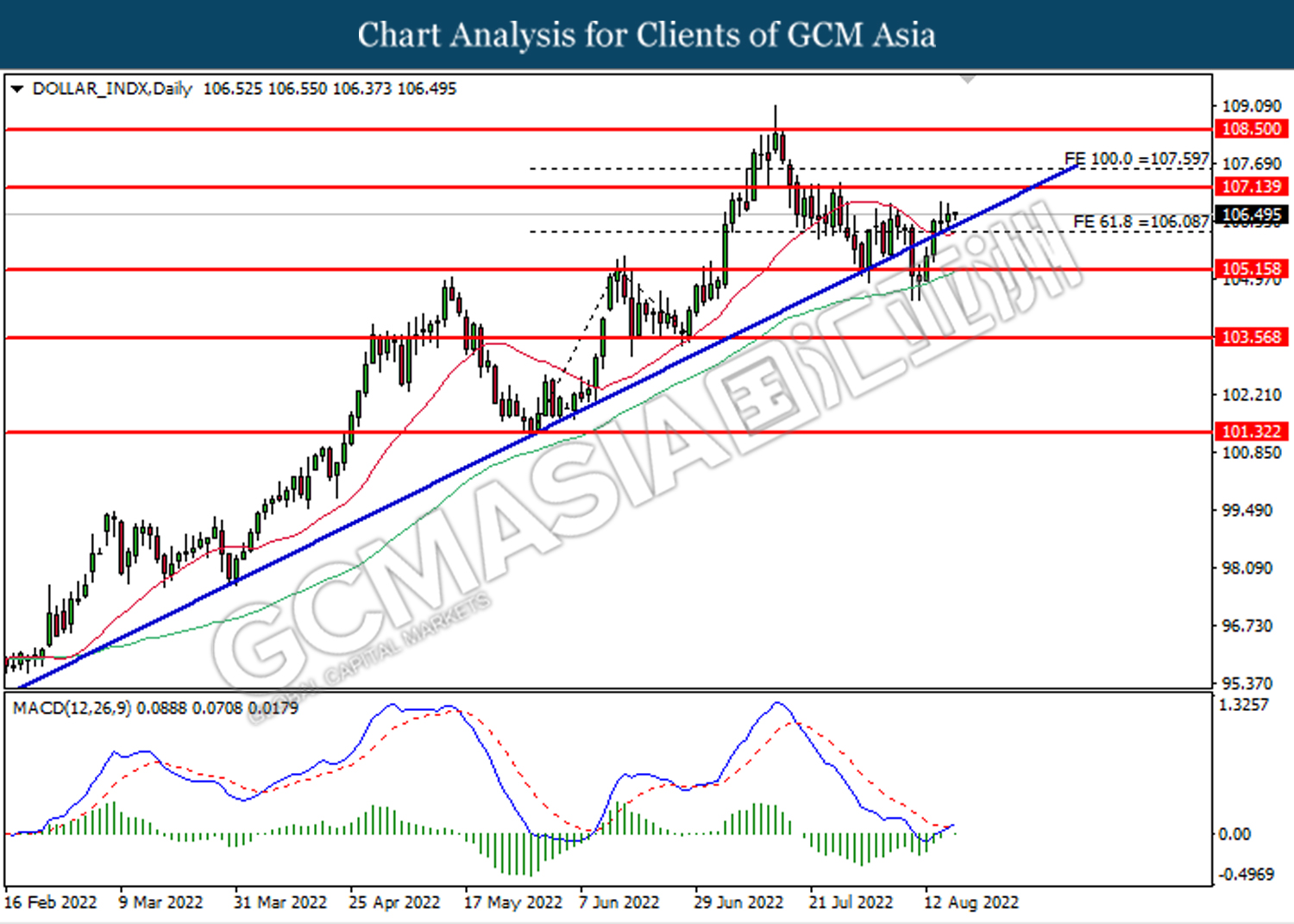

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

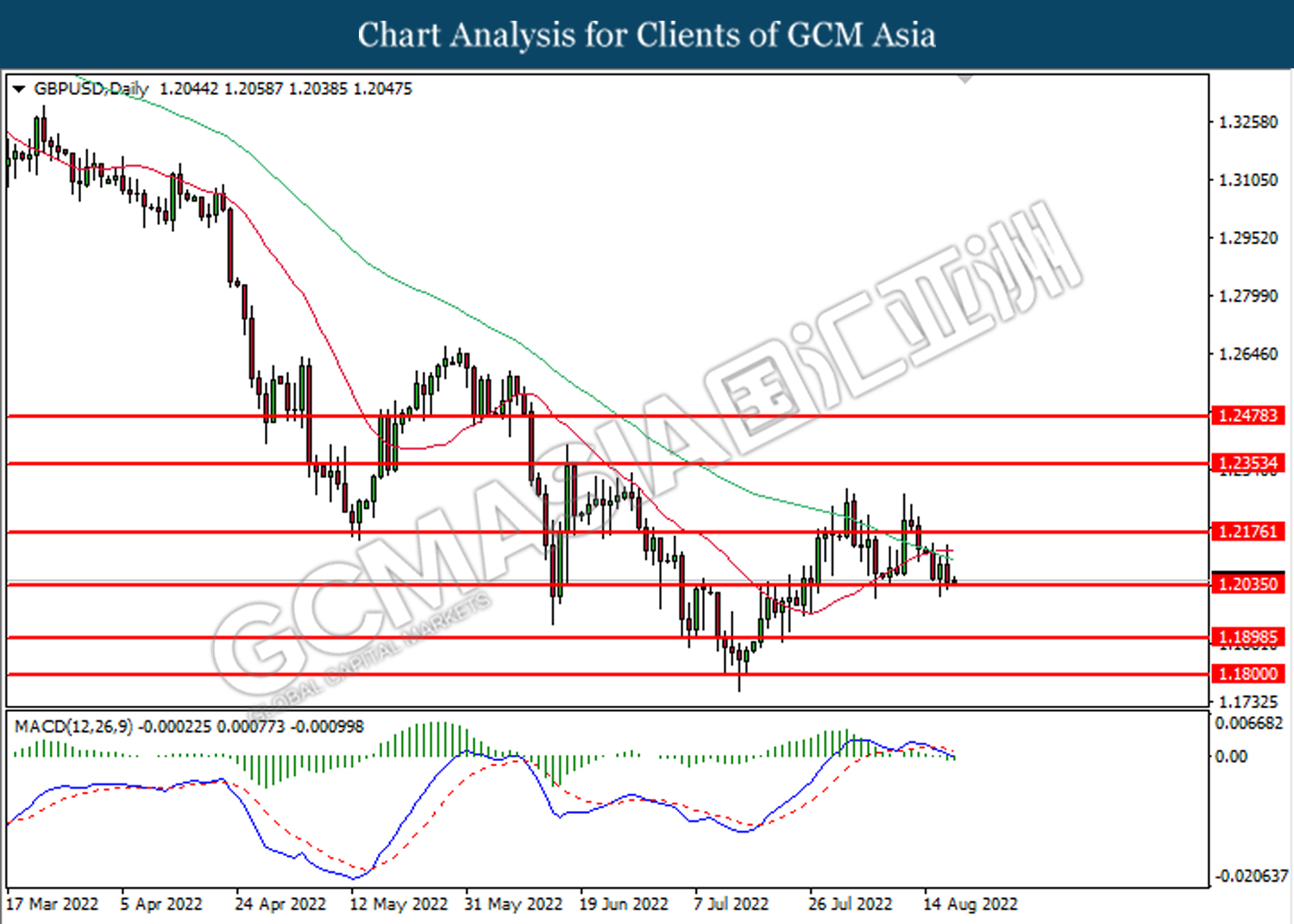

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2035. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

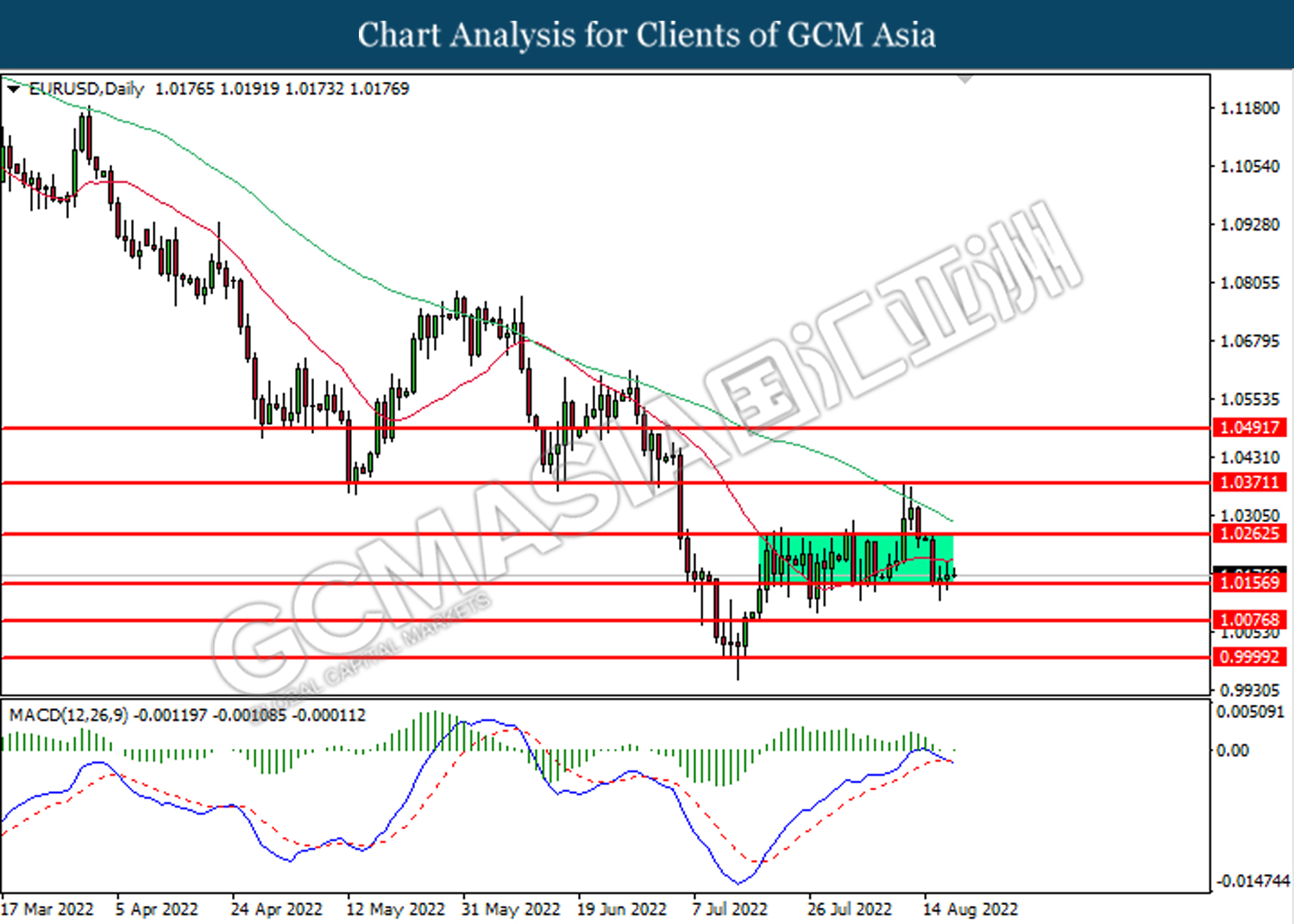

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

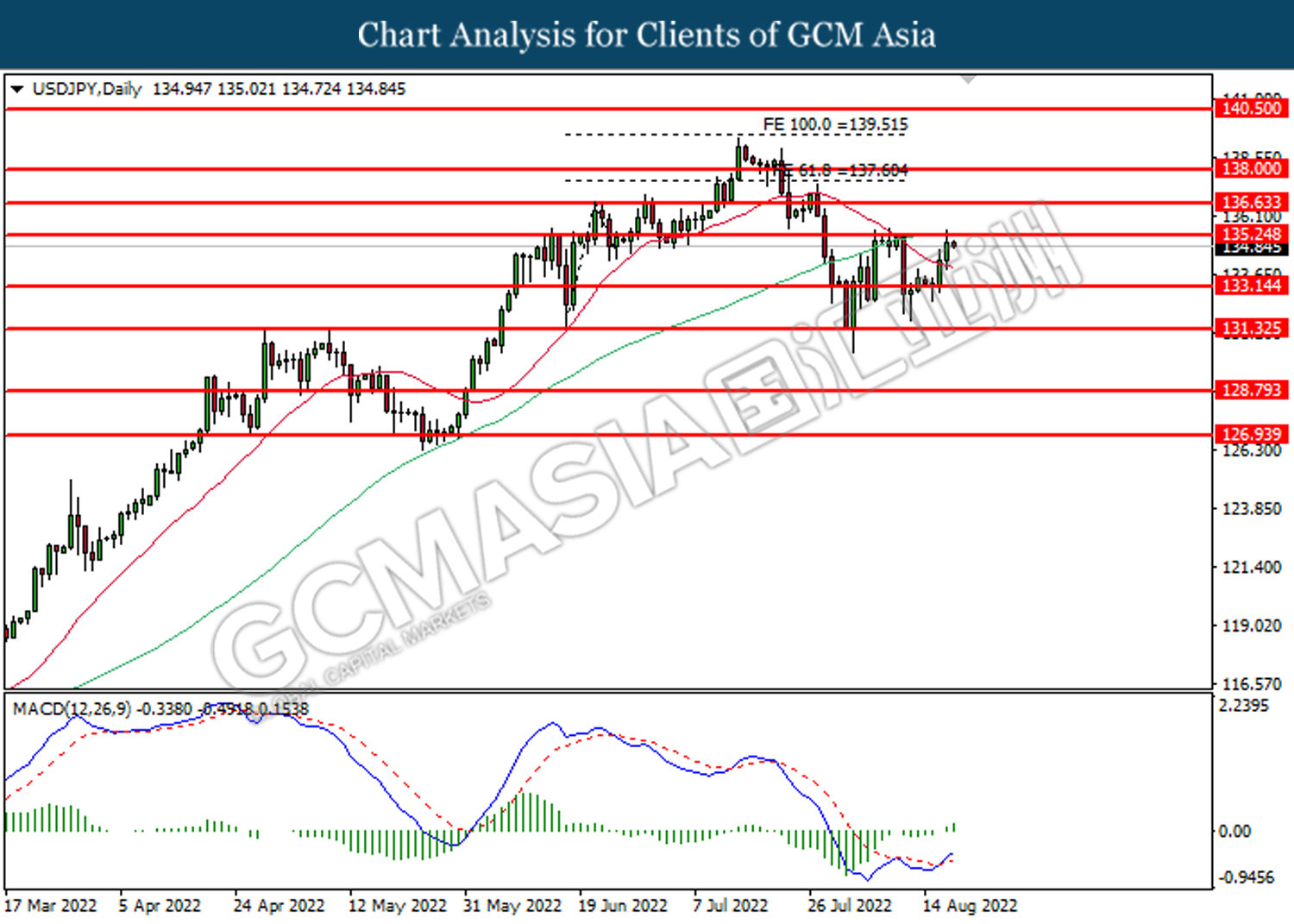

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

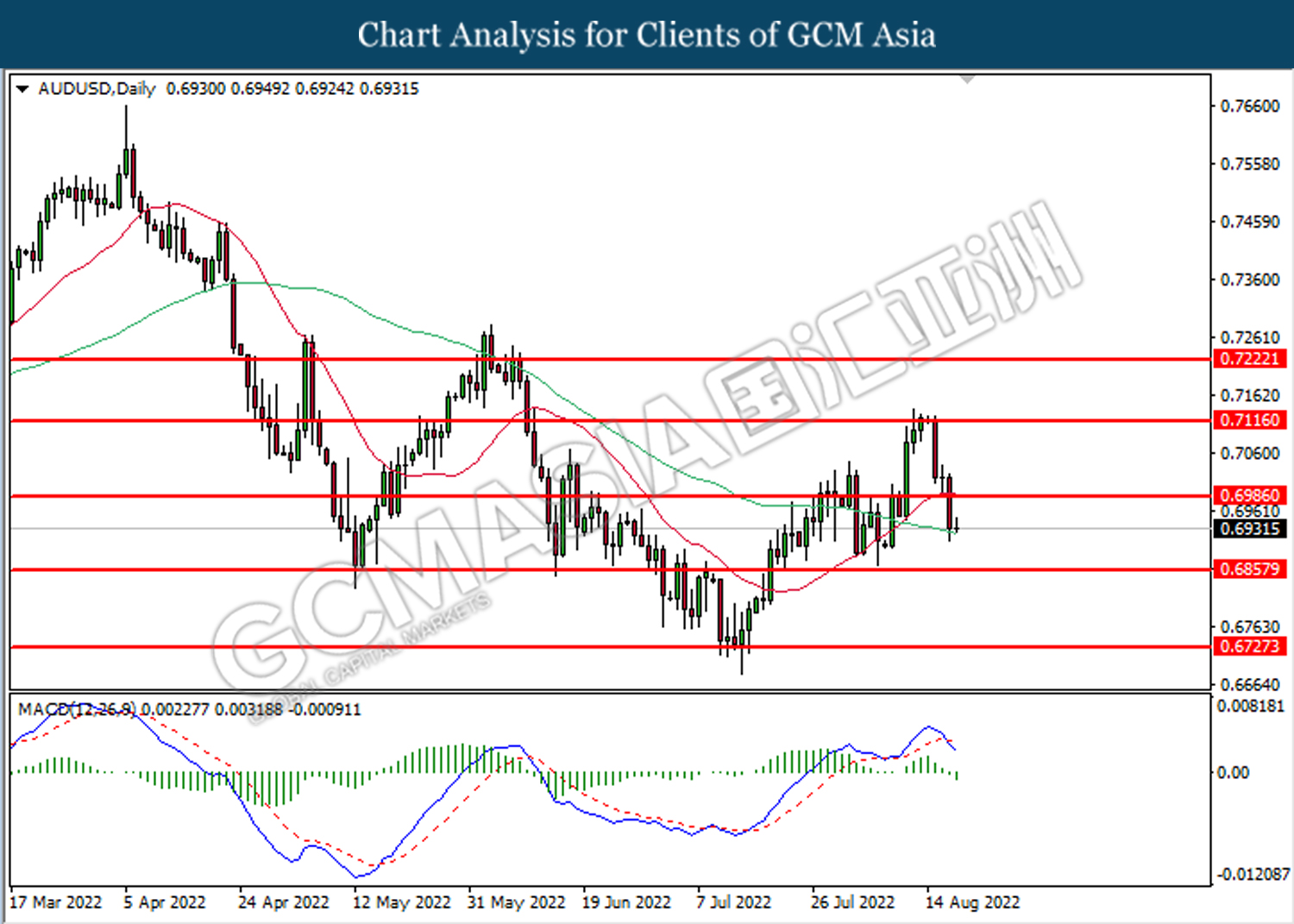

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

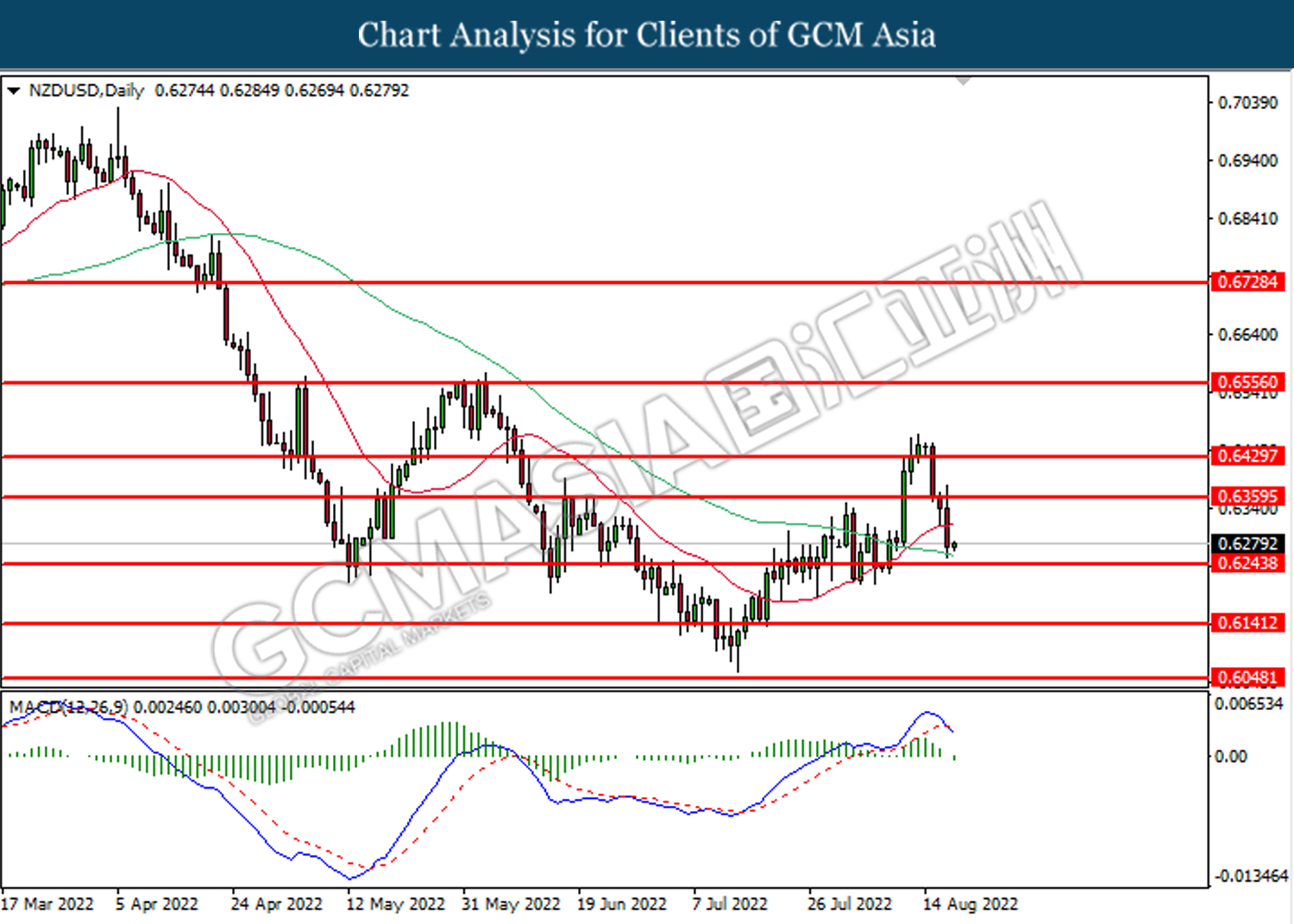

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6360. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6245.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2925. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

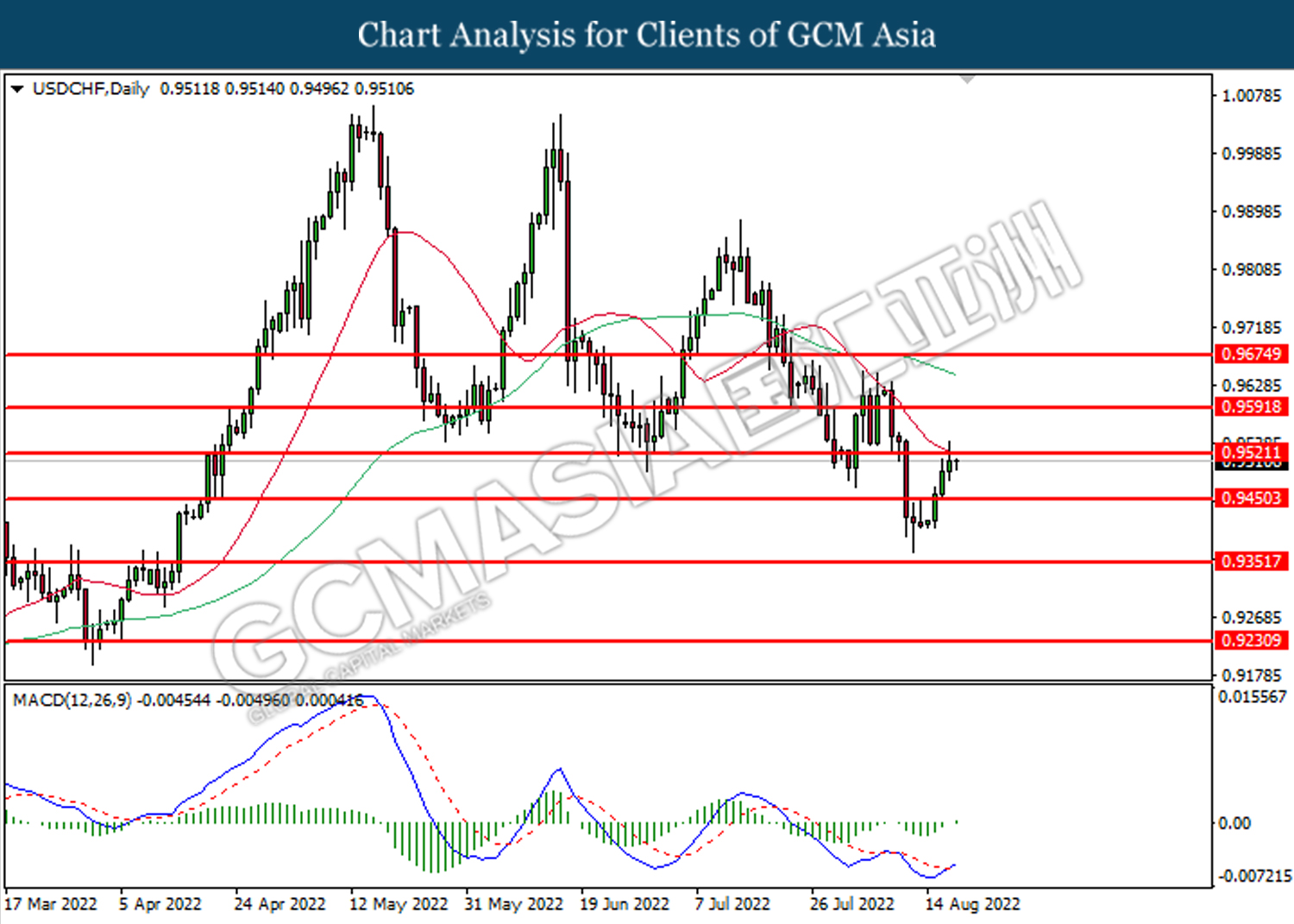

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9520. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9520, 0.9590

Support level: 0.9450, 0.9350

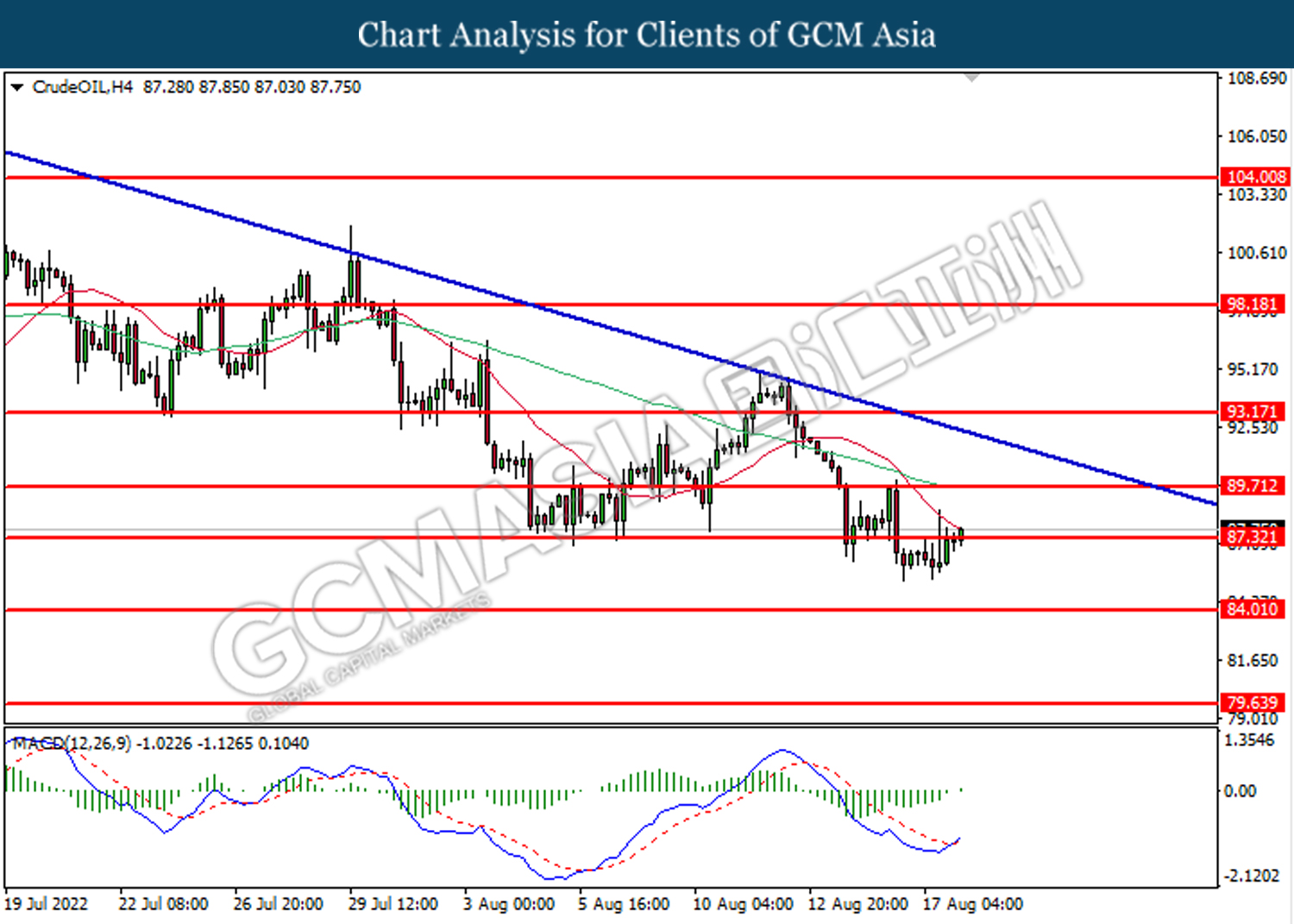

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 87.30. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 87.30, 89.70

Support level: 84.00, 79.65

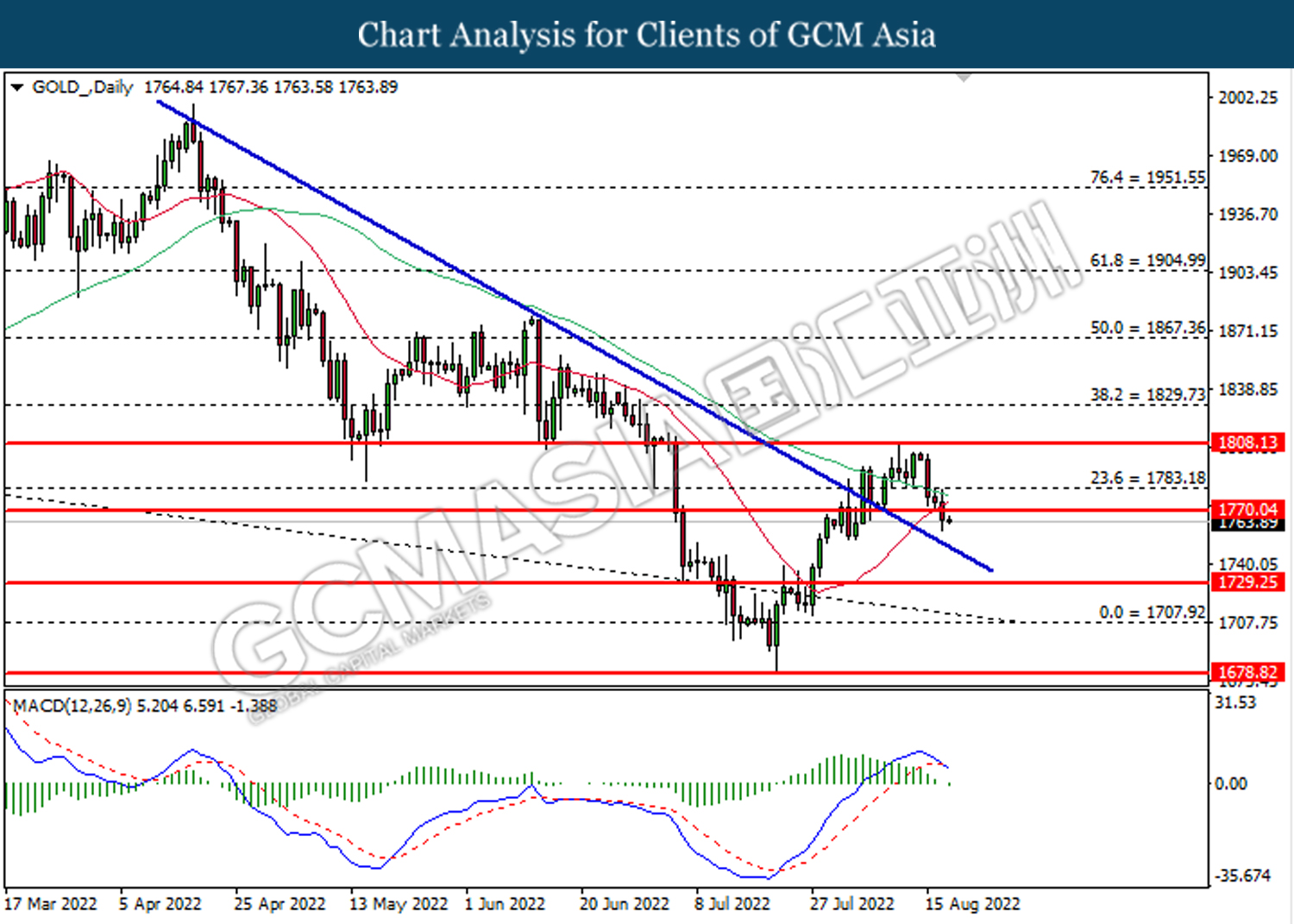

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90