19 August 2022 Morning Session Analysis

Dollar buoyed following the hawkish stance from Fed officials.

The dollar index, which gauges its value against a basket of six major currencies, surged as the members of the Federal Reserve (Fed) spoke of the need for further rate hikes. Early today, although Kansas City Federal Reserve President Esther George did not provide any clear stance on whether a 75-basis point of a rate hike is favourable, she did reveal that the drop in inflation registered in July, was great news. However, she emphasized that it was not good evidence the underlying problem was fixed, which hinted that the aggressive rate hike would not stop at the moment. Besides, St. Louis Fed President Jim Bullard has vowed that he sees about an 18-month process of getting inflation back to the Fed’s 2% target while reiterating his point of view that the inflation surge was not peaked yet. With that, he is leaning toward a 0.75% rate hike in the September meeting. On the data front, a series of positive economic data prompted the investors to shift their capital toward the dollar market. According to the labour department, US Initial Jobless Claims data came in at 250K, lower than the consensus forecast at 265K, indicating that the US labour market remains tight. Last but not least, the Philadelphia Fed Manufacturing Index (Aug) which was used to gauge the manufacturing activity in the region for August turned the table from the prior reading of -12.3 to 6.2, as the firms reported that the input price pressures eased. As of writing, the dollar index climbed 0.86% to 107.50.

In the commodities market, the crude oil price rose 3.62% to $91.05 a barrel as positive U.S. economic data and the nuclear deal remains silent offset the market concerns that slowing economic growth in other countries could undercut demand. Besides, the gold prices depreciated by -0.02% to $1758.00 a troy ounce amid the dollar’s weakening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM)(Jul) | -0.1% | -0.2% | – |

| 20:30 | CAD – Core Retail Sales (MoM)(Jun) | 1.9% | 0.9% | – |

Technical Analysis

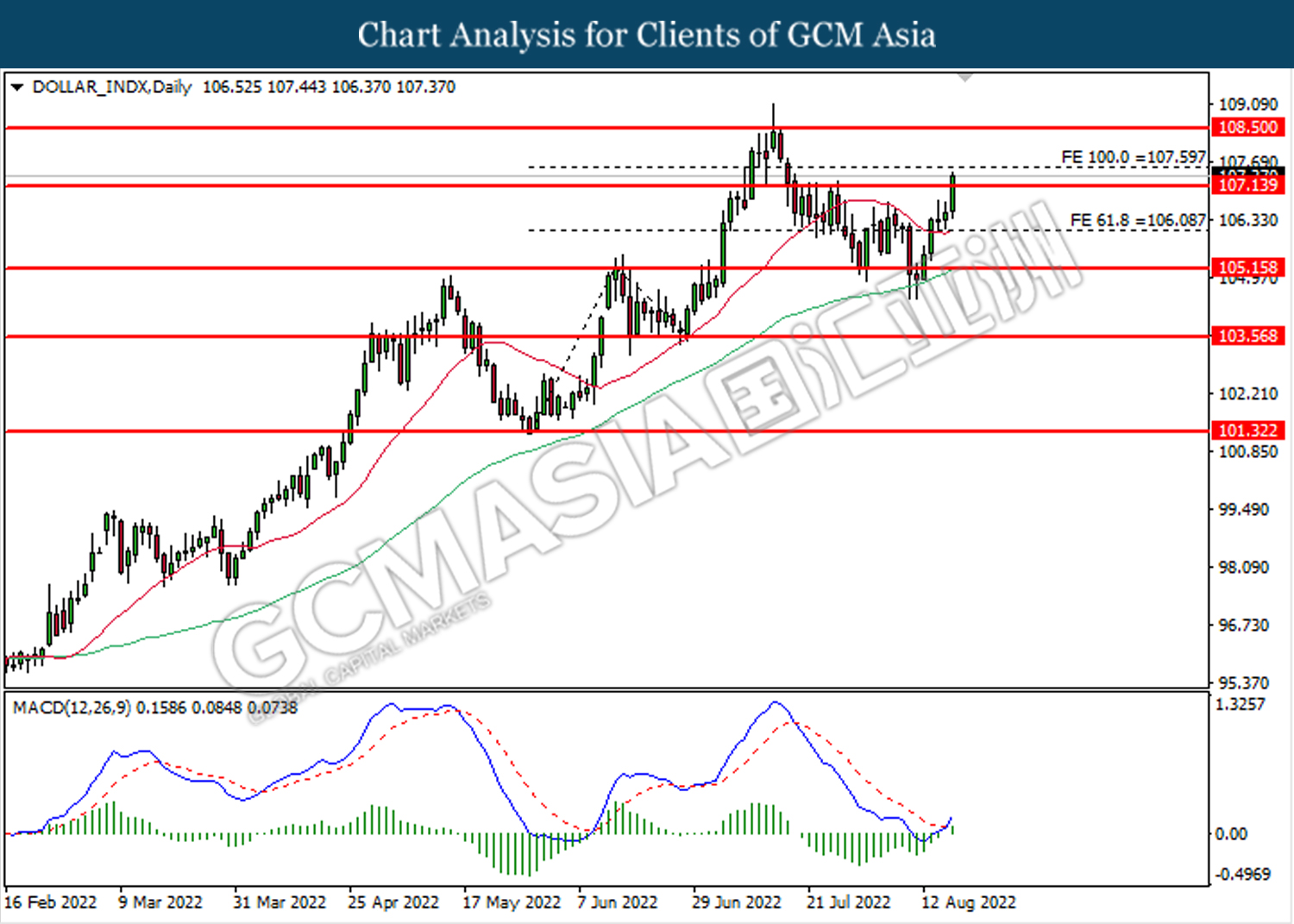

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 107.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

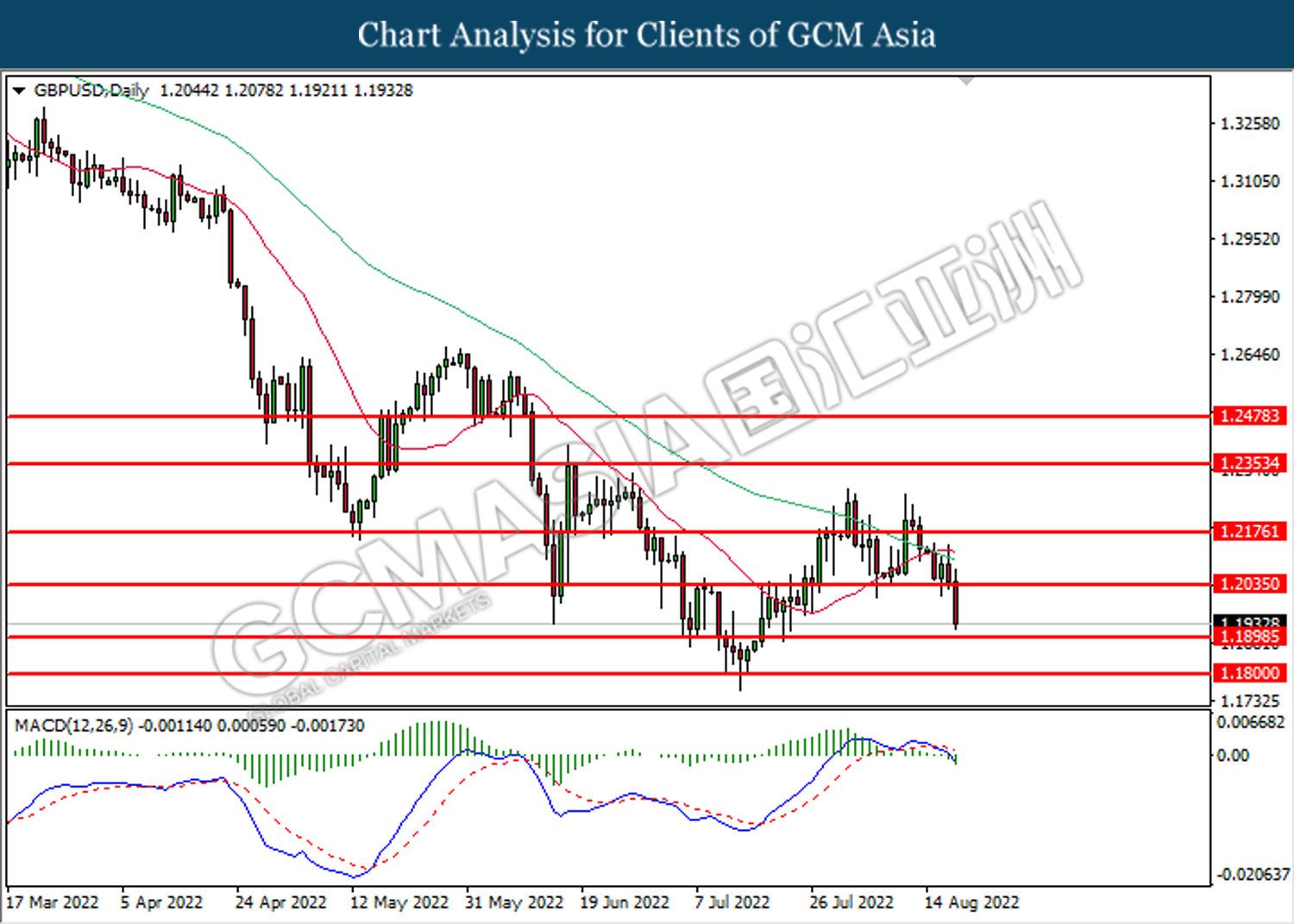

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2035. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1900.

Resistance level: 1.2035, 1.2175

Support level: 1.1900, 1.1800

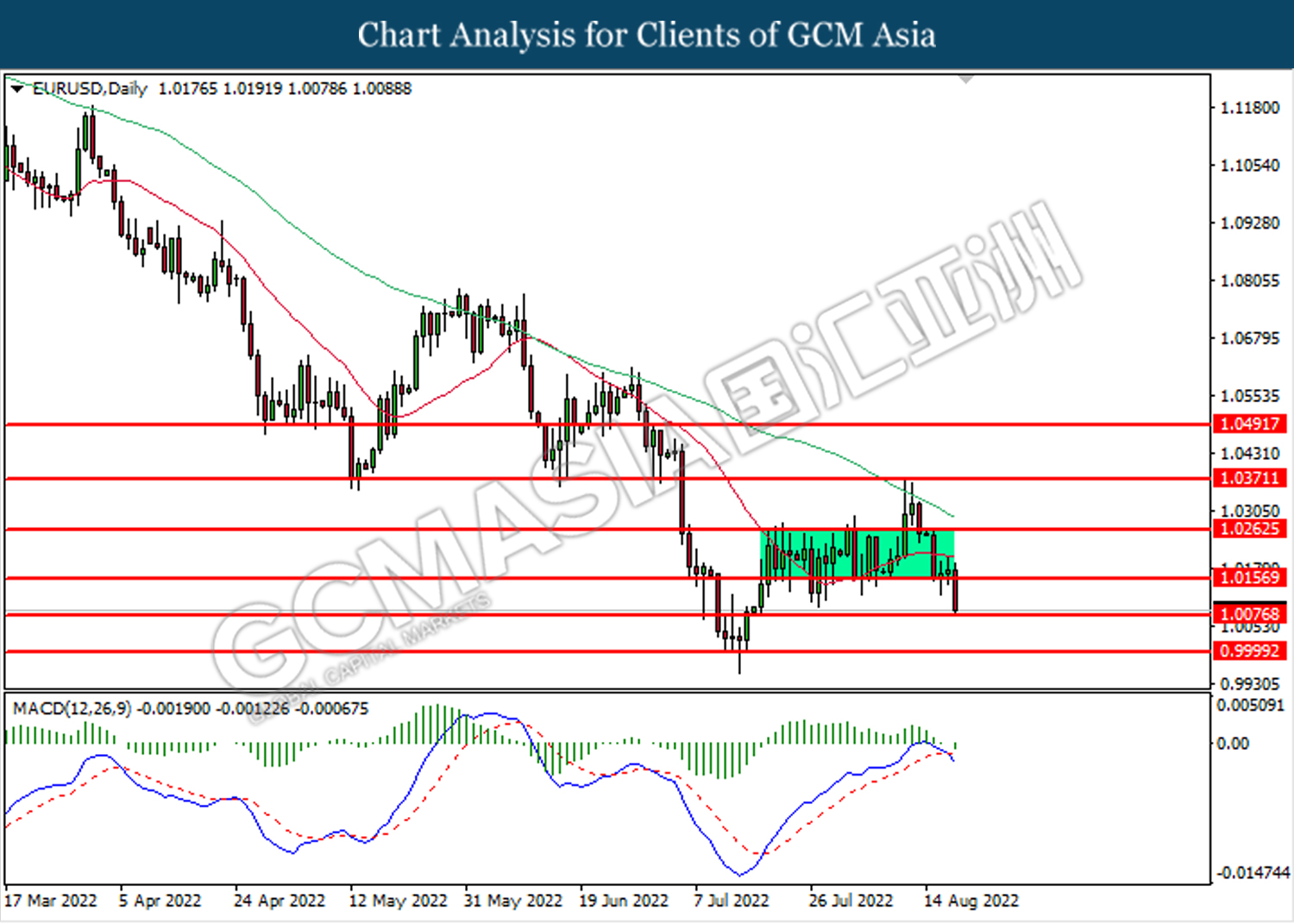

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0075. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0155, 1.0265

Support level: 1.0075, 0.9990

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.30

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

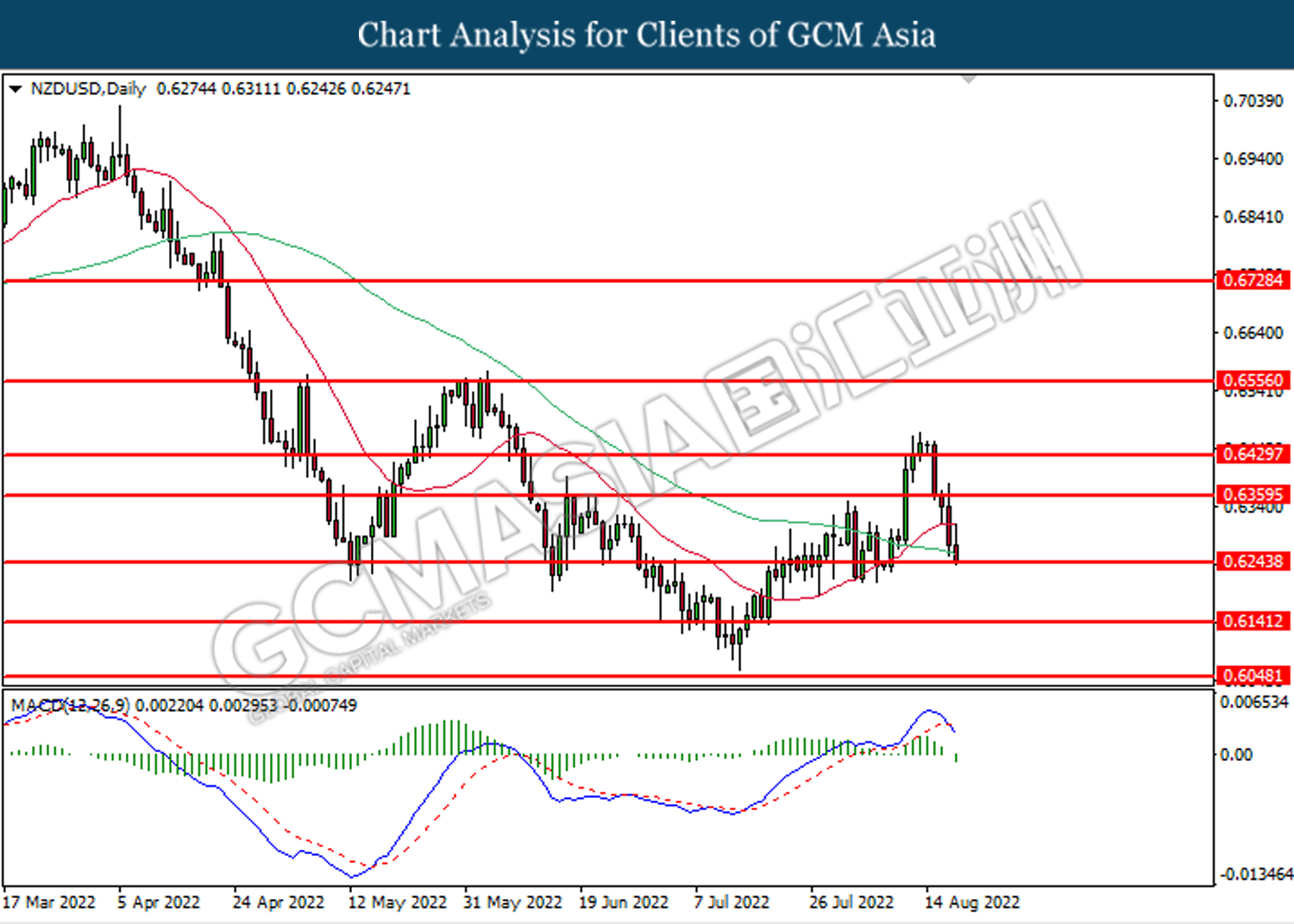

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6245. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

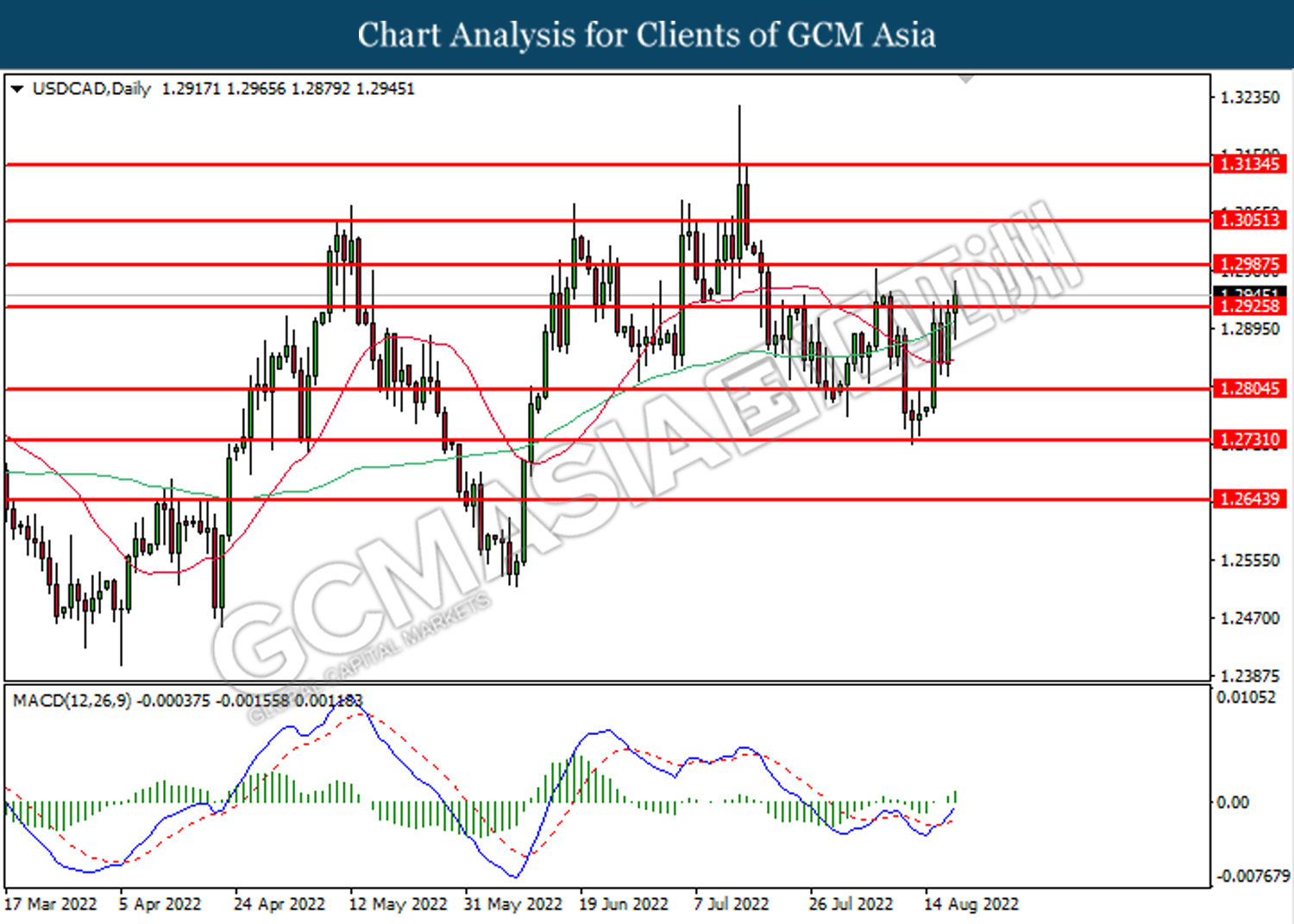

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2925. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

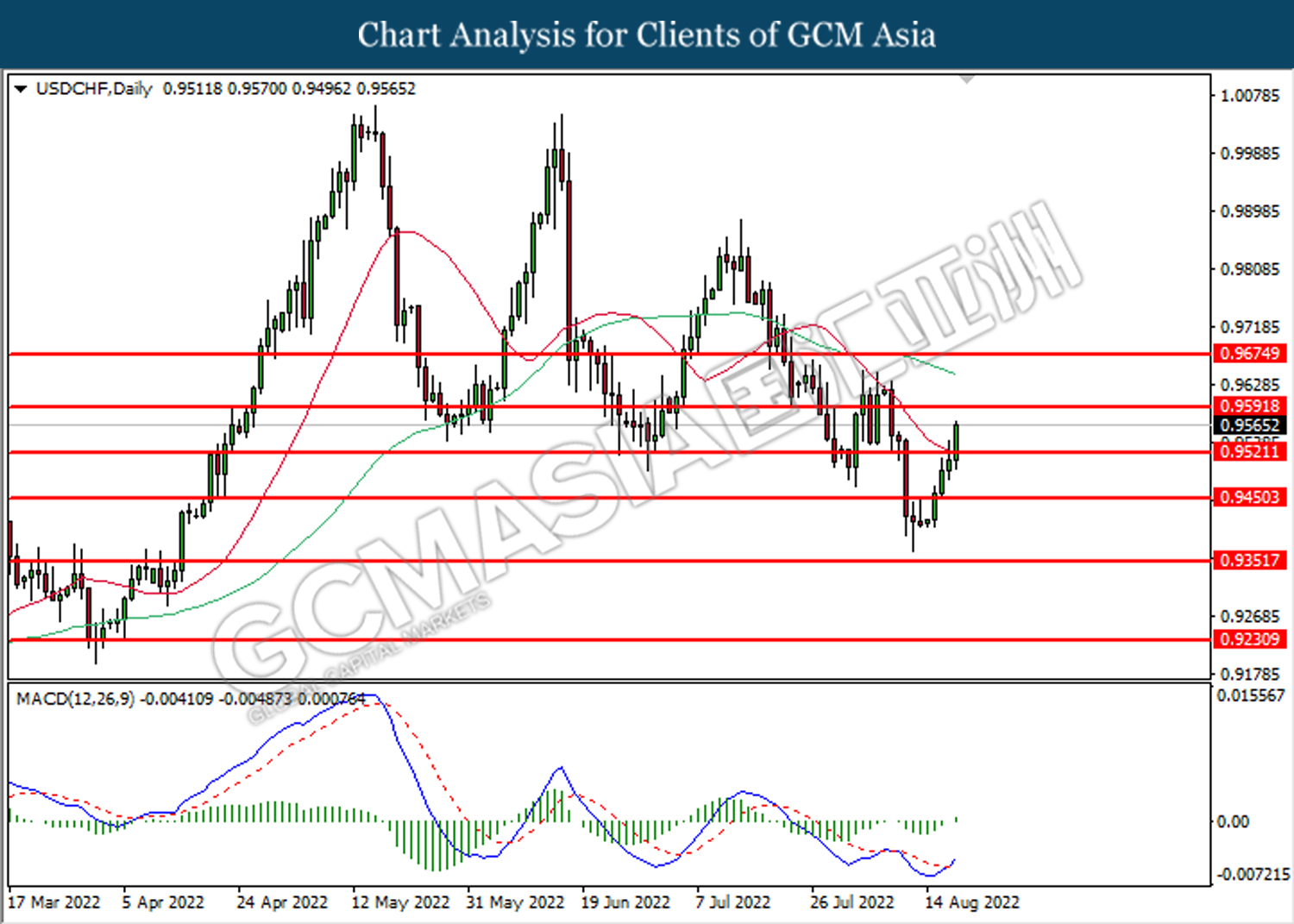

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9520. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9520, 0.9590

Support level: 0.9450, 0.9350

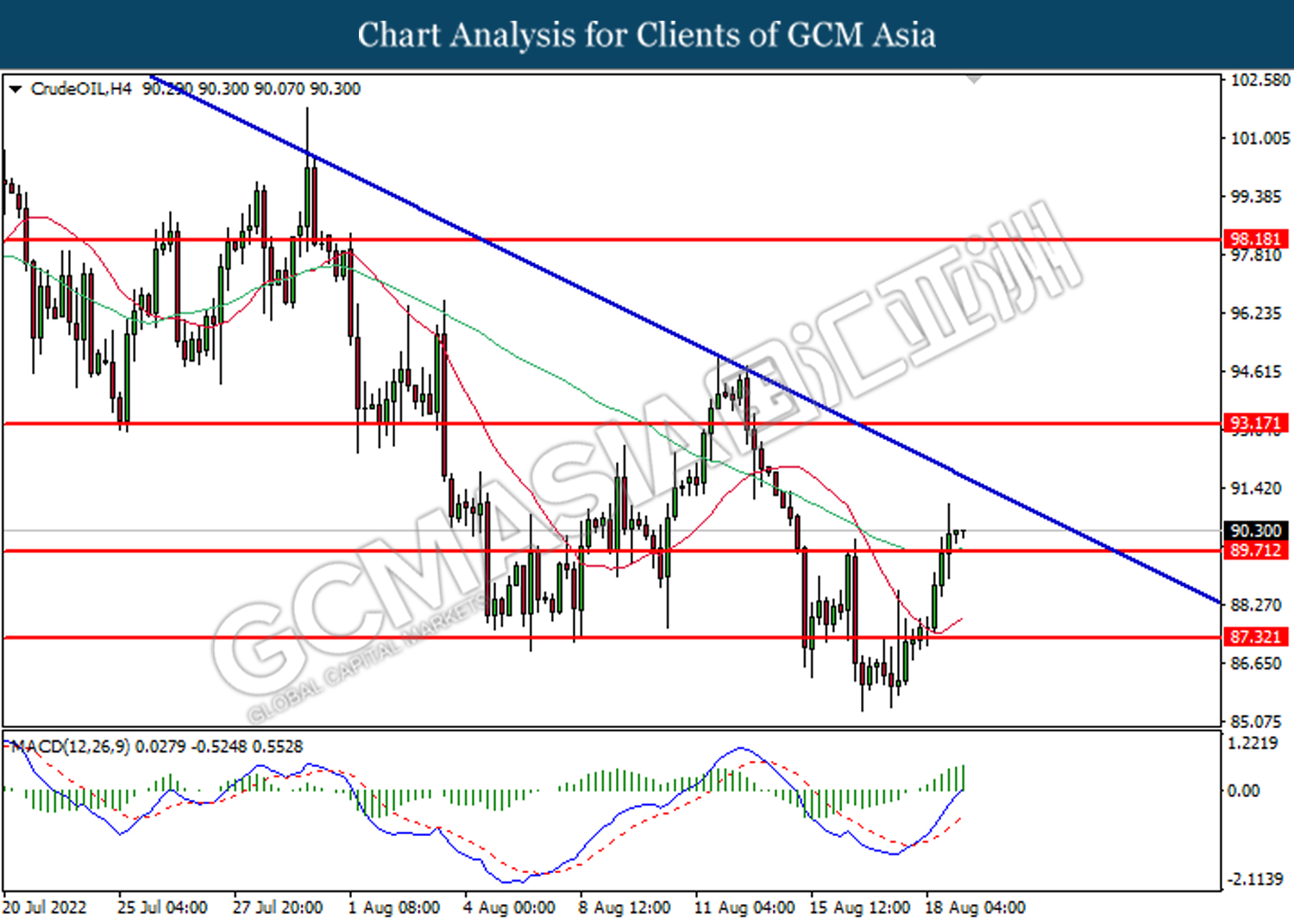

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 89.70. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 93.15.

Resistance level: 93.15, 98.20

Support level: 89.70, 87.30

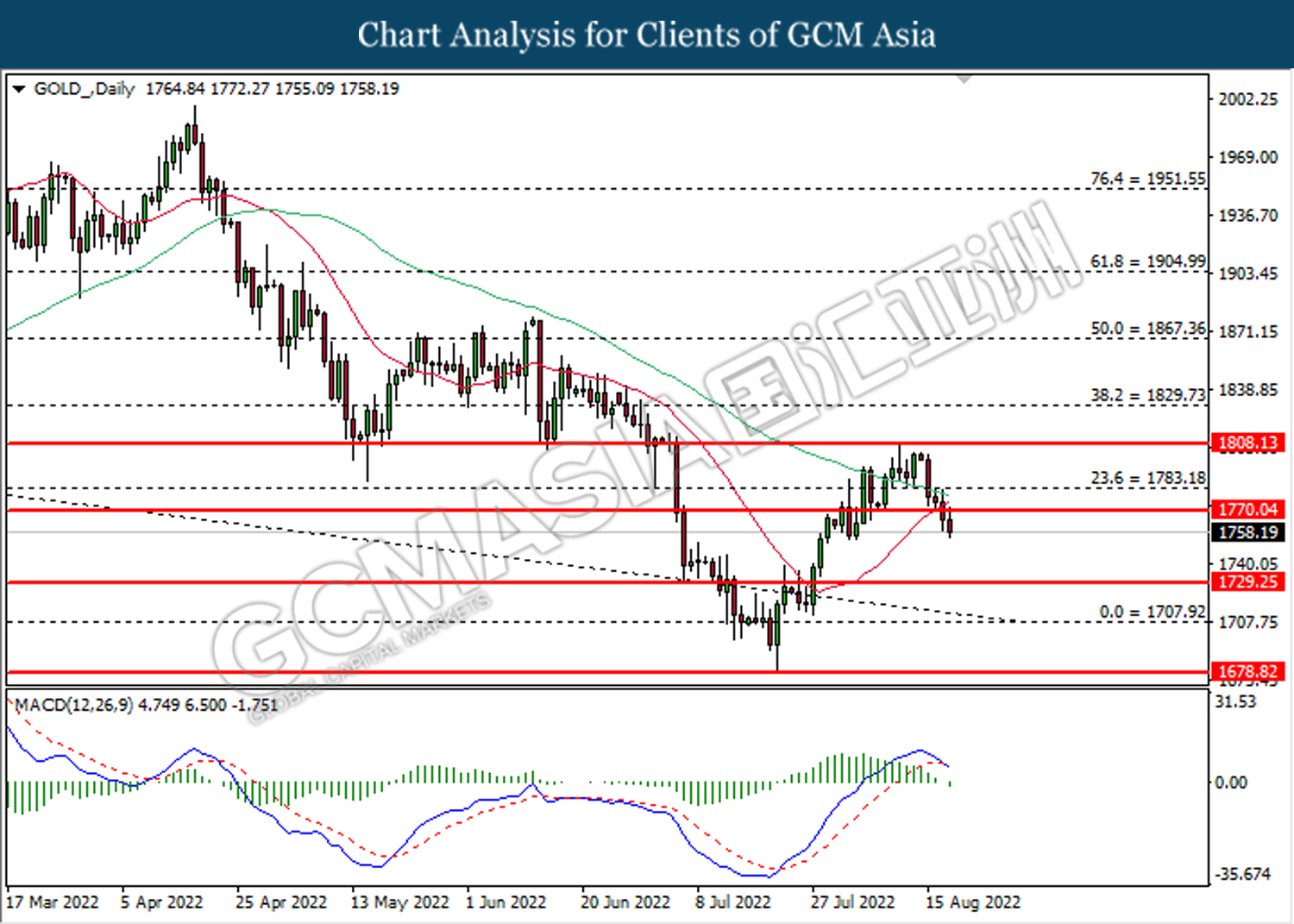

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90