19 August 2022 Afternoon Session Analysis

Pessimistic economic outlook in China, spurred bearish momentum on China-proxy Aussie.

The China-proxy currencies such as Australia Dollar slumped significantly as the liquidity strain in the China property sector had sparked further recession risk concerns toward the global economic progression. According to CNBC, Chinese property developers’ cash flow had shrunken this year following steady growth over the last decade. The developer cash flow through July are down by 24% year-on-year on an annualized basis. In addition, the late mortgage payments to the developer had also added further constraints toward the source of cash flow. Analysts estimate property and industries related to real estate account for more than a quarter of China’s GDP. The real estate slump would contribute to further slowdown in economic growth this year. On the other hand, the Australia Dollar extend its losses over the backdrop of downbeat economic data. According to Australian Bureau of Statistics, Australia Employment Change came in at -40.9K, missing the market forecast at 25.0K. As of writing, AUD/USD depreciated by 0.10% to 0.6910.

In the commodities price, the crude oil price extends its surged 0.01% to $89.80 barrel per day. The crude oil price was edged higher yesterday following US released their upbeat economic data, which spurring positive prospect toward the oil demand. On the other hand, the gold price depreciated by 0.13% to $1756.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM)(Jul) | -0.1% | -0.2% | – |

| 20:30 | CAD – Core Retail Sales (MoM)(Jun) | 1.9% | 0.9% | – |

Technical Analysis

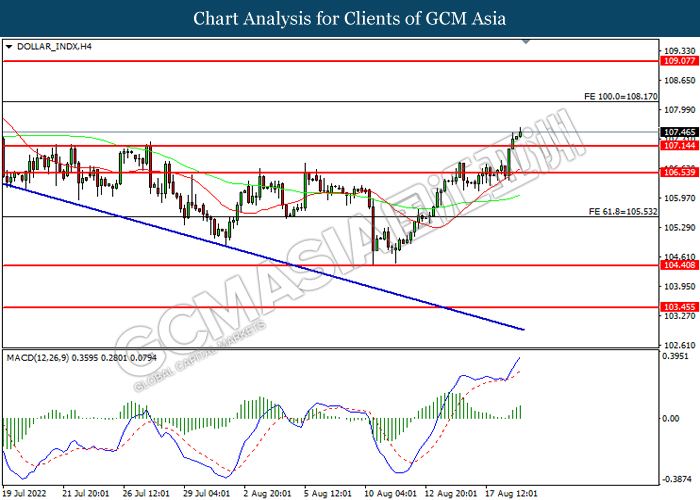

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 108.15, 109.10

Support level: 107.15, 106.55

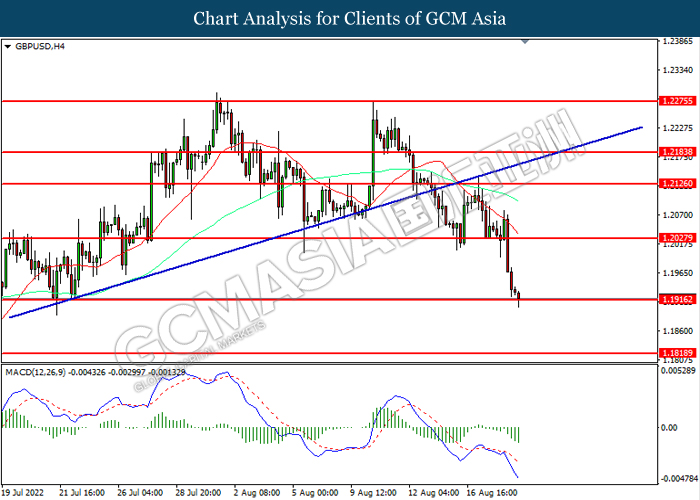

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2025, 1.2125

Support level: 1.1915, 1.1820

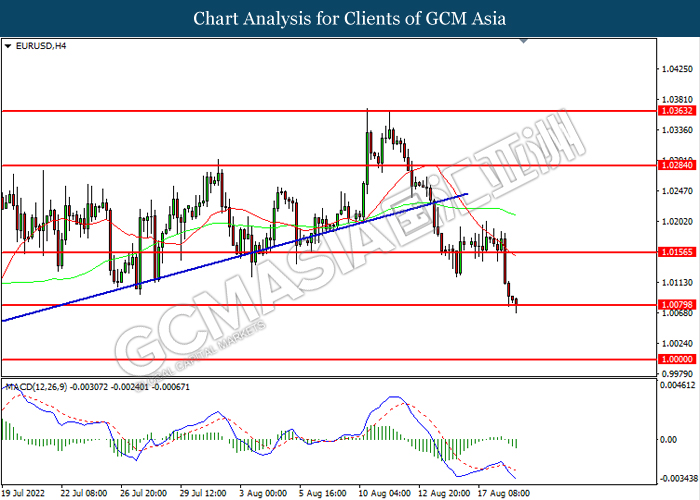

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0155, 1.0285

Support level: 1.0080, 1.000

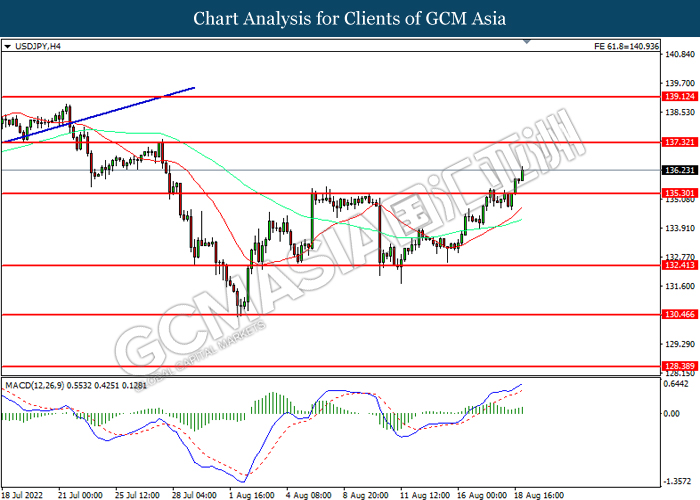

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 137.30, 139.10

Support level: 135.30, 132.40

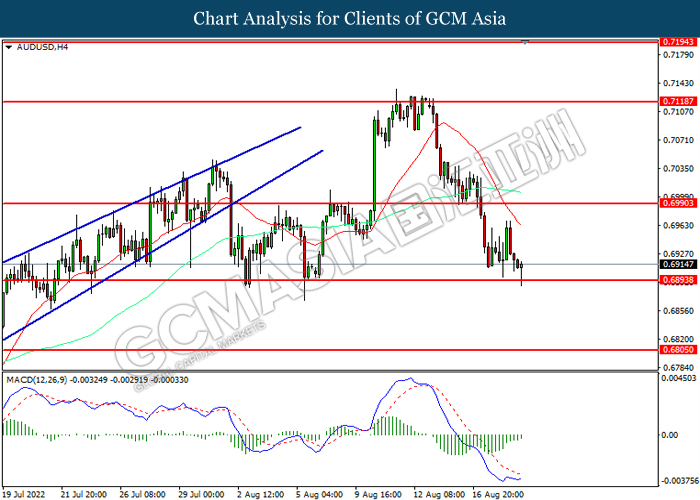

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6990, 0.7120

Support level: 0.6895, 0.6805

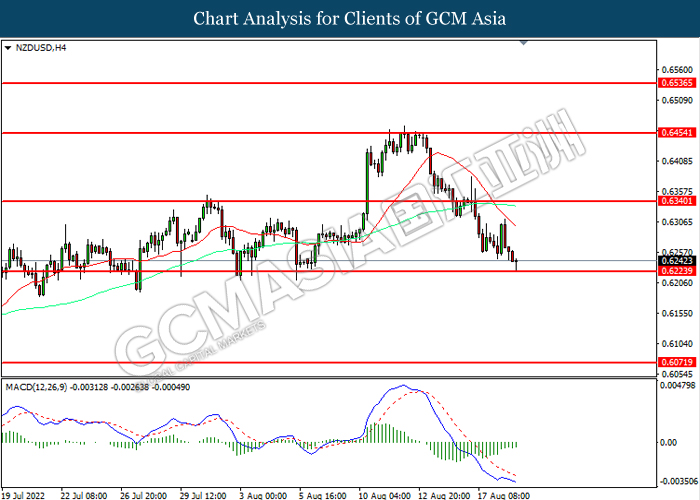

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6340, 0.6455

Support level: 0.6225, 0.6070

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2955, 1.3105

Support level: 1.2755, 1.2645

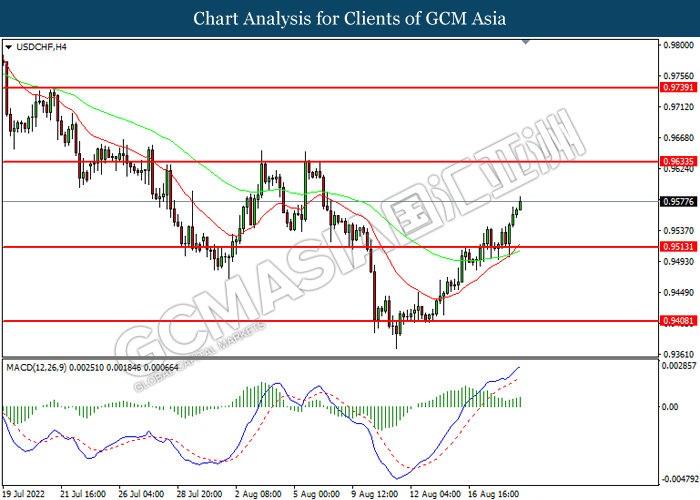

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9635, 0.9740

Support level: 0.9515, 0.9410

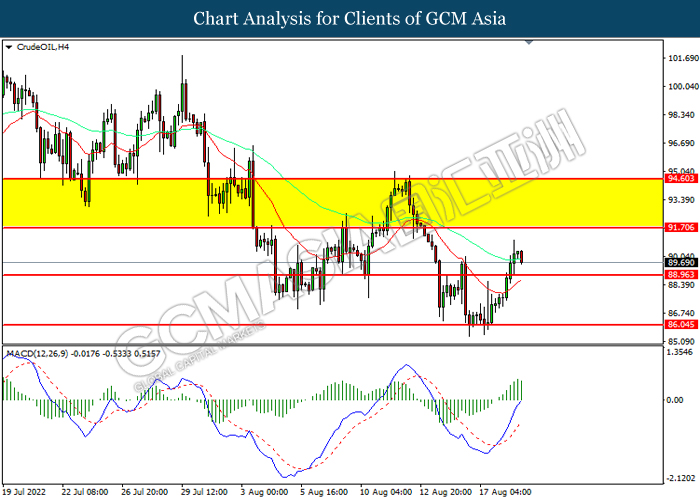

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 91.70, 94.60

Support level: 88.95, 86.05

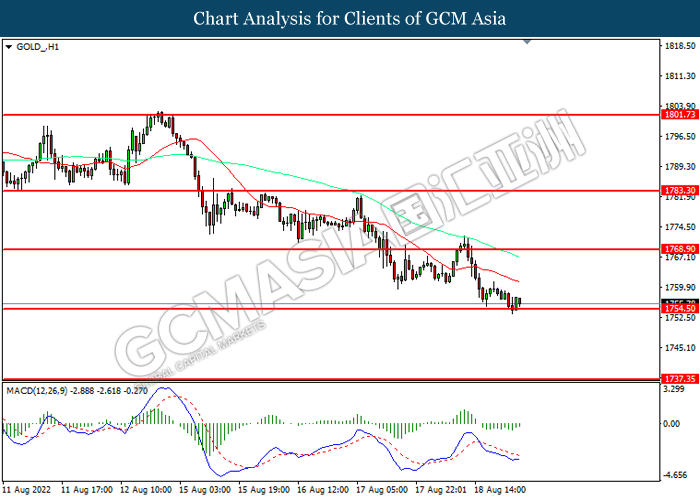

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1768.90, 1783.30

Support level: 1754.50, 1737.35