22 August 2022 Afternoon Session Analysis

Aussie dived amid China economic clouded by power rationing.

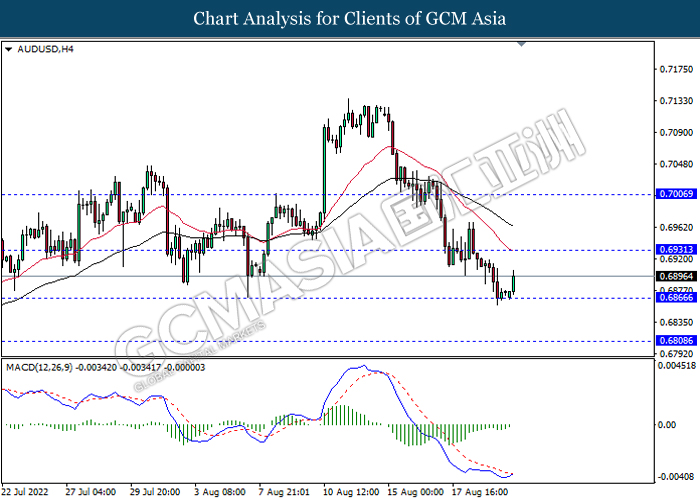

The AUD/USD, which traded by majority of investors dropped significantly on last Friday over the pessimistic economic outlook in China, which spurred bearish momentum on the Aussie. According to Reuters, one of the largest city in China, Sichuan, has extended power rationing across the region amid extreme heat and drought. The power rationing has caused the factories and industrials remained closed until 25 August, which would likely to add further pressure on the economic progression in China. Thus, it would also brought negative prospects toward Australia’s economy as China was the largest trading partner for Australia. Besides that, the losses of Aussie was extended following the Fed’s member has appeared their hawkish statement recently, leading investors to flee away from the risk-appetite market and purchase US Dollar. As of writing, AUD/USD appreciated by 0.36% to 0.6897.

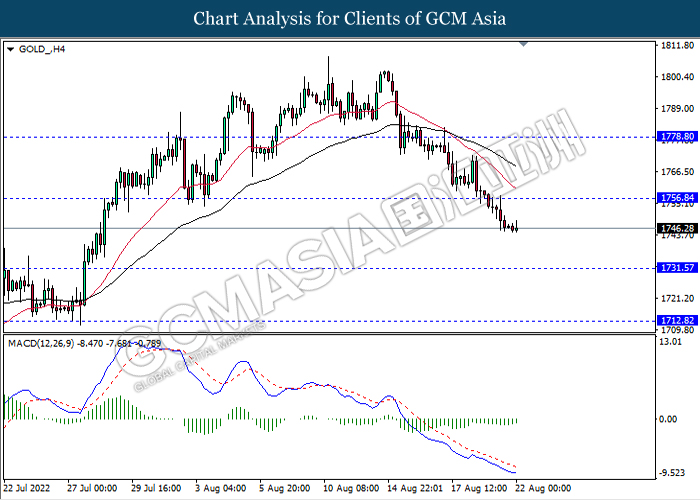

In the commodities market, the crude oil price depreciated by 1.01% to $89.55 per barrel as of writing. According to the source, Iran and Western countries were close to striking a deal that would lift sanctions on the oil supply. On the other hand, the gold price eased by 0.14% to $1747.20 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

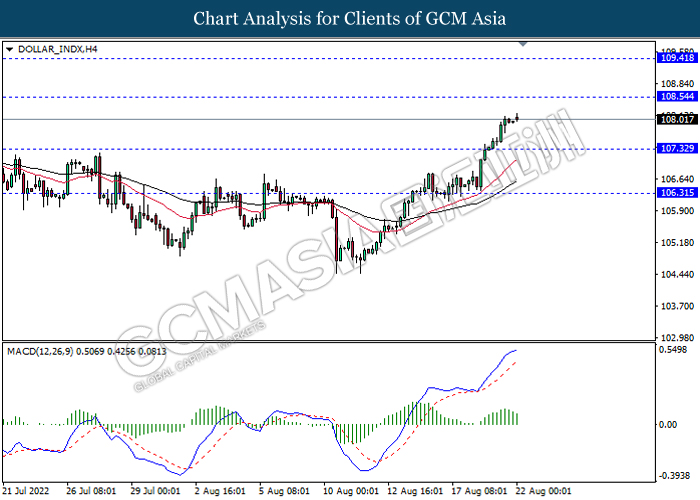

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.55, 109.40

Support level: 107.30, 106.30

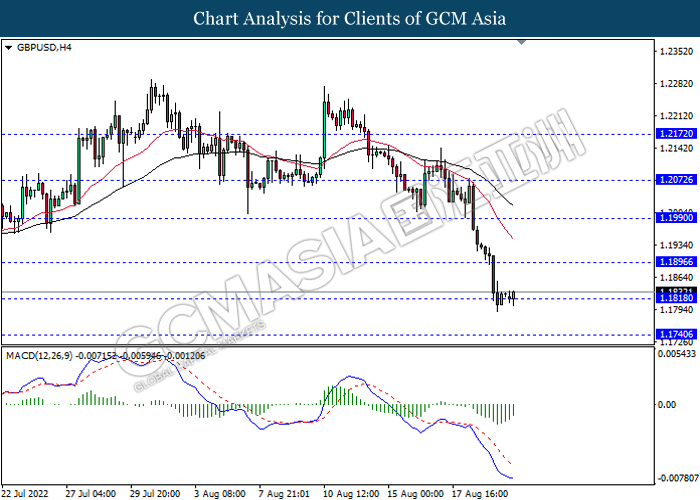

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1895, 1.1990

Support level: 1.1820, 1.1740

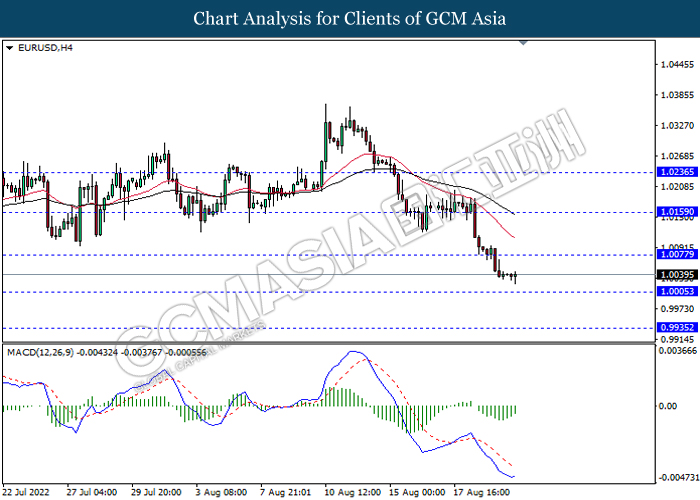

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0075, 1.0160

Support level: 1.0005, 0.9935

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6930, 0.7005

Support level: 0.6865, 0.6810

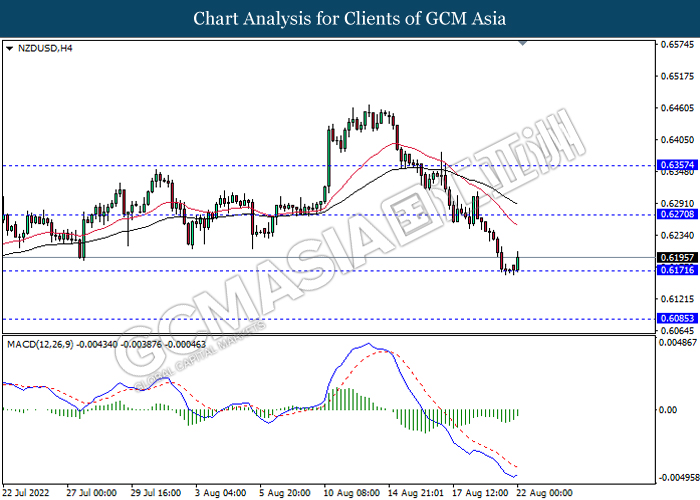

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

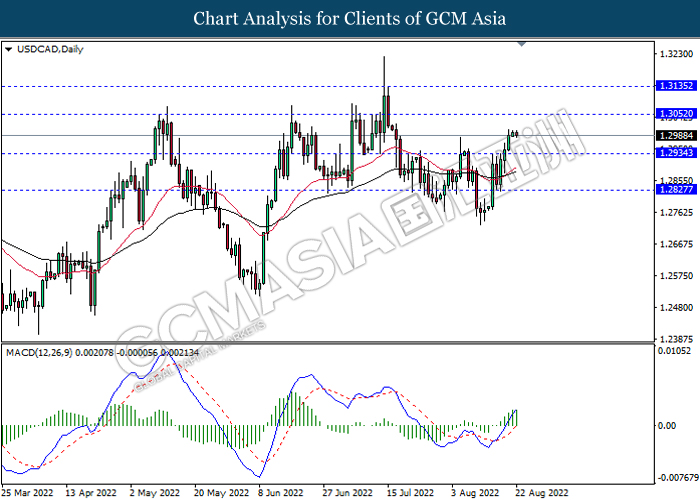

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

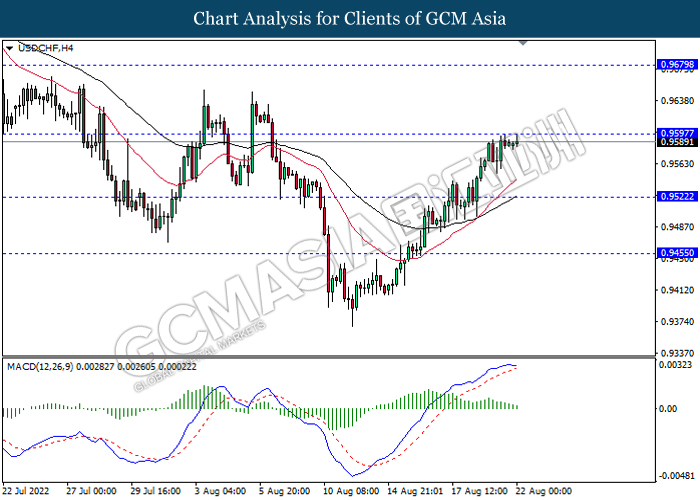

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9595, 0.9680

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.40

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80