24 August 2022 Morning Session Analysis

A series of downbeat data limited the gains of Greenback.

The dollar index, which gauges its value against a basket of six major currencies, failed to extend its gains yesterday as a series of data showed that US published downbeat figures. Late yesterday, the S&P Global Composite PMI was released with a weaker-than-expected figure, whereby the actual reading came in at 45.0, far lower than both the consensus forecast and prior reading at 49.0 and 47.7 respectively. The reduction in output was broad-based, with manufacturers and service providers registering lower activity. Diving deeper into the manufacturing sector, US Manufacturing PMI for the month of August came in at 51.3, lower than the consensus forecast at 52.0. On the other hand, the US service sector firms recorded a steeper rate of decline, whereby the August figure dropped from 47.3 to 44.1 while indicating the sector activity fell sharply month over month. The customer demand has significantly dampened mainly attributed to a few factors including material shortages, delivery delays, hikes in interest rates and strong inflationary pressures. The renewed contraction risk in the US urged the investors to flee away from the US dollar market and enter into some other market such as Pound and Euro. As of writing, the dollar index edged down 0.49% to 108.50.

In the commodities market, the crude oil price up 0.10% to $93.70 a barrel as Saudi Arabia floated the idea of OPEC+ may trim their oil production to support prices if the US were to remove the oil exportation sanction against Iranian. Besides, the gold prices up by 0.09% to $1746.40 a troy ounce following the release of downbeat data from the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jul) | 0.4% | 0.2% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Jul) | -8.6% | -4.0% | – |

Technical Analysis

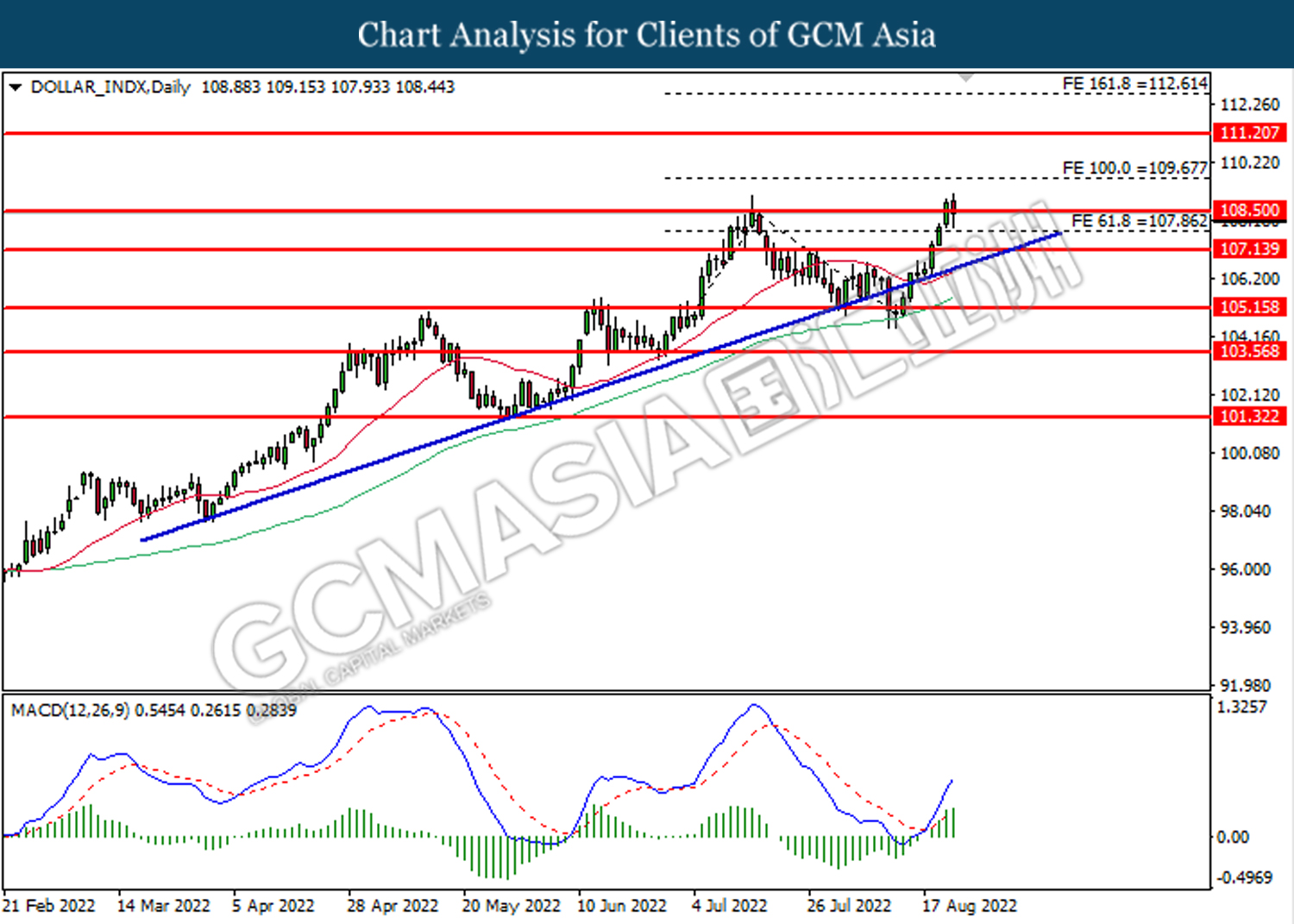

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 108.50. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 109.70.

Resistance level: 109.70, 111.20

Support level: 108.50, 107.85

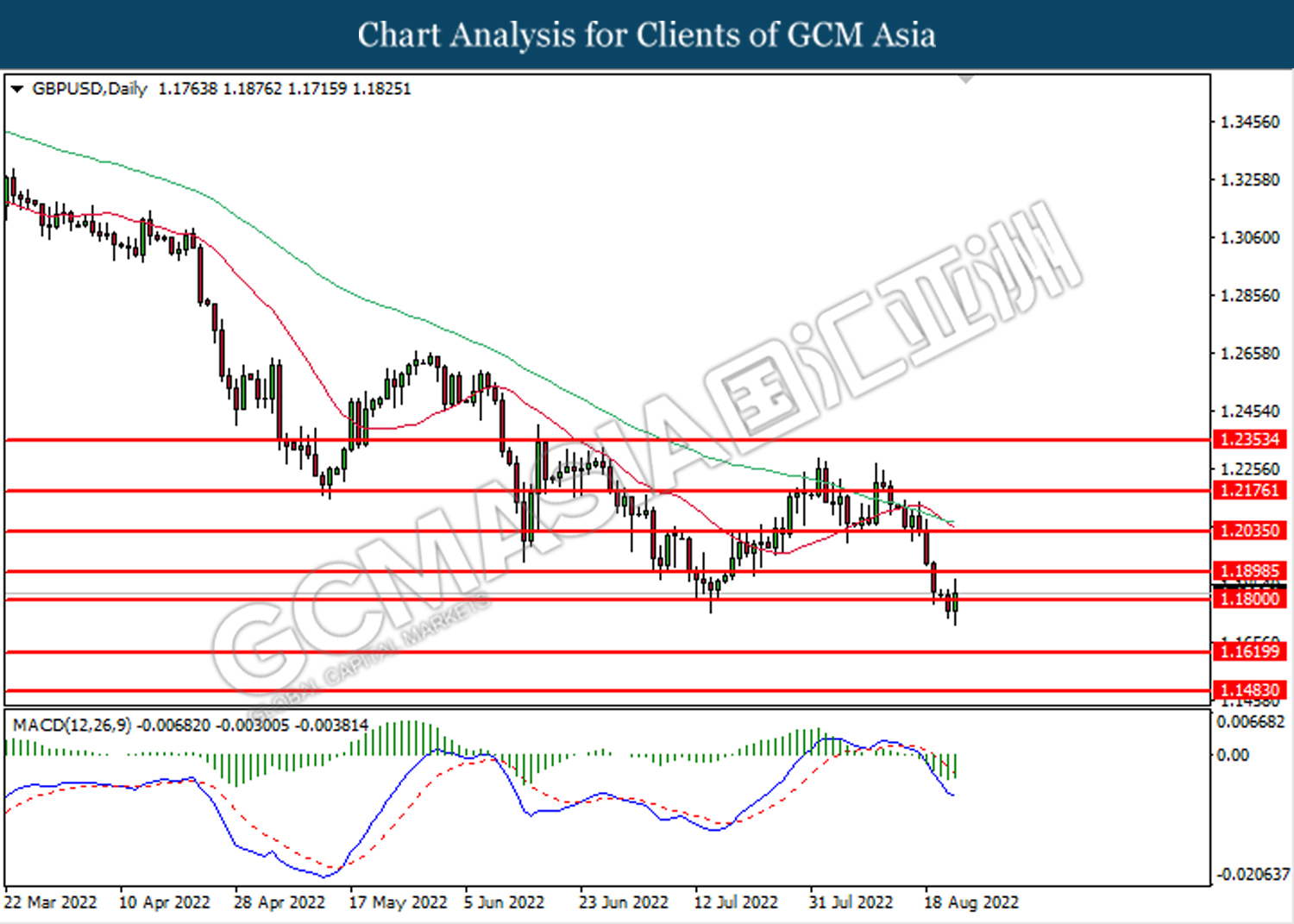

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1800. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1800, 1.1900

Support level: 1.1620, 1.1485

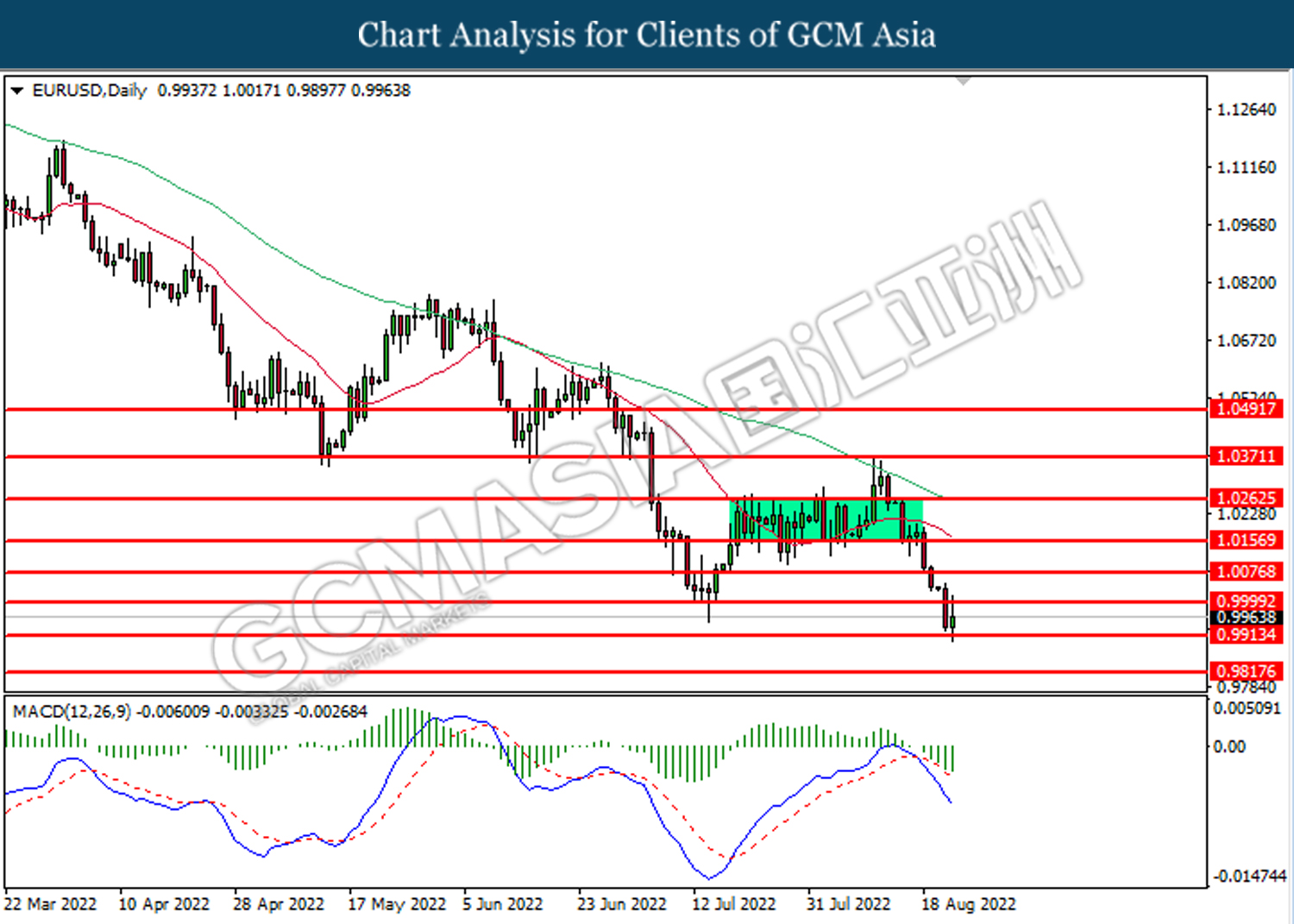

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 138.00.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

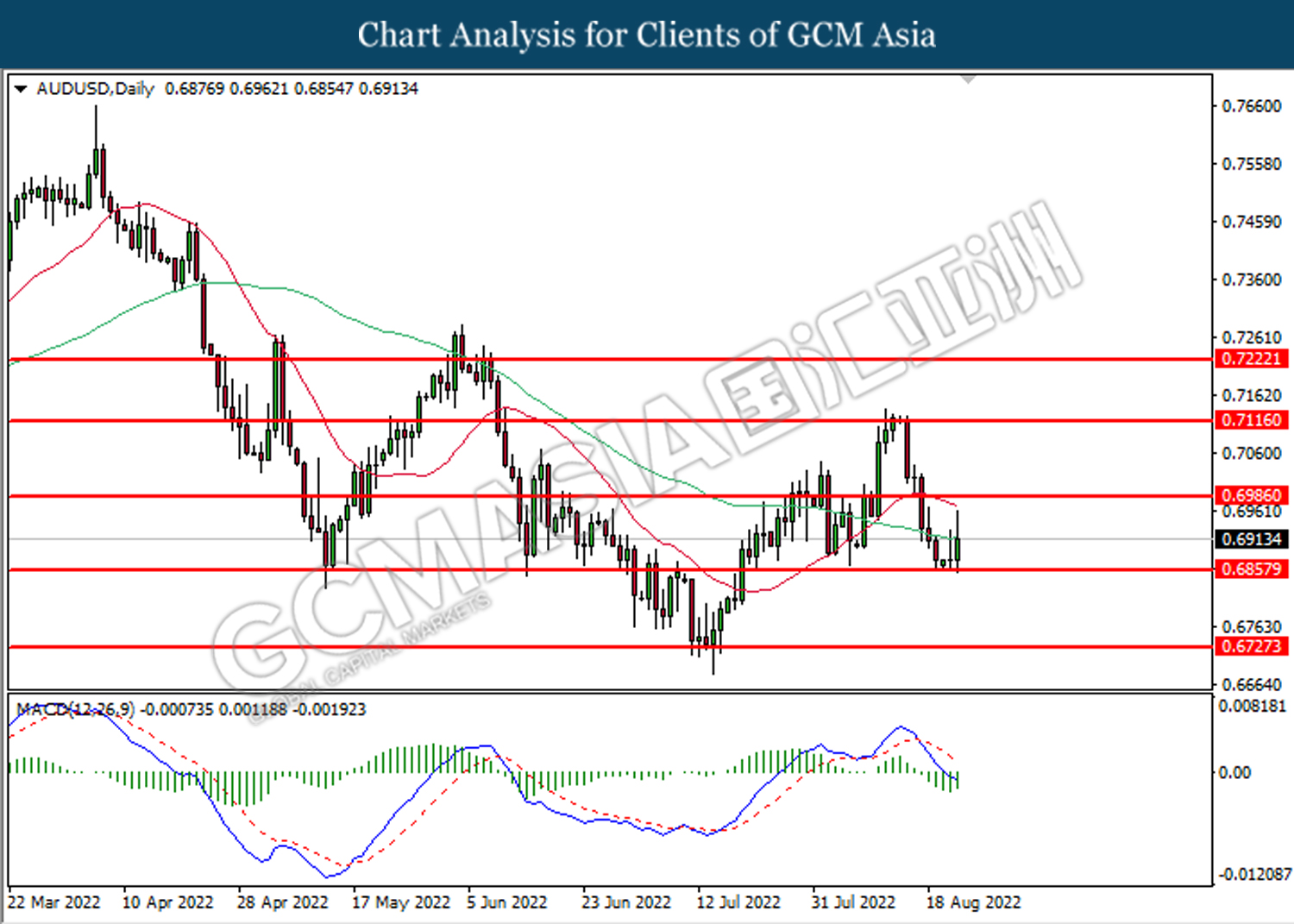

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

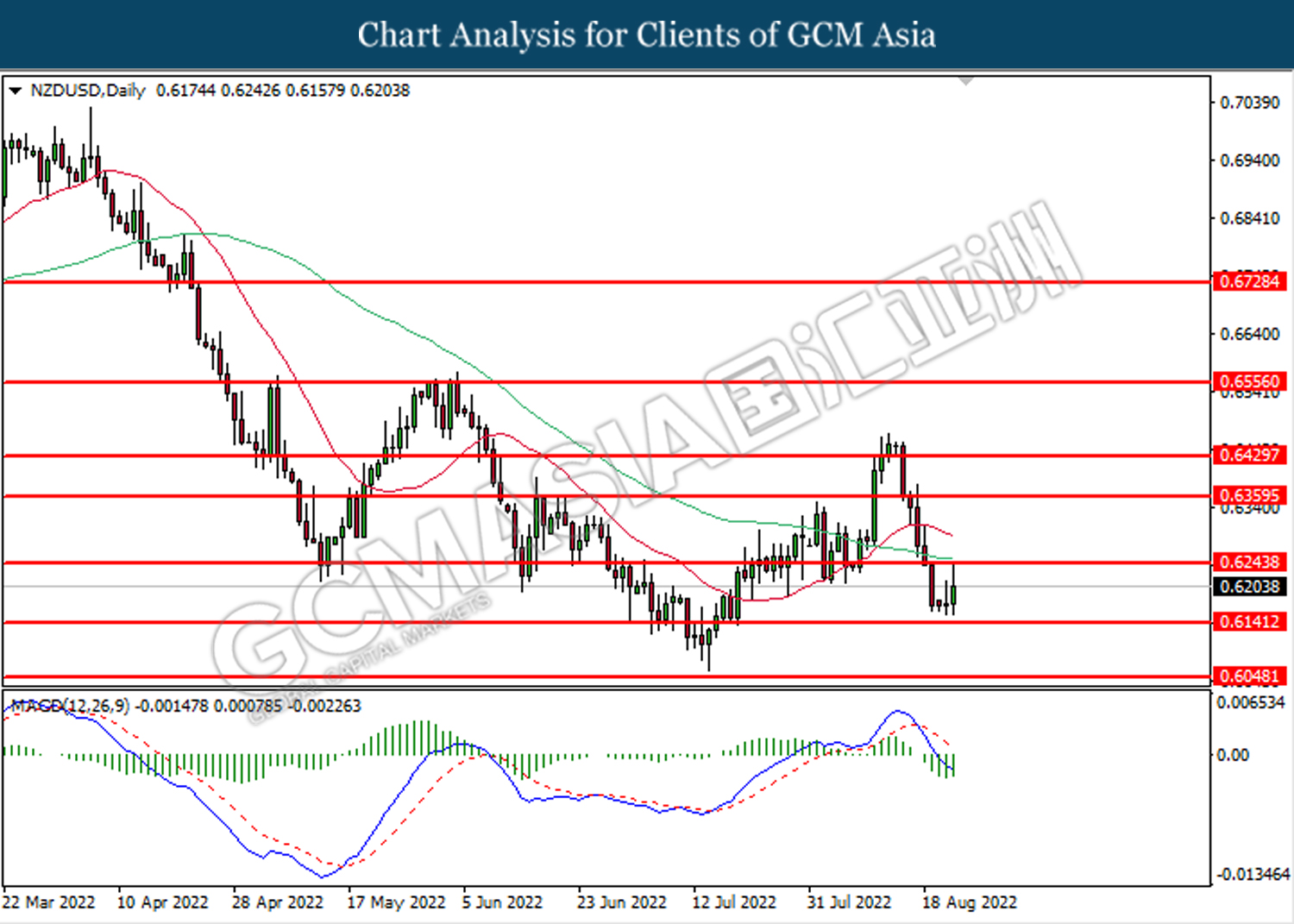

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6245. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2985. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully closes its candle below the support level.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

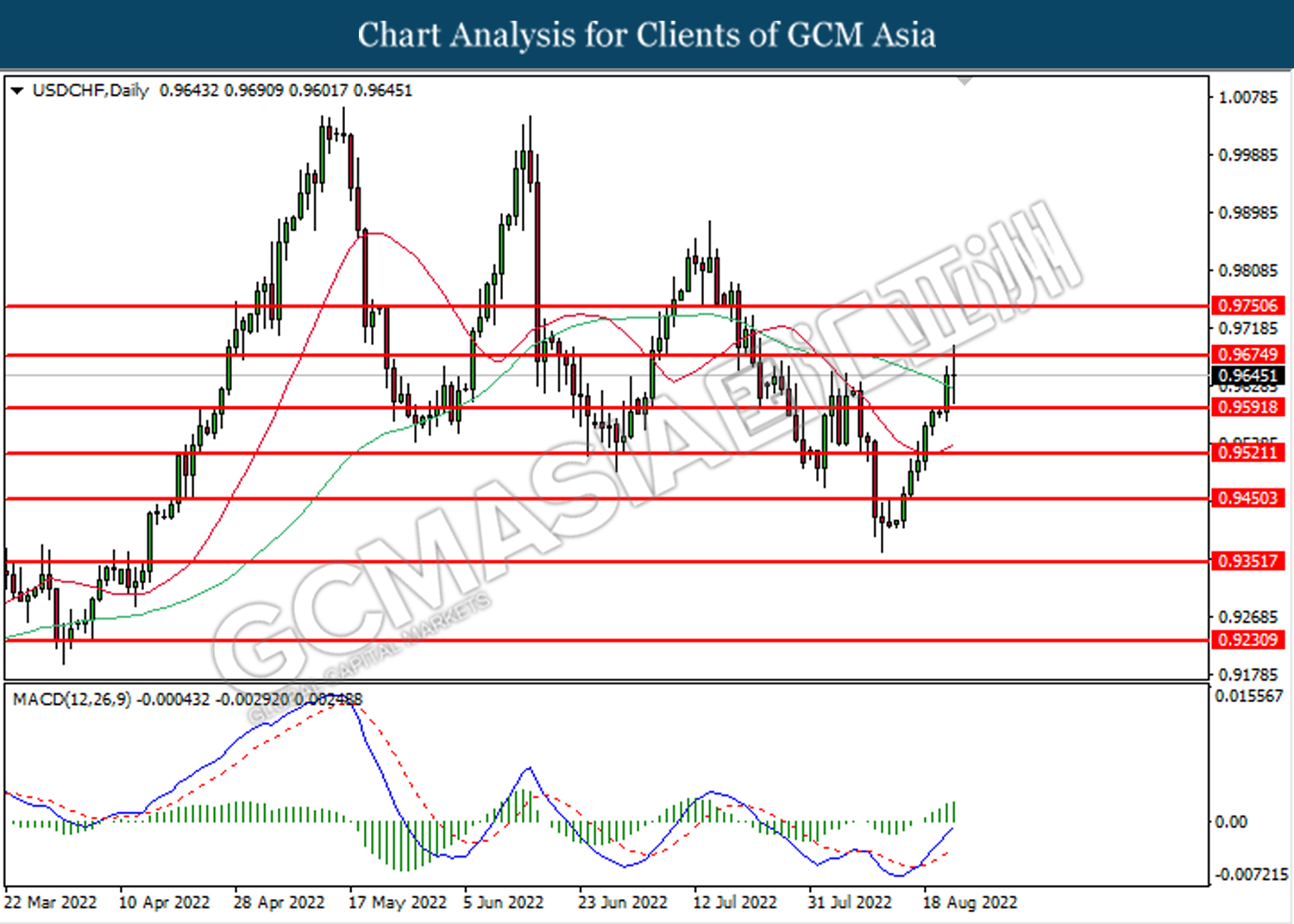

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

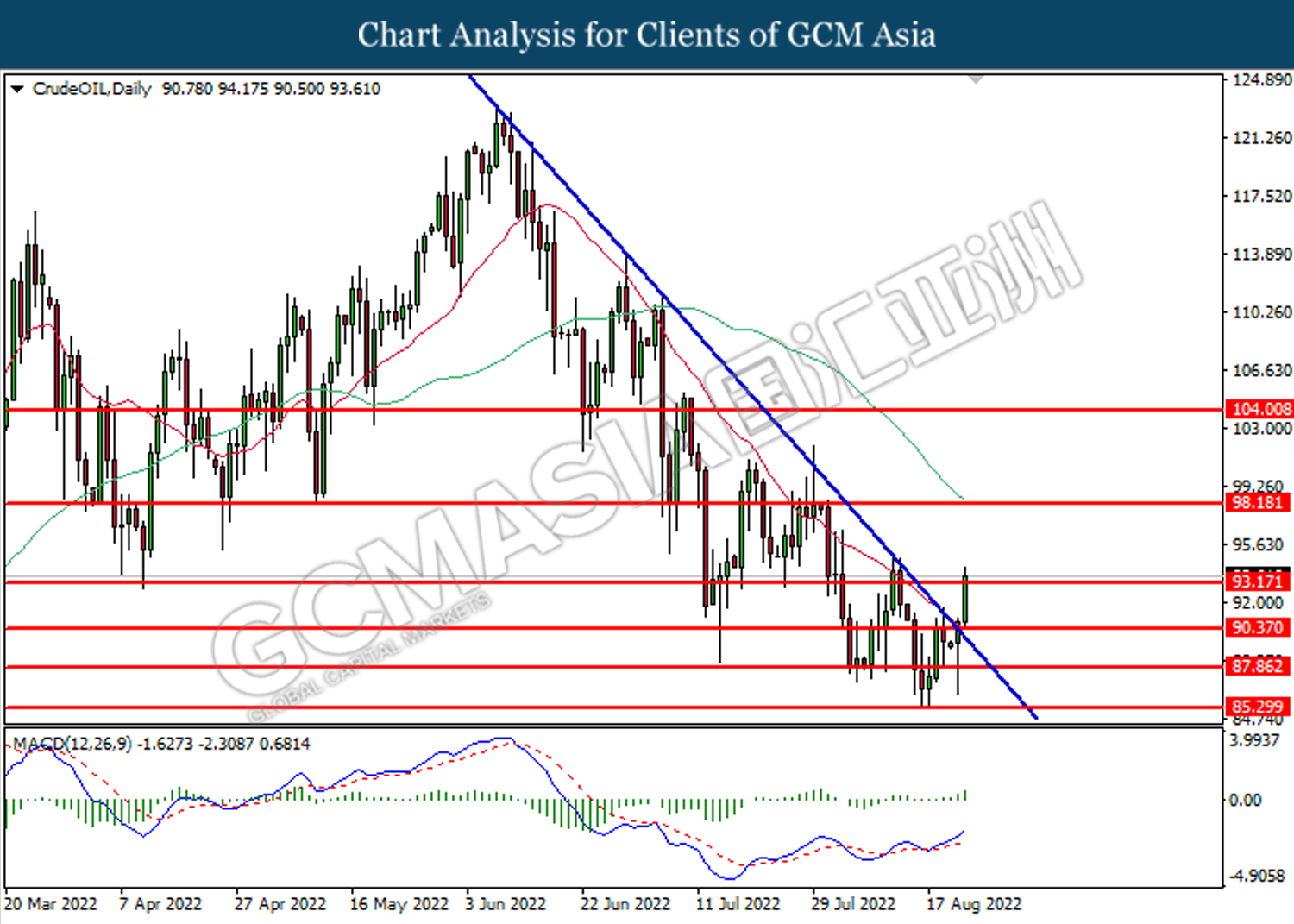

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 93.20. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.15, 98.20

Support level: 90.35, 87.85

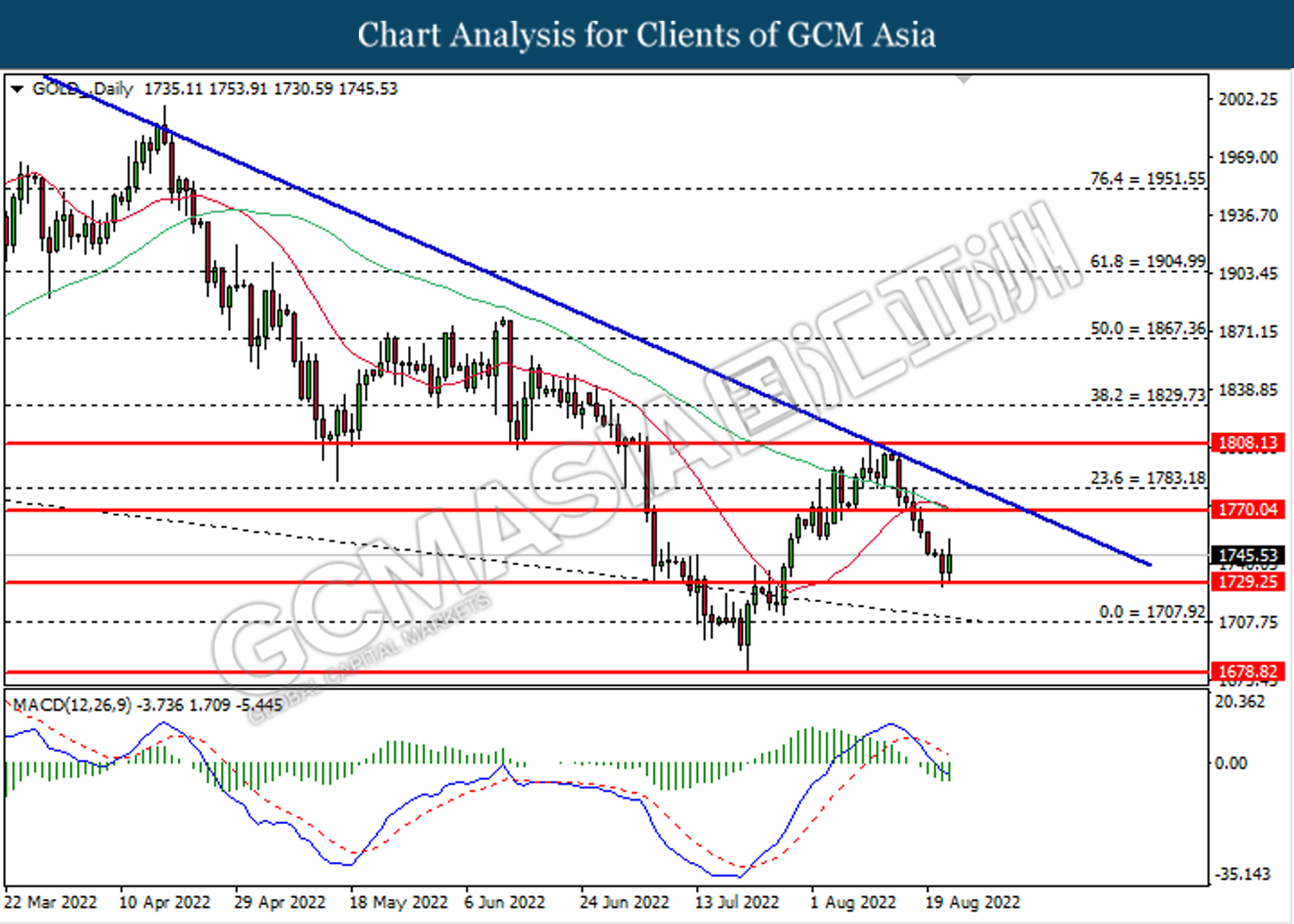

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1729.25. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90