25 August 2022 Morning Session Analysis

Dollar standstill ahead of the GDP data.

The dollar index, which gauges its value against a basket of six major currencies, hovered near the recent high level as the investors are waiting for the announcement of the crucial data – GDP. In the past few months, the US GDP has continuously shown a negative figure, mirroring that the nation was teetering on brink of recession. With the rising concern of market participants over the recession risk, investors are eyeing the GDP data in order to gauge the ongoing economic condition of the US. Other than that, the investors are also waiting for a Friday Speech by Federal Reserve Chairman Jerome Powell for some clues on how aggressive the central bank will be in fighting against the sky-high inflationary pressures. After the majority of the Fed members revealed their hawkish stance toward the tightening path, investors have pared back expectation that the Fed would likely increase the interest rate aggressively, says a 75-basis point in the coming Fed meeting. According to the Fed Watch Tool, the possibility of a 75-basis point rate hike is now at 61.0%, up from the previous week’s 28.0%. As of writing, the dollar index dropped -0.02% to 108.60.

In the commodities market, the crude oil price was down by 0.18% to $95.20 a barrel as the US data showed crude inventory draw for the second consecutive week. According to the EIA, the US inventory data came in at -3.282M, while the consensus forecast was -0.933M. Besides, the gold prices appreciated by 0.01% to $1751.50 a troy ounce as market participants are waiting for the crucial GDP data to be released.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q2) | 0.2% | 0.0% | – |

| 16:00 | EUR – German Ifo Business Climate Index (Aug) | 88.6 | 86.8 | – |

| 20:30 | USD – GDP (QoQ) (Q2) | -0.9% | -0.8% | – |

| 20:30 | USD – Initial Jobless Claims | 250K | 253K | – |

Technical Analysis

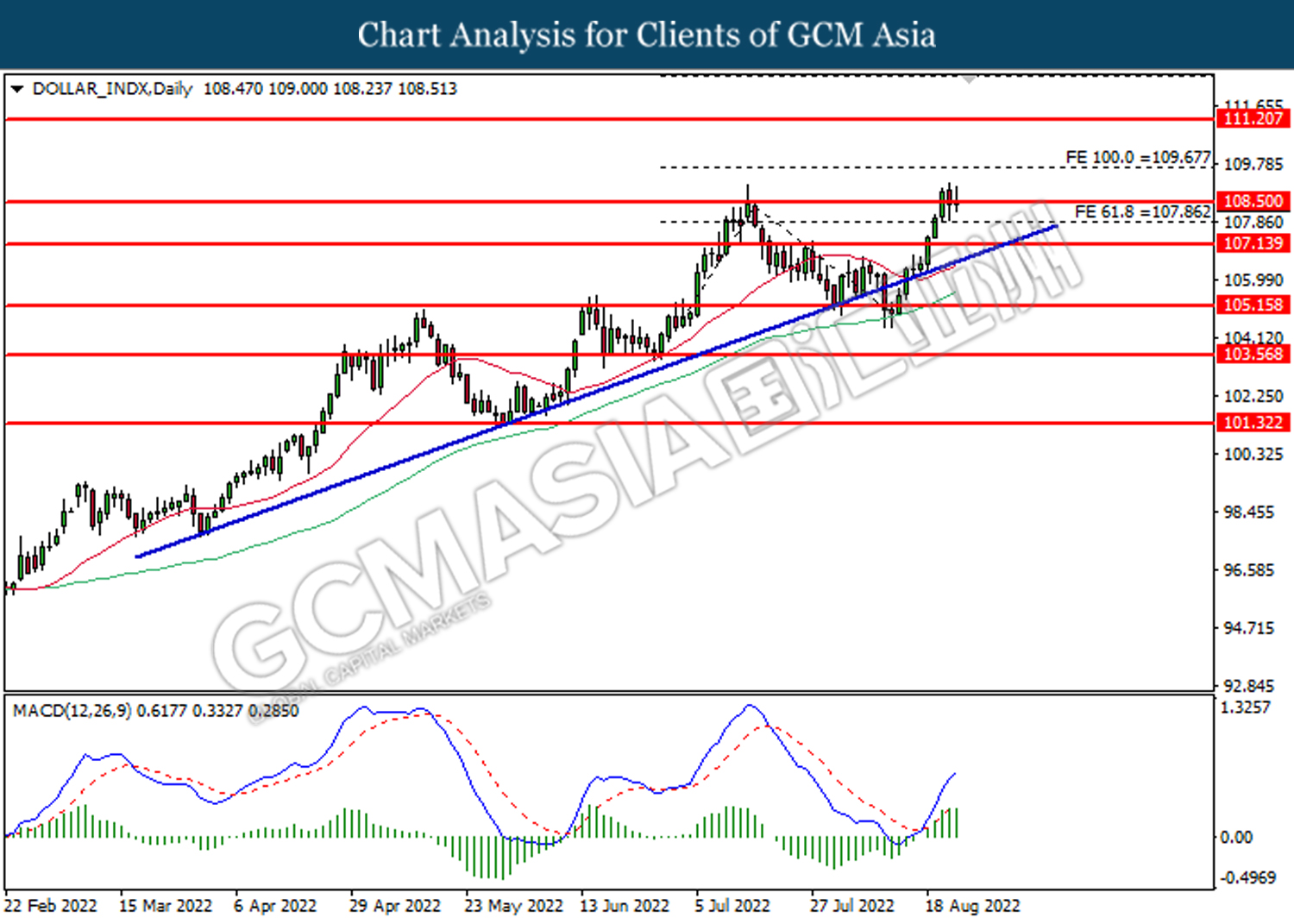

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 108.50. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 109.70.

Resistance level: 109.70, 111.20

Support level: 108.50, 107.85

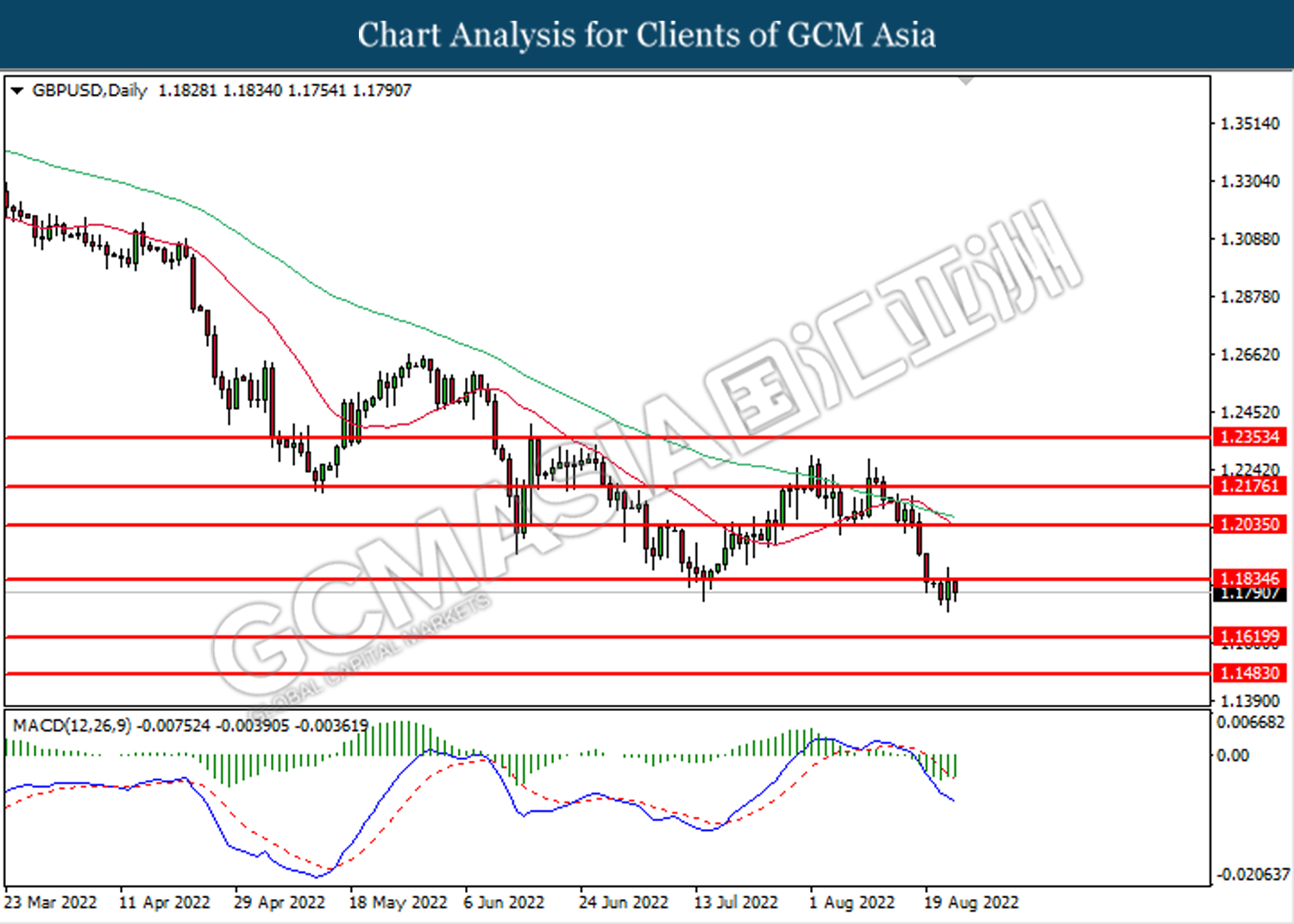

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1835. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1835, 1.2035

Support level: 1.1620, 1.1485

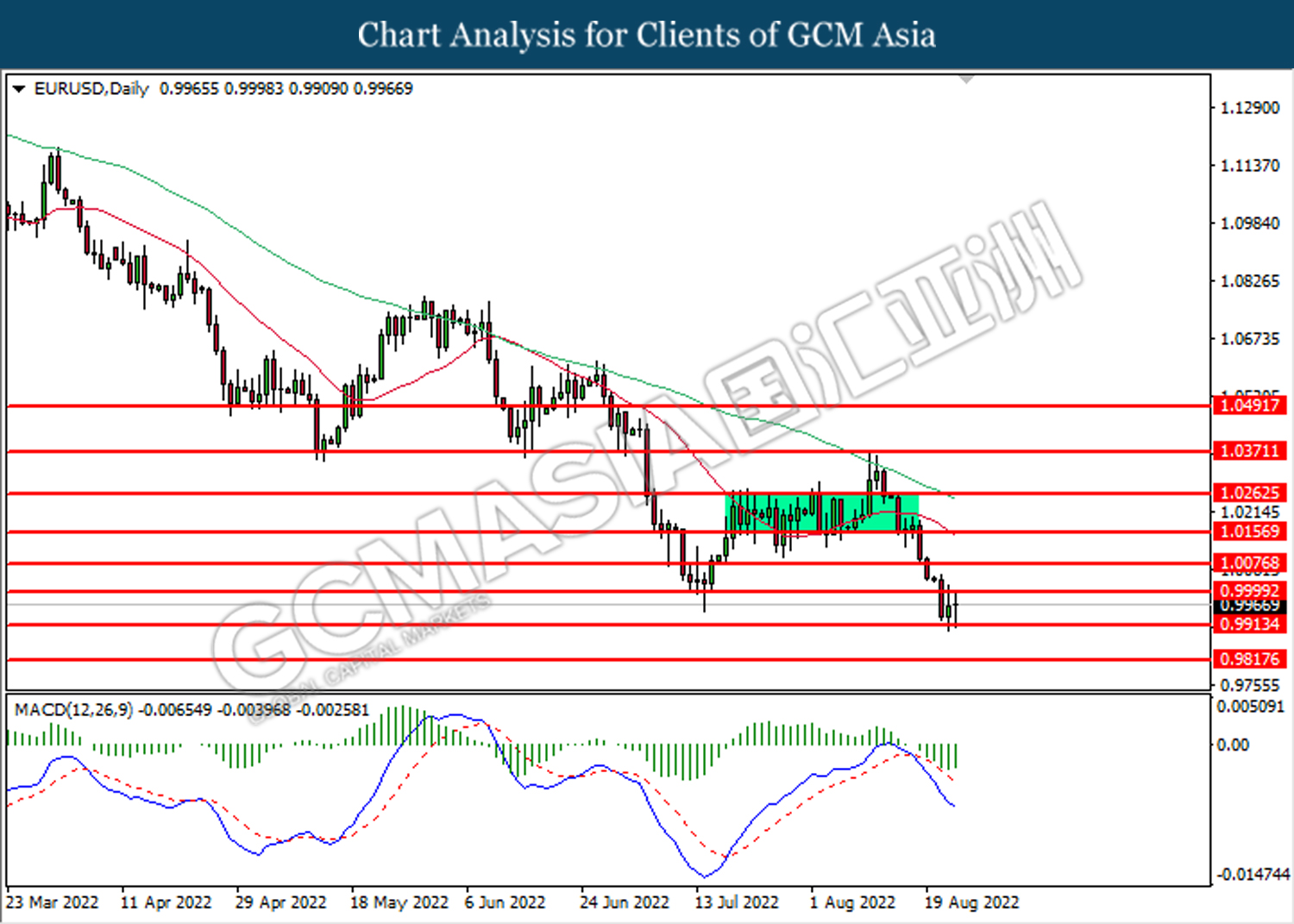

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 136.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 138.00.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

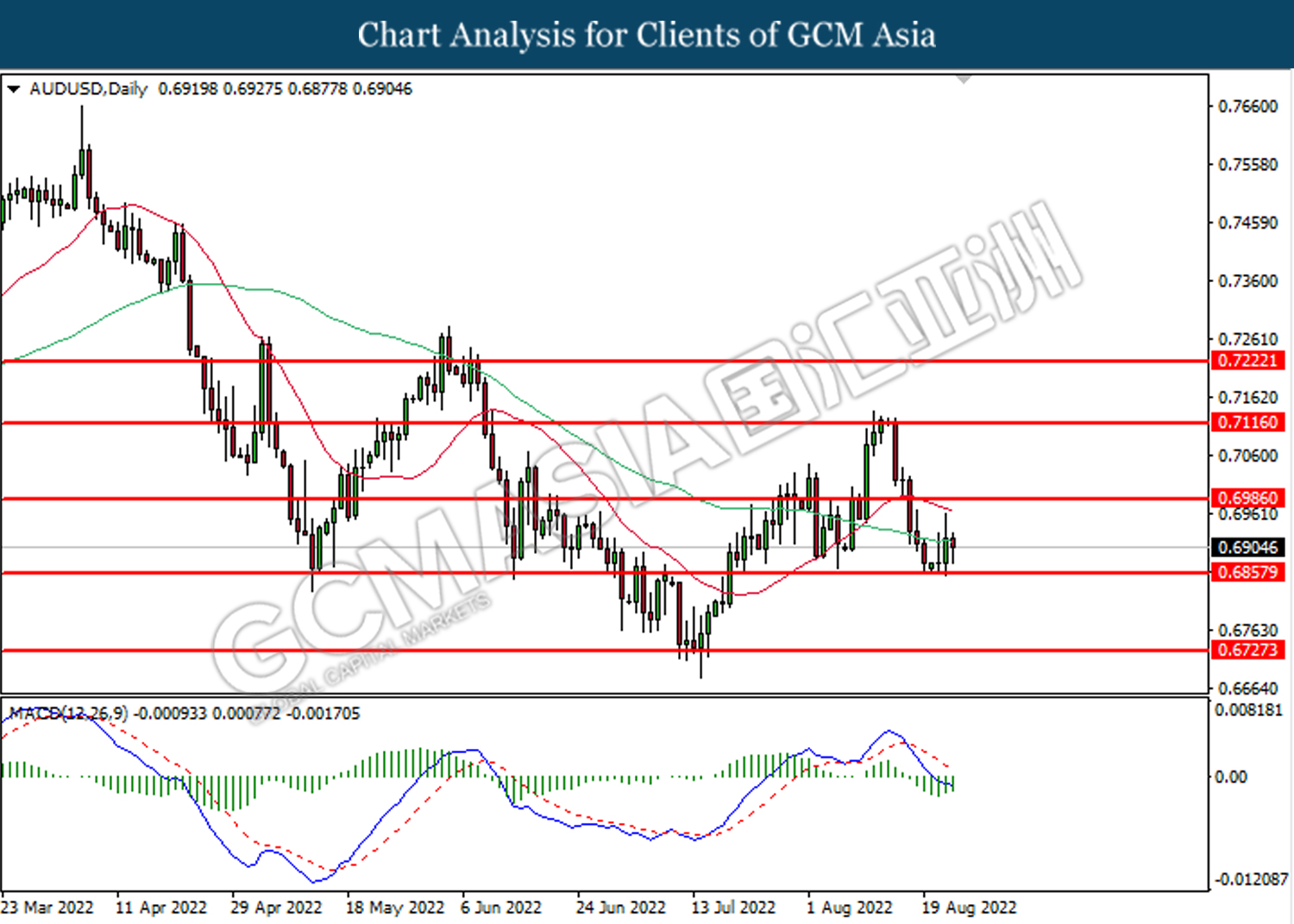

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish bias momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

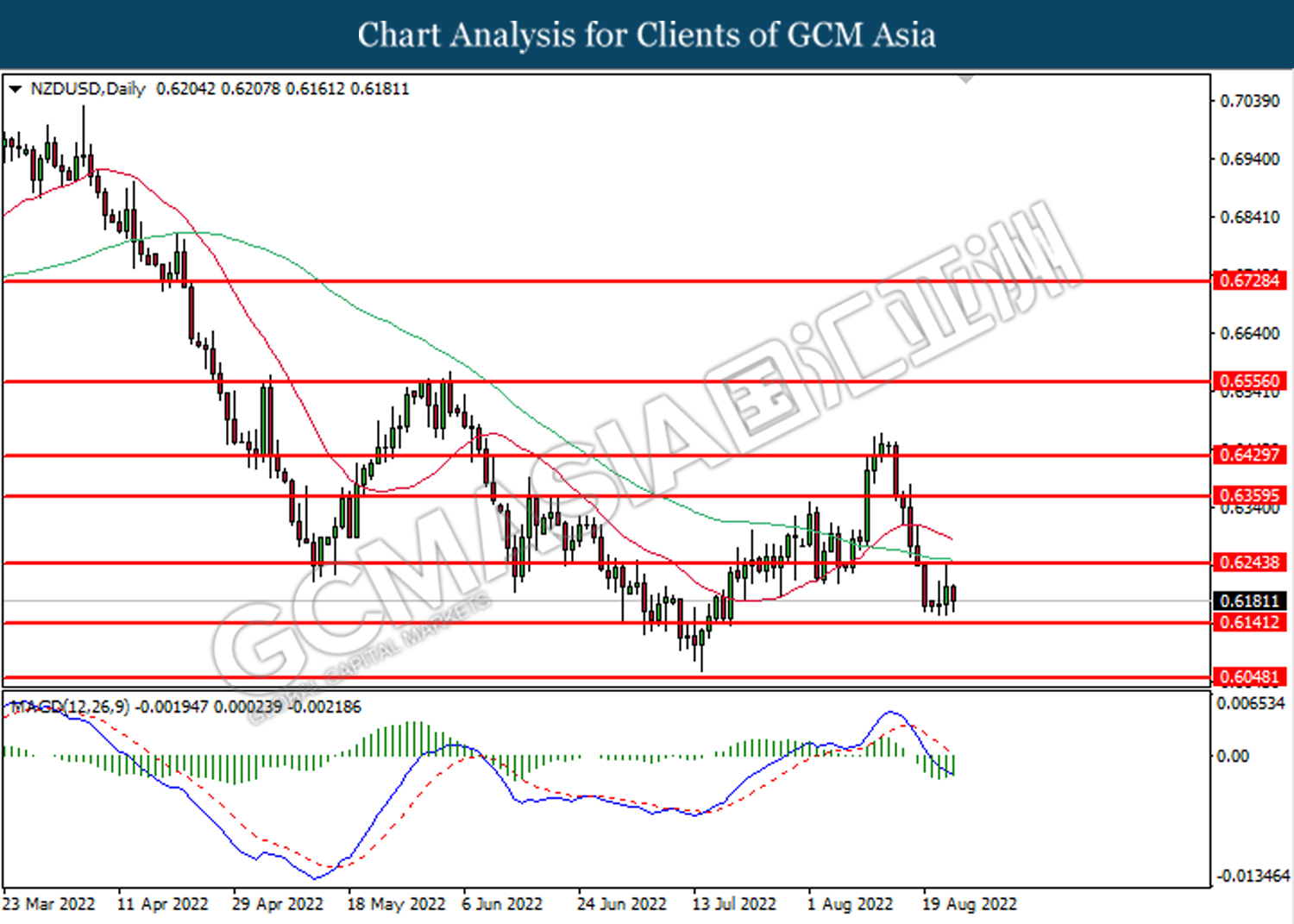

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level 0.6140. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6245.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

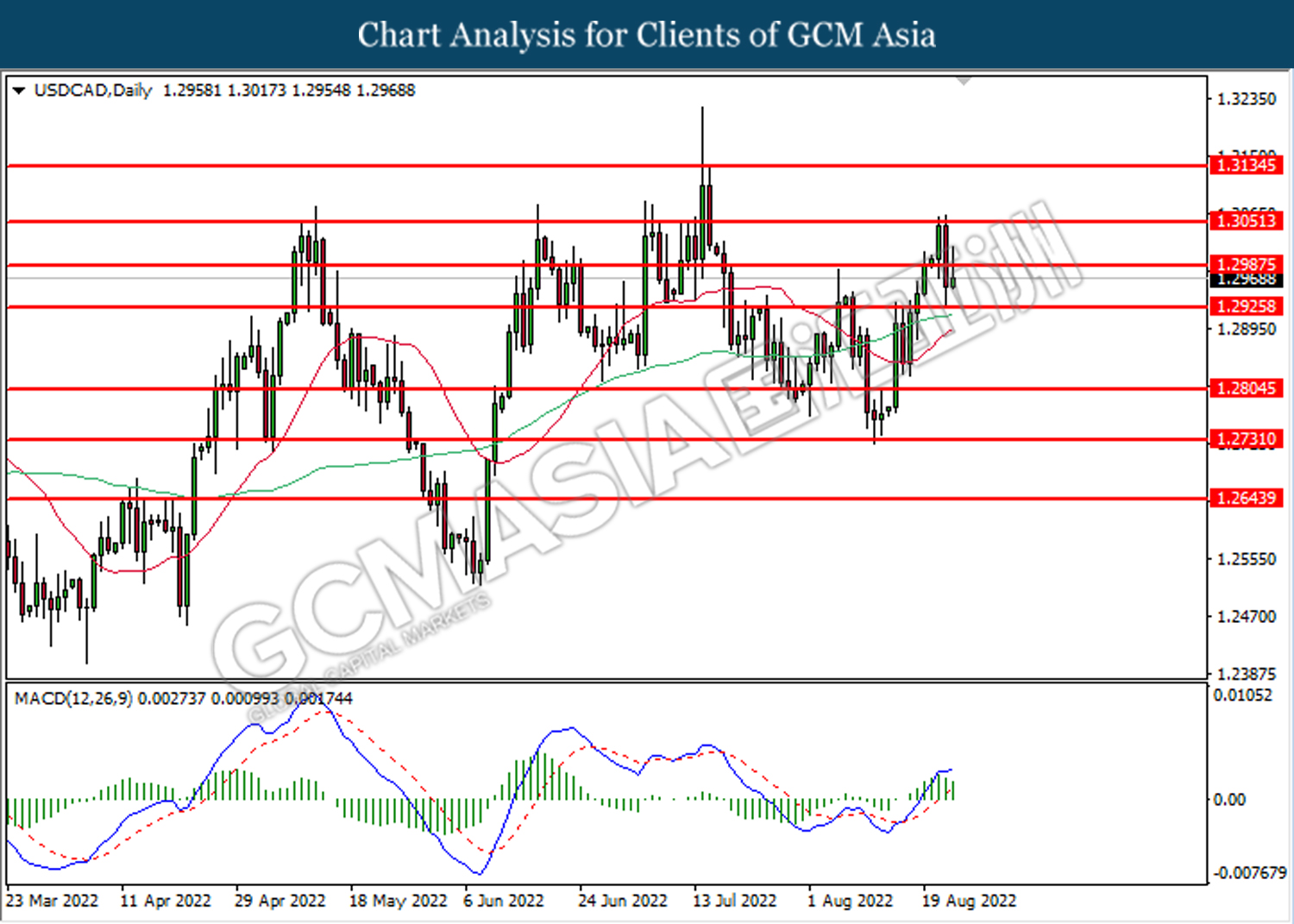

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2985. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.2925.

Resistance level: 1.2985, 1.3050

Support level: 1.2925, 1.2805

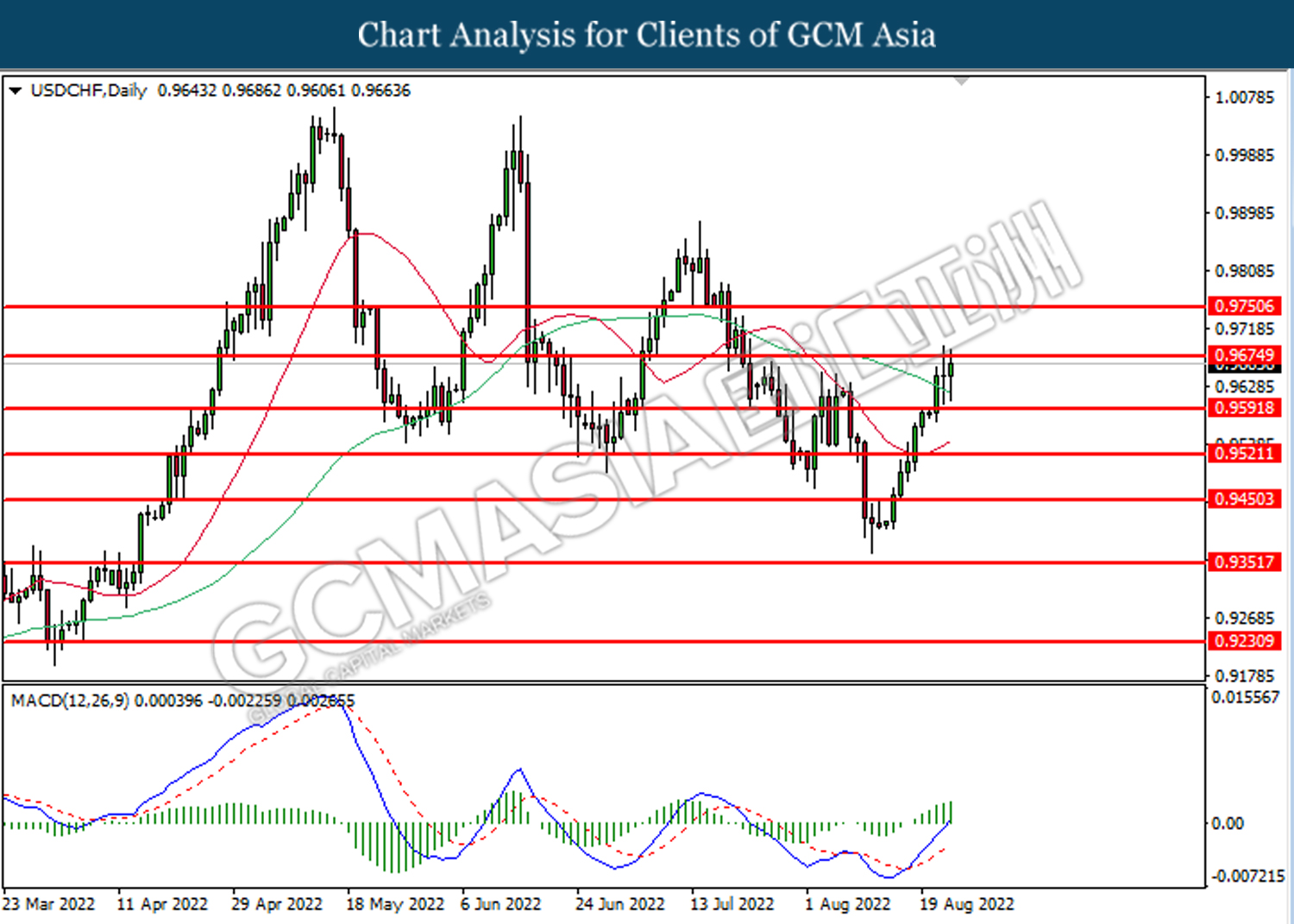

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 96.00.

Resistance level: 96.00, 98.20

Support level: 93.15, 90.35

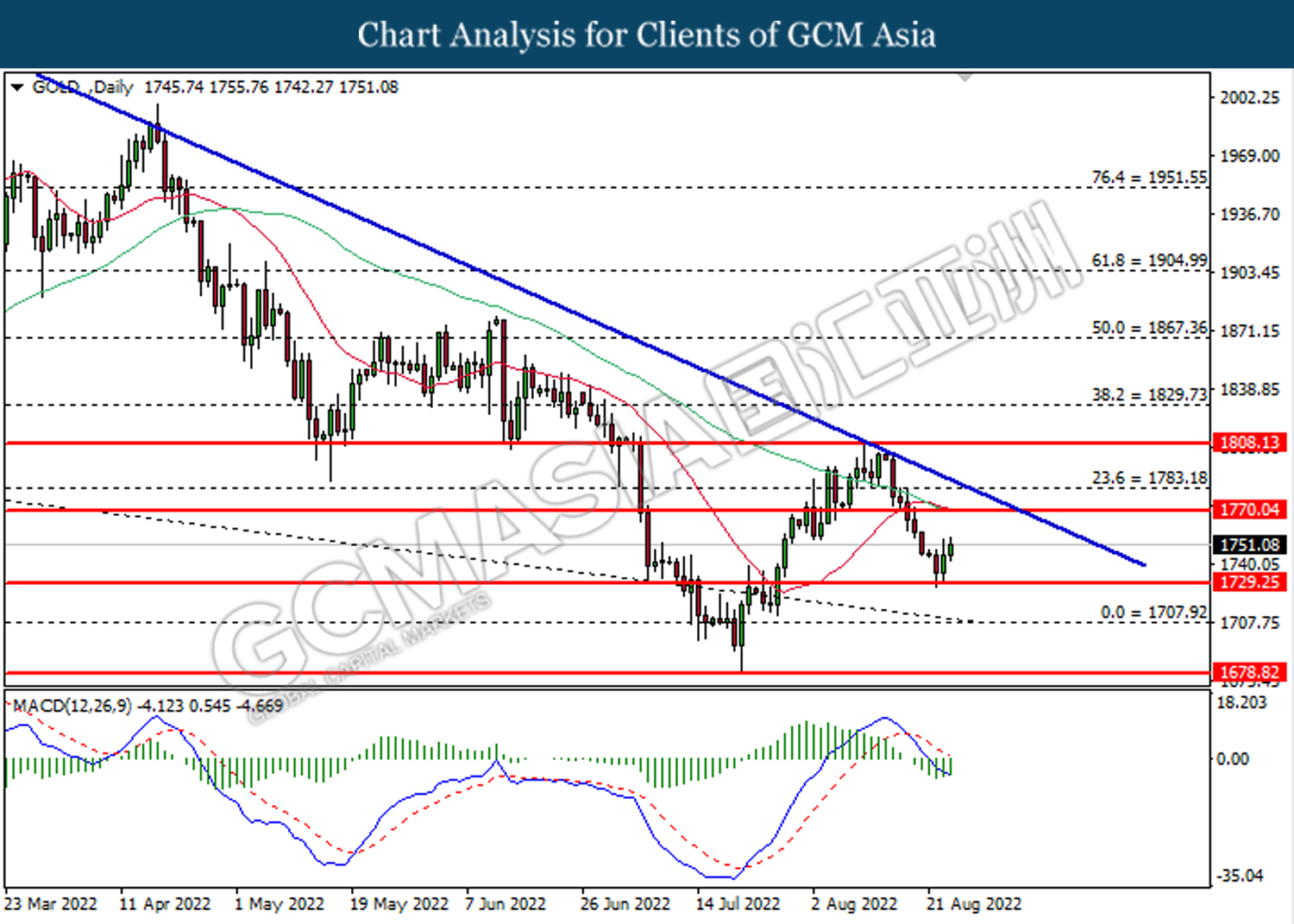

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1729.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90