25 August 2022 Afternoon Session Analysis

Euro lingered as the nation economy clouded by rising gas price.

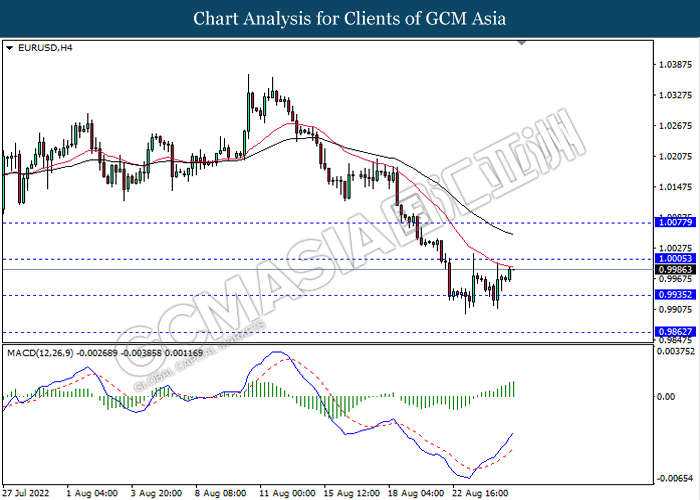

The EUR/USD, which traded by majority of investors, seesawed under 1.0000 level amid the spiking gas price. The price of natural gas used to reach $9.97 per cubic foot in recent time while it was adding pressures toward economic momentum in Europe. As Europe was one of the dependent on commodities products such as natural gas, the skyrocketed gas price would increase the costs in Europe region, which jeopardize the market outlook in Europe. Besides, Russian state energy firm Gazprom said Russia will pause natural gas supplies to Europe for three days through Nord Stream 1 due to unscheduled maintenance, suppressing the market optimism upon the prospects of Euro. As of now, the market participants would focus on the monetary policy meeting from ECB which scheduled tonight in order to gauge the likelihood movement of EUR/USD. As of writing, EUR/USD raised by 0.22% to 0.9987.

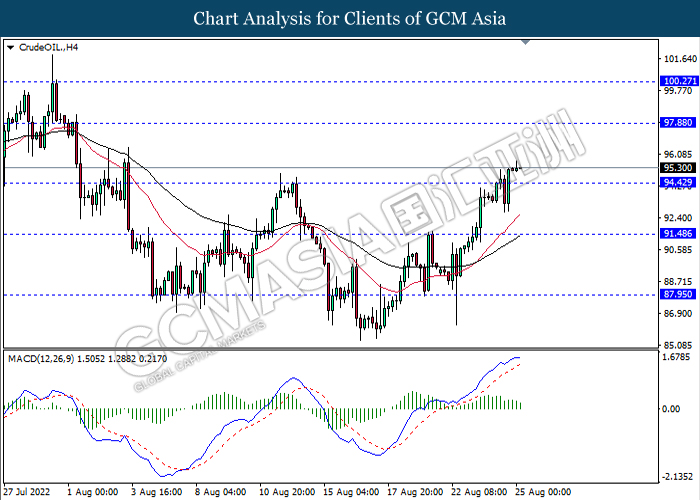

In the commodities market, the crude oil price appreciated by 0.48% to $95.34 per barrel as of writing following the US has sent its response to the European Union on a proposal to try to save the Iran nuclear deal. On the other hand, the gold price rose by 0.41% to $1755.85 per troy ounce as of writing over the value of US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Aug) | 88.6 | 86.8 | – |

| 20:30 | USD – GDP (QoQ) (Q2) | -0.9% | -0.8% | – |

| 20:30 | USD – Initial Jobless Claims | 250K | 253K | – |

Technical Analysis

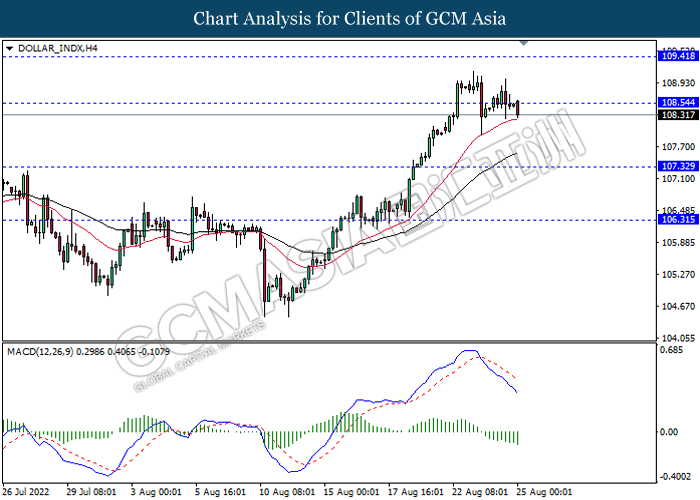

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 108.55, 109.40

Support level: 107.30, 106.30

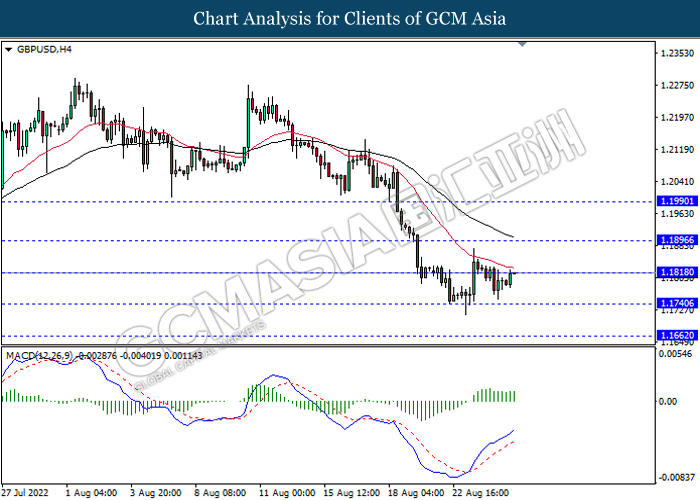

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1820, 1.1895

Support level: 1.1740, 1.1660

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

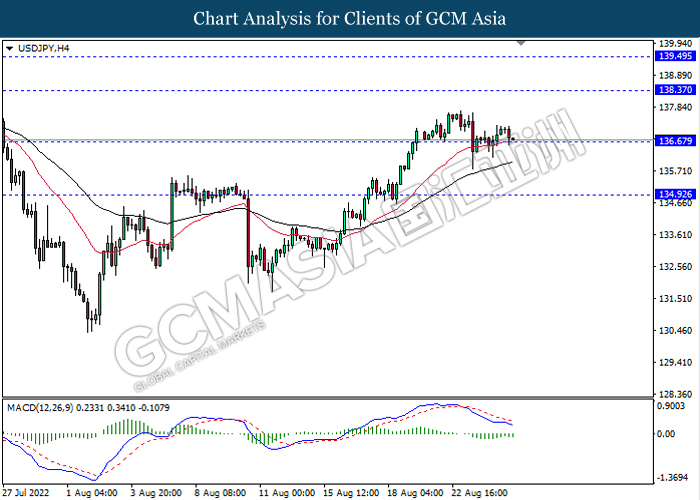

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

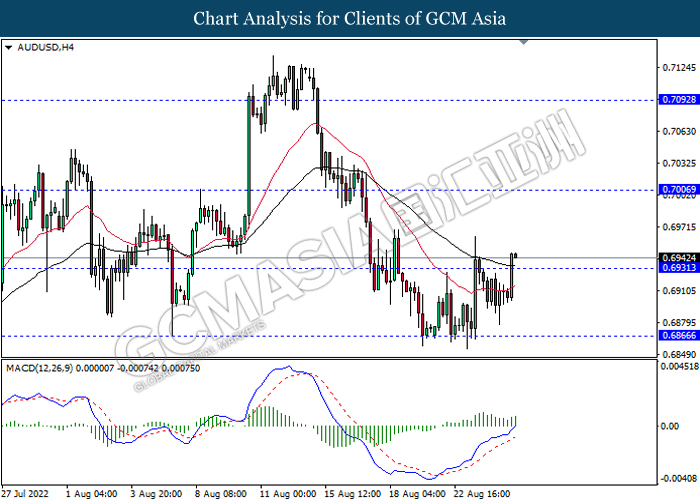

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7090

Support level: 0.6930, 0.6865

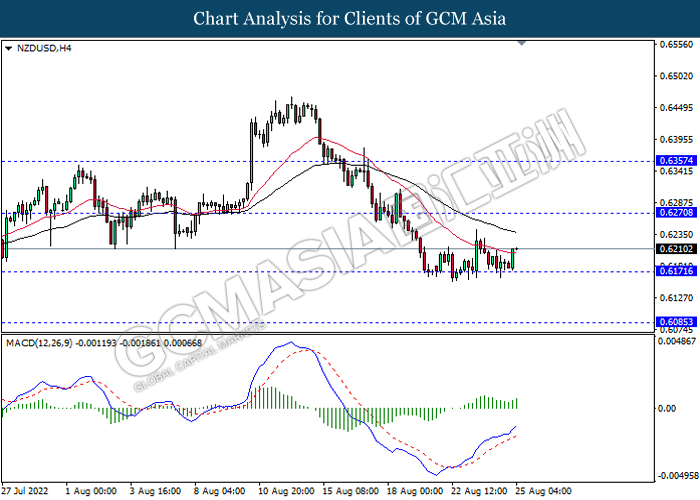

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

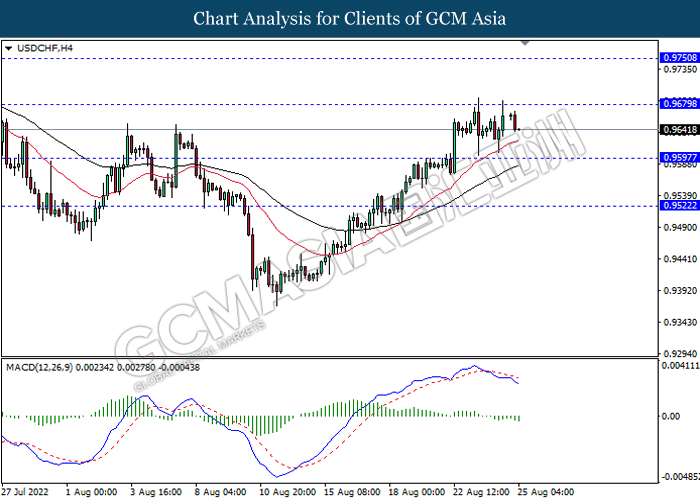

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9680, 0.9750

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 97.90, 100.25

Support level: 94.45, 91.50

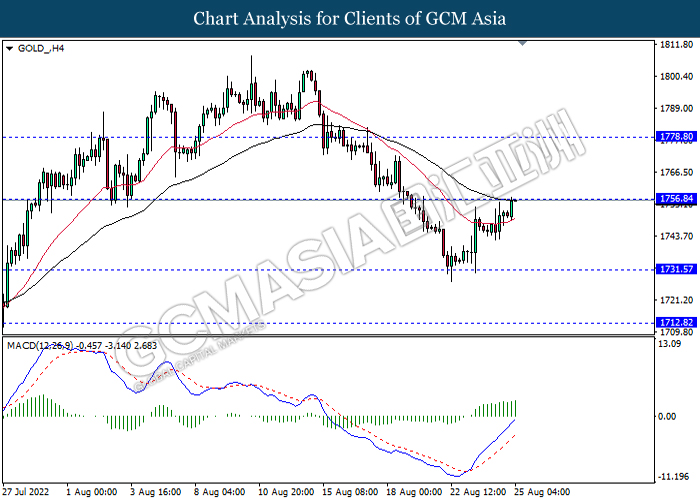

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80