26 August 2022 Afternoon Session Analysis

Yen slipped as BoJ stand with its loosen monetary policy.

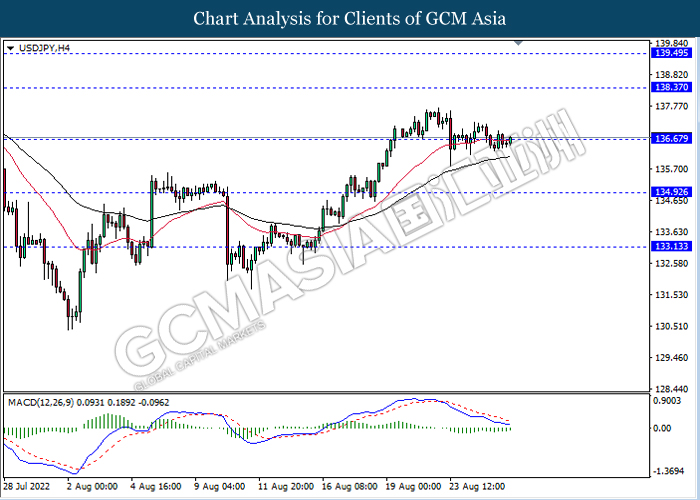

The USD/JPY, which traded by global investors edged up on the early Friday over the dovish statement from Bank of Japan (BoJ). According to Reuters, the BoJ board member Toyoaki Nakamura claimed on Thursday that the central bank would maintain its ultra-low rates in order to tackle the current economy slowdown. Besides, he reiterated that the implementation of rate increase by major central banks for stabilizing inflation risk would likely to trigger an outflow of capital from emerging economies, which dragging down the global economic prospects. As the monetary policy of Japan remained divergence against other central banks, market participants tend to shift their capitals away from Japan markets as well as eyeing on other currencies. Nonetheless, the gains of USD/JPY was limited amid the upbeat economic data. According to Statistics Bureau, the Japan Tokyo Core Consumer Price Index (CPI) YoY for August notched up from the previous reading of 2.3% to 2.6%, exceeding the market forecast of 2.5%. As of writing, USD/JPY rose by 0.17% to 136.74.

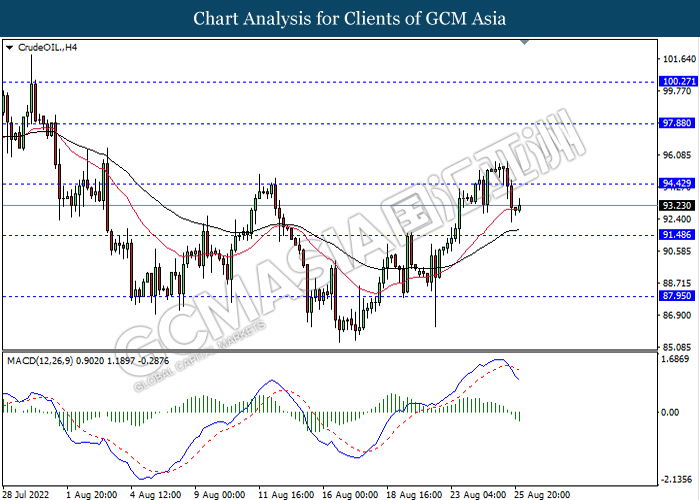

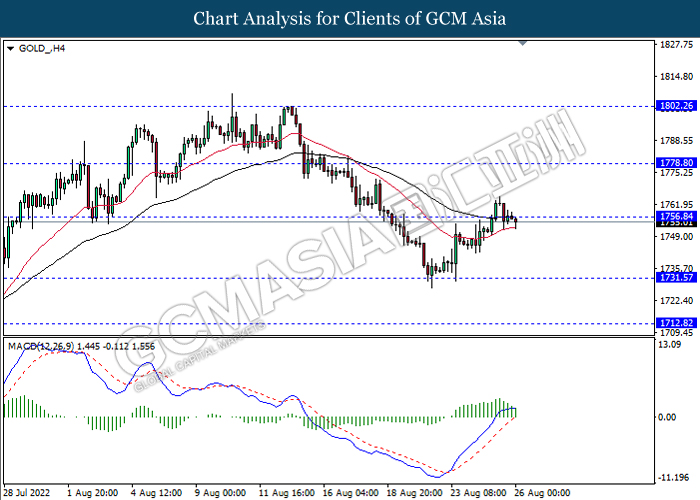

In the commodities market, the crude oil price appreciated by 0.93% to $93.38 per barrel as of writing after a sharp decline throughout overnight trading session amid the expectation of hawkish speech from Fed President. On the other hand, the gold price dropped by 0.20% to $1755.05 per troy ounce as of writing as the US Dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core PCE Price Index (MoM) (Jul) | 0.6% | 0.3% | – |

Technical Analysis

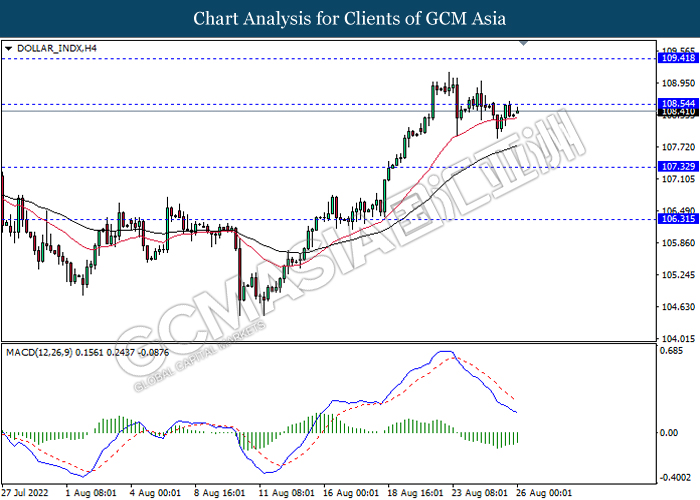

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 108.55, 109.40

Support level: 107.30, 106.30

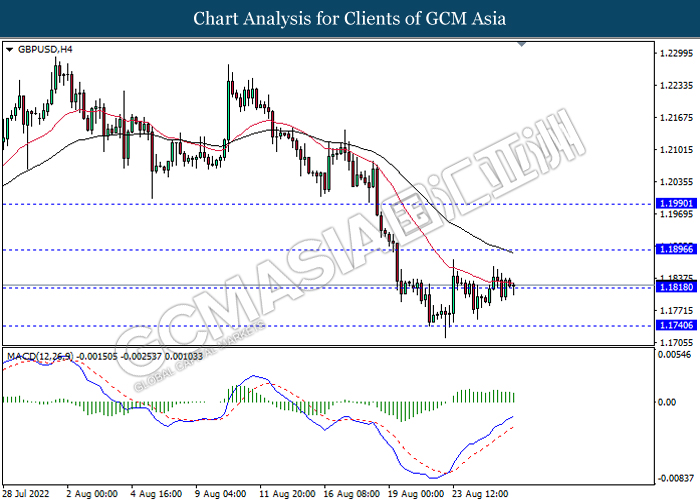

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1895, 1.1990

Support level: 1.1820, 1.1740

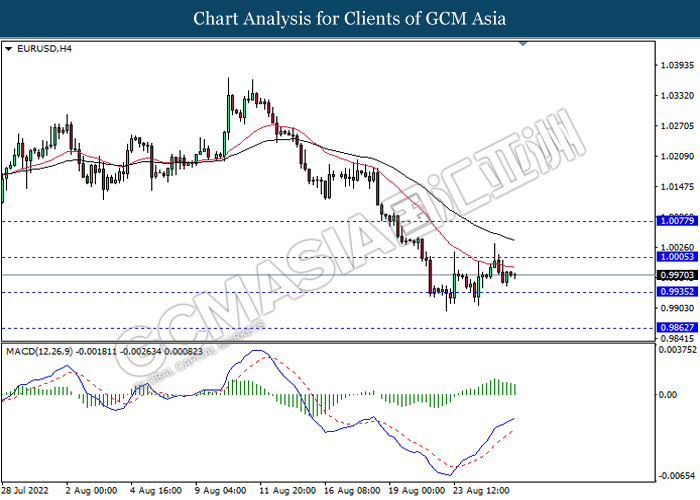

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 138.35, 139.50

Support level: 136.65, 134.90

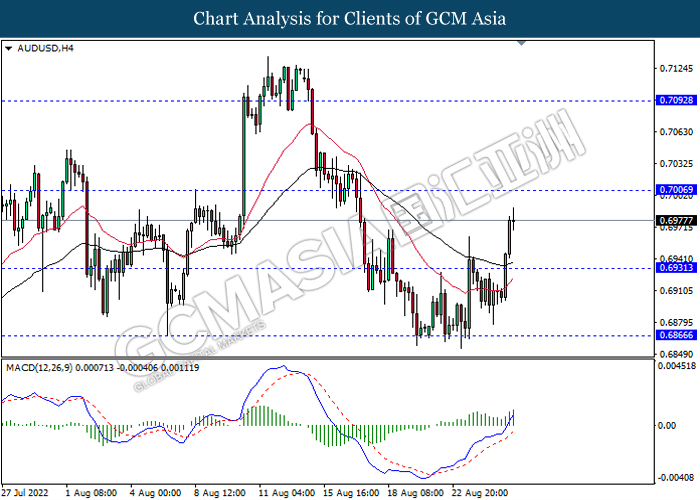

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7090

Support level: 0.6930, 0.6865

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6270, 0.6355

Support level: 0.6170, 0.6085

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2935, 1.3050

Support level: 1.2825, 1.2735

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9680, 0.9750

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 94.40, 97.90

Support level: 91.50, 87.95

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80