29 August 2022 Morning Session Analysis

Jerome Powell signaled aggressive rate hike plan to continue.

The dollar index, which gauges its value against a basket of six major currencies, extended its gains with a large step before the market entered the weekend as Federal Reserve Chairman Jerome Powell vowed that aggressive rate hikes will be continued at this point in time. During the Jackson Hole Symposium, Jerome Powell finally presented his long-awaited view on the rate hike plan, whereby he said that the central bank’s job of cooling down the overheating economy is not done yet, mirroring that the Fed will not back off from increasing the interest rate aggressively. Besides, Jerome Powell warned that “in order to restore the price stability, it will likely require maintaining a restrictive policy stance for some time as the historical record cautions strongly against easing the policy too soon.” Powell also revealed that the economy needed more rate hikes, with “another unusually large” increase still on the table for the next meeting. Following the hawkish statement from the Chairman of the Fed, the possibility of a 75-basis point of a rate hike in the upcoming September meeting jumped from the prior week’s reading of 47.0% to 61.0%. As of writing, the dollar index is up 0.18% to 109.00.

In the commodities market, the crude oil price was down by 0.02% to $92.77 a barrel amid the aggressiveness of the Fed Chairman regarding the rate hike plan exacerbated the investor worries over the risk of recession. Besides, the gold prices depreciated -by 0.16% to $1735.20 per troy ounce following the hawkish statement from Jerome Powell.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

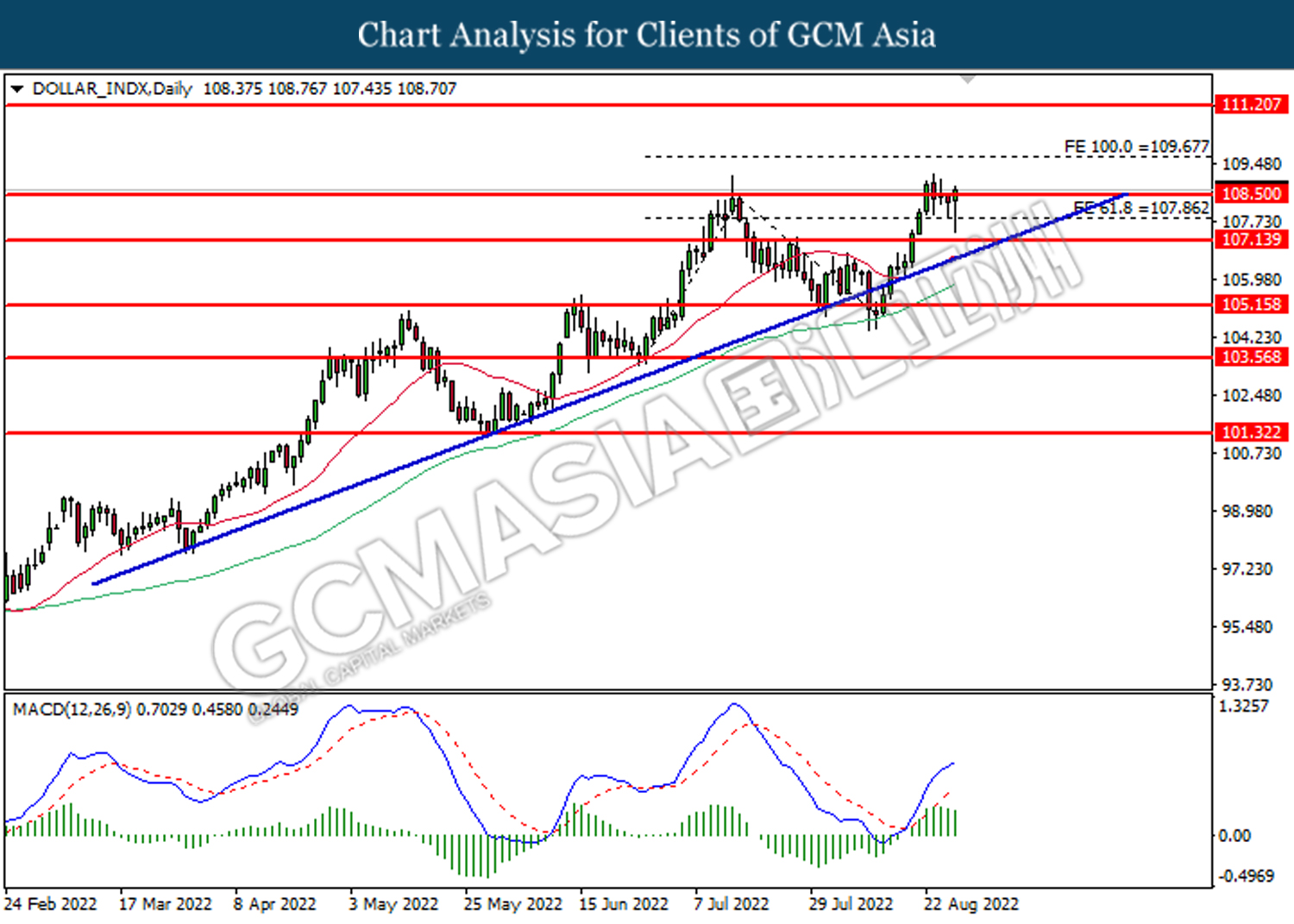

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 108.50. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 108.50, 109.65

Support level: 107.85, 107.15

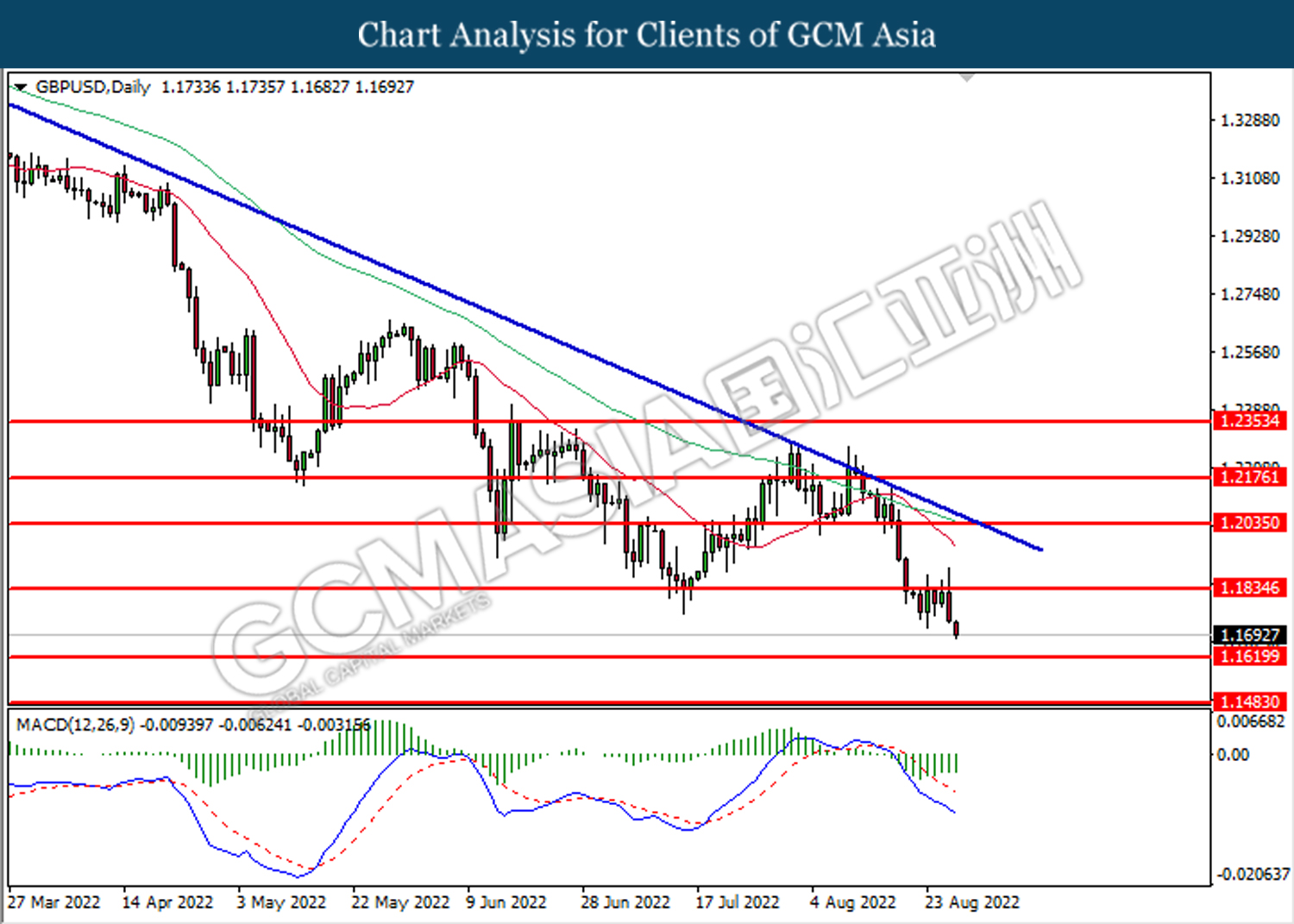

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1835. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1835, 1.2035

Support level: 1.1620, 1.1485

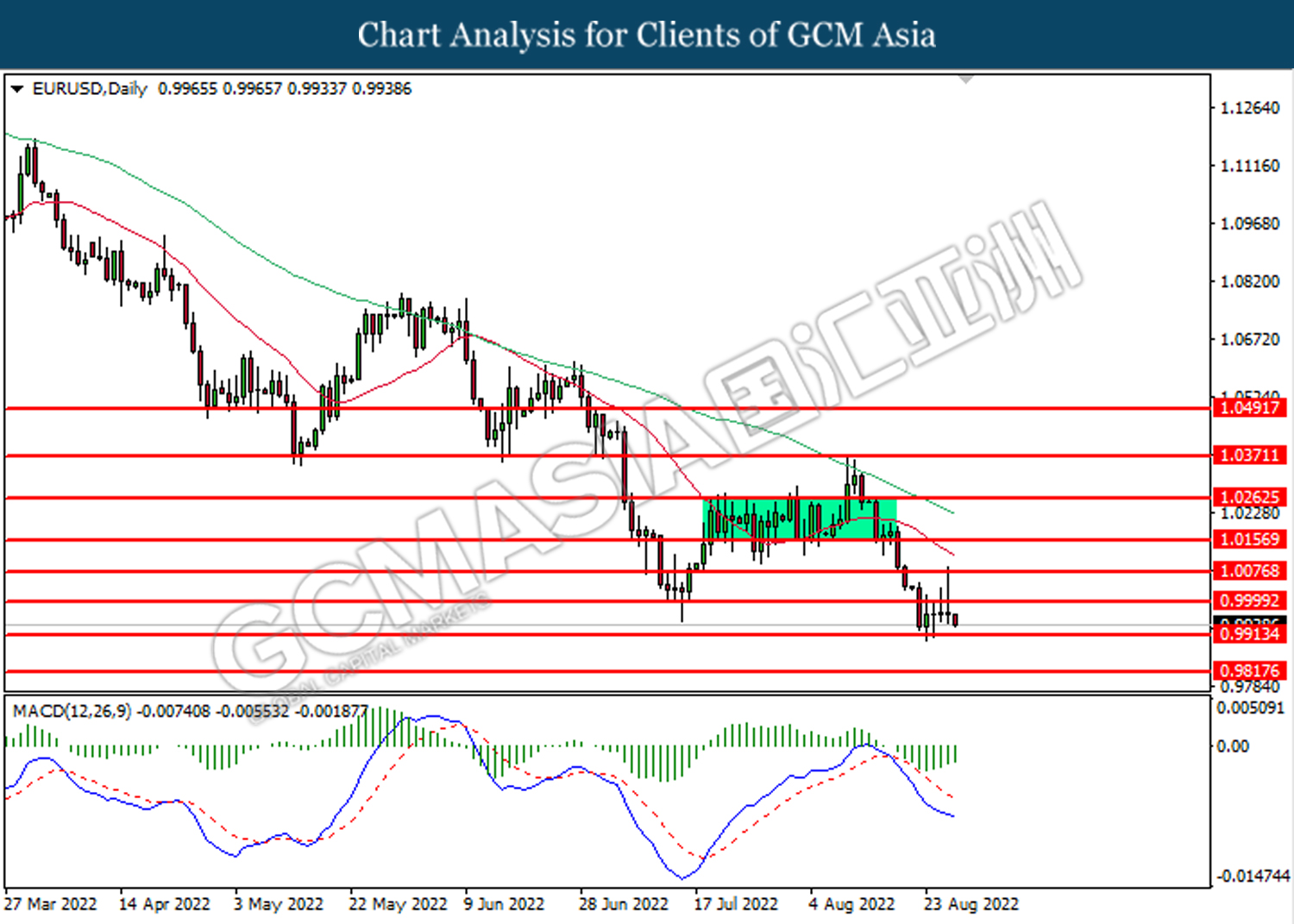

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 138.00 MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 138.00, 139.35

Support level: 136.65, 135.25

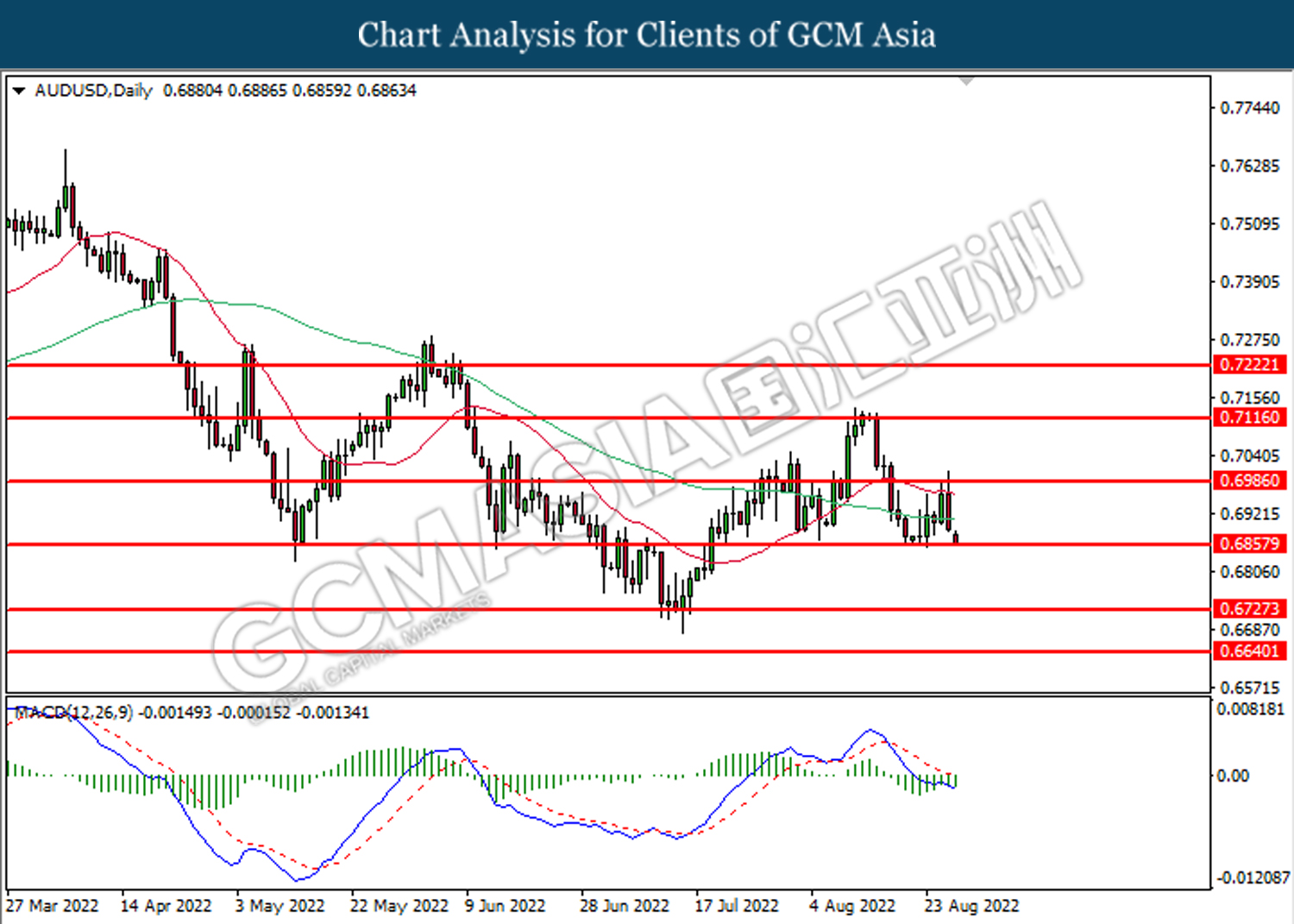

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

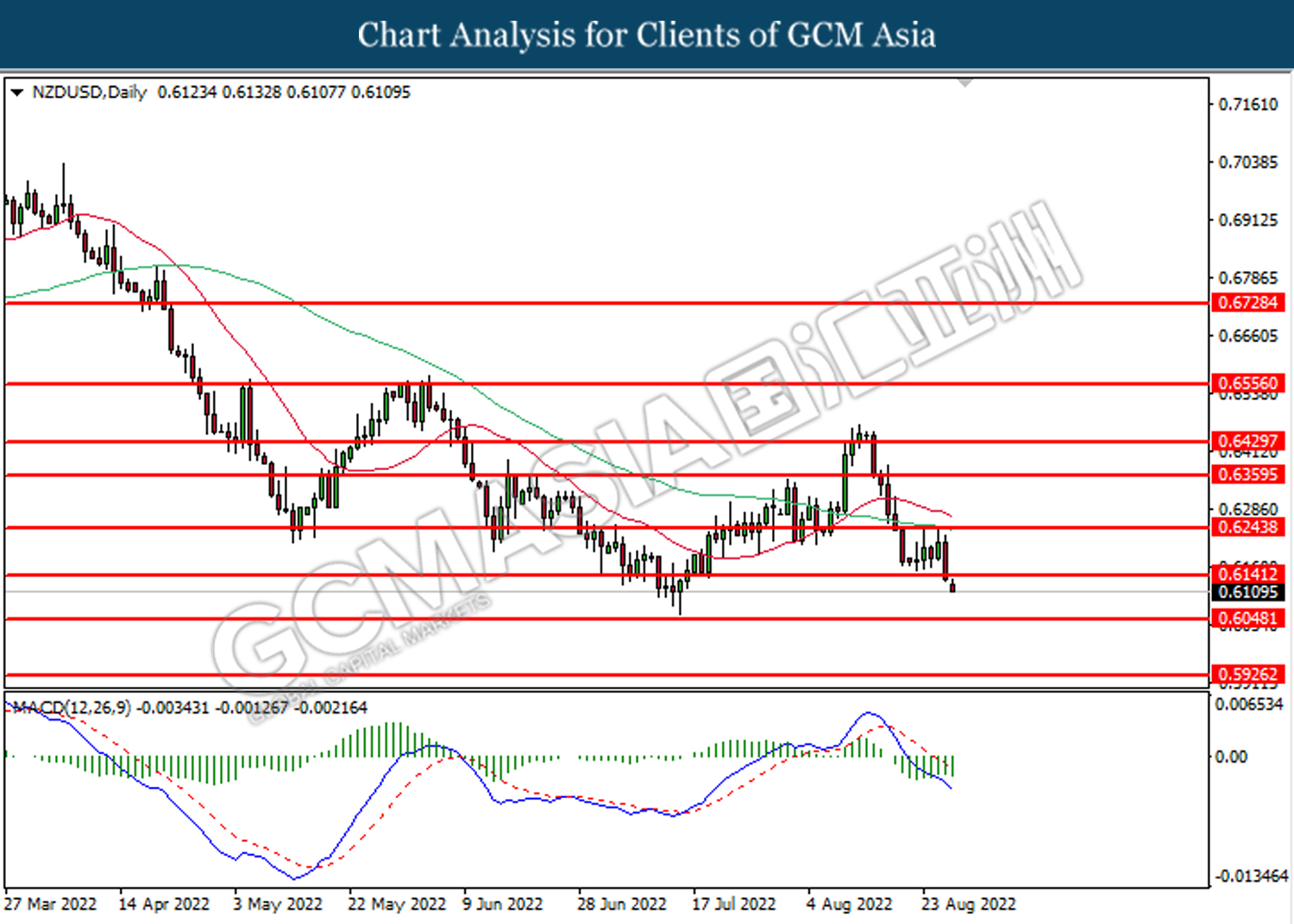

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6050.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

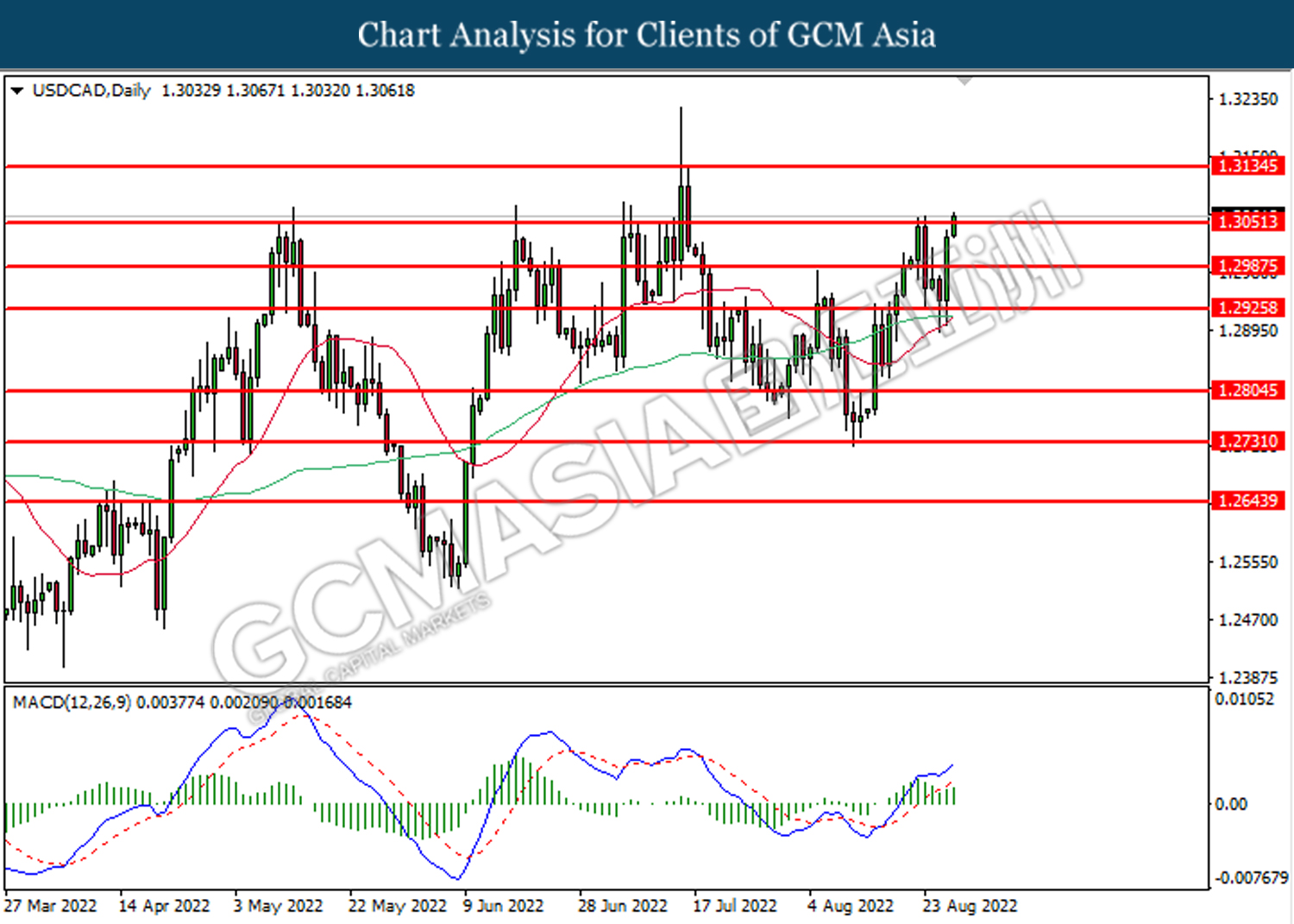

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3050. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

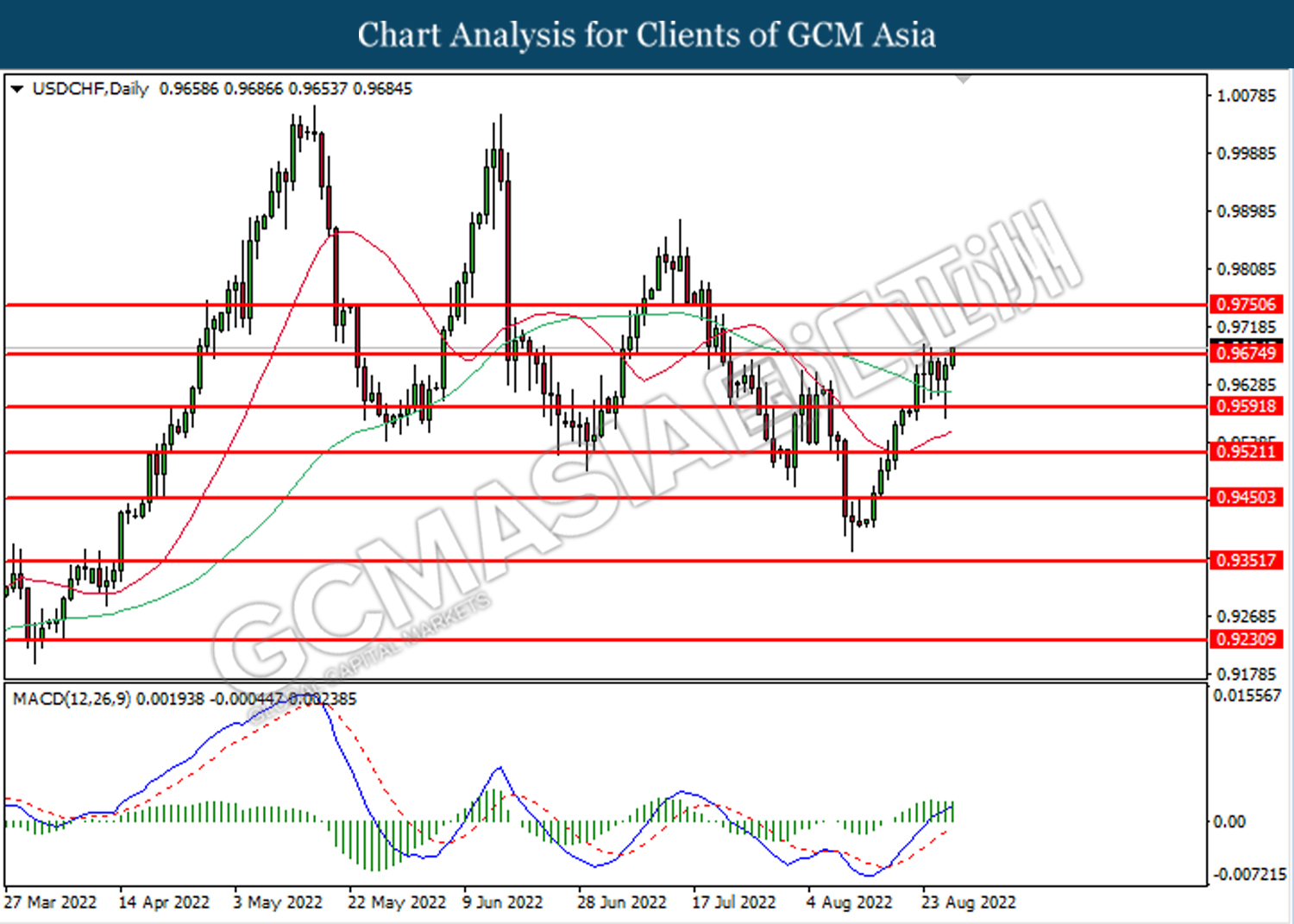

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

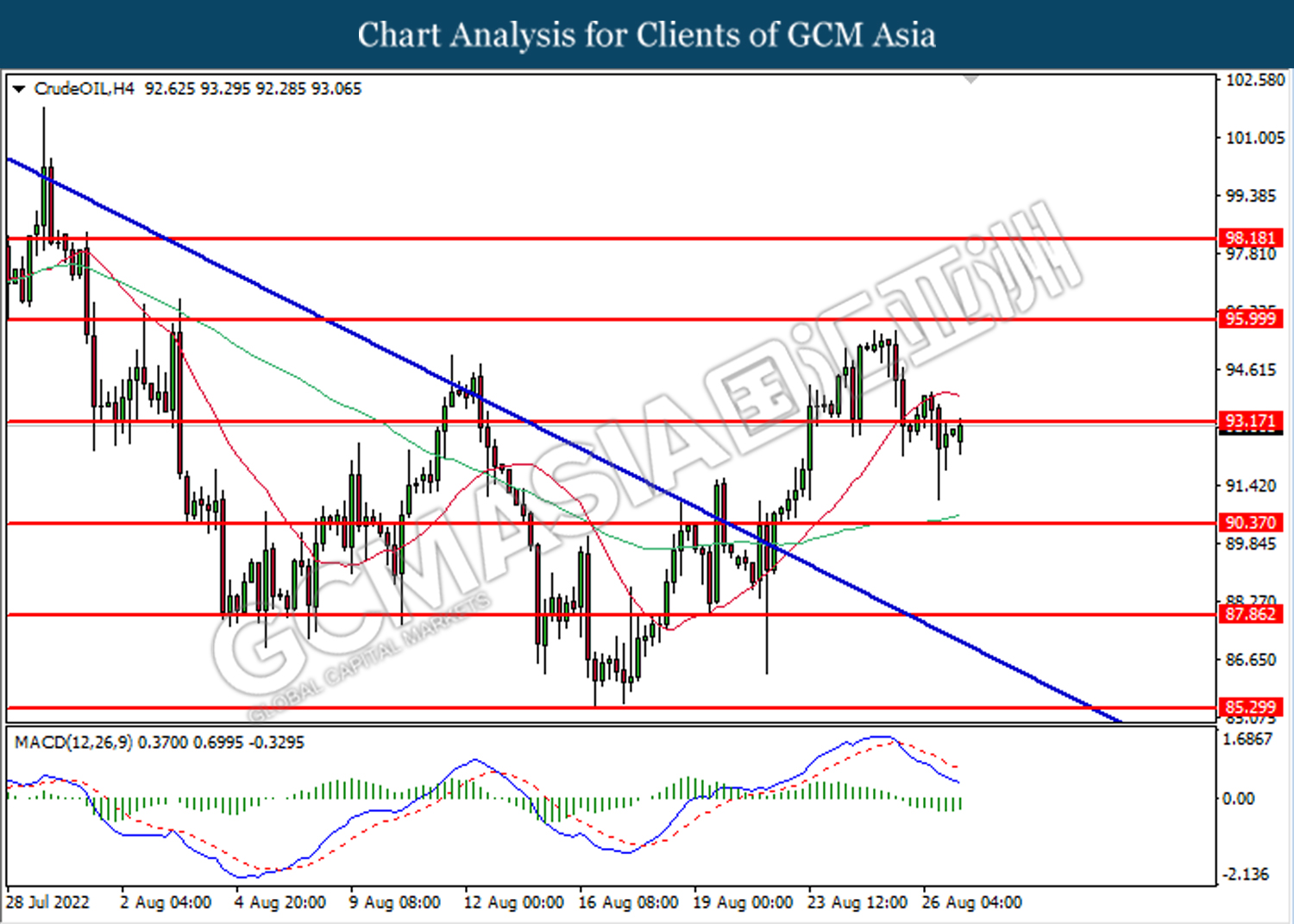

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 93.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 93.15, 96.00

Support level: 90.35, 87.85

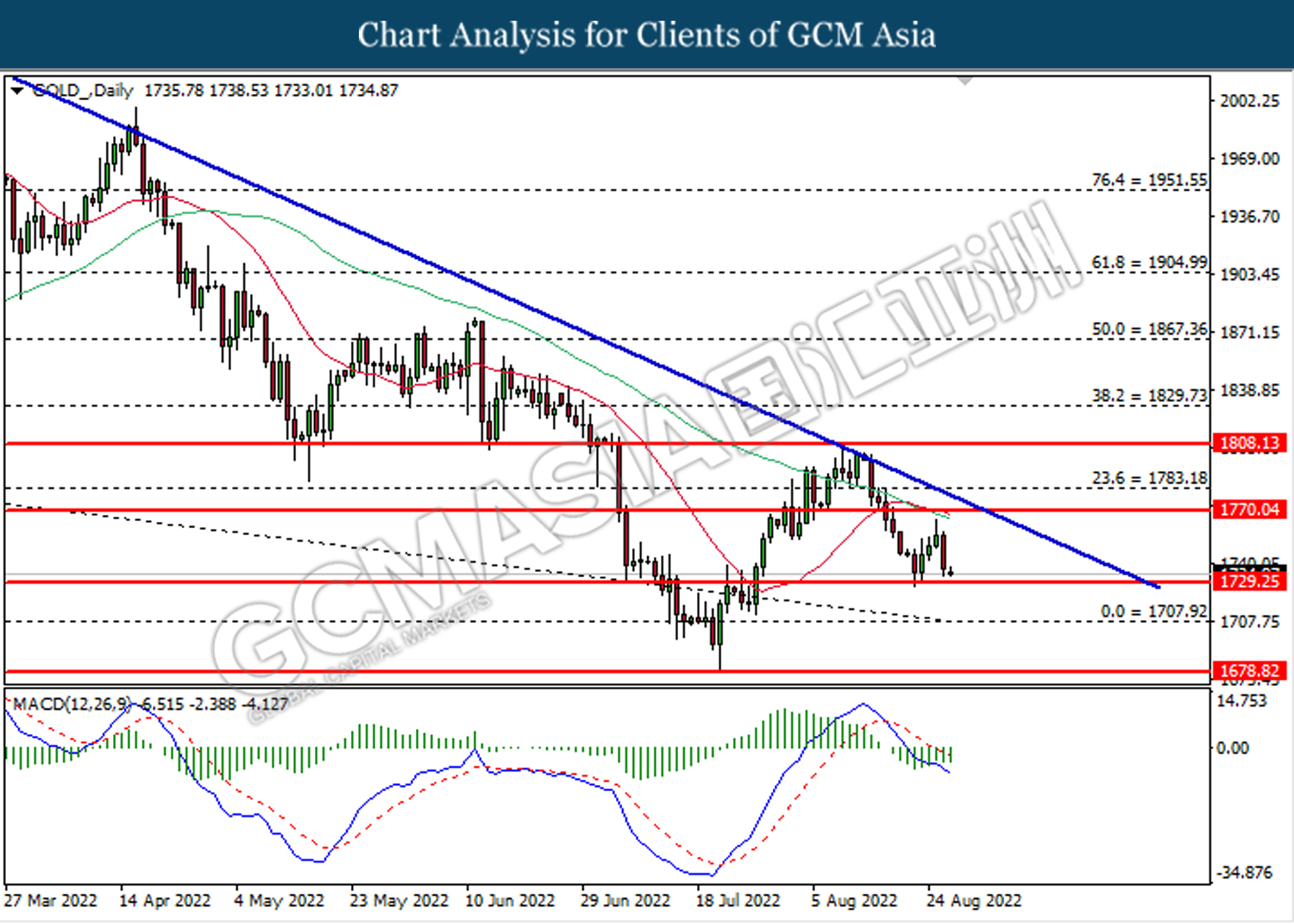

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1729.25. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90