2 September 2022 Afternoon Session Analysis

Aussie slipped on downbeat economic data.

The AUD/USD, which well known by global investors, dropped significantly on yesterday amid the bearish economic data, which spurred bearish momentum on the Australia Dollar. According to Markit, the China Caixin Manufacturing Purchasing Managers Index (PMI) for August notched down from the previous reading of 50.4 to 49.5, lower than the consensus expectation of 50.2. The figures that lower than 50 means a contraction in China manufacturing sector, which brought negative prospects toward economic progression in China. Besides, the China economy was deteriorated upon the background of lockdown which driven by Covid-19 pandemic. Thus, as China was the trading partner for Australia, the pessimistic economic outlook has suppressed the value of Aussie. Nonetheless, the losses experienced by Aussie was limited over the rate hikes expectation from Reserve Bank of Australia (RBA). According to Reuters, the Australia’s central bank would raise its interest rate by 0.50% on 6 September to stabilize the spiking inflationary pressure. As of writing, the AUD/USD appreciated by 0.09% to 0.6789.

In the commodities market, the crude oil price rose by 1.71% to $88.09 per barrel as of writing following the expectation of output cuts from OPEC+. On the other hand, the gold price edged up by 0.03% to $1699.15 per troy ounce as of writing after a sharp decline throughout yesterday trading session amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Aug) | 528K | 300K | – |

| 20:30 | USD – Unemployment Rate (Aug) | 3.5% | 3.5% | – |

Technical Analysis

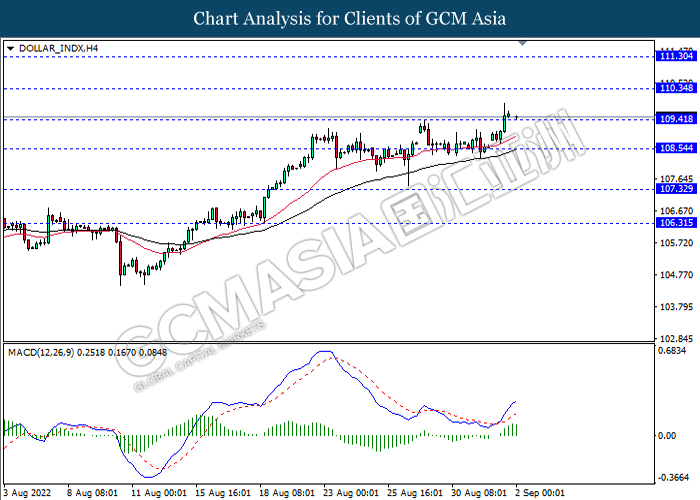

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 110.35, 111.30

Support level: 109.40, 108.55

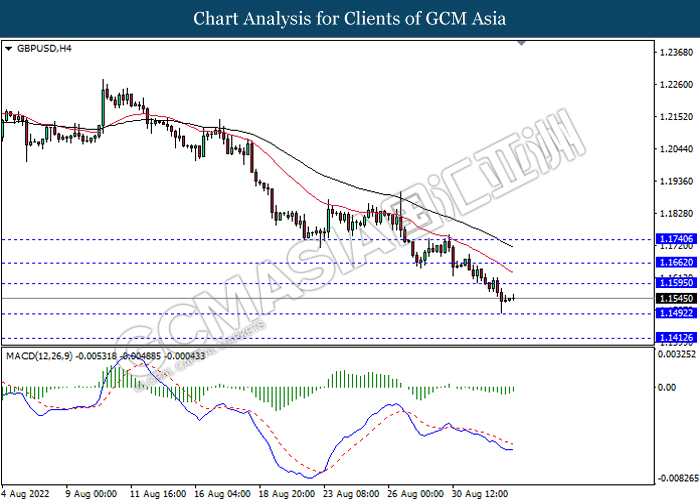

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1595, 1.1660

Support level: 1.1490, 1.1410

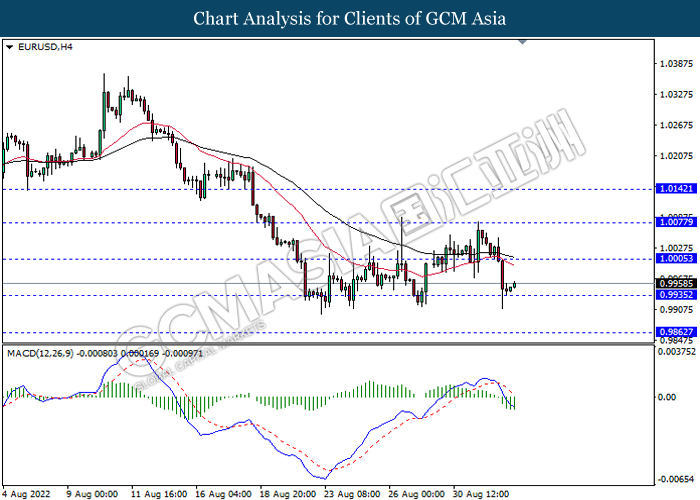

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

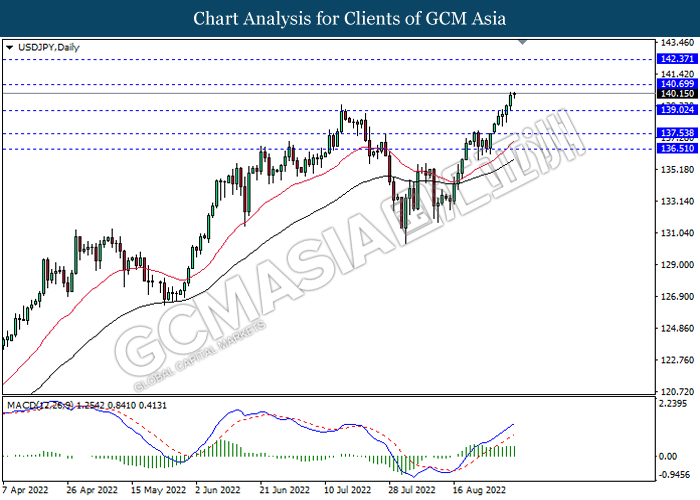

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 140.70, 142.35

Support level: 139.00, 137.55

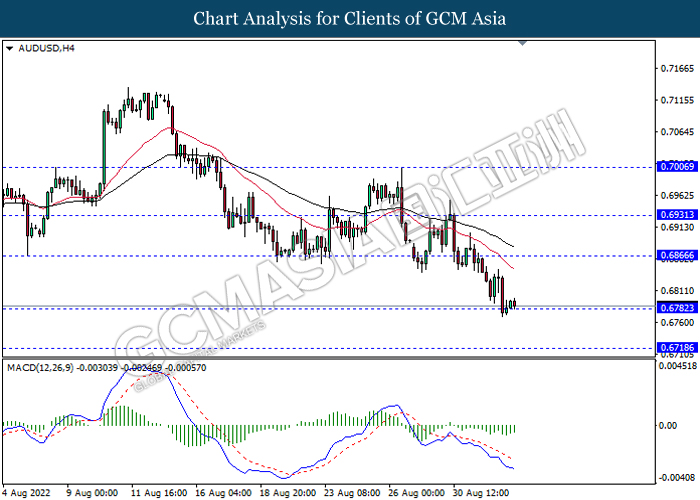

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

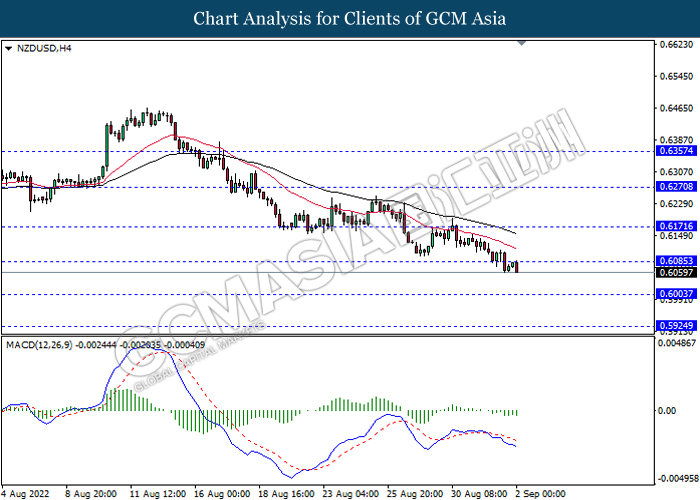

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6085, 0.6170

Support level: 0.6005, 0.5925

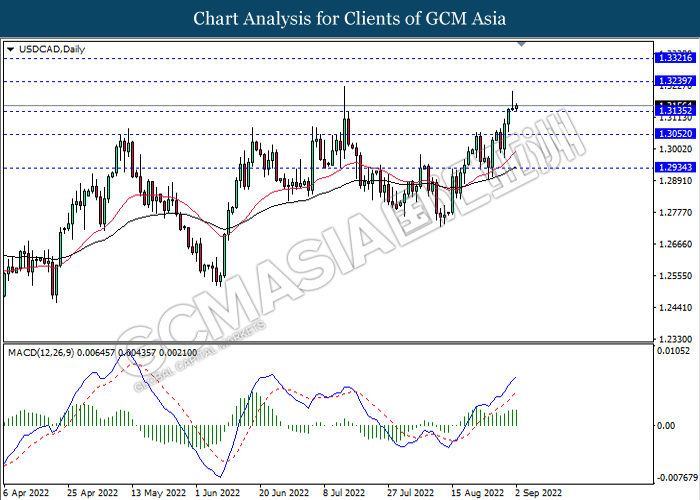

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3240, 1.3320

Support level: 1.3135, 1.3050

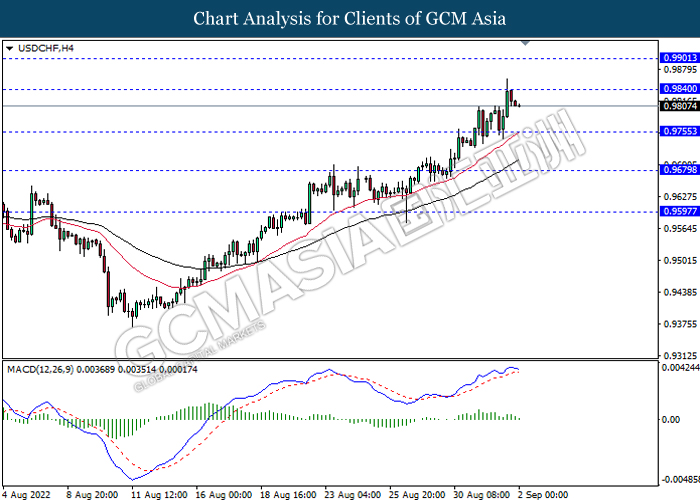

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9840, 0.9900

Support level: 0.9755, 0.9680

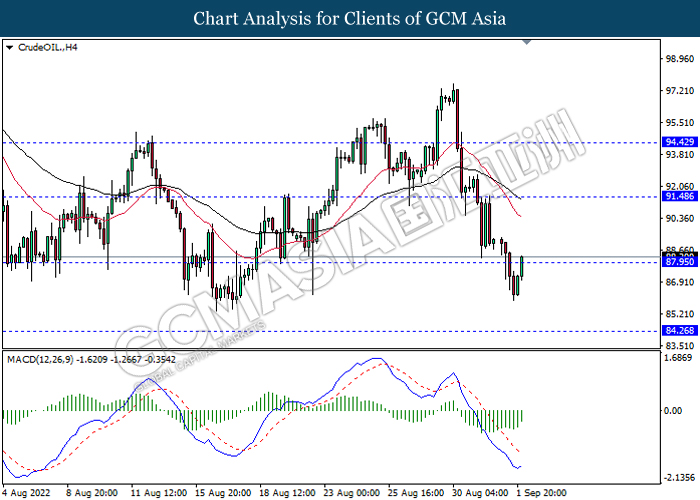

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.25

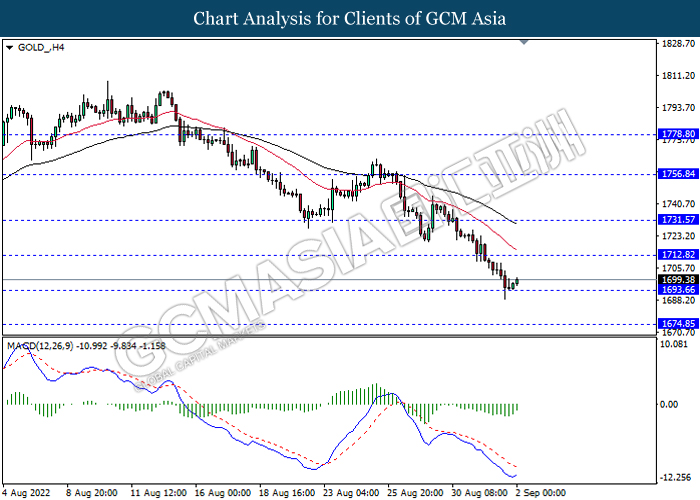

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1712.80, 1731.55

Support level: 1693.65, 1674.85