5 September 2022 Afternoon Session Analysis

Euro dipped as energy crisis risk heightened.

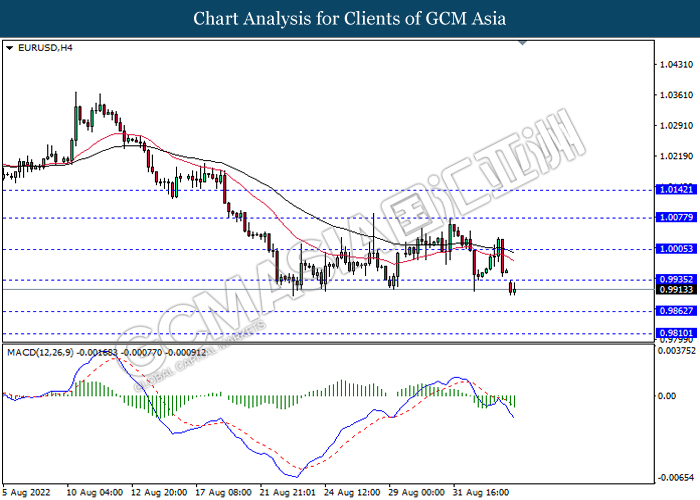

The EUR/USD, which traded by global investors dropped significantly on last Friday amid the rising fears upon energy crisis faced by European. According to Bloomberg, Russia energy company Gazprom had claimed on Friday that they would not resume the gas supply via Nord-Stream 1 on Saturday as planned due to the oil leak at its Portovaya compressor station. The company did not mention the date of reopening the gas pipeline after maintenance as well as it said that the Nord Stream pipeline would completely stopped until the equipment operation has been solved. The lack supply of commodities would deteriorated the energy issues in Europe region before entering into winter season, which dialed down the market optimism toward European economic momentum. Besides that, European are still facing the issues of spiking power and gas price, spurring further bearish momentum on the Euro. As of writing, EUR/USD eased by 0.37% to 0.9914.

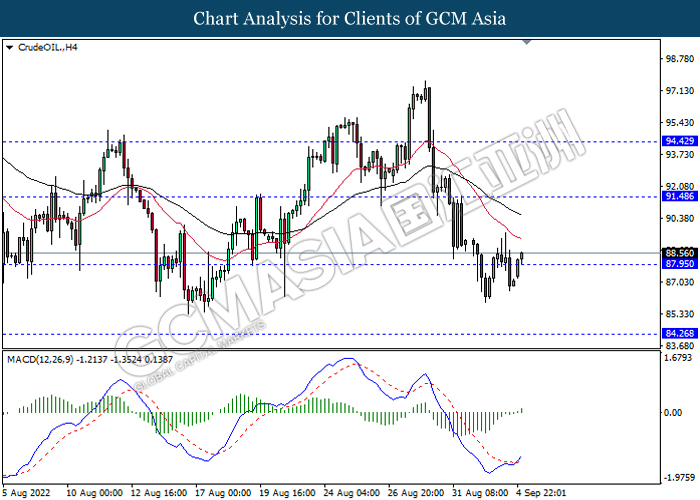

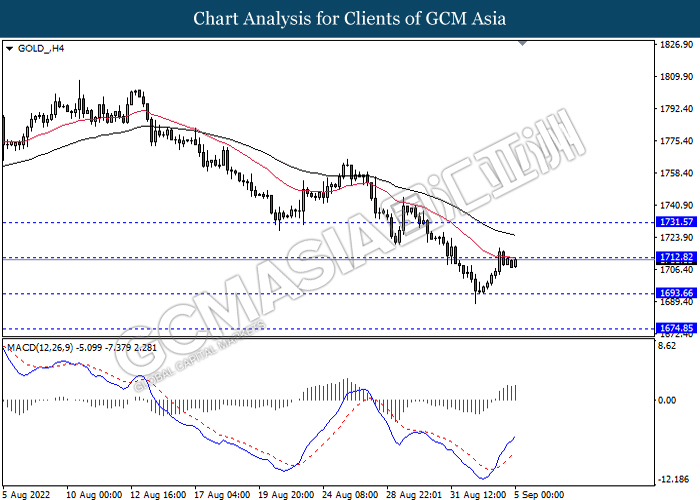

In the commodities market, the crude oil price rose by 1.81% to $88.44 per barrel as of writing as investors awaited details on potential OPEC production cuts from a meeting later in the day. On the other sides, the gold price appreciated by 0.04% to $1712.18 per troy ounce as of writing over the US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day USD Labor Day

All Day CAD Labor Day

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Aug) | 50.9 | 50.9 | – |

| 16:30 | GBP – Services PMI (Aug) | 52.5 | 52.5 | – |

Technical Analysis

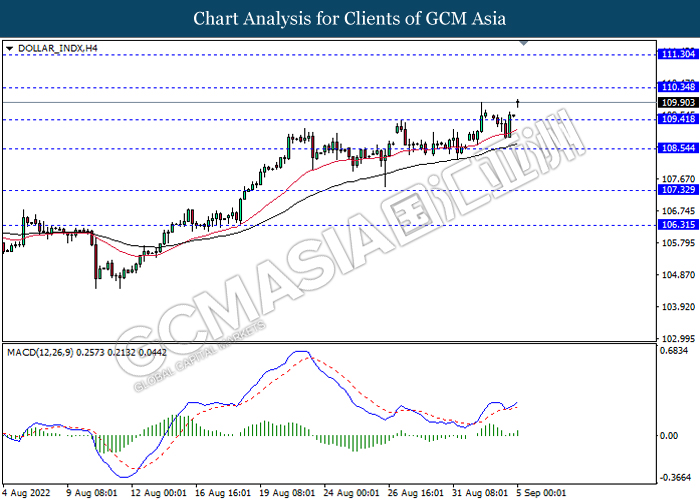

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 110.35, 111.30

Support level: 109.40, 108.55

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1490, 1.1595

Support level: 1.1410, 1.1330

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9935, 1.0005

Support level: 0.9860, 0.9810

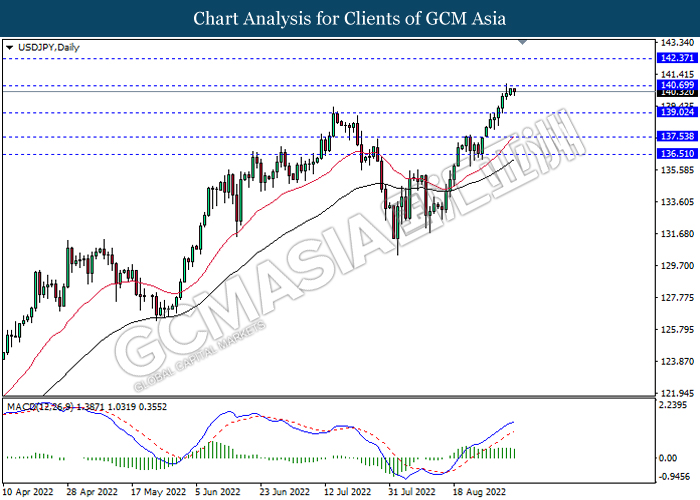

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 140.70, 142.35

Support level: 139.00, 137.55

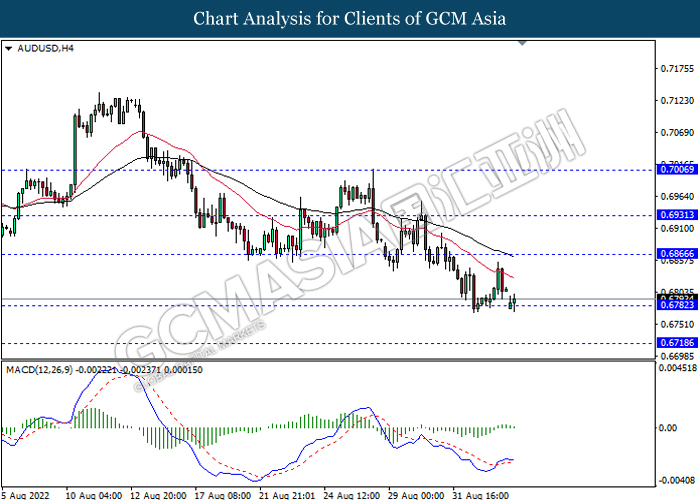

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

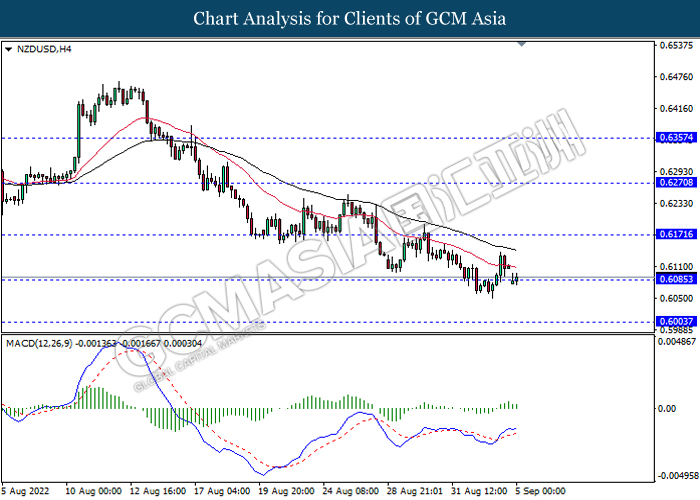

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3240, 1.3320

Support level: 1.3135, 1.3050

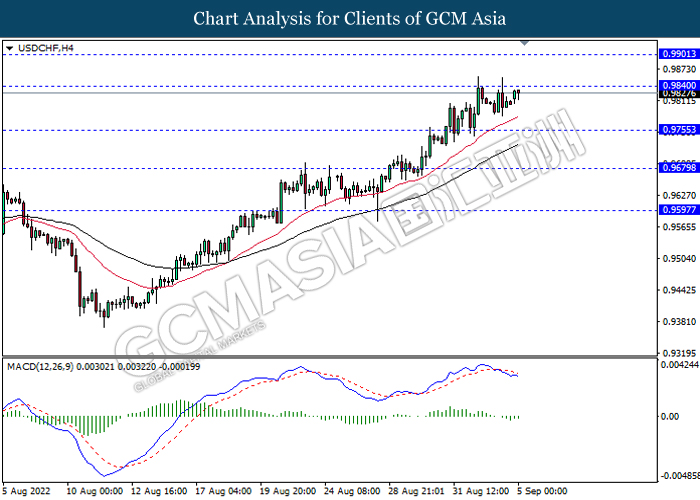

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9840, 0.9900

Support level: 0.9755, 0.9680

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.25

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1712.80, 1731.55

Support level: 1693.65, 1674.85