8 September 2022 Afternoon Session Analysis

Canadian dollar surged following rate hike decision.

The Canadian dollar, which is one of the major currencies that is majorly traded by investors, jumped after the long-awaited rate hike decision. Yesterday, the Bank of Canada (BoC) adjusted the cash rate upward by 0.75%, from 2.50% to 3.25%. In Canada, the inflation measured figure – CPI eased in July to 7.6% from 8.1% due to the decline in energy prices. However, the Core CPI which excludes the gasoline price, pointed to a further build-up of the price pressures, particularly in the services sector. On the other side, the labour market in Canada remained tight while the domestic demand remained strong. Given the strong inflation outlook, the members of the BoC reckon that the policy interest rate will need to rise further, in order to maintain price stability and achieve the long-term inflation target – 2%. Besides, the Ivey Purchasing Managers Index (PMI) which was released yesterday, showed a reading of 60.9, higher than the consensus forecast of 48.3. With such bullish data, the value of the Canadian dollar surged further, dragging the currency pair of USD/CAD to a lower level. As of writing, USD/CAD rebound by 0.08% to 1.3135.

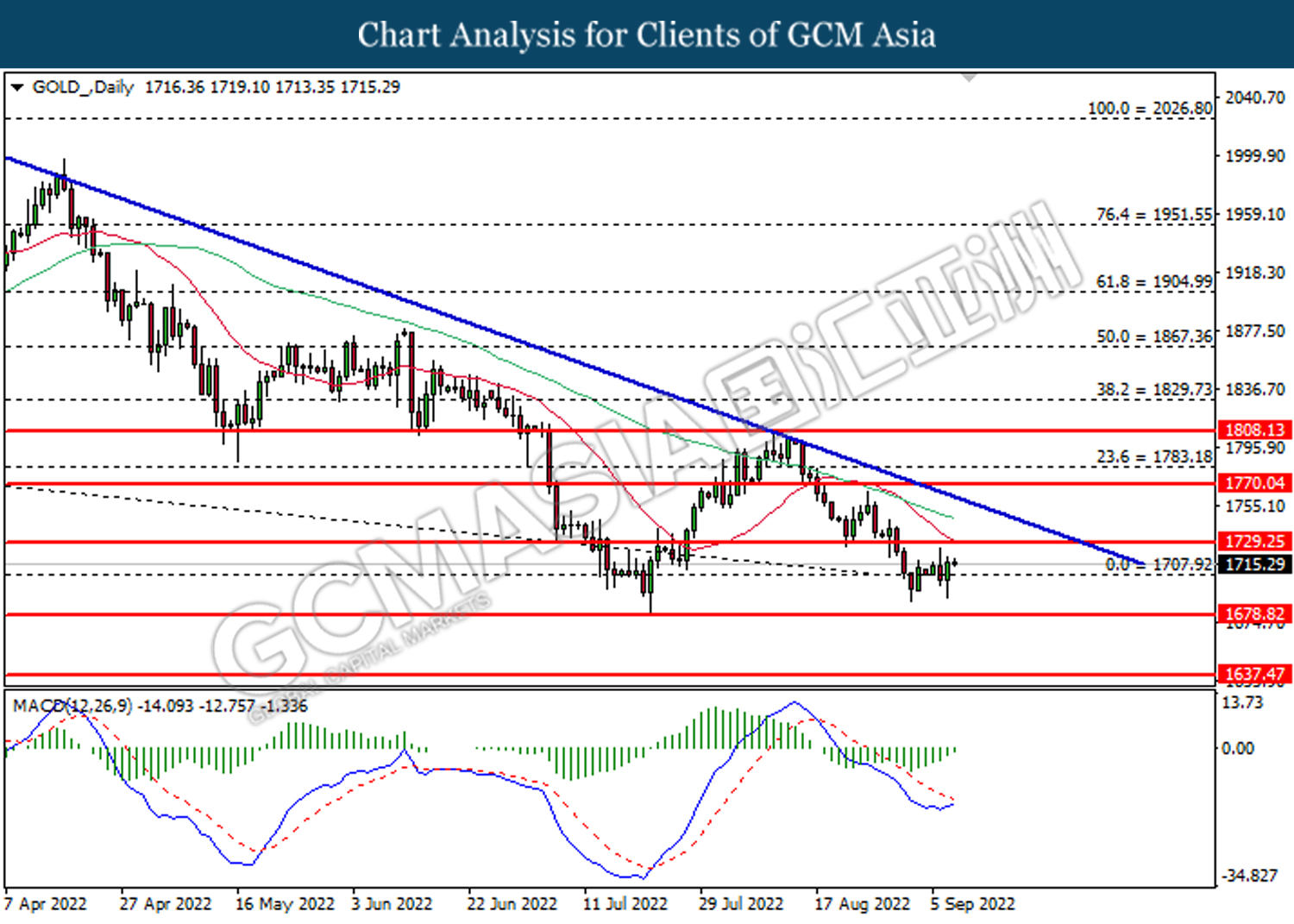

In the commodities market, the crude oil price up 0.86% to $82.50 a barrel as the EIA Short Term Energy report showed that the US crude production and petroleum demand would both rise in 2022 amid the ongoing economic recovery in the US. Besides, the gold prices edged down by -0.17% to $1715.60 per troy ounce as the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:15 EUR ECB Interest Rate Decision (Sep)

20:45 EUR ECB Press Conference

21:10 USD Fed Chair Powell Speaks

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Sep) | 0.00% | 0.50% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.75% | – | – |

| 20:30 | USD – Initial Jobless Claims | 232K | 240K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 3.326M | – | – |

Technical Analysis

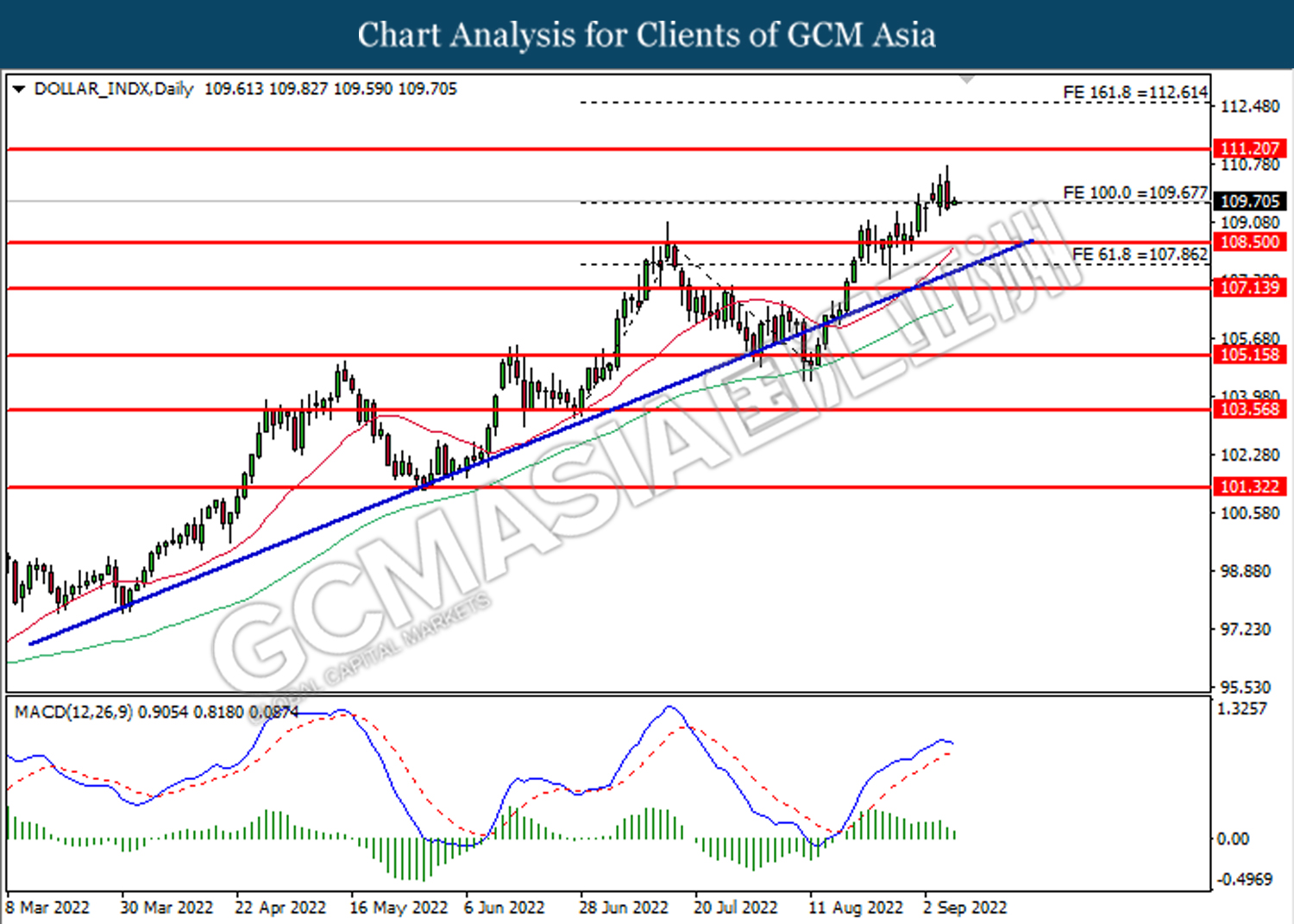

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 109.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 111.20, 112.60

Support level: 109.65, 108.50

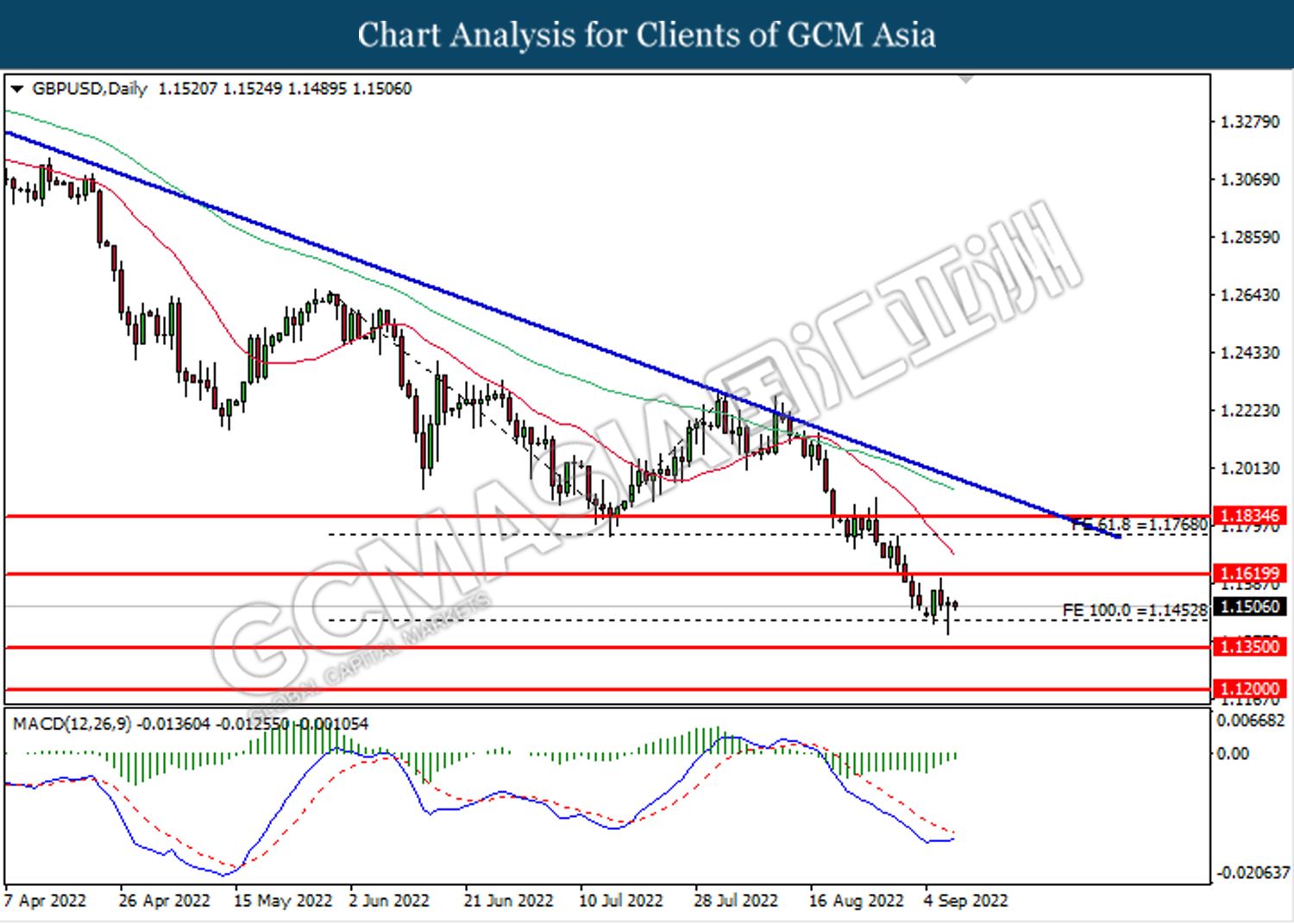

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1620. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical rebound for short term.

Resistance level: 1.1620, 1.1775

Support level: 1.1465, 1.1350

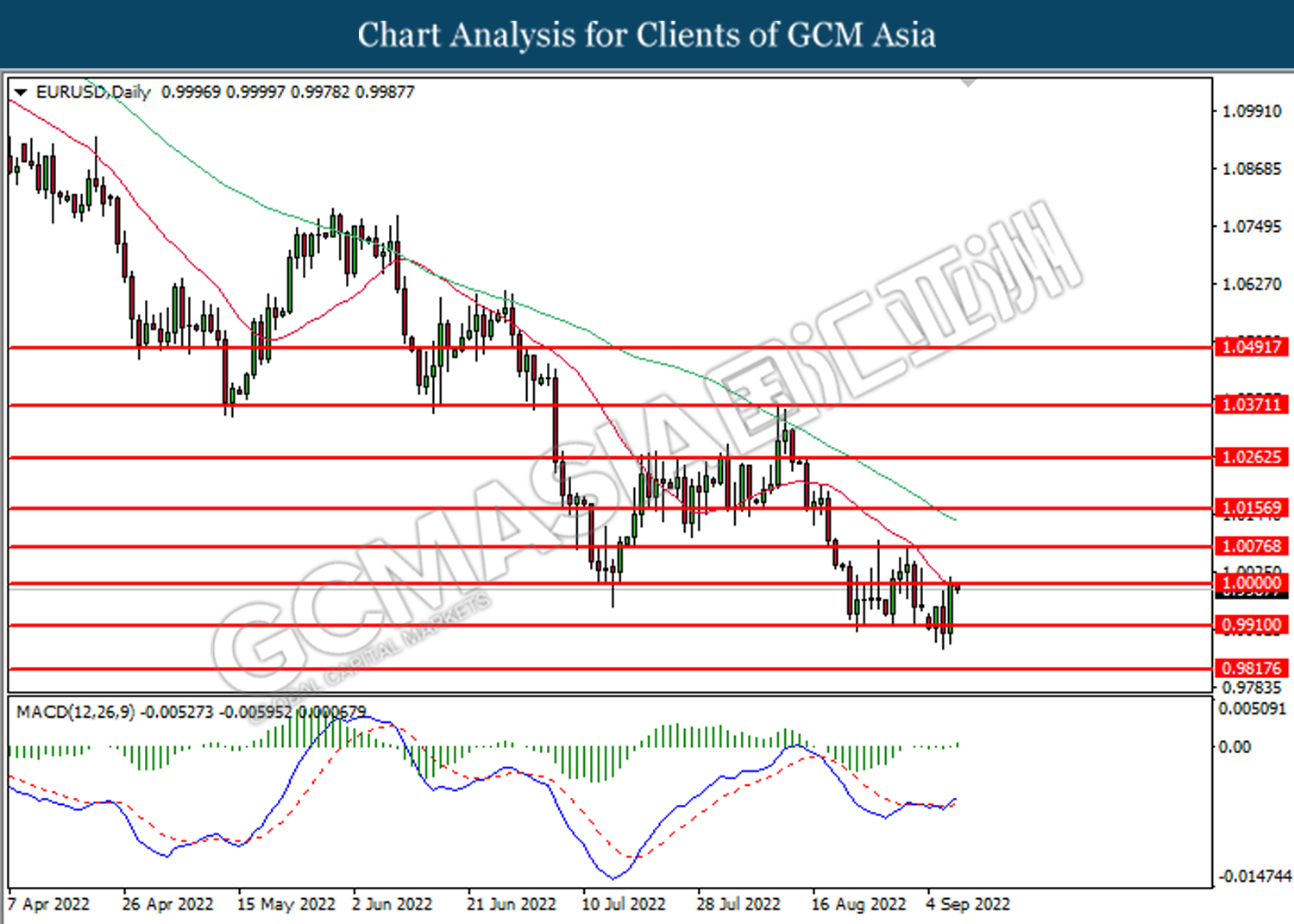

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0000. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 1.0000.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9820

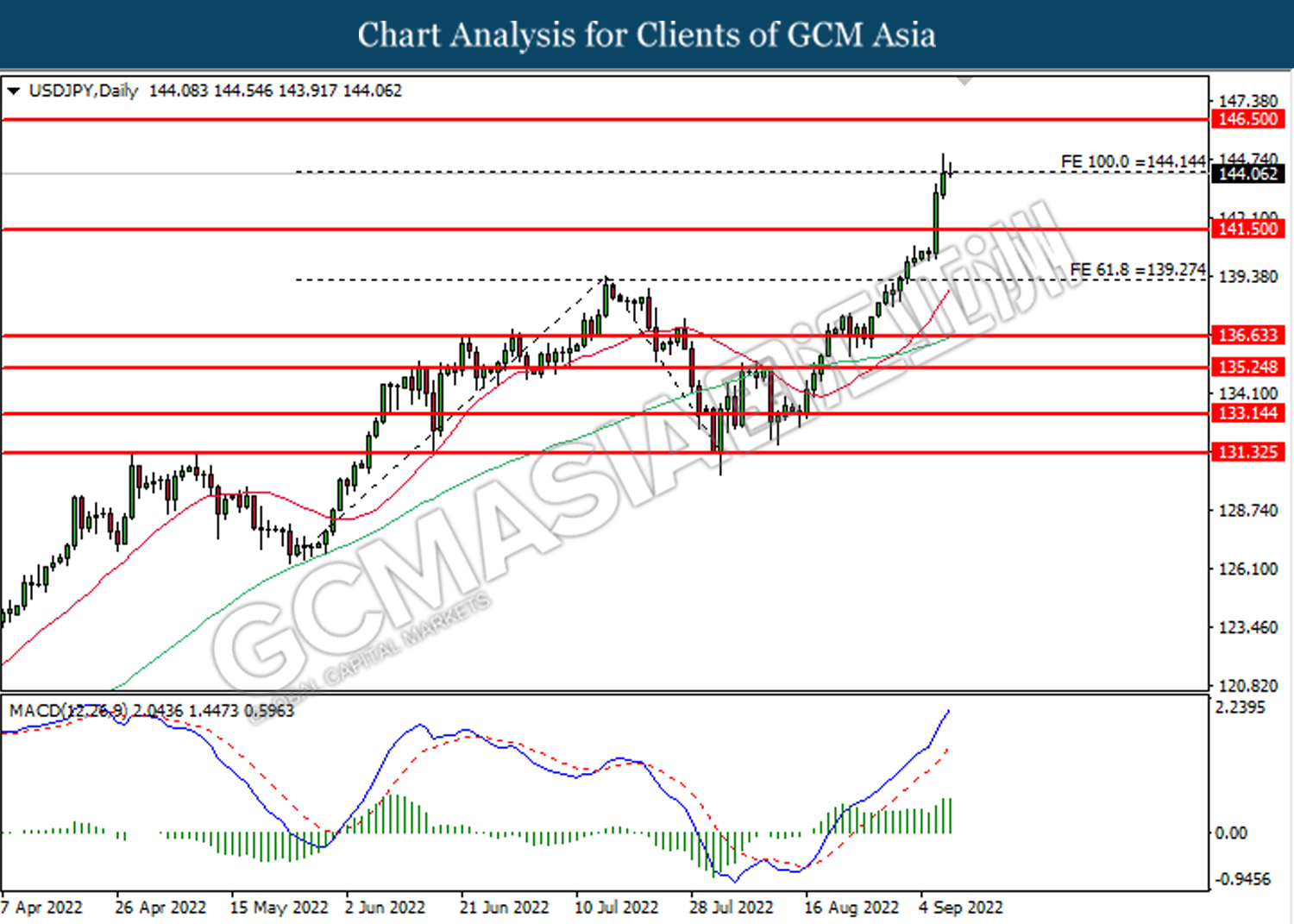

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

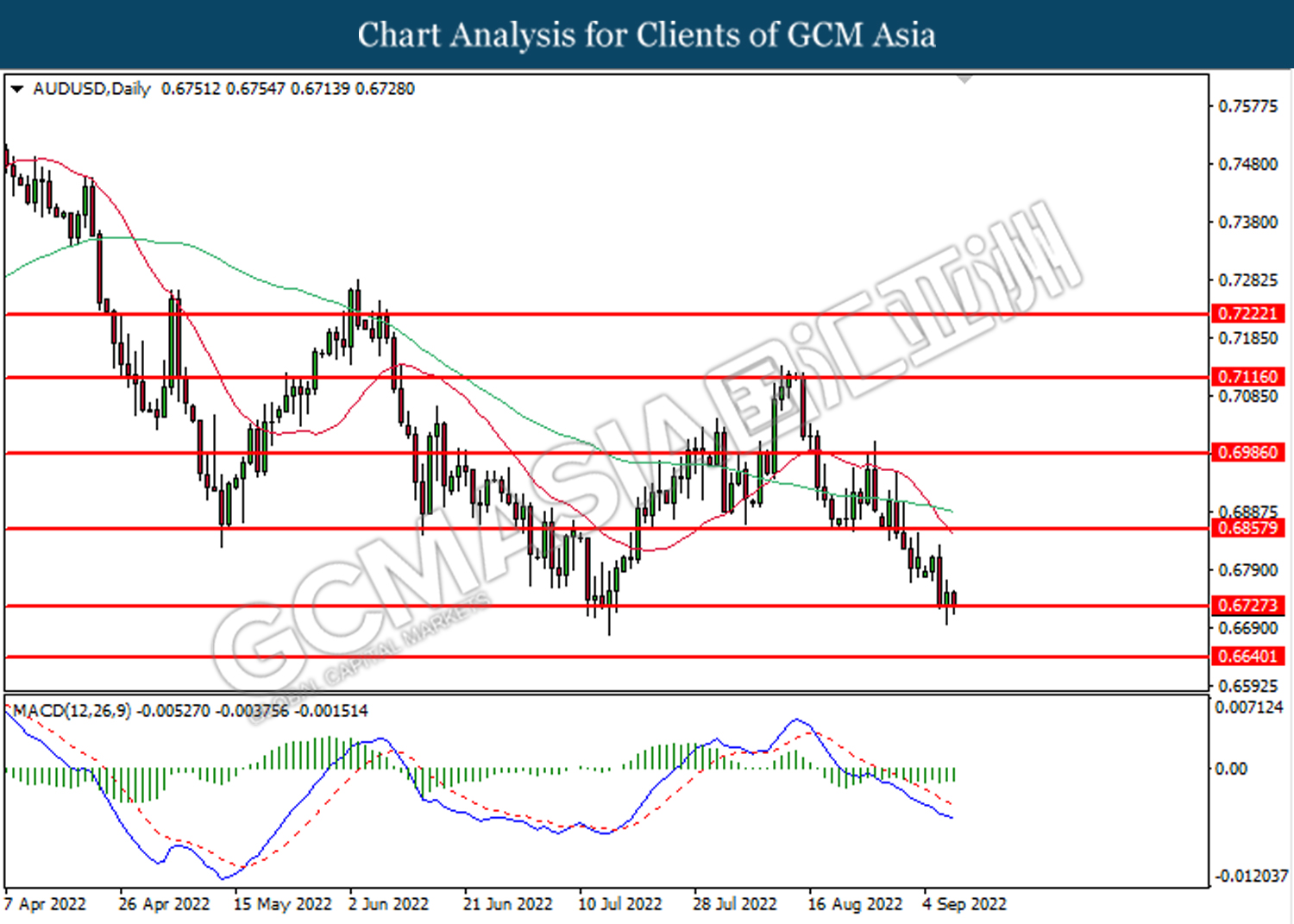

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

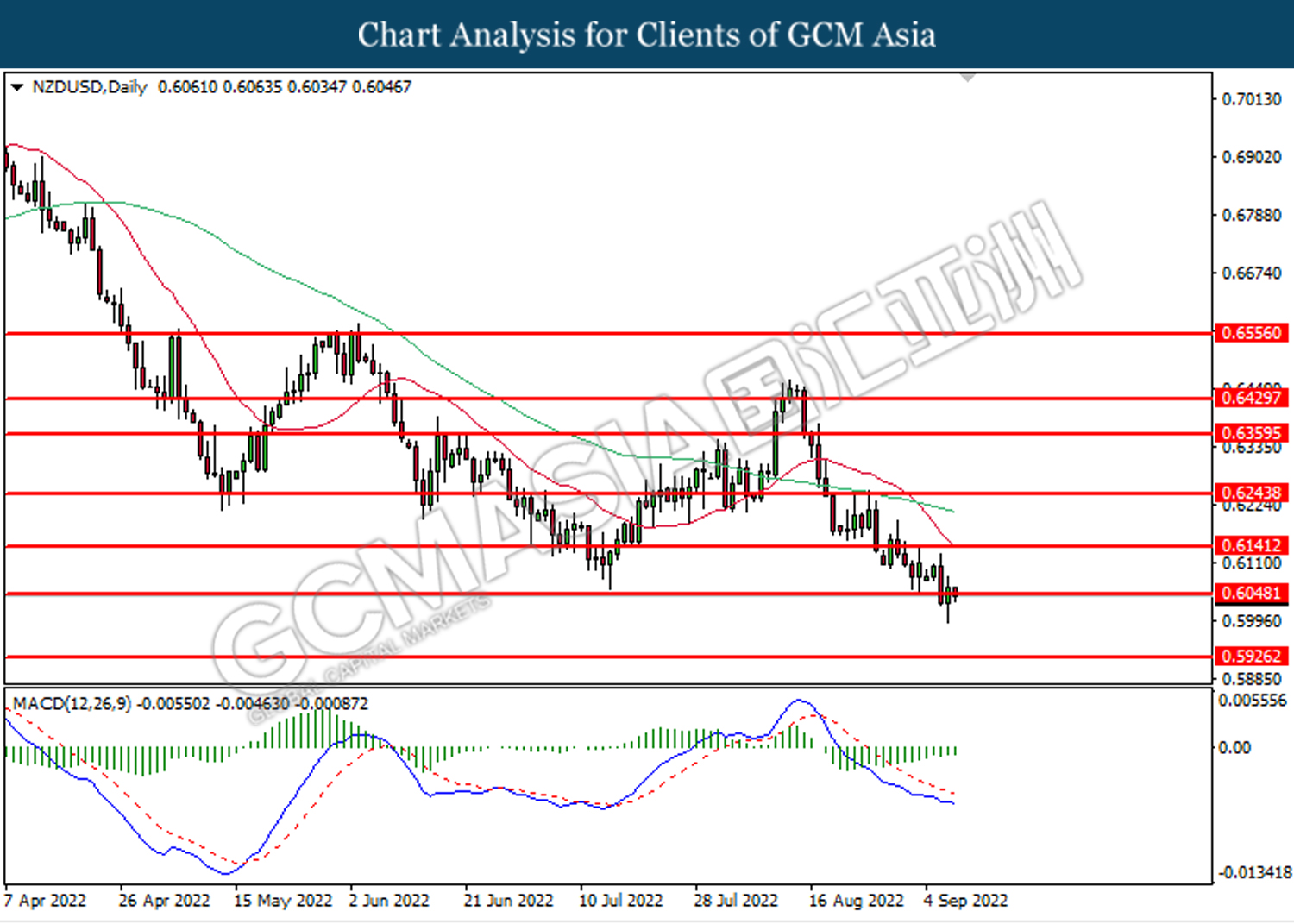

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6050. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3140. MACD which illustrated diminishing bullish momentum suggests the pair to extend losses toward the support level at 1.3050.

Resistance level: 1.3140, 1.3220

Support level: 1.3050, 1.2985

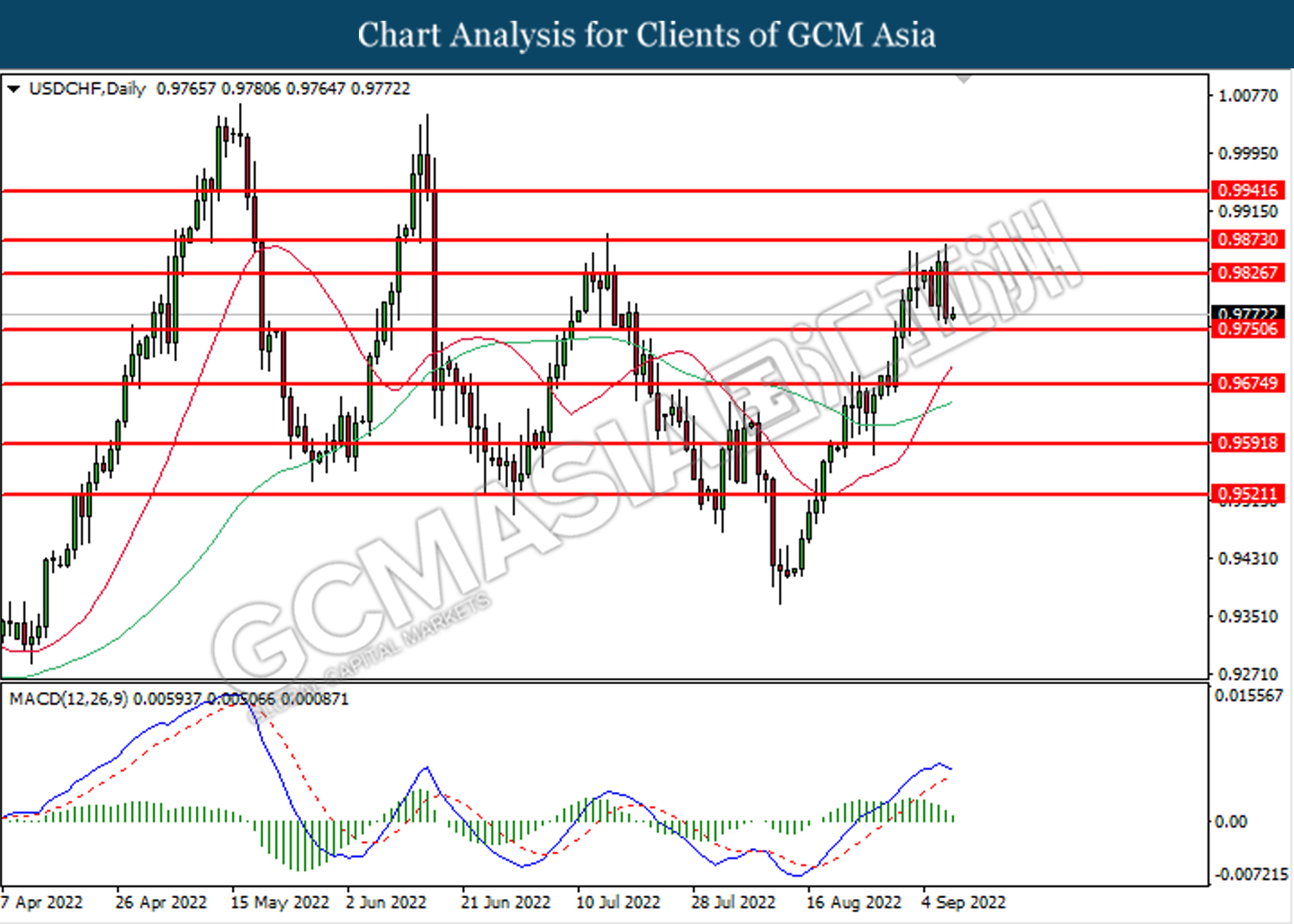

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9825. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9750.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 83.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 83.50, 86.15

Support level: 80.60, 78.20

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80