9 September 2022 Morning Session Analysis

US Dollar surged following Fed unleashed hawkish tone.

The Dollar Index which traded against a basket of six major currencies surged following the Federal Reserve unleashed their hawkish tone toward the economic progression in the United States. According to CNBC, Federal Reserve Chair Jerome Powell emphasized the importance of combating inflation before the public gets too used to higher prices. Market participants began to widely expect the 75-basis point for interest rate hike for this month. The CME Group’s FedWatch tracker speculated around 86% probability of 75 basis point rate hike during the next monetary policy meeting. Though, Federal Reserve will focus at inflation data before the meeting next weeks, when the Bureau of Labor Statistics releases the August Consumer Price Index (CPI) data. The Fed will hold its next monetary policy meeting on 20-21st September, when it will issue an updated economic projections and latest monetary policy decision to stabilize the economy momentum. As of writing, the Dollar Index appreciated by 0.02% to 105.65.

In the commodities market, the crude oil price appreciated by 0.30% to $82.99 per barrel as of writing amid technical correction. Though, the overall prospect for the crude oil still remained bearish following the US stockpile build hit nearly five months high. According to Energy Information Administration (EIA), the crude oil inventories came in at 8.844M, higher than the market forecast at -0.250M. On the other hand, the gold market depreciated by 0.01% to $1710.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (Aug) | -30.6K | 15.0K | – |

Technical Analysis

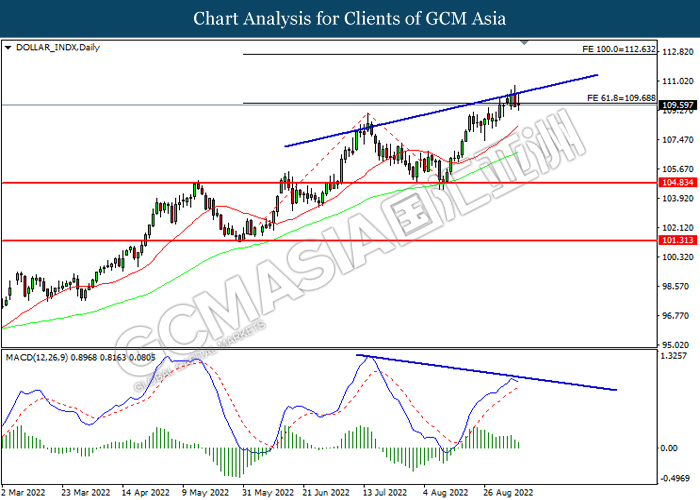

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

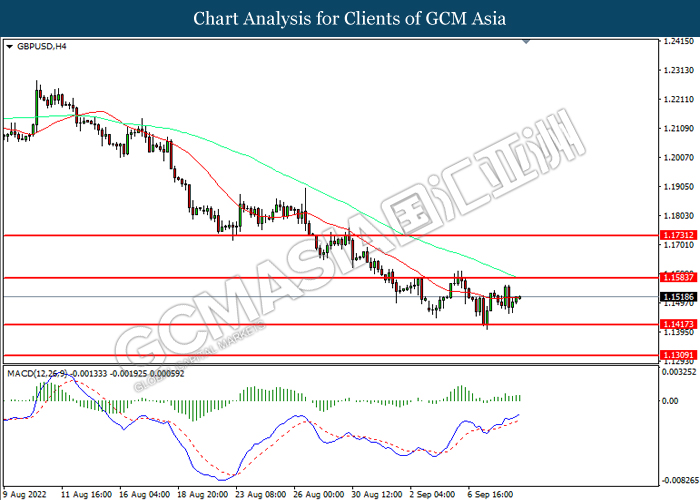

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1585, 1.1730

Support level: 1.1415, 1.1310

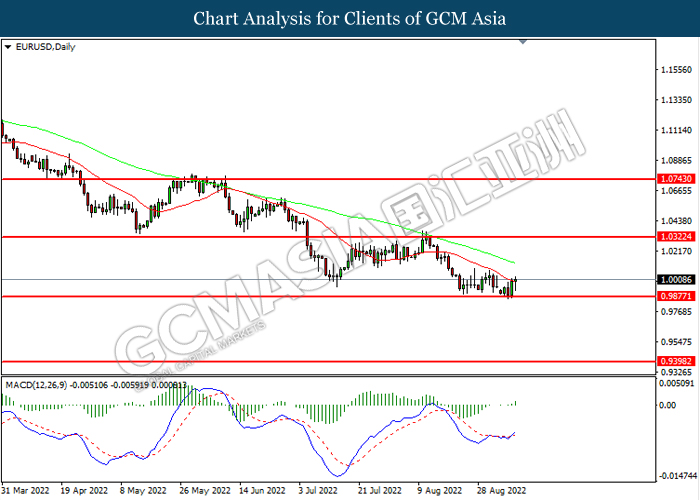

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0320, 1.0745

Support level: 0.9875, 0.9400

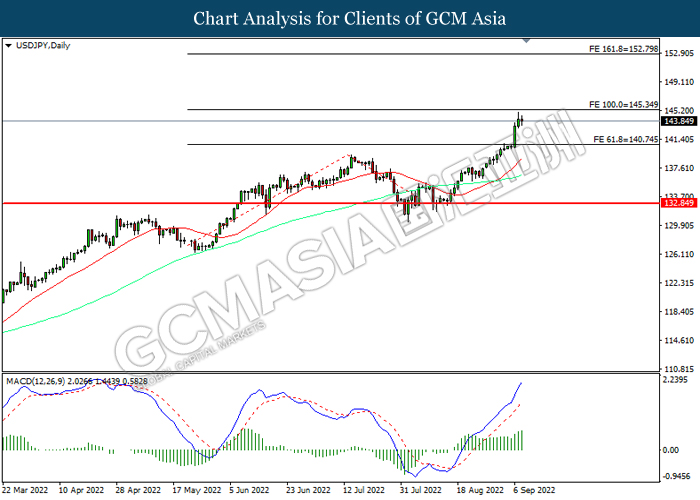

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 145.35

Resistance level: 145.35, 152.80

Support level: 140.75, 132.85

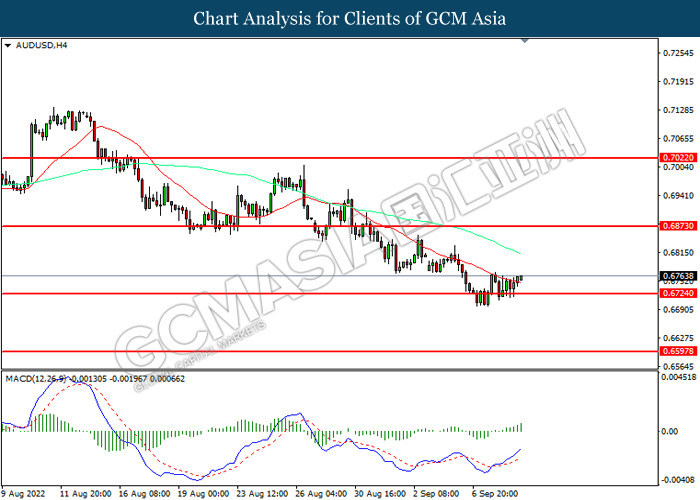

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.7020

Support level: 0.6725, 0.6595

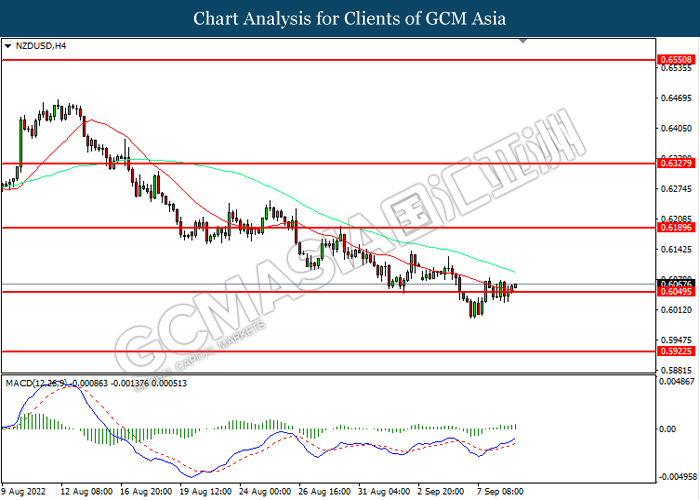

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6190, 0.6330

Support level: 0.6050, 0.5920

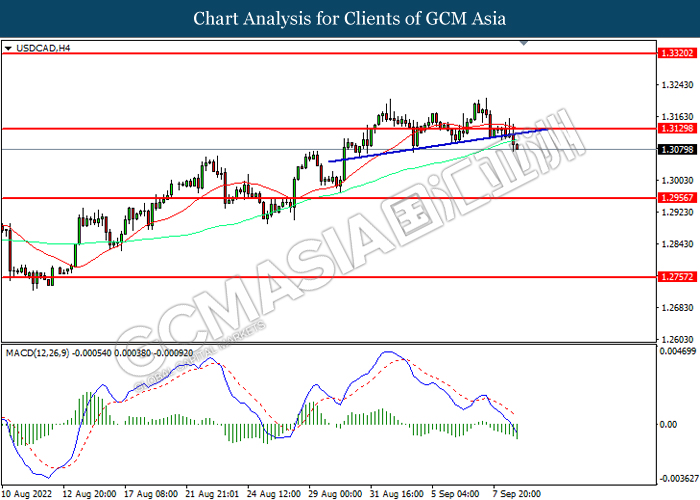

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3130, 1.3320

Support level: 1.2955, 1.2755

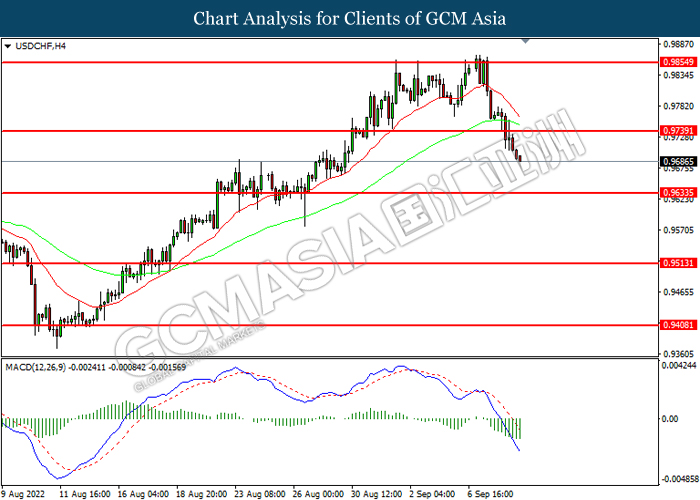

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

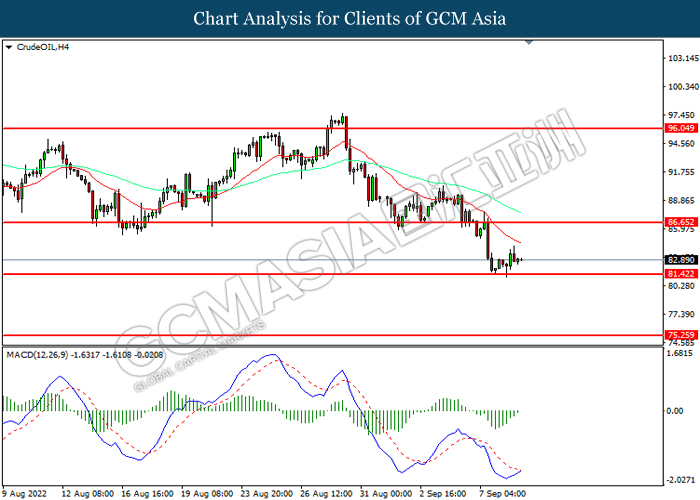

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.65, 96.05

Support level: 81.40, 75.25

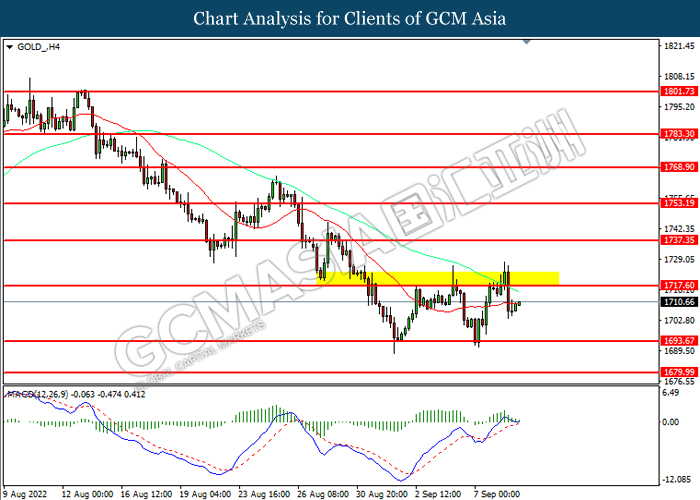

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1717.60. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1717.60, 1737.35

Support level: 1693.65, 1680.00