12 September 2022 Afternoon Session Analysis

Euro surged upon the aggressive rate hike path.

The EUR/USD, which traded by majority of investors jumped on the early of the day amid the rate hike expectation from ECB policymakers. According to Reuters, the ECB policymakers had claimed on Saturday that the central bank was suggested to raise its key interest rate to 2% in order to tackle sky-high inflation risk despite a recession would happen. Last week, ECB had increased its interest rate by 75 basis point to 1.25% and the ECB President Christine Lagarde guided for another two or three hikes, while she emphasized that the rates were still far away from a level that will bring inflation back to 2%. Such hawkish statement has sparked the appeal of Euro. At this juncture, the investors would continue to scrutinize the announcement of Eurozone CPI data to anticipate the rate hike decision from ECB. As of writing, EUR/USD appreciated by 0.51% to 1.0090.

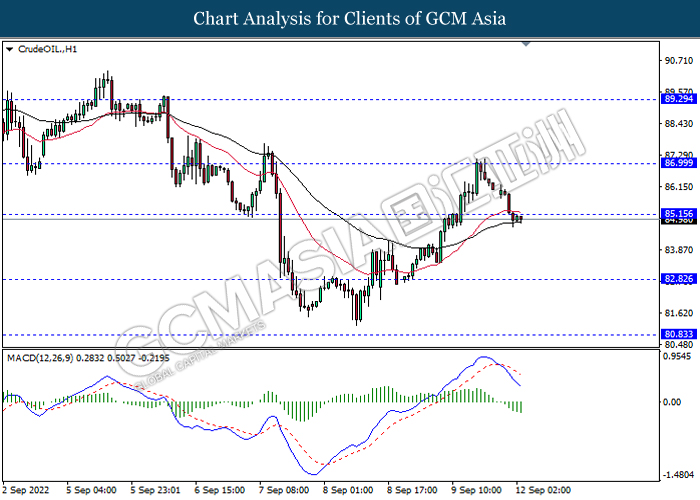

In the commodities market, the crude oil price dropped significantly by 1.71% to $85.31 per barrel as of writing as the China lockdown which driven by pandemic Covid-19 had threaten the oil demand. On the other hand, the gold price eased by 0.28% to $1712.82 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY Mid-Autumn Moon Festival

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | -0.6% | 0.3% | – |

| 14:00 | GBP –Manufacturing Production (MoM) (Jul) | -1.6% | 0.4% | – |

Technical Analysis

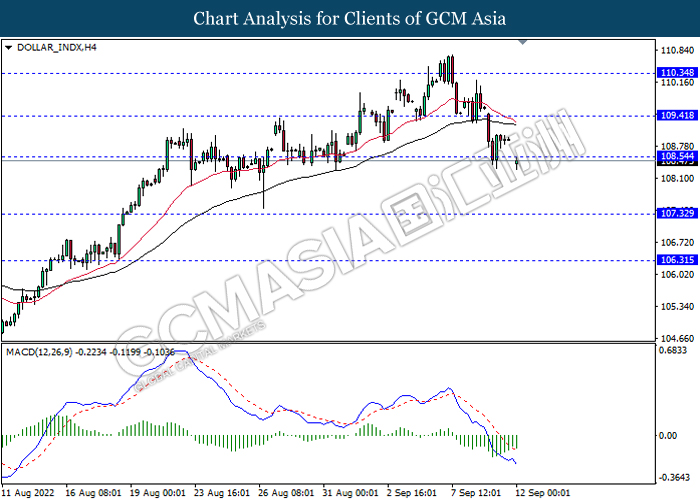

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 108.55, 109.40

Support level: 107.30, 106.30

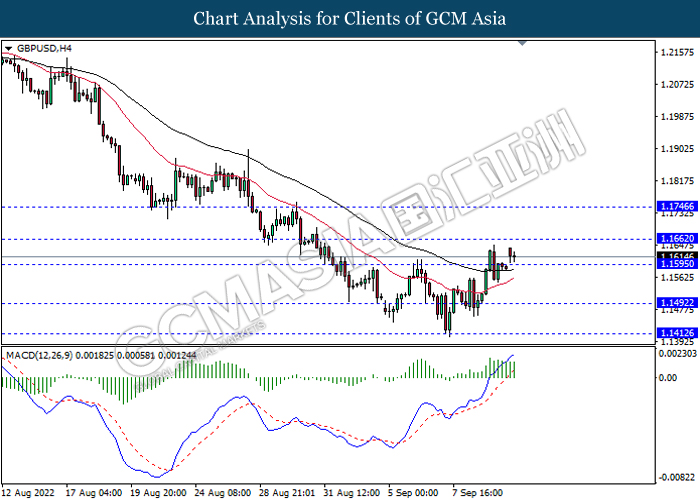

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1660, 1.1745

Support level: 1.1595, 1.1490

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0105, 1.0180

Support level: 1.0020, 0.9935

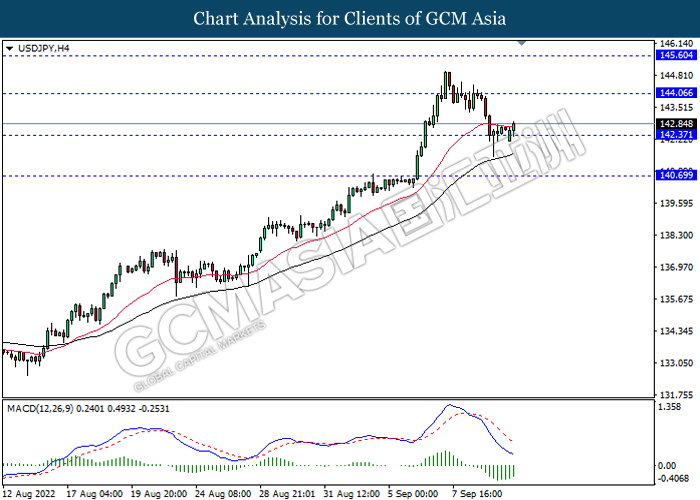

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 144.05, 145.60

Support level: 142.35, 140.70

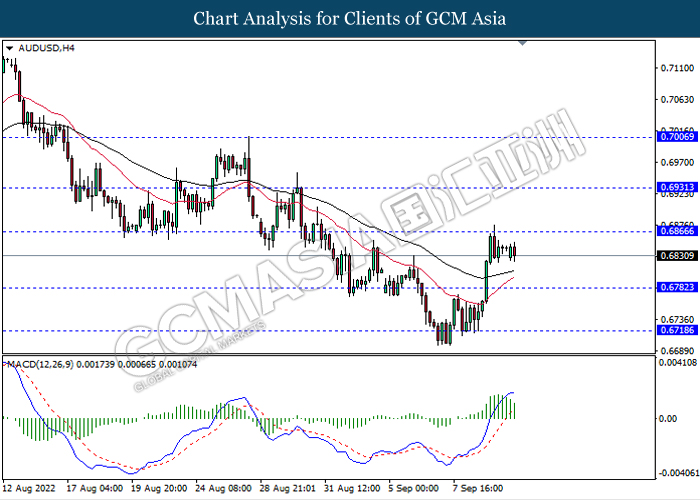

AUDUSD, H4: AUDUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

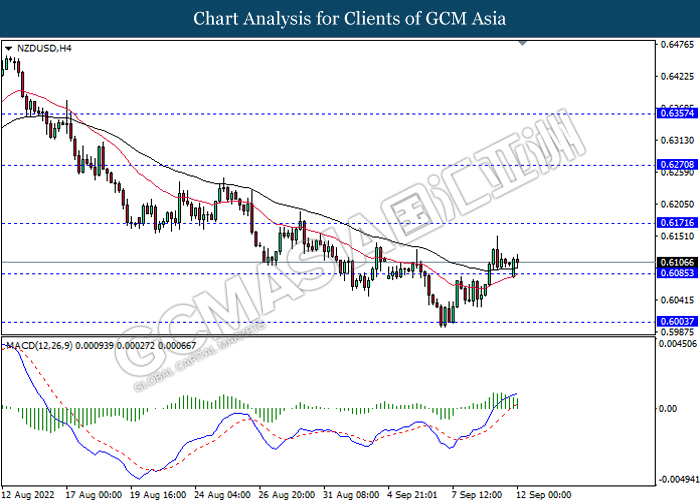

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

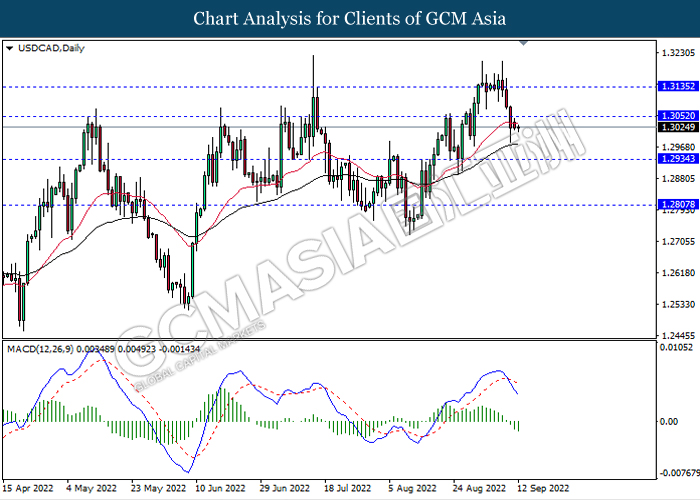

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2805

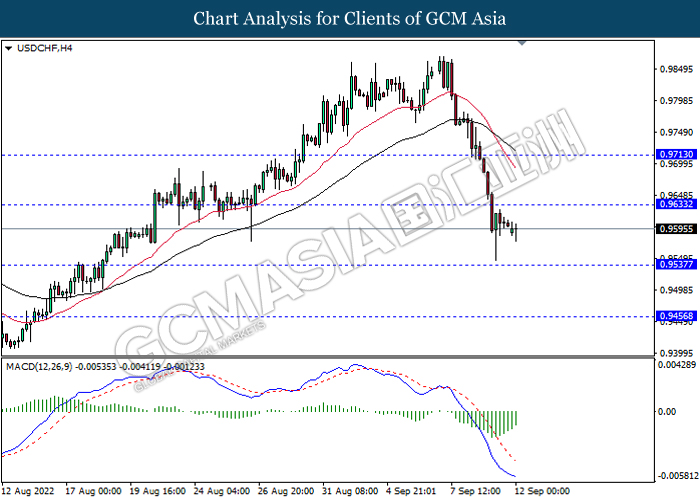

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9635, 0.9715

Support level: 0.9535, 0.9455

CrudeOIL, H1: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 85.15, 87.00

Support level: 82.80, 80.85

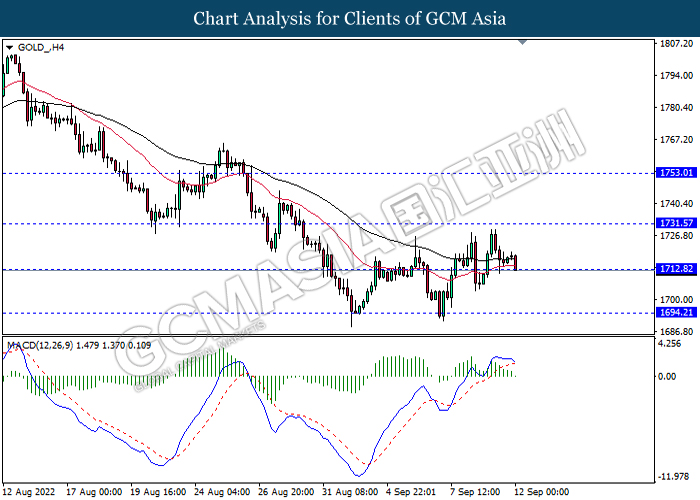

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1731.55, 1753.00

Support level: 1712.80, 1694.20