13 September 2022 Morning Session Analysis

US Dollar slumped ahead of crucial CPI data tonight.

The Dollar Index which traded against a basket of six major currencies extend its losses to lowest level in more than two weeks as investors had started to profit-taking from US Dollar ahead of US inflation data. The economists forecasted that the US inflation rate would likely to decline in August from a 40-year high in July as easing price for the commodities product would likely to weigh down the inflation risk. Such development would bring some relief to Federal Reserve who have been worrying that the highest inflation in 40 years might continue to jeopardize the US economic growth. The US authorities also predicted that the US Consumer Price Index (CPI) would indicate an 8% increase in August, down from the previous reading of 8.5% in July. As for now, investors would continue to scrutinize the latest updates with regards of the latest US data as well as the Federal Reserve’s monetary policy decision to receive further trading signal. As of writing, the Dollar Index depreciated by 0.64% to 108.30.

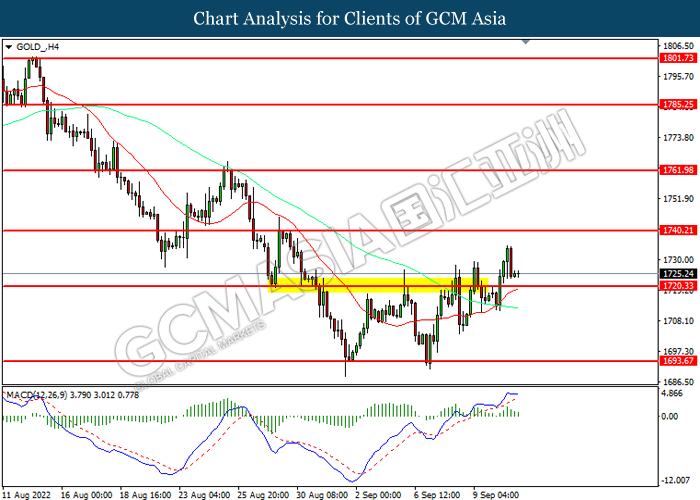

In the commodities market, the crude oil price appreciated by 0.01% to $87.75 per barrel as of writing. The crude oil price extends its gains yesterday as the oil supply constraints continue to spur bullish momentum on the crude oil price. According to Reuters, US emergency crude oil stocks fell 8.4-million-barrel last week to 431.1 million barrels, their lowest oil reserve since October 1984. On the other hand, the gold price surged 0.02% to $1725.00 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Jul) | 5.10% | 5.20% | – |

| 14:00 | GBP – Claimant Count Change (Aug) | -10.5K | -13.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Sep) | -55.3 | -60 | – |

| 20:30 | USD – Core CPI (MoM) (Aug) | 0.30% | 0.30% | – |

| 20:30 | USD – CPI (YoY) (Aug) | 8.50% | 8.10% | – |

| 20:30 | USD – CPI (MoM) (Aug) | 0.00% | -0.10% | – |

Technical Analysis

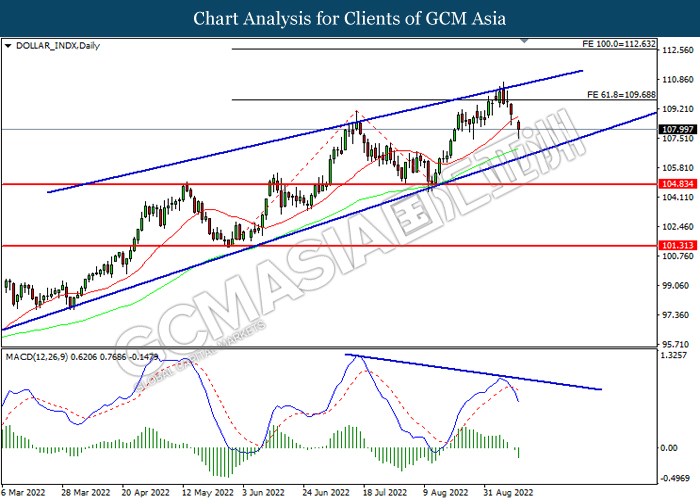

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1730, 1.1850

Support level: 1.1585, 1.1415

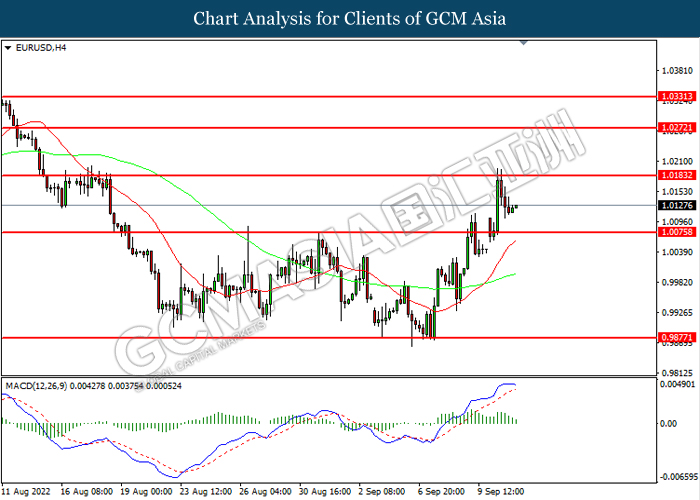

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.0185, 1.0270

Support level: 1.0075, 0.9875

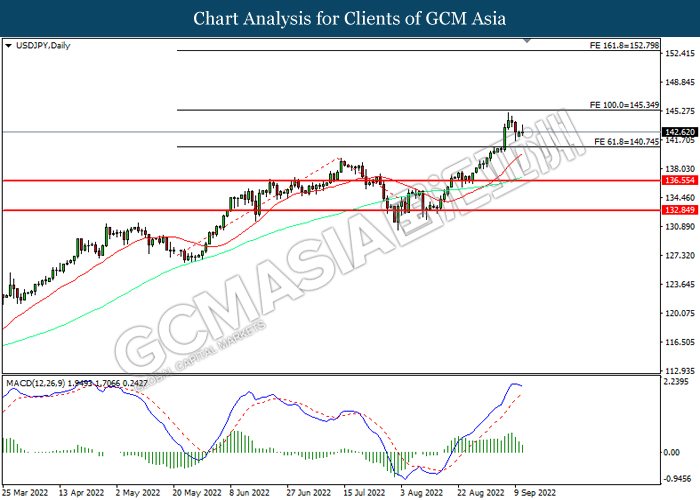

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

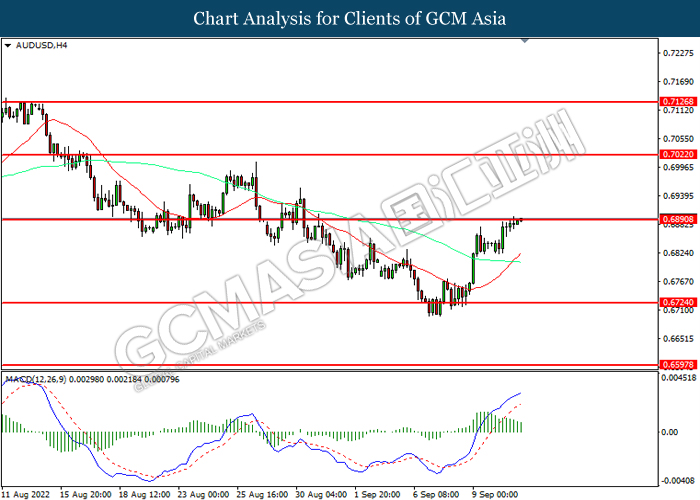

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6890, 0.7020

Support level: 0.6725, 0.6595

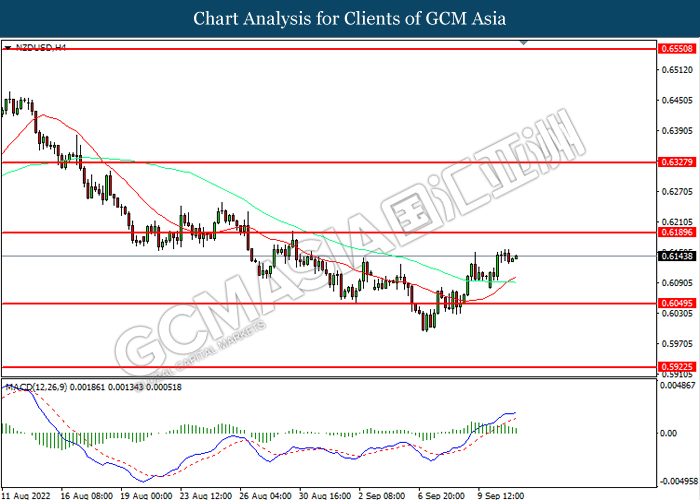

NZDUSD, H4: NZDUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6190, 0.6330

Support level: 0.6050, 0.5920

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3100, 1.3195

Support level: 1.2955, 1.2845

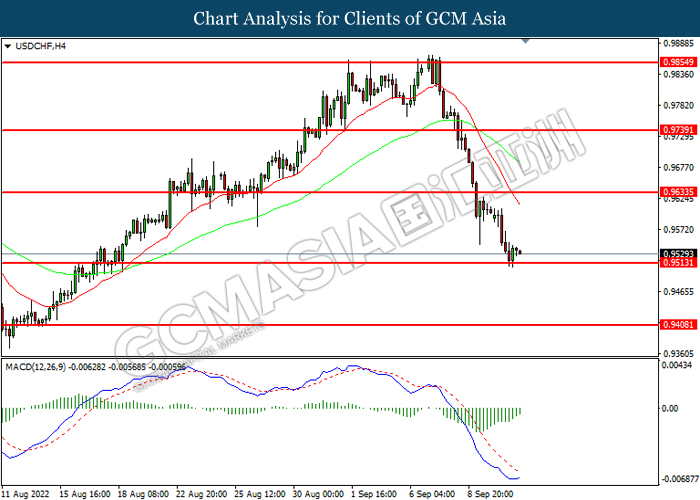

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9635, 0.9740

Support level: 0.9515, 0.9410

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 90.25, 96.05

Support level: 86.05, 81.40

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1740.20, 1762.00

Support level: 1720.35, 1693.65