14 September 2022 Morning Session Analysis

US Dollar surged as spiking inflation rate implies an aggressive rate hike decision.

The Dollar Index which traded against a basket of six major currencies rebounded significantly over the backdrop of surprising inflation data, prompting bets for more aggressive rate hike from Federal Reserve in future. According to US Bureau of Labor Statistics, US Core Consumer Price Index (CPI) for last month notched up significantly from the previous reading of 0.3% to 0.6%, exceeding the market forecast at 0.3%. The recent data had indicated that the inflation levels have continue to creep upward, coupled with the vast improvement in employment market in US on the back of strong economic growth would likely to cause the Federal Reserve to make a more hawkish tone during the FOMC meeting next week. Besides that, the safe-haven US Dollar extend its gains following the S&P 500 tumbled by more than 4%, which stoked a shift in sentiment toward the safe-haven US Dollar. Financial market is currently fully priced in an interest rate hike of at least 75 basis point during the FOMC meeting next week, with another 32% probability of 100 basis point rate hike, according to CME’s FedWatch Tool. As of writing, the Dollar Index appreciated by 1.55% to 109.56.

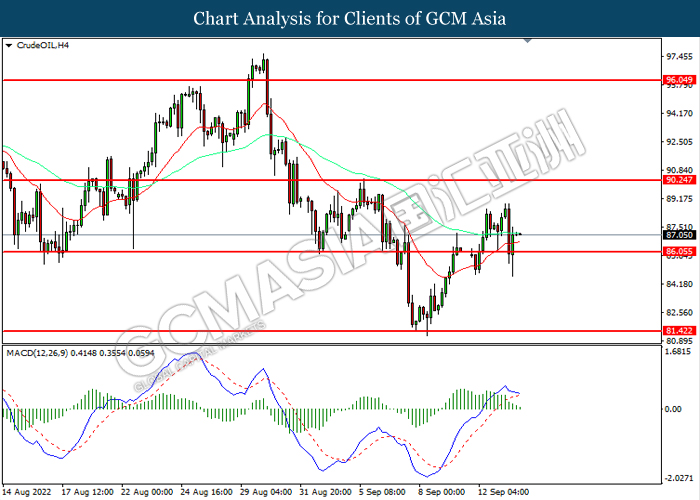

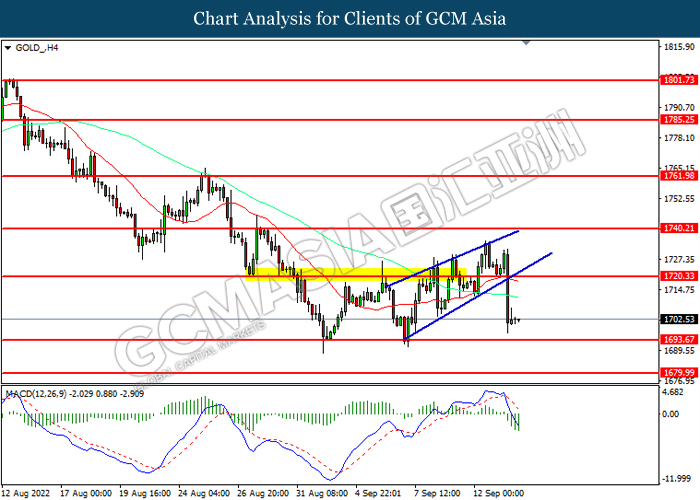

In the commodities market, the crude oil price slumped 0.08% to $87.05 per barrel as of writing. The oil market edged lower following the release of inventory data. According to American Petroleum Institute (API), US API Weekly Crude Oil Stock came in at 6.035M, higher than the market forecast at -0.200M. On the other hand, the gold price dipped significantly to $1700.05 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Aug) | 10.10% | 10.20% | – |

| 20:30 | USD – PPI (MoM) (Aug) | -0.50% | -0.10% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.844M | – | – |

Technical Analysis

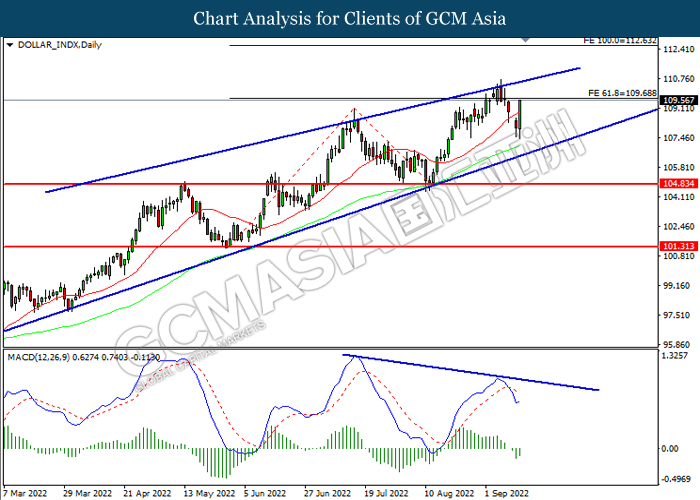

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

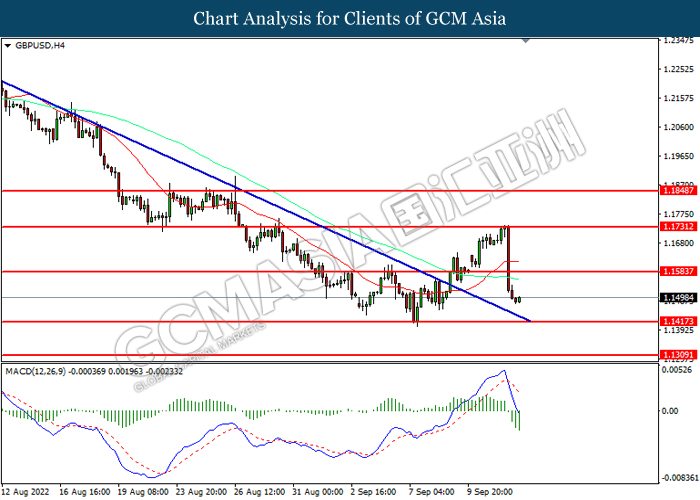

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1585, 1.1730

Support level: 1.1415, 1.1310

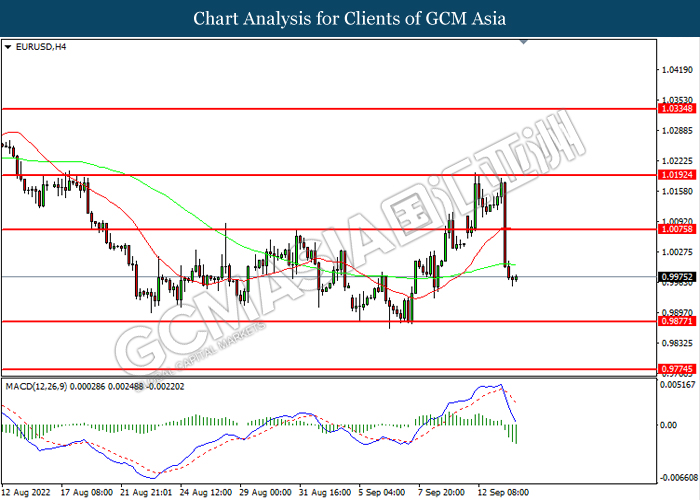

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.0075, 1.0190

Support level: 0.9875, 0.9775

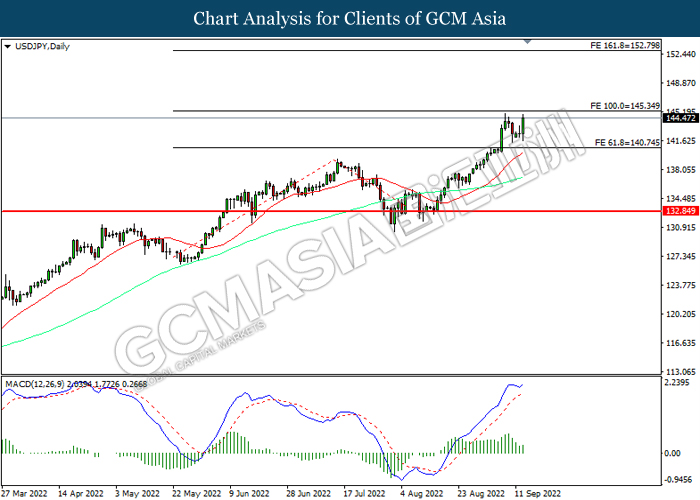

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 132.85

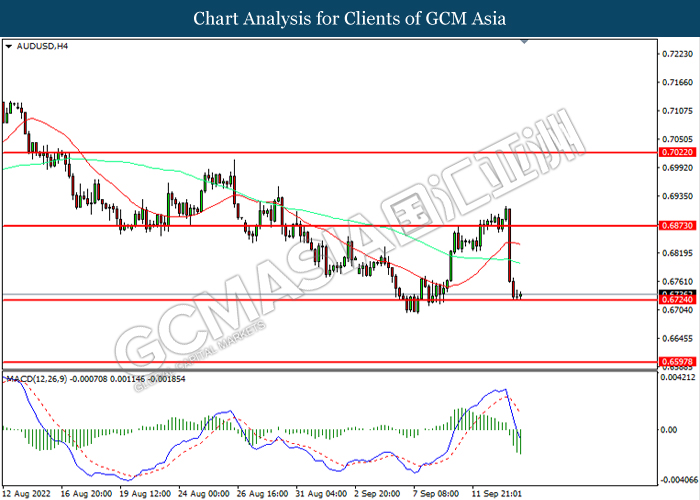

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6875, 0.7020

Support level: 0.6725, 0.6595

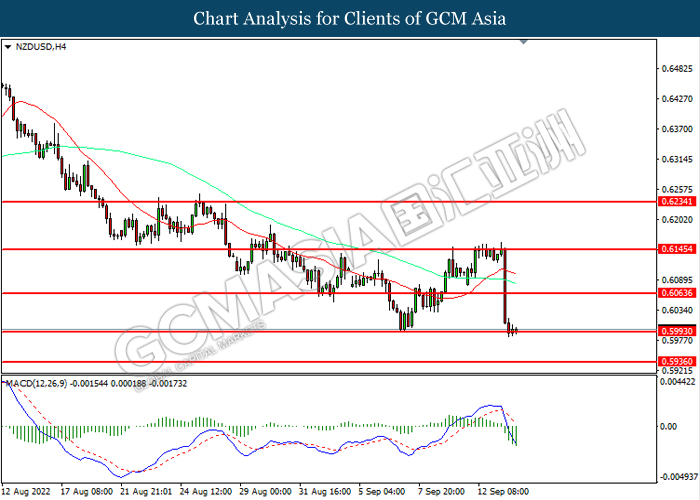

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6065, 0.6145

Support level: 0.5995, 0.5935

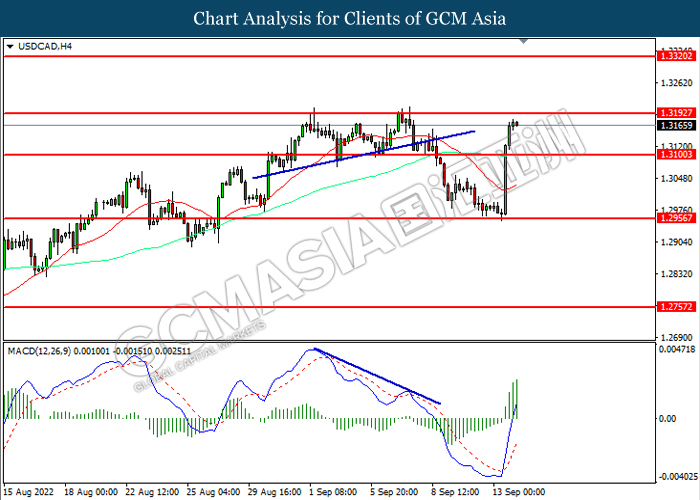

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3195, 1.3320

Support level: 1.3100, 1.2955

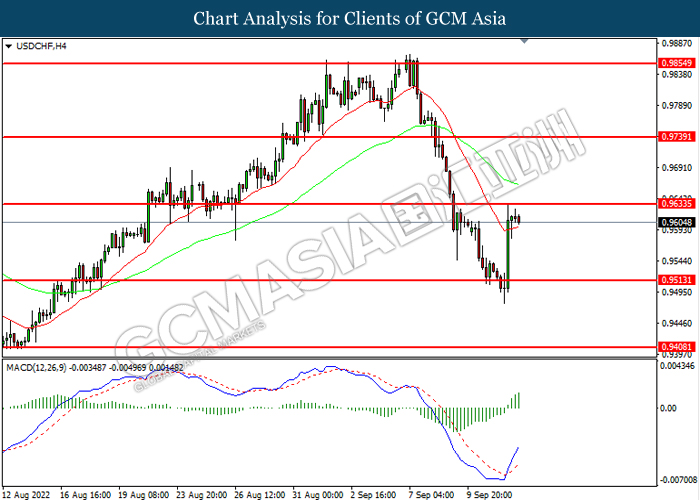

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9635, 0.9740

Support level: 0.9515, 0.9410

CrudeOIL, H4: Crude oil price was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 90.25, 96.05

Support level: 86.05, 81.40

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1720.35, 1740.20

Support level: 1693.65, 1680.00