14 September 2022 Afternoon Session Analysis

Pound stunned ahead of long-awaited CPI data.

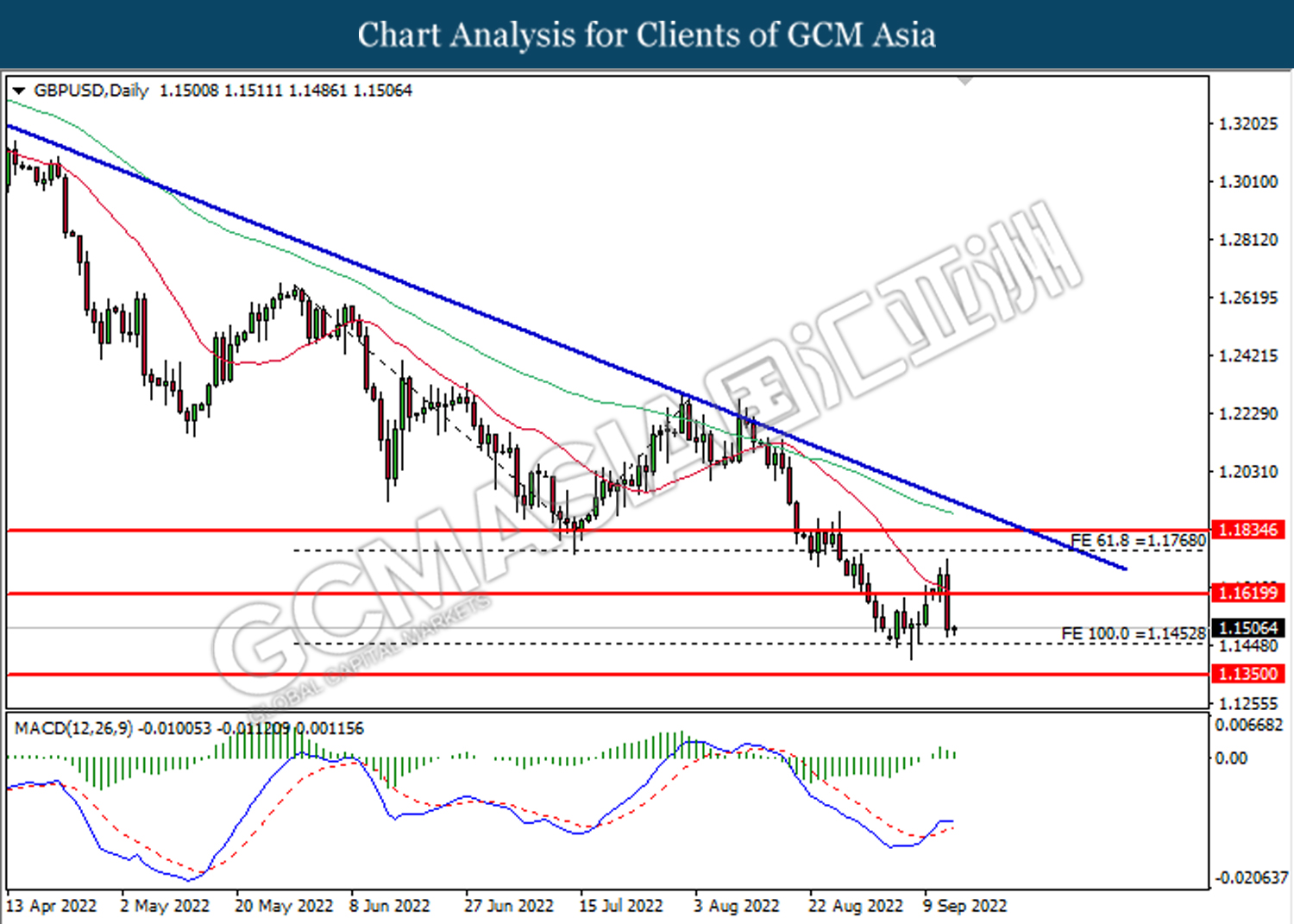

The Sterling Pound, which was majorly traded by global investors, experienced huge buy in pressures as hotter-than-expected CPI data was released in the US yesterday. Following the release of the CPI data, it hurt the market sentiment as market were expecting the price of goods and services was to start falling, seeing economy to cool down in near-term. As such, the pair of GBP/USD plunged tremendously, heading toward the recent low level again. Going forward, the market participants are eyeing on the upcoming crucial data – Consumer Price Index (CPI), which scheduled at 14:00 (GMT+8) today. Now, the investors are expecting the UK inflation figure will not cool down at the moment as BoE has already warned that it expects CPI to reach as high as 13% in October and the economy would enter into a recession for an extended period. Hence, the investors are waiting for the upcoming CPI data to gauge the further direction of the currency. As of writing, the pair of GBP/USD surged 0.14% to 1.1505.

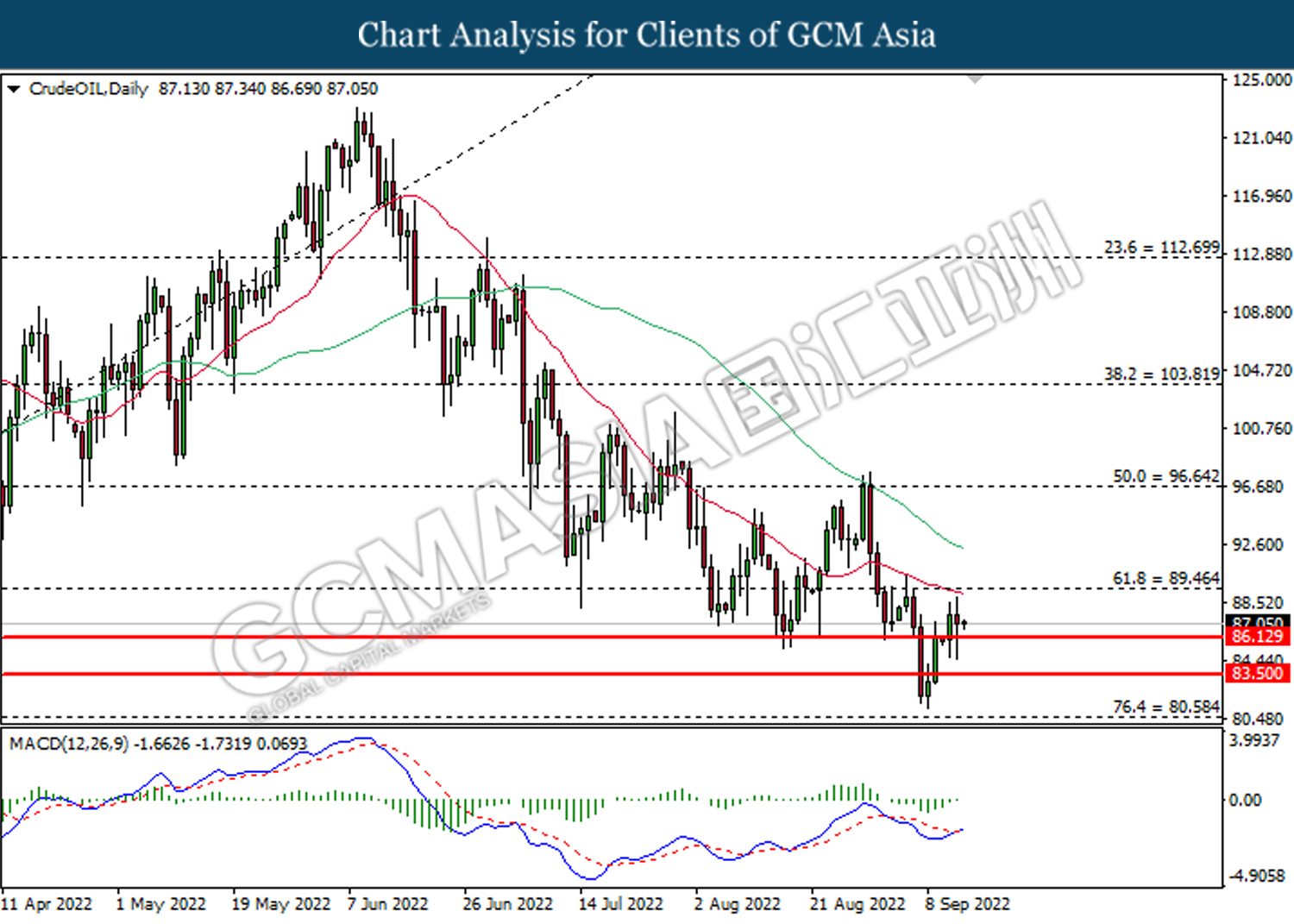

In the commodities market, the crude oil price plunged -0.15% to $87.00 per barrel as the surge in the greenback value urged the non-US oil buyer to temporarily shy away from the black commodity market amid a more expensive price compared to usual. Besides, the gold prices depreciated by 0.04% to $1703.05 per troy ounce amid the stronger-than-expected CPI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Aug) | 10.10% | 10.20% | – |

| 20:30 | USD – PPI (MoM) (Aug) | -0.50% | -0.10% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.844M | – | – |

Technical Analysis

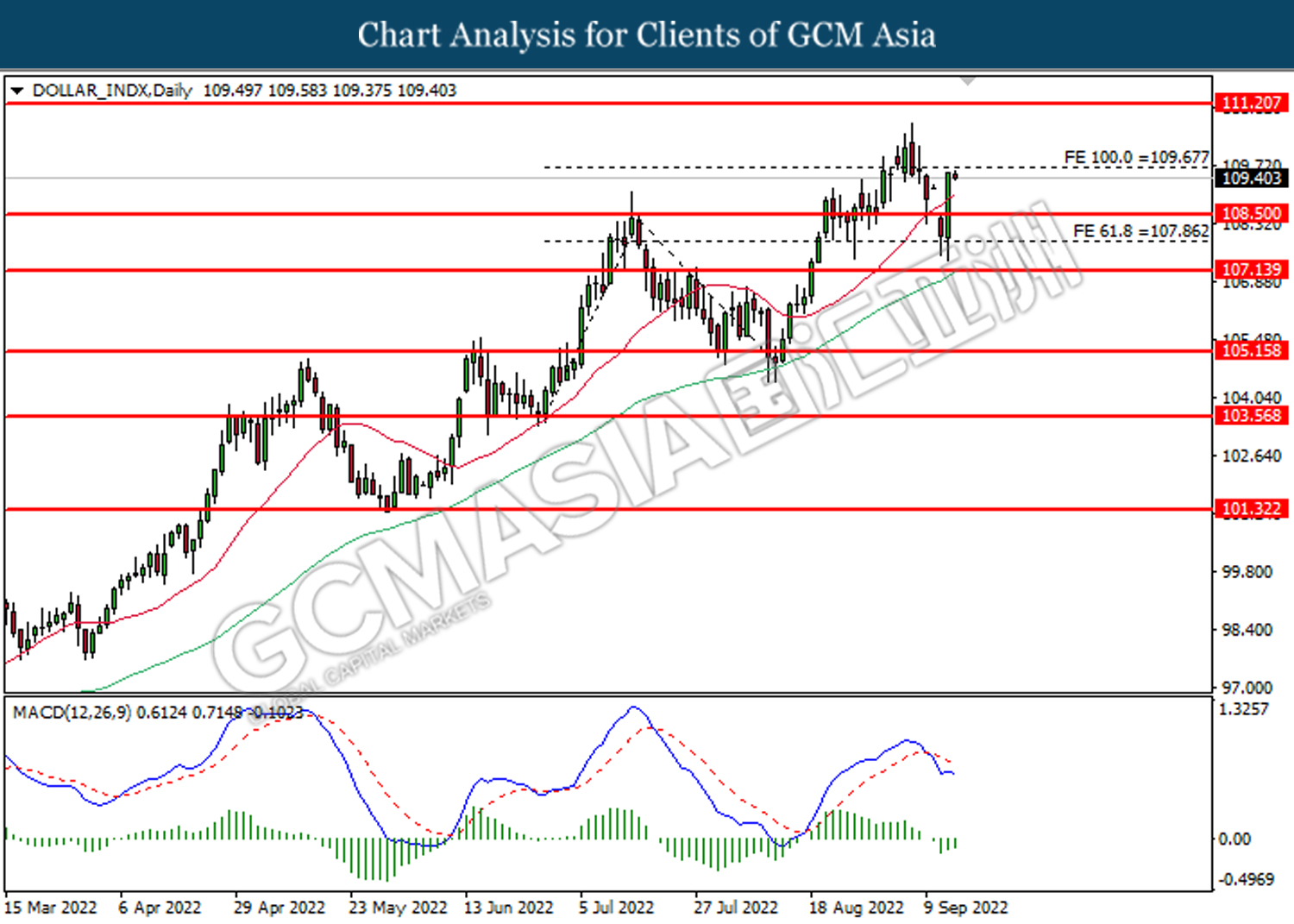

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1620. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1455.

Resistance level: 1.1620, 1.1770

Support level: 1.1455, 1.1350

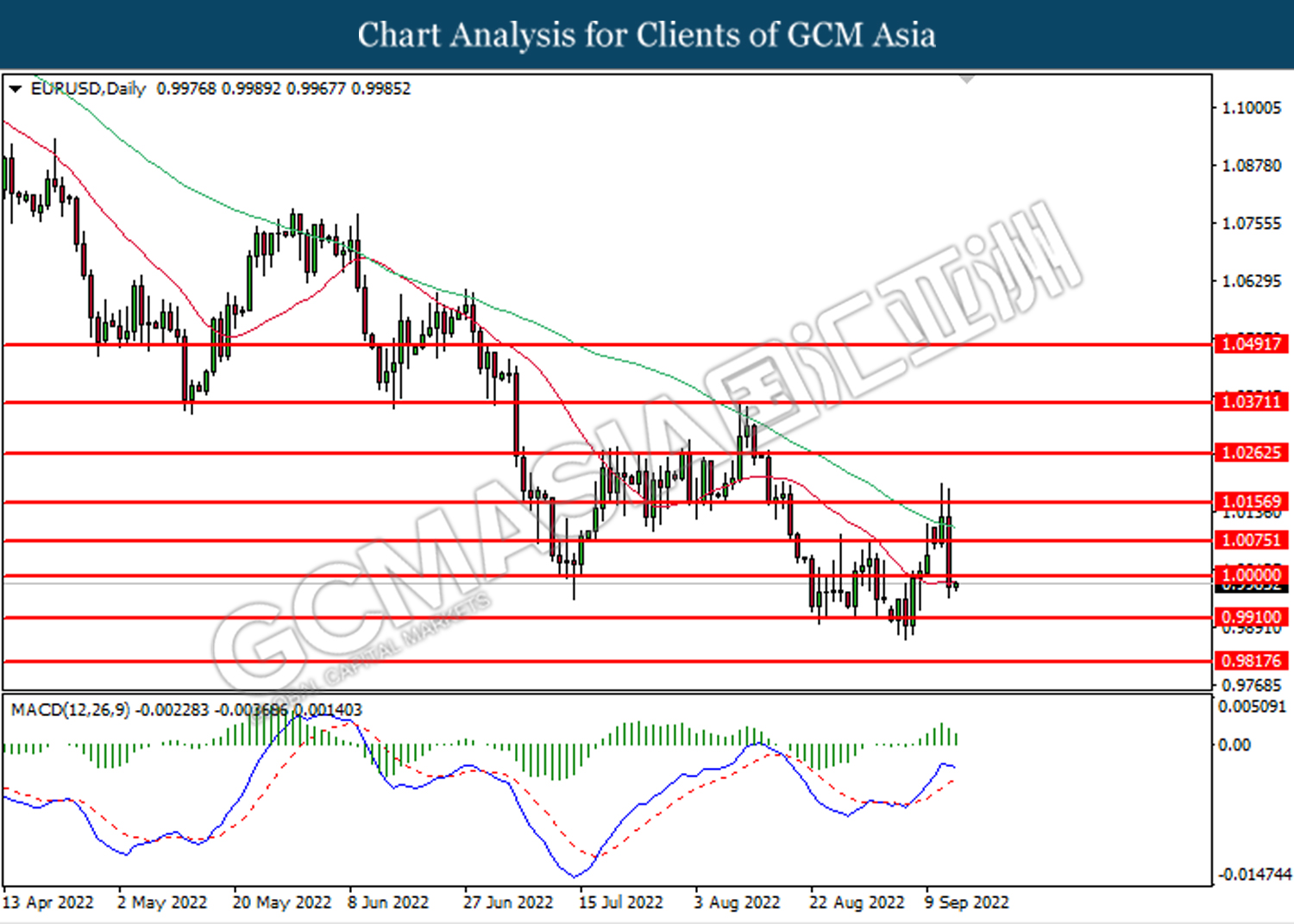

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9910.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9815

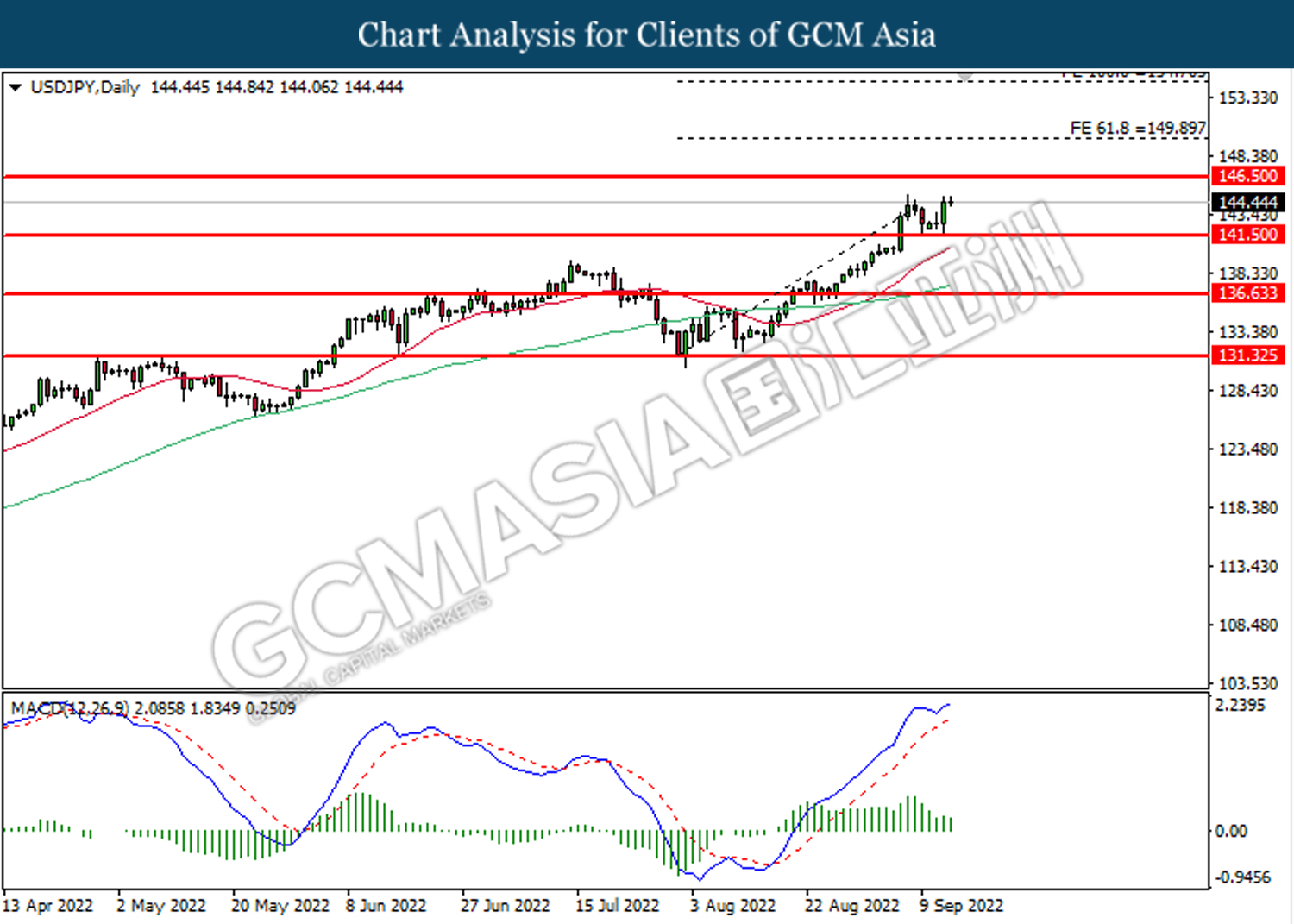

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 141.50. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 146.50.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

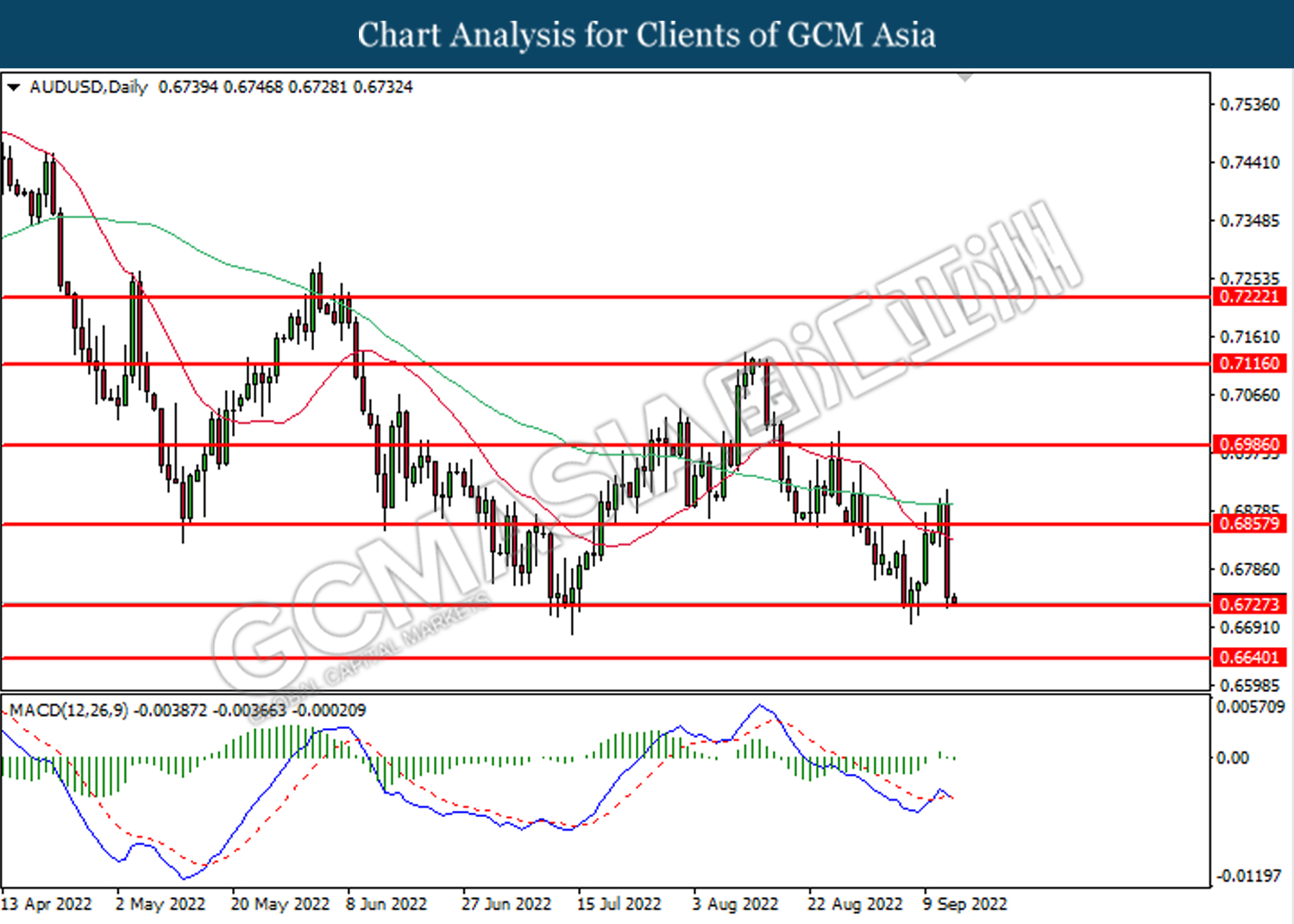

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

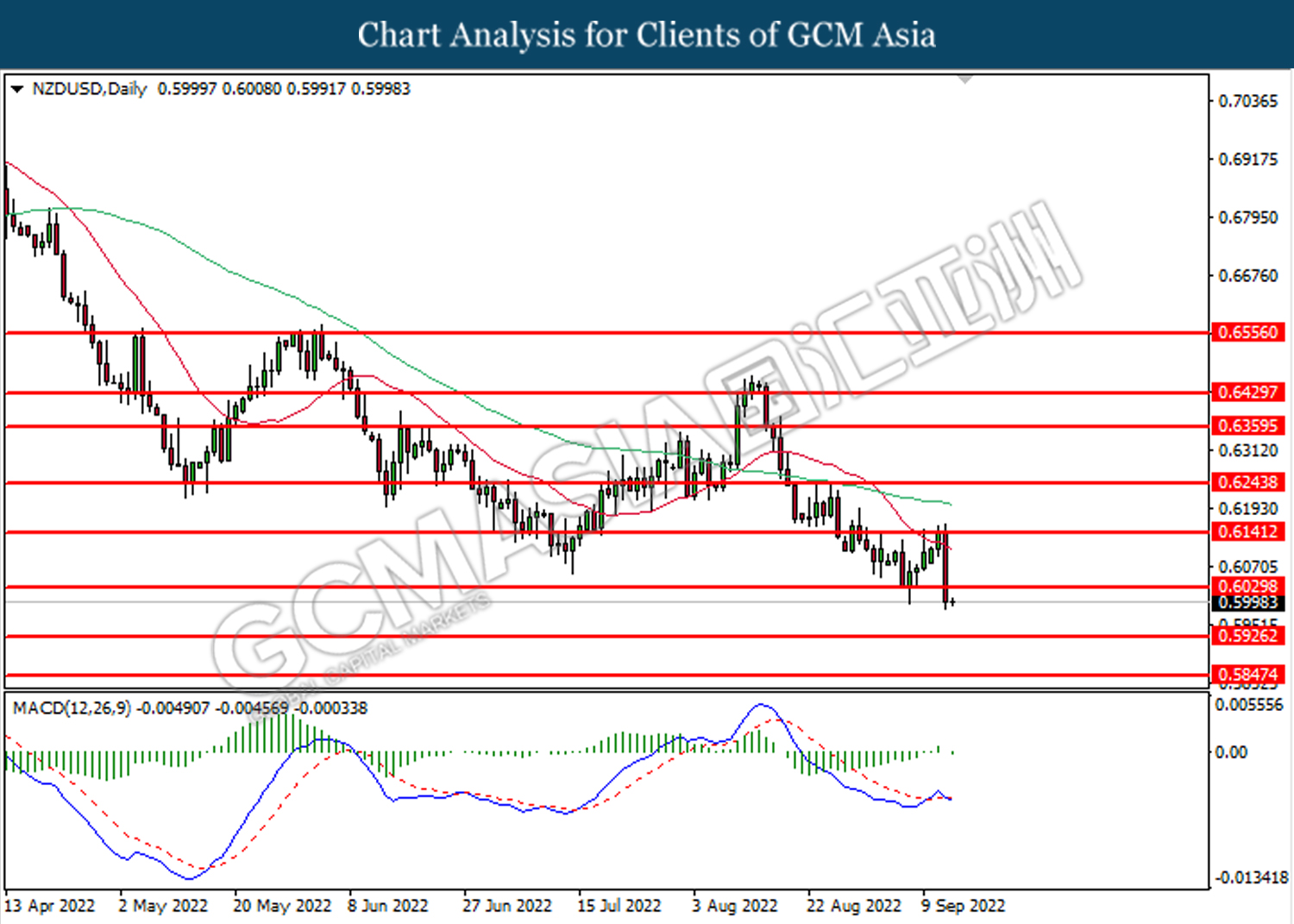

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6030. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.5925.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

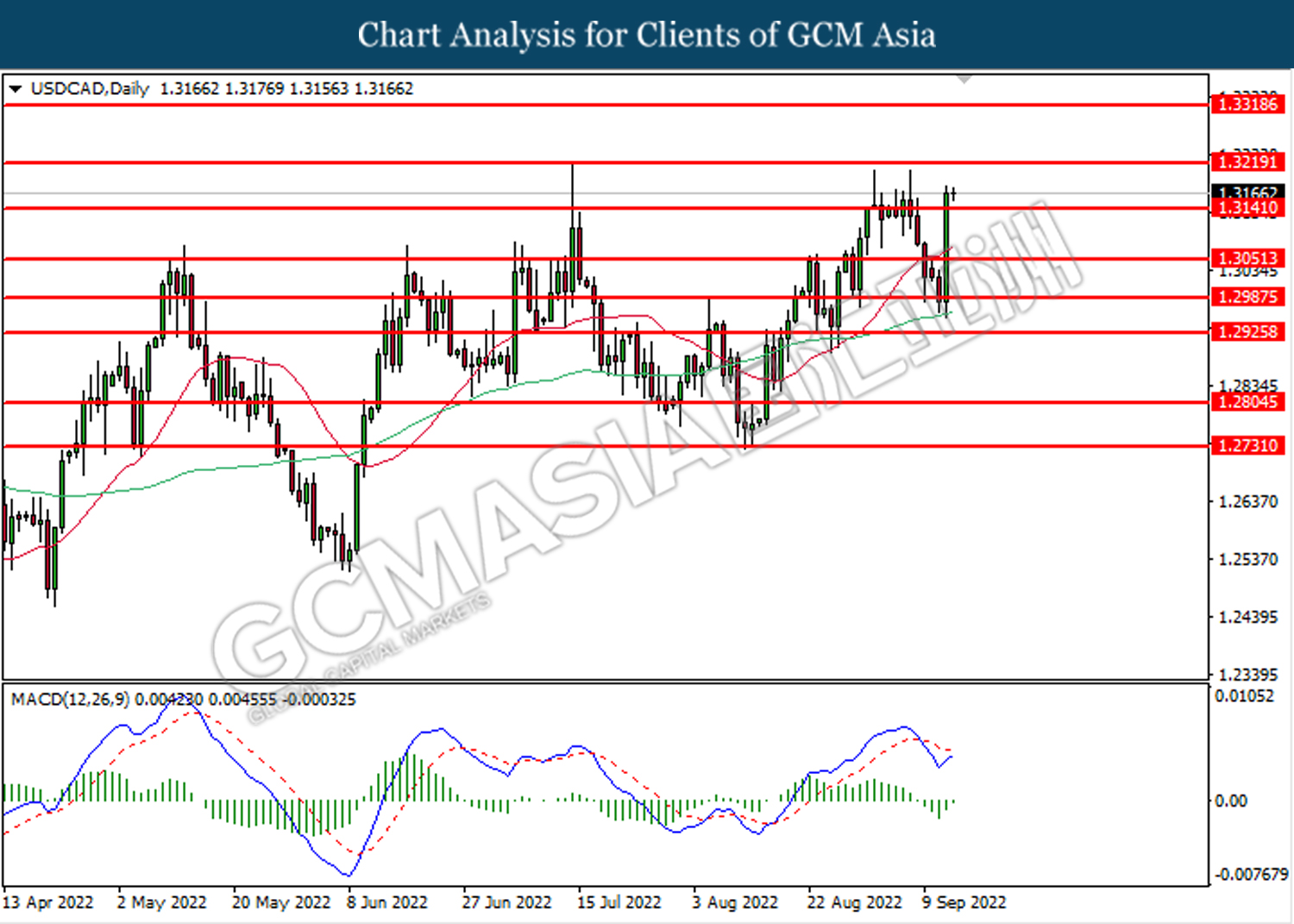

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3140. MACD which illustrated diminishing bearish momentum suggests the pair to extend gains toward the resistance level at 1.3220.

Resistance level: 1.3220, 1.3320

Support level: 1.3140, 1.3050

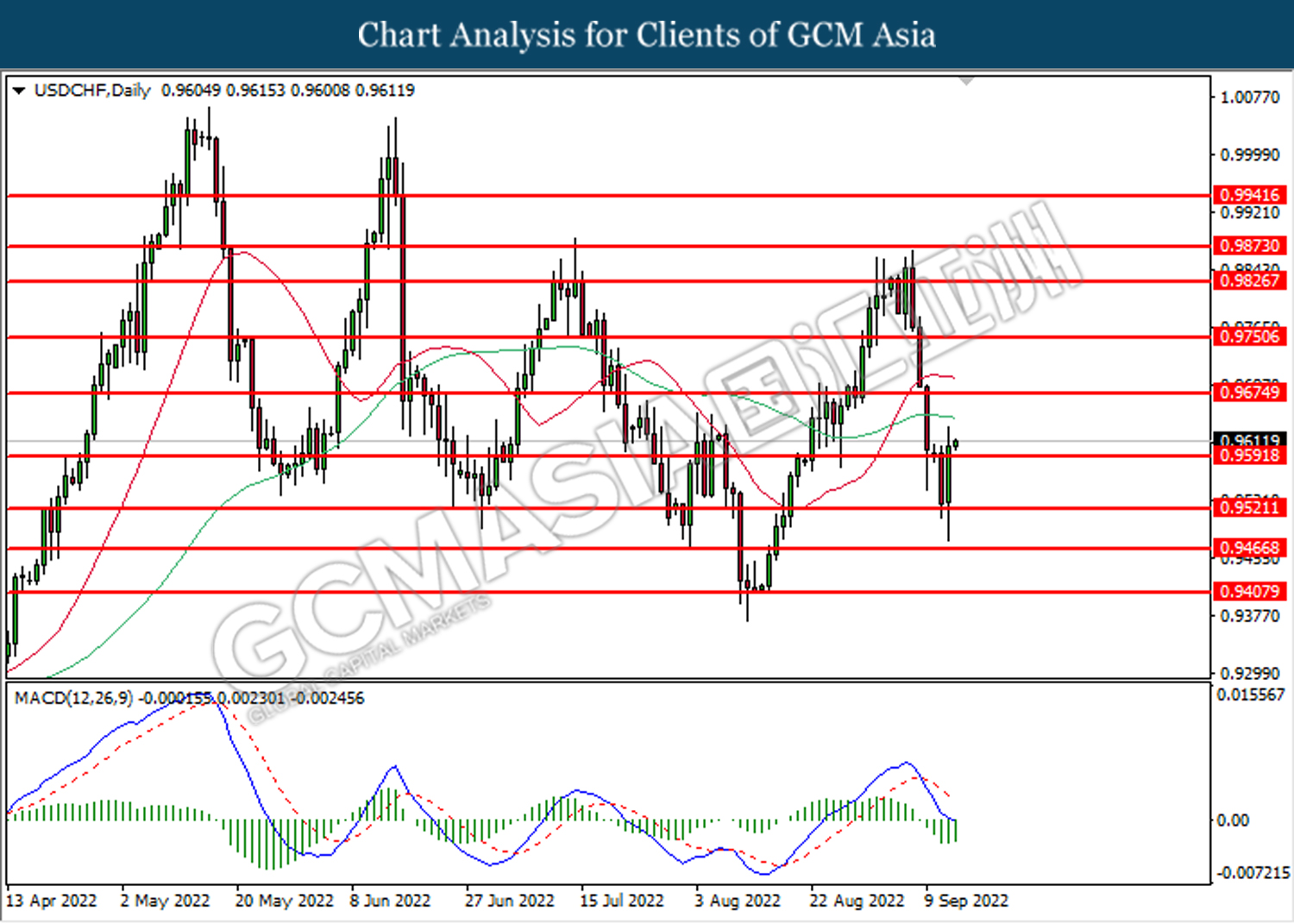

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 89.45. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical rebound in short term.

Resistance level: 89.45, 96.65

Support level: 86.15, 83.50

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1707.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1678.80.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80