15 September 2022 Afternoon Session Analysis

New Zealand GDP beats expectation.

The New Zealand dollar rebounded sharply early morning as upbeat economic data spurred optimism in the currency market. According to Statistics New Zealand, the nation’s economy expanded by 1.7% in the second quarter of 2022, reviving from a -0.2% fall in the prior quarter, as the lifting of the Covid-19 restriction rebooted the New Zealand economy. However, the recovery was largely in line with the economist’s expectations, where the economy was expected to recover strongly following two consecutive quarters of recession amid the reignition of Covid-19 cases and rising commodity prices. With such a backdrop, it provides ample room for the Reserve Bank of New Zealand (RBNZ) to further tighten the monetary policy, curbing the sky-high inflationary pressures in the country. Last year, the RBNZ was among the first central banks in the world to increase their cash rate. As of writing, the pair of NZD/USD up 0.20% to 0.6015.

In the commodities market, the crude oil price plunged -by 0.44% to $88.10 per barrel on the prospect of rising interest rates in the US. Besides, the gold prices depreciated by -0.16% to $1695.00 per troy ounce as the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Aug) | 0.40% | 0.20% | – |

| 20:30 | USD – Initial Jobless Claims | 222K | 225K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Sep) | 6.2 | 3.5 | – |

| 20:30 | USD – Retail Sales (MoM) (Aug) | 0.00% | 0.20% |

Technical Analysis

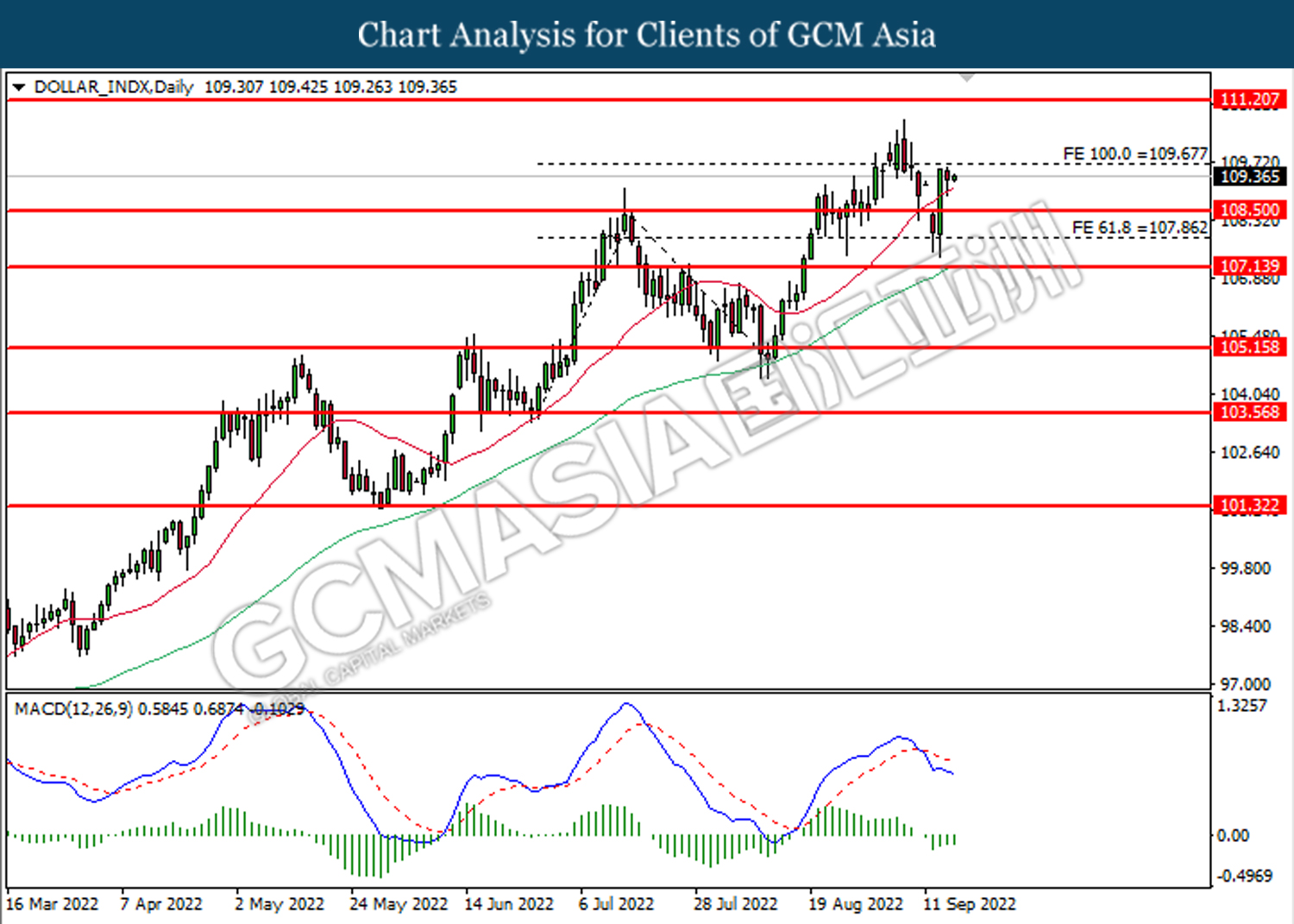

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1620. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1455.

Resistance level: 1.1620, 1.1770

Support level: 1.1455, 1.1350

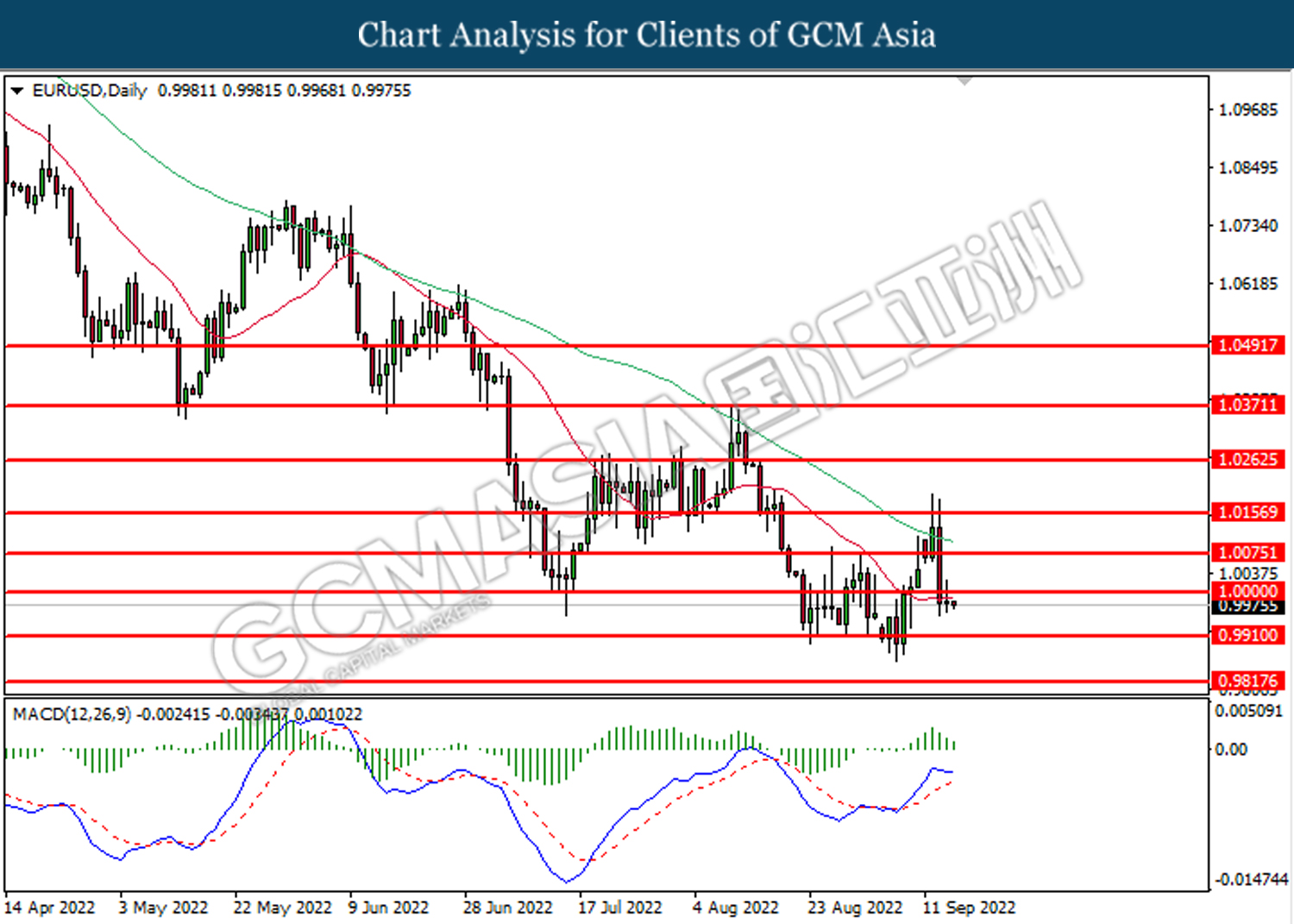

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9910.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9815

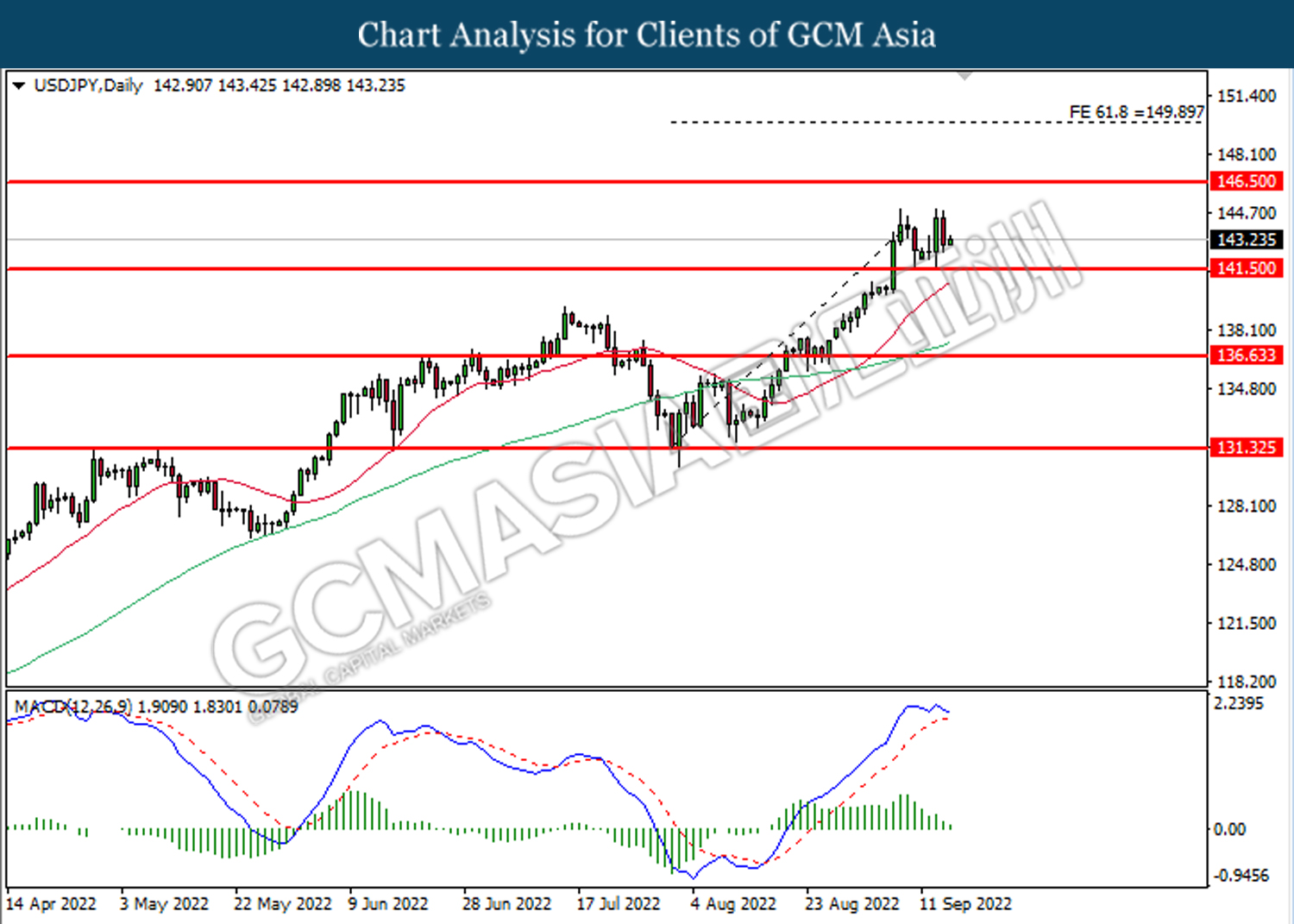

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 141.50. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

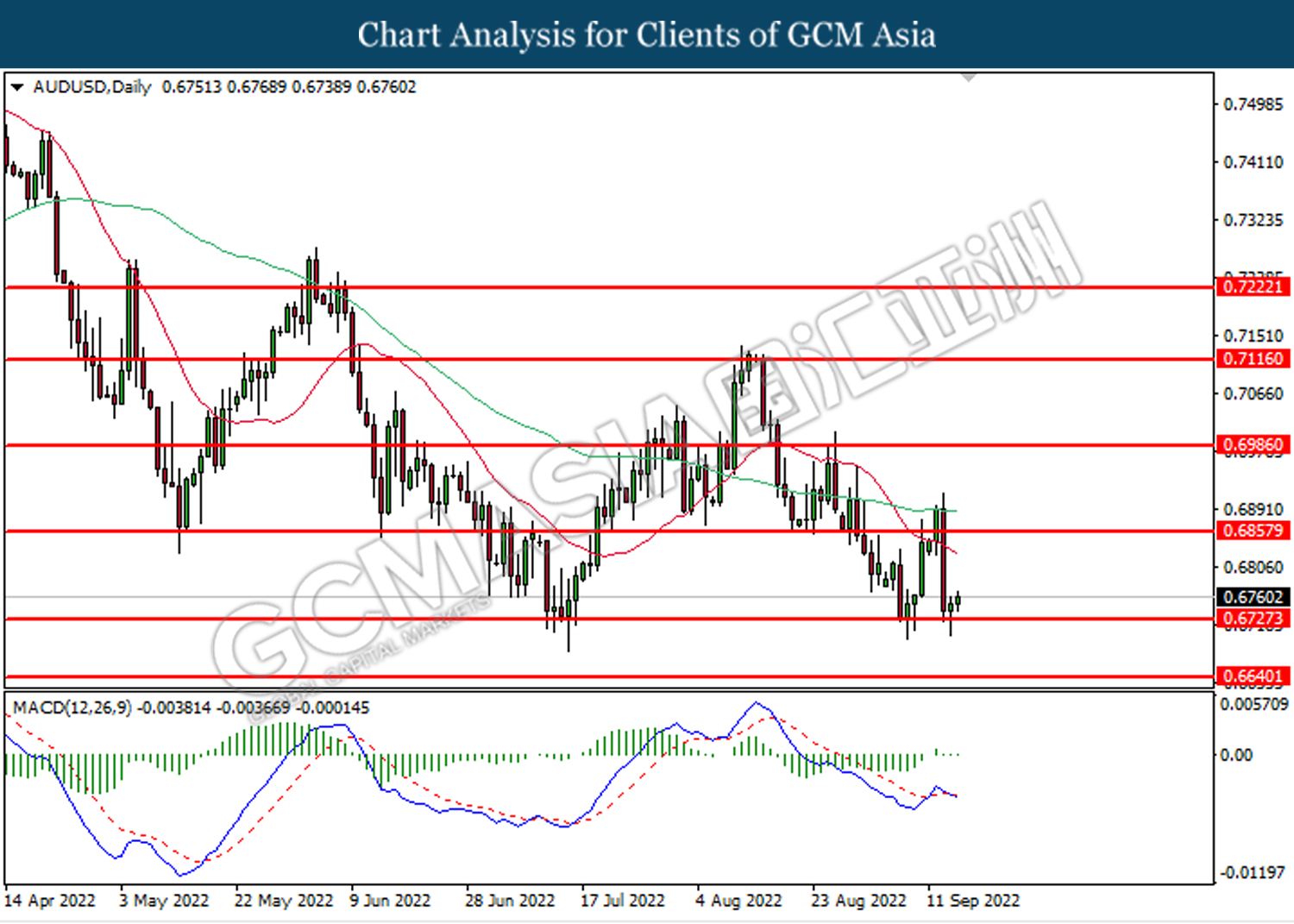

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6725. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

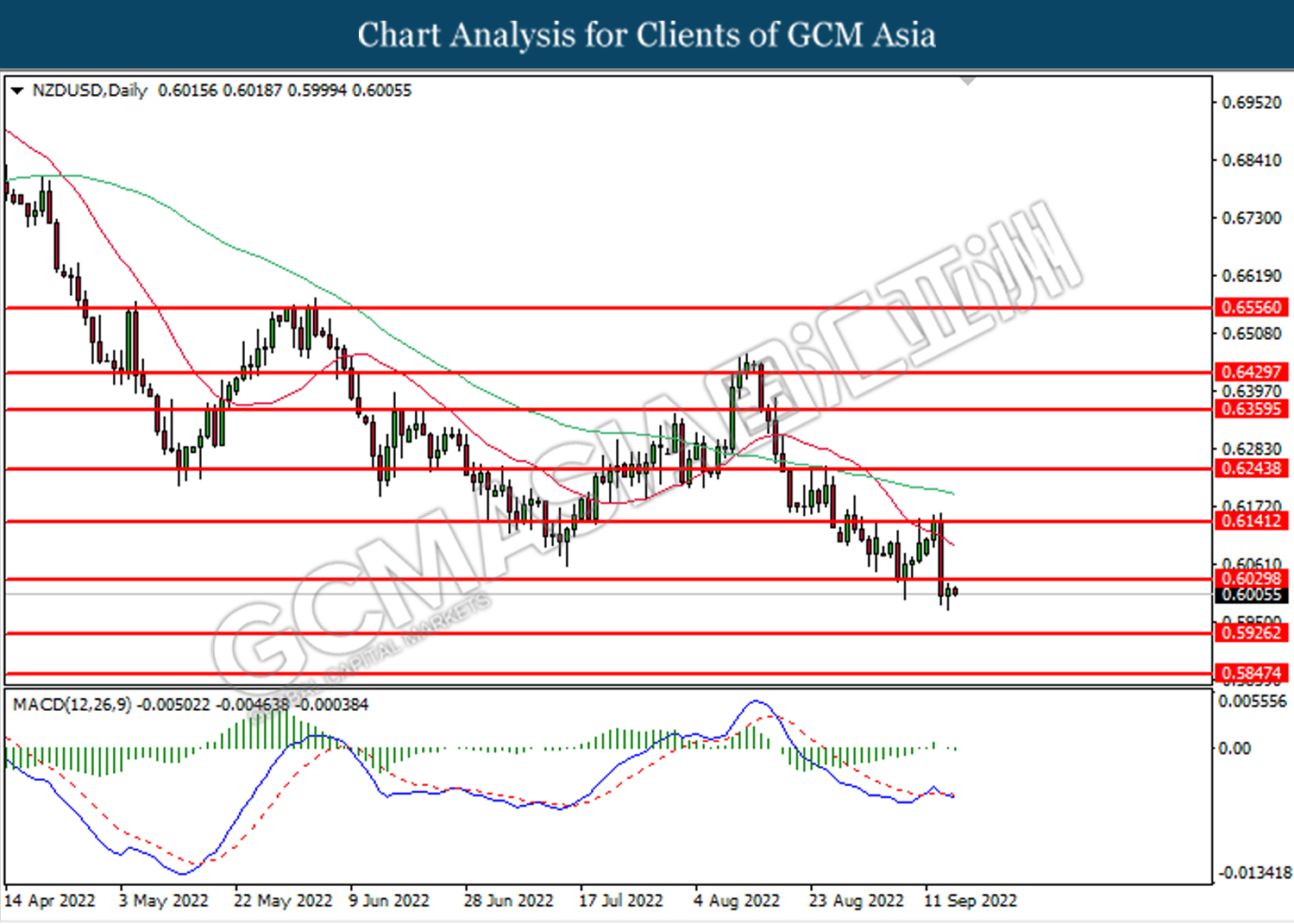

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6030. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.5925.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

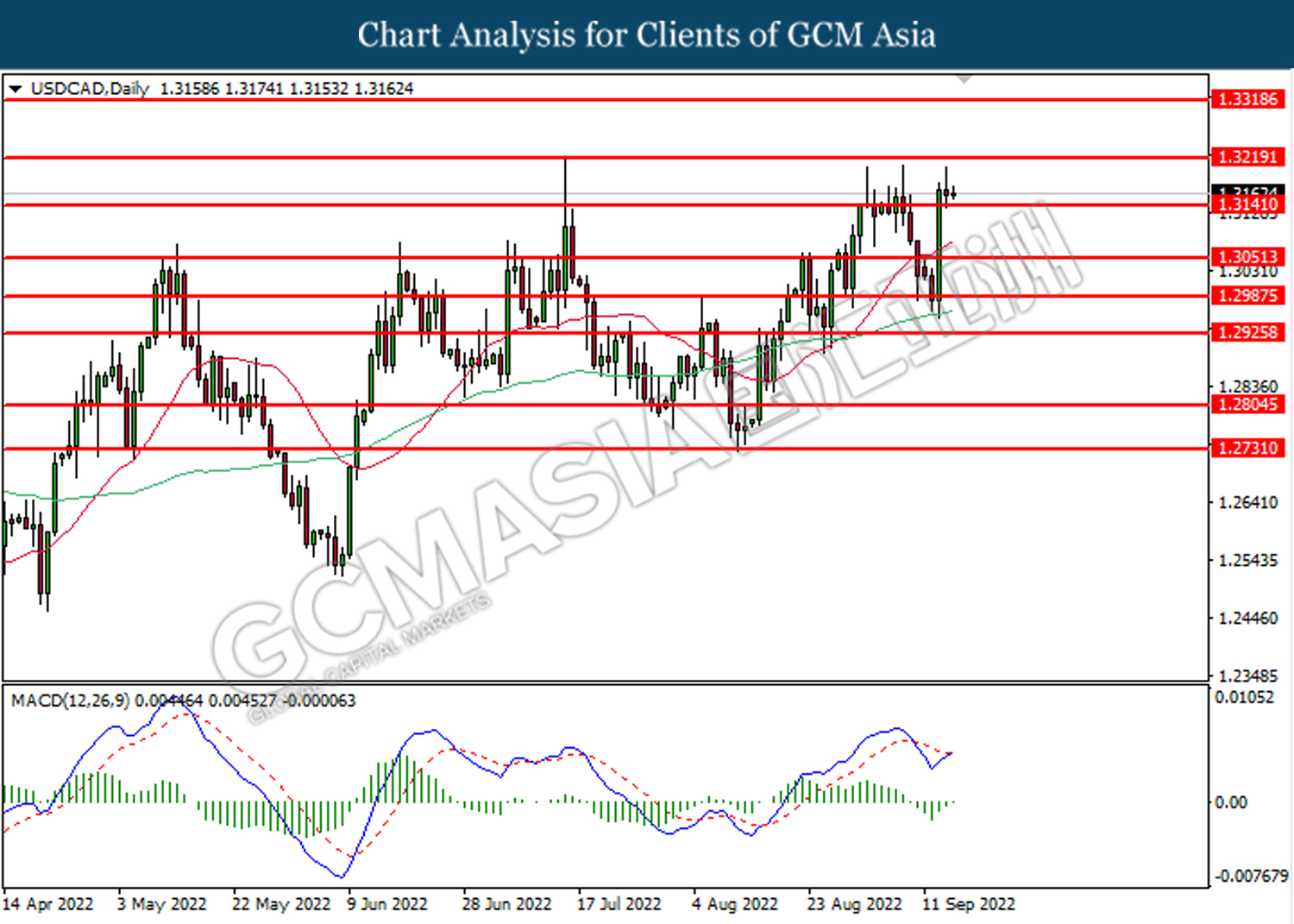

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3140. MACD which illustrated diminishing bearish momentum suggests the pair to extend gains toward the resistance level at 1.3220.

Resistance level: 1.3220, 1.3320

Support level: 1.3140, 1.3050

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

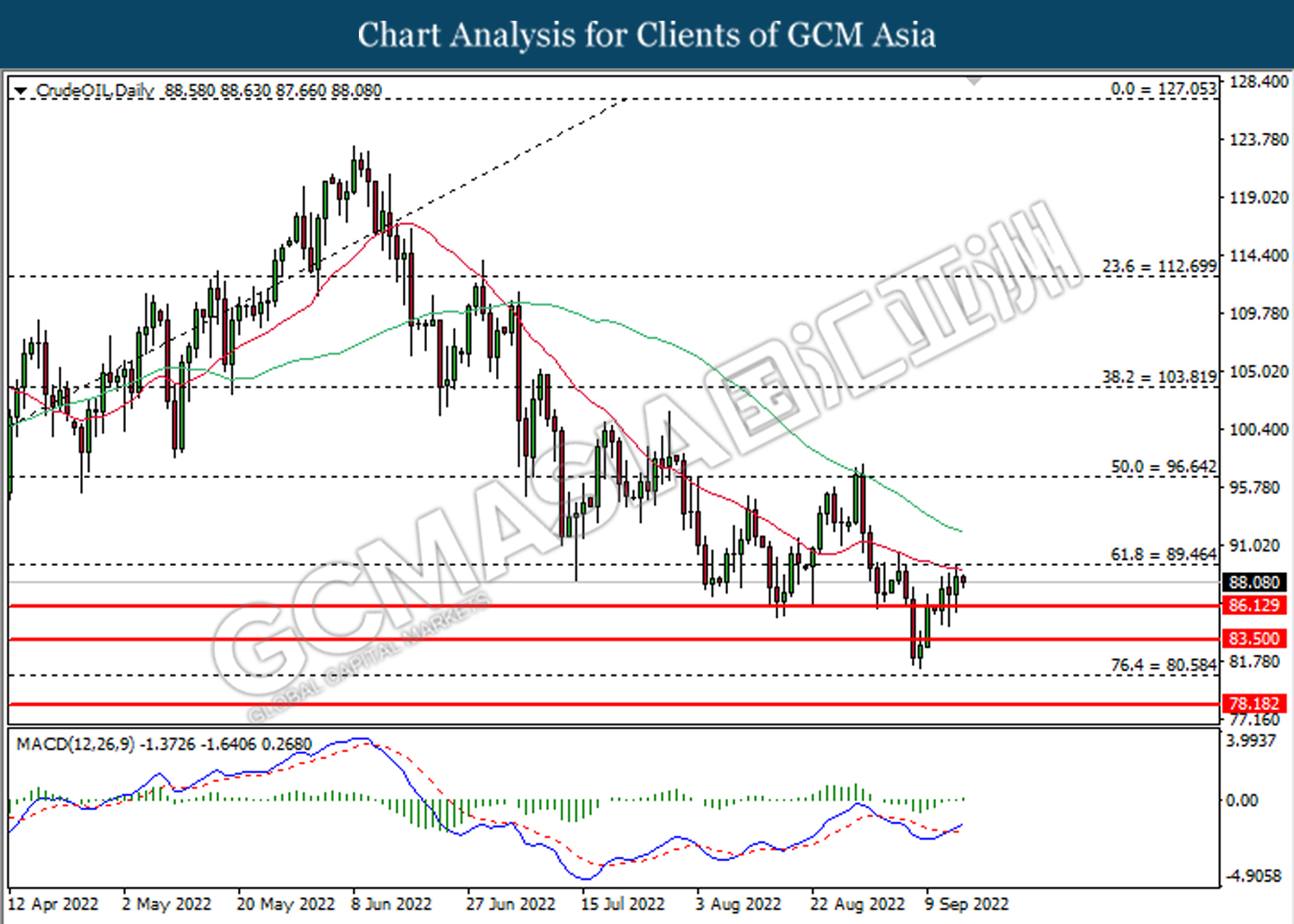

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 96.65

Support level: 86.15, 83.50

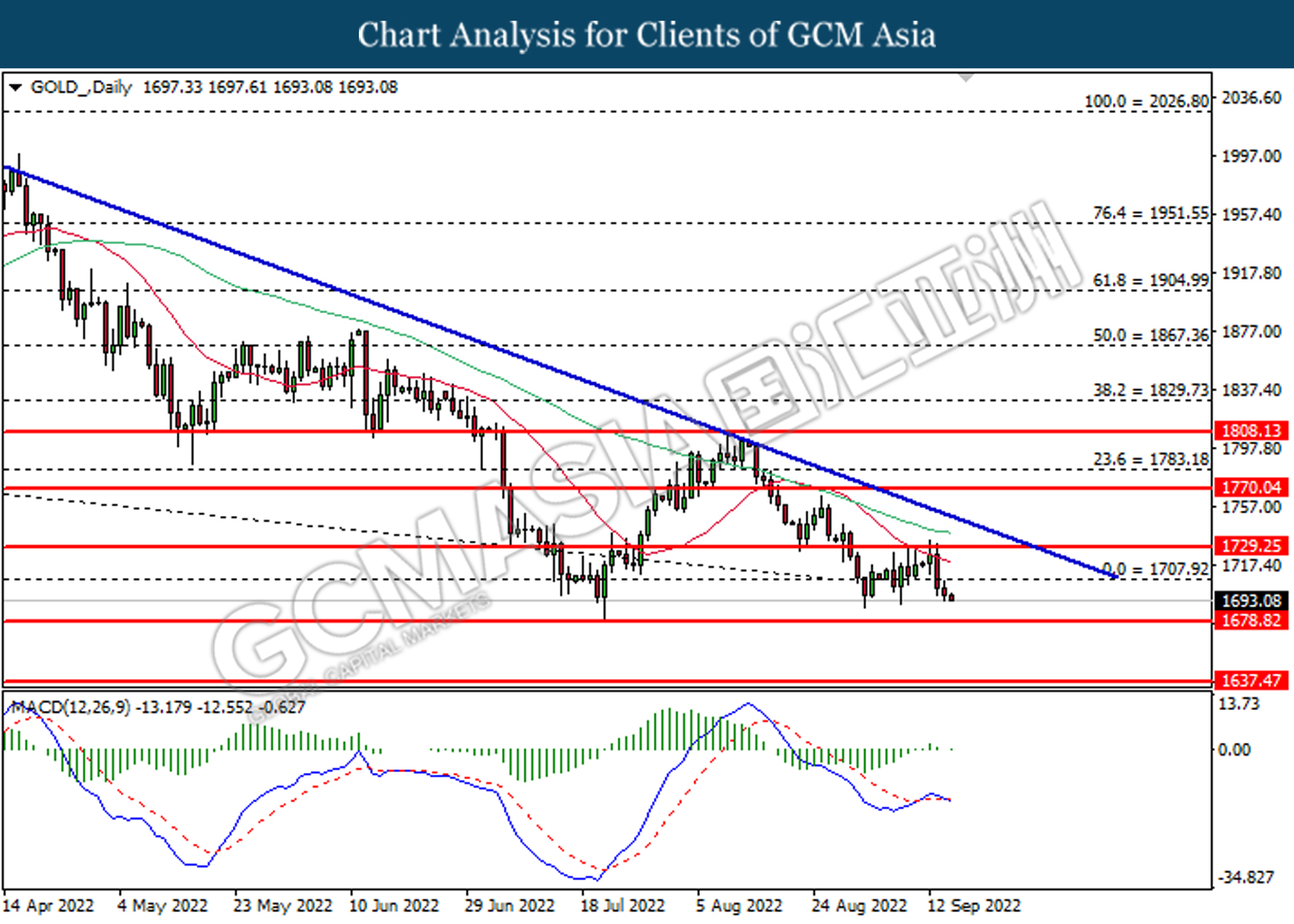

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1707.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1678.80.

Resistance level: 1707.90, 1729.25

Support level: 1678.80, 1637.45