19 September 2022 Morning Session Analysis

Dollar remains elevated ahead of Fed Meeting.

The dollar index, which gauges its value against a basket of six major currencies, hovered near the recent high level as the investors are expecting the Federal Reserve to hike the interest rate aggressively in the upcoming meeting. Last Thursday, US Retail Sales data for the month of August came in at 0.3%, slightly higher than the consensus forecast of 0.2%, showing resilience in face of inflation. The gains, in fact, has outpaced the inflation and marked a reversal from July -0.4% decline, whereby the consumer spending increased at a steady pace over the month. Nonetheless, market participants are waiting for the Federal Reserve rate hike decision on 22th September before restructuring their investment portfolio. At this point in time, the investors are widely expecting the Federal Reserve will increase at least 75-basis point, while a 100-basis point rate hike is also on the table. Hence, the dollar is expected to continue supported by the view that Fed will keep the tightening policy aggressively going forward. As of writing, the dollar index inched down -0.11% to 109.65.

In the commodities market, the crude oil price rose by 0.40% to $85.35 per barrel but remained down amid the fears that hefty rate hike will dampen the global demand in the future. Besides, the gold prices appreciated by 0.20% to $1678.70 per troy ounce as the dollar index weakened.

Today’s Holiday Market Close

Time Market Event

All Day JPY Respect for the Aged Day

All Day GBP Bank Holiday

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

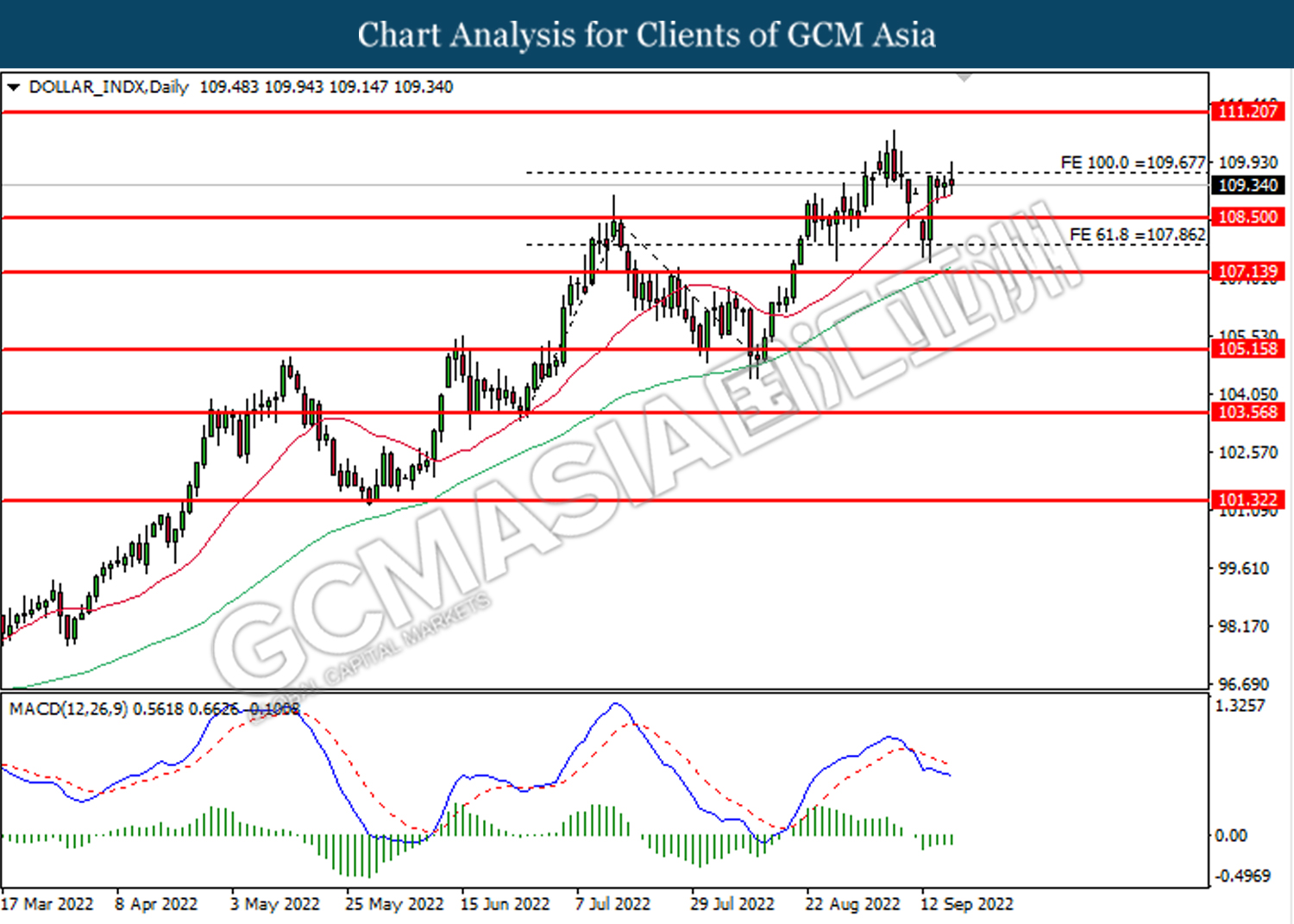

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

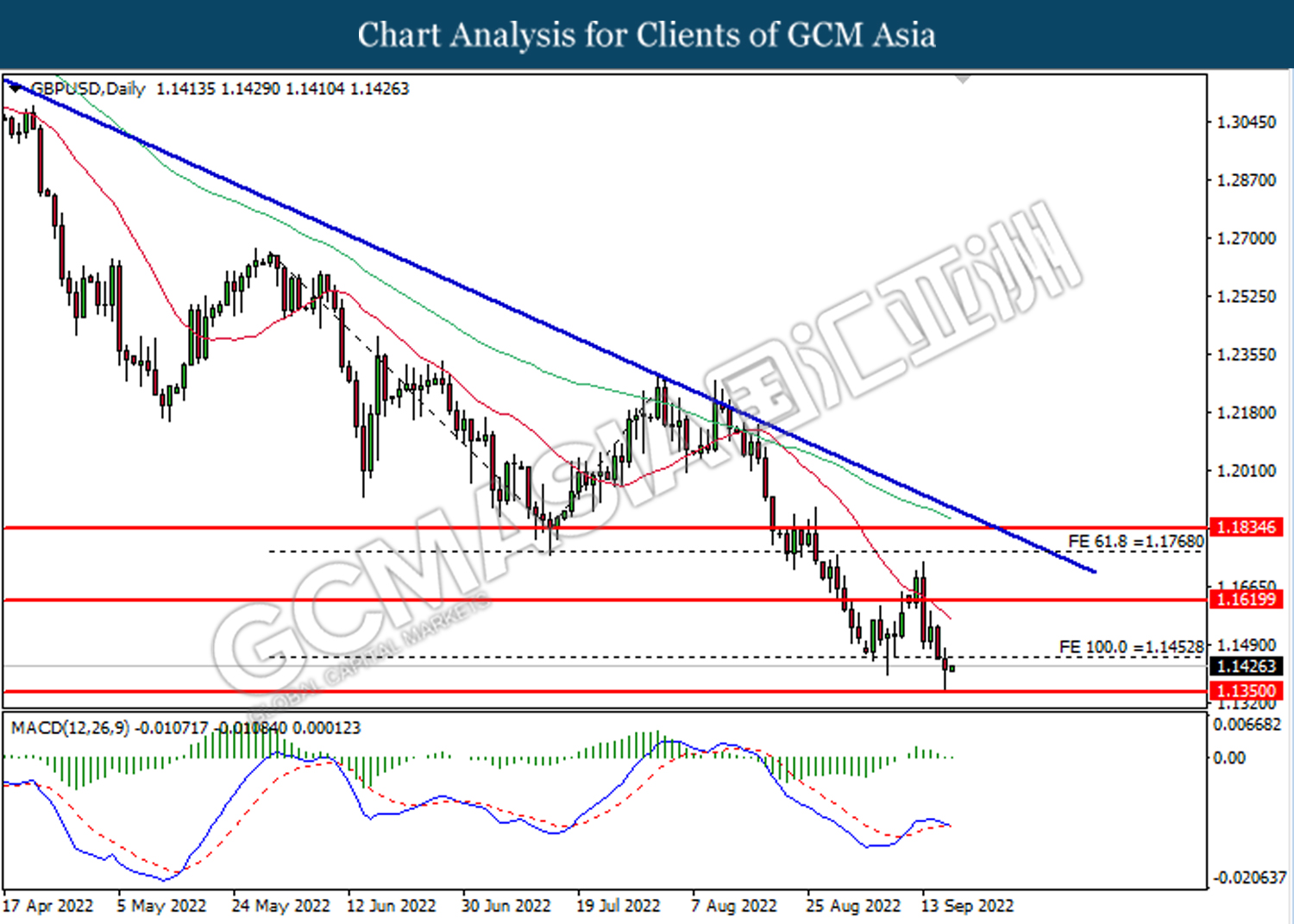

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1455. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1350.

Resistance level: 1.1455, 1.1620

Support level: 1.1350, 1.1200

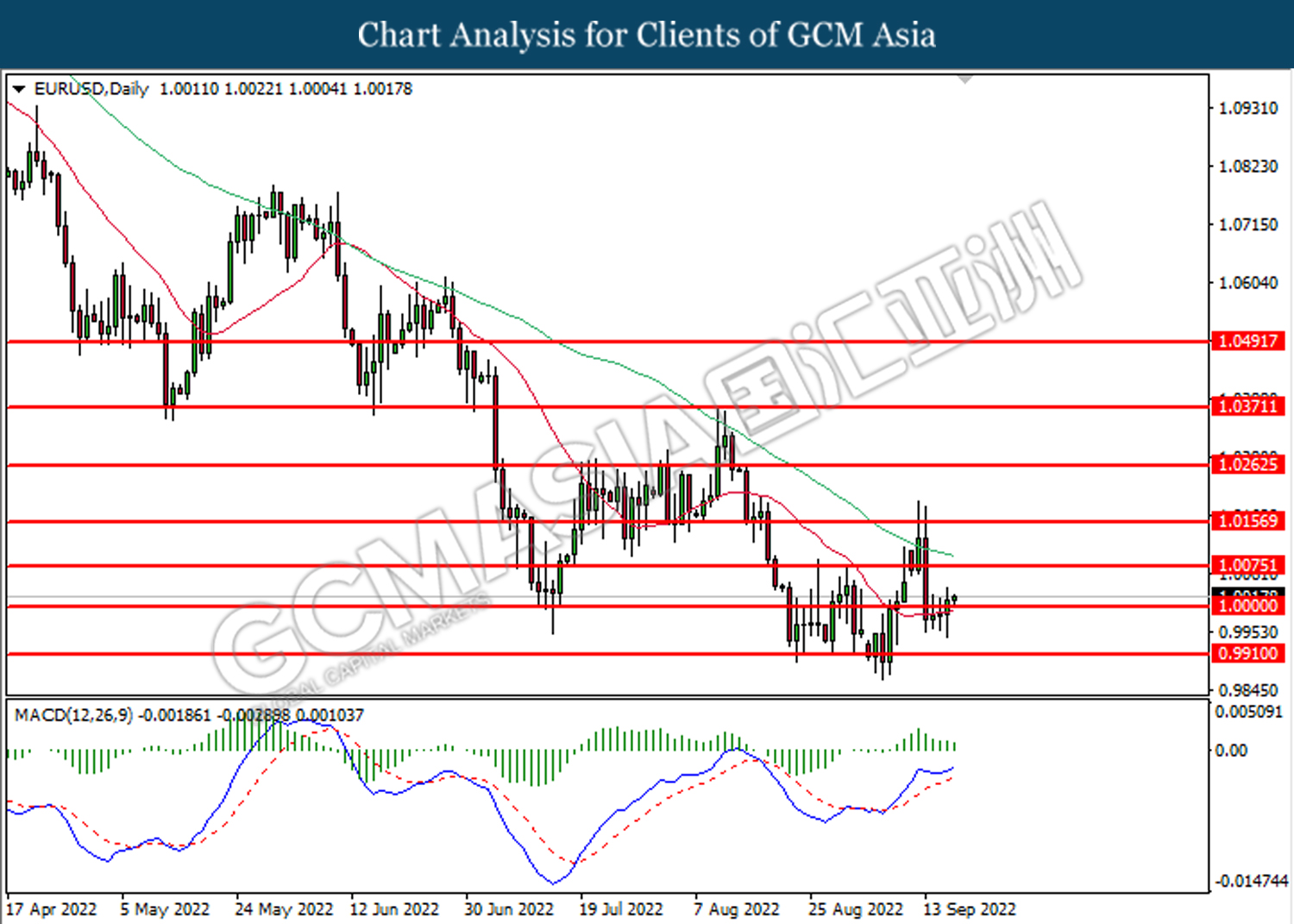

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0000. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9910

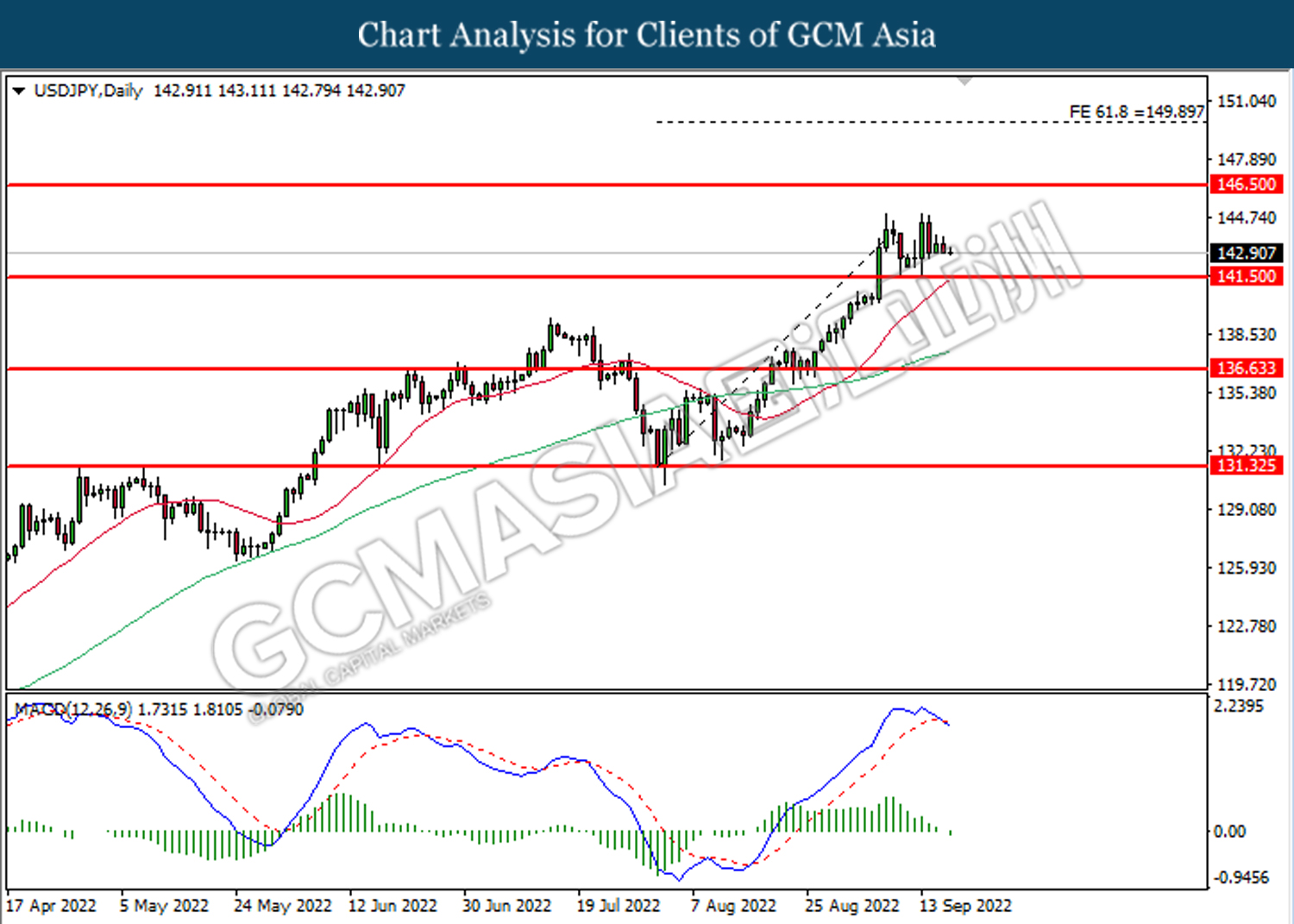

USDJPY, Daily: USDJPY was traded lower following prior retracement from the higher level. MACD which illustrated bearish momentum suggest the pair to extend its losses toward the support level at 141.50.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

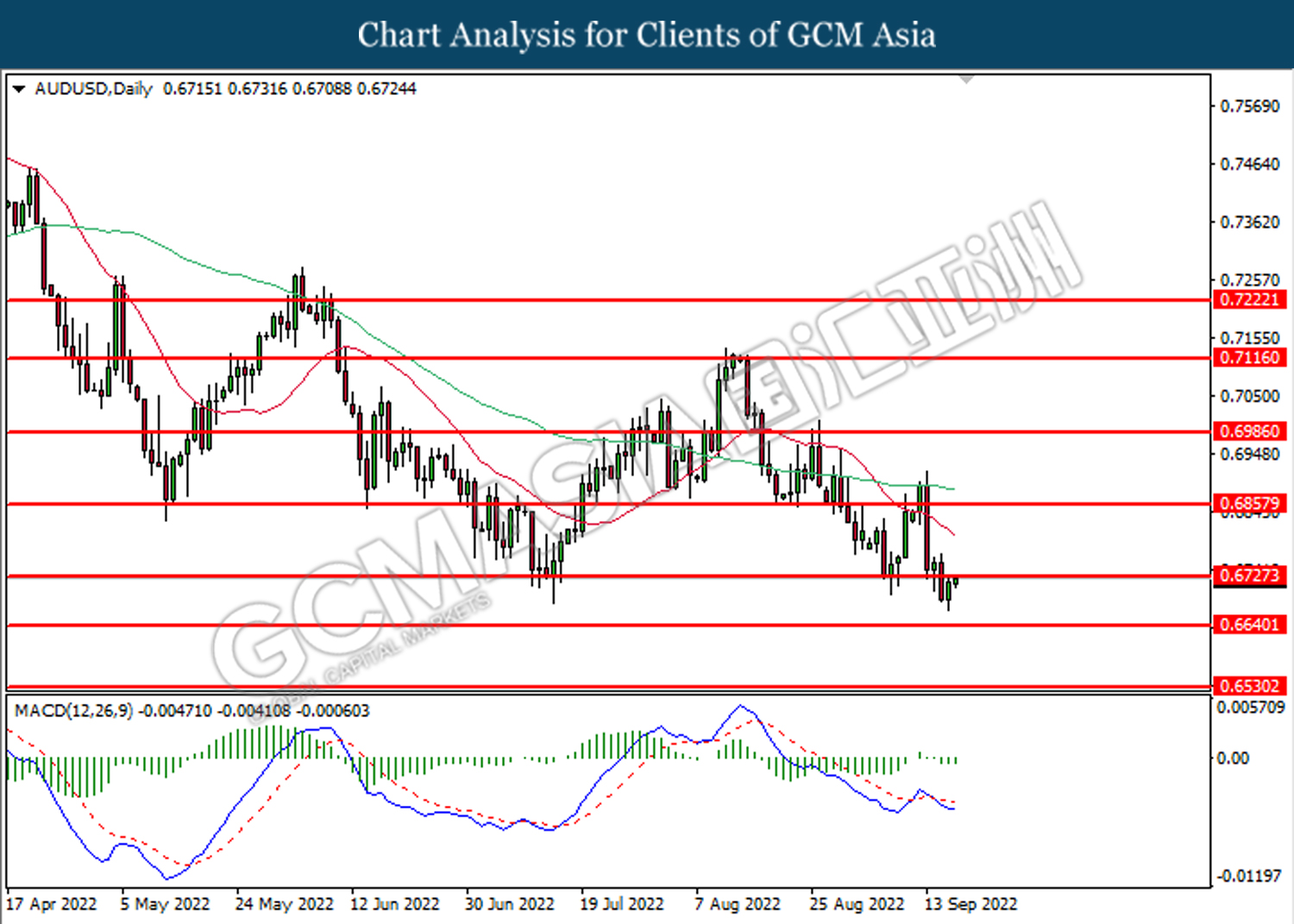

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

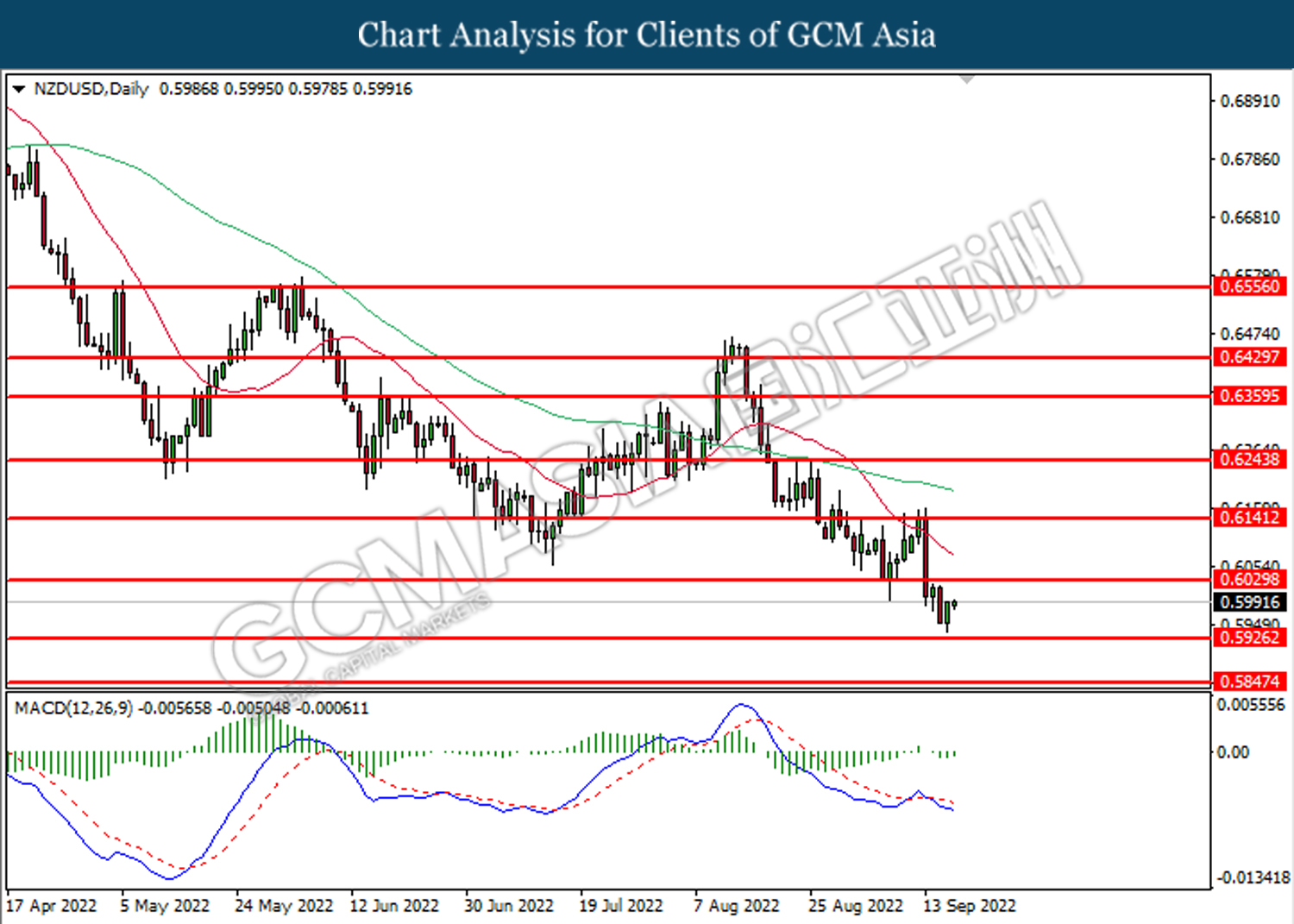

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5925. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6030.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

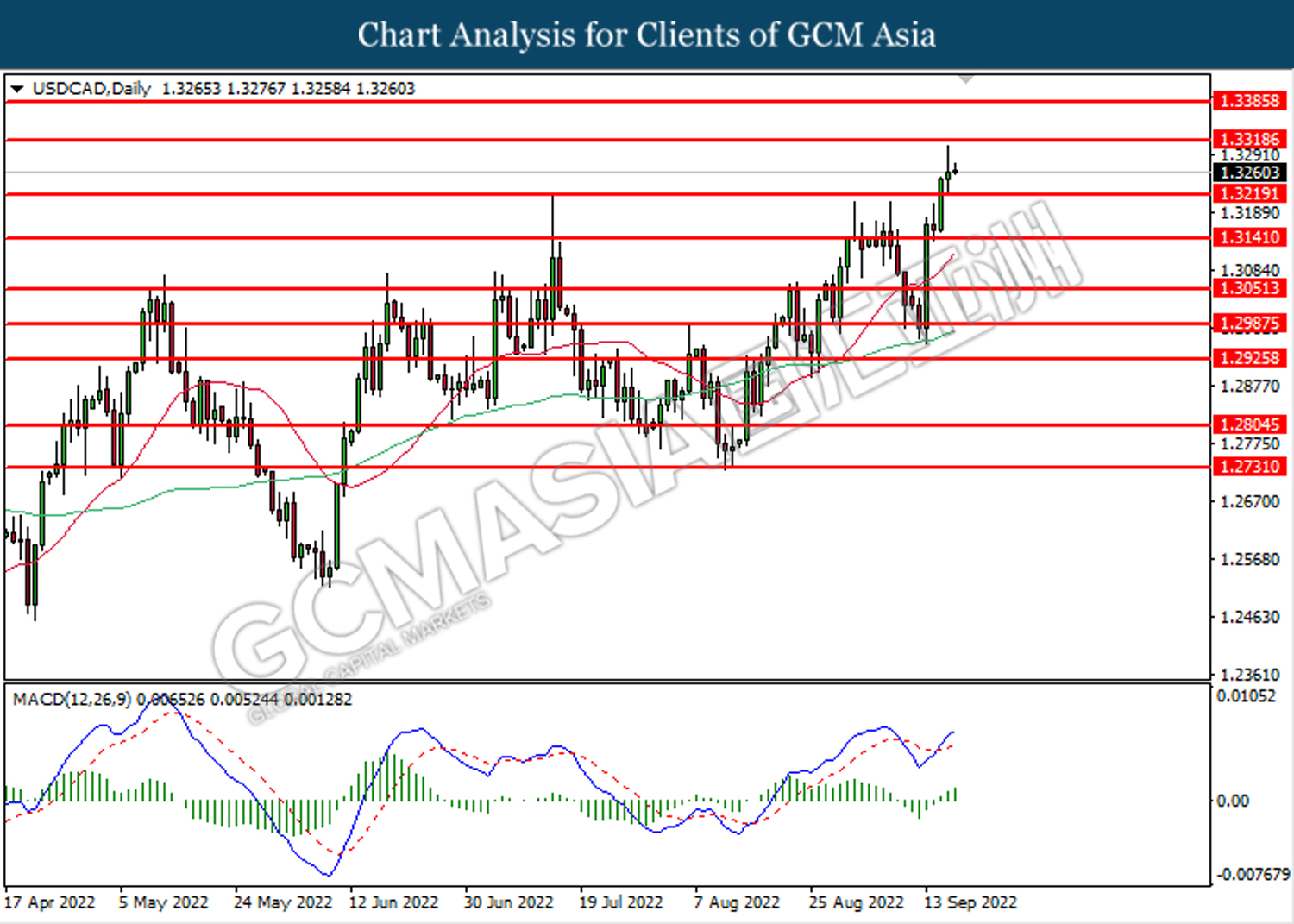

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3220. MACD which illustrated bullish bias momentum suggests the pair to extend gains toward the resistance level at 1.3320.

Resistance level: 1.3320, 1.3385

Support level: 1.3220, 1.3140

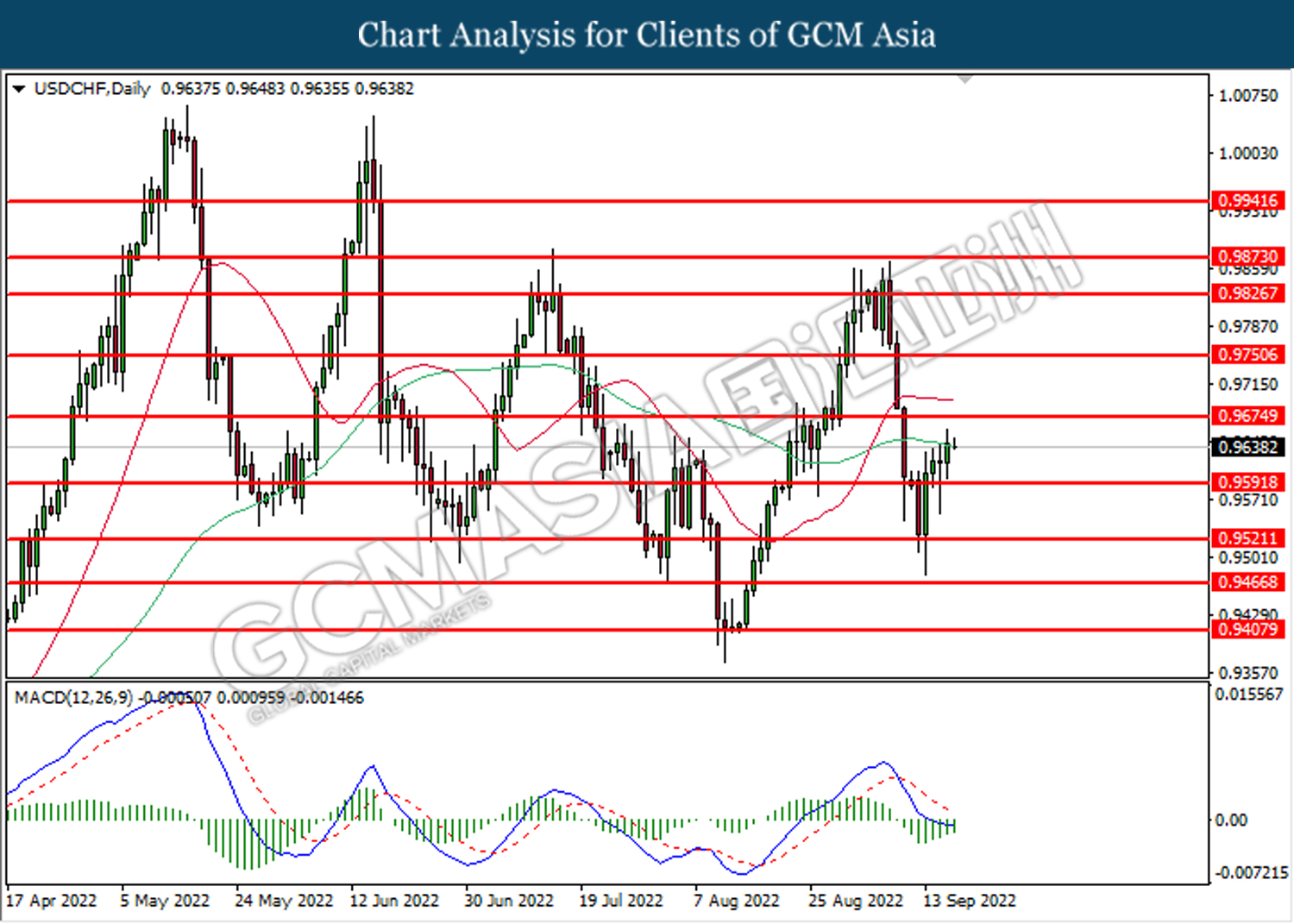

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

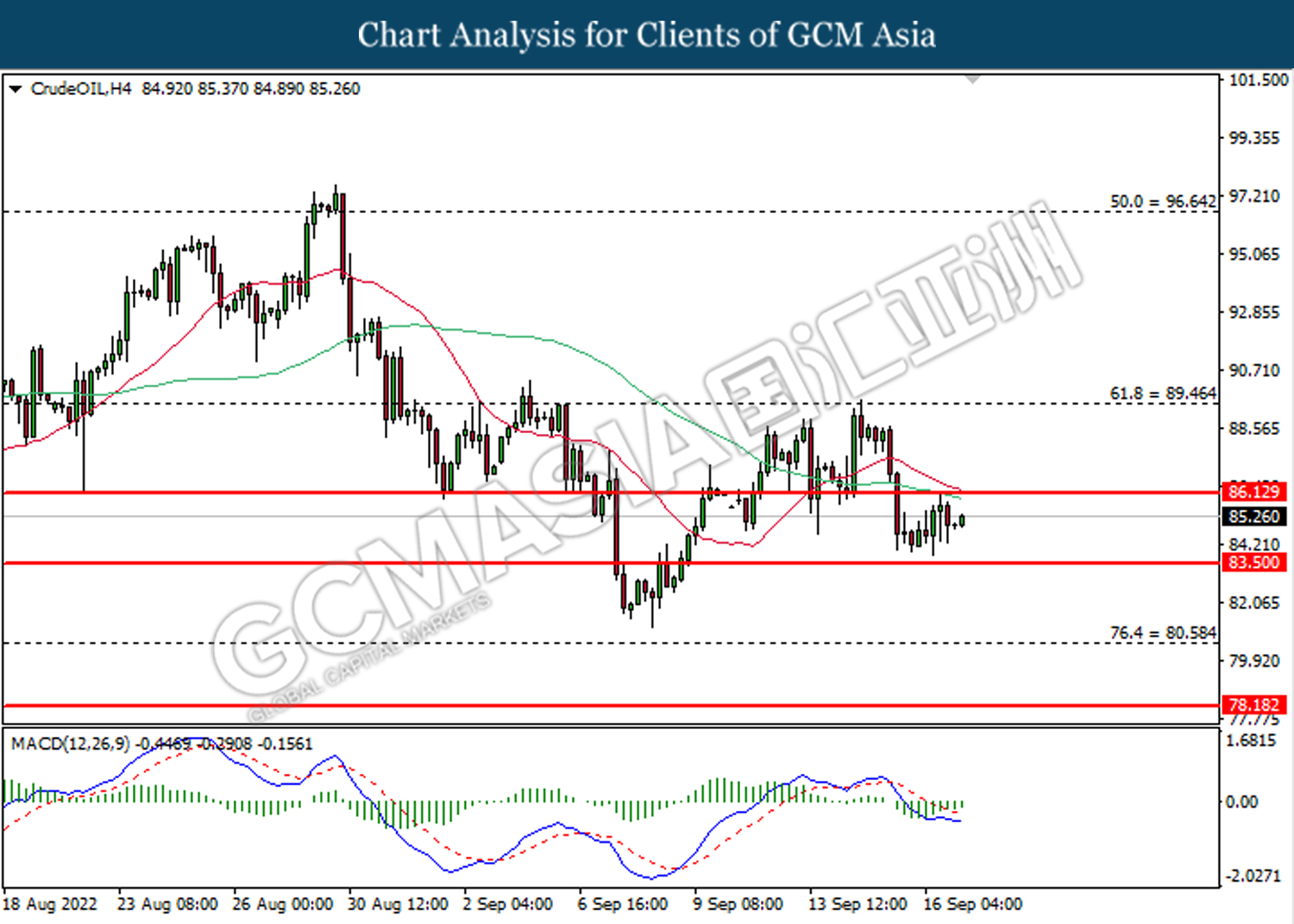

CrudeOIL, Daily: Crude oil price was traded higher while currently testing near the resistance level at 86.15. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 86.15, 89.45

Support level: 83.50, 80.60

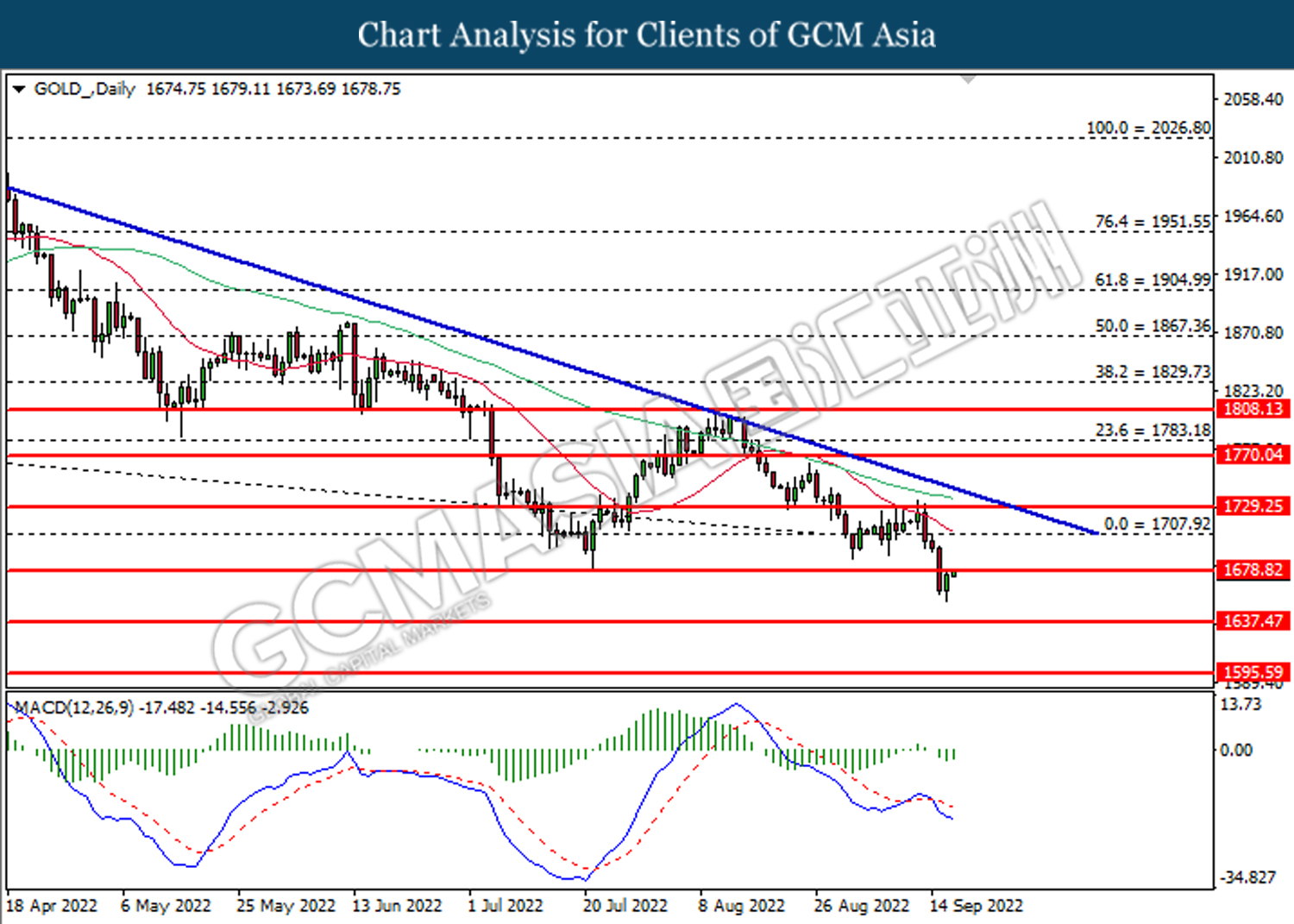

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1678.80. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1678.80, 1707.90

Support level: 1637.45, 1595.60