19 September 2022 Afternoon Session Analysis

Pound dipped as downbeat economic data sparked recession risk.

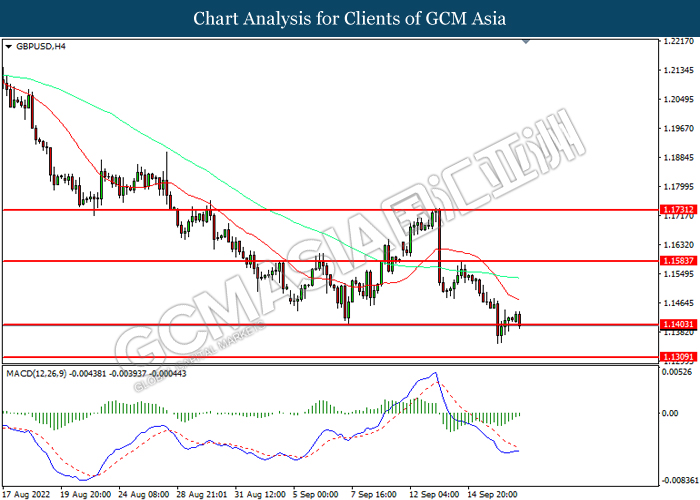

The Pound Sterling slumped significantly last week as the downbeat economic data had sparked recession fears, which dragging down the appeal for the Pound Sterling. According to Office for National Statistics, UK Retail sales for last month down significantly from the previous reading of 0.4% to -1.6%, missing the market forecast at -0.5%. With average UK wages continuing to fall behind rising prices and higher borrowing cost, the market participants remained pessimistic toward the economic progression in United Kingdom. In addition, the World Bank warned that the global financial market may be edging toward a global recession following the aggressive rate hike expectation from central bank, which stoked a shift in sentiment toward other safe-haven asset such as US Dollar, triggering further selloff for the Pound Sterling. Nonetheless, investors would be on high alert on monetary policy decision from Bank of England on Thursday to receive trading signal. The UK Policymakers are expected to increase their interest rate by another 50-basis point to stabilize the inflation risk. As of writing, GBP/USD depreciated by 0.09% to 1.1403.

In the commodities market, the crude oil price depreciated by 0.20% to $85.15 per barrel as of writing. The oil market edged lower as rising global recession risk continue to weigh down the market demand on this black-commodity. On the other hand, the gold price depreciated by 0.36% to $1669.00 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day JPY Respect for the Aged Day

All Day GBP Bank Holiday

Today’s Highlight Events

Time Market Event

11:00 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

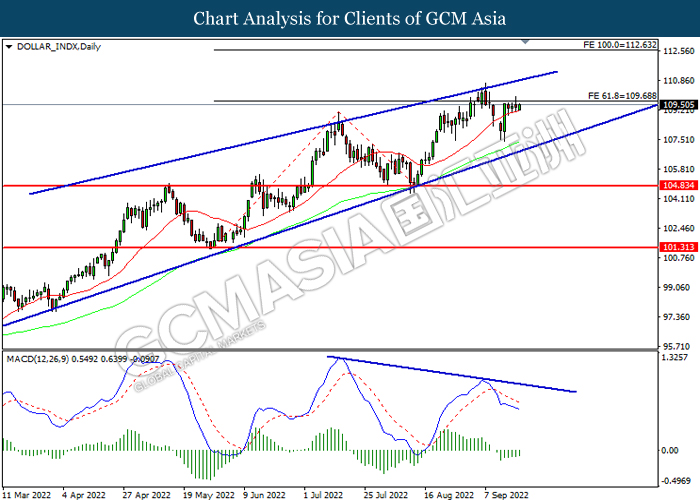

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1585, 1.1730

Support level: 1.1405, 1.1310

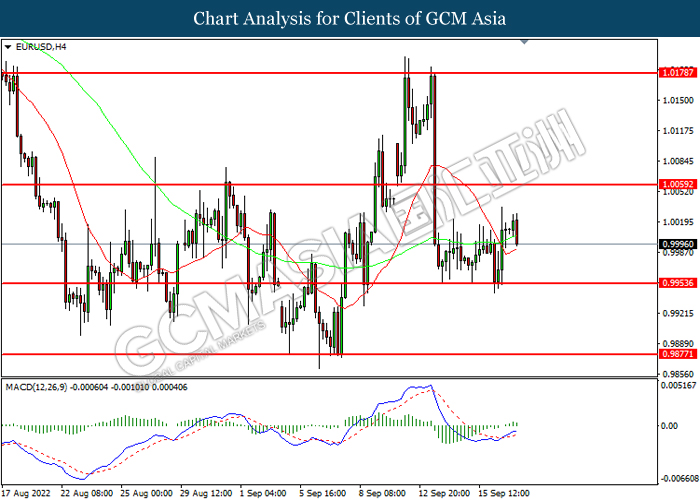

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0060, 1.0180

Support level: 0.9955, 0.9875

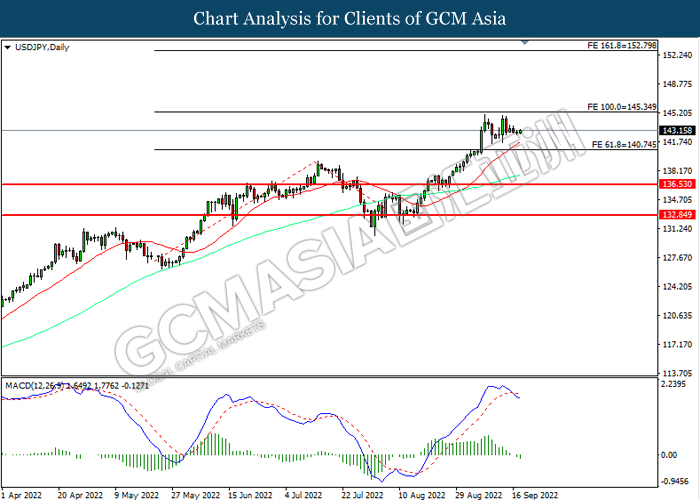

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

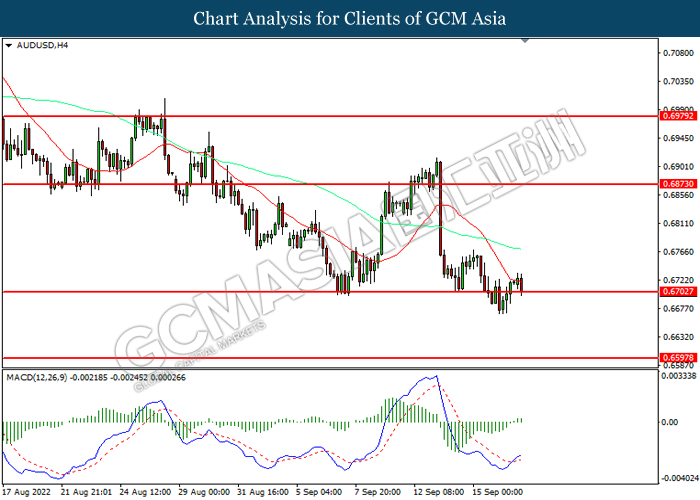

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.6980

Support level: 0.6705, 0.6595

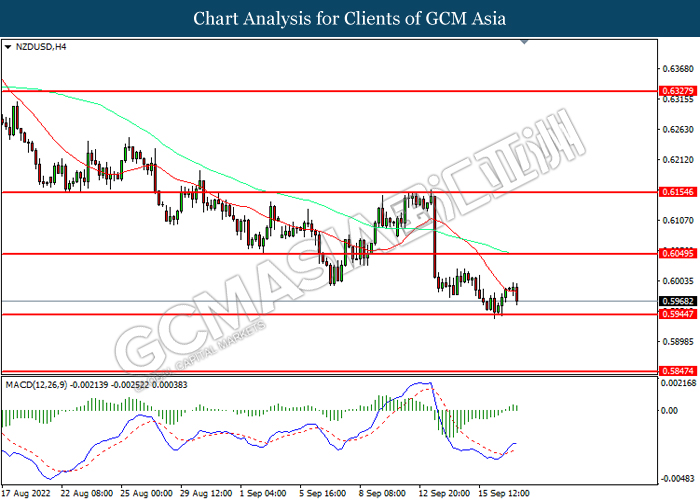

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6050, 0.6155

Support level: 0.5945, 0.5845

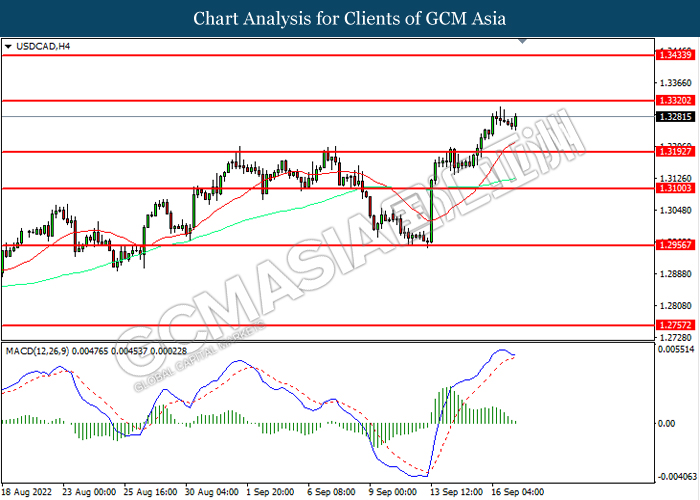

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3320, 1.3435

Support level: 1.3195, 1.3100

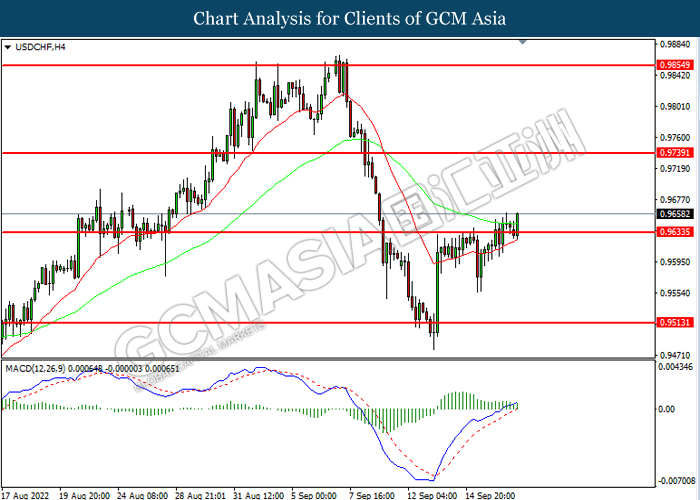

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

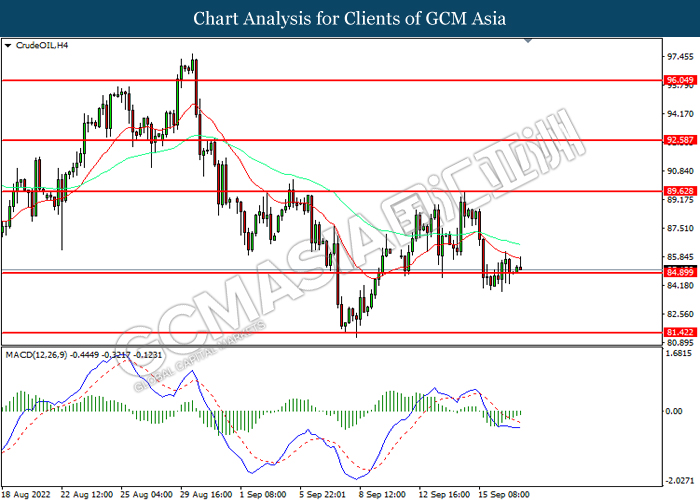

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 89.65, 92.60

Support level: 84.90, 81.40

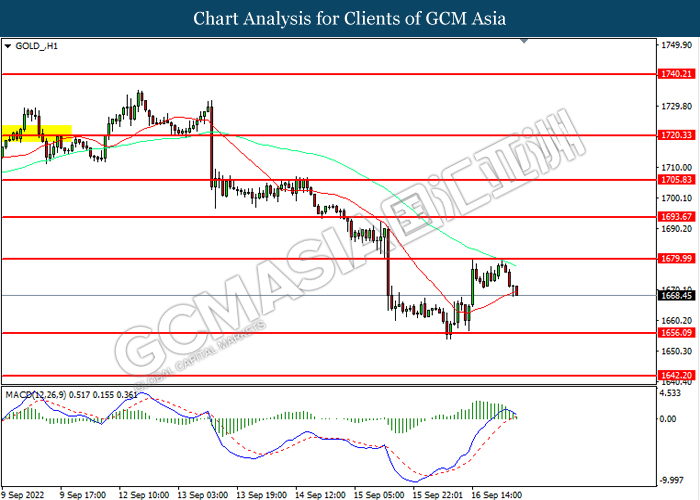

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1680.00, 1693.65

Support level: 1656.10, 1642.20