21 September 2022 Morning Session Analysis

The Dollar’s bull run continues.

The dollar index, which gauges its value against a basket of six major currencies, regained its ground while extending the gains toward a higher level over the trading session as the hefty rate hike is not expected to come to an end at any time soon. According to the recent development, investors reckon that the US central bank will raise its cash rate by three-quarters of a basis percentage point at the end of the two-day policy meeting. Prior to now, the Federal Reserve has increased the interest rate from January’s 0.25% to 2.50% in the face of stubborn inflation. Talking about inflation, the CPI data used to represent the inflationary pressure of a nation has started to decline over the last two months in the US. However, the current inflation figure is still far above the 2% long-term target of the Fed, which was the main attributor to urging the central bank to continue with the aggressive tightening path. According to the FedWatch Tool, the target rate probability for a 75-basis point rate hike in the 22 Sep 2022 Fed Meeting was 83.0%, while the probability of a 1 per cent rate hike was 17%. As of writing, the dollar index surged 0.42% to 110.20.

In the commodities market, the crude oil price dropped 0.92% to $83.93 per barrel as the Dollar Index jumped amid a hefty rate hike ahead. Besides, the gold prices depreciated by 0.04% to $1665.50 per troy ounce following the dollar strengthening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Economic Projections

(22nd Sep)

02:00 USD FOMC Statement

(22nd Sep)

02:00 USD FOMC Press Conference

(22nd Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Existing Home Sales (Aug) | 4.81M | 4.70M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.442M | 2.161M | – |

| 02:00

(22nd Sep) |

USD -Fed Interest Rate Decision | 2.50% | 3.25% | – |

Technical Analysis

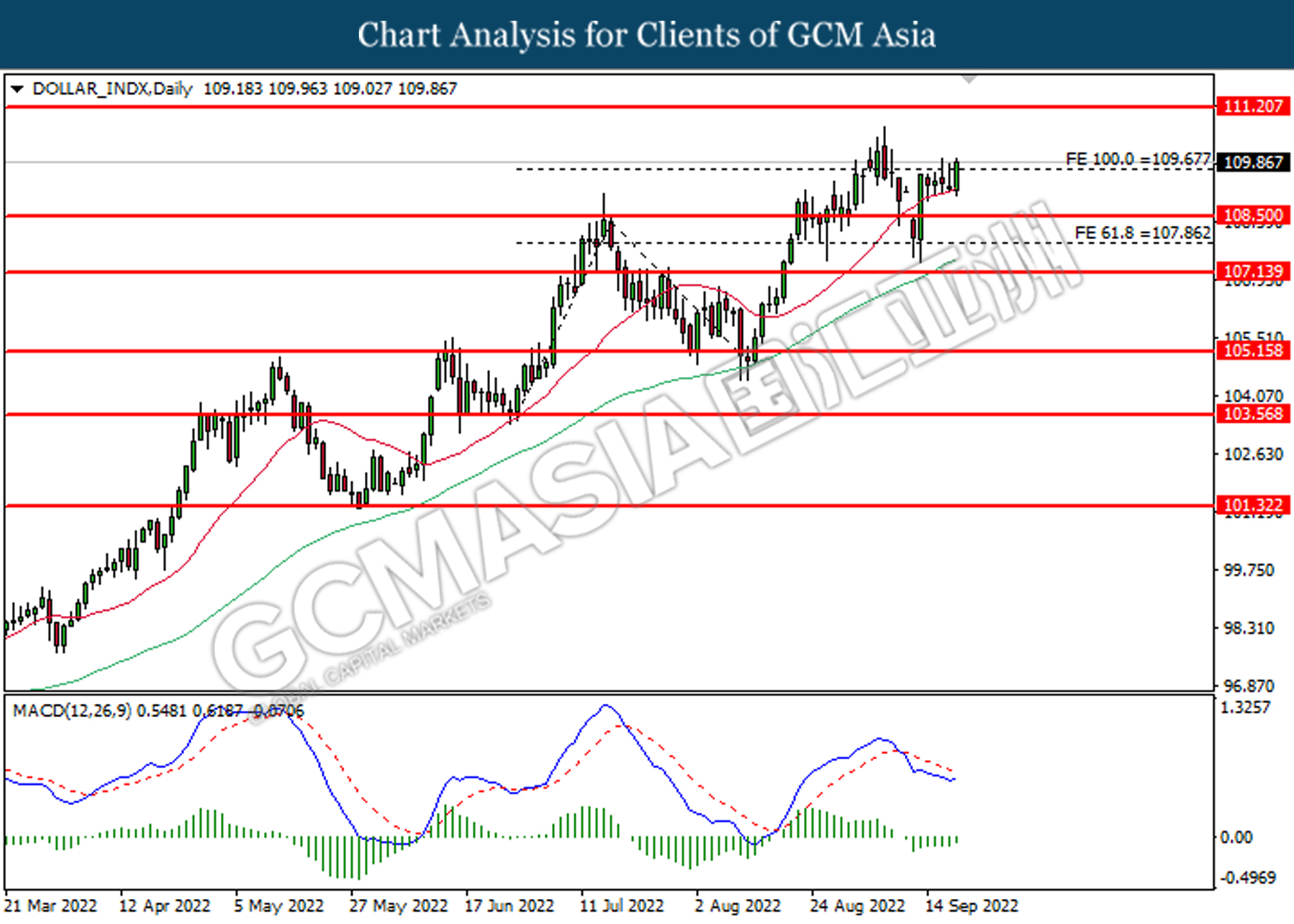

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1455. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1350.

Resistance level: 1.1455, 1.1620

Support level: 1.1350, 1.1200

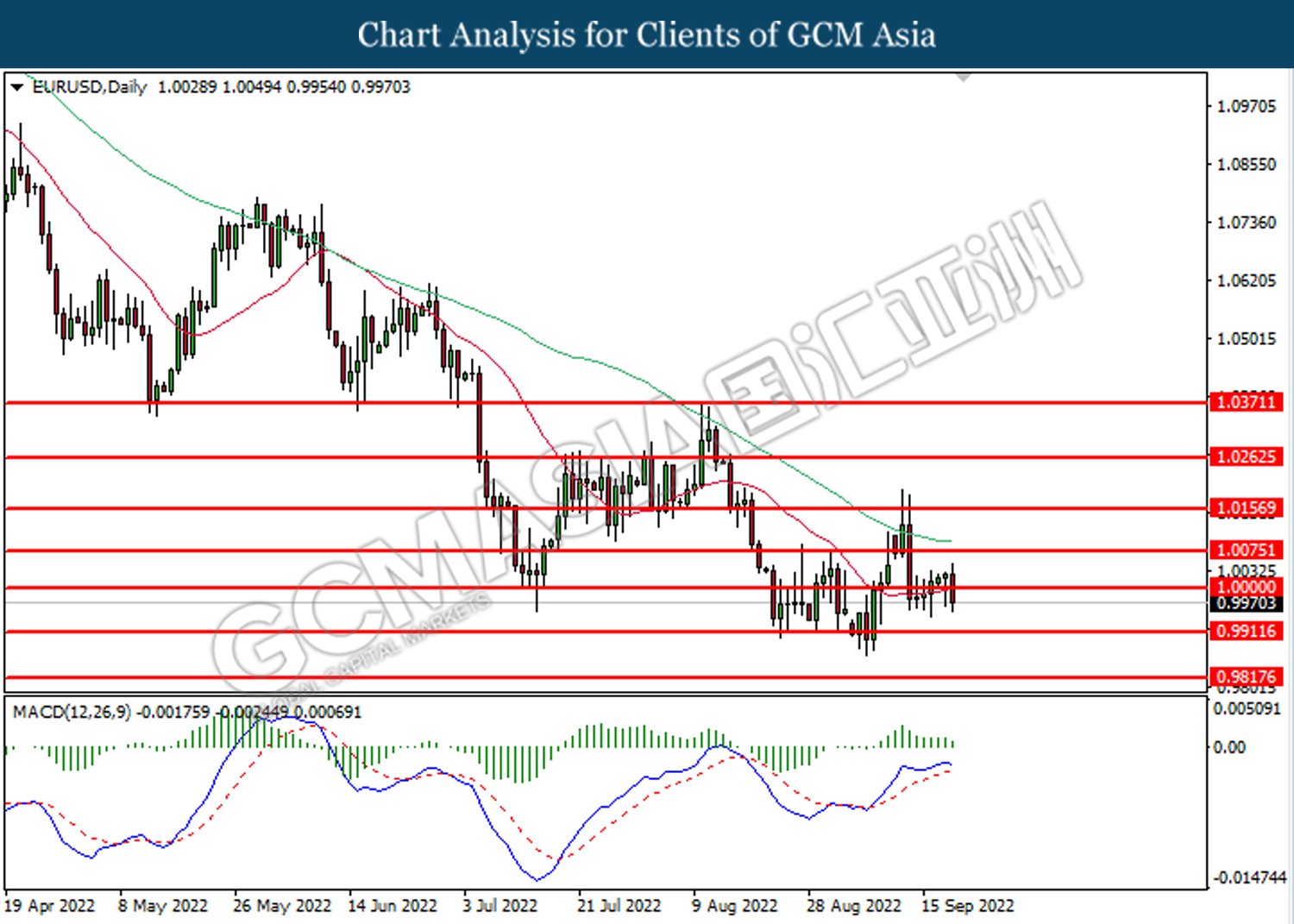

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the previous support level at 1.0000.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9910

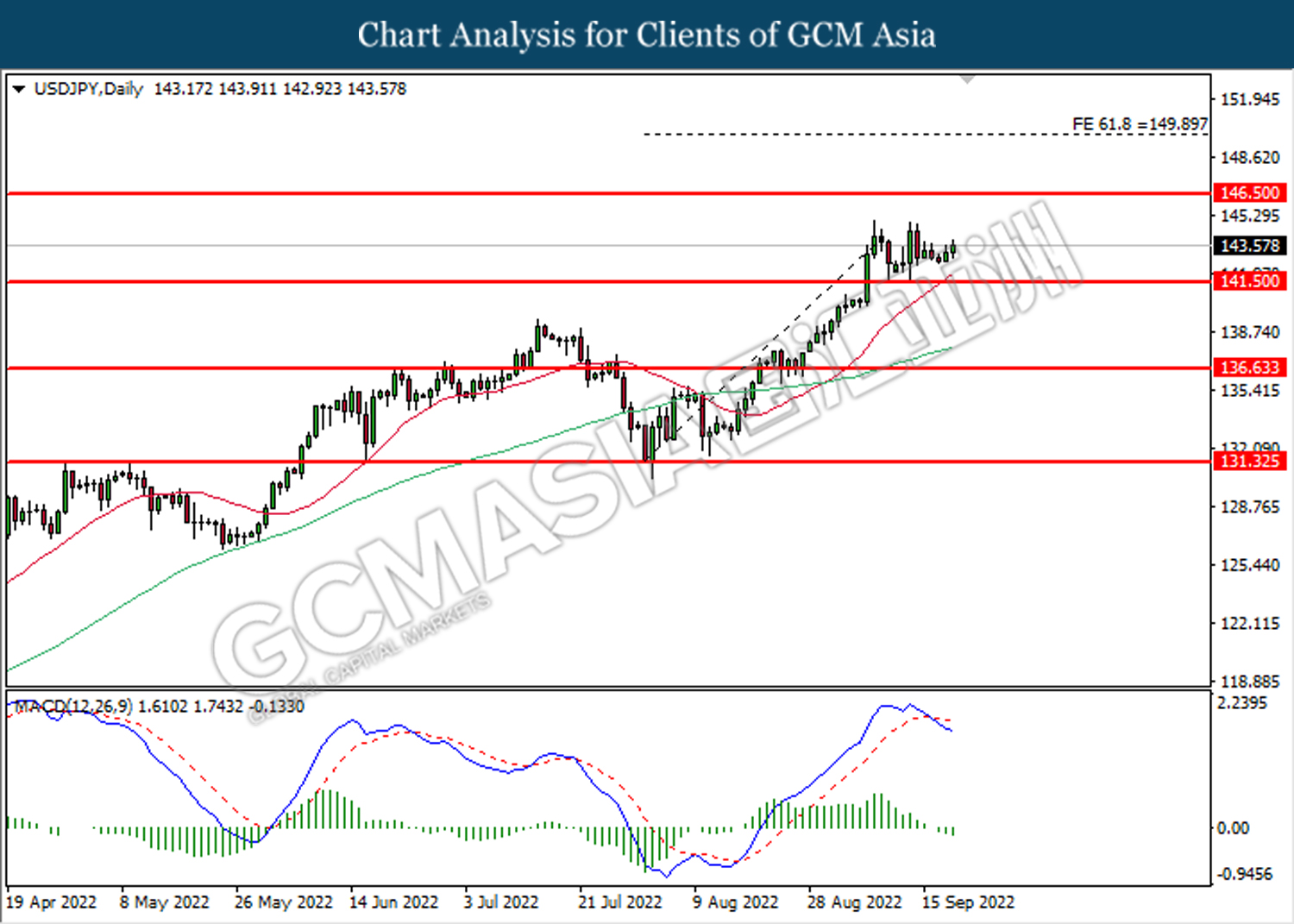

USDJPY, Daily: USDJPY was traded higher following prior rebound from the lower level. However, MACD which illustrated bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 146.50, 149.90

Support level: 141.50, 136.65

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

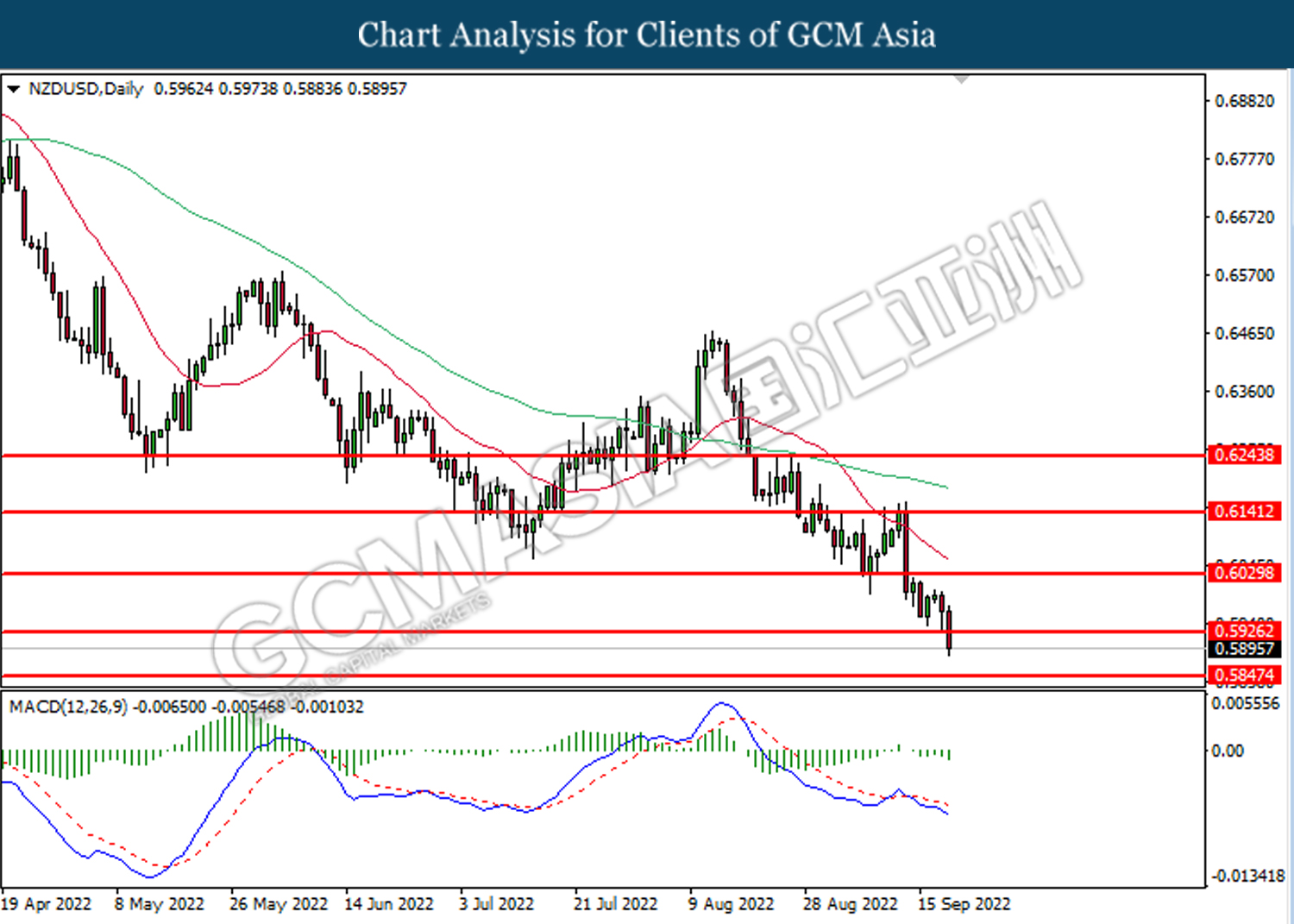

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.5925. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle successfully closes below the support level.

Resistance level: 0.6030, 0.6140

Support level: 0.5925, 0.5845

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3320. MACD which illustrated bullish momentum suggests the pair to extend gains after its candle successfully closes above the resistance level at 1.3320.

Resistance level: 1.3320, 1.3385

Support level: 1.3220, 1.3140

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 80.60.

Resistance level: 86.15, 89.45

Support level: 80.60, 78.20

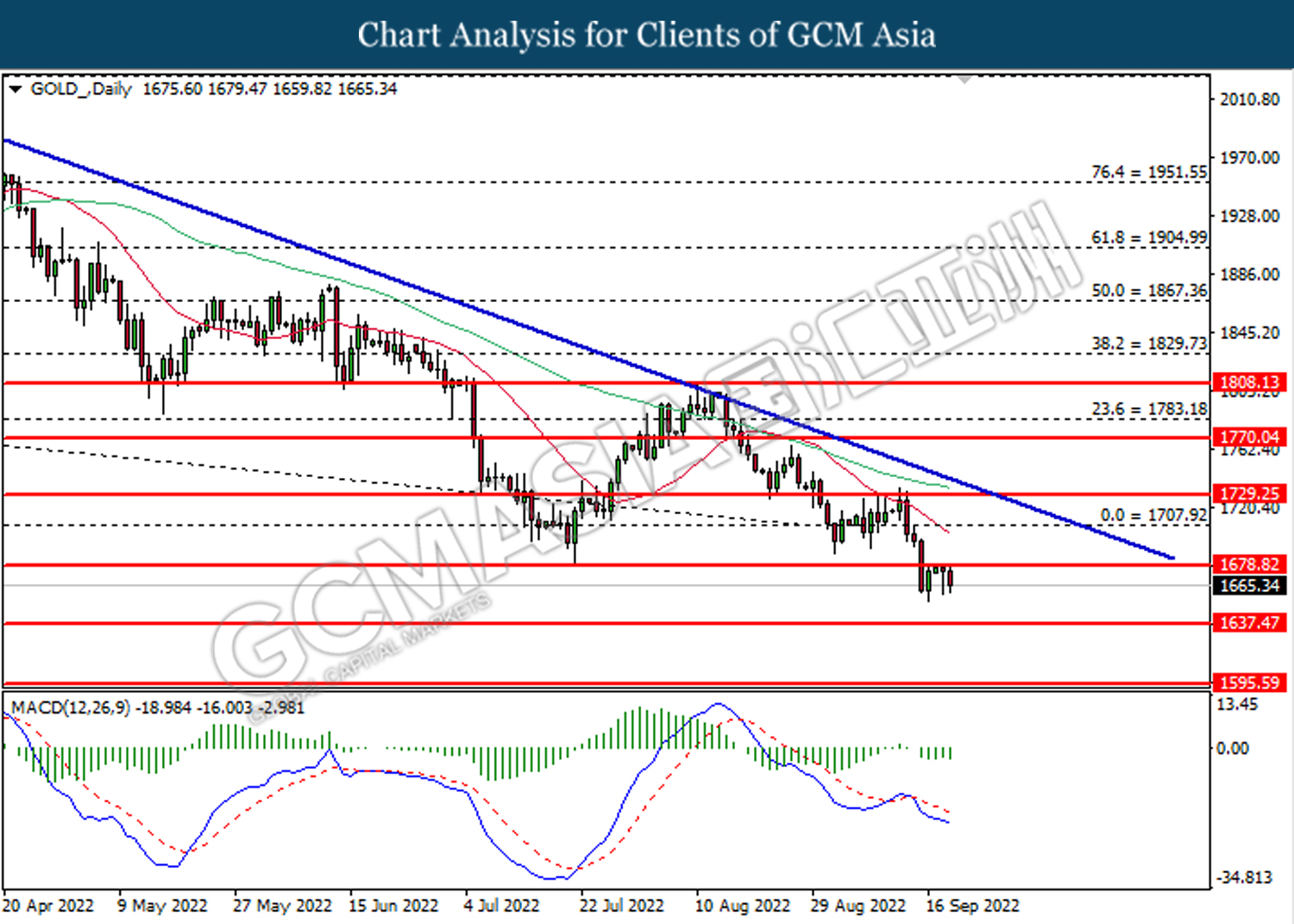

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1678.80. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 1637.45.

Resistance level: 1678.80, 1707.90

Support level: 1637.45, 1595.60