21 September 2022 Afternoon Session Analysis

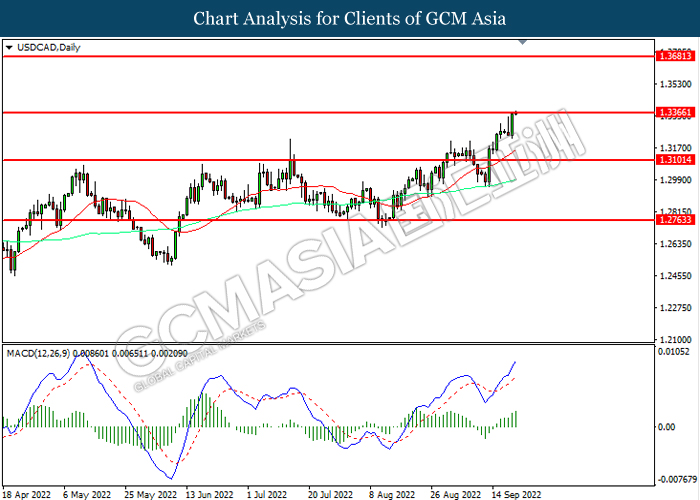

Canada Dollar retreated as easing inflation risk.

The Canada Dollar extends its losses following the released of crucial inflation data, which dialed down the market optimism toward rate hike expectation from Bank of Canada in future. According to Statistics Canada, the annual inflation rate had eased more than expected in August despite the food prices rose at their fastest pace in 41 years. The Canada annual inflation rate came in at 7.0% in August, below the market forecasts at 7.3% and the preliminary reading of 7.6% in July. Currently, the money market speculated on at 50 basis point rate hike to 3.75% at the October rate decision following the data, slightly lower than the previous expectation. Earlier, the Bank of Canada had increased its interest rate by 75 basis point to 3.25% for this month, while claiming that they will still continue to scrutinize the latest updates with regards of latest economic data to determine the monetary policy. As of writing, the pair of USD/CAD appreciated by 0.07% to 1.3370.

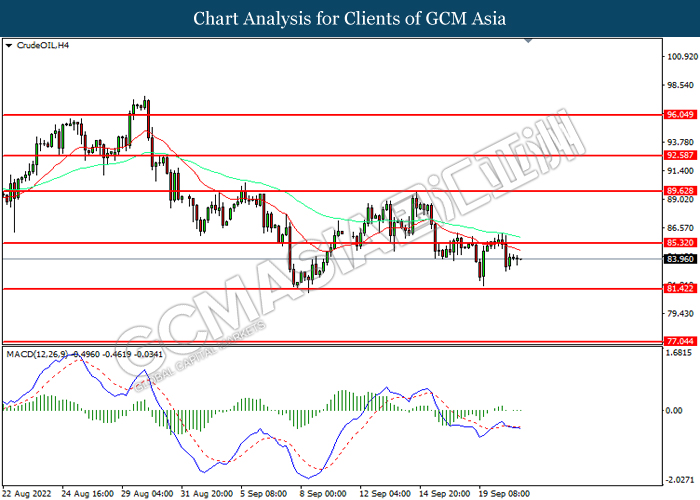

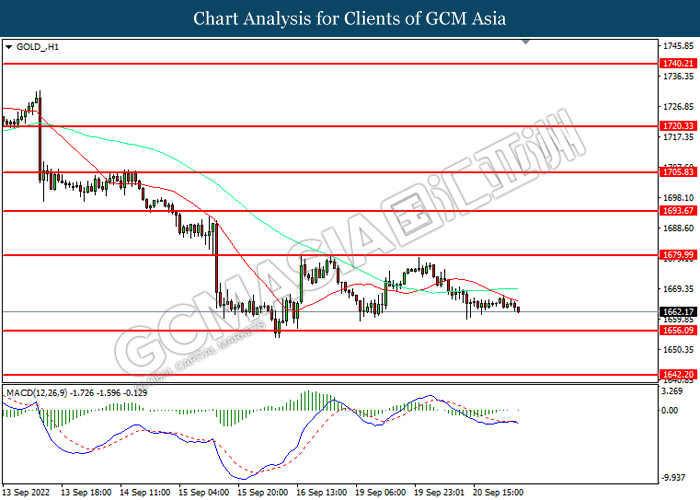

In the commodities market, the crude oil price depreciated by 0.25% to $84.00 per barrel as of writing. The oil market edged lower as market participants concerned that the tightening monetary policy from the global central bank would likely to jeopardize the economic momentum, dragging down the appeal for the crude oil demand. On the other hand, the gold price depreciated by 0.08% to $1663.65 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Economic Projections

(22nd Sep)

02:00 USD FOMC Statement

(22nd Sep)

02:00 USD FOMC Press Conference

(22nd Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Existing Home Sales (Aug) | 4.81M | 4.70M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.442M | 2.161M | – |

| 02:00

(22nd Sep) |

USD -Fed Interest Rate Decision | 2.50% | 3.25% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 111.20, 113.20

Support level: 107.95, 104.85

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1455, 1.1585

Support level: 1.1365, 1.1310

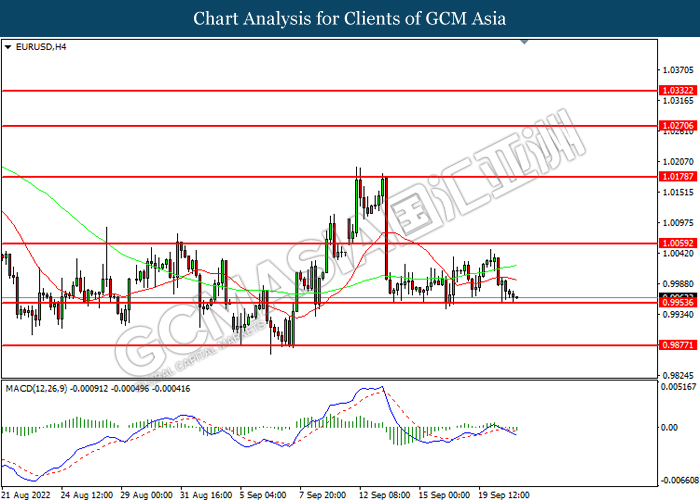

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0060, 1.0180

Support level: 0.9955, 0.9875

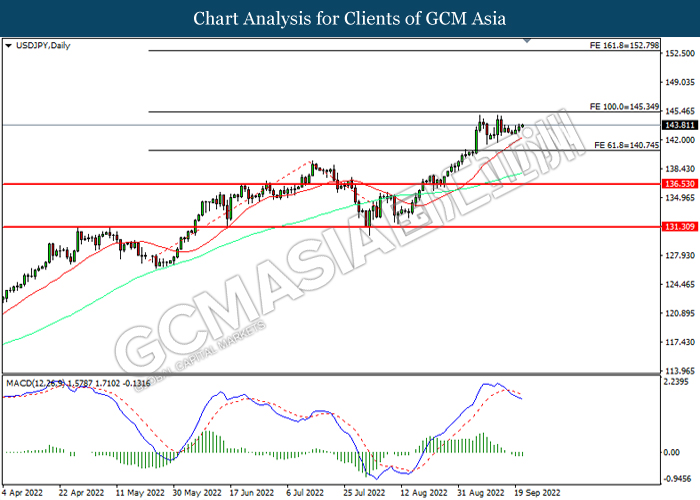

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

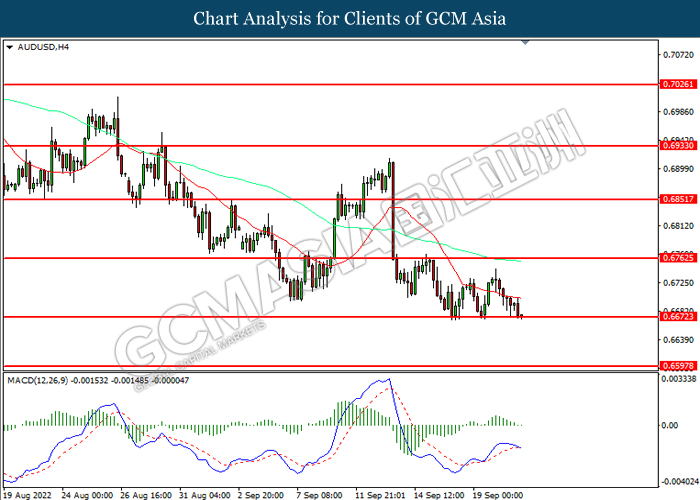

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6765, 0.6850

Support level: 0.6675, 0.6595

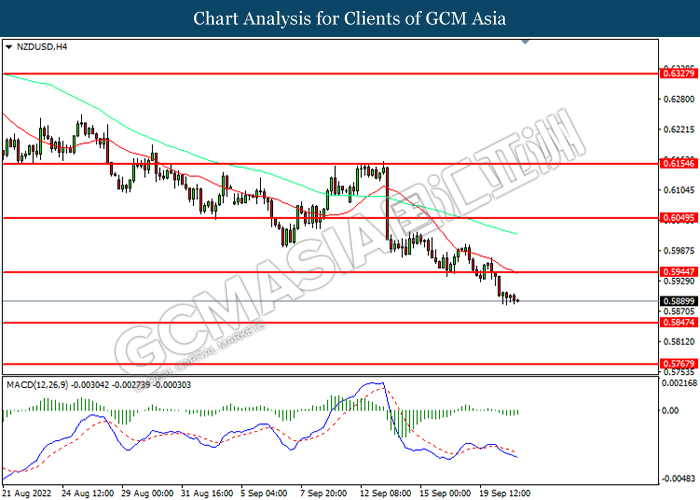

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5945, 0.6050

Support level: 0.5845, 0.5765

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3365, 1.3680

Support level: 1.3100, 1.2765

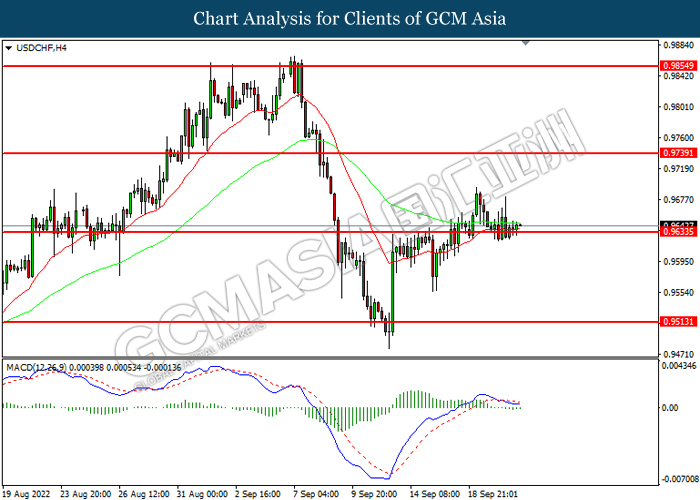

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9740, 0.9855

Support level: 0.9635, 0.9515

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 85.30, 89.65

Support level: 81.40, 77.05

GOLD_, H1: Gold price was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1680.00, 1693.65

Support level: 1656.10, 1642.20