22 September 2022 Afternoon Session Analysis

Pound Sterling dipped as economic outlook remain clouded.

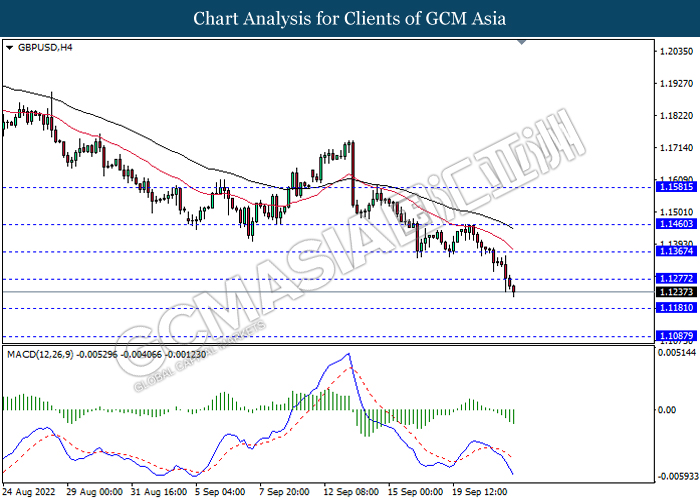

The GBP/USD, which widely traded by global investors slumped on yesterday amid the pessimistic economic outlook in UK. According to Reuters, Britain’s manufacturers association has diminished the factory output forecast from 1.7% to 0.6%, which driven by soaring energy price and uncertainty of demand. The spiking inflation risk which caused by Russia-Ukraine conflict has threaten the consumer demand and pushed up the operating cost in UK region, which exacerbated the possibility of UK economy entering into recession. Such situation has dragged down the value of Pound Sterling. Besides, that, the GBP/USD has extended its losses after the Fed Chairman Jerome Powell stand with its aggressive rate hike path during early trading session. However, the losses of Pound was limited following the Bank of England (BoE) was expected to hike its rate by 50 basis point in the policy meeting today, while some market participant were anticipating a higher rate hike, says 75 basis point. At this juncture, investors would continue to focus on the interest rate decision from BoE in order to gauge the likelihood movement of Pound. As of writing, GBP/USD depreciated by 0.32% to 1.1229.

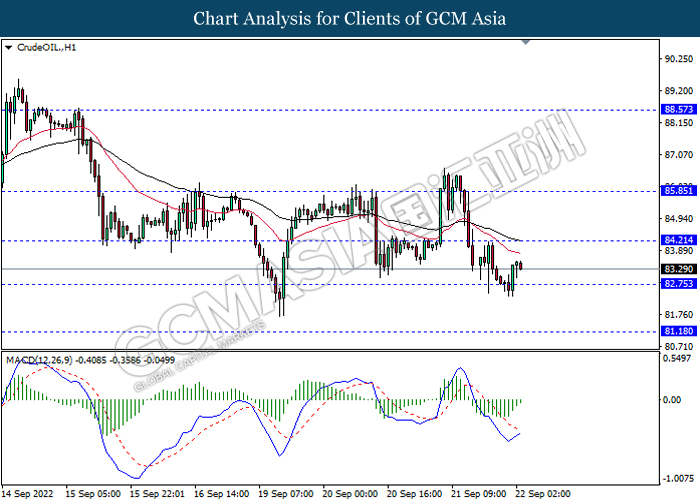

In the commodities market, the crude oil price rose by 0.64% to $83.45 per barrel as of writing after a sharp decline on earlier trading session following the hawkish statement from Fed. On the other hand, the gold price eased by 0.41% to $1660.96 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:30 JPY BoJ Press Conference

15:30 CHF SNB Monetary Policy Assessment

15:30 CHF SNB Press Conference

19:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q3) | -0.25% | 0.50% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Sep) | 1.75% | 2.25% | – |

| 20:30 | USD – Initial Jobless Claims | 213K | 218K | – |

Technical Analysis

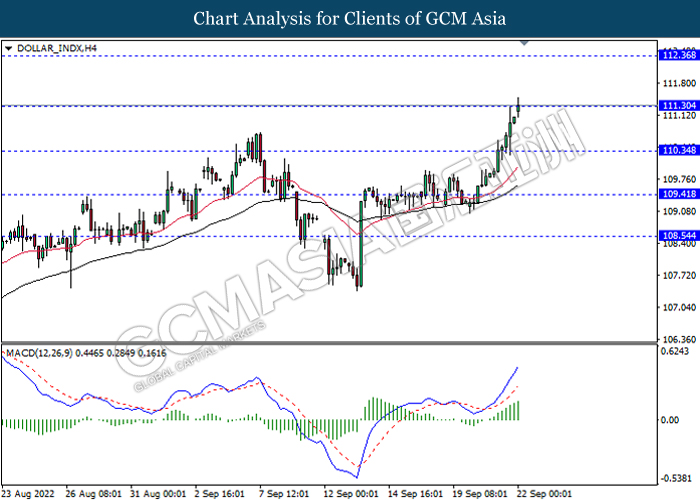

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 111.30, 112.35

Support level: 110.35, 109.40

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1275, 1.1365

Support level: 1.1180, 1.1085

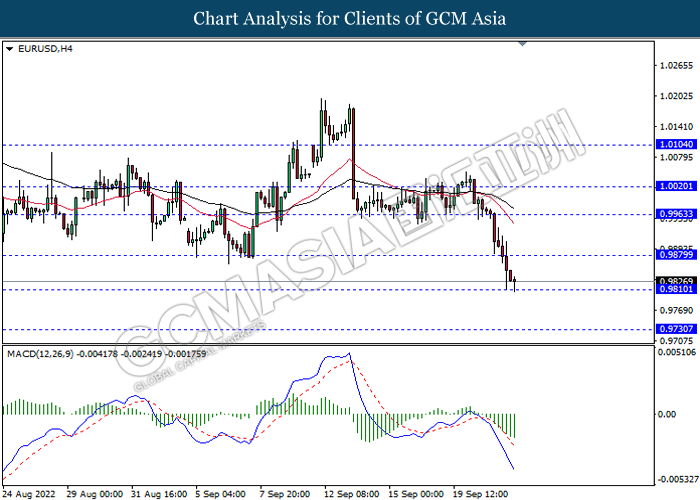

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9880, 0.9965

Support level: 0.9810, 0.9730

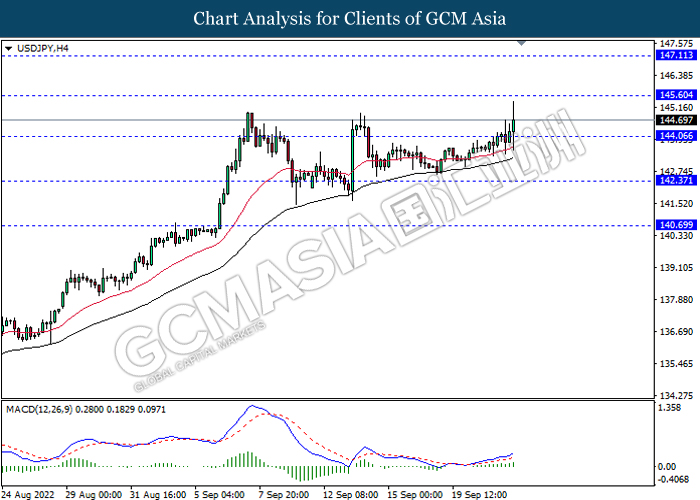

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

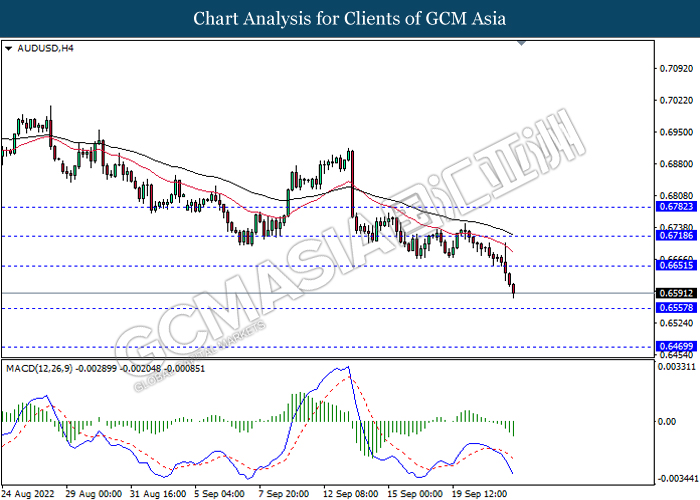

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6650, 0.6720

Support level: 0.6555, 0.6470

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.5850, 0.5925

Support level: 0.5770, 0.5680

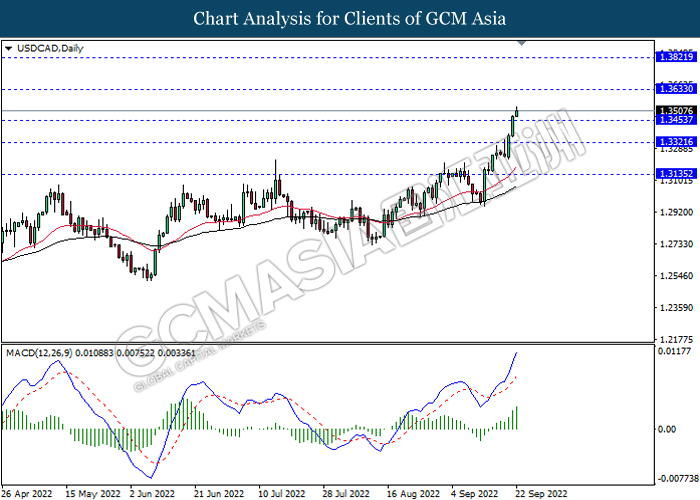

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

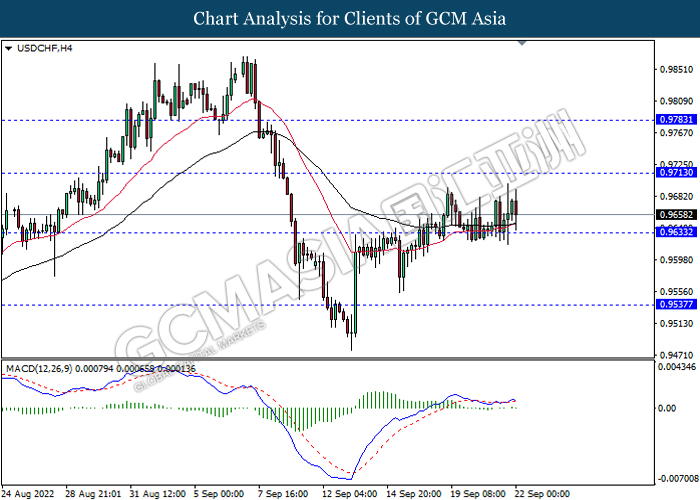

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9715, 0.9785

Support level: 0.9635, 0.9535

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 84.20, 85.85

Support level: 82.75, 81.20

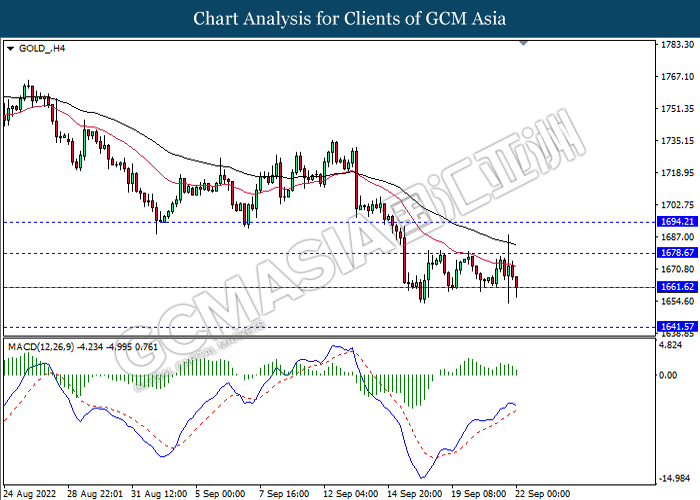

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1678.65, 1694.20

Support level: 1661.60, 1641.55