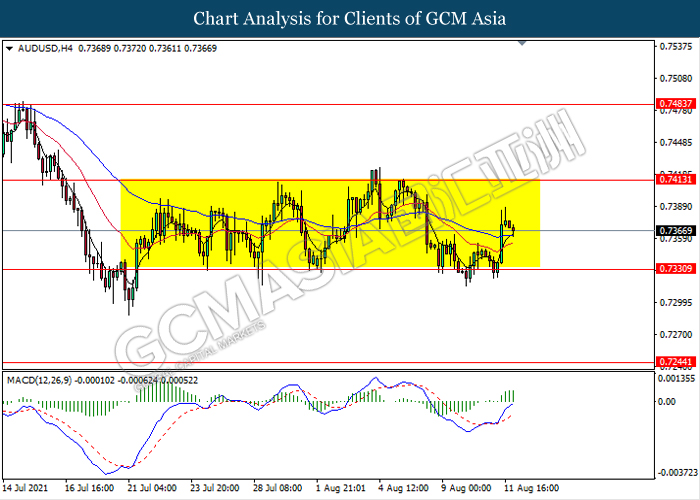

AUDUSD, H4: AUDUSD remain traded in a sideway channel following recent rebound from the support level 0.7330. However, MACD which illustrate bullish momentum signal suggest the pair to extend its rebound in short term towards the resistance level 0.7415.

Resistance level: 0.7415, 0.7485

Support level: 0.7330, 0.7245