26 September 2022 Morning Session Analysis

US Dollar continues its bull trend as hawkish expectation from Fed.

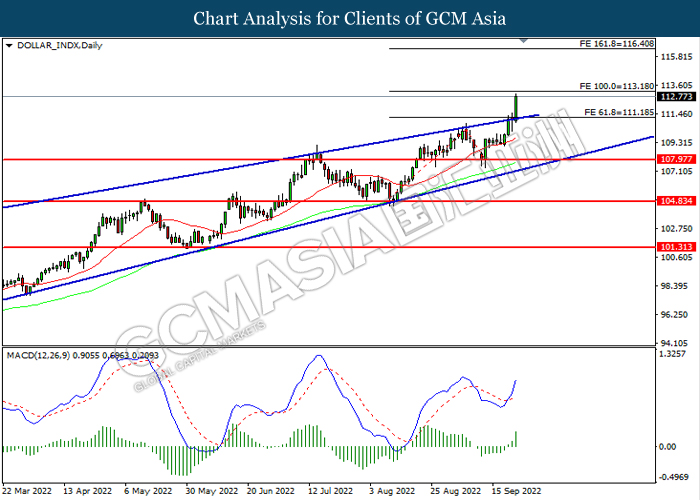

The Dollar Index which traded against a basket of six major currencies surged significantly into a fresh two-decade high as market participants continue to digest the rate hike decision from Federal Reserve. Last week, the Federal Reserve increased their interest rates by another 75-basis point while signaling a larger rate hike decision at its upcoming meetings. According to Reuters, the Fed Chair Jerome Powell claimed that the Fed will act aggressively now to stabilize the inflation rate into 2%. Currently, the Fed’s new projections indicated the US policy rate rising to 4.4% by the end of 2022 while rate cuts are not expected until the year of 2024. Following the implementation of the aggressive contractionary monetary policy from the major central bank last week, investors will be bracing themselves for new volatility in the week ahead. Several Federal Reserve members are expected to speak this week, while other crucial economic data from US region would be also the main focus for the global investors to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index depreciated by 0.16% to 113.00.

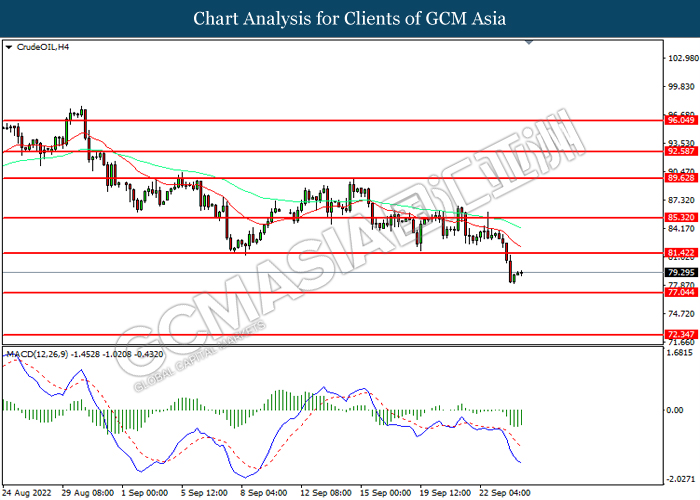

In the commodities market, the crude oil price slumped 0.03% to $79.45 per barrel as of writing amid concerns upon the global recession risk continue to weigh down the appeal for this black-commodity. On the other hand, the gold market slumped 0.01% to $1642.15 per troy ounces amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q3) | -0.25% | 0.50% | – |

| 16:00 | EUR – German Ifo Business Climate Index (Sep) | 1.75% | 2.25% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 113.20, 116.40

Support level: 111.20, 107.95

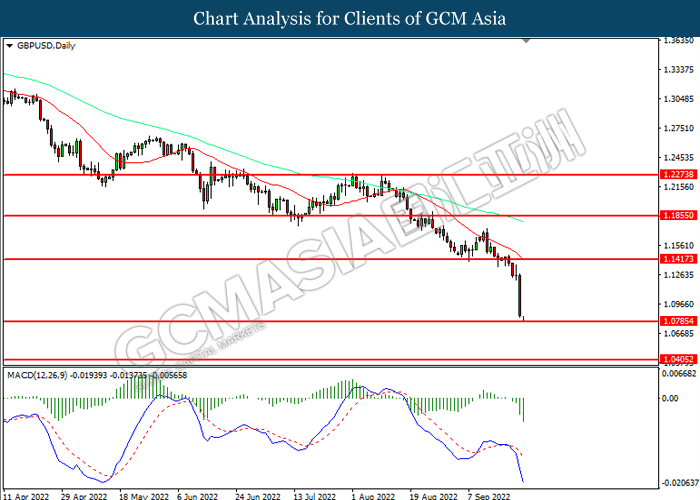

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1415, 1.1855

Support level: 1.0785, 1.0405

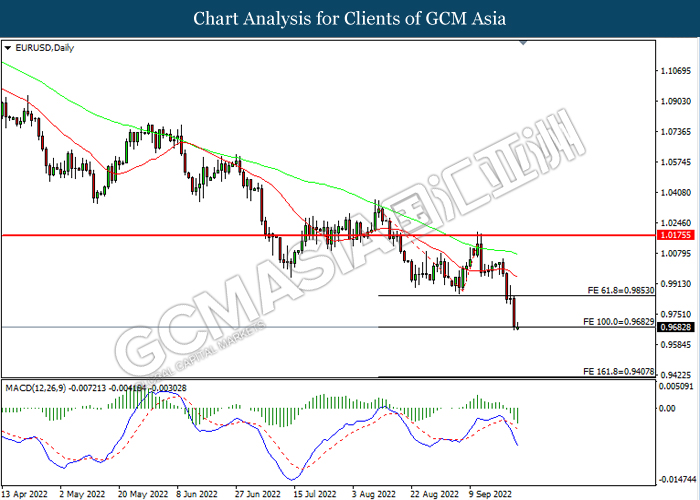

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9855, 1.0175

Support level: 0.9685, 0.9410

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

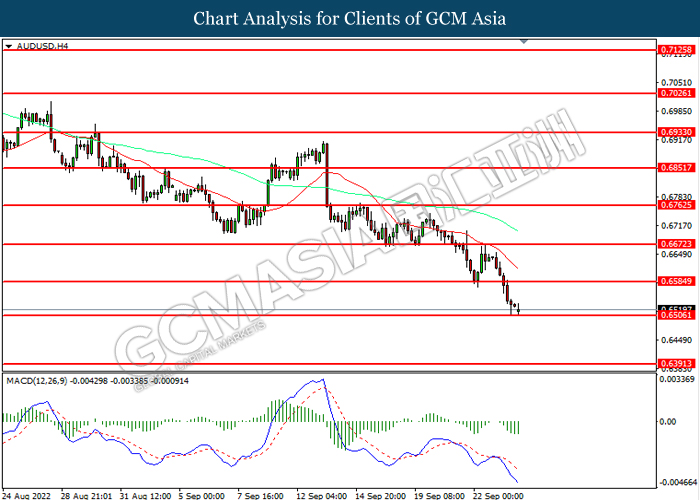

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6585, 0.6670

Support level: 0.6505, 0.6390

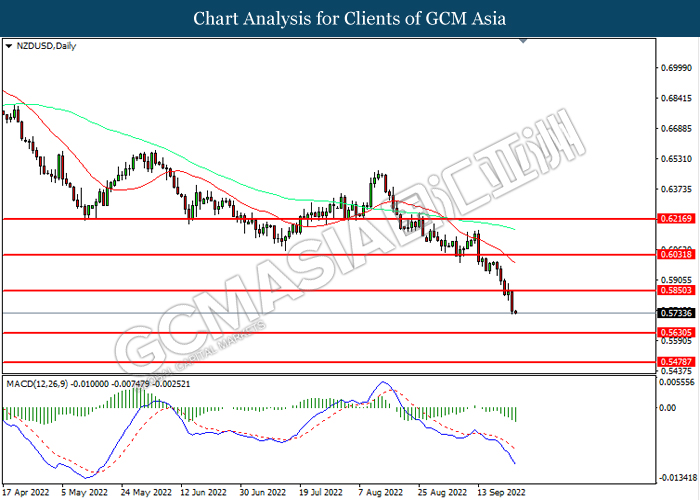

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.5850, 0.6030

Support level: 0.5630, 0.5480

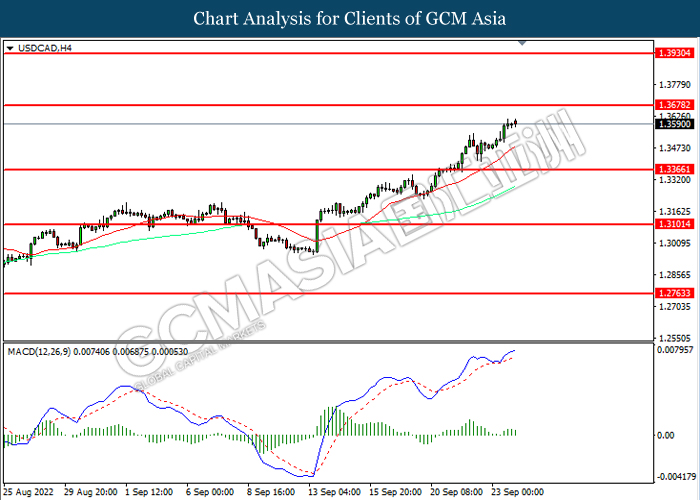

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3680, 1.3930

Support level: 1.3365, 1.3100

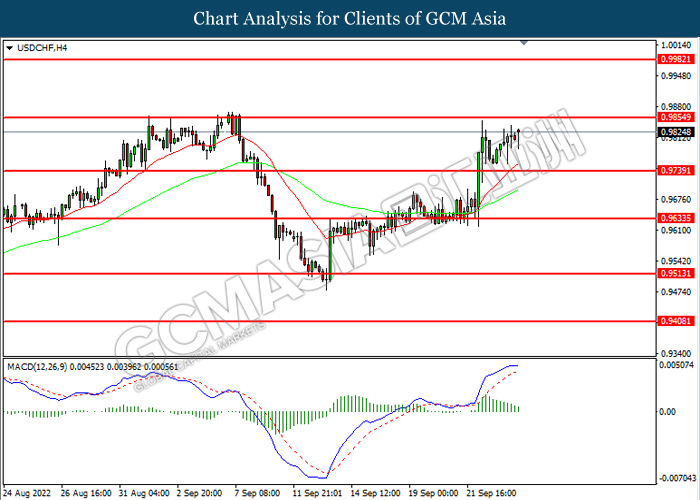

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9855, 0.9980

Support level: 0.9740, 0.9635

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 81.40, 85.30

Support level: 77.05, 72.235

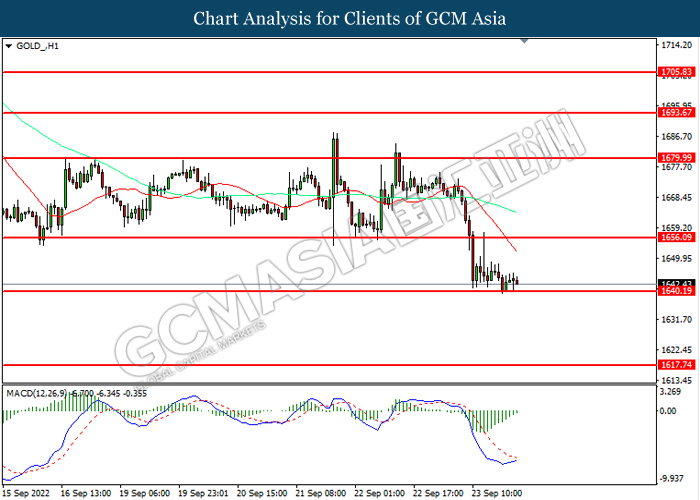

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1656.10, 1680.00

Support level: 1640.20, 1617.75