26 September 2022 Afternoon Session Analysis

Pound dived after UK government announced for tax cuts.

The GBP/USD slumped significantly on last Friday trading session after UK government announced to apply tax cut to tackle recession. According to CNBC, the new UK government that leaded by Liz Truss was targeting a medium-term 2.5% trend rate in economic growth, while they believe that high taxes rate would diminish incentives to work as well as disrupt investment and corporate development. Based on the announcement, a reduction in the basic rate of income tax from 20% to 19% has implemented. Also, they have cancelled a planned rise in corporation tax to 25% and keeping it at 19%, the tax paid on incomes over high income groups would take a top rate of 40%. Tax cuts would increase consumer spending in nation. However, in the perspective of investors, the move from the UK government would likely to reduce nation income, which make the economic progression in UK become pessimistic. As of writing, GBP/USD dropped by 2.86% to 1.0546.

In the commodities market, the crude oil price depreciated by 0.37% to $78.44 per barrel as of writing following the market feared that showing global economic activity recession will dent demand for oil. On the other hand, the gold price eased by 0.52% to $1639.85 per troy ounce as of writing following the value of US Dollar heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q3) | -0.25% | 0.50% | – |

| 16:00 | EUR – German Ifo Business Climate Index (Sep) | 1.75% | 2.25% | – |

Technical Analysis

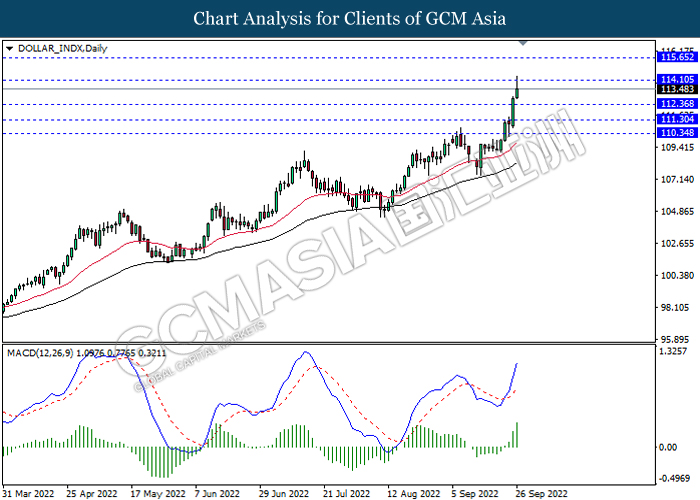

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 114.10, 115.65

Support level: 112.35, 111.30

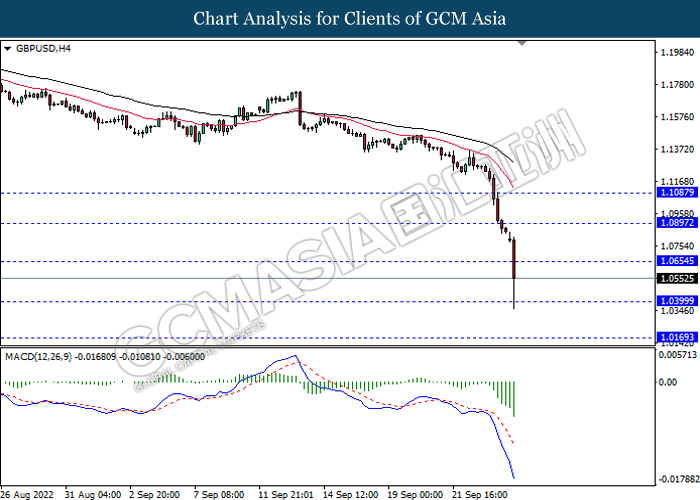

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0655, 1.0895

Support level: 1.0400, 1.0170

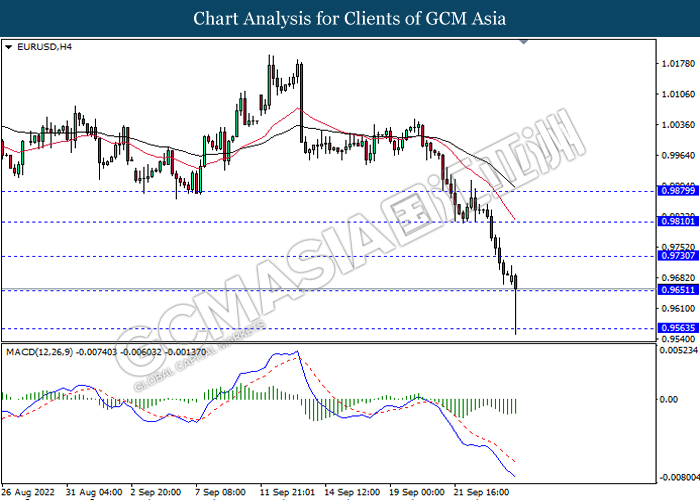

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9730, 0.9810

Support level: 0.9650, 0.9565

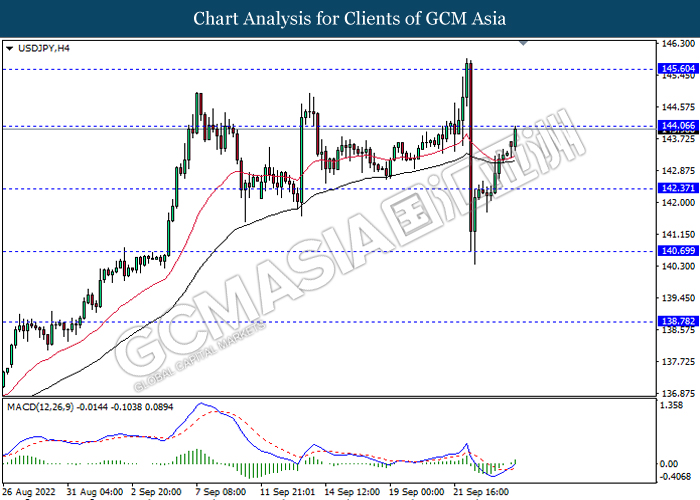

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 144.05, 145.60

Support level: 142.35, 140.70

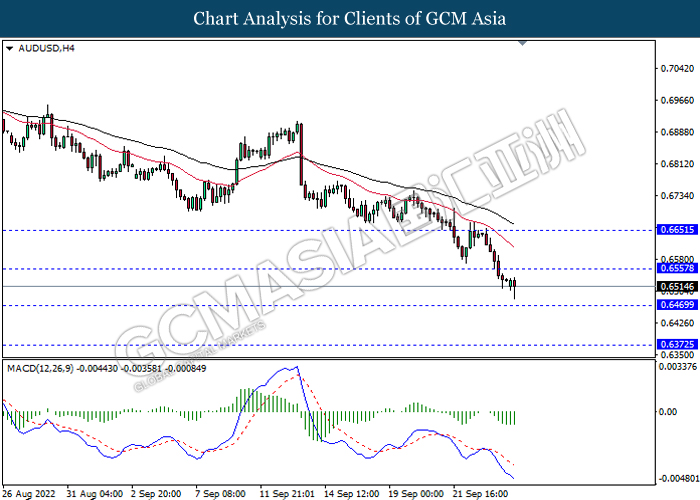

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6555, 0.6650

Support level: 0.6470, 0.6370

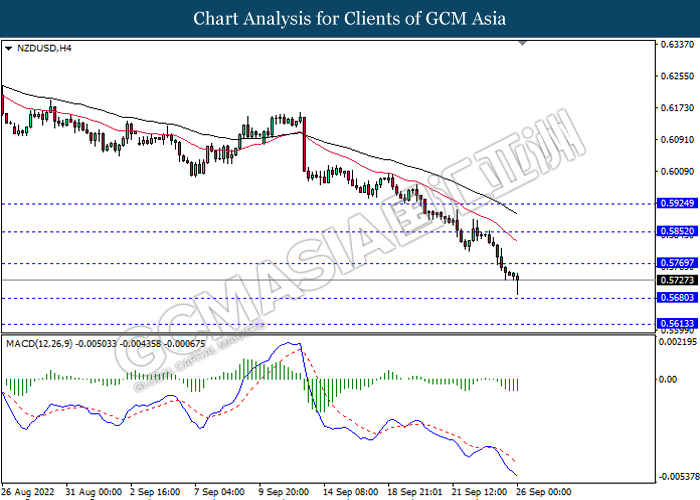

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.5770, 0.5850

Support level: 0.5680, 0.5615

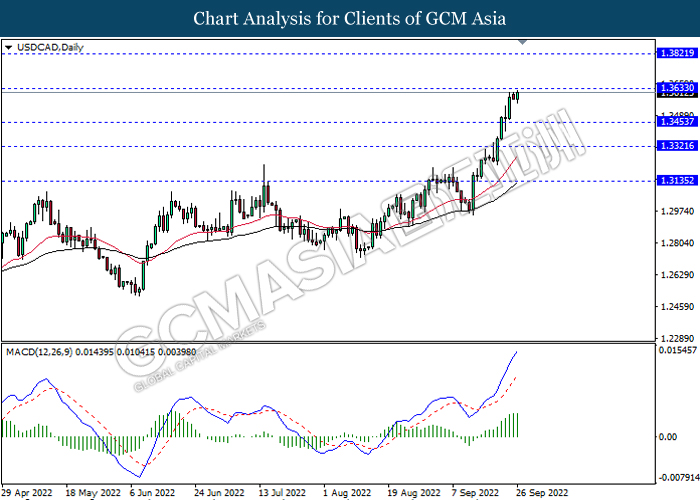

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfullt breakout the resistance level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

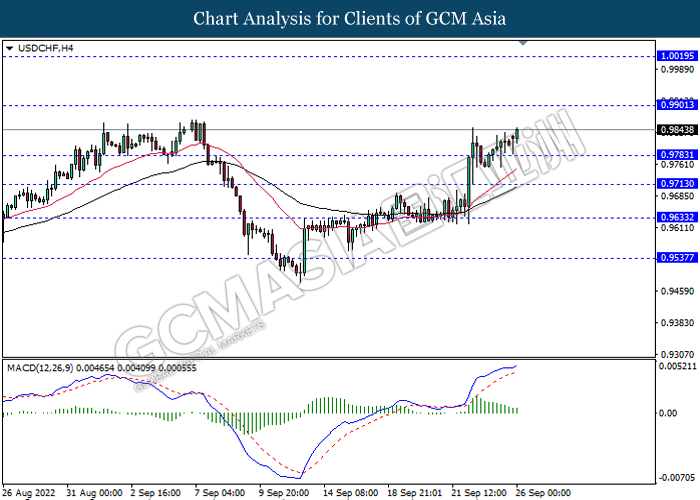

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9900, 1.0020

Support level: 0.9785, 0.9715

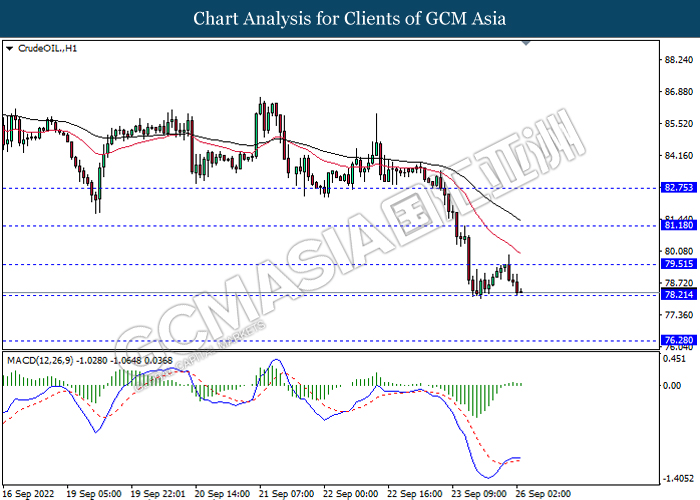

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 79.50, 81.20

Support level: 78.20, 76.30

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1641.55, 1661.60

Support level: 1621.85, 1600.30