27 September 2022 Morning Session Analysis

US Dollar jumped as rate hike expectation remain aggressive.

The dollar index which traded against a basket of six major currencies surged on yesterday over the hawkish statement from Fed member. According to Reuters, Cleveland Fed President Loretta Mester claimed on Monday that the central bank should life rates higher and keep the contractionary policy for some time in order to tamp down the “unacceptable high” inflation. She also expressed her thoughts that it can be better policymakers to act more aggressively when there was uncertainty, because the aggressive and pre-emptive action can prevent the worst-case outcomes from actually coming out. Last week, Fed has hiked its interest rate by 75 basis point for the third consecutive time as well as hinting that same size of rate hike might be implemented again in the upcoming meeting. On the other hand, the possibility of 0.75% rate hike has reached 67.5%, according to CME FedWatch Tool. The recent hawkish speech from Fed members had sparked positive prospects of US Dollar, which made the US currency remain optimistic. As of writing, the Dollar Index appreciated by 1.02% to 114.11.

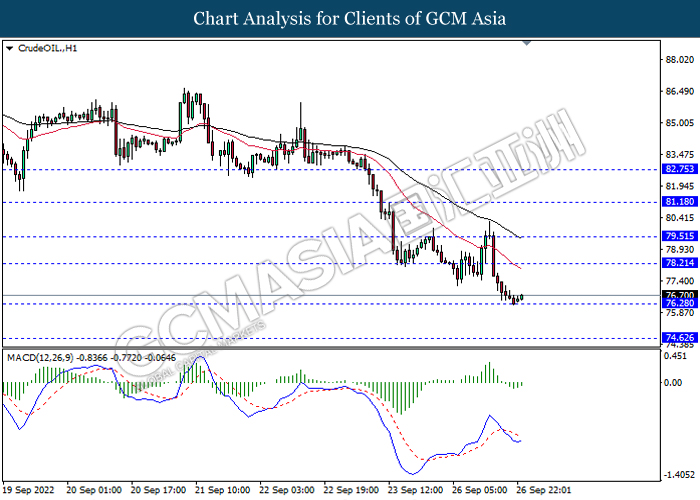

In the commodities market, the crude oil price edged down by 0.01% to $76.70 per barrel as of writing following the global economy recession has weighed down the demand of this black commodity. In addition, the gold price rose by 0.02% to $1633.70 per troy ounce as of writing after a sharp decline throughout the yesterday trading session amid the US Dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 USD Fed Chair Powell Speaks

19:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Aug) | 0.2% | 0.2% | – |

| 22:00 | USD – CB Consumer Confidence (Sep) | 103.2 | 104.0 | – |

| 22:00 | USD – New Home Sales (Aug) | 511K | 500K | – |

Technical Analysis

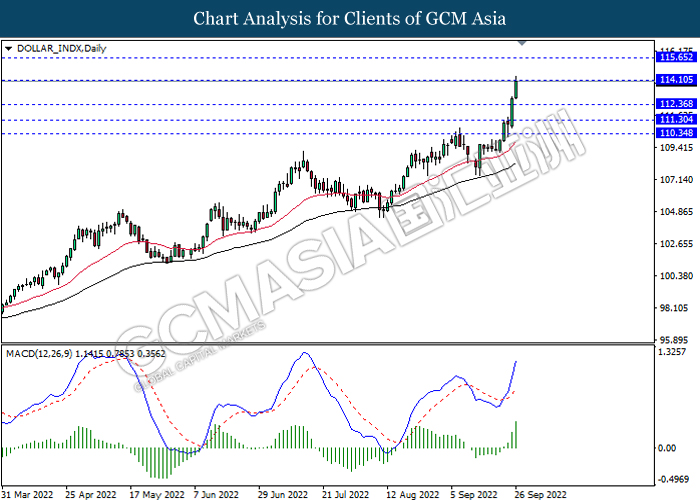

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 114.10, 115.65

Support level: 112.35, 111.30

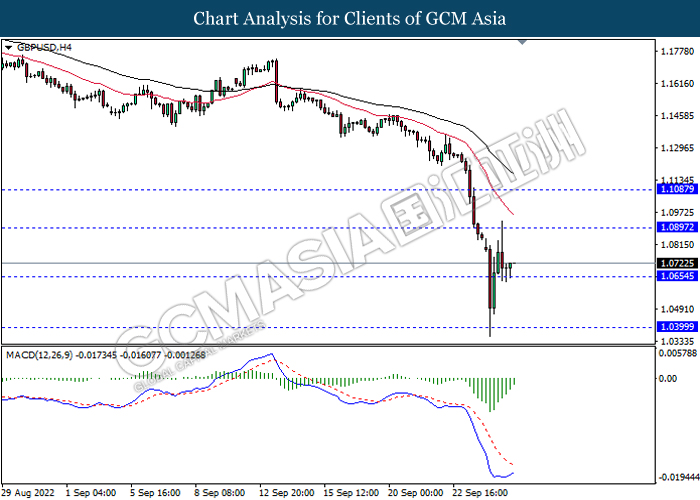

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0895, 1.1085

Support level: 1.0655, 1.0400

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9650, 0.9730

Support level: 0.9565, 0.9445

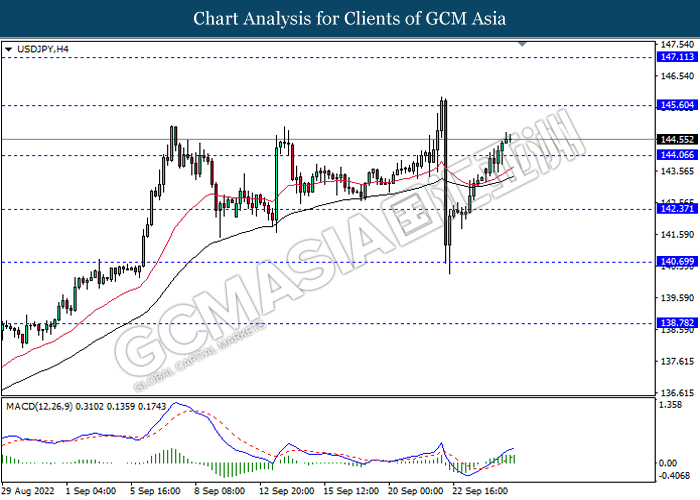

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

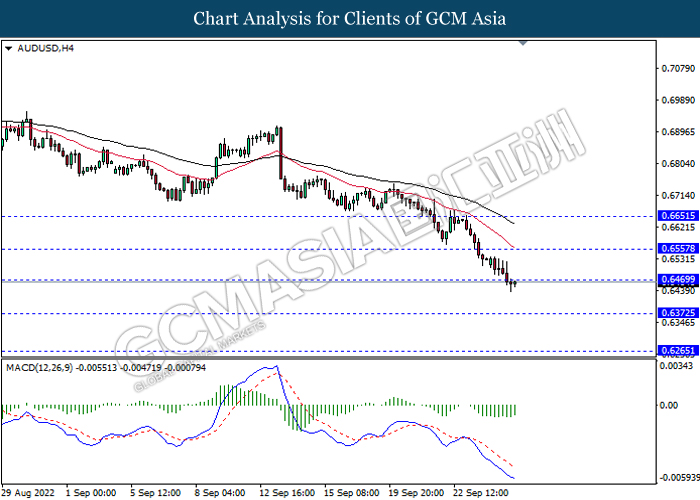

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6470, 0.6555

Support level: 0.6370, 0.6265

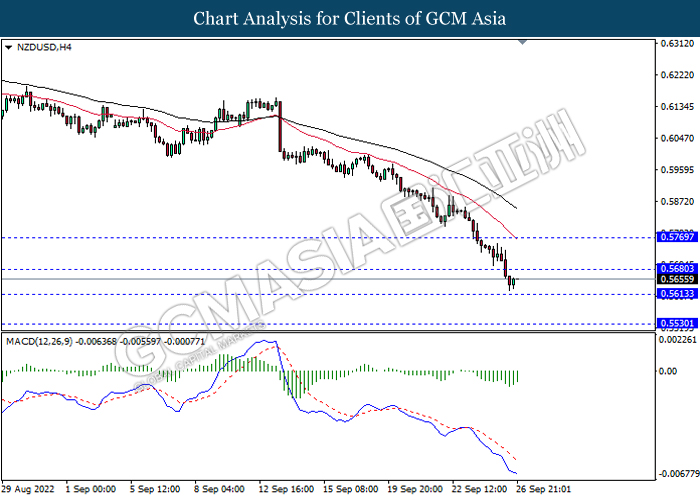

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.5680, 0.5770

Support level: 0.5615, 0.5530

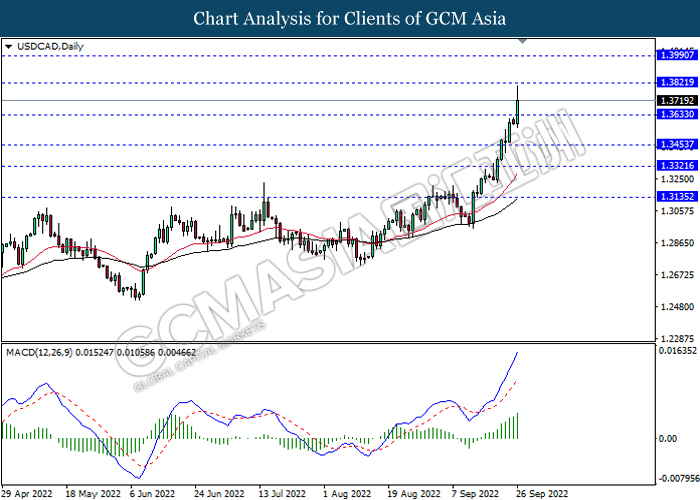

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

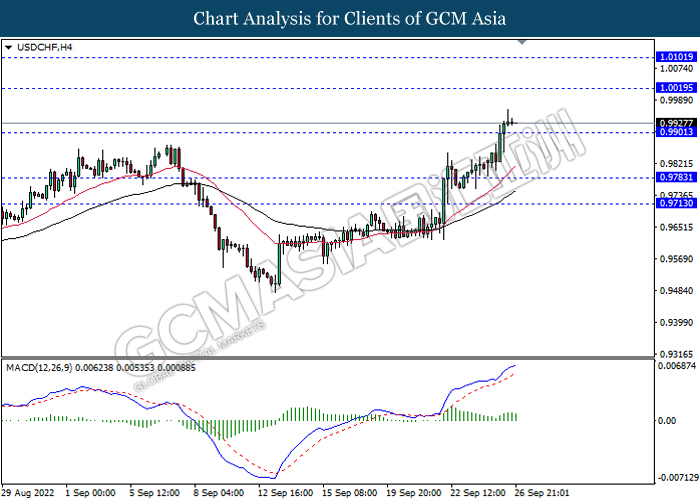

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0020, 1.0100

Support level: 0.9900, 0.9785

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 78.20, 79.50

Support level: 76.30, 74.60

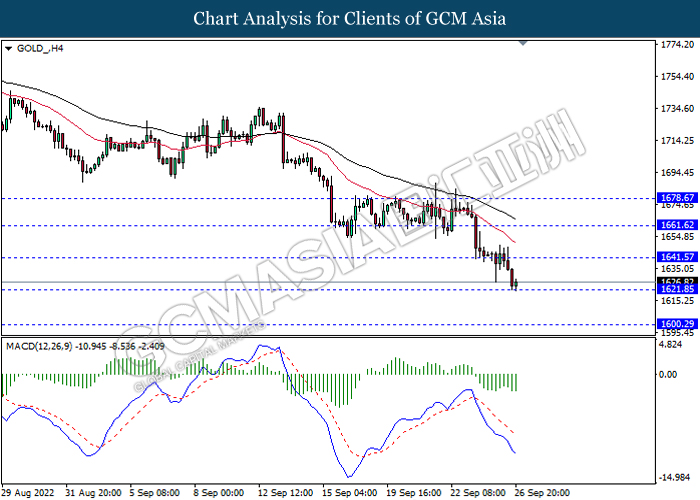

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1641.55, 1661.60

Support level: 1621.85, 1600.30