27 September 2022 Afternoon Session Analysis

Pound rebounded on rate hike expectation from BoE.

The Pound Sterling rebounded from an all-time low against the Greenback on Monday following the Bank of England (BoE) unleashed their hawkish tone to shore up the battered of Pound Sterling. According to CNBC, the BOE governor claimed that the Monetary Policy Committee (MPC) would make a “full assessment” at its next monetary policy meeting in November while reiterating to act accordingly to stabilize the significant depreciation of Pound Sterling as well as the inflation risk. As for now, the money markets priced in more than 200 basis point rate hike from Bank of England (BoE) during the next monetary policy meeting in November, four times higher compare to its last hike. Earlier, the announcement by the Prime Minister Liz Truss’ administration with regards of a significant tax cuts had sent the Pound Sterling to slump significantly, which prompting the Pound Sterling to be weakened by more than 20% against US Dollar this year. As of writing, GBP/USD appreciated by 0.89% to 1.0780.

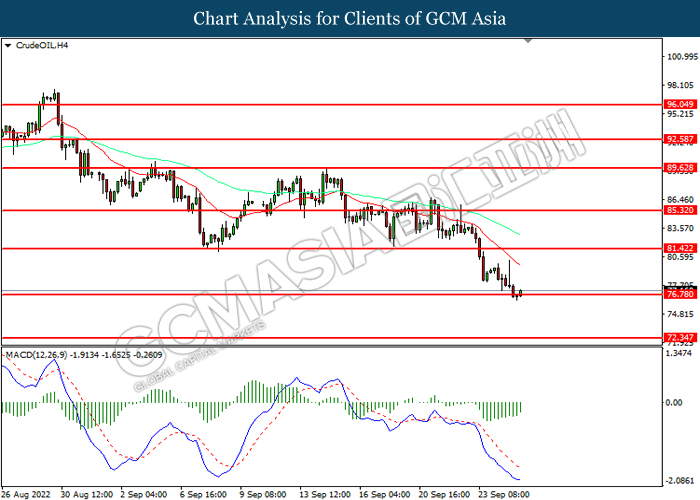

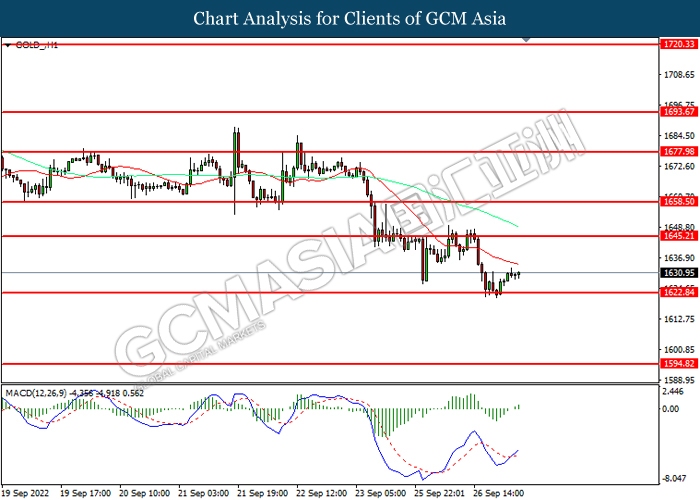

In the commodities market, the crude oil price appreciated by 1.02% to $77.10 per barrel as of writing amid technical correction following reaching its recent low. Nonetheless, the overall long-term prospect for this black-commodity still remained bearish amid the rate hike decision from the global central bank continue to drag down the appeal for the crude oil. On the other hand, the gold price extend its losses by 0.01% to $1630.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 USD Fed Chair Powell Speaks

19:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Aug) | 0.2% | 0.2% | – |

| 22:00 | USD – CB Consumer Confidence (Sep) | 103.2 | 104.0 | – |

| 22:00 | USD – New Home Sales (Aug) | 511K | 500K | – |

Technical Analysis

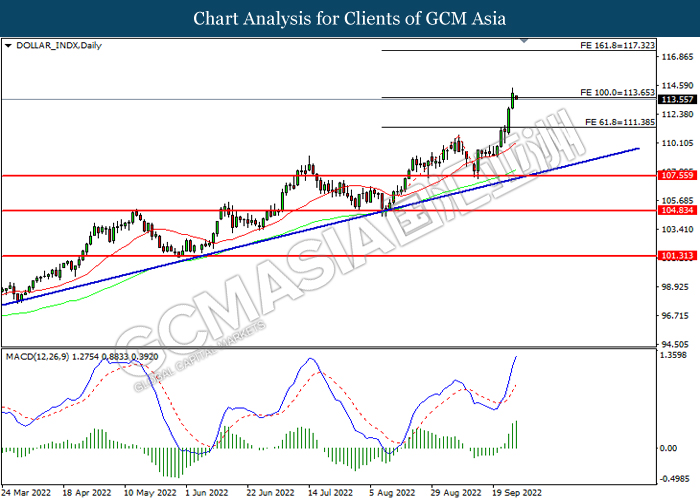

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 113.65, 117.30

Support level: 111.40, 107.55

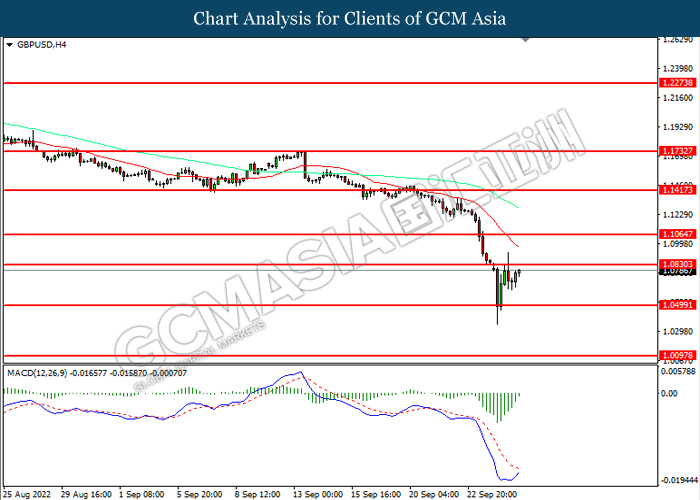

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0830, 1.1065

Support level: 1.0500, 1.0095

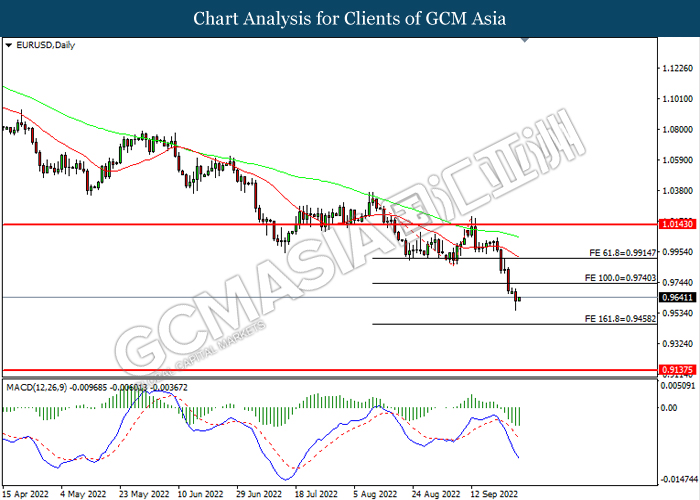

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9740, 0.9915

Support level: 0.9460, 0.9135

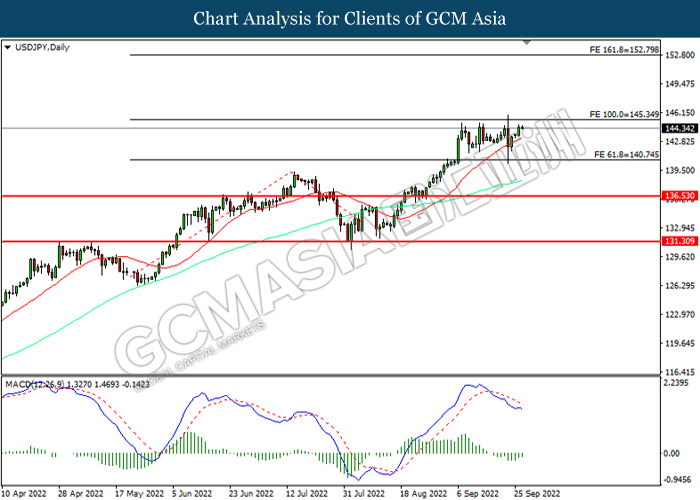

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

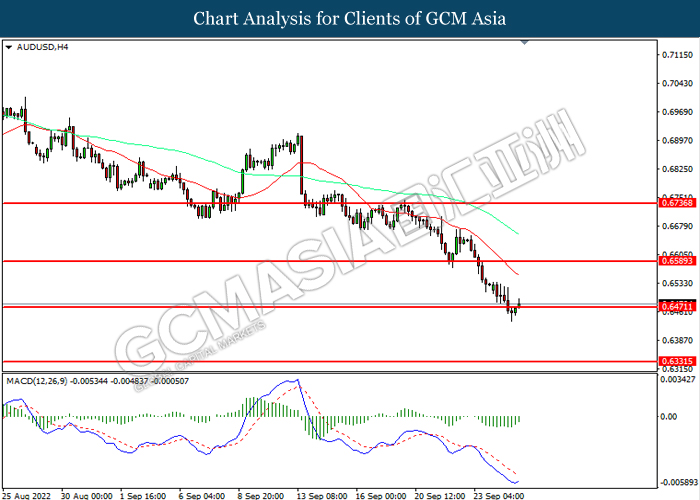

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6590, 0.6735

Support level: 0.6470, 0.6330

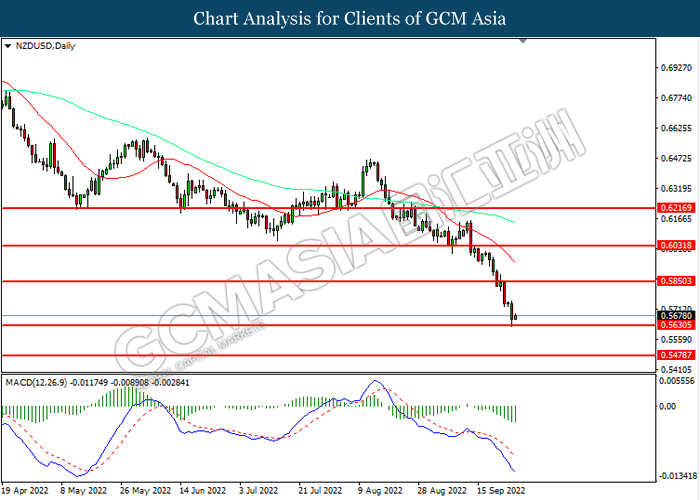

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5850, 0.6030

Support level: 0.5630, 0.5480

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3700, 1.3930

Support level: 1.3365, 1.3100

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9980, 1.0185

Support level: 0.9855, 0.9640

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 81.40, 85.30

Support level: 76.80, 72.35

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1645.20, 1658.50

Support level: 1622.85, 1594.80