12 October 2022 Afternoon Session Analysis

Japanese Yen slumped into 24-year low, trigger intervention expectation.

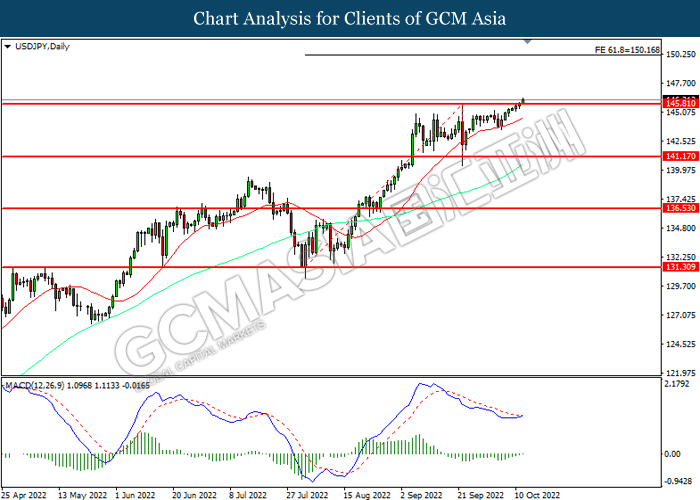

The Japanese Yen slumped into another new 24-year low to US Dollar on Wednesday, spurring market expectation upon the currency intervention by Bank of Japan (BOJ) to stabilize the significant depreciation of the currency. The Japan is currently struggling to cope with high inflation and expensive commodity imports, both of which jeopardizing the Japan’s economy this year. On the other hand, the aggressive rate hike expectation from Federal Reserve had also widened the interest rate gap between Japanese and US Treasury yield. The Bank of Japan has so far shown no indication to increase their interest rates from ultra-low levels, citing continued recession risk in the Japanese region. On the other hand, the US Dollar extend its gains following the International Monetary Fund cut its global economic growth forecast in 2023, which stoked a shift in sentiment toward the safe-haven US Dollar. As of writing, USD/JPY appreciated by 0.24% to 146.20 while the Dollar Index surged 0.21% to 113.25.

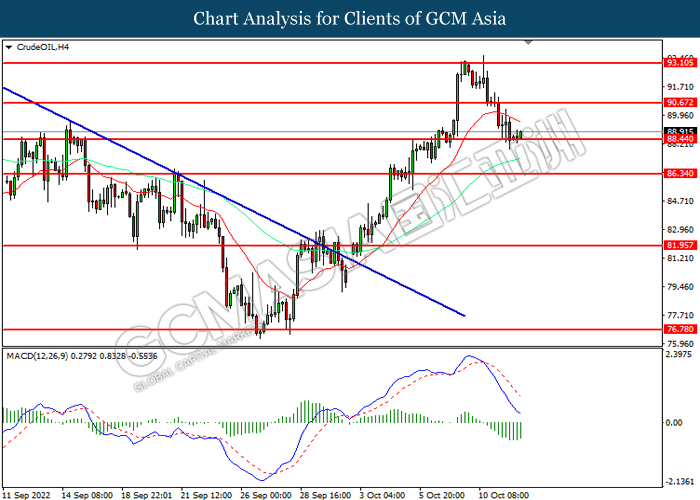

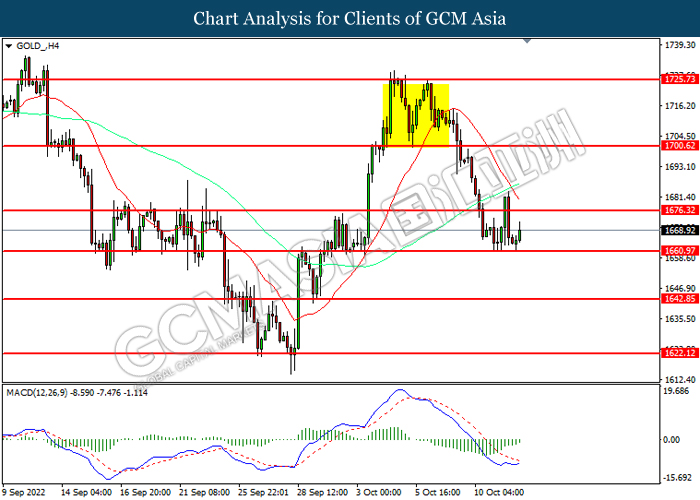

In the commodities market, the crude oil price depreciated by 0.01% to $88.60 per barrel as of writing. The oil market edged lower amid rising recession risk in global economy continue to weigh down the appeal for this black-commodity. On the other hand, the gold price dipped by 0.05% to $1665.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | 0.2% | 0.0% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Aug) | 0.1% | 0.2% | – |

| 20:30 | USD – PPI (MoM) (Sep) | -0.1% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 114.35, 117.05

Support level: 109.95, 107.55

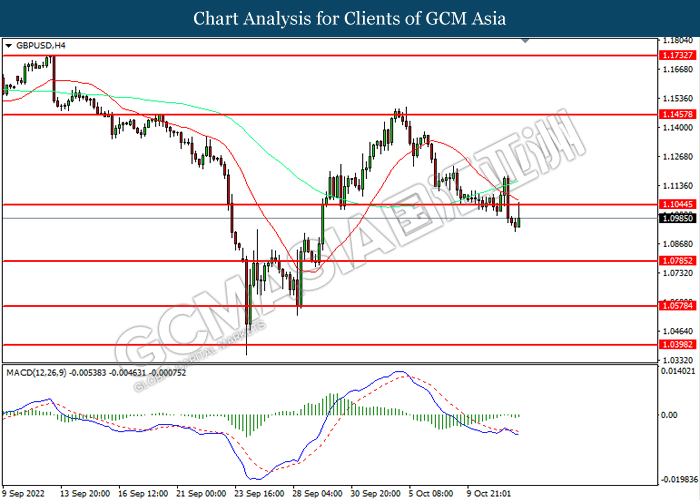

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.1045, 1.1455

Support level: 1.0785, 1.0580

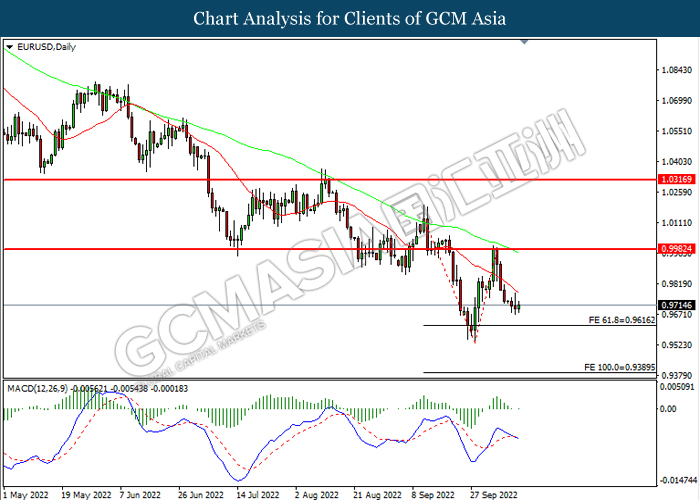

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9980, 1.0315

Support level: 0.9615, 0.9390

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.80, 150.15

Support level: 141.15, 136.55

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6515

Support level: 0.6185, 0.5985

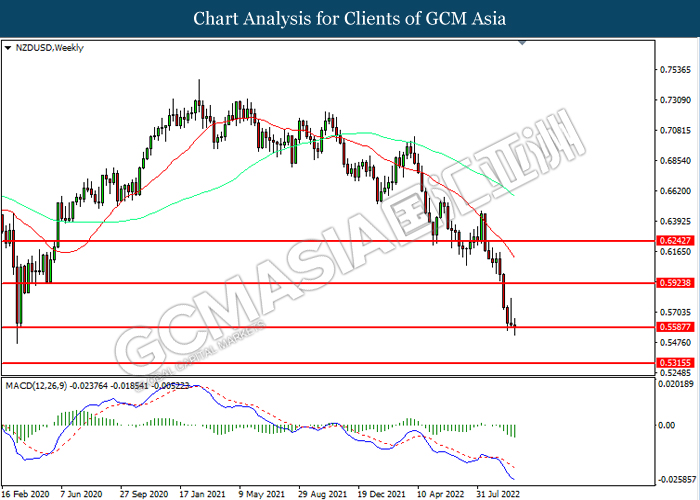

NZDUSD, Weekly: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5925, 0.6245

Support level: 0.5585, 0.5315

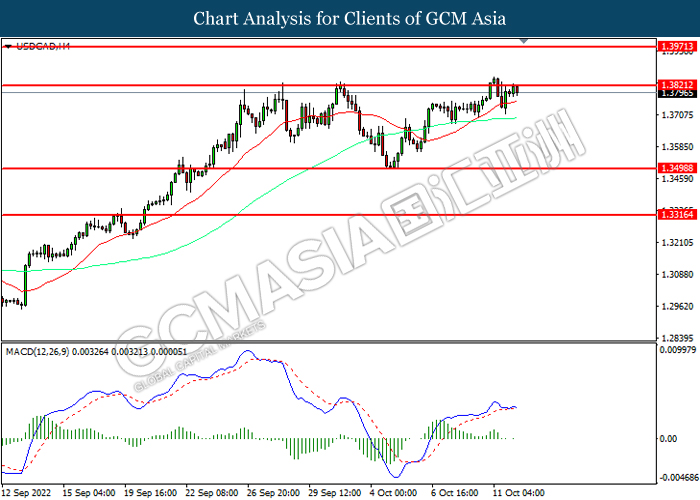

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

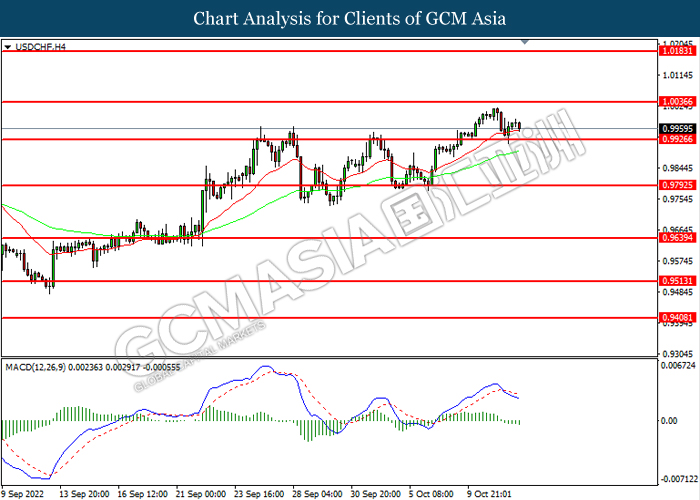

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 90.65, 93.10

Support level: 88.45, 86.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1676.30, 1700.60

Support level: 1660.95, 1642.85