14 October 2022 Morning Session Analysis

US Dollar seesawed following the released of crucial CPI data.

The Dollar Index which traded against a basket of six major currencies whipsawed on yesterday following the released of spiking inflation data from United State region. According to US Bureau of Labor Statistics, US Consumer Price Index (CPI) YoY came in at 8.2%, exceeding the market forecast at 8.1%. Such upbeat inflation data had insinuated greater expectation for the Federal Reserve to continue on its aggressive path of rate hike decision during the FOMC meeting in early November. As for now, the Fed fund futures have speculated in a 9.1% probability of a 100-basis point rate hike and another 90.9% probability of a 75 basis-point increase during the next month’s Federal Reserve policy meeting. Nonetheless, the gains experienced by the US Dollar was limited by the negative job data. The US Initial Jobless Claims came in at 228K, worse than the market forecast at 225K, according to Department of Labor. As of writing, the Dollar Index depreciated by 0.76% to 112.30.

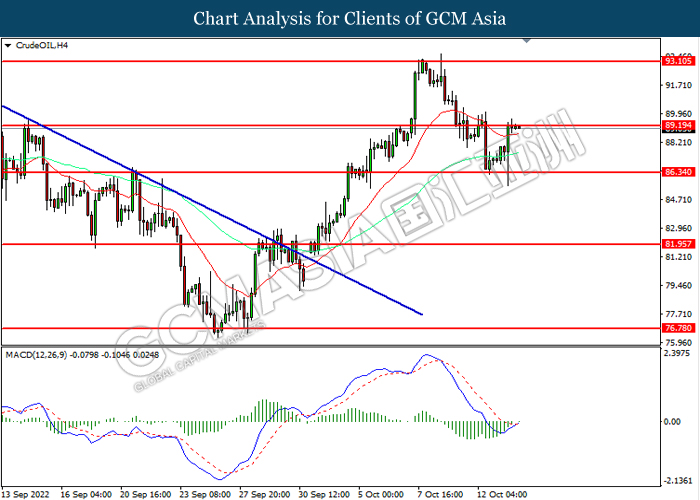

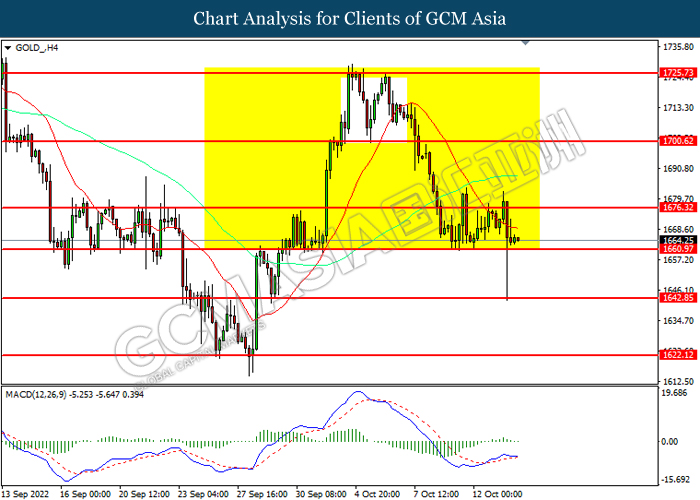

In the commodities market, the crude oil price surged 0.05% to $89.20 per barrel as of writing. The oil market rebounded significantly yesterday amid the depreciation of US Dollar yesterday urged the non-US oil buyer to repurchase this black-commodity. On the other hand, the gold market dipped by 0.09% to $1664.55 per troy ounces as of writing as market participants speculated a more aggressive rate hike decision from the Federal Reserve.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Sep) | -0.3% | -0.1% | – |

| 20:30 | USD – Retail Sales (MoM) (Sep) | 0.3% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. However, MACD which illustrated increasing bearish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.35, 117.05

Support level: 109.95, 107.55

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1455, 1.1735

Support level: 1.1045, 1.0785

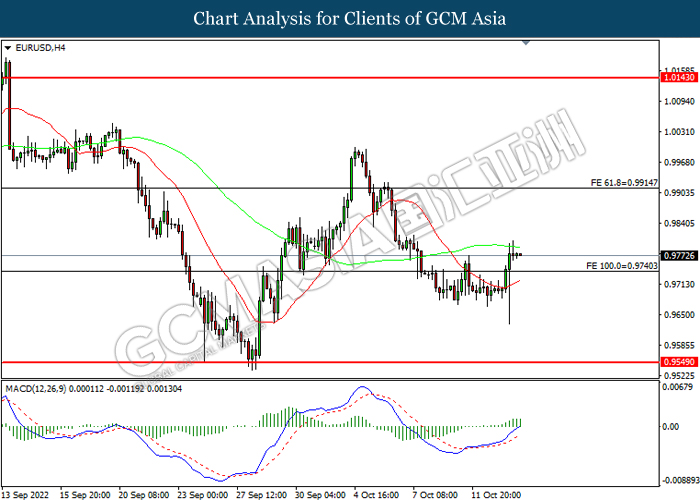

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

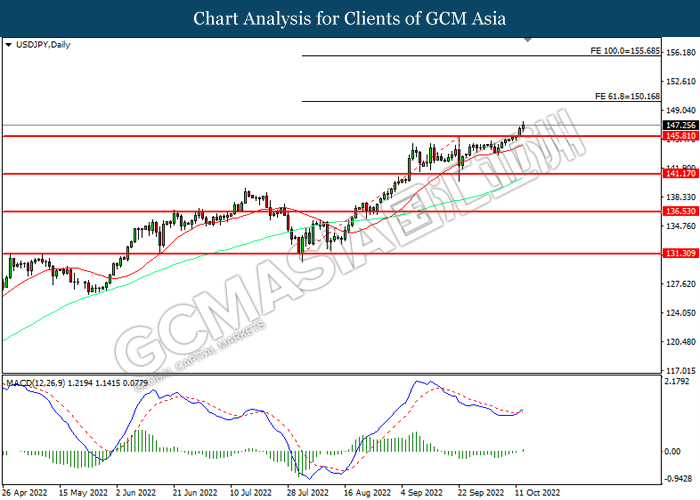

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 150.15, 155.70

Support level: 145.80, 141.15

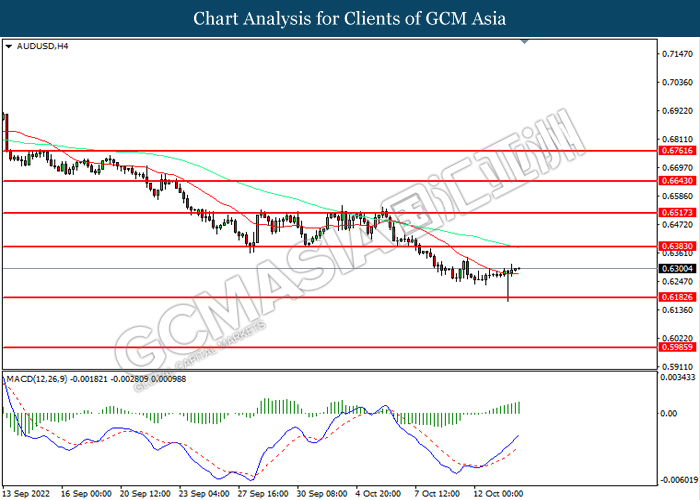

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6385, 0.6515

Support level: 0.6185, 0.5985

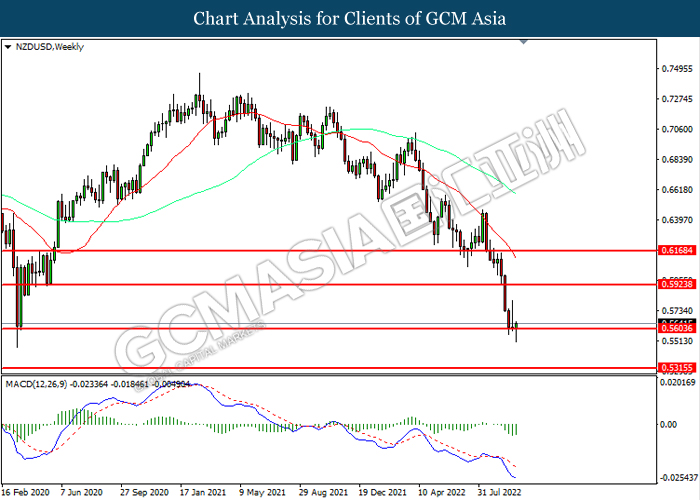

NZDUSD, Weekly: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout the support level.

Resistance level: 0.5925, 0.6170

Support level: 0.5605, 0.5315

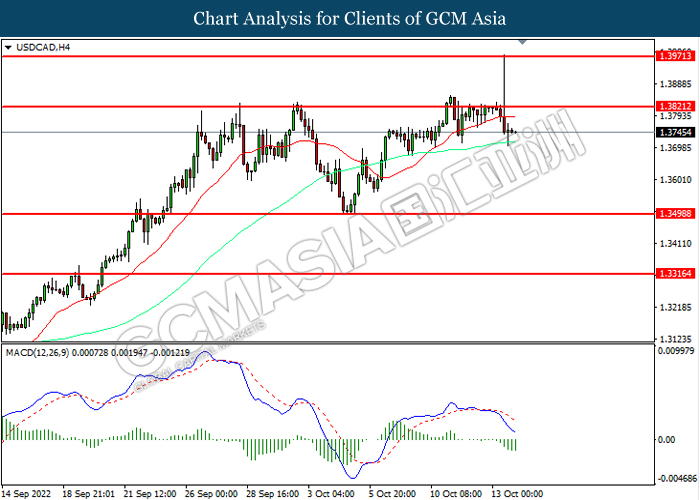

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3820, 1.3970

Support level: 1.3500, 1.3315

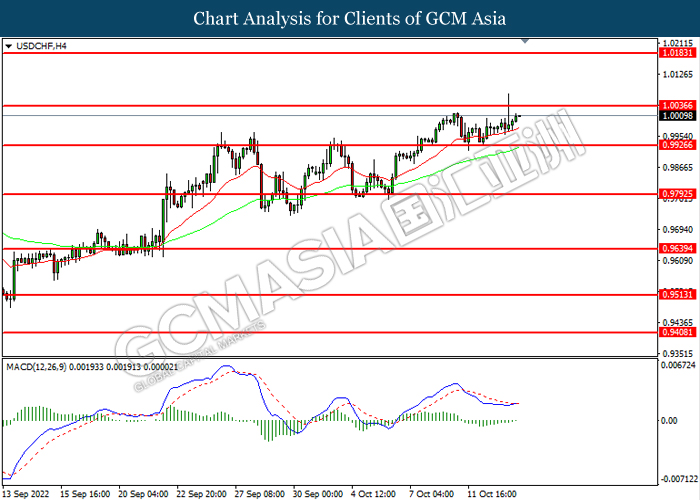

USDCHF, H4: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0035, 1.0185

Support level: 0.9925, 0.9795

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 89.20, 93.10

Support level: 86.35, 81.95

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1676.30, 1700.60

Support level: 1660.95, 1642.85