19 October 2022 Afternoon Session Analysis

Pound ‘stick’ on the ceiling amid BoE start selling bonds.

The Pound Sterling, which was majorly traded by the global investors hovered near the highest level in 2-week after the Bank of England (BoE) announced to start selling bonds. Yesterday, BoE said it would start selling some of its short-term and medium-term UK government bonds from 1st November. However, the plan ruled out the longer-duration bonds selling activity following the recent storm in the British government bond market. Since the outbreak of the Covid-19 crisis, the central bank has been implementing easing monetary policy, where they acquired government bond more than usual to help the economy tide through the pandemic. With that, the BoE and UK government are now in the same position to tackle the sky-high inflation, where both the tightening monetary and fiscal policies are expected to cool down the overheating economy. As of writing, the pair of GBP/USD rose 0.25% to 1.1345.

In the commodities market, the crude oil price rose by 0.07% to $84.10 per barrel following some crude oil draw in the API data early today. Besides, the gold prices dropped 0.12% to $1649.95 per troy ounce following the dollar’s rebound.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Sep) | 9.90% | 10.00% | – |

| 17:00 | GBP – CPI (YoY) (Sep) | 9.10% | 10.00% | – |

| 20:30 | USD – Building Permits (Sep) | 1.542M | 1.530M | – |

| 20:30 | CAD – Core CPI (MoM) (Sep) | 0.00% | – | – |

| 22:30 | USD – Crude Oil Inventories | 9.880M | – | – |

Technical Analysis

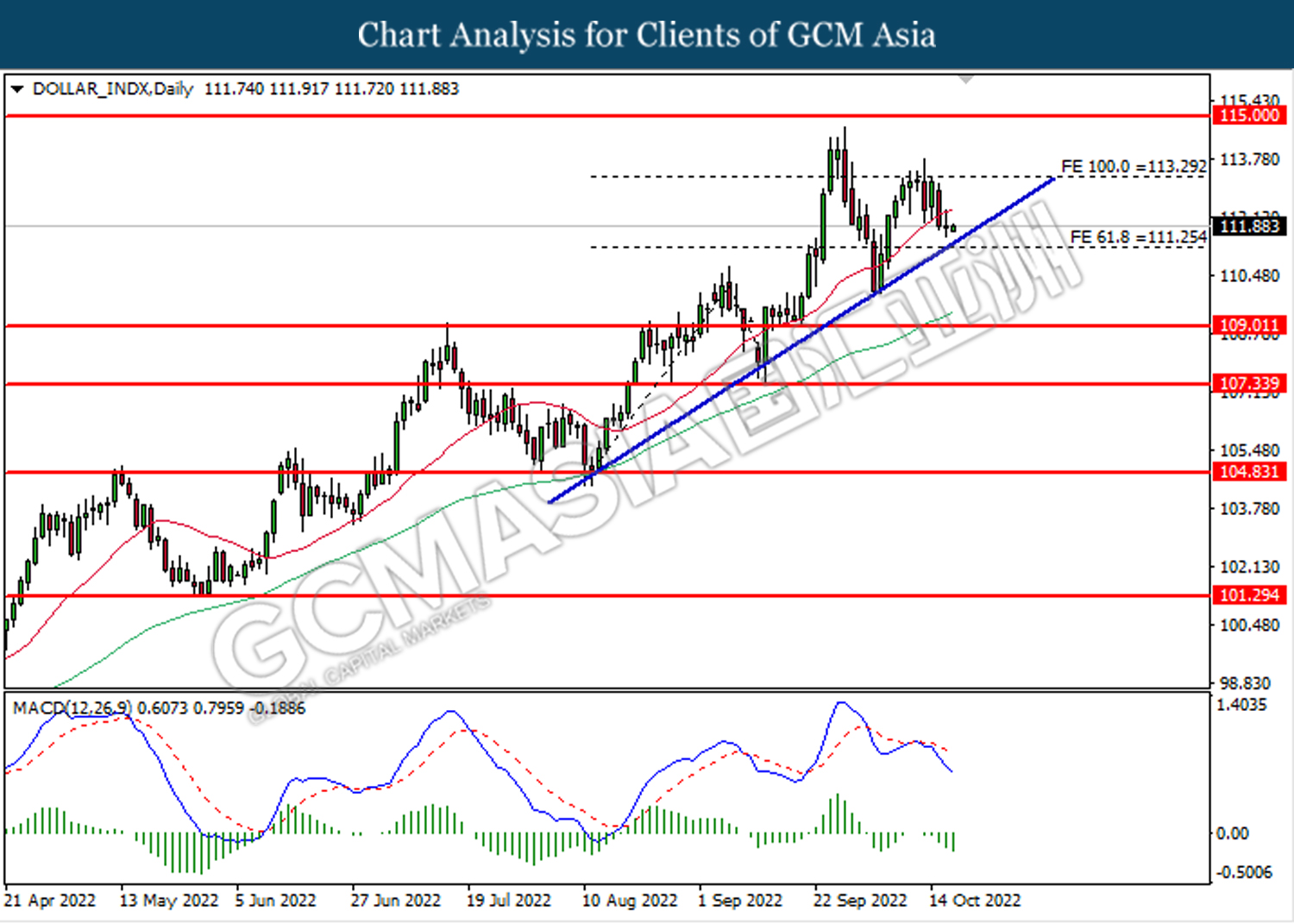

DOLLAR_INDX, Daily: Dollar index was traded lower following the retracement from the resistance level at 113.30. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 111.25.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

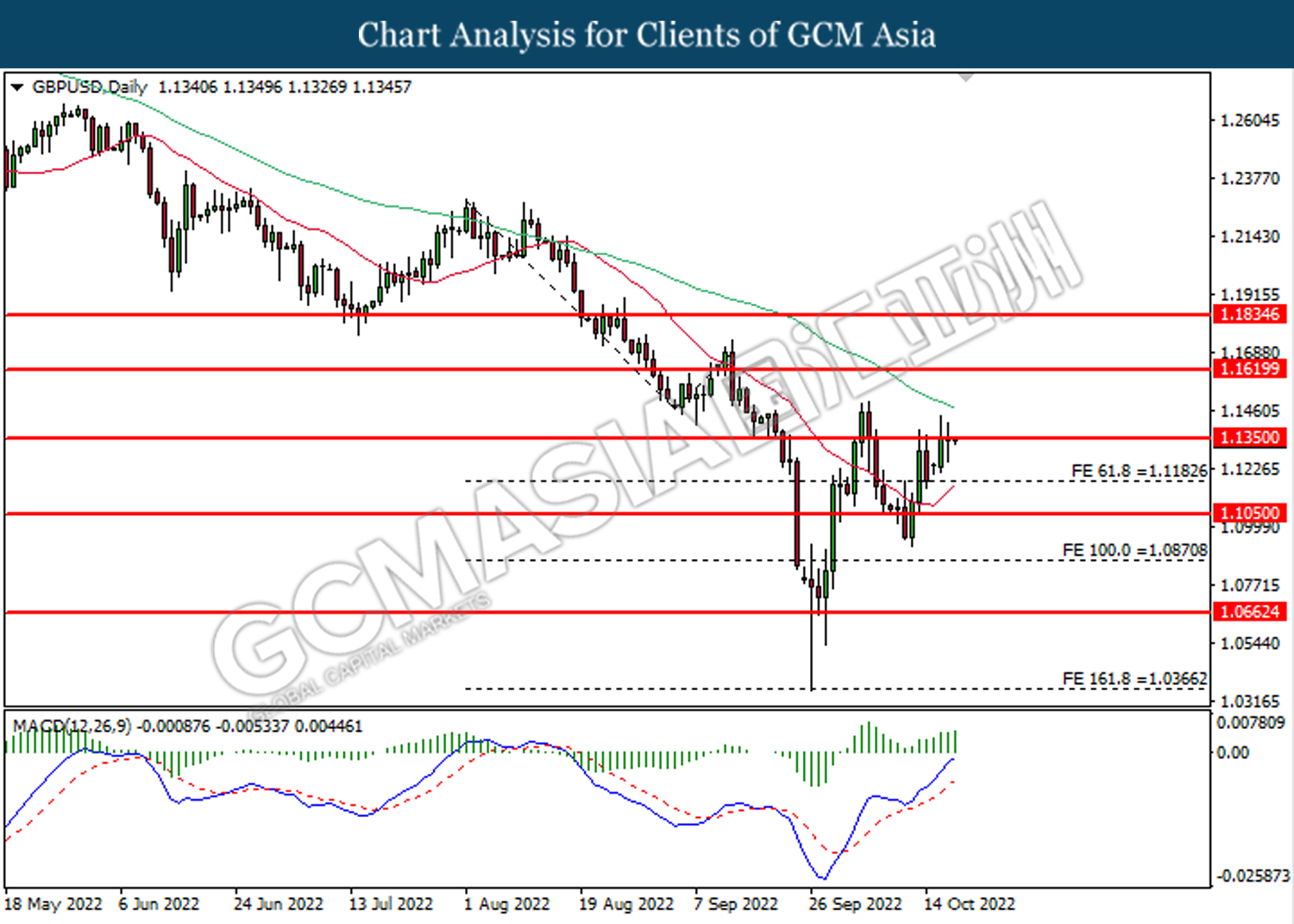

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1350. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

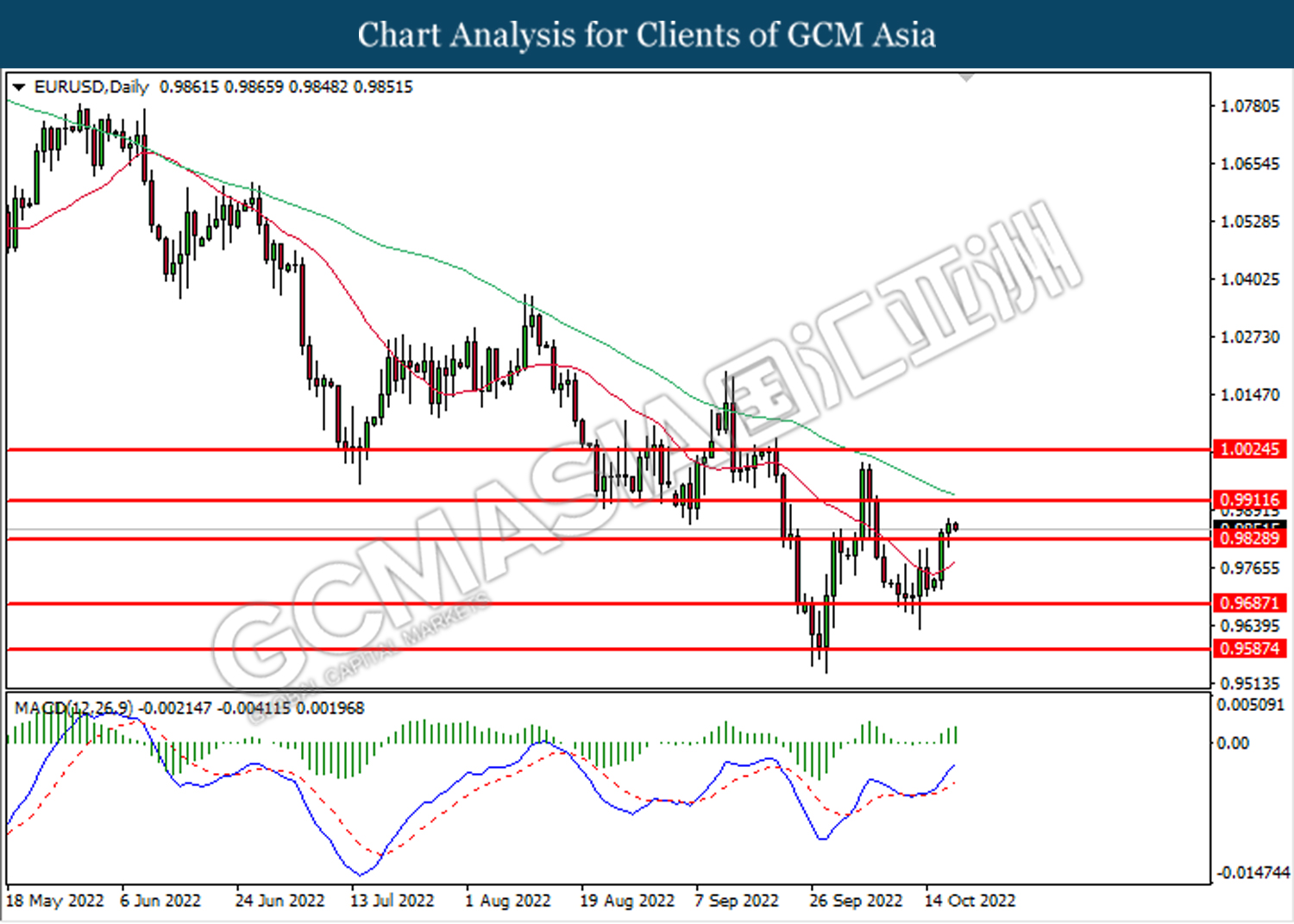

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9830. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9910.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

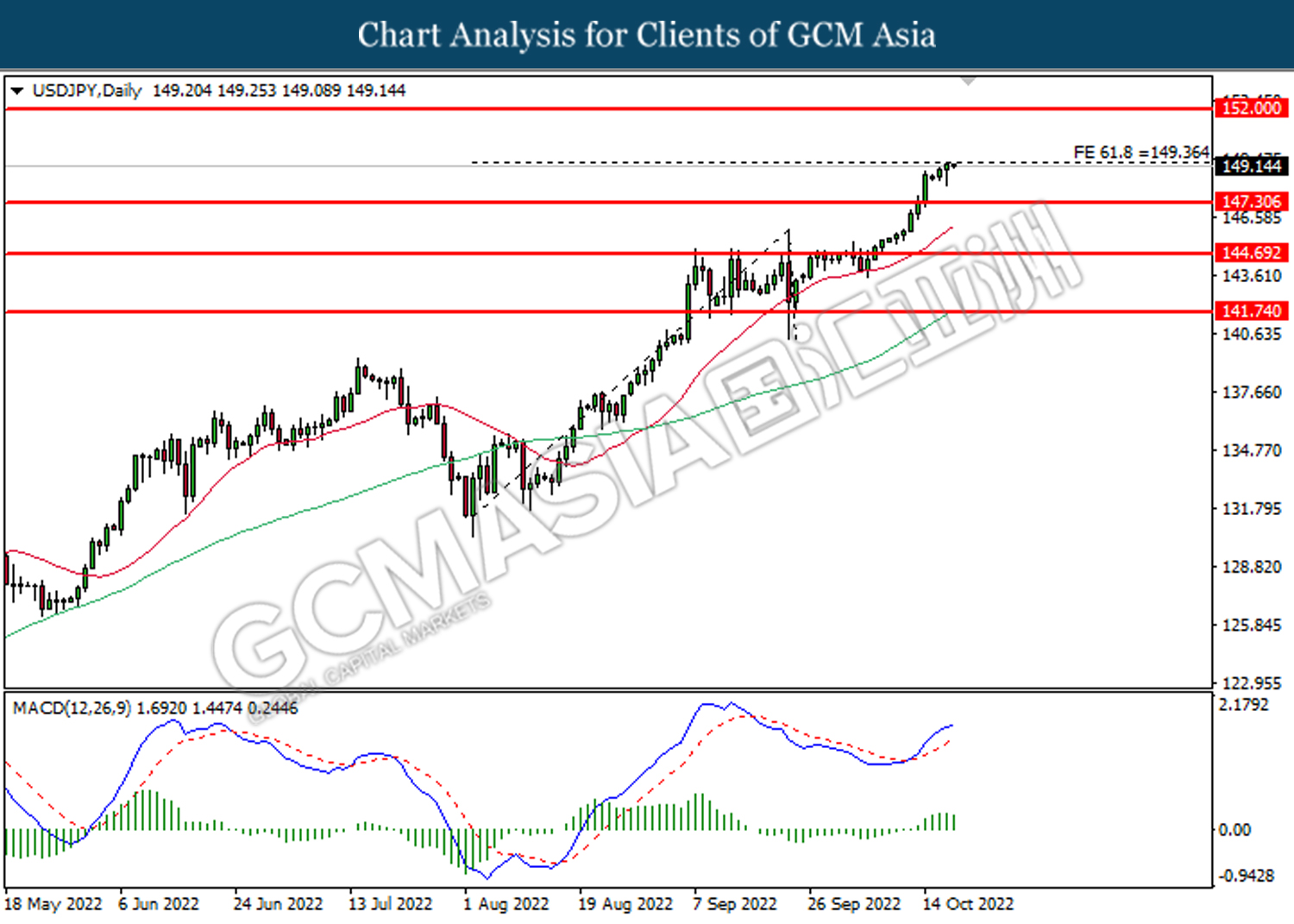

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

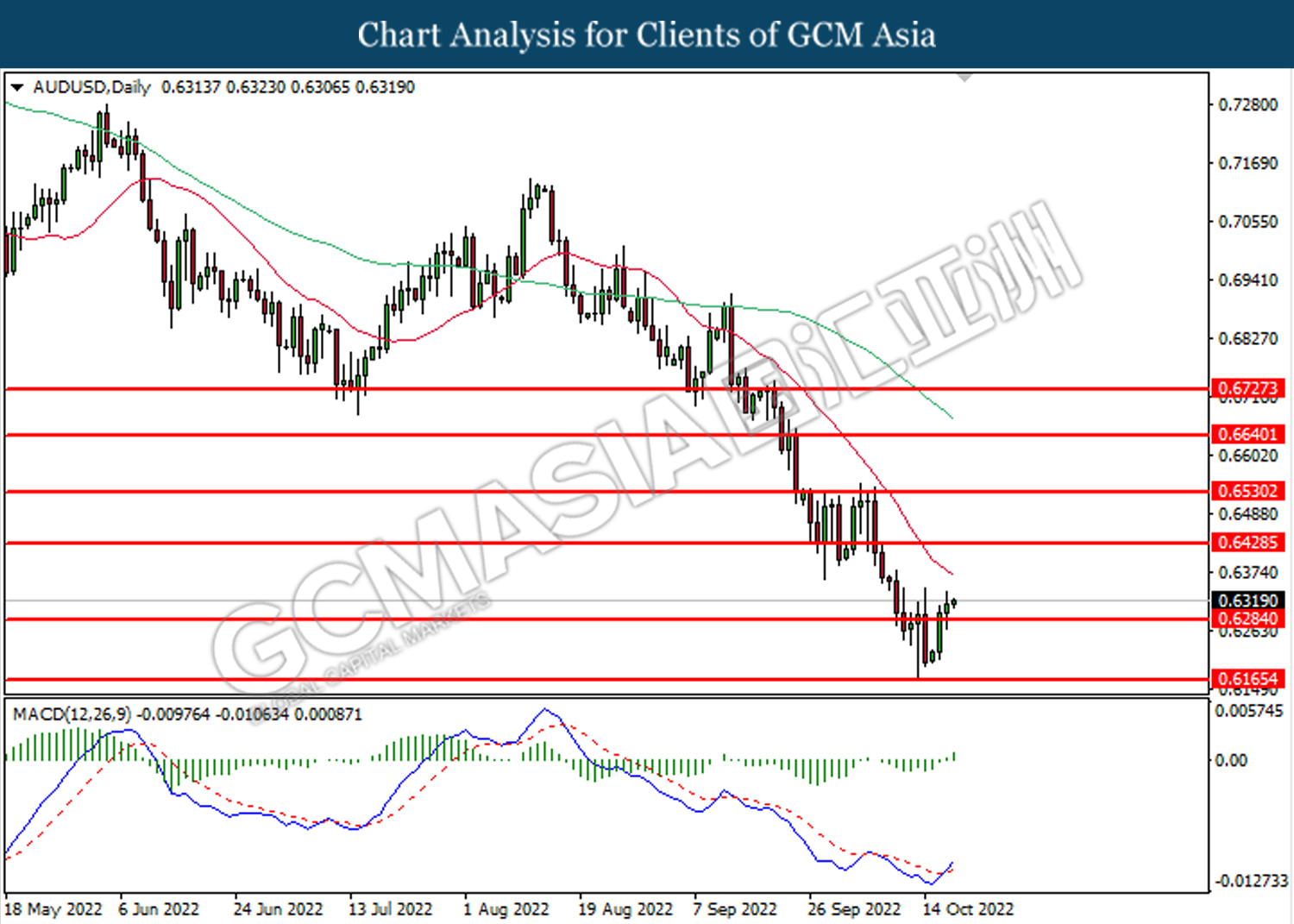

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6285. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6430.

Resistance level: 0.6430, 0.6530

Support level: 0.6285, 0.6165

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5710. MACD which illustrated bullish bias momentum suggest the pair to extend gains after it successfully breakout above the resistance level at 0.5710.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

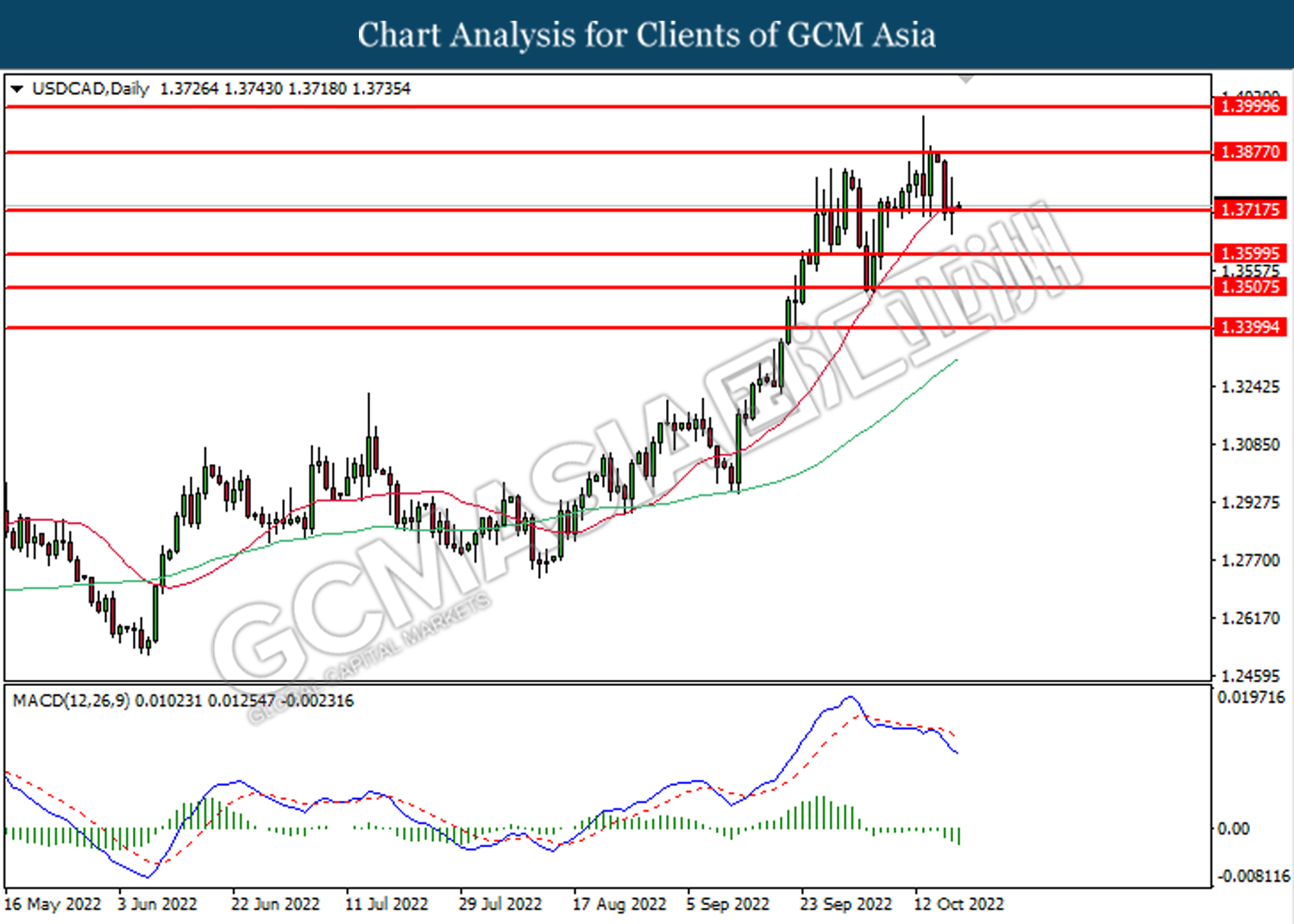

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3715. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9930. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0030, 1.0110

Support level: 0.9930, 0.9840

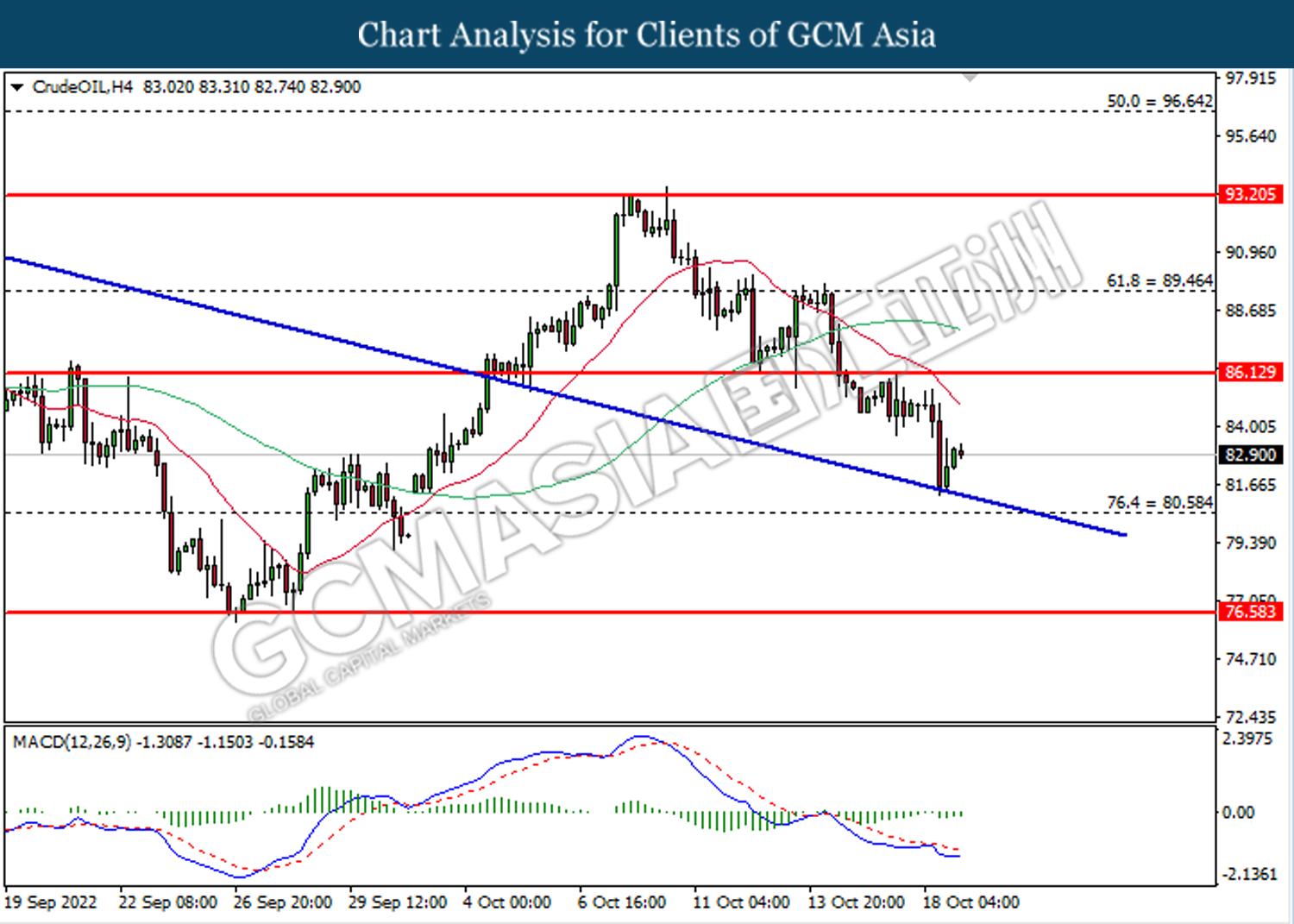

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the downward trendline. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 86.15.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its rebound toward the resistance level at 1661.40.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00