20 October 2022 Morning Session Analysis

The rising treasury yield pushed the dollar higher.

The dollar index, which traded against a basket of six major currencies, managed to pare its losses after consolidating for few trading sessions amid the rising treasury yield. At the moment, the benchmark 10-year Treasury yield hit the highest level in 14 years as the market participants are expecting the Federal Reserve to increase the interest rate aggressively in the upcoming meeting, in order to cool down the overheating economy. According to the CME FedWatch Tool, the probability of a 75-basis point rate hike is about 94.5%, far higher than the 1-week ago reading. On the other sides, a series of upbeat economic data which have been released during the past few weeks showed that the US labor market remained resilience, while there was no sign of recession at this point of time. With that, it actually provides more room for the Federal Reserve to hike the cash rate in a more aggressive way. As of writing, the dollar index rose 0.67% to 112.90.

In the commodities market, the crude oil price rose by 2.21% to $85.90 per barrel following some crude oil draw in the US EIA data yesterday night. According to the EIA, US Crude Oil Inventories data dropped by -1.725M, missing the economist forecast at 1.380M. Besides, the gold prices dropped 0.06% to $1628.20 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leader Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 228K | 230K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Oct) | -9.9 | -5.0 | – |

| 22:00 | USD – Existing Home Sales (Sep) | 4.80M | 4.70M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

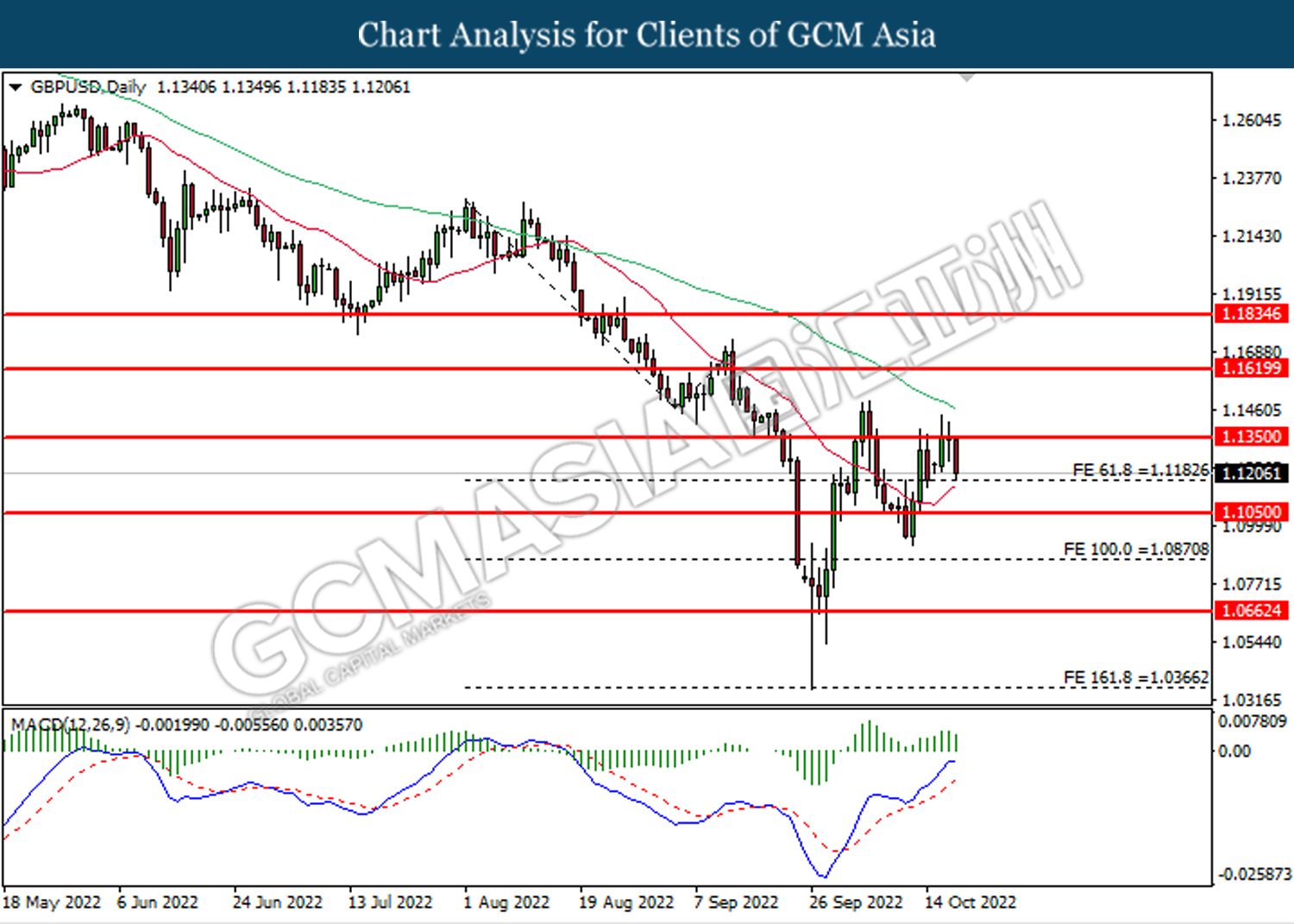

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1350. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1185.

Resistance level: 1.1350, 1.1620

Support level: 1.1185, 1.1050

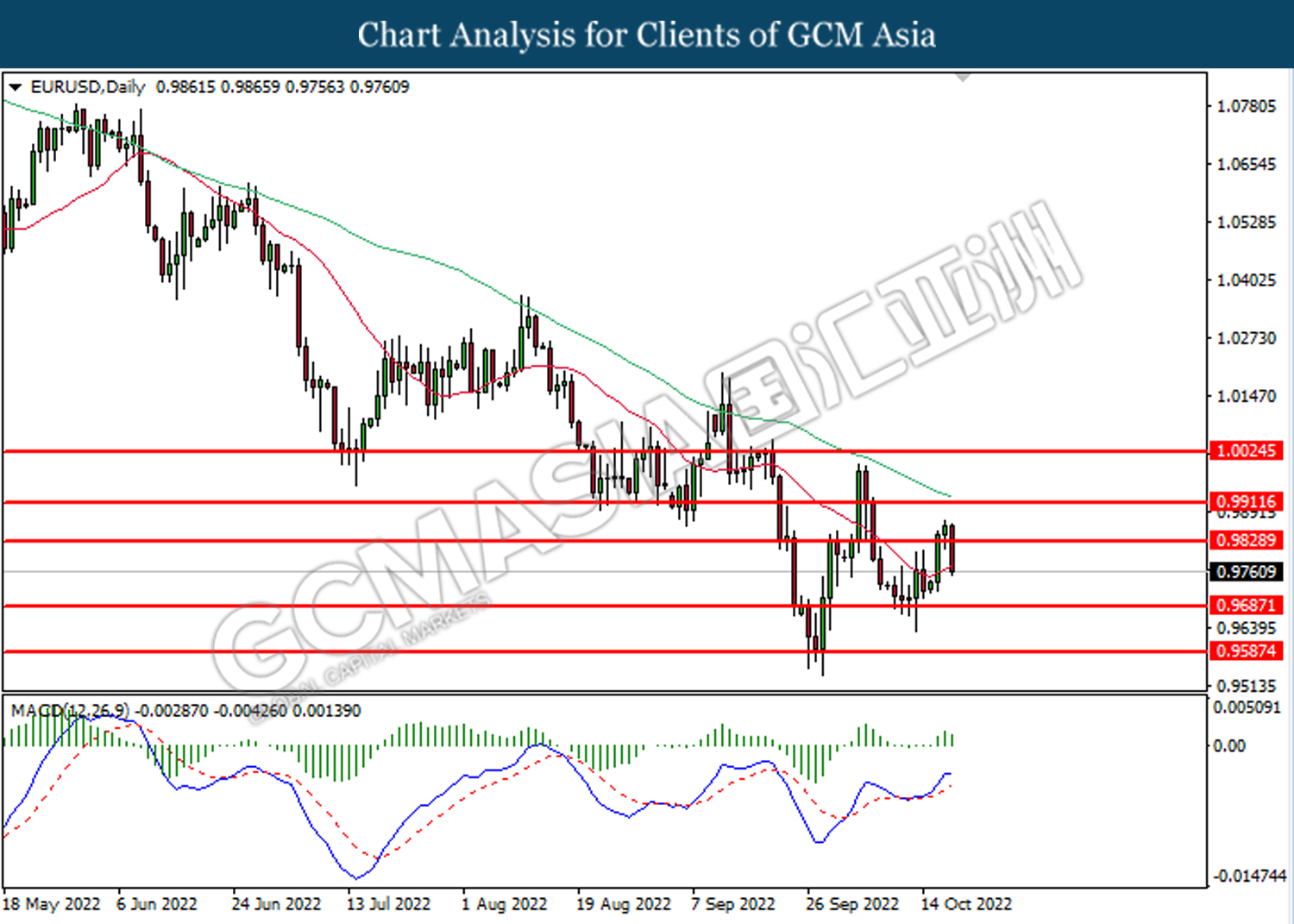

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 0.9830. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9685.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 149.35. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after its candle successfully closes above the resistance level.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

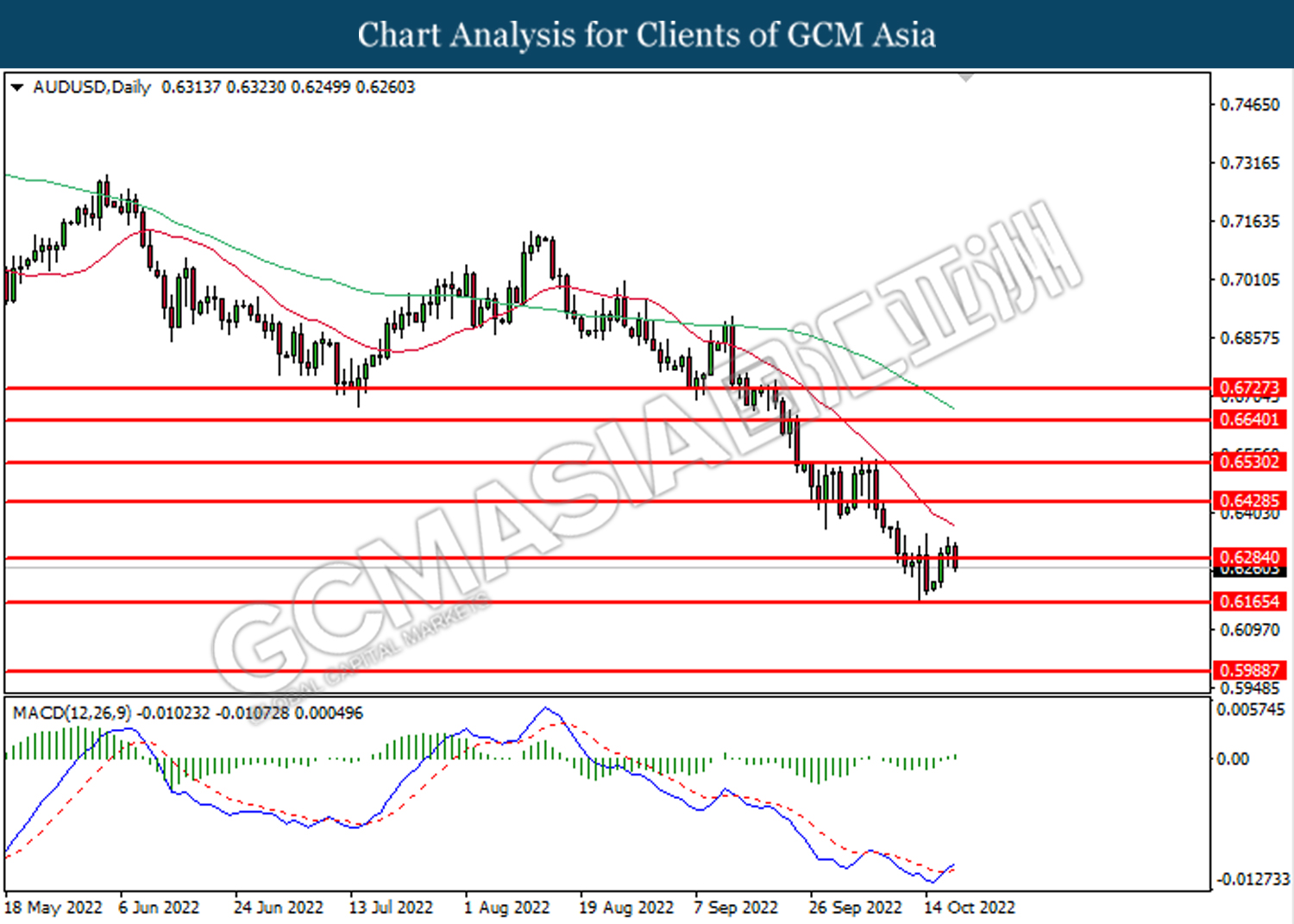

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6285. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6430, 0.6530

Support level: 0.6285, 0.6165

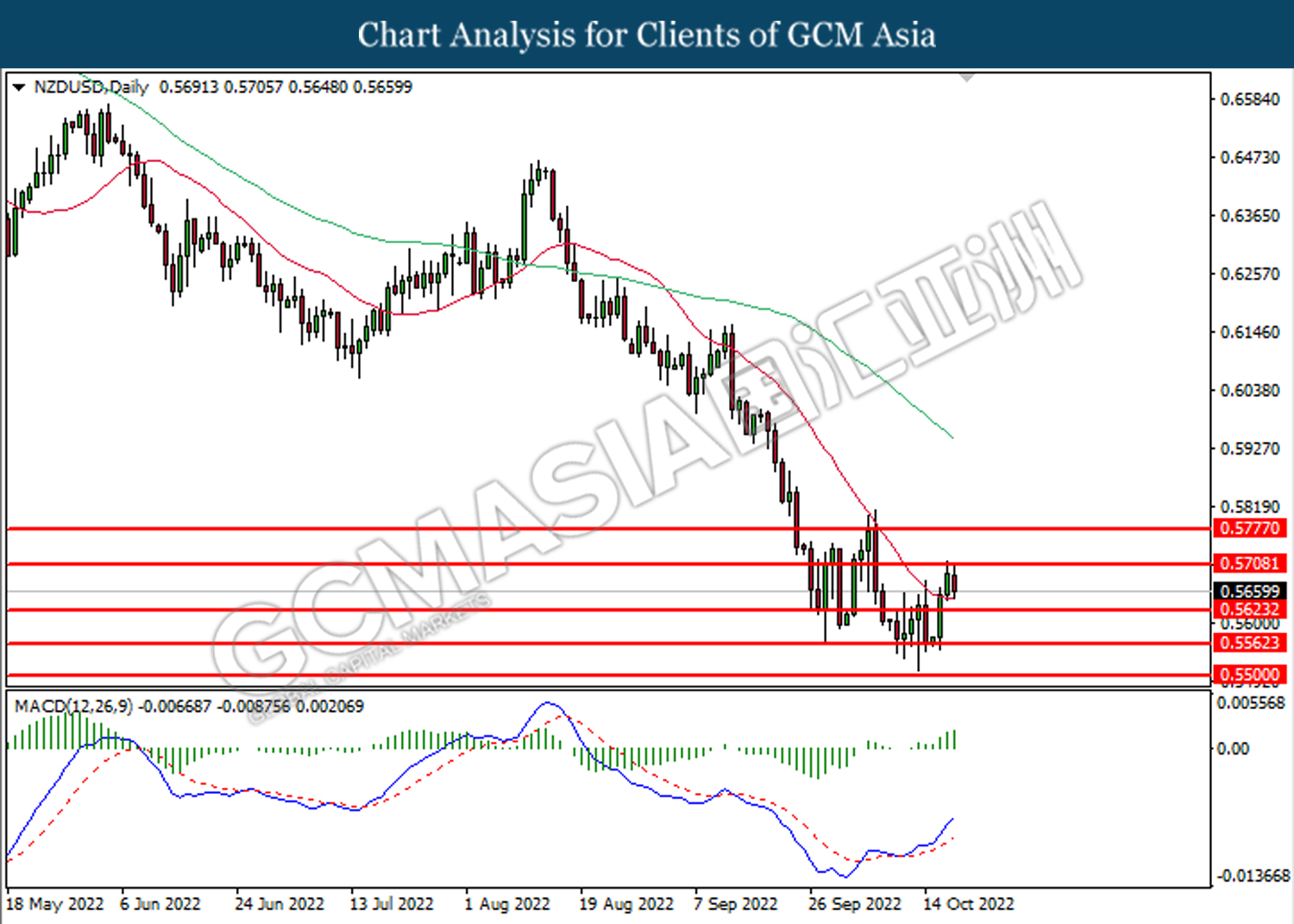

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.5710. However, MACD which illustrated bullish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 0.5710, 0.5775

Support level: 0.5625, 0.5560

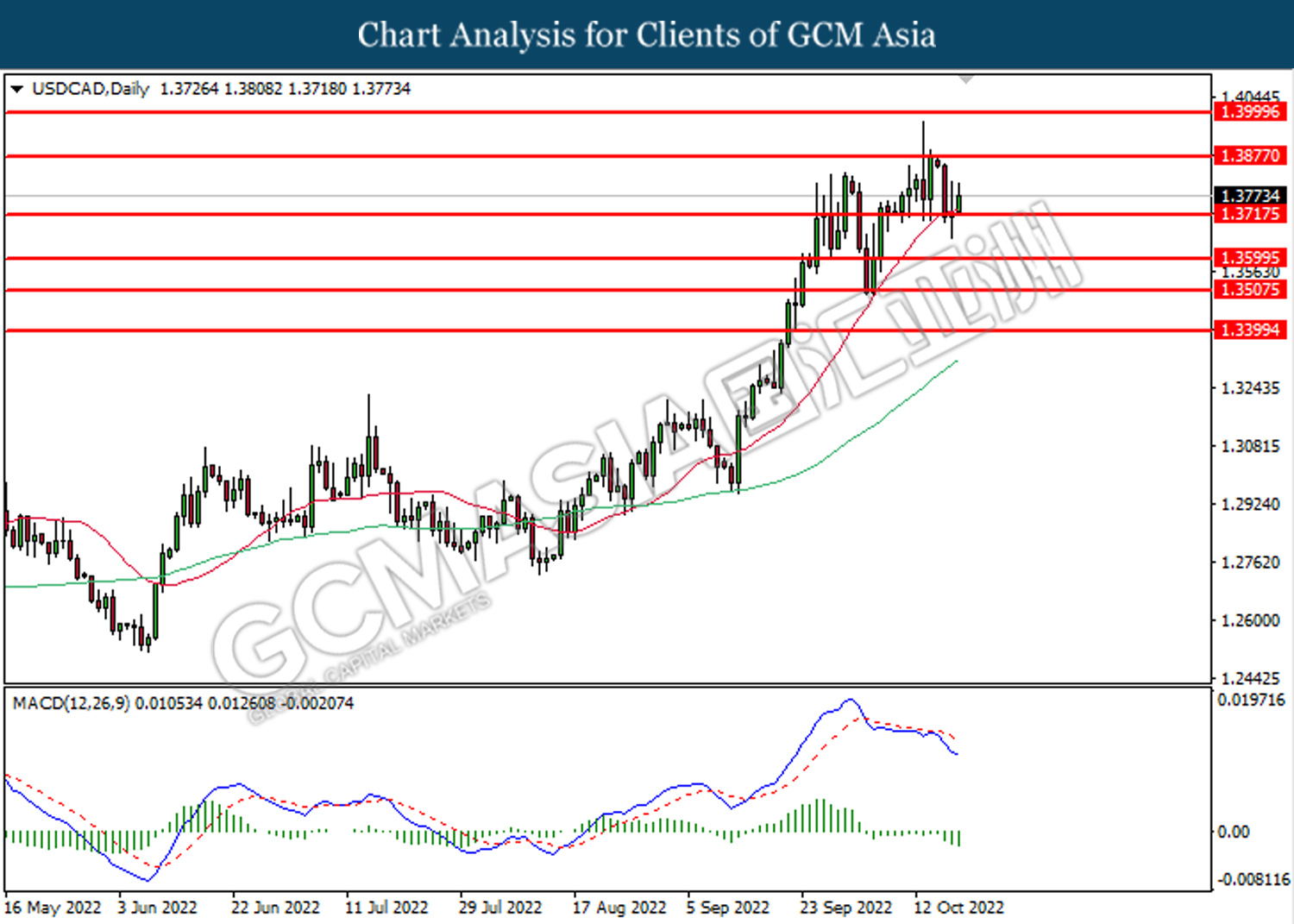

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3715. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical retracement in short term.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

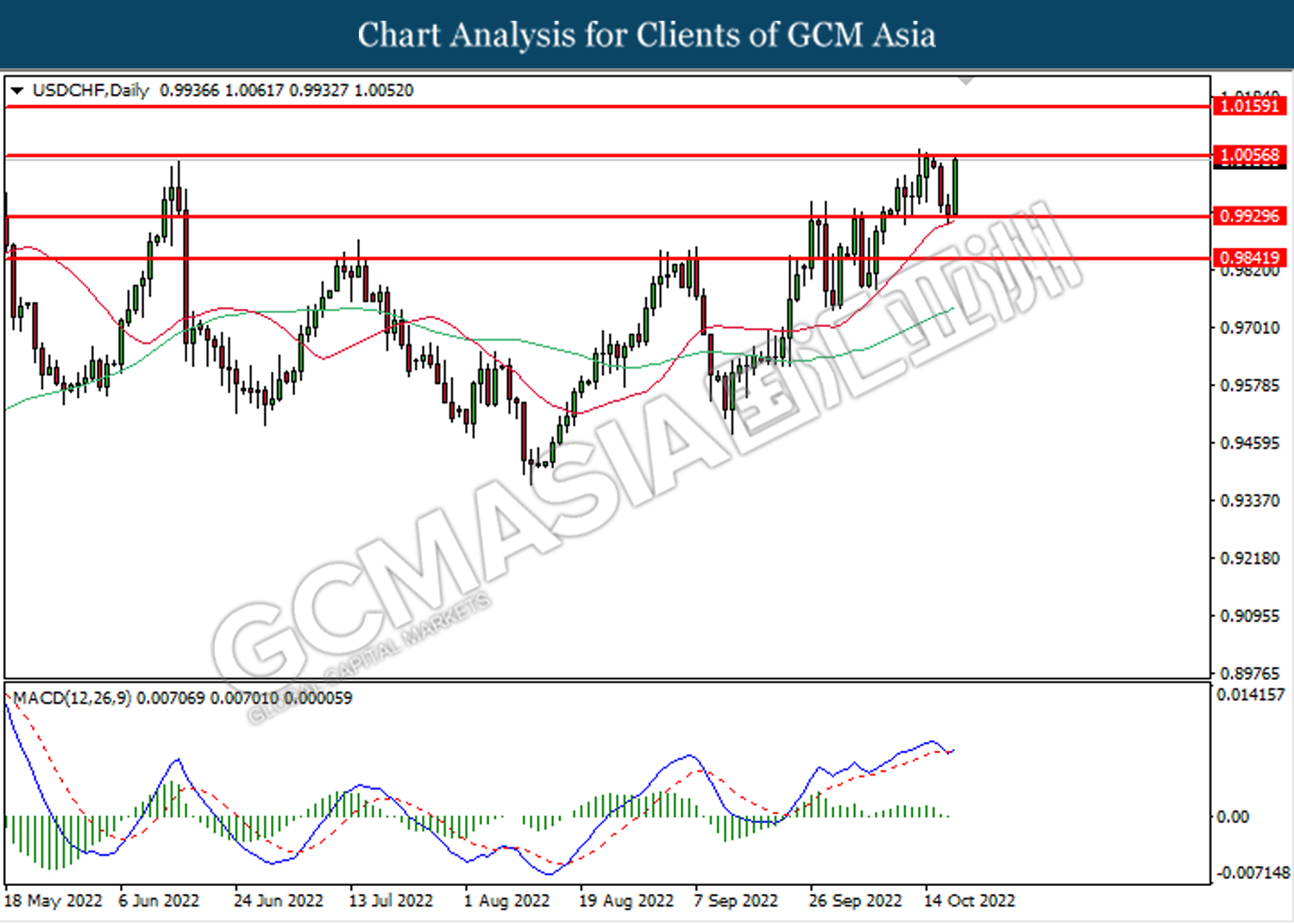

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 1.0055. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

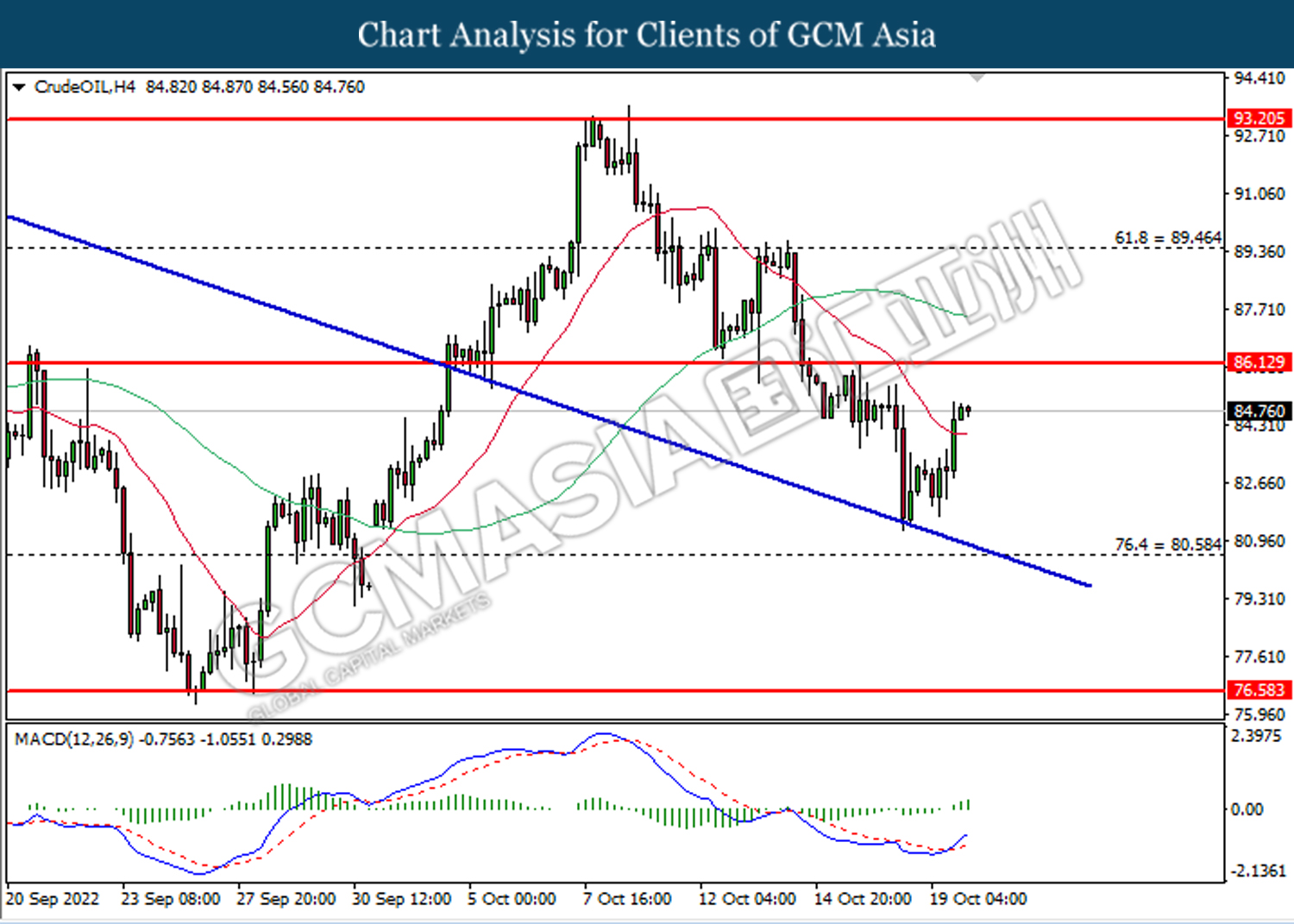

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the downward trendline. MACD which illustrated bullish bias momentum momentum suggests the commodity to extend its gains toward the resistance level at 86.15.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.60

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1627.60. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1661.40, 1693.35

Support level: 1627.40, 1600.00