20 October 2022 Afternoon Session Analysis

Pound retraced from recent high upon bearish pessimistic economy outlook.

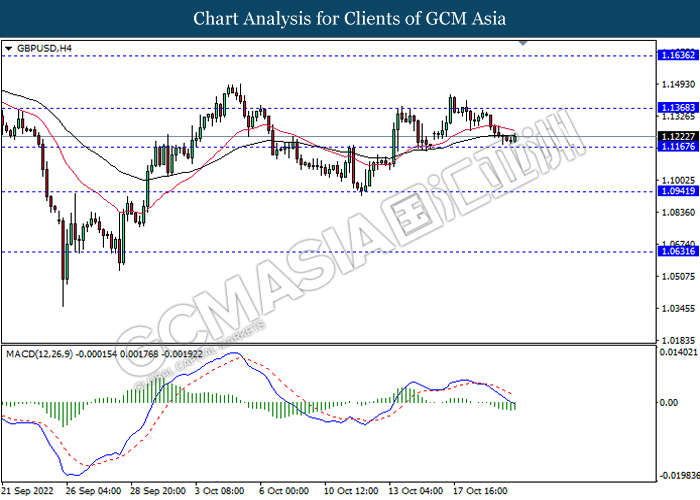

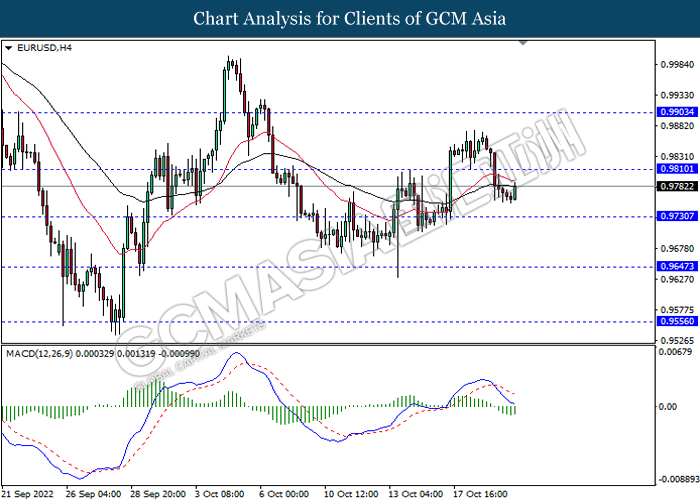

The GBP/USD which traded by majority of investors dropped significantly on yesterday following the economic progression in UK remained clouded. On the economic data front, the UK Consumer Price Index (CPI) YoY in September notched up from the previous reading of 9.9% to 10.1%, exceeding the market forecast of 10%. This crucial inflationary data would likely to lead Bank of England to raise its interest rate in order to stabilize the sky-high inflation. Though, with the downbeat economic data that had been released last week, it hinted that the UK economy started entering into recession. With the rate hike expectation upon weaken UK economy, it would likely to cause another serious issues such as stagflation risk. Thus, it dragged down the value of Pound Sterling. On the other hand, the EUR/USD slumped on yesterday amid the diminishing inflation risk. The Eurozone Consumer Price Index (CPI) YoY posted at the figures of 9.9%, lower than the consensus expectation of 10%. As of writing, the GBP/USD edged up by 0.09% to 1.1224 while EUR/USD rose by 0.10% to 0.9783.

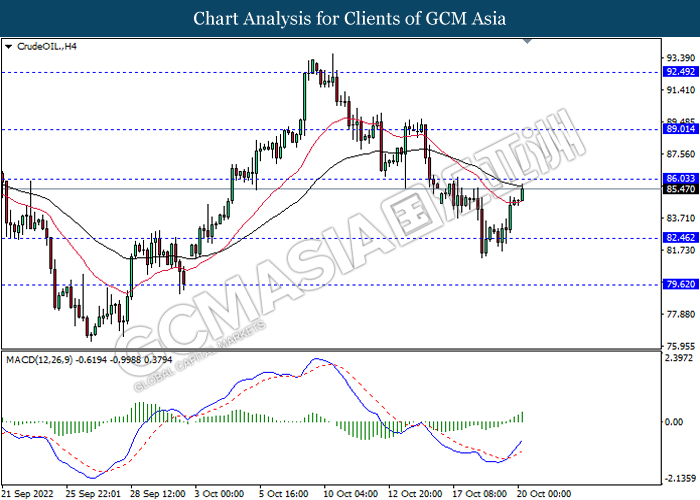

In the commodities market, the crude oil price raised by 1.37% to $85.67 per barrel as of writing, as caution over tightening supply outweighed the negative impact of uncertain demand. In addition, the gold price appreciated by 0.19% to $1633.01 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leader Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 228K | 230K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Oct) | -9.9 | -5.0 | – |

| 22:00 | USD – Existing Home Sales (Sep) | 4.80M | 4.70M | – |

Technical Analysis

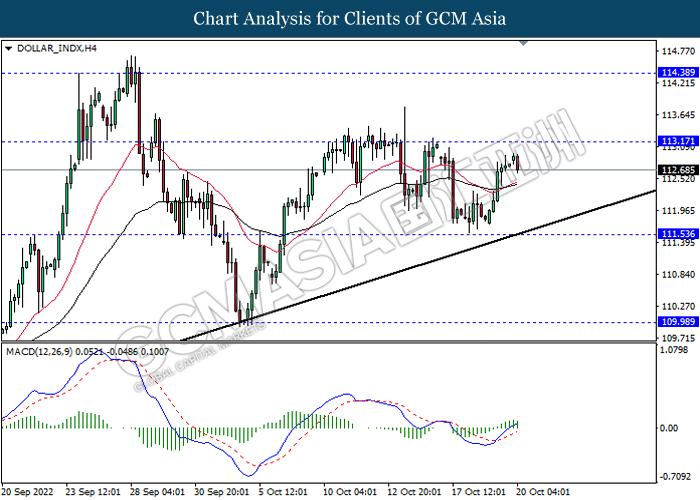

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 113.15, 114.40

Support level: 111.55, 109.95

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9810, 0.9905

Support level: 0.9730, 0.9645

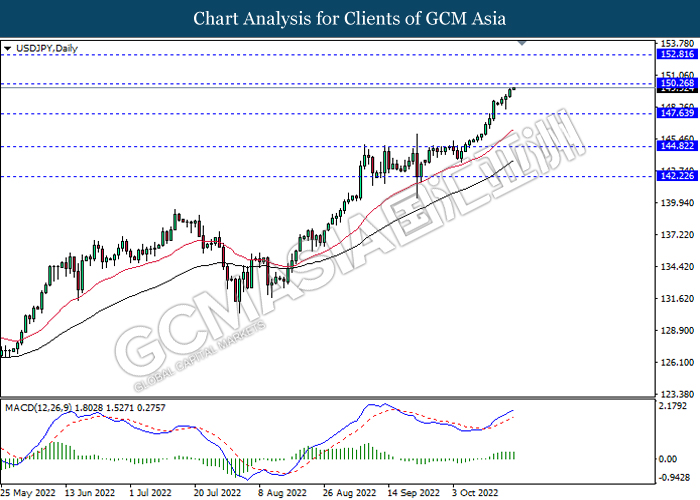

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

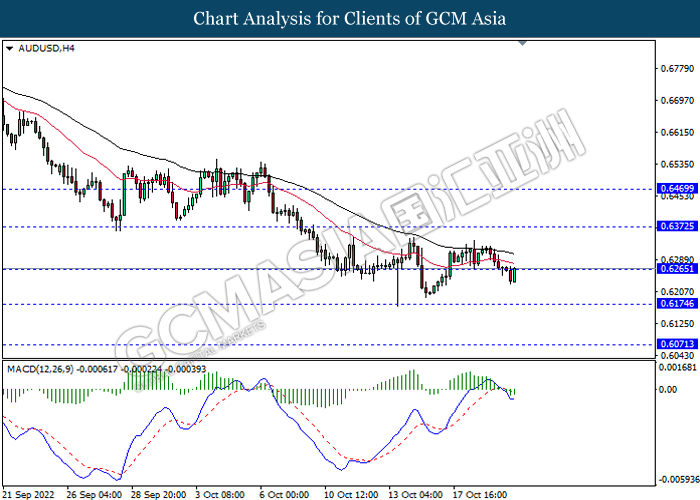

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6265, 0.6370

Support level: 0.6175, 0.6070

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.5725, 0.5805

Support level: 0.5635, 0.5545

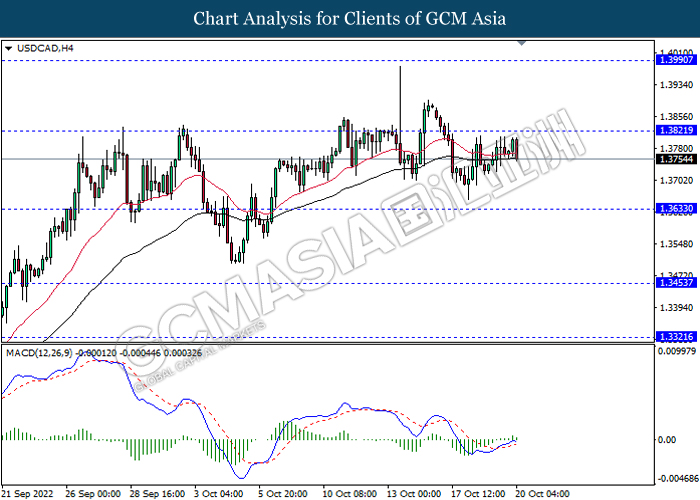

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

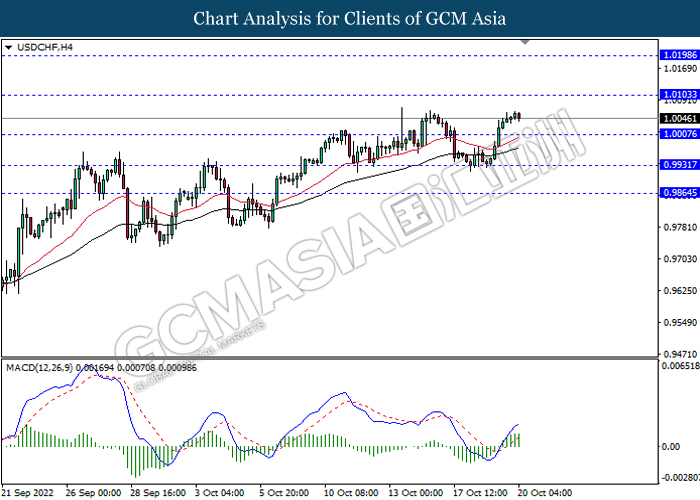

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0105, 1.0200

Support level: 1.0005, 0.9930

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 86.05, 89.00

Support level: 82.45, 79.60

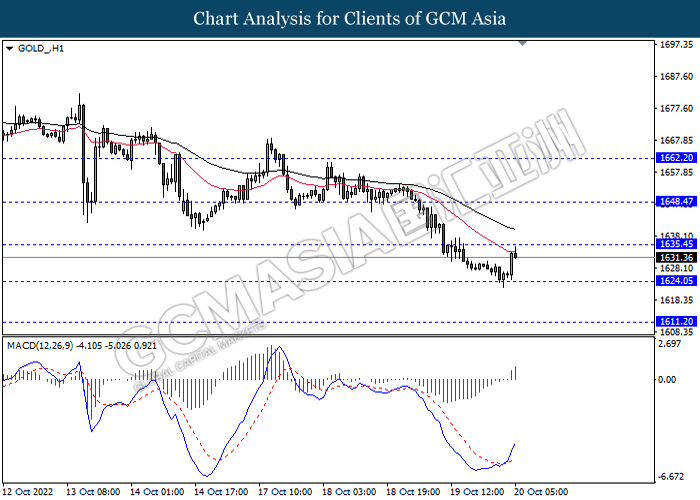

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1635.45, 1648.45

Support level: 1624.05, 1611.20