14 May 2018 Weekly Analysis

GCMAsia Weekly Report: May 14 – 18

Market Review (Forex): May 7 – 11

Greenback slid lower against other major currencies for the third day on last Friday while investors booked their profits after it rallied to the highest level of the year due to boosted expectation for a faster pace of interest rate hike by the Federal Reserve. The dollar index was down 0.14% while quoted at 92.44 during late trading after touching four-months high of 93.26 on Wednesday.

Prior rally in the greenback loses its momentum following weaker-than-expected inflation data from last Thursday which has tempered some expectation for a more aggressive rate hike by the Feds. According to the US Bureau of Labor Statistics, Core CPI for the month of April came in at only 2.1%, missing economist expectation of 2.2%.

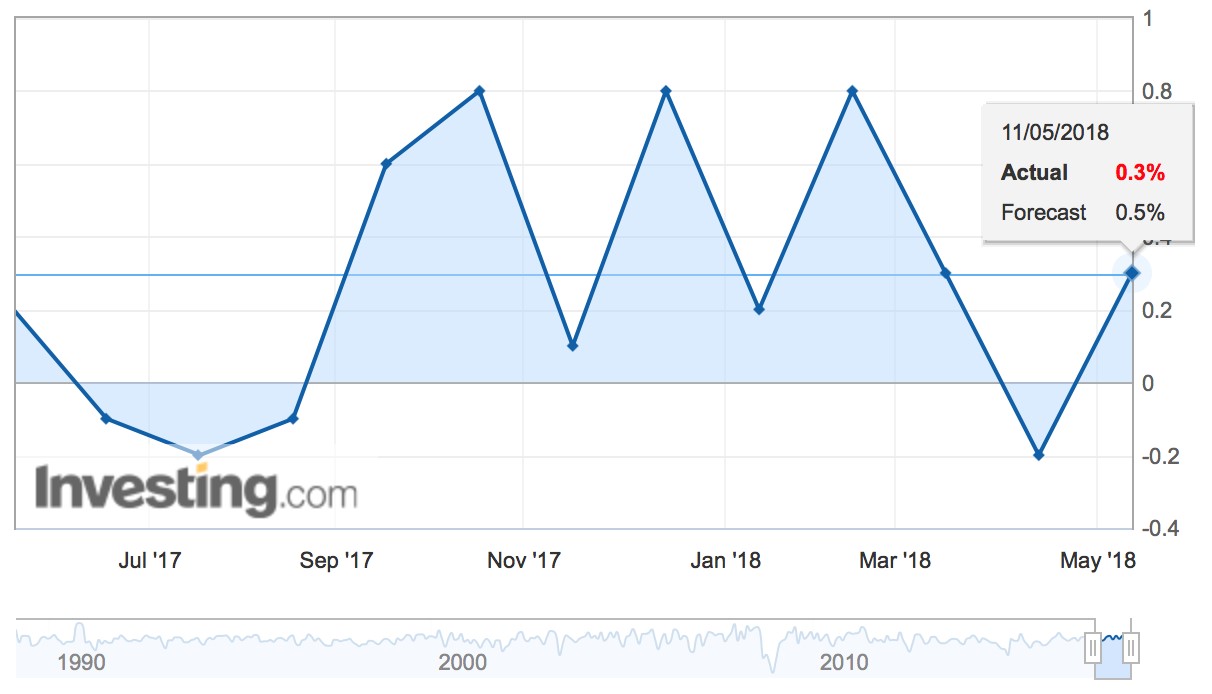

Adding on further upon the current bearish pressure was a lower-than-expected Import Price Index which came in with only 0.3% for the month of April, slightly lower than economist consensus for a 0.5% reading. Both data which has portrayed some sluggishness in inflationary pressure has led some investors to scale down their bullish bets for the time being.

US Core Inflation Rate

—– Forecast

US Core Inflation Rate came in with only 2.1%, missing economist forecast of 2.2% for the month of April.

US Import Price Index

US Import Price Index missed economist forecast with only 0.3% versus 0.5% seen.

USD/JPY

Pair of USD/JPY was little changed last Friday, last quoted at 109.39 while recording a weekly gain of 0.23%.

EUR/USD

Euro climbs further against the greenback, up 0.22% to $1.1941. However, gains remained capped following recessive economic momentum in the EU zone since the start of the year that may hinder ECB from making any changes to their stimulus program by September.

GBP/USD

Pairing of GBP/USD rose 0.17% to $1.3542 as investors book their profits on the greenback.

Market Review (Commodities): May 7 – 11

GOLD

Gold price ended lower last Friday as investors cheered over subsiding geopolitical risk from the Korean Peninsula over the announcement of summit details in between the US and North Korea during last week. Price of the yellow metal was down 0.24% while ended the week at $1,318.21 a troy ounce.

The announcement of summit between the United States and North Korea that are due to be held in Singapore next month has paved way for higher demand of riskier assets. Previously, heightened geopolitical risk between both nations has limit risk appetite in the market when US and North Korea threw war threats against each other, risking an imminent outbreak of nuclear war between both countries.

Crude Oil

Crude oil price settled lower last Friday while posting a weekly gain as market sentiment turned positive despite rising output from the United States. Price of the black commodity fell 1.25% to $70.52 albeit well supported above the $70 threshold.

According to the oilfield service provider, Baker Hughes reported that the number of active oil drilling rig in the US rose by 10 to 844. The uptick has raised expectation for a further ramp up in US output after data released on Wednesday showed that the domestic output has climbed by 84,000 barrels per day to 10.7 million barrels per day.

The level of output in US is now inching nearer to the world largest oil producer – Russia which currently clocks in at 11 million barrels per day. Yet, sentiment in the global oil market remained positive following United States decision to pull out from the Iranian Nuclear Deal last Tuesday which may prompt for fresh sanctions to be enacted on the oil producing country.

Fresh sanctions are expected to commerce on November 5th which may significantly limit Iranian’s oil export over the next six months with an estimated total of 250,000 barrels per day. Lower output in the market could ease the global supply glut which has been lingering for around three years while OPEC engage tirelessly to reduce its pressure by cutting daily oil output since early this year.

Weekly Outlook: May 14 – 18

For the week ahead, investors will be paying their attention on EU zone inflation report which may provide further indication of their economic momentum which may shed some light over ECB’s stimulus taper timing. Otherwise, major data releases from the Unites States which includes retail sales and Philly manufacturing index will also be sidelined in order to gauge Fed’s possibility to act more aggressively with regards to their rate hike pace.

As for oil traders, they will place their focus on monthly report from Organization of the Petroleum Exporting Countries (OPEC) and International Energy Agency to gauge global oil market demand and supply levels.

Highlighted economy data and events for the week: May 14 – 18

| Monday, May 14 |

Data N/A

Events USD – FOMC Member Mester Speaks CrudeOIL – OPEC Monthly Report USD – FOMC Member Bullard Speaks

|

| Tuesday, May 15 |

Data CNY – Industrial Production (YoY) (Apr) CNY – Retail Sales (YoY) (Apr) EUR – German GDP (QoQ) (Q1) GBP – Average Earnings Index +Bonus (Mar) GBP – Claimant Count Change (Apr) GBP – Unemployment Rate (Mar) EUR – German ZEW Economic Sentiment (May) EUR – GDP (QoQ) (Q1) EUR – ZEW Economic Sentiment USD – Core Retail Sales (MoM) (Apr) USD – Retail Sales (MoM) (Apr) USD – Business Inventories (MoM) (Apr)

Events AUD – RBA Meeting Minutes GBP – Inflation Report Hearings

|

| Wednesday, May 16 |

Data CrudeOIL – API Weekly Crude Oil Stock JPY – GDP (QoQ) (Q1) AUD – Wage Price Index (QoQ) (Q1) JPY – Industrial Production (MoM) (Mar) EUR – German CPI (MoM) (Apr) EUR – CPI (YoY) (Apr) USD – Building Permits (Apr) USD – Housing Starts (Apr) USD – Industrial Production (MoM) (Apr) CrudeOIL – Crude Oil Inventories CrudeOIL – Gasoline Inventories

Events CrudeOIL – IEA Monthly Report EUR – ECB President Draghi Speaks USD – FOMC Member Bostic Speaks

|

| Thursday, May 17 |

Data AUD – Employment Change (Apr) AUD – Unemployment Rate (Apr) USD – Initial Jobless Claims USD – Philadelphia Fed Manufacturing Index (May) USD – Philly Fed Employment (May) CAD – Foreign Securities Purchases (Mar)

Events USD – FOMC Member Bullard Speaks USD – FOMC Member Kashkari Speaks

|

|

Friday, May 18

|

Data JPY – National Core CPI (YoY) (Apr) EUR – German PPI (MoM) (Apr) CAD – Core CPI (MoM) (Apr) CAD – Core Retail Sales (MoM) (Apr) CrudeOIL – US Baker Hughes Oil Rig Count

Events USD – FOMC Member Kaplan Speaks USD – FOMC Member Mester Speaks USD – FOMC Member Brainard Speaks USD – FOMC Member Kaplan Speaks

|

Technical Weekly Outlook: May 14 – 18

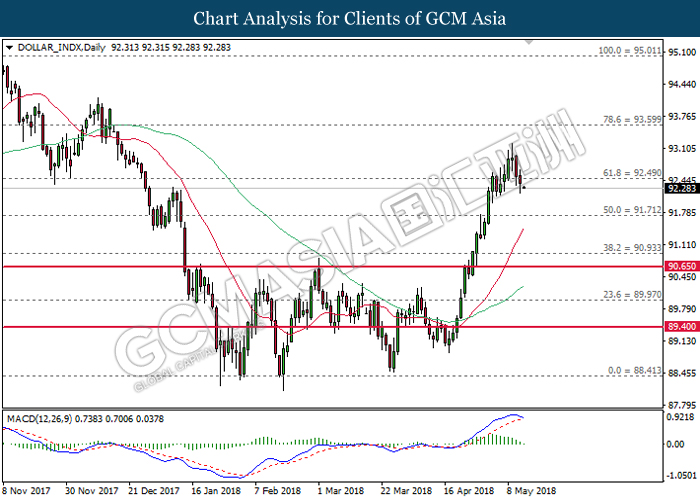

Dollar Index

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement and closure below the support level near 92.50. MACD histogram which illustrate diminishing upward momentum may suggest the pair to extend its losses in short-term as technical correction.

Resistance level: 92.50, 93.60

Support level: 91.70, 90.95

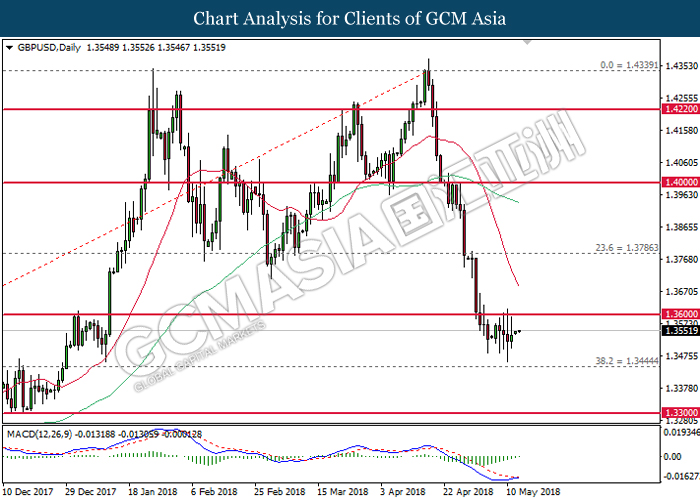

GBPUSD

GBPUSD, Daily: GBPUSD was traded higher following prior rebound near the support level at 1.3445. MACD histogram which illustrate the formation of golden cross signal may suggests the pair to be traded higher in short-term as technical correction before extending its bearish bias thereafter.

Resistance level: 1.3600, 1.3785

Support level: 1.3445, 1.3300

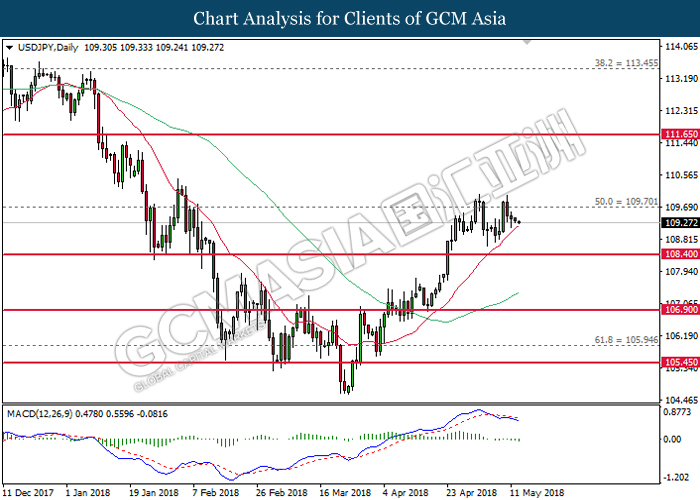

USDJPY

USDJPY, Daily: USDJPY was traded lower following prior retracement near the resistance level at 109.70. MACD histogram which has formed a death cross signal may suggests the pair to extend its losses in the event of a closure below the 20-MA line (red).

Resistance level: 109.70, 111.65

Support level: 108.40, 106.90

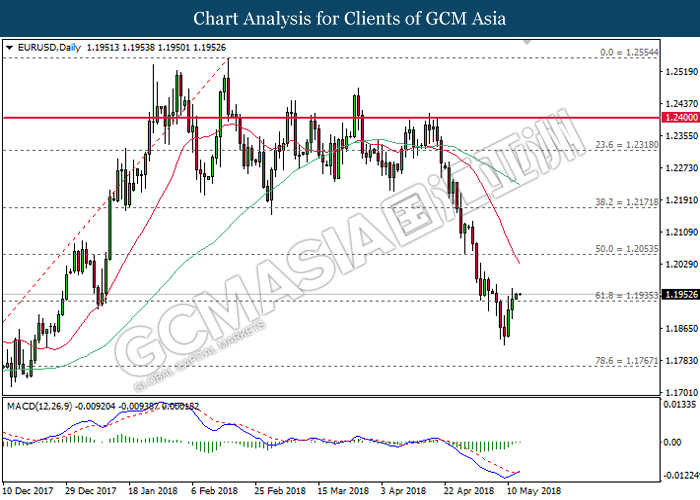

EURUSD

EURUSD, Daily: EURUSD pared its prior losses following a rebound and closure above the resistance level at 1.1935. MACD histogram which has formed a golden cross signal may suggest the pair to extend its gains in short-term, towards the 20-MA line (red).

Resistance level: 1.2055, 1.2170

Support level: 1.1935, 1.1770

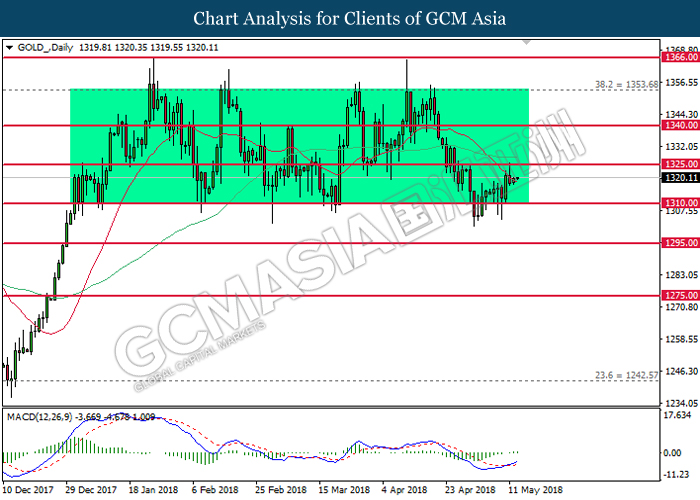

GOLD

GOLD_, Daily: Gold price was traded higher following prior rebound and closure above the 20-MA line (red). MACD histogram which illustrate substantial upward signal may suggest the commodity price to extend its gains in short-term, towards the direction of resistance level near 1325.00.

Resistance level: 1325.00, 1340.00

Support level: 1310.00, 1295.00

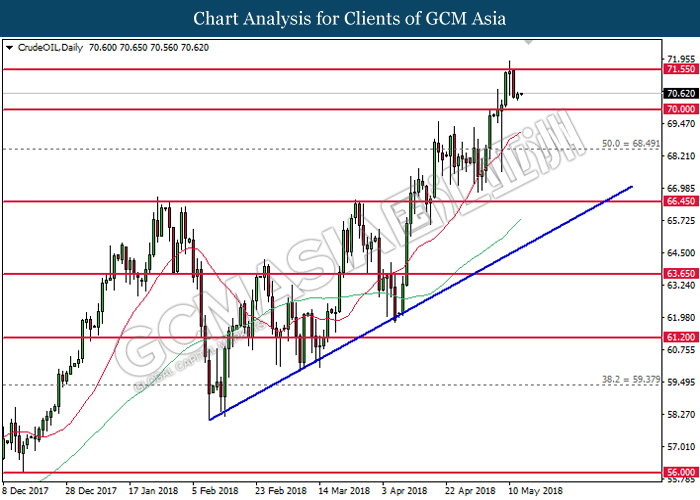

Crude Oil

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound before the support level of 70.00. Both MA lines which continues to expand upwards suggests further bullish bias. Thus, overall major trend still suggests the commodity price to extend its gains towards the direction of resistance level near 71.55.

Resistance level: 70.00, 71.55

Support level: 66.45, 63.65