21 October 2022 Afternoon Session Analysis

US Dollar revived after upbeat economic data released.

The Dollar Index which traded against a basket of six major currencies surged on yesterday amid the upbeat economic data, which spurred bullish momentum toward US Dollar. According to the US Department of Labor, the US Initial Jobless Claims notched down from the previous reading of 226K to 214K, missing the consensus forecast of 230K. Besides, the US Existing Home Sales came in at the figures of 4.71M, exceeding the market expectation of 4.70M. These data shown an optimistic economy condition and labor market, which dialed up the market optimism toward economic progression in the US. Nonetheless, the gains experienced by the US Dollar was limited amid the appreciation of Pound Sterling. Yesterday, Liz Truss has resigned as UK Prime Minister, while she became the shortest serving prime minister in the UK history. As of now, Rishi Sunak and Penny Mordaunt are the front-runners for the next nation Prime Minister, which high hopes were placed on these two candidates to stabilize UK economy headwind. As of writing, the Dollar Index edged up by 0.03% to 112.85.

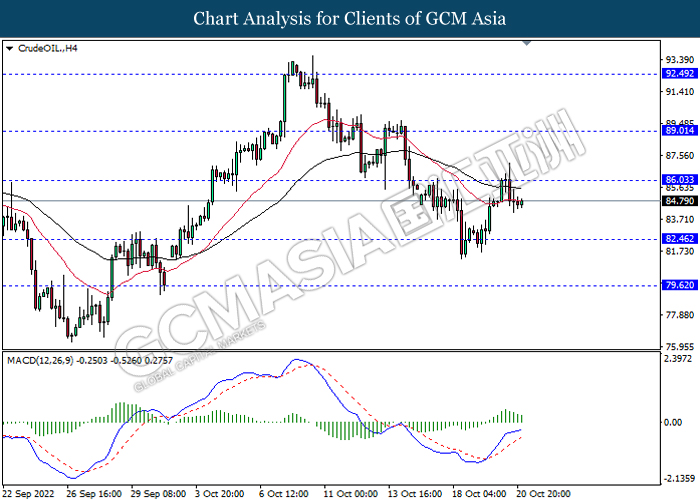

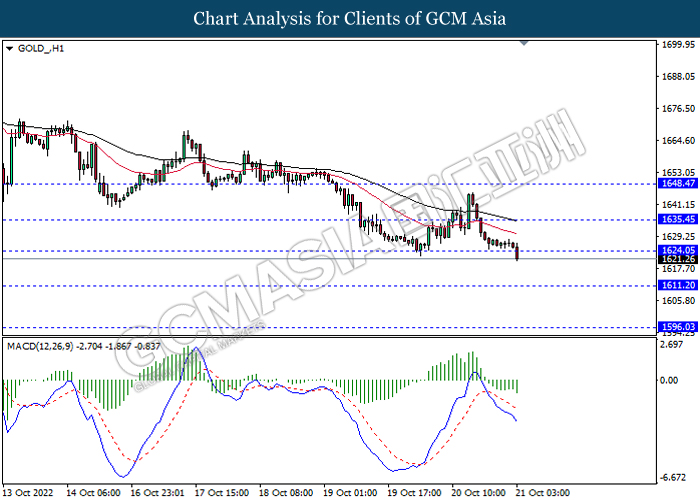

In the commodities market, the crude oil price appreciated by 0.39% to $84.84 per barrel as of writing after a sharp decline throughout overnight trading session following the rate hike expectation from Fed has weigh down the demand of this black commodity. In addition, the gold price depreciated by 0.46% to $1625.09 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Sep) | -1.6% | -0.5% | – |

| 20:30 | CAD – Core Retail Sales (MoM) (Aug) | -3.1% | 0.4% | – |

Technical Analysis

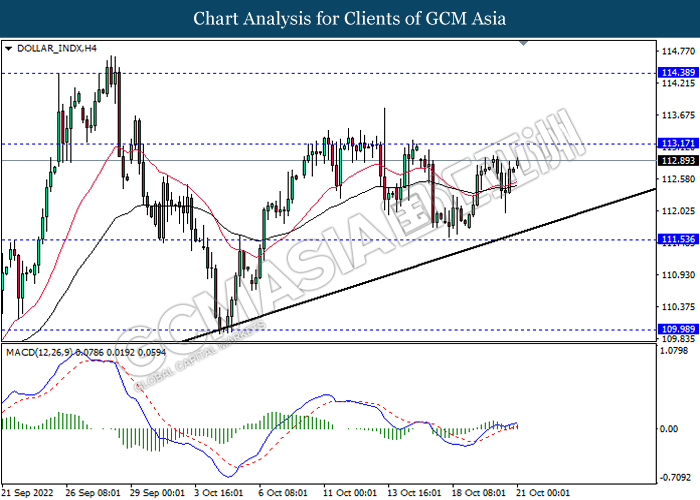

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 113.15, 114.40

Support level: 111.55, 109.95

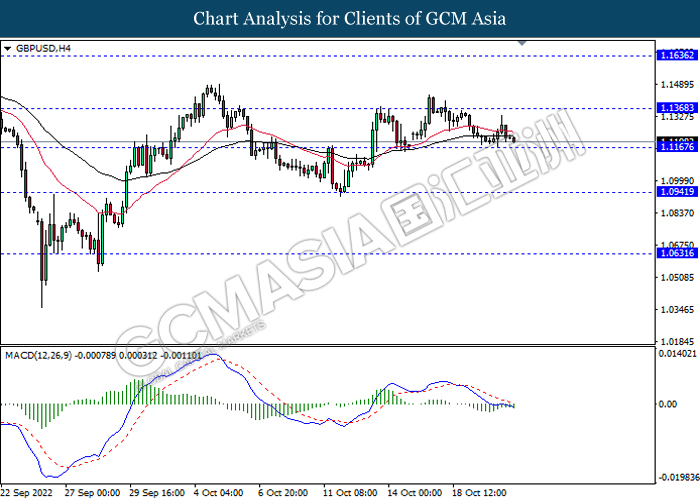

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

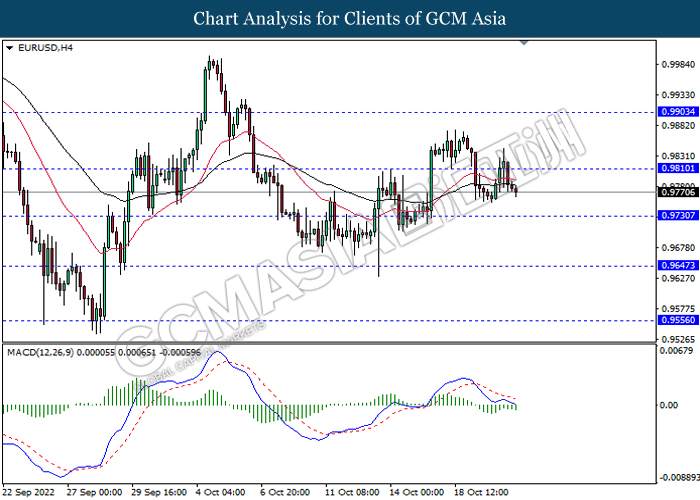

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9810, 0.9905

Support level: 0.9730, 0.9645

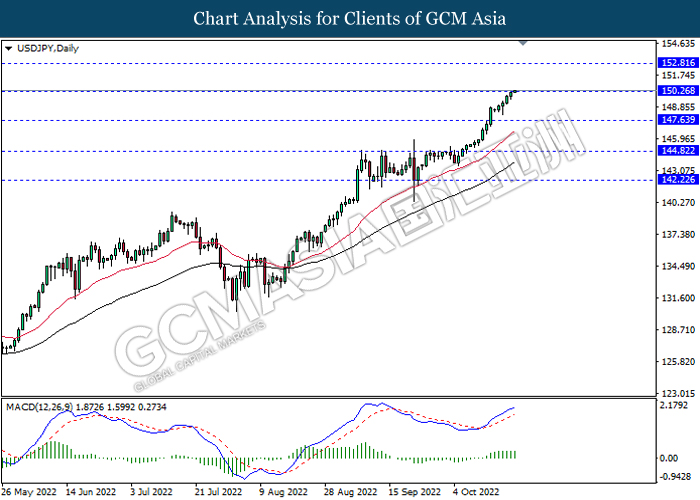

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

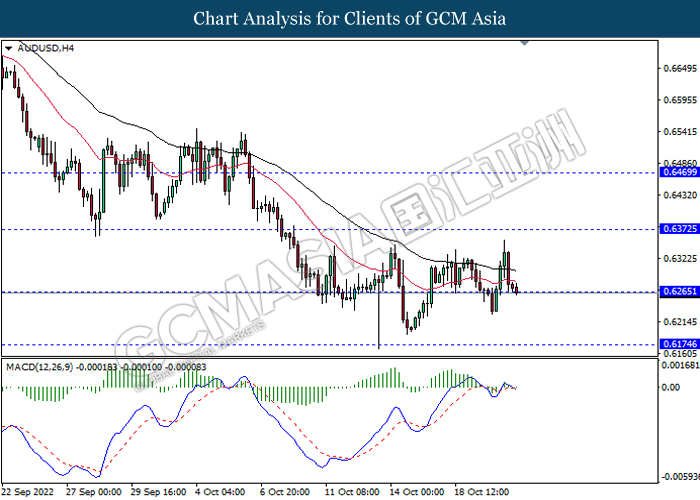

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6175

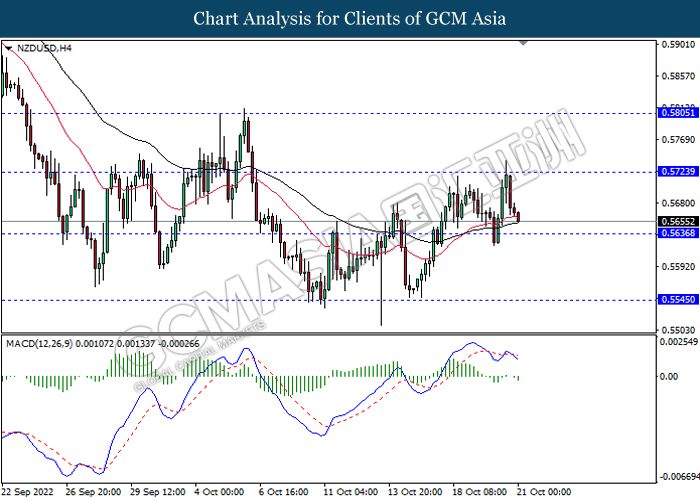

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.5725, 0.5805

Support level: 0.5635, 0.5545

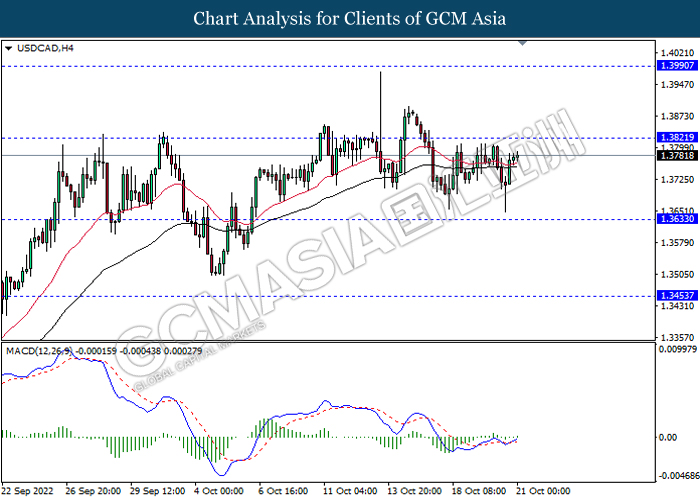

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

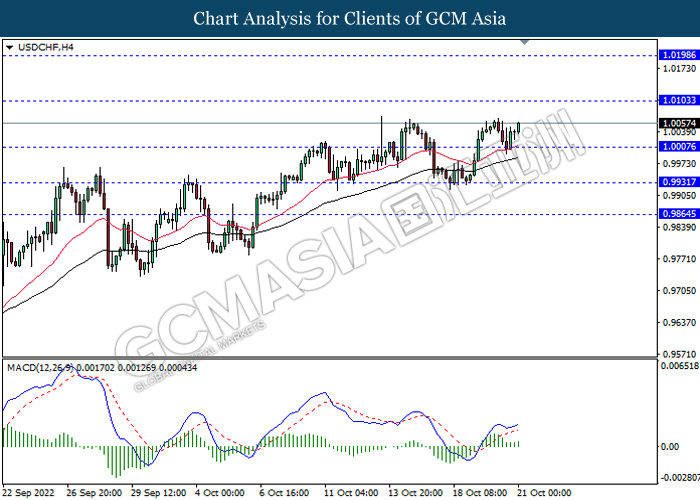

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0105, 1.0200

Support level: 1.0005, 0.9930

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 86.05, 89.00

Support level: 82.45, 79.60

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1624.05, 1635.45

Support level: 1611.20, 1596.05