10 November 2022 Morning Session Analysis

US Dollar raised as aggressive rate hike path might be continued.

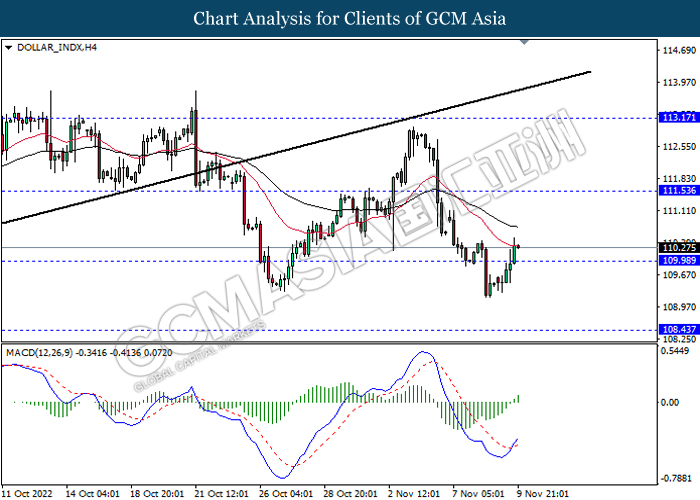

The Dollar Index which traded against a basket of six major currencies rose significantly on yesterday following the aggressive rate hike path by Fed might be continued. According to Bloomberg, the CPI and Core CPI that excluding the food and energy prices had appeared a sign of dropping. Nonetheless, the overall CPI is seen rising from a month earlier by the most since June. With that, the Fed would likely to apply fifth consecutive 75 basis point rate hike in the upcoming meeting. Besides that, Richmond Fed President Thomas Barkin had reiterated on Wednesday that the necessary of hefty rate increase in order to restore price stability, which adding the odds that aggressive rate hike pace might be continued. As of now, the release of CPI data would highly catch the attention market participants. On the other hand, investors would also focus on the results of the US midterm election, as the control of the US House and Senate was still up in the air. As of writing, the Dollar Index appreciated by 0.72% to 110.33

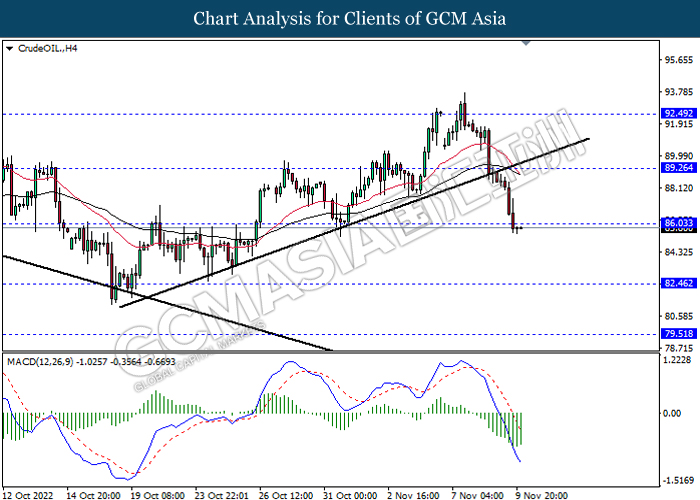

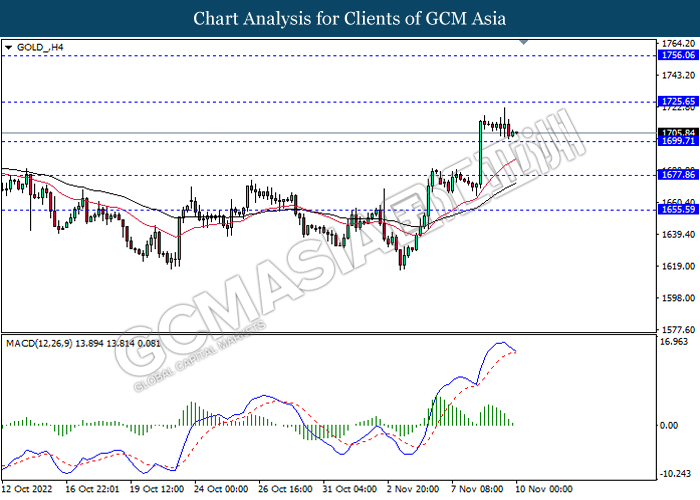

In the commodities market, the crude oil price rose by 0.25% to $85.86 per barrel as of writing after a sharp decline throughout overnight trading session following the increase of crude oil inventories. According to EIA, the U.S. Crude Oil Inventories rose by 3.925M barrel, exceeding the market forecast of 1.360M barrel. In addition, the gold price depreciated by 0.05% to $1705.61 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Oct) | 0.6% | 0.5% | – |

| 21:30 | USD – CPI (YoY) (Oct) | 8.2% | 8.0% | – |

| 21:30 | USD – Initial Jobless Claims | 217K | 220K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

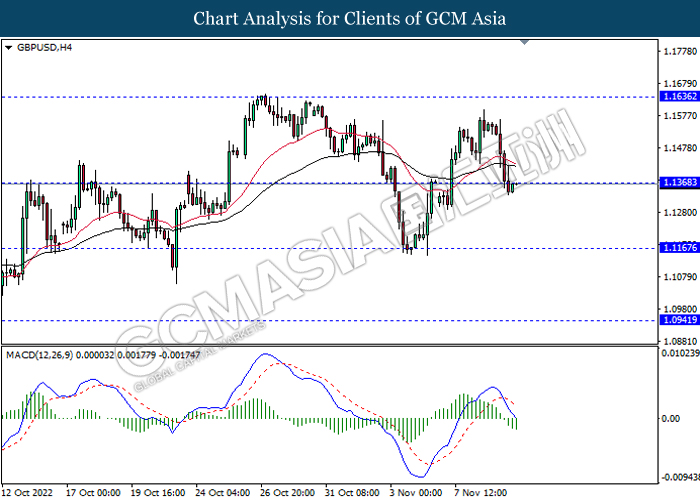

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

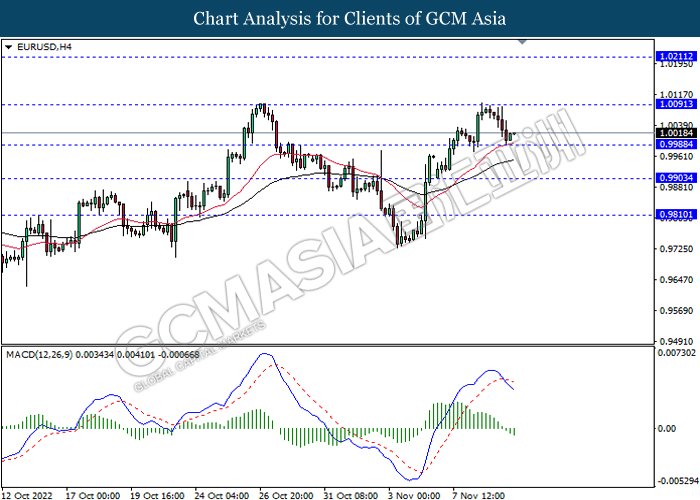

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0090, 1.0210

Support level: 0.9990, 0.9905

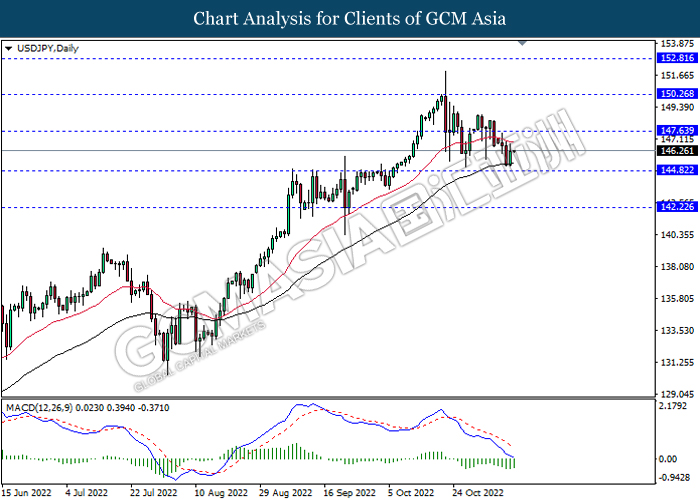

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

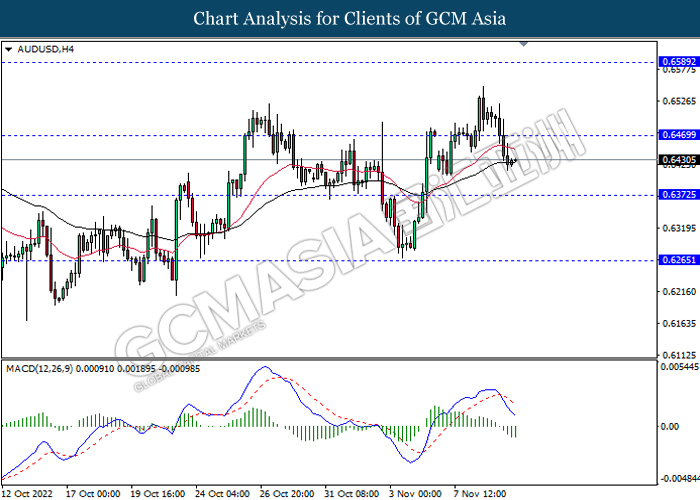

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

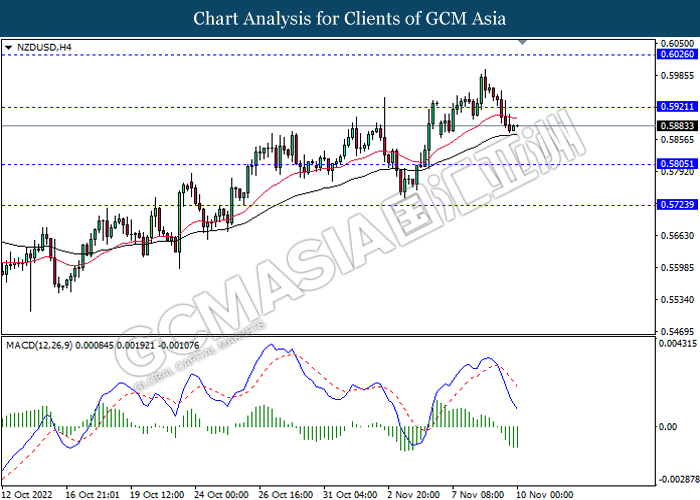

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5920, 0.6025

Support level: 0.5805, 0.5725

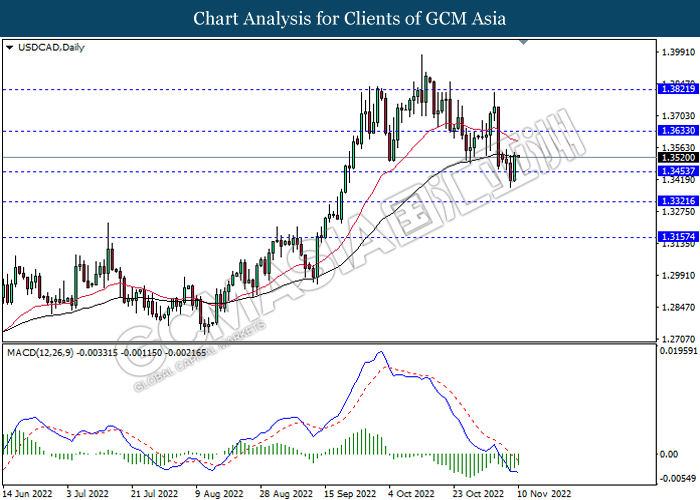

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

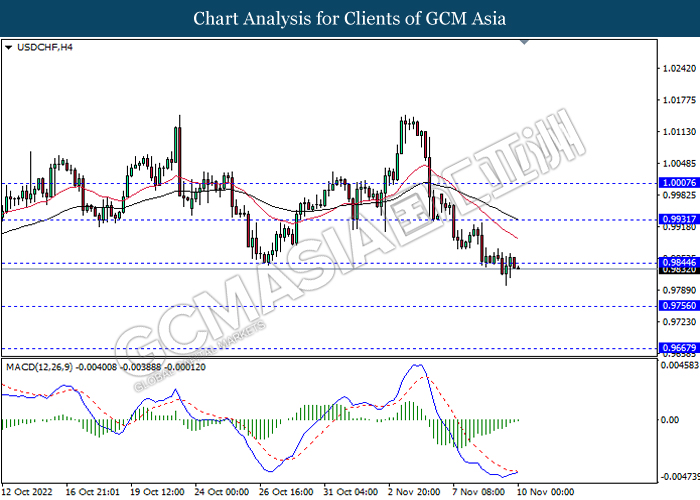

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9845, 0.9930

Support level: 0.9755, 0.9665

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 86.05, 89.25

Support level: 82.45, 79.50

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1725.65, 1756.05

Support level: 1699.70, 1677.85