28 May 2018 Weekly Analysis

GCMAsia Weekly Report: May 28 – June 1

Market Review (Forex): May 21 – 25

Greenback extended gains to fresh six-months high against a basket of major currencies following positive US economic data which is enough so sustain further rate hikes by the Federal Reserve. The dollar index rose 0.53% while closing the week at 94.25 last Friday.

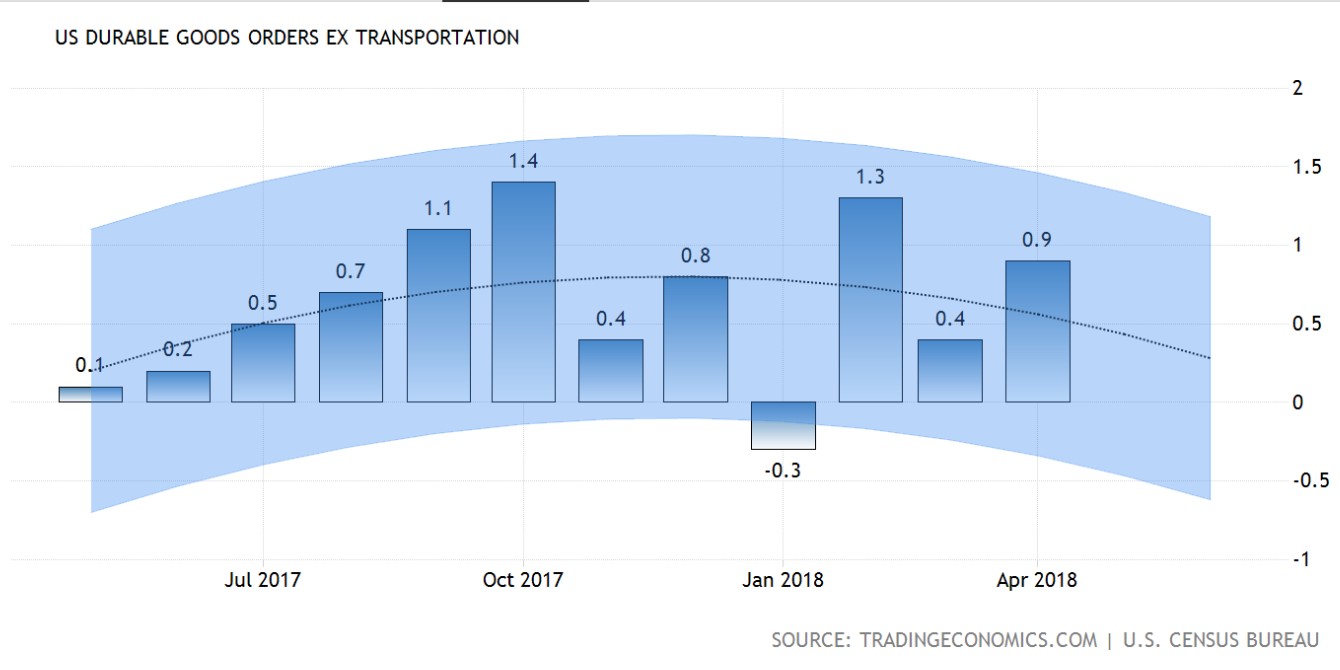

According to the US Commerce Department, US Core Durable Goods Orders rose 0.9% for the month of April, beating economist expectation for a rise of only 0.5%. In conjunction with that, US Nondefense capital goods orders ex-aircraft rose 1.0%, showing higher regional business spending.

Both data suggests that the economy is performing well to resist any rate hikes by the Federal Reserve which is scheduled to have at least two more this year. However, gains on the dollar remained capped after Feds downplayed market expectation for a third rate hike this year following their reiteration to enable inflation to surpass their 2% target in order to maintain its sustainable momentum in the long-run.

US Core Durable Goods Orders

—– Forecast

US Core Durable Goods Orders came in at 0.9% versus consensus reading of 0.5% for the month of April.

USD/JPY

Pair of USD/JPY rose 0.16% to 109.43 during late Friday trading after North Korean leader Kim Jong-Un reiterate to negotiate with the United States at any time albeit President Donald Trump’s cancelation of next month’s highly anticipated summit between both countries.

EUR/USD

Pair of EUR/USD fell 0.59% to $1.1650 after Spanish Prime Minister Mariano Rajoy faces a no-confidence vote while Italian political uncertainty continues to weigh on the currency.

GBP/USD

GBP/USD extended losses by 0.63% to $1.3296 following higher demand for the greenback.

Market Review (Commodities): May 21 – 25

GOLD

Gold price depreciates slightly during late Friday trading following dollar’s resurgence while coupled with lower geopolitical risk from the Korean Peninsula. Price of the yellow commodity tumbled down by 0.25% while closing the week at $1,301.60 a troy ounce.

The safe-haven commodity pared some of its gains following a sharp rebound in the US dollar over-the-backdrop of better-than-expected economic data which warrants for further rate hike from the Federal Reserve.

Likewise, the precious metal sheds its gains further after North Korean leader Kim Jong-Un reiterates to held peace talk with the United States at any point of time despite Trump’s rhetoric to cancel the highly anticipated summit.

Crude Oil

Crude oil price plunged sharply as of last Friday following market signals to increase their oil production in order to prevent crude shortage from Iran and Venezuela. Price of the black commodity plunged 4.46% while closing the week at $67.42 per barrel.

Both Organization of the Petroleum Exporting Countries and Russia suggested to increase their oil output by dialing down the current production cut levels following lower oil production from two OPEC’s members – Iran and Venezuela.

Iran, one of the producers from OPEC may be subjected to US sanctions following President Donald Trump’s decision to withdraw from the Nuclear Agreement with the oil producing country. Likewise, oil production from Venezuela has taken a toll following political and civilian unrest in the oil nation due to dictatorial policies and non-recognition electoral results from the global community.

The increase in production is scheduled to be discuss in the next meeting among members and non-members of OPEC which is to be held in June at Vienna. Investors will keep an eye on the outcome of the meeting in order to attain further prospects with regards to the commodity price and future outlook.

Weekly Outlook: May 28 – June 1

For the week ahead, investors will be place their full attention on major economic reports from the United States such as Nonfarm Payrolls report and ADP Nonfarm Employment Change. Likewise, global geopolitical condition and current US-North Korea conundrum will also be sidelined in order to gauge investor’s sentiment towards the greenback and safe-haven assets.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: May 28 – June 1

| Monday, May 28 |

Data N/A

Events N/A

|

| Tuesday, May 29 |

Data USD – CB Consumer Confidence (May)

Events USD – FOMC Member Bullard Speaks

|

| Wednesday, May 30 |

Data AUD – Building Approvals (MoM) (Apr) EUR – German Unemployment Change (May) EUR – German Unemployment Rate (May) EUR – German CPI (MoM) (May) USD – ADP Nonfarm Employment Change (May) USD – GDP (QoQ) (Q1) USD – GDP Price Index (QoQ) (Q1) CAD – RMPI (MoM) (Apr) CAD – BoC Interest Rate Decision

Events NZD – RBNZ Gov Orr Speaks CAD – BoC Rate Statement

|

| Thursday, May 31 |

Data CrudeOIL – API Weekly Crude Oil Stock JPY – Industrial Production (MoM) (Apr) CNY – Manufacturing PMI (May) CNY – Non-Manufacturing PMI (May) EUR – German Retail Sales (MoM) (Apr) EUR – CPI (YoY) (May) USD – Core PCE Price Index (MoM) (Apr) USD – Initial Jobless Claims USD – Personal Income (MoM) (Apr) USD – Personal Spending (MoM) (Apr) CAD – GDP (MoM) (Mar) USD – Pending Home Sales (MoM) (Apr) CrudeOIL – Crude Oil Inventories CrudeOIL – Gasoline Inventories

Events N/A

|

|

Friday, June 1

|

Data CNY – Caixin Manufacturing PMI (May) EUR – German Manufacturing PMI (May) GBP – Manufacturing PMI (May) USD – Average Hourly Earnings (MoM) (May) USD – Nonfarm Payrolls (May) USD – Unemployment Rate (May) USD – ISM Manufacturing PMI (May) USD – ISM Manufacturing Employment (May) CrudeOIL – US Baker Hughes Oil Rig Count

Events USD – FOMC Member Bostic Speaks USD – FOMC Member Bullard Speaks USD – FOMC Member Kaplan Speaks USD – FOMC Member Kashkari Speaks

|

Technical Weekly Outlook: May 28 – June 1

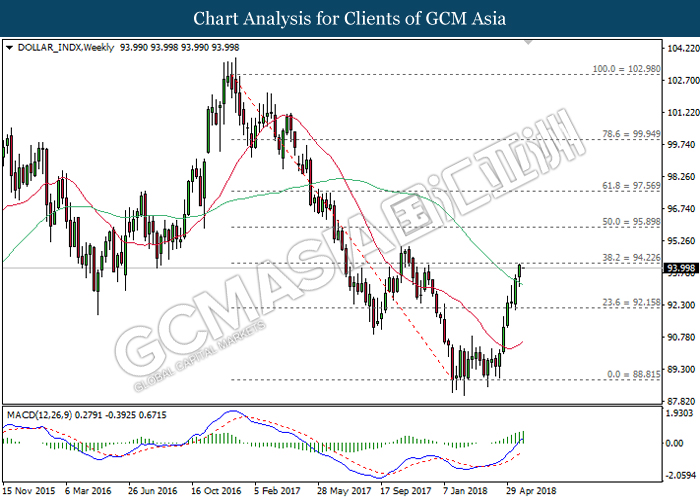

Dollar Index

DOLLAR_INDX, Weekly: Dollar index extended gains following prior rebound from the support level at 92.15. MACD histogram which illustrate upward signal suggests further bullish bias. Thus, a successful close above the target of 94.20 would provide further clarification.

Resistance level: 94.20, 95.90

Support level: 92.15, 88.80

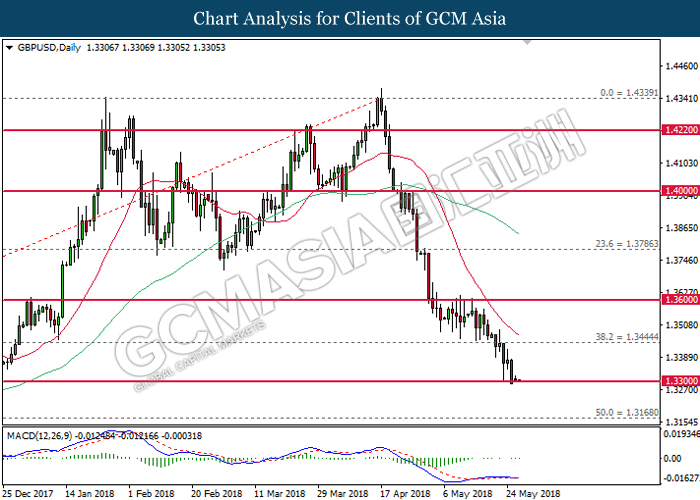

GBPUSD

GBPUSD, Daily: GBPUSD extended its losses after losing its support near 1.3445. MACD histogram and both MA lines which illustrate downward signal and momentum suggests the pair to advance further downwards after breaking the support level near 1.3300.

Resistance level: 1.3445, 1.3600

Support level: 1.3300, 1.3170

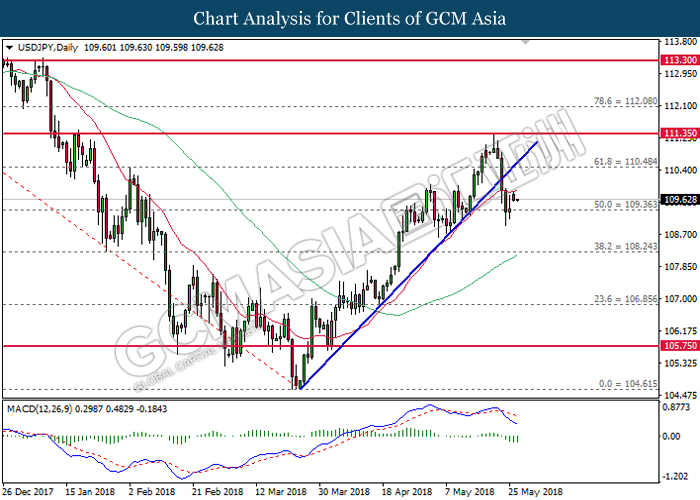

USDJPY

USDJPY, Daily: USDJPY was traded lower following prior breakout from the upward trend line. MACD histogram which illustrate downward signal suggests the pair to extend its losses after successfully breaking the support level at 109.35.

Resistance level: 110.50, 111.35

Support level: 109.35, 108.25

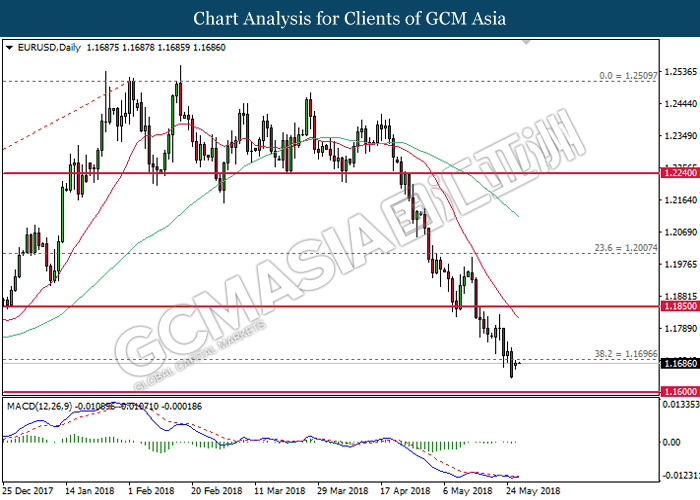

EURUSD

EURUSD, Daily: EURUSD was traded higher following prior rebound while currently testing at 1.1700. MACD histogram which illustrate the formation of upward signal may suggests the pair to be traded higher in short-term as technical correction before extending its bearish bias thereafter.

Resistance level: 1.1700, 1.1850

Support level: 1.1600, 1.1445

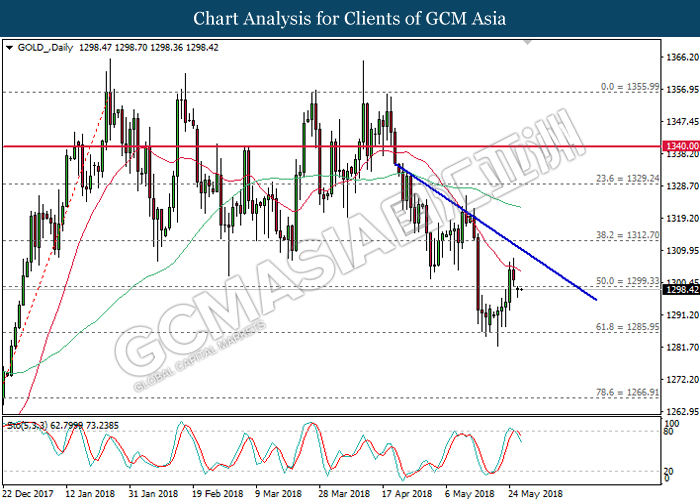

GOLD

GOLD_, Daily: Gold price was traded lower following prior retracement from the 20-MA line (red). Stochastic Oscillator which illustrate the formation of retrace signal from the overbought region suggests the commodity price to extend its losses, towards the direction of support level near 1285.95.

Resistance level: 1300.00, 1312.70

Support level: 1285.95, 1266.90

Crude Oil

CrudeOIL, Daily: Crude oil price plunged sharply following previous retracement from the resistance level at 72.50. MACD histogram which illustrate bearish signal suggest the commodity price to extend its losses after breaking the strong support level at 67.30.

Resistance level: 69.30, 72.50

Support level: 67.30, 65.70