8 December 2022 Morning Session Analysis

Euro rebounded as hefty rate increase implied.

The EUR/USD, which widely traded by major investors rose significantly amid the upbeat GDP data, which prompting investors to shift their capital toward Euro which having better prospects. According to Eurostat, the Eurozone Gross Domestic Product (GDP) QoQ for the third quarter notched up from the previous reading of 0.2% to 0.3%. The positive GDP data has outweighed investors’ thoughts of a recession in the Eurozone, while it provide more rooms for European Central Bank (ECB) to tighten its monetary policy further. On the other hand, the gains of Euro currency was extended following the hawkish statement by ECB member. According to Reuters, ECB policymaker Peter Kazimir claimed on Wednesday that the Europe central bank should not scale back the aggressive rate hike pace even the inflationary eased. Besides, he also reiterated that it would be too soon to diminish the rate hike size because of a single better inflation number, whereas emphasizing his stance to raise interest rate sharply. As of writing, the EUR/USD appreciated by 0.09% to 1.0514.

In the commodities market, the crude oil price rose by 0.29% to $72.62 per barrel as of writing. Though, the overall trend of oil price remained bearish following the US government data showed an unexpectedly large build in fuel stocks. In addition, the gold price edged up by 0.04% to $1787.03 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 225K | 230K | – |

Technical Analysis

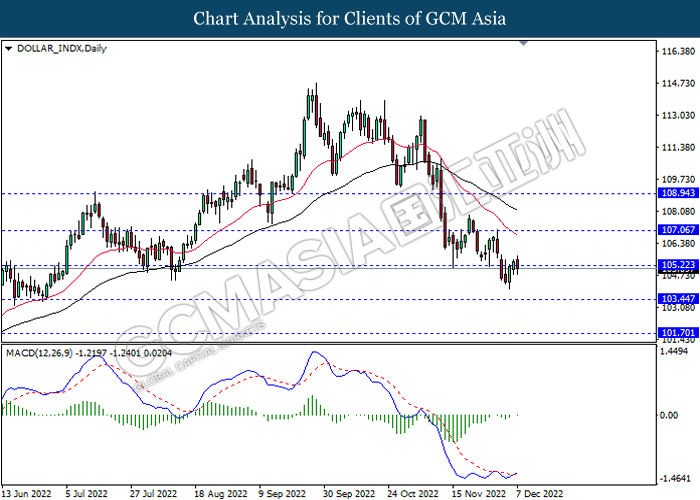

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

GBPUSD, H4: GBPUSD was traded higher while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

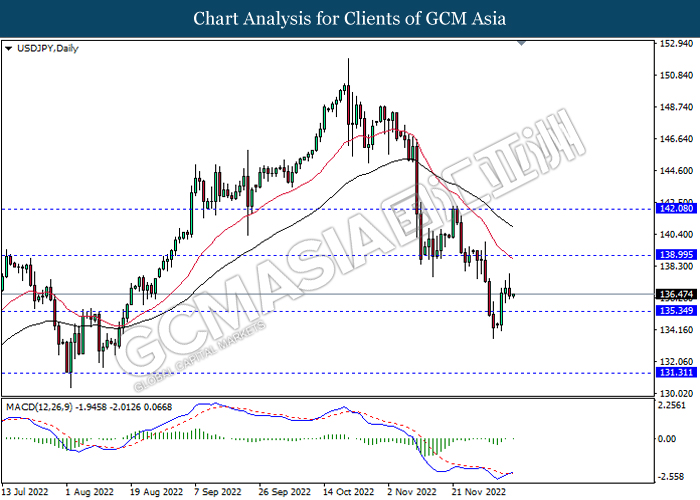

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

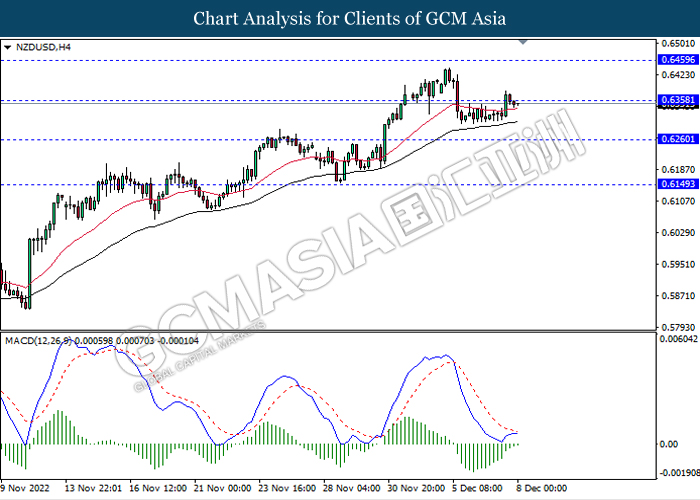

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

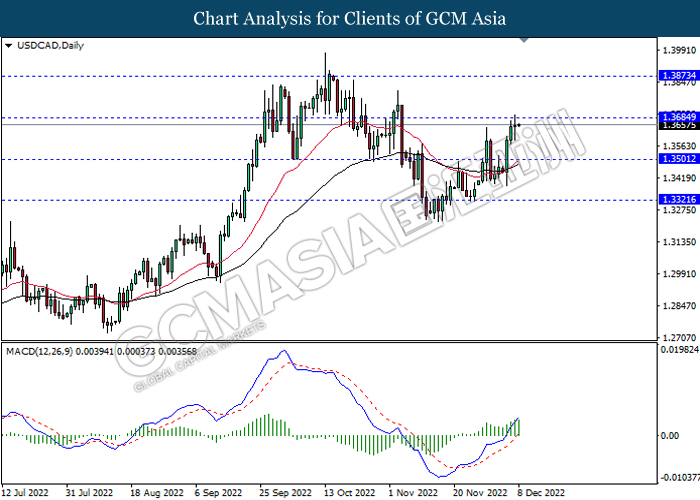

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9550, 0.9680

Support level: 0.9400, 0.9235

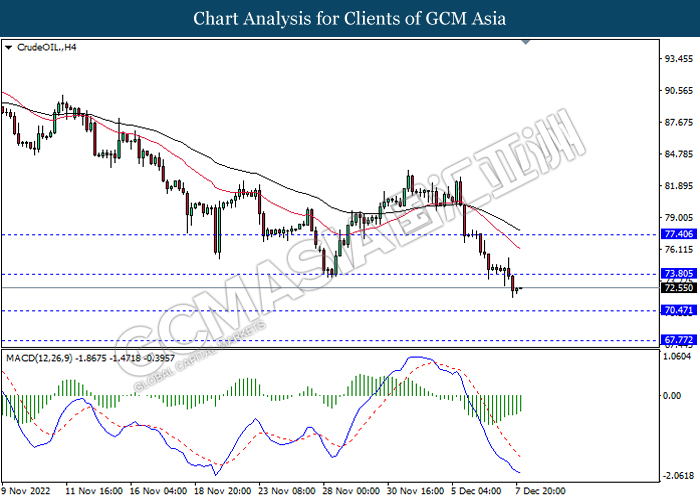

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 73.80, 77.40

Support level: 70.45, 67.75

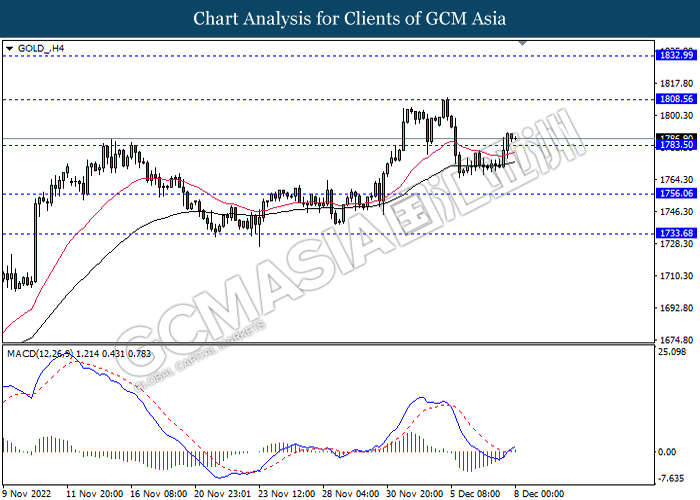

GOLD_, H4: Gold price was traded higher following prior breakout above the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05