9 December 2022 Afternoon Session Analysis

Yen surged following upbeat GDP figures.

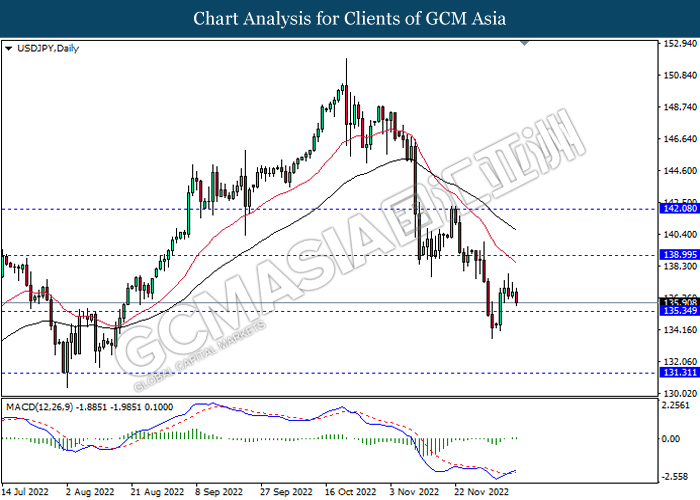

The USD/JPY, which widely traded by global investors dropped significantly throughout overnight trading session after the bullish economic data has been released. According to the Japan Cabinet Office, the Japan Gross Domestic Product (GDP) QoQ for third quarter posted at the reading of -0.2%, exceeding the market forecast of -0.3%. The economic condition that better than consensus expectations has dialed up the market optimism toward economic progression in Japan, which spurring bullish momentum on the Japanese Yen. Besides that, the pairing extended its losses over the fragile labor market in the US. Yesterday, the US Department of Labor had announced the downbeat Initial Jobless Claims data, while it sparked the hopes that a lower rate hike in the December interest rate decision might be implemented. With that, it dragged down the appeal of US Dollar. At this juncture, investors are highly eyeing on the announcement of PPI data in order to gauge the likelihood movement of the pairing. As of writing, the USD/JPY depreciated by 0.60% to 135.83.

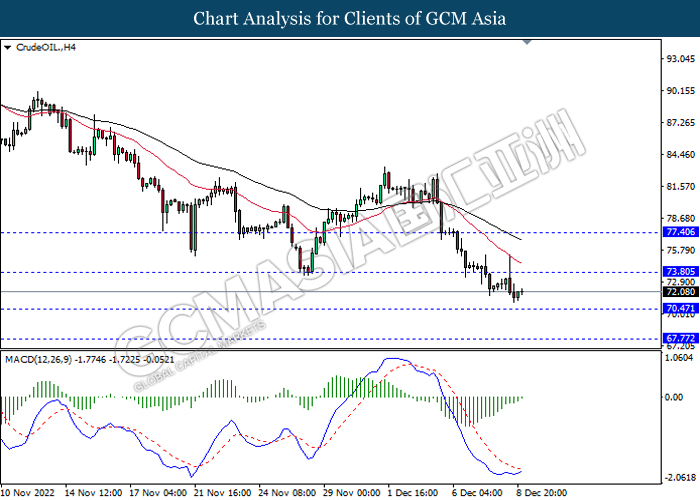

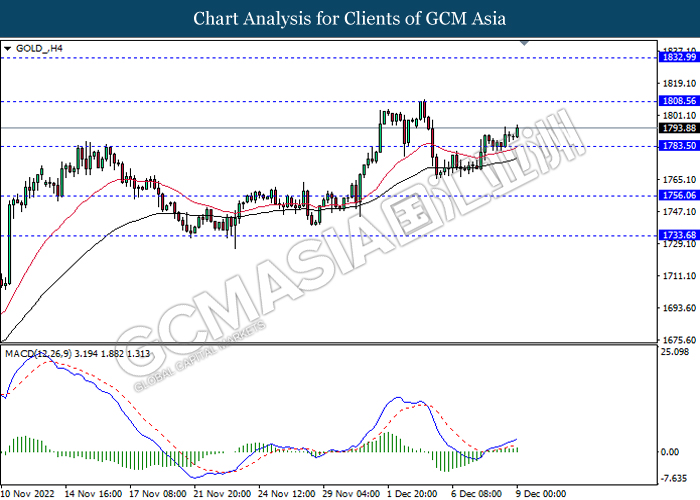

In the commodities market, the crude oil price raised by 0.95% to $72.13 per barrel as of writing following the Canada’s TC Energy shut its Keystone pipeline for maintenance. On the other hand, the gold price rose by 0.32% to $1794.87 per troy ounce as of writing over the value of US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – PPI | 0.2% | 0.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

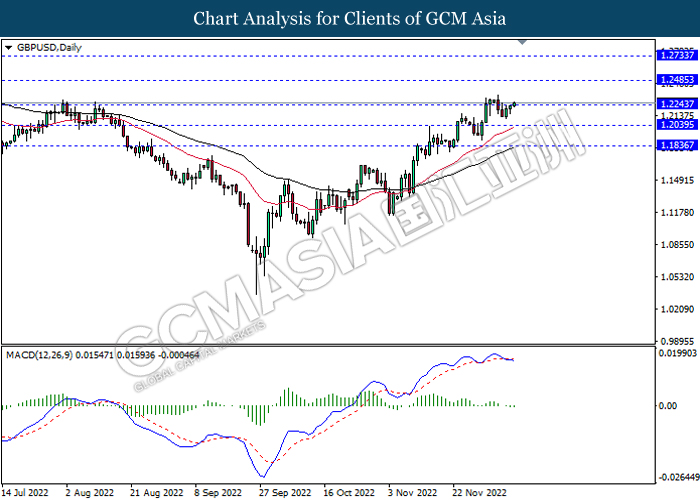

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2485, 1.2735

Support level: 1.2245, 1.2040

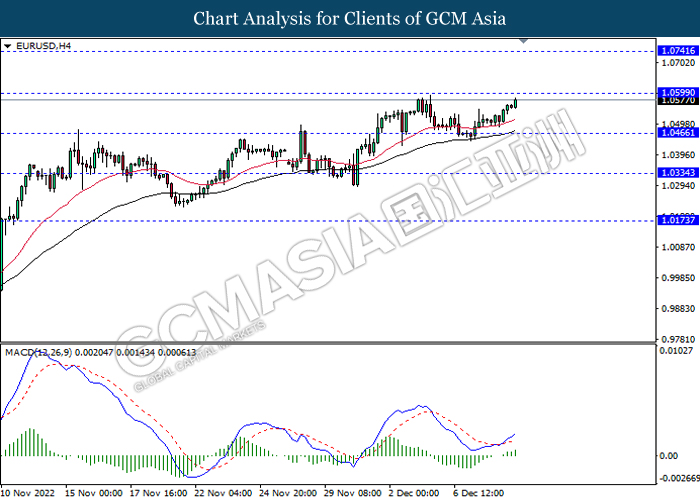

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

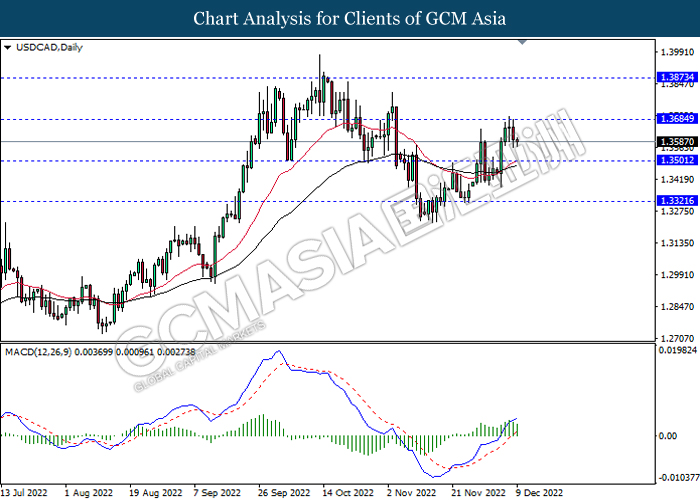

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

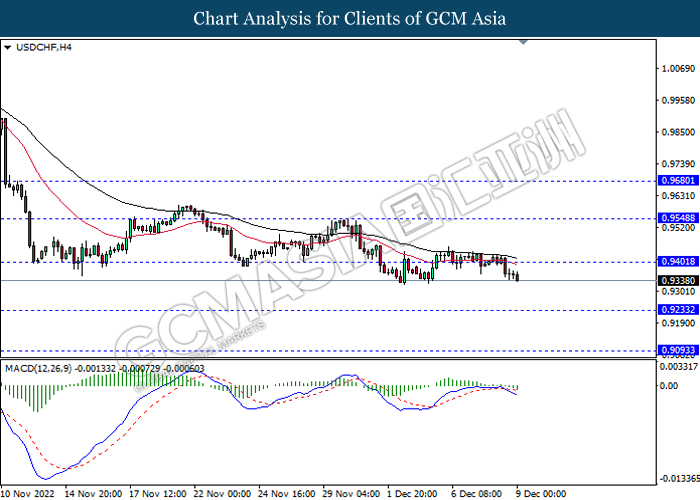

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 73.80, 77.40

Support level: 70.45, 67.75

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05