14 December 2022 Morning Session Analysis

Greenback plunged as inflation eased.

The dollar index, which traded against a basket of six major currencies, recorded huge losses yesterday as the US inflation data came in at a softer than expected reading. According to the US Labor Department, the goods and services prices in the nation rose less than expected in November, mirroring the sign that the inflation was being well-controlled following a series of rate hike since early of this year. The Consumer Price Index (CPI) rose by 7.1% from a year ago, missing the consensus forecast at 7.3%, while the core CPI, which excluding volatile food and energy prices rose 0.2% on the month, compared with the estimates of 0.3%. The cooling inflation boosted the risk on sentiment of the market as it take pressure off the Fed for raising larger rate for longer period of time. Despite, it is noteworthy to emphasize that the current inflation rate is still far away from the Fed’s 2% long-term inflation target. At this juncture, the market participants are eyeing on the Fed interest rate decision, which scheduled to announce in the early morning on 15th Dec. As of writing ,the dollar index dropped by -1.07% to 104.00.

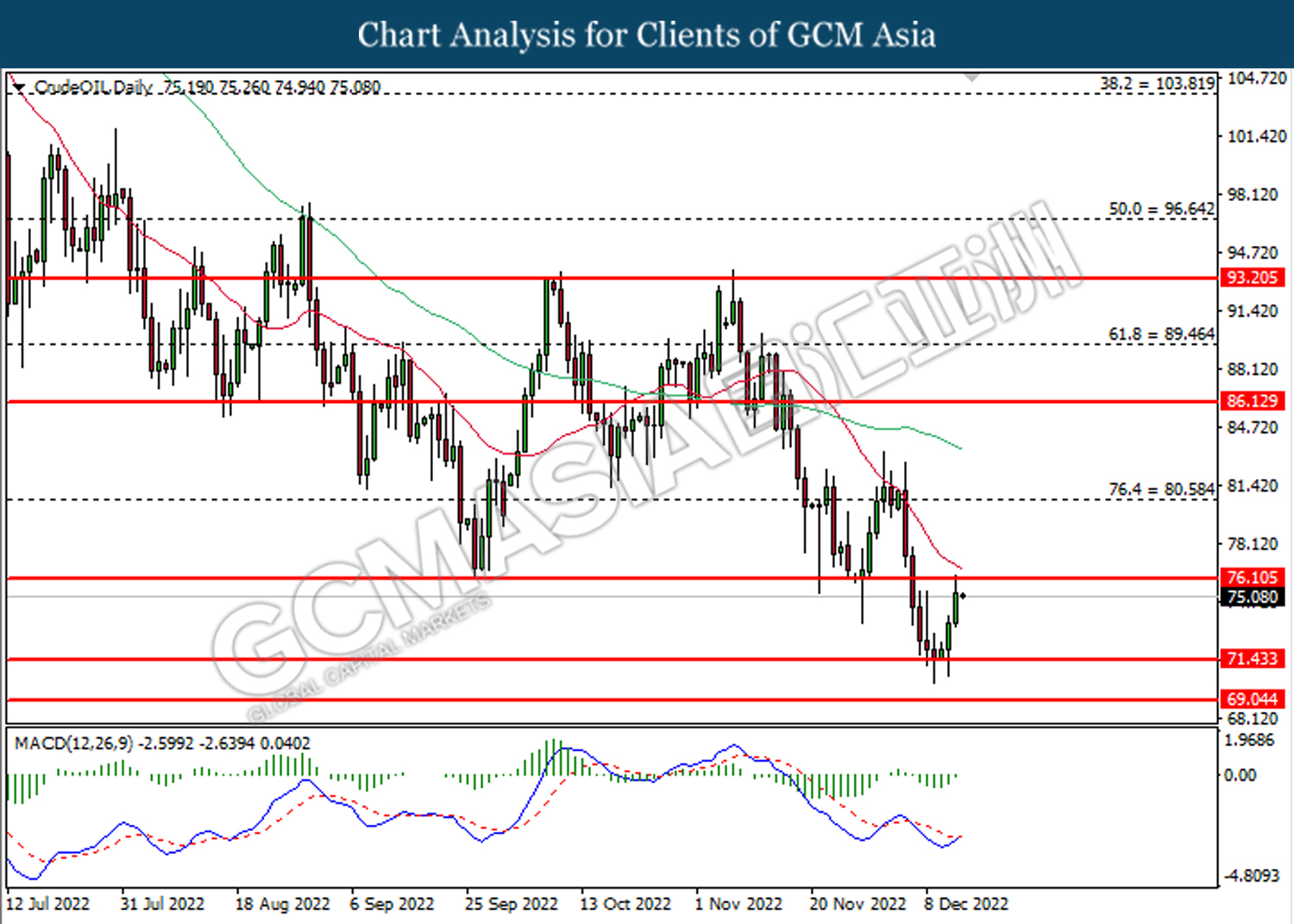

In the commodities market, crude oil prices skyrocketed by 3.54% to $75.25 per barrel as there is no timeline for a restart of the Keystone pipeline as of now. On top of that, the slumping of the Greenback urged the global investors to buy into the oil market with a lowest cost. Besides, gold prices appreciated by 0.10% to $1810.10 per troy ounce as the US dollar weakened on softer inflation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – CPI (YoY) (Nov) | 11.1% | 10.9% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -5.187M | -3.595M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 105.00. However, MACD which illustrated bullish bias momentum suggests the index to undergo technical correction in short term.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

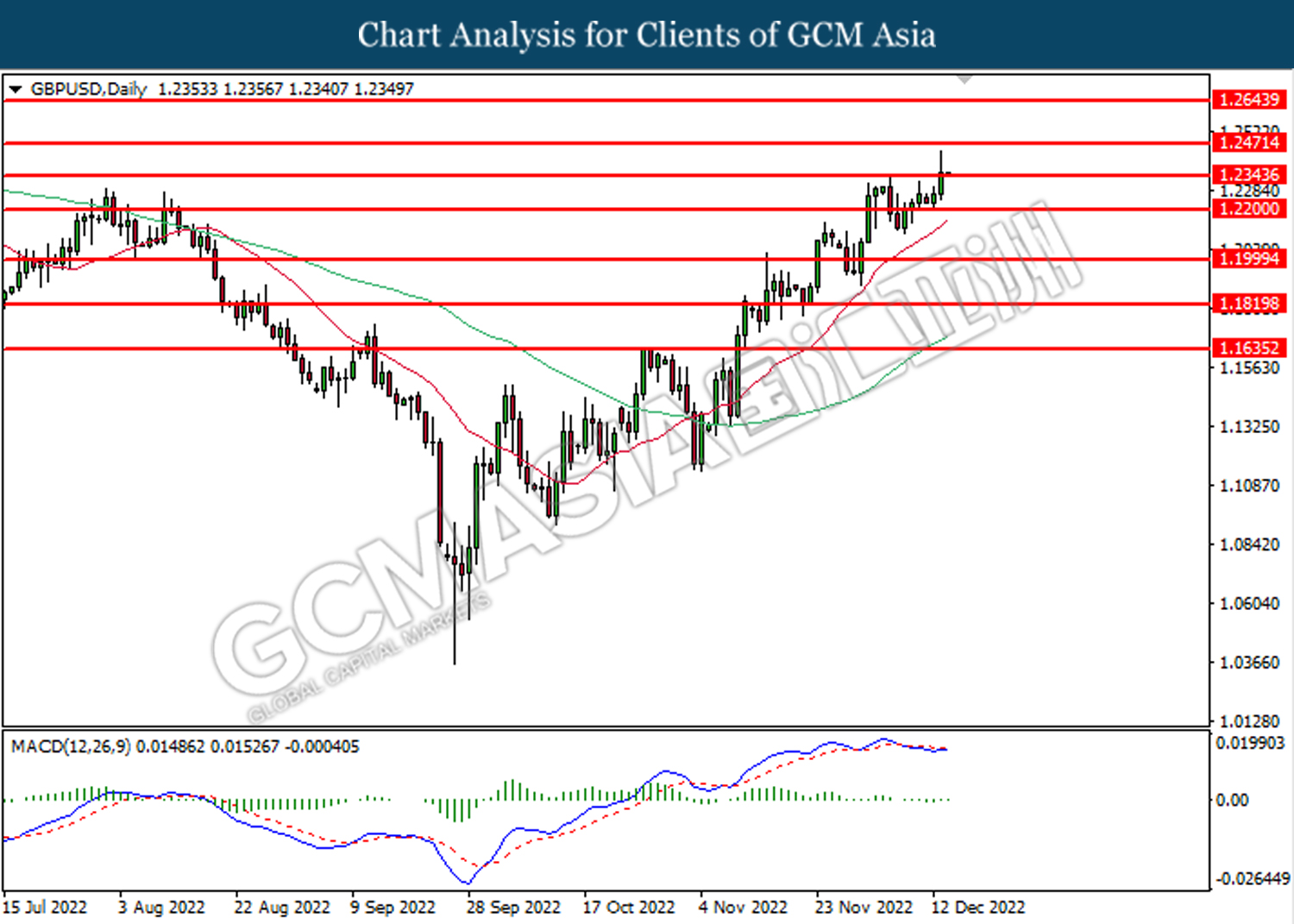

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2345. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

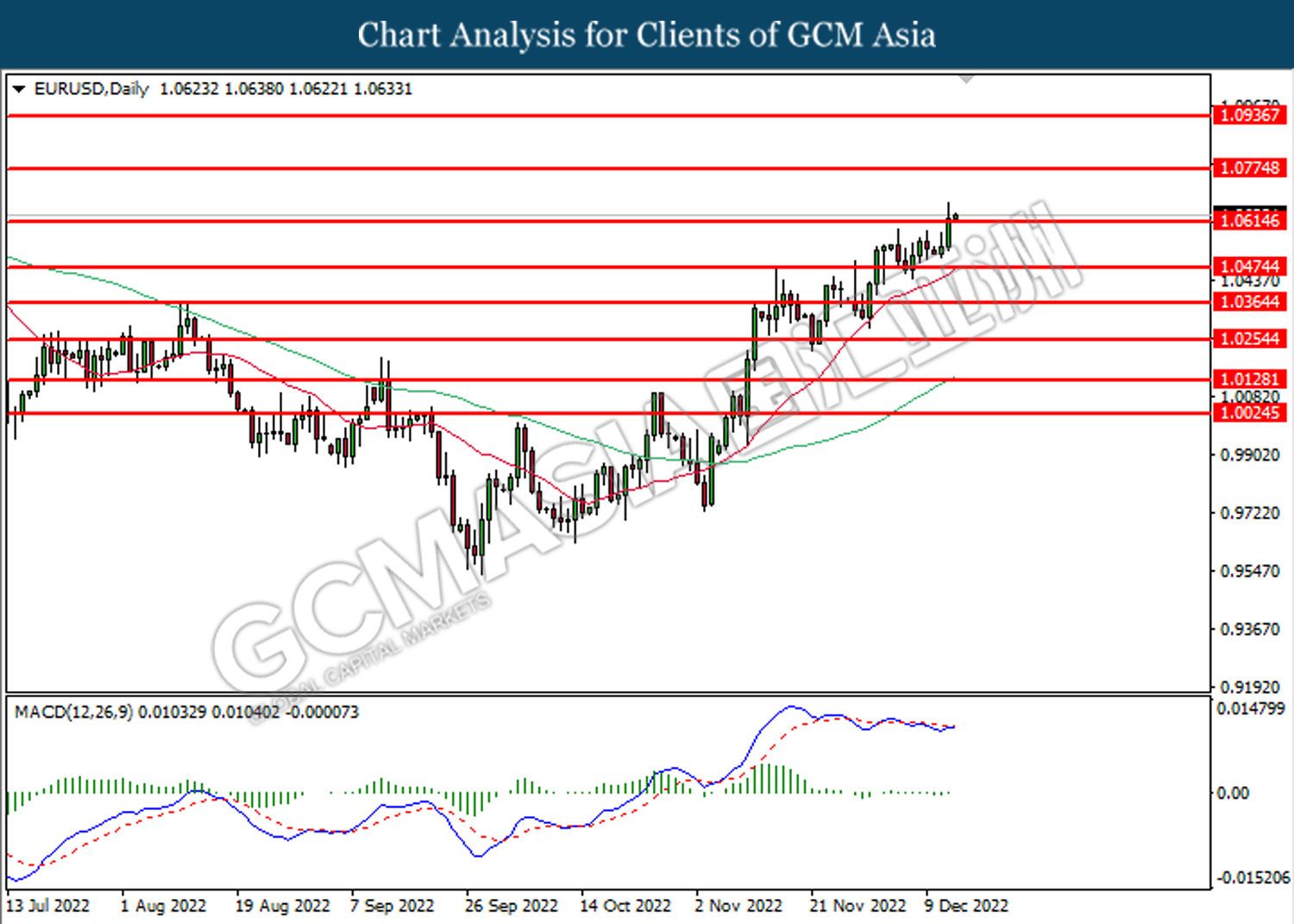

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0615. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0615, 1.0475

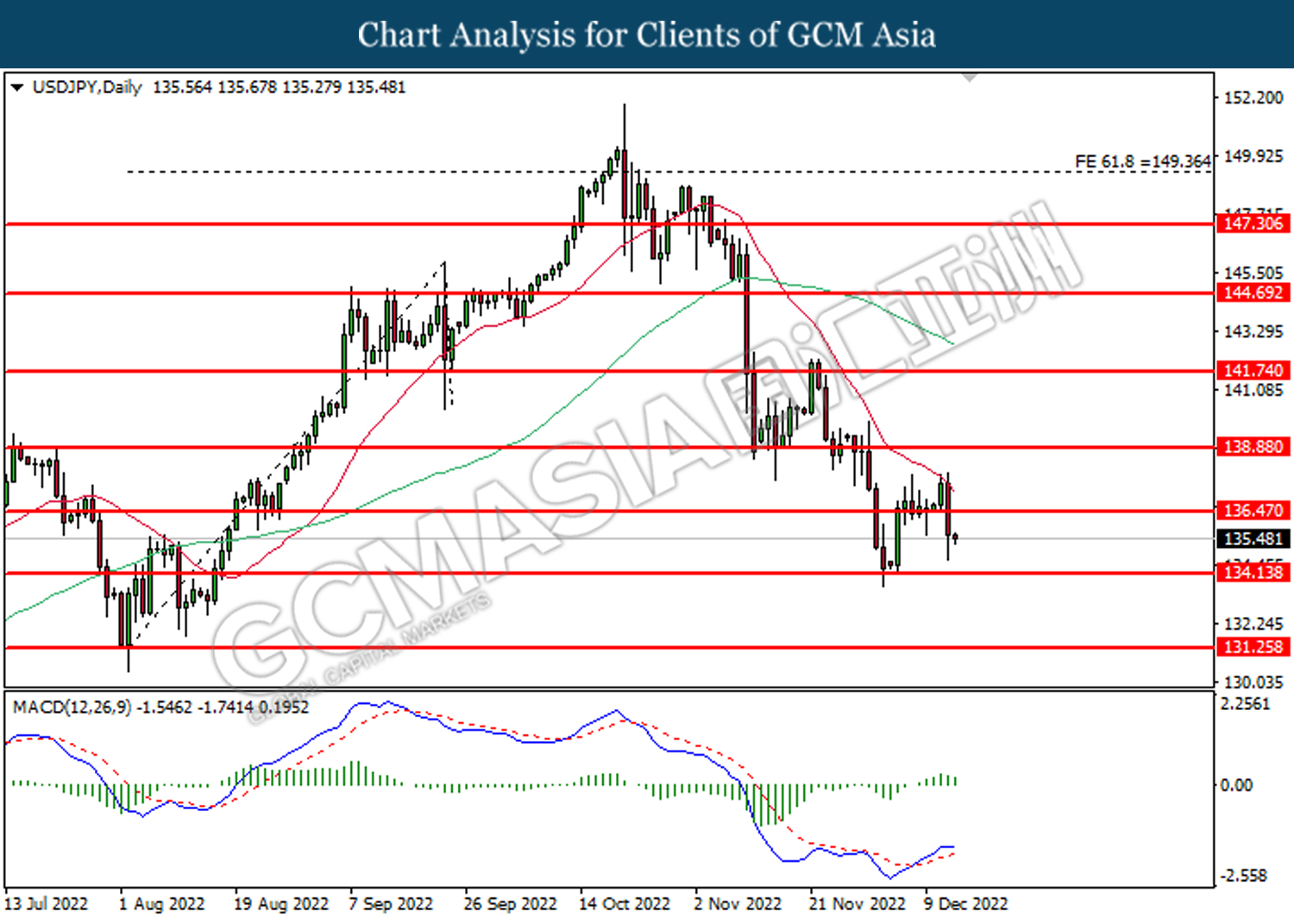

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 136.45. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 134.15.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

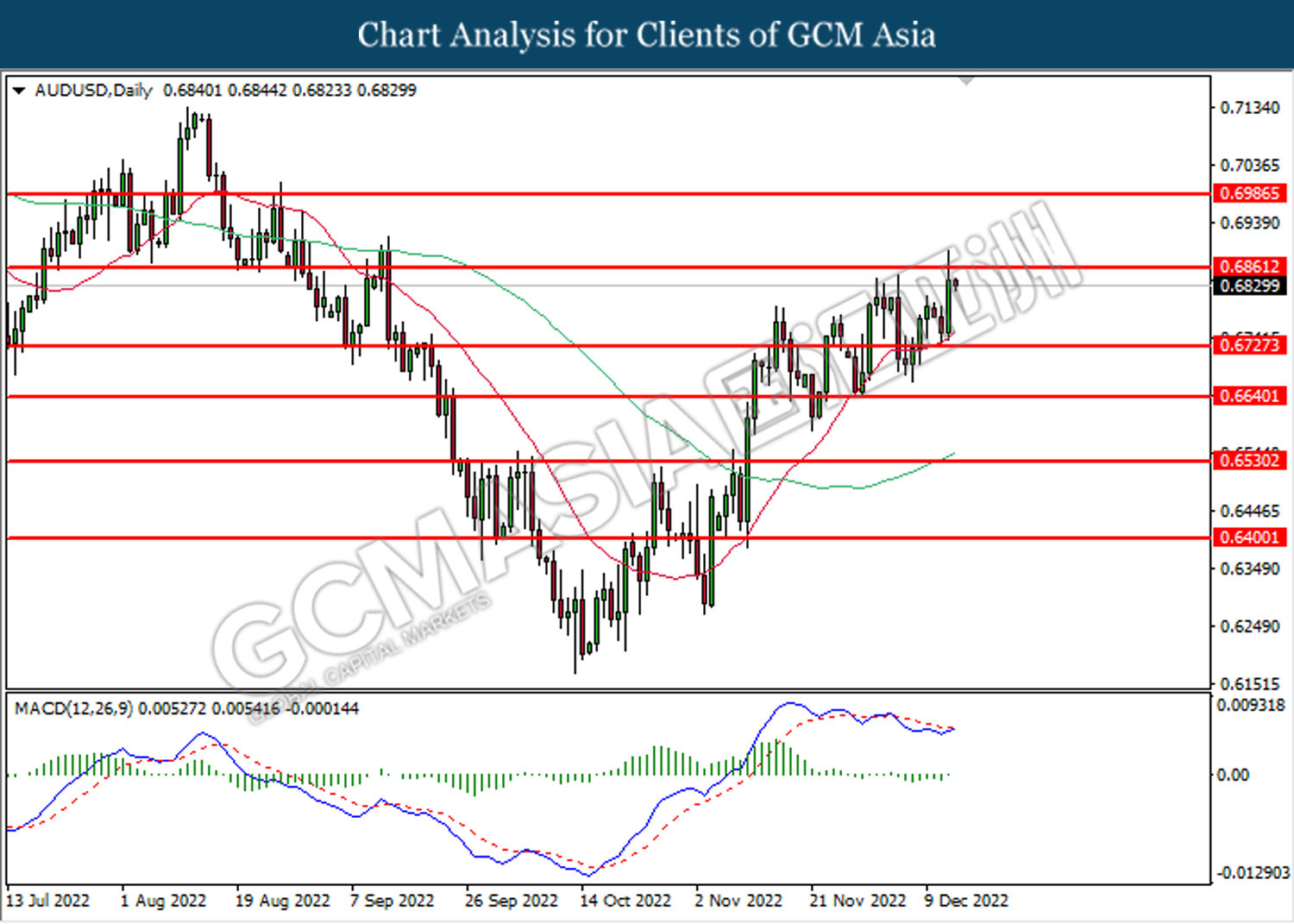

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

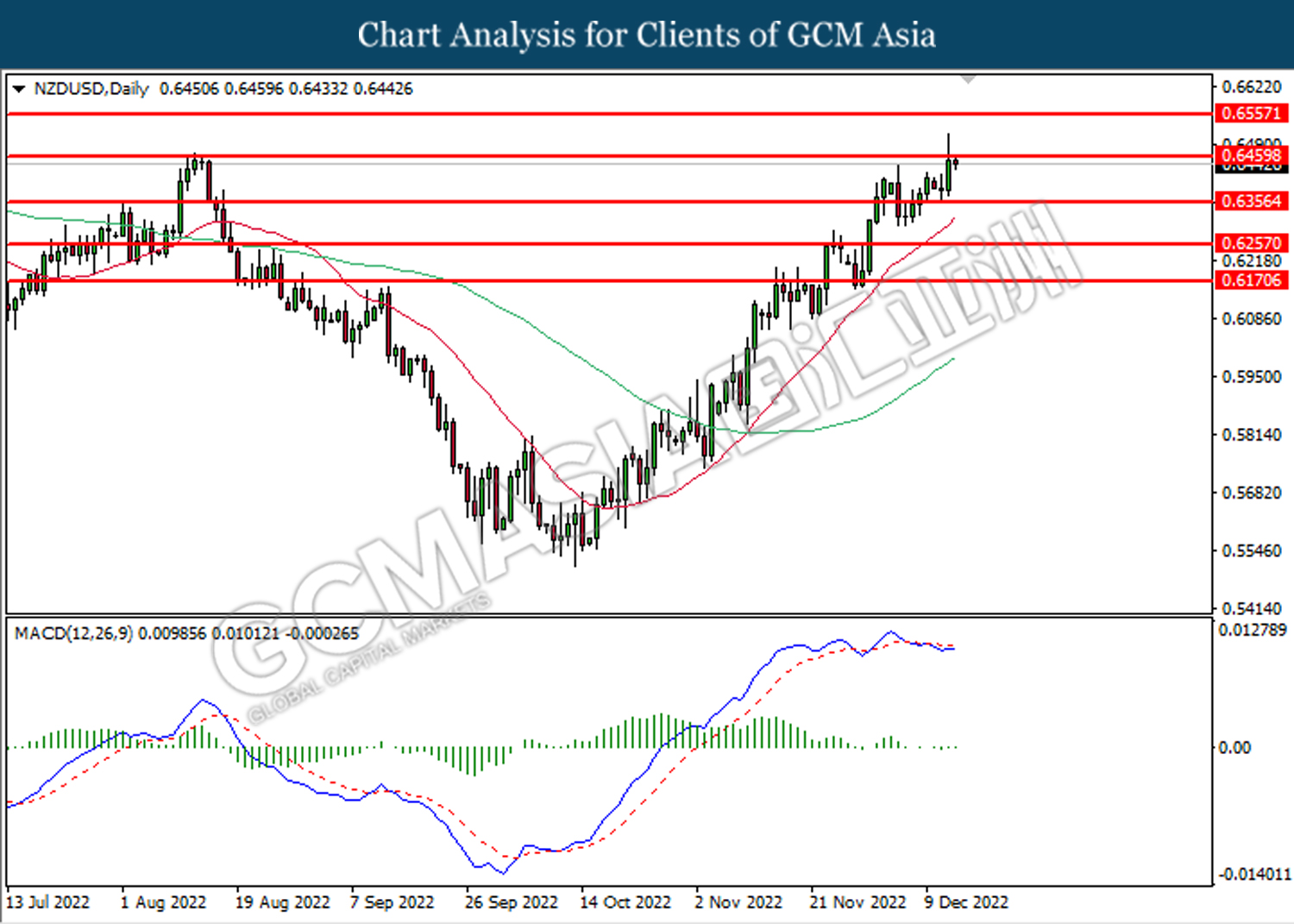

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6460. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

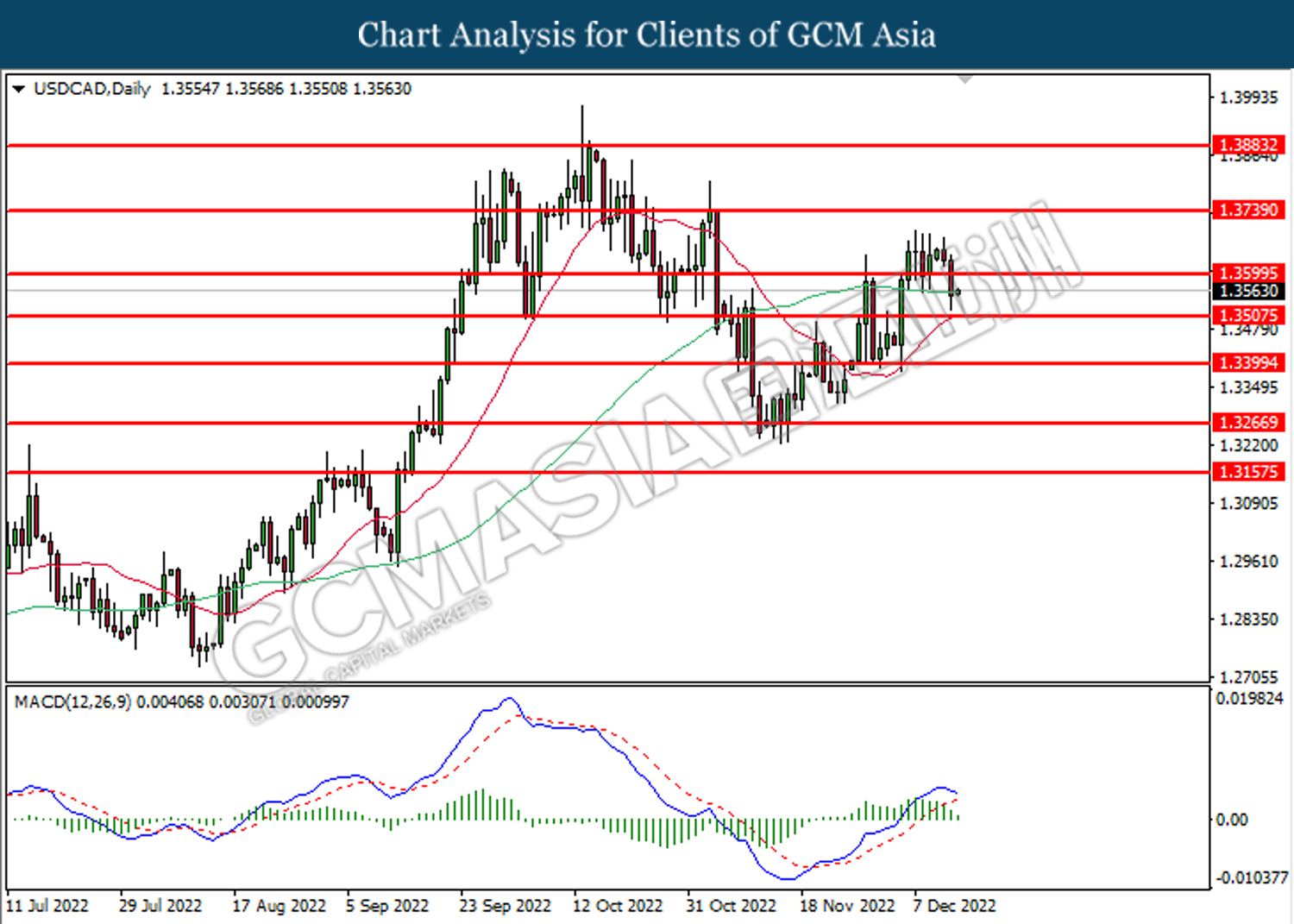

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

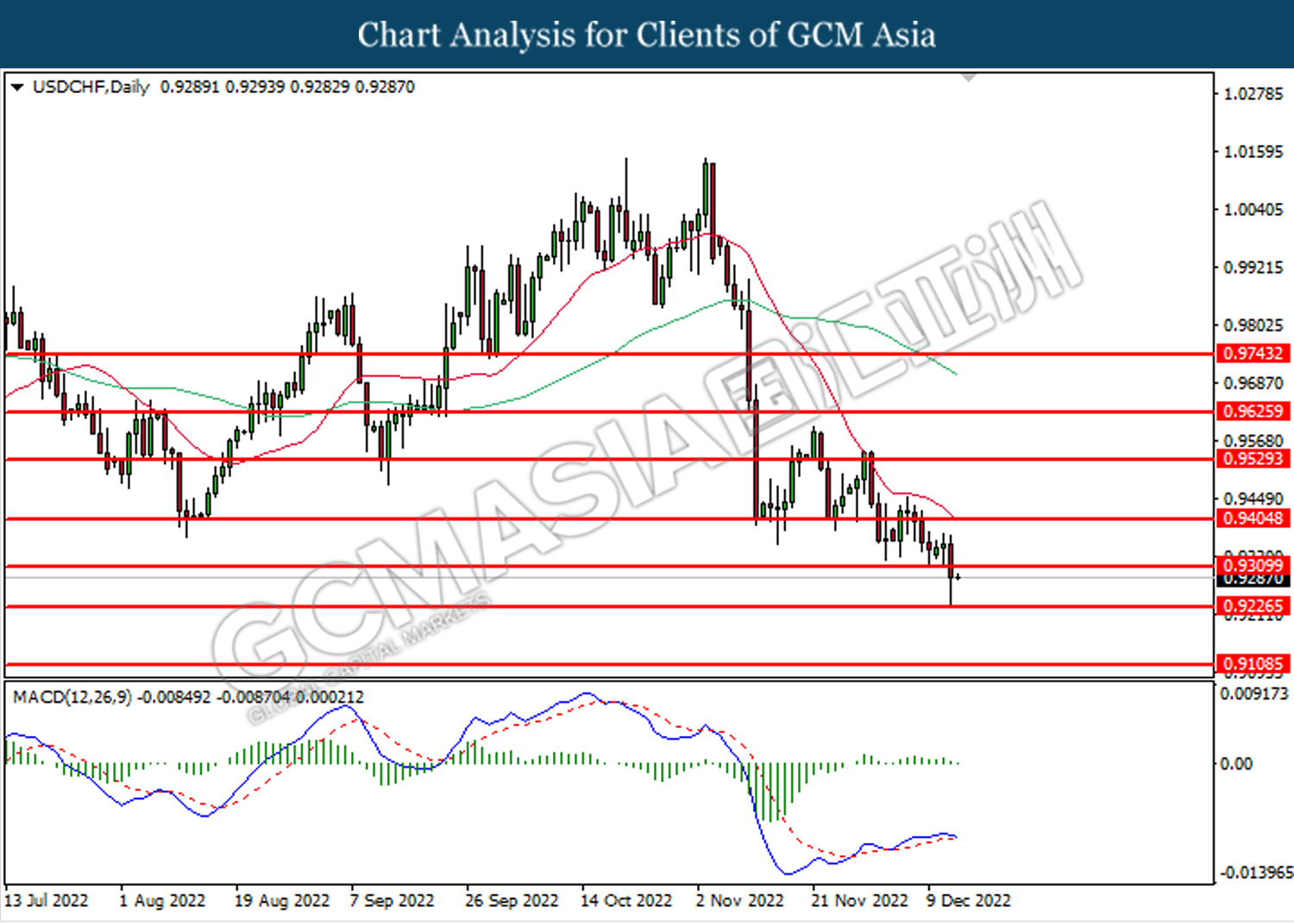

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 71.45. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 76.10.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

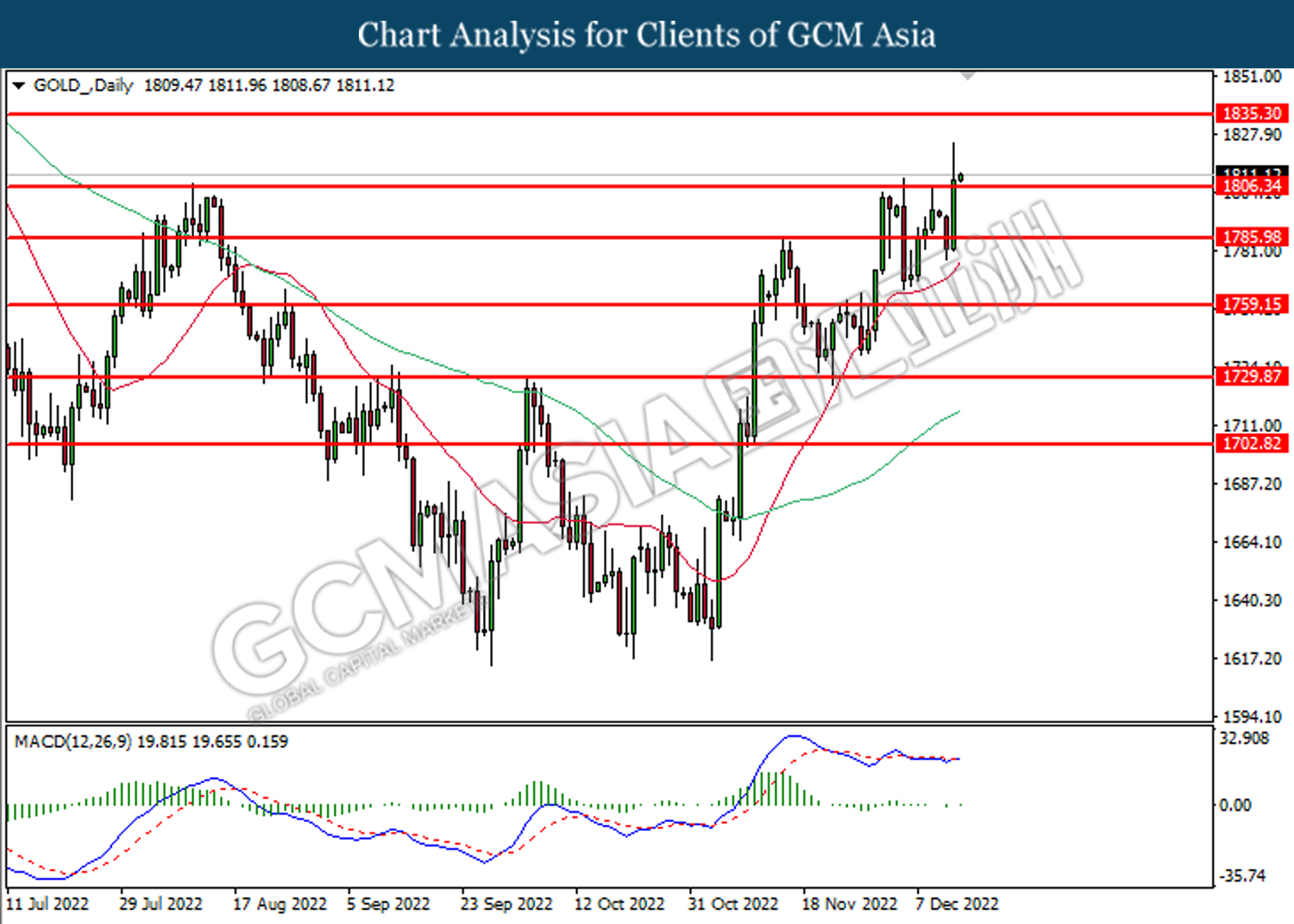

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1806.35. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1806.35, 1786.00